Posts tagged ‘economy’

Market Champagne Sits on Ice

Summer may be coming to an end, but the heat in the stock market has not cooled down, as the stock market registered its hottest August performance in 14 years (S&P 500 index up +3.8%). With these stellar results, one would expect the corks to be popping, cash flowing into stocks, and the champagne flowing. However, for numerous reasons, we have not seen this phenomenon occur yet. Until the real party begins, I suppose the champagne will stay on ice.

At the end of last year, I wrote further about the inevitable cash tsunami topic in an article entitled, “Here Comes the Dumb Money.” At that point in time, stocks had remarkably logged an approximate +30% return, and all indications were pointing towards an upsurge of investor interest in the stock market. So far in 2014, the party has continued as stocks have climbed another +8.4% for the year, but a lot of the party guests have not arrived yet. With the water temperature in the pool being so enticing, one would expect everyone to jump in the stock market pool. Actually, we have seen the opposite occur as -$12 billion has been pulled out of U.S. stock funds so far in 2014 (see ICI chart below).

How can the market be up +8.4% when money is coming out of stocks? For starters, companies are buying stock by the hundreds of billions of dollars. An estimated $480 billion of stock was purchased by corporations last year via share repurchase authorizations. Adding fuel to the stock fire are near record low interest rates. The ultra-low rates have allowed companies to borrow money at unprecedented rates for the purpose of not only buying back chunks of stock, but also buying the stock of whole companies (Mergers & Acquisitions). Thomson Reuters estimates that M&A activity in 2014 has already reached $2.2 trillion, up more than +70% compared to the same period last year.

Another factor contributing to the lackluster appetite for stocks is the general public’s apathy and disinterest in the market. This disconnected sentiment was captured beautifully by a recent Gallup survey, which asked people the following question:

As you can see, only 7% of the respondents realized that stocks were up by more than +30% in 2013. More specifically, the S&P 500 (Large Cap) index was up +29.6%, S&P 600 (Small Cap) +39.7%, and the S&P 400 (Mid Cap) +31.6% (all percentages exclude dividends). Despite these data points, if taken with near 15-year low household stock ownership data, the results prove sentiment is nowhere near the euphoric phases reached before the 2000 bubble burst or the 2006-2008 real estate collapse.

Beyond the scarring effects of the 2008-2009 financial crisis, tempered moods regarding stocks can also be attributed to fresher geopolitical concerns (i.e., military tensions in Ukraine, Islamic extremists in Iraq, and missile launches from the Gaza Strip). The other area of never-ending anxiety is Federal Reserve monetary policy. The stock market, which has tripled in value from early 2009, has skeptics continually blaming artificial Quantitative Easing/QE policies (stimulative bond purchases) as the sole reason behind stocks advance. With current Fed Chair Janet Yellen pulling 70% of the QE punch bowl away (bond purchases now reduced to $25 billion per month), the bears are having a difficult time explaining rising stock prices and declining interest rates. Once all $85 billion in monthly QE purchases are expected to halt in October, skeptics will have one less leg on their pessimistic stool to sit on.

Economy and Profits Play Cheery Tune

While geopolitical and Federal Reserve clouds may be preventing many sourpusses from joining the stock party, recent economic and corporate data have party attendees singing a cheery tune. More specifically, the broadest measurement of economic activity, GDP (Gross Domestic Product), came in at a higher-than-expected level of +4.2% for the 2nd quarter (see Wall Street Journal chart below).

Moreover, the spike in July’s Durable Goods orders also paints a healthy economic picture (see chart below). The data is volatile (i.e., Boeing Co orders – BA), nevertheless, CEO confidence is on the rise. Improved confidence results in executives opening up their wallets and investing more into their businesses.

Source: Calafia Beach Pundit

Last but not least, the lifeblood of appreciating stock prices (earnings/profits) have been accelerating higher. In the most recent quarterly results, we saw a near doubling of the growth rate from 1st quarter’s +5% growth rate to 2nd quarter’s +10% growth rate (see chart below).

Source: Dr. Ed’s Blog

With the S&P 500 continuing to make new record highs despite scary geopolitical and Federal Reserve policy concerns, the stock market party is still waiting for guests to arrive. When everyone arrives and jumps in the pool, it will be time to pop the corks and sell. Until then, there is plenty of appreciation potential as the champagne sits on ice.

Psst…Do You Want to Join the Club?

#2. Don’t waste your time listening to the media.

