Posts tagged ‘energy’

Fed Ripping Off the Inflation Band-Aid

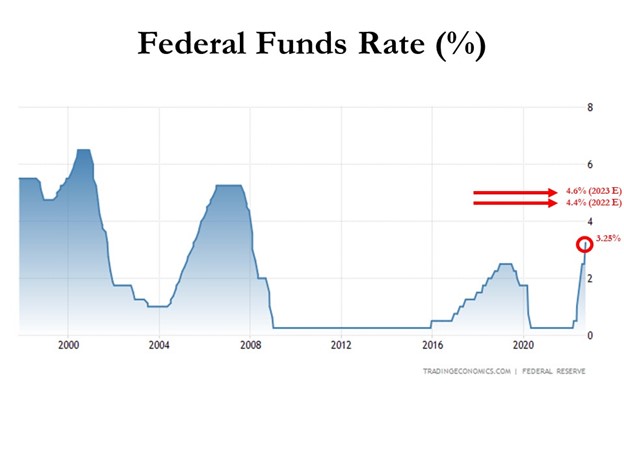

Inflation rates have been running near 40-year highs, and as a result, the Federal Reserve is doing everything in its power to rip off the Band-Aid of insidious high price levels in a swift manner. The Fed’s goal is to inflict quick, near-term pain on the economy in exchange for long-term price stability and future economic gains. How quickly has the Fed been hiking interest rates? The short answer is the rate of increases has been the fastest in decades (see chart below). Essentially, the Federal Reserve has pushed the targeted benchmark Federal Funds target rate from 0% at the beginning of this year to 3.25% today. Going forward, the goal is to lift rates to 4.4% by year-end, and then to 4.6% by next year (see Fed’s “dot plot” chart).

How should one interpret all of this? Well, if the Fed is right about their interest rate forecasts, the Band-Aid is being ripped off very quickly, and 95% of the pain should be felt by December. In other words, there should be a light at the end of the tunnel, soon.

The Good News on Inflation

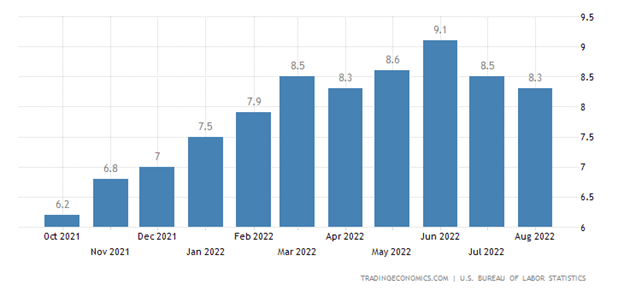

When it comes to inflation, the good news is that it appears to be peaking (see chart below), and many economists see the declining inflation trend continuing in the coming months. Why do pundits see inflation peaking? For starters, a broad list of commodity prices have declined significantly in recent months, including gasoline, crude oil, steel, copper, and gold, among many others.

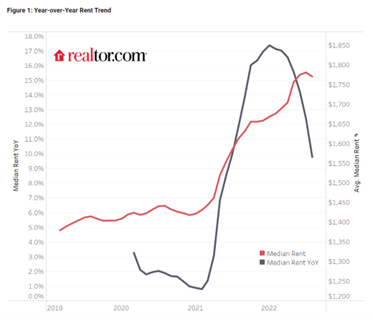

Outside of commodities, investors have seen prices drop in other areas of the economy as well, including housing prices, which recently experienced the fastest monthly price drop in 11 years, and rent prices as well (see chart below).

