Posts tagged ‘economy’

Fed Ponders New Surgical Tool

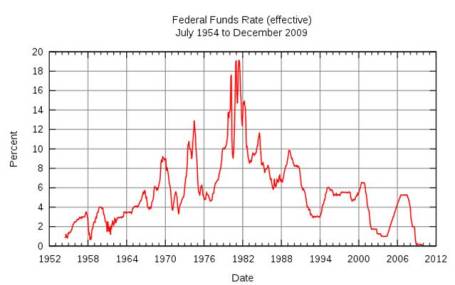

The Fed is closely monitoring the recovering patient (the U.S. economy) after providing a massive dose of monetary stimulus. The patient is feeling numb from the prescription, but if the Fed is not careful in weaning the subject off the medicine (dangerously low Federal Funds rate), dangerous side- effects such as a brand new bubble, rampant inflation, or a collapsing dollar could ensue.

In preparing for the inevitable pain of the Federal Reserve’s “exit strategy,” the institution is contemplating the use of a new tool – interest rates paid to banks on excess reserves held at the Fed. A likely by-product of any deposit-based rate increase will be higher rates charged on consumer loans.

Currently, the Federal Reserve primarily controls the targeted Federal funds rate (the rate at which banks make short-term loans to each other) through open market operations, such as the buying and selling of government securities. Specifically, repurchase agreements made between the Federal Reserve and banks are a common strategy used to control the supply and demand of money, thereby meeting the Fed’s interest rate objective.

Although a relatively new tool created from a 2006 law, paying interest on excess reserves can help in stabilizing the Federal Funds rate when the system is awash in cash – the Fed currently holds over $1 trillion in excess reserves. Failure to meet the inevitably higher Fed Funds target is a major reason policymakers are contemplating the new tool. The Fed started paying interest rates on reserves, presently 0.25%, in the midst of the financial crisis in late 2008. Rate policy implementation based on excess reserves would build a stable floor for Federal Funds rate since banks are unlikely to lend to each other below the set Fed rate. The excess reserve rate-setting tool, although a novel one for the United States, is used by many foreign central banks.

Watching the Fed

While the Fed discusses the potential of new tools, other crisis-originated tools designed to improve liquidity are unwinding. For example, starting February 1st, emergency programs supporting the commercial paper, money market, and central bank swap markets will come to a close. The closure of such program should have minimal impact, since the usage of these tools has either stopped or fizzled out.

Fed watchers will also be paying attention to comments relating to the $1 trillion+ mortgage security purchase program set to expire in March. A sudden repeal of that plan could lead to higher mortgage rates and hamper the fragile housing recovery.

When the Fed policy makers meet this week, another tool open for discussion is the rate charged on emergency loans to banks – the discount rate (currently at 0.50%). Unlike the interest rate charged on excess reserves, any change to the discount rate will not have an impact charged on consumer loans.

While the Fed’s exit strategy is a top concern, market participants can breathe a sigh of relief now that Federal Reserve Chairman Ben Bernanke has been decisively reappointed – lack of support would have resulted in significant turmoil.

The patient (economy) is coming back to life and now the extraordinary medicines prescribed to the subject need to be responsibly removed. As the Federal Reserve considers its range of options, old instruments are being removed and new ones are being considered. The health of the economy is dependent on these crucial decisions, and as a result all of us will be carefully watching the chosen prescription along with the patient’s vital signs.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds but at the time of publishing had no direct positions in securities mentioned in the article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Soros on the Super Bubble

Like a bubble formed from chewing gum, the gradual expansion of the spherical formation occurs much slower than the immediacy of the pop. A minority of investors identified the treacherous, credit-induced bubble of 2008 before it burst, however not included in that group are financial regulators. Now we’re left with the task of cleaning up the sticky mess on our faces and establishing measures to prevent future blow-ups.

George Soros, Chairman of Soros Fund Management and author of The Crash of 2008, has been around the financial market block a few times, so I think it pays to heed the regulatory reform recommendations as it relates to the “Super bubble” of 2008. As you probably know, financial bubbles are not a new concept. Beyond the oft-mentioned technology and real estate bubbles of this decade, bubbles such as the “Tulip-mania” of the 1630s serve as a gentle reminder of the everlasting existence of irrational economic behavior. If the Dutch were willing to pay $76,000 for a tulip bulb (inflation-adjusted) almost 400 years ago, then virtually any mania is possible.

Bubbles and Efficiency

Efficient markets are somewhat like UFOs. Some people believe in them, but many do not. In order to believe in the existence of bubbles, one needs to question the validity of the pure form of efficient markets (read more about market efficiency). Here’s how Soros feels about market efficiency:

“I contend that financial markets always present a distorted picture of reality.”