Like dieting, the framework is simple to understand, but difficult to execute. Theoretically, if you follow Rule #1, you don’t have worry about Rule #2. Unfortunately, many people have no rules or discipline in place, and instead let their emotions drive all investing decisions. When it comes to following the media, Mark Twain stated it best:

“If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.”

It’s fine to be informed, as long as the deluge of data doesn’t enslave you into bad, knee-jerk decision-making. You’ve seen those friends, family members and co-workers who are glued to their cell phones or TVs while insatiably devouring real-time data from CNBC, CNN, or their favorite internet blog. The grinding teeth and sweaty palms should be a dead giveaway that these habits are not healthy for investment account balances or blood pressure.

Thanks to the endless scary headlines and stream of geopolitical turmoil (fear sells), millions of investors have missed out on one of the most staggering bull market rallies in history. More specifically, the S&P 500 index (large capitalization companies) has almost tripled in value from early 2009 (666 to 1,931) and the S&P 600 index (small capitalization companies) almost quadrupled from 181 to 645.

The Challenge

Becoming a member of the Successful Investors Club (SIC) is no easy feat. As I’ve written in the past, the human brain has evolved dramatically over tens of thousands of years, but the troubling, emotionally-driven amygdala tissue mass at the end of the brain stem (a.k.a., “Lizard Brain“) still remains. The “Lizard Brain” automatically produces a genetic flight response to perceived worrisome stimuli surrounding us. In other words, our “Lizard Brain” often interprets excessively sensationalized current events as a threat to our financial security and well-being.

It’s no wonder amateur investors have trouble dealing with the incessantly changing headlines. Yesterday, investors were panicked over the P.I.I.G.S (Portugal, Italy, Ireland, Greece, Spain), the Arab Spring (Tunisia, Egypt, Iran, etc.), and Cyprus. Today, it’s Ukraine, Argentina, Israel, Gaza, Syria, and Iraq. Tomorrow…who knows? It’s bound to be another fiscally irresponsible country, terrorist group, or autocratic leader wreaking havoc upon their people or enemies.

During the pre-internet or pre-smartphone era, the average person couldn’t even find Ukraine, Syria, or the Gaza Strip on a map. Today, we are bombarded 24/7 with frightening stories over these remote regions that have dubious economic impact on the global economy.

Take the Ukraine for example, which if you think about it is a fiscal pimple on the global economy. Ukraine’s troubled $177 billion economy, represents a mere 0.29% of the $76 trillion global GDP. Could an extended or heightened conflict in the region hinder the energy supply to a much larger and significant European region? Certainly, however, Russian President Vladimir Putin doesn’t want the Ukrainian skirmish to blow up out of control. Russia has its own economic problems, and recent U.S. and European sanctions haven’t made Putin’s life any easier. The Russian leader has a vested economic interest to keep its power hungry European customers happy. If not, the U.S.’s new found resurgence in petroleum supplies from fracking will allow our country to happily create jobs and export excess reserves to a newly alienated EU energy buyer.

The Solution

Rather than be hostage to the roller coaster ride of rising and falling economic data points, it’s better to follow the sage advice of investing greats like Peter Lynch, who averaged a +29% return per year from 1977 – 1990.

Here’s what he had to say about news consumption:

“If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.”

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Rather than fret about the direction of the market, at Sidoxia Capital Management we are focused on identifying the best available opportunities, given any prevailing economic environment (positive or negative). We assume the market will go nowhere and invest our client assets (and personal assets) accordingly by focusing on those areas we see providing the most attractive risk-adjusted returns. Investors who try to time the market, fail miserably over the long-run. If timing the market were easy, you would see countless people’s names at the tops of the Forbes billionaire list – regrettably that simply is not the case.

Since “fear” sells in the media world, it’s always important to sift through the deluge of data to gain a balanced perspective. During panic periods, it’s important to find the silver linings. When everyone is euphoric, it’s vital to discover reasons for caution.

While a significant amount of geopolitical turmoil occurred last month, it’s essential to remember the underlying positive fundamentals propelling the stock market to record highs. The skeptics of the recovery and record stock market point to the Federal Reserve’s unprecedented, multi-trillion dollar money printing scheme (Quantitative Easing – QE) and the inferior quality of the jobs created. Regarding the former point, if QE has been so disastrous, I ask where is the run-away inflation (see chart below)? While the July jobs report may show some wage pressure, you can see we’re still a long ways away from the elevated pricing levels experienced during the 1970s-1980s.