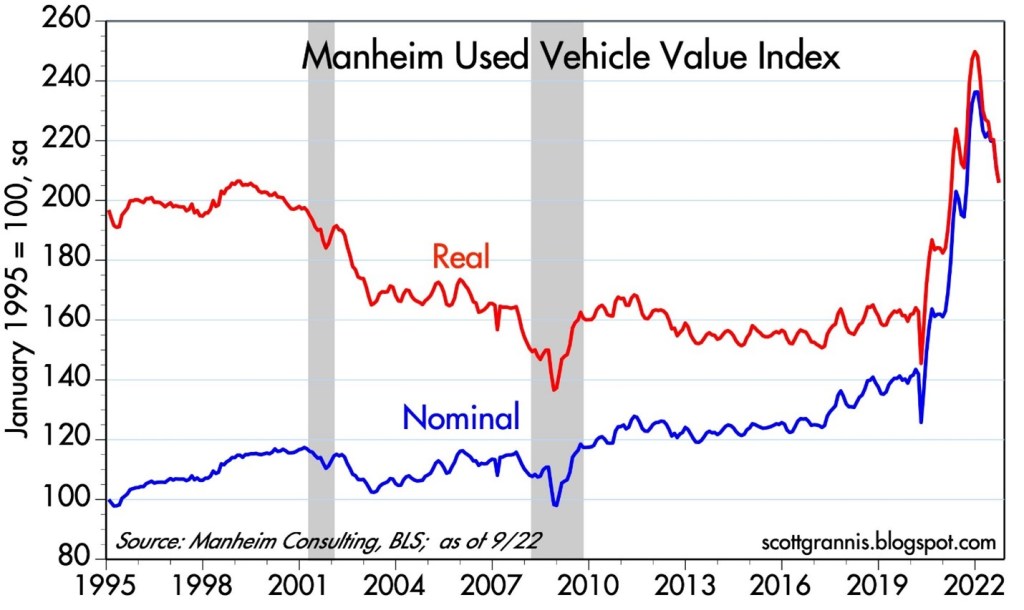

Anybody who was shopping for a car during the pandemic knows what happened to pricing – it exploded higher. But even in this area, we are seeing prices coming down (see chart below), and CarMax Inc. (KMX), the national used car retail chain confirmed the softening price trend last week.

Pain Spread Broadly

When interest rates increase at the fastest pace in 40 years, pain is felt across almost all asset classes. It’s not just U.S. stocks, which declined -9.3% last month (S&P 500), but it’s also housing -8.5% (XHB), real estate investment trusts -13.8% (VNQ), bonds -4.4% (BND), Bitcoin -3.1%, European stocks -10.1% (VGK), Chinese stocks -14.4% (FXI), and Agriculture -3.0% (DBA). The +17% increase in the value of the U.S. dollar this year against a basket of foreign currencies is substantially pressuring cross-border business for larger multi-national companies too – Microsoft Corp. (MSFT), for example, blamed U.S. dollar strength as the primary reason to cut earnings several months ago. Like Hurricane Ian, large interest rate increases have caused significant damage across a wide swath of areas.

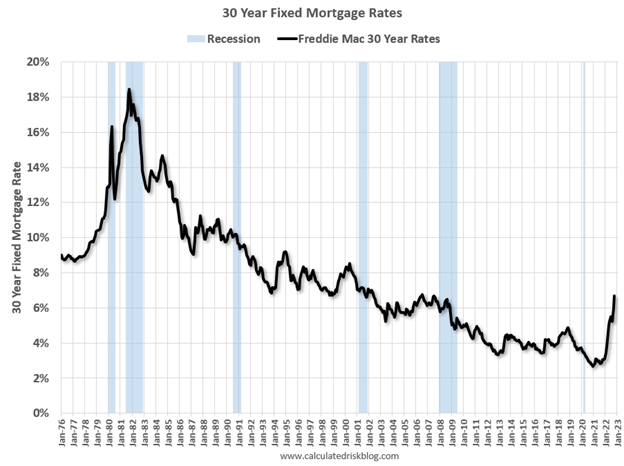

But for those following the communication of Federal Reserve Chairman, Jerome Powell, in recent months, they should not be surprised. Chairman Powell has signaled on numerous occasions, including last month at a key economic conference in Jackson Hole, Wyoming, that the Fed’s war path to curb inflation by increasing interest rates will inflict wide-ranging “pain” on Americans. Some of that pain can be seen in mortgage rates, which have more than doubled in 2022 and last week eclipsed 7.0% (see chart below), the highest level in 20 years.

Now is Not the Time to Panic

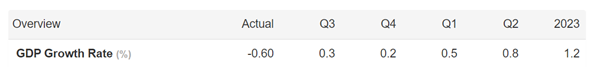

There is a lot of uncertainty out in the world currently (i.e., inflation, the Fed, Russia-Ukraine, strong dollar, elections, recession fears, etc.), but that is always the case. There is never a period when there is nothing to be concerned about. With the S&P 500 down more than -25% from its peak (and the NASDAQ down approximately -35%), now is not the right time to panic. Knee-jerk emotional decisions during stressful times are very rarely the right response. With these kind of drops, a mild-to-moderate recession is already baked into the cake, even though the economy is expected to grow for the next four quarters and for all of 2023 (see GDP forecasts below). Stated differently, it’s quite possible that even if the economy deteriorates into a recession, stock prices could rebound smartly higher because any potential future bad news has already been anticipated in the current price drops.

