Posts tagged ‘Education’

Curing Our Ills with Innovation

Fareed Zakaria thoughts have blanketed both traditional and internet media outlets, spanning everything from Newsweek to Time, and the New York Times to CNN. With an undergraduate diploma from Yale and his PhD from Harvard, Dr. Zakaria has built up quite a following, especially when it comes to foreign affairs.

In his latest Time magazine article, Can America Keep Pace?, Zakaria addresses the role of innovation in the U.S., “Innovation is as American as apple pie.” The innovation lead the U.S. maintains over the rest of the world will not evaporate over night because this cultural instinct is bred into our DNA – innovation is not something you one can learn directly from a textbook, Wikipedia, or Google (GOOG). With that said, the innovation gap is narrowing between developed and developing countries. New York Times columnist Tom Friedman captured this sentiment when he stated the following:

“French voters are trying to preserve a 35-hour work week in a world where Indian engineers are ready to work a 35-hour day.”

The fungibility of labor has pressured industries by transferring jobs abroad to much lower-cost regions like China and India, and that trend is only expanding further into countries with even lower labor cost advantages. Zakaria agrees:

“America’s future growth will have to come from new industries that create new products and processes. Older industries are under tremendous pressure.”

The good news is the United States maintains a significant lead in certain industries. For instance, we Yankees have a tremendous lead in fields such as biotechnology, entertainment, internet technologies, and consumer electronics.

The poster child for innovation is Apple Inc. (AAPL), which arose from the ashes of death ten years ago with its then ground-breaking new product, the iPod. Since then, Apple has introduced many innovative products and upgrades as a result of its research and development efforts, including the recently launched iPad.

The Education Engine

Where we are falling short is in education, which is the foundation to innovation. In a country with a high school system that Microsoft Corp.’s (MSFT) founder Bill Gates calls “obsolete,” society is left with one-third of the students not graduating and nearly half of the remaining graduates unprepared for college. In this instant gratification society we live in, the long-term critical education issue has been pushed to the backburner. Other emerging countries like China and India are churning out more college graduates by the millions, and also dominating us in the key strategic count of engineering degrees.

Government’s Role

With the massive debt and deficits our country currently faces, an ongoing debate about the size and role of government persists. Zakaria makes the case that government must place a significant role when it comes to innovation. Unfortunately, the U.S. wastes billions on pork-barrel projects and suboptimal subsidies while dilly-dallying in political gridlock over critical investments in education, infrastructure spending, basic research, and energy policies. In the meantime, our fellow competing countries are catching up to us, and in certain cases passing us (e.g., alternative energy investments – see Electric Profits).

Zakaria makes this point on the subject:

“The fastest-growing economies are all busy using government policy to establish commanding leads in one industry after another. Google’s Eric Schmidt points out that ‘the fact of the matter is, other countries are putting a lot more money into nurturing new industries than we are, and we are not going to win unless we do something like what they’re doing.’”

As a matter of fact, an ITIF (Information Technology & Innovation Foundation) study measuring innovation improvement from 1999 to 2009, as it related to government funding for basic research, education and corporate-tax policies, ranked the U.S. dead last out of 40 countries.

Not All is Lost – Pie Slice Maintained

Although the outlook may sounds bleak, not all is lost. In a recent Wall Street Journal interview with Bob Doll Chief Equity Strategist at the world’s largest money management company (BlackRock has $3.6 trillion in assets under management), he makes the case that the U.S. remains the leading source of technological innovation and home to the greatest universities and the most creative businesses in the world. He sees this trend persisting in part because of our country’s relative demographic advantages:

“Over the next 20 years, the U.S. work force is going to grow by 11%, Europe’s going to fall by five, and Japan’s going to fall by 17. This alone tells me the U.S. has a huge advantage over Europe and a bigger one over Japan for growth.”

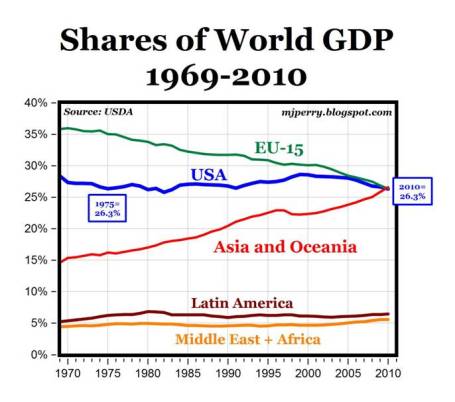

So while emerging markets, like those in Asia, continue to gain a larger slice of the global GDP pie, Mark Perry at Carpe Diem shows how the U.S has maintained its proportional slice of a growing global economic pie, over the last four decades.