I believe we will be in a hyper-sensitive period of bubble witch-hunting for a while, as the fresh wounds of 2008-09 heal themselves. If you get in early enough, bubbles can be profitable. Unfortunately, like a distracted teen fixated on the sunbathers at a nude beach, the excitement can lead to a painful burn if preventative sunscreen measures are not taken. Most bubble participants are too exhilarated to carry out a thoughtful exit strategy – the news can just be too tempting to jump off the top.

In his analysis of market regulation, Soros lays some of the “Great Recession” blame on the Federal Reserve and Alan Greenspan (Chairman of Fed):

“Instead of a tendency towards equilibrium, financial markets have a tendency to develop bubbles. Bubbles are not irrational: it pays to join the crowd, at least for a while. So regulators cannot count on the market to correct its excesses…The crash of 2008 was caused by the collapse of a super-bubble that has been growing since 1980. This was composed of smaller bubbles. Each time a financial crisis occurred the authorities intervened, took care of the failing institutions, and applied monetary and fiscal stimulus, inflating the super-bubble even further.”

Soros’ Recipe for Reform

What is Soros’ solution for the “Super bubble?” Here are some recommendations from his Op-Ed in the Financial Times:

- Regulator Accountability: First of all, financial authorities need to accept responsibility for preventing excesses – excuses are not an acceptable response.

- Control Credit: Rather than having static monetary targets such as margin requirements, capital reserve requirements, and loan-to-value ratios, Soros argues these metrics can be adjusted in accordance with the swinging moods of economic cycles. He punctuates the point by saying, “To control asset bubbles it is not enough to control the money supply; you must also control credit.”

- Limit Overheating in Specific Sectors: Had regulators limited lending during the real estate explosion or had the SEC limited technology IPOs in the late 1990s, perhaps our country would be in better financial health today.

- Manage Derivatives and Systemic Risk: Basically what Soros is saying here is that many market participants can become overwhelmed by certain exposures or exotic instruments, therefore it behooves regulators to proactively step in and regulate.

- Manage Too Big to Fail (read related Graham IC article): According to Soros a big reason we got into this trouble relates to the irresponsible proprietary trading departments at some of the larger banks. Responsibly separating these departments and limiting the amount of risk undertaken is an important element to the safety of our financial system.

- Reformulate Asset Holding Rules: Underestimating the risk profile of a certain security can lead to concentration issues, which can potentially generate systemic risk. Soros highlights the European Basel Accord rules as an area that can use some improvement.

Soros admits most, if not all, the measures he proposes will choke off the profitability of banks. For this reason, regulators must be very careful with the implementation and timing of these financial strategies. If employed too aggressively, the economy could find itself in a deflationary spiral. Move too slowly, and the loose monetary measures instituted by the Fed could fan the flames of inflation.

Bubbles will never go away. Eventually, the recent panic-induced fear will fade away and the entrepreneurial seeds of greed will germinate into new budding flowers of optimism. As investors nervously chomp away at their chewing gum, I will patiently await for the next financial bubble to form. I echo George Soros’s hope that regulators prick future “mini-bubbles” before they become “super-bubbles.”

Read Full George Soros Op-Ed on The Financial Times 10/25/09

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in an security referenced. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Celebrity Tax Evaders Run But Can’t Hide

As Mark Twain said, “The only certainties in life are death and taxes.” That is, of course, unless you decide to not pay your taxes. Some well known celebrities fall into this camp.

The financial crisis has hit the economy hard and the impact has been felt directly by our nation’s cash register (i.e., the Internal Revenue Service – IRS). Based on 2006 IRS data, the U.S. had about an 84% Voluntary Compliance Rate (VCR) by tax payers in 2001; a goal of 85% VCR in 2009; and Senate Finance Committee Chairman Max Baucus has thrown out a 90% voluntary compliance goal by 2017. Those collection goals may be a little ambitious given the recession and the escalating unemployment trends over 2008 – 2009.

So who makes up the deadbeats who have deliberately or unintentionally not paid their taxes? Obviously 10-15% of the non-paying tax-payer base is a large number, but the real fun comes by tracking the smaller celebrity component of the tax evaders. Let’s take a look at some of the more prominent dodgers (data provided by The Daily Beast):

- O.J. Simpson: In 2007 the state of California placed listed Mr. Simpson as one of their worst tax offenders, owing close to $1.5 million. Currently he is serving a 33-year sentence in a Nevada prison for an armed robbery and kidnapping conviction.