Worth noting, as I have pointed out previously, numerous data points are indicating inflation is peaking, if not already coming down. Inflation expectations have already dropped to about 2%, if you consider the spread between the yield on the 5-Year Note (4%) and the yield on the 5-Year TIP-Treasury Inflation Protected Note (2%). If the economy continues to slow down, and inflation has stabilized or declined, the Federal Reserve will likely pivot to decreasing interest rates, which should act like a tailwind for financial markets, unlike the headwind of rising rates this year.

Ripping off the Band-Aid can be painful in the short-run, but the long-term gains achieved during the healing process can be much more pleasurable.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in MSFT, BND and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in KMX, XHB, VNQ, VGK, FXI, DBA or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

April Flowers Have Investors Cheering Wow-sers!

Normally April showers bring May flowers, but last month the spring weather was dominated by sunshine that caused stock prices to blossom to new, all-time record highs across all major indexes. More specifically, the S&P 500 jumped +5.2% last month, the NASDAQ catapulted +5.4%, and the Dow Jones Industrial Average rose +2.7%. For the year, the Dow and S&P 500 index both up double-digit percentages (11%), while the NASDAQ is up a few percentage points less than that (8%).

What has led to such a bright and beaming outlook by investors? For starters, economic optimism has gained momentum as the global coronavirus pandemic appears to be improving after approximately 16 months. Not only are COVID-19 cases and hospitalizations rates declining, but COVID-19 related deaths are dropping as well. A large portion of the progress can be attributed to the 246 million vaccine doses administered so far in the United States.

Blossoming Economy

As a result of the improving COVID-19 health climate, economic activity, as measured by Gross Domestic Product (GDP), expanded by a healthy +6.4% rate during the first quarter. Economists are forecasting second quarter growth to accelerate to an even more brilliant rate of +10%.

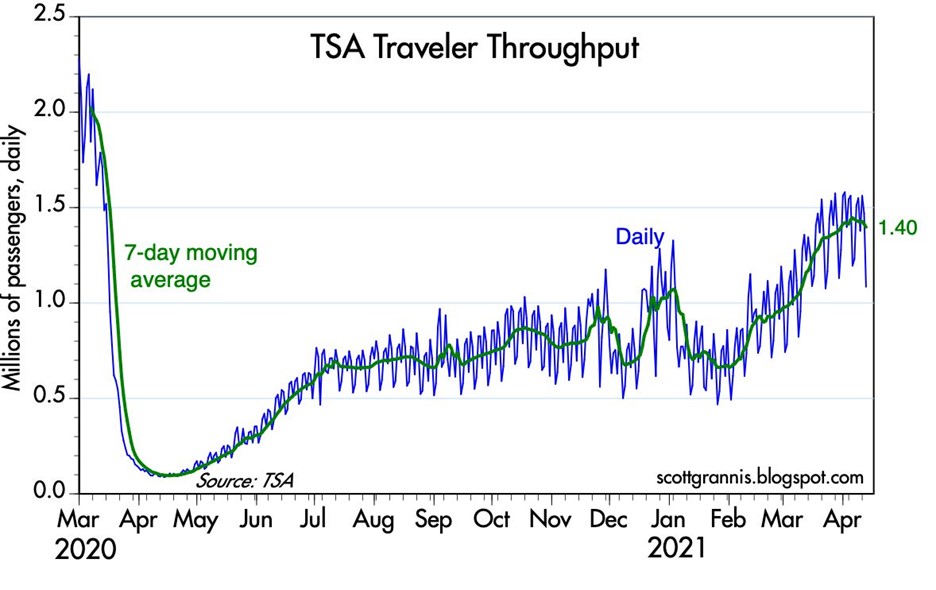

As the economy further re-opens and pent-up consumer demand is unleashed, activity is sprouting up in areas like airlines, hotels, restaurants, bars, movie theaters and gyms. An example of consumer demand climbing can be seen in the volume of passenger traffic in U.S. airports, which has increased substantially from the lows a year ago, as shown below in the TSA (Transportation Security Administration) data.