Growth is driven by innovation, and innovation is driven by education. If America wants to maintain its greatness, the focus needs to be placed on innovation-led growth. The world is moving at warp speed, and our neighbors are moving swiftly, whether we come along for the ride or not. The current, sour conversations regarding deficits, debt ceilings, entitlements, wars, and unemployment are all essential discussions, but more importantly, if these debates can be refocused on accelerating innovation, the country will be well on its way to curing its ills.

See also Our Nation’s Keys to Success

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, GOOG, and AAPL, but at the time of publishing SCM had no direct position in MSFT, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Lessons Learned from Financial Crisis Management 101

For many investors the financial crisis over the last 24 months was an expensive education. Rather than have to enroll and take the courses all over again, I am hopeful we can put that past education to good use. Here are some valuable lessons I learned from my two year degree in Financial Crisis Management 101.

Investors Don’t Get Paid For Emotions: In investing, emotional decisions generally lead to suboptimal  decisions. Over the financial crisis, despite the market rebound last year, many investors fell prey to fear. This queasiness (see Queasy Investors article) resulted in money being stuffed under the mattress – earning subpar yields – and asset allocations dramatically shifting towards bonds. Not surprisingly, the Barclays Aggregate Bond Index fell -1% in 2009 as the herd piled in. On the flip side, those willing to brave the equity markets were rewarded with a +23% gain in the S&P500 index. Certainly this bond-equity picture looked different in 2008, but unfortunately many mainstream portfolios lacked adequate bond exposure then. As famed Fidelity Magellan fund manager Peter Lynch points out, fretting about your portfolio can work against you: “Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

decisions. Over the financial crisis, despite the market rebound last year, many investors fell prey to fear. This queasiness (see Queasy Investors article) resulted in money being stuffed under the mattress – earning subpar yields – and asset allocations dramatically shifting towards bonds. Not surprisingly, the Barclays Aggregate Bond Index fell -1% in 2009 as the herd piled in. On the flip side, those willing to brave the equity markets were rewarded with a +23% gain in the S&P500 index. Certainly this bond-equity picture looked different in 2008, but unfortunately many mainstream portfolios lacked adequate bond exposure then. As famed Fidelity Magellan fund manager Peter Lynch points out, fretting about your portfolio can work against you: “Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

Martin Luther King Jr. put anxious emotions into perspective by expressing, “Normal fear protects us; abnormal fear paralyses us.” Prudent conservatism makes sense, but panicked alarm can lead you astray. Behavioral economists Daniel Kahneman and Amos Tversky punctuated this idea by showing the impact that “loss” has on peoples’ psyches. Through their research, Kahneman and Tversky demonstrated the pain of loss is more than twice as painful as the pleasure from gain. Euphoria, whether for homes or for other forms of credit-induced spending, is not a desirable emotion when investing either – just ask any house-flipping Florida or California resident looking for work. The moral of the story: plan for a rainy day and don’t succumb to the elation of the herd. Create a disciplined systematic approach that relies less on your gut. Emotional decisions, as we’ve seen over the last few years, generally do not fare well.

Quality Doesn’t Die in a Crisis: Good companies with solid growth prospects don’t disappear in a bear market. On  the contrary, they typically are in much better position to invest, step on the throats of their competitors, and steal market share. Many of the quality companies left for dead last year have risen from the ashes. Leveraged financials and debt laden companies were hit the hardest, and bounced nicely last year, but the market leaders are the companies that endure through bull and bear markets.

the contrary, they typically are in much better position to invest, step on the throats of their competitors, and steal market share. Many of the quality companies left for dead last year have risen from the ashes. Leveraged financials and debt laden companies were hit the hardest, and bounced nicely last year, but the market leaders are the companies that endure through bull and bear markets.

Buy and Hold is Not Dead: Catching fish  can be difficult if one constantly dips their line in and out of the water. Academic research falls pretty bluntly on the shoulders of “day traders,” and I’m still searching for a Warren Buffett equivalent to show up on Oprah or Charlie Rose espousing the virtues of speculation – oh wait, maybe Jim Cramer qualifies?

can be difficult if one constantly dips their line in and out of the water. Academic research falls pretty bluntly on the shoulders of “day traders,” and I’m still searching for a Warren Buffett equivalent to show up on Oprah or Charlie Rose espousing the virtues of speculation – oh wait, maybe Jim Cramer qualifies?