- Willie Nelson: The long-haired hippy and king of country music, Willie Nelson, was hunted down by the IRS for $16.7 million in 1990. Fortunately for him, his star-power allowed him to record albums and pay back his debt by 1993.

- Wesley Snipes: The Blade movie star claimed the reason he owed more than $17 million in taxes, penalties, and interest is because he was a “non-resident alien.” The judge didn’t buy the explanation, and now he is appealing a three-year prison sentence.

- Pete Rose: “Charlie Hustle,” the all-star baseball player of the Cincinnati Reds served five months in prison for not paying taxes on his autograph, memorabilia, and horse-racing income. Mr. Rose cleared the slate by performing 1,000 hours of community service and paying off $366,000 in debt.

- Nicolas Cage: Not sure if he is shooting a movie in New Orleans, but Mr. Cage is attempting to iron out a $6.2 million tax liability through a Louisiana court for his failure to keep up with 2007 taxes.

- Judy Garland: Men are not the only non-compliers, even if they account for the majority. Judy Garland, from Wizard of Oz fame, had her own tax problems. Besides tax evasion charges in the early 1950s, she accumulated about $4 million in IRS debt after her 1964 variety show (The Judy Garland Show) was cancelled.

- Al Capone: One of most well known cases in tax evasion history is tied to famous mobster Al Capone. After a long, controversial trial, Mr. Capone was convicted and handed an 11-year sentence, predominantly at Alcatraz. He got out early on parole in 1939 and kept a relatively low profile.

There are countless others that have gotten into tax problems with the IRS. Many of them make plenty of money to pay their taxes, however spending habits, laziness, or aggressive tax accountants may explain the reasons behind the tax evasion problems.

See a more complete media gallery of tax evaders here, provided by The Daily Beast.

Regardless of the celebrities’ tax-paying compliance rates, the IRS will have its collection hands full, given the sad state of the current economic environment and the crafty tax-dodging techniques pursued by some citizens. Unlike others, I’ll make sure to write myself a note, reminding me to write a check to my friends at the IRS on April 15th – especially if it involves millions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

“Bye Bye Roubini, Hello Abby”

Bye-bye” Dr. Doom” and hello “Happy Abby.” Abby Joseph Cohen is back in the spotlight with the recent market resurgence and is calling for a sustained bull market rally. The death-like sentiment spread by NYU professor Nouriel Roubini has now swung – it’s time for CNBC to call in the bulls, much like a baseball coach calls in a fresh reliever after a starter has exhausted his strength.

Over the last year, we’ve gone from full-fledged panic, into a healthy level of fear – the decline in the CBOE Volatility Index (VIX) supports this claim. But with cash still piled to the ceiling and broad indices still are about -35% below 2007 peaks, I wouldn’t say sentiment is wildly ebullient quite yet. The low-hanging fruit has been picked and now we need to tread lightly and delay the victory lap for a little longer. Market timing has never been my gig, so gag me any time I attempt a market prediction. Having said that, sentiment comprises the softer art aspects of investing, and therefore it can swing the markets wildly in the short-run. Ultimately in the long-run, profits and cash flows are what drive stock prices higher, and that’s what I pay attention to. Profits and cash flows are currently depressed and unemployment remains high by historical standards, but there are signs of recovery. Cohen highlights easy profit comparisons in the second half of 2009 (versus 2008), coupled with inventory replenishment, as significant factors that can lead to larger than anticipated surges in early economic cycle recoveries. Whether the pending economic advance is sustainable is a question that Cohen would not address.

Investors are emotional creatures, and CNBC realizes this fact. Before investing in that 30-1 leveraged, long-only hedge fund, prudence should reign supreme as we start to see some of the previously bullish strategists begin crawling out of their caves – including perma-bull Abby Joseph Cohen.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Pinning Down Roubini Requires a Lasso

Pinning down a Nouriel Roubini forecast is like lassoing a frenzied cow. They say a broken clock is right twice a day, and maybe the same principle applies to renowned economist, Professor Roubini (NYU)? Sure, credit should be given where credit is due. He nailed the forecast relating to the housing led financial bubble and subsequent financial collapse – even if the prediction was years early.

Here’s where I have a beef. Now that Roubini has become a celebrated rock star with frequent television interviews and speaking engagements, his touring views are becoming more fluid and slippery as time progresses. Sure it’s more comfortable to ride the fence and lean in whatever direction the weekly economic winds are blowing. I suppose if you throw out enough changing viewpoints, which adjust to evolving moods, you can never be wrong.

Let’s examine some of his views:

- Out of Context: Just last week, Mr. Roubini said the “worst is behind us,” but in order to retain his “Dr. Doom” celebrity status he felt compelled to issue a press release clarifying his statements. He noted his “views were taken out of context,” and added, “I have said on numerous occasions that the recession would last roughly 24 months.” That’s funny, because he just stated last year it would be 12-18 months (Click Here for Video).