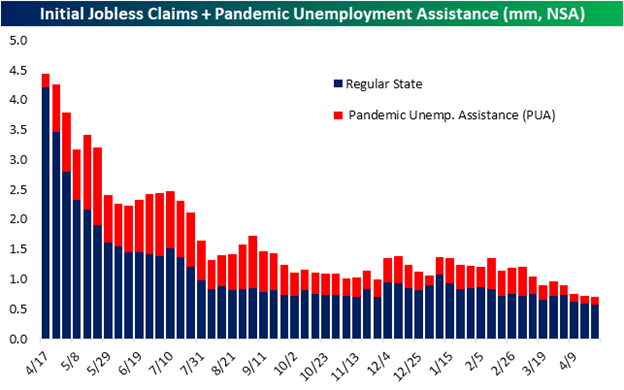

A germinating economy also means a healthier employment market and more jobs. The chart below shows the dramatic decline in the number of jobless receiving benefits and pandemic unemployment assistance.

Fed Fertilizer & Congressional Candy

Monetary and fiscal stimulus are creating fertile ground for the surge in growth as well. The Federal Reserve has been clear in their support for the economy by effectively maintaining its key interest rate target at 0%, while also maintaining its monthly bond buying program at $120 billion – designed to sustain low interest rates for the benefit of consumers and businesses.

From a fiscal perspective, Congress is serving up some sweet candy by doling out free money to Americans. So far, roughly $4 trillion of COVID-19 related stimulus and relief have passed Congress (see also Consumer Confidence Flies), and now President Biden is proposing roughly an additional $4 trillion of stimulus in the form of a $2 trillion jobs and infrastructure plan and a $1.8 trillion American Families Plan.

Candy and Spinach

While Congress is serving up trillions in candy, eventually, Americans are going to have to eat some less appetizing spinach in the form of higher taxes. Generally speaking, nobody likes higher taxes, so the question becomes, how does the government raise the most revenue (taxes) without upsetting a large number of voters? As 17th century French statesman Jean-Baptiste Colbert proclaimed, “The art of taxation consists in so plucking the goose as to get the most feathers with the least hissing.”

President Biden has stated he will only increase income taxes on people earning more than $400,000 annually and increase capital gains taxes for those earning more than $1,000,000 per year. According to CNBC, those earning more than $400,000 only represents 1.8% of total taxpayers.

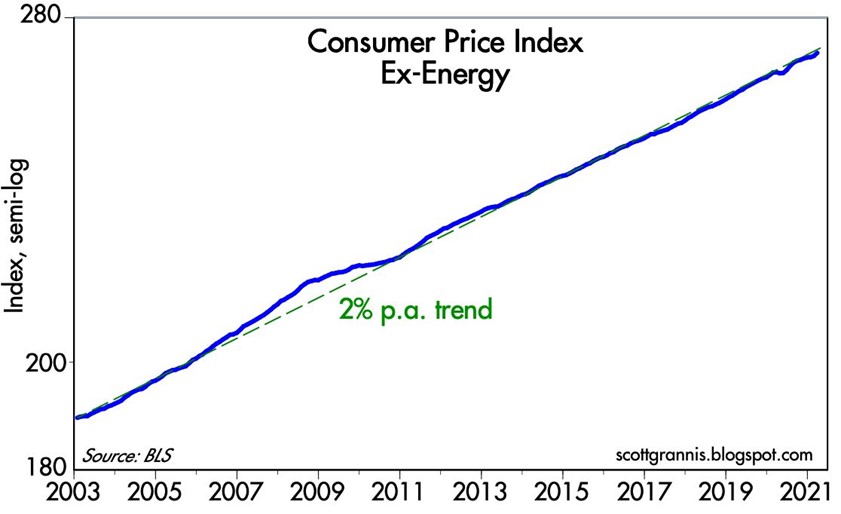

Bitter tasting spinach for Americans may also come in the form of higher inflation (i.e., a general rise in a basket of goods and services), which silently eats away at everyone’s purchasing power, especially those retirees surviving on a fixed income. Federal Reserve Chairman Jerome Powell sees any increase in inflation as transitory, but if prices keep rising, the Federal Reserve will be forced to increase interest rates. Such a reversal in rates could choke off economic growth and potentially force the economy into a recession.