Long-term investors are a rare but dying breed – just look at the average fund manager’s holding period, which has dropped from about five years in the 1960s to less than one year today. The 1980s and 1990s weren’t too bad for buy and holders (about a +1,400% increase), but the strategy has subsequently gone in hibernation for a decade. Warren Buffett may be pushing a bit too far when he says, “Our favorite holding period is forever,” but directionally this posture may actually work well over the next ten years. Patience can pay off – even if you arrive late to the game. For example, if you bought Wal-Mart shares (WMT) after it rose 10-fold during its first 10 years, you still could have achieved a 60x return over the next 30 years. I, myself, believe there is a happy medium between high frequency trading (see HFT article) and “forever” investing. Regardless of your time horizon, I agree with late Sir John Templeton who said, “The only way to avoid mistakes is not to invest – which is the biggest mistake of all.”

Cyclical is Not Secular: Party crashers may be optimistic about the prospects of a gathering, but if they arrive too  late to the event, there may be no more food or wine left. The same principle applies to investment themes, as well-known value manager Bill Miller states, “Latecomers are usually persuaded that the cyclical has become the secular.” Over the last few years, the secular arguments of “real estate prices will never go down nationally,” and the belief that emerging markets like China would “decouple” from the U.S. market in 2008, simple were proved wrong. Time will tell if the gold-bugs will be right regarding their call for continued secular increases, or if the spike is a crescendo on a return to more normalized levels. On the whole, I much rather prefer to arrive at a big party prematurely, rather than showing up late sifting through the crumbs and scraping the bottom of the punch bowl.

late to the event, there may be no more food or wine left. The same principle applies to investment themes, as well-known value manager Bill Miller states, “Latecomers are usually persuaded that the cyclical has become the secular.” Over the last few years, the secular arguments of “real estate prices will never go down nationally,” and the belief that emerging markets like China would “decouple” from the U.S. market in 2008, simple were proved wrong. Time will tell if the gold-bugs will be right regarding their call for continued secular increases, or if the spike is a crescendo on a return to more normalized levels. On the whole, I much rather prefer to arrive at a big party prematurely, rather than showing up late sifting through the crumbs and scraping the bottom of the punch bowl.

Turn Off the TV: Fanning the flames of our daily emotions are media outlets. Thanks to globalization, the internet,  and the 24/7 news cycle, we are bombarded with some type of daily fear factor to worry about. Typically, an eloquent strategist or economist pontificates on the direction of the market. In many instances these talking heads don’t even manage client money or are not held accountable for their predictions (see Peter Schiff article). I like Barron’s Michael Santoli’s description of these story-telling market mavens, “A strategist’s first job is to have a plausible, defensible case to shop around client conference rooms globally. Being right is gravy.” Although intellectually stimulating, I advise you to limit your consumption and delivery of strategist commentary to cocktail parties and don’t let their advice sway your portfolio decisions. You’ll be much better served by listening to veteran investors who have successfully navigated choppy market cycles. Famed growth investor William O’Neil shrewdly chimes in on the subject too, “Since the market tends to go in the opposite direction of what the majority of people think, I would say 95% of all these people you hear on TV shows are giving you their personal opinion. And personal opinions are almost always worthless … facts and markets are far more reliable.”

and the 24/7 news cycle, we are bombarded with some type of daily fear factor to worry about. Typically, an eloquent strategist or economist pontificates on the direction of the market. In many instances these talking heads don’t even manage client money or are not held accountable for their predictions (see Peter Schiff article). I like Barron’s Michael Santoli’s description of these story-telling market mavens, “A strategist’s first job is to have a plausible, defensible case to shop around client conference rooms globally. Being right is gravy.” Although intellectually stimulating, I advise you to limit your consumption and delivery of strategist commentary to cocktail parties and don’t let their advice sway your portfolio decisions. You’ll be much better served by listening to veteran investors who have successfully navigated choppy market cycles. Famed growth investor William O’Neil shrewdly chimes in on the subject too, “Since the market tends to go in the opposite direction of what the majority of people think, I would say 95% of all these people you hear on TV shows are giving you their personal opinion. And personal opinions are almost always worthless … facts and markets are far more reliable.”