- Sweating Out Rebound: Maybe the 41% bounce in the S&P 500 or the 49% jump in the NASDAQ from March 9th lows compelled Roubini to make the “worst is behind us” comments, but why then at the beginning of this year did he say, “We are still only in the early stages of this crisis. My predictions for the coming year, unfortunately, are even more dire: The bubbles, and there were many, have only begun to burst.” Hmmm…excuse me while I scratch my head.

- Alphabet Soup Recovery: Also frustrating are the John Kerry-esque waffling comments relating to whether this economic recovery will be a U, W, or L-shaped economic recovery. Last April he was in the U-camp: “My view is closer to a U-shaped recession as I expect that the economic contraction will last at least 12 months and possibly as long as 18 months through the middle of 2009.” Now, as early as last month Roubini is warning of a double dip or “W-shaped” recovery with the rising possibility of a “perfect storm” in 2010 (Click Here for Video). He sees the expiration of tax cuts, rising oil prices, inflating debt and interest rates leading to another downturn. So is it U or W, or will we hear more about an “L” shaped recovery? Maybe the worst is not behind us? I’m confused.

- Doomsday Earnings Yet to Arrive: Still early in the quarterly earnings reporting season but Roubini’s call for a downside in corporate earnings has yet to materialize. As a matter of fact, Zacks Investment Research reported last week that early second quarter upside surprises are beating downside surprises by a ratio of 7 to 1. So far not too “Doom-full.”

I’m no economist or recovery expert, but what I do know is that I’m having difficulty pinning down Professor Roubini’s ever-changing views. I suppose I will just mail CNBC, Bloomberg, or the bevy of other Roubini media groupies a lasso in hopes they will pin Mr. Roubini down.

Wade W. Slome, CFA, CFP®

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

California the Golden State Turning Brown

California is facing a significant cash crunch as the state attempts the narrowing of its $24 billion budget deficit. The crisis will come to a head now that the fiscal year, June 2009, budget deadline has passed. Without a budget resolution and in order to fill the budget gap, the California government will need to start issuing billions of government IOUs to contractors and vendors, local agencies handling health programs, as well as some receiving state aid.

California is facing a significant cash crunch as the state attempts the narrowing of its $24 billion budget deficit. The crisis will come to a head now that the fiscal year, June 2009, budget deadline has passed. Without a budget resolution and in order to fill the budget gap, the California government will need to start issuing billions of government IOUs to contractors and vendors, local agencies handling health programs, as well as some receiving state aid.

Moodys rates the Golden State as the lowest rated state of all 50 at A2. The average rating for all states is AA2 and only two other states besides California are rated below AA. At the beginning of 2009 the state bought some breathing room by delaying cash tax refunds, but that cushion has rapidly deteriorated as the economy and employment outlook have deteriorated. Making things worse for the state, relative to other states, is the state constitutional inflexibility requiring voter approval for deficit borrowing.

Time will tell if Governor Schwarzenegger can gather the votes necessary to prevent bond defaults. President Obama and other states are watching closely as the actions (or inactions) will have a ripple through effect for everyone. At 13% of the nation’s GDP, California’s economy impacts the overall country in a significant manner.

Let’s hope the state maintains its “golden” status and does not get burnt.

Is the Recession Over?

Dennis Kneale, bullish commentator on CNBC presented his case on why he thinks the recession is over:

Positive Technical Indicators: Kneale points out that in recent history when the 50-day moving price average cuts upward through the 200-day moving average there is a positive directional bias for the market in the ensuing months.

Personal Income: +1.4% in May for 2 consecutive months.

Personal Spending: Consumer spending was up again in May, and up more than in April.

University of Michigan Consumer Sentiment: The survey rose again to a reading of 70.8 in the recent measurement period.

VIX Volatity Index: The so called “Fear Index” is down -43% in about 3 months – stabilizing to a more normalized level. He argues this should bring in some cash on the sidelines into the stock market.

Eric Schmidt Positive: CEO of search giant, Google, says the worst is behind for the U.S. economy.

Most of the guests rang a more cautious tone, not the least of which, Peter Schiff sees Armageddon ahead for the U.S. economy. Mr. Schiff goes on to compare CNBC to the Gardening channel with all the talk about “green shoots.” Not to mention, he sees the trillions of stimulus dollars only providing a temporary, artificial boost that will eventually cause a horrible economic hangover. Lucky for Peter, he has perfectly timed the international rebound in 2009…cough, cough.