Source: Calafia Beach Pundit

A final point worth contemplating as it relates to the unparalleled Fed Policy actions was highlighted by strategist Scott Grannis. If achieving real economic growth through money printing was so easy, how come Zimbabwe and Argentina haven’t become economic powerhouses? The naysayers also fail to acknowledge that the Fed has already reversed the majority of its stimulative $85 billion monthly bond buying program (currently at $25 billion per month). What’s more, the Federal Open Market Committee has already signaled a rate hike to 1.13% in 2015 and 2.50% in 2016 (see chart below).

Source: Financial Times

The rise in interest rates from generationally low levels, especially given the current status of our improving economy, as evidenced by the recent robust +4.0% Q2-GDP report, is inevitable. It’s not a matter of “if”, but rather a matter of “when”.

On the latter topic of job quality, previously mentioned, I can’t defend the part-time, underemployed nature of the employment picture, nor can I defend the weak job participation rate. In fact, this economic recovery has been the slowest since World War II. With that said, about 10 million private sector jobs have been added since the end of the Great Recession and the unemployment rate has dropped from 10% to 6.1%. However you choose to look at the situation, more paychecks mean more discretionary dollars in the wallets and purses of U.S. workers. This reality is important because consumer spending accounts for 70% of our country’s economic activity.

While there is a correlation between jobs, interest rates, and the stock market, less obvious to casual observers is the other major factor that drives stock prices…record corporate profits. That’s precisely what you see in the chart below. Not only are trailing earnings at record levels, but forecasted profits are also at record levels. Contrary to all the hyped QE Fed talk, the record profits have been bolstered by important factors such as record manufacturing, record exports, and soaring oil production …not QE.

Join the Club

Those who have been around the investing block a few times realize how challenging investing is. The deafening information noise instantaneously accessed via the internet has only made the endeavor of investing that much more challenging. But the cause is not completely lost. If you want to join the bull market and the SIC (Successful Investors Club), all you need to do is follow the two top secret rules. Creating a plan and sticking to it, while ignoring the mass media should be easy enough, otherwise find an experienced, independent investment advisor like Sidoxia Capital Management to help you join the club.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds ans securities, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Only Thing to Fear is the Unknown Itself

Martin Luther King, Jr. famously stated, “The only thing we have to fear is fear itself,” but when it comes to the stock market, the only thing to fear is the “unknown.” As much as people like to say, “I saw that crisis coming,” or “I knew the bubble was going to burst,” the reality is these assertions are often embellished, overstated, and/or misplaced.

How many people saw these events coming?

- 1987 – Black Monday

- Iraqi War

- Thai Baht Currency Crisis

- Long-Term Capital Management Collapse & Bailout

- 9/11 Terrorist Attack

- Lehman Brothers Bankruptcy / Bear Stearns Bailout

- Flash Crash

- U.S. Debt Downgrade

- Arab Spring

- Sequestration Cuts

- Cyprus Financial Crisis

- Federal Reserve (QE1, QE2, QE3, Operation Twist, etc.)

Sure, there will always be a prescient few who may actually get it right and profit from their crystal balls, but to assume you are smart enough to predict these events with any consistent accuracy is likely reckless. Even for the smartest and brightest minds, uncertainty and doubt surrounding such mega-events leads to inaction or paralysis. If profiting in advance of these negative outcomes was so easy, you probably would be basking in the sun on your personal private island…and not reading this article.

Coming to grips with the existence of a never-ending series of future negative financial shocks is the price of doing business in the stock market, if you want to become a successful long-term investor. The fact of the matter is with 7 billion people living on a planet orbiting the sun at 67,000 mph, the law of large numbers tells us there will be many unpredictable events caused either by pure chance or poor human decisions. As the great financial crisis of 2008-2009 proved, there will always be populations of stupid or ignorant people who will purposely or inadvertently cause significant damage to economies around the world.

Fortunately, the power of democracy (see Spreading the Seeds of Democracy) and the benefits of capitalism have dramatically increased the standards of living for hundreds of millions of people. Despite horrific outcomes and unthinkable atrocities perpetrated throughout history, global GDP and living standards continue to positively march forward and upward. For example, consider in my limited lifespan, I have seen the introduction of VCRs, microwave ovens, mobile phones, and the internet, while experiencing amazing milestones like the eradication of smallpox, the sequencing of the human genome, and landing space exploration vehicles on Mars, among many other unimaginable achievements.