Bad Loans are Made in Good Times: Markus Brunnermeier, a Princeton economist known for studying financial bubbles, declared this observation regarding loans. Hindsight is 20-20, but it’s no wonder that boat loads of no-doc, no down-payment, teaser rate subprime loans and overleveraged risky private equity loans were being made when unemployment was at 5% — not today’s 10% rate. Now with the loan spigots shut, the tables have been turned. Relatively few loans are now being made, but with a massively steep yield curve, surviving financial institutions are in a golden age for bringing on new wildly lucrative assets onto their balance sheets. Sure, the industry is still saddled with toxic legacy assets, but the negative impact should begin fading in coming quarters if the economy can continue building a firmer foundation.

Diversification Matters: Contrary to current thinking, which believes diversification didn’t help investors through  the crisis, owning certain asset classes like treasuries, certain commodities, and cash did help in 2008. Certainly, the correlations between many asset classes converged in the heat of the panic, but I’m convinced the benefits of diversification provide beneficial shock absorbers for most investment portfolios. Princeton professor and economist Burton Gordon Malkiel sums it up succinctly, “Diversity reduces adversity.”

the crisis, owning certain asset classes like treasuries, certain commodities, and cash did help in 2008. Certainly, the correlations between many asset classes converged in the heat of the panic, but I’m convinced the benefits of diversification provide beneficial shock absorbers for most investment portfolios. Princeton professor and economist Burton Gordon Malkiel sums it up succinctly, “Diversity reduces adversity.”

The Herd is Often Led to the Slaughterhouse: The technology and housing bubble implosions serve as gentle  reminders of the slaughterhouse fate for those who follow the herd. Avoiding consensus thinking is virtually a requirement of long-term outperformance. As Sir John Templeton stated, “It’s impossible to produce superior performance unless you do something different from the majority.” John Paulson can also attest to this fact. If aggressively shorting the housing market and loading up on CDS insurance was the consensus, his firm would not have made $20 billion over 2007 and 2008.

reminders of the slaughterhouse fate for those who follow the herd. Avoiding consensus thinking is virtually a requirement of long-term outperformance. As Sir John Templeton stated, “It’s impossible to produce superior performance unless you do something different from the majority.” John Paulson can also attest to this fact. If aggressively shorting the housing market and loading up on CDS insurance was the consensus, his firm would not have made $20 billion over 2007 and 2008.

These are obviously not all the lessons to be learned from the financial crisis, and by following a philosophy of continual learning, future mistakes should provide additional insights to help guard against losses and capitalize on potential opportunities. Having freshly graduated from Financial Crisis Management 101, I hope to immediately implement this education to land on the financial market’s Dean’s List.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including fixed income ETFs and FXI). Also at time of publishing SCM and some of its clients had a direct long position in WMT, but no position in BEN or BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Jack Welch University: Diploma or Black Belt?

You too can get your name plastered across a university (or online) for a measly $2 million. That’s what Jack Welch did when he purchased a 12% stake in the primarily online Masters of Business Administration Program (MBA) of Chancellor University. The name of the school according to The Wall Street Journal will be the Jack Welch Institute (JWI).

According to the WSJ:

Boston research firm EduVentures Inc. estimates that 11% of the roughly 18.5 million U.S. college students took most of their classes online in the fall of 2008, up from 1% a decade ago.Online higher education will generate revenue of $11.5 billion this year, EduVentures says. But “there is a concern about quality,” says EduVentures Chief Executive Tom Dretler, because there’s “much, much less selectivity” of students in the admissions process.

So what does a Jack Welch student receive upon graduation – a diploma or a General Electric (GE) Six Sigma Black Belt? And what about Jack’s hard-nosed, no-nonsense business approach? Will all students learn how to negotiate like Jack, especially when it comes to retirement perks? The $21,000 tuition bill sounds steep on the surface, but well worth it if graduates can finagle exit package perks like Welch’s $86,000 a year consultant fee, use of an $80,000 per month Manhattan apartment, court-side seats to the New York Knicks and U.S. Open, seating at Wimbledon, box seats at Red Sox and Yankees baseball games, country club fees, security services and restaurant bills (The New York Times), not to mention a limousine, a cook, free flowers, country-club memberships and a charge account at Jean Georges restaurant.

Now that’s an MBA degree that may attract interest.

Wade W. Slome, CFA, CFP® www.Sidoxia.com