If you strip out volatile energy prices, the good news is that underlying inflation has not spiraled higher out of control, as you can see from the chart below.

In addition to the concerns of potential higher taxes, inflation, and rising interest rate policies from the Federal Reserve, for many months I have written about my apprehension about the speculation in SPACs (Special Purpose Acquisition Companies) and cryptocurrencies like Bitcoin. There are logical explanations to invest selectively into SPACs and purchase Bitcoin as a non-correlated asset for diversification purposes and a hedge against the dollar. But unfortunately, if history repeats itself, speculators will eventually end up in a pool of tears.

While there are certainly some storm clouds on the horizon (e.g., taxes, inflation, rising interest rates, speculative trading), April bloomed a lot of flowers, and the near-term forecast remains very sunny as the economy emerges from a global pandemic. As long as the government continues to provide candy to millions of Americans; the Federal Reserve remains accommodative in its policies; and the surge in pent-up demand persists to drive economic growth, we likely have some more time before we are forced to eat our spinach.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 3, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Financial Markets Recharge with a Nap…Zzzzzz

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 4, 2016). Subscribe on the right side of the page for the complete text.

Did you enjoy your New Year’s festivities? If you were like me and ate excessively and drank too much egg nog, you may have decided along the line to take a nap. It’s not a bad idea to recharge those batteries before implementing those New Year’s resolutions and jumping on the treadmill. That’s exactly what happened in the financial markets this year. After six consecutive years of positive returns in the Dow Jones Industrial Average (2009 – 2014), stock markets took a snooze in 2015, as measured by the S&P 500 and Dow, which were each down -0.7% and -2.2%, respectively. And bonds didn’t fare any better, evidenced by the -1.9% decline in the Aggregate Bond ETF (AGG), over the same time period. Given the deep-seated fears about the Federal Reserve potentially catapulting interest rates higher in 2015, investors effectively took a big yawn by barely nudging the 10-year Treasury Note yield higher by +0.1% from 2.2% to 2.3%.

Even though 2015 ended up being a quiet year overall, there were plenty of sweet dreams mixed in with scary nightmares during the year-long nap:

INVESTMENT SWEET DREAMS

Diamonds in the Rough: While 2015 stock prices were generally flat to down around the globe (Vanguard Total Word -4.2%), there was some sunshine and rainbows gleaming for a number of segments in the market. For example, handsome gains were achieved in the NASDAQ index (+5.7%); Biotech Index – BTK (+10.9%); Consumer Discretionary ETF – XLY (+8.3%); Health Care ETF – VHT (+5.8%); Information Technology ETF – VGT (+4.6%); along with numerous other investment areas.

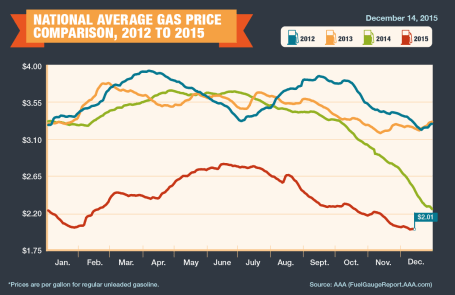

Fuel Fantasy Driven by Low Gas Prices: Gas prices averaged $2.01 per gallon nationally in December (see chart below), marking the lowest prices seen since 2009. Each penny in lower gas prices roughly equates to $1 billion in savings, which has strengthened consumers’ balance sheets and contributed to the multi-year economic expansion. Although these savings have partially gone to pay down personal debt, these gas reserves have also provided a financial tailwind for record auto sales (estimated 17.5million in 2015) and a slow but steady recovery in the housing market. The outlook for “lower-for-longer” oil prices is further supported by an expanding oil glut from new, upcoming Iranian supplies. Due to the lifting of economic sanctions related to the global nuclear deal, Iran is expected to deliver crude oil to an already over-supplied world energy market during the first quarter of 2016. Additionally, the removal of the 40-year ban on U.S. oil exports -could provide a near-term ceiling on energy prices as well.