Despite amazing advancements, many investors are paralyzed into inaction out of fear of a harmful outcome. If I received a penny for every negative prediction I read or heard about over my 20+ years of investing, I would be happily retired. The stock market is never immune from adverse events, but chances are a geopolitical war in Ukraine/Iraq; accelerated Federal Reserve rate tightening; China real estate bubble; Argentinian debt default; or other current, worrisome headline is unlikely to be the cause of the next -20%+ bear market. History shows us that fear of the unknown is more rational than the fear of the known. If you can’t come to grips with fear itself, I fear your long-term results will lead to a scary retirement.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Buy in May and Tap Dance Away

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (May 1, 2014). Subscribe on the right side of the page for the complete text.

The proverbial Wall Street adage that urges investors to “Sell in May, and go away” in order to avoid a seasonally volatile period from May to October has driven speculative trading strategies for generations. The basic premise behind the plan revolves around the idea that people have better things to do during the spring and summer months, so they sell stocks. Once the weather cools off, the thought process reverses as investors renew their interest in stocks during November. If investing was as easy as selling stocks on May 1 st and then buying them back on November 1st, then we could all caravan in yachts to our private islands while drinking from umbrella-filled coconut drinks. Regrettably, successful investing is not that simple and following naïve strategies like these generally don’t work over the long-run.

Even if you believe in market timing and seasonal investing (see Getting Off the Market Timing Treadmill ), the prohibitive transaction costs and tax implications often strip away any potential statistical advantage.

Unfortunately for the bears, who often react to this type of voodoo investing, betting against the stock market from May – October during the last two years has been a money-losing strategy. Rather than going away, investors have been better served to “Buy in May, and tap dance away.” More specifically, the S&P 500 index has increased in each of the last two years, including a +10% surge during the May-October period last year.

Nervous? Why Invest Now?

With the weak recent economic GDP figures and stock prices off by less than 1% from their all-time record highs, why in the world would investors consider investing now? Well, for starters, one must ask themselves, “What options do I have for my savings…cash?” Cash has been and will continue to be a poor place to hoard funds, especially when interest rates are near historic lows and inflation is eating away the value of your nest-egg like a hungry sumo wrestler. Anyone who has completed their income taxes last month knows how pathetic bank rates have been, and if you have pumped gas recently, you can appreciate the gnawing impact of escalating gasoline prices.

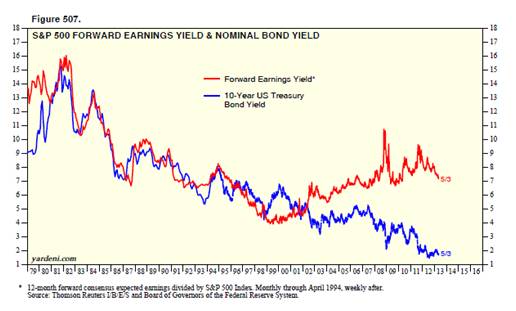

While there are selective opportunities to garner attractive yields in the bond market, as exploited in Sidoxia Fusion strategies, strategist and economist Dr. Ed Yardeni points out that equities have approximately +50% higher yields than corporate bonds. As you can see from the chart below, stocks (blue line) are yielding profits of about +6.6% vs +4.2% for corporate bonds (red line). In other words, for every $100 invested in stocks, companies are earning $6.60 in profits on average, which are then either paid out to investors as growing dividends and/or reinvested back into their companies for future growth.

Source: Dr. Ed’s Blog

Hefty profit streams have resulted in healthy corporate balance sheets, which have served as ammunition for the improving jobs picture. At best, the economic recovery has moved from a snail’s pace to a tortoise’s pace, but nevertheless, the unemployment rate has returned to a more respectable 6.7% rate. The mended economy has virtually recovered all of the approximately 9 million private jobs lost during the financial crisis (see chart below) and expectations for Friday’s jobs report is for another +220,000 jobs added during the month of April.

Source: Bespoke

Wondrous Wing Woman

Investing can be scary for some individuals, but having an accommodative Fed Chair like Janet Yellen on your side makes the challenge more manageable. As I’ve pointed out in the past (with the help of Scott Grannis), the Fed’s stimulative ‘Quantitative Easing’ program counter intuitively raised interest rates during its implementation. What’s more, Yellen’s spearheading of the unprecedented $40 billion bond buying reduction program (a.k.a., ‘Taper’) has unexpectedly led to declining interest rates in recent months. If all goes well, Yellen will have completed the $85 billion monthly tapering by the end of this year, assuming the economy continues to expand.

In the meantime, investors and the broader financial markets have begun to digest the unwinding of the largest, most unprecedented monetary intervention in financial history. How can we tell this is the case? CEO confidence has improved to the point that $1 trillion of deals have been announced this year, including offers by Pfizer Inc. – PFE ($100 billion), Facebook Inc. – FB ($19 billion), and Comcast Corp. – CMCSA ($45 billion).

Source: Entrepreneur

Banks are feeling more confident too, and this is evident by the acceleration seen in bank loans. After the financial crisis, gun-shy bank CEOs fortified their balance sheets, but with five years of economic expansion under their belts, the banks are beginning to loosen their loan purse strings further (see chart below).

The coast is never completely clear. As always, there are plenty of things to worry about. If it’s not Ukraine, it can be slowing growth in China, mid-term elections in the fall, and/or rising tensions in the Middle East. However, for the vast majority of investors, relying on calendar adages (i.e., selling in May) is a complete waste of time. You will be much better off investing in attractively priced, long-term opportunities, and then tap dance your way to financial prosperity.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in PFE, CMCSA, and certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in FB or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Goldilocks Meets the Fragile 5 and the 3 Bears

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 3, 2014). Subscribe on the right side of the page for the complete text.

The porridge for stock market investors was hot in 2013, with the S&P 500 index skyrocketing +30%, while the porridge for bond investors was too cold, losing -4% last year (AGG). Like Goldilocks, investors are waiting to get more aggressive with their investment portfolios once everything feels “just right.” Dragging one’s feet too long is not the right strategy. Counterintuitively, and as I pointed out in “Here Comes the Dumb Money,” the investing masses have been very bashful in committing large sums of money out of cash/bonds into stocks, despite the Herculean returns experienced in the stock market over the last five years.

Once the party begins to get crowded is the period you should plan your exit. As experienced investors know, when the porridge, chair, and bed feel just right, is usually around the time the unhappy bears arrive. The same principle applies to the investing. In the late 1990s (i.e., technology bubble) and in the mid-2000s (i.e., housing bubble) everyone binged on tech stocks and McMansions with the help of loose credit. Well, we all know how those stories ended…the bears eventually arrived and left a bunch of carnage after tearing apart investors.

Fragile 5 Bed Too Hard

After enjoying some nice porridge at a perfect temperature in 2013, Goldilocks and investors are now searching for a comfortable bed. The recent volatility in the emerging markets has caused some lost sleep for investors. At the center of this sleeplessness are the financially stressed countries of Argentina and the so-called “Fragile Five” (Brazil, India, Indonesia, Turkey and South Africa) – still not sure why they don’t combine to call the “Sick Six” (see chart below).

|

| Source: Financial Times |

Why are these countries faced with the dilemma of watching their currencies plummet in value? One cannot overly generalize for each country, but these dysfunctional countries share a combination of factors, including excessive external debt (loans denominated in U.S. dollars), large current account deficits (trade deficits), and small or shrinking foreign currency reserves. This explanation may sound like a bunch of economic mumbo-jumbo, but at a basic level, all this means is these deadbeat countries are having difficulty paying their lenders and trading partners back with weaker currencies and depleted foreign currency reserves.

Many pundits, TV commentators, and bloggers like to paint a simplistic picture of the current situation by solely blaming the Federal Reserve’s tapering (reduction) of monetary stimulus as the main reason for the recent emerging markets sell-off. It’s true that yield chasing investors hunted for higher returns in in emerging market bonds, since U.S. interest rates have bounced around near record lows. But the fact of the matter is that many of these debt-laden countries were already financially irresponsible basket cases. What’s more, these emerging market currencies were dropping in value even before the Federal Reserve implemented their stimulative zero interest rate and quantitative easing policies. Slowing growth in China and other developed countries has made the situation more abysmal because weaker commodity prices negatively impact the core economic engines of these countries.

Argentina’s Adversity

In reviewing the struggles of some emerging markets, let’s take a closer look at Argentina, which has seen its currency (peso) decline for years due to imprudent and inflationary actions taken by their government and central bank. More specifically, Argentina tried to maintain a synchronized peg of their peso with the U.S. dollar by manipulating its foreign currency rate (i.e., Argentina propped up their currency by selling U.S. dollars and buying Argentinean pesos). That worked for a little while, but now that their foreign currency reserves are down -45% from their 2011 peak (Source: Scott Grannis), Argentina can no longer realistically and sustainably purchase pesos. Investors and hedge funds have figured this out and as a result put a bulls-eye on the South American country’s currency by selling aggressively.

Furthermore, Argentina’s central bank has made a bad situation worse by launching the money printing presses. Artificially printing additional money may help in paying off excessive debts, but the consequence of this policy is a rampant case of inflation, which now appears to be running at a crippling 25-30% annual pace. Since the beginning of last year, pesos in the black market are worth about -