Counting Cash Cows

Catching some shut-eye after reading frightening 2015 headlines on the China slowdown, $96 billion Greek bailout/elections, and Paris/San Bernardino terrorist attacks forced some nervous investors to count sheep to fall asleep. However, long-term investors understand that underpinning this long-lived bull market are record revenues, profits, and cash flows. The record $4.7 trillion dollars in 2015 estimated mergers along with approximately $1 trillion in dividends and share buybacks (see chart below) is strong confirmation that investors should be concentrating on counting more cash cows than sheep, if they want to sleep comfortably.

INVESTMENT NIGHTMARES

Creepy Commodities: Putting aside the -30% collapse in WTI crude oil prices last year, commodity investors overall were exhausted in 2015. The -24% decline in the CRB Commodity Index and the -11% weakening in the Gold Index (GLD) was further proof that a strong U.S. dollar, coupled with stagnant global growth, caused investors a lot of tossing and turning. While bad for commodity exporting countries, the collapse in commodity prices will ultimately keep a lid on inflation and eventually become stimulative for those consumers suffering from lower standards of living.

Dollar Dread: The +25% spike in the value of the U.S. dollar over the last 18 months has made life tough for multinational companies. If your business received approximately 35-40% of their profits overseas and suddenly your goods cost 25% more than international competitors, you might grind your teeth in your sleep too. Monetary policies around the globe, including the European Union, will have an impact on the direction of future foreign exchange rates, but after a spike in the value of the dollar in early 2015, there are signs this scary move may now be stabilizing. Although multinationals are getting squeezed, now is the time for consumers to load up on cheap imports and take that bargain foreign vacation they have long been waiting for.

January has been a challenging month the last couple years, and inevitably there will be additional unknown turbulence ahead – the opening day of 2016 not being an exception (i.e., China slowdown concerns and Mideast tensions). However, given near record-low interest rates, record corporate profits, and accommodative central bank policies, the 2015 nap taken by global stock markets should supply the necessary energy to provide a lift to financial markets in the year ahead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions VHT, AGG, and in certain exchange traded funds (ETFs), but at the time of publishing had no direct position VT, BTK, XLY, VGT, GLD, or in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Marathon Market Gets a Cramp

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2015). Subscribe on the right side of the page for the complete text.

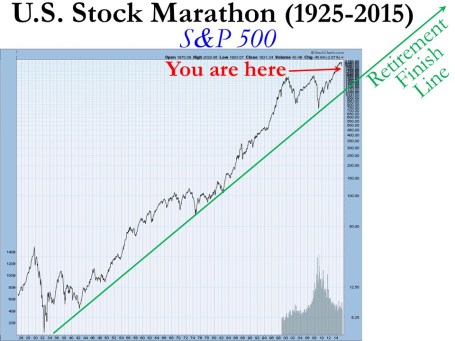

“Anyone can run a hundred meters, it’s the next forty-two thousand and two hundred that count.”

Investing is a lot like running a marathon…but it’s not a sprint to the retirement finish line. The satisfaction of achieving your long-term goal can be quite rewarding, but attaining ambitious objectives does not happen overnight. Along the hilly and winding course, there can be plenty of bumps and bruises mixed in with the elation of a runner’s high. While stocks have been running at a record pace in recent years, prices have cramped up recently as evidenced by the -2.6% decline of the S&P 500 stock index last month.

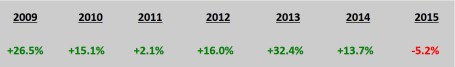

But the recent correction should be placed in the proper perspective as you approach and reach retirement. Since the end of the 2008 Financial Crisis the stock market has been racing ahead at a brisk rate, as you can see from the total return performance below (excluding 2015):

This performance is more indicative of a triumph than a catastrophe, but if you turned on the TV, listened to the radio, or surfed the web, you may come to a more frightening conclusion.

What’s behind the recent dip? These are some of the key concerns driving the recent price volatility:

- China: Slowing growth in China and collapse in Chinese stock market. China is suffering from a self-induced slowdown designed to mitigate corruption, prick the real estate bubble, and shift its export-driven economy to a more consumer-driven economy. These steps diminish short-term growth (albeit faster than U.S. growth), but nevertheless the measures should be constructive for longer-term growth.

- Interest Rates: Uncertainty surrounding the timing of a 0.25% target interest rate increase by the Federal Reserve. The move from 0% to 0.25% is like walking from the hardwood floor onto the rug…hardly noticeable. The inevitable move by the Fed has been widely communicated for months, and given where interest rates are today, the move will have a negligible impact on corporate borrowing costs. Like removing a Band-Aid, the initial action may cause some pain, but should be comfortably received shortly thereafter.

- Politics: Potential government shutdown / sequestration. The epic political saga will never end, however, as I highlighted in “Who Said Gridlock is Bad?,” political discourse in Washington has resulted in positive outcomes as it relates to our country’s fiscal situation (limited government spending and declining deficits). The government shutdown appears to have been averted for now, but it looks like we will be blanketed with brinkmanship nonsense again in a few months.

- Biotech/Pharmaceuticals: Politics over lofty drug prices and the potential impact of future regulation on the biotech sector. Given the current Congressional balance of power, any heavy-handed Democratic proposals is likely to face rigorous Republican opposition.

- Emerging Markets: Emerging market weakness, especially in Latin America (e.g., Brazil). These developments deserve close monitoring, but the growth in the three largest economic regions (U.S., Europe, and China) will have a much larger effect on the direction of global economic expansion.

- Middle East: Destabilized Middle East and Syria. Terrorist extremism and cultural animosity between various Middle East populations has existed for generations. There will be no silver bullet for a peaceful solution, so baby steps and containment are critical to maintain healthy global trade activity with minimal disruptions.

Worth noting, this current list of anxieties itemized above is completely different from six months ago (remember the Greece crisis?), and the list will change again six months into the future. Investing, like any competitive challenge, does not come easy…there is always something to worry about in the land of economics and geopolitics.

Here’s what the world’s top investor Warren Buffett said a few decades ago (1994) on the topic of politics and economics:

“We will continue to ignore political and economic forecasts which are an expensive distraction for investors and businessmen. Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%.”

In a world of 7.3 billion people and 196 countries there will never be a shortage of fear, uncertainty, and doubt (F.U.D.) – see events chart in The Bungee Market. In an ever-increasing, globally connected world, technology and the media continually amplify molehills into mountains, thereby making the next imagined Armageddon a simple click of a mouse or swipe of a smartphone away.

Today’s concerns are valid but in the vast majority of cases the issues are completely overblown, sensationalized and over-emphasized without context. Context is an integral part to investing, but unfortunately context usually cannot be explained in a short soundbite or headline. On the flip side, F.U.D. thrives in the realm of soundbites and headlines.

While investors may feel fatigued from a strong flow of headline headwinds, financial market race participants should take a break at the water stop to also replenish themselves with a steady tailwind of positive factors, including the following:

- Employment: The unemployment rate has been cut from a recession peak of 10.0% down to 5.1%, and the economy has been adding roughly +200,000 new monthly jobs on a fairly consistent basis. On top of that, there are a record 5.8 million job openings versus 3.7 million two years ago – a sign that the economy continues to hum along.

- Housing/Commercial Real Estate/Mortgage Rates: Housing prices have rebounded by about +30% from the 2012 lows; Housing starts have increased by +25% in the past year and 120% in the past four years; and 30-Year Fixed mortgage interest rates sit at 3.85% – a highly stimulative level within a spitting distance from record lows.

- Auto Sales: Surged to a post-recession record of 17.8 million units in August.

- Interest Rates: Massively stimulative and near generational lows, even if the Fed hikes its interest rate target by 0.25% in October, December or sometime in 2016.

- Capital Goods Orders: Up for three consecutive months.

- Rail Shipments/Truck Tonnage: Both these metrics are rising by about 3-4%.

- Retail Sales: Rising at a very respectable pace of 7% over the last six months.

- Low Energy & Commodity Prices: Inflation has remained largely in check thanks to plummeting commodity prices. Low oil and gas prices are benefiting consumers in numerous ways, including the contribution to car sales, home sales, and/or debt reduction.

While the -10% dip in stock prices from mid-August might feel like a torn knee ligament, long-term investors know -10% corrections historically occur about one-time per year, on average. So, even though you may be begging for a wheelchair, the best course of action is to take a deep breath, stick to your long-term investment plan, rebalance your portfolio if necessary, and continue staying on course towards your financial finish line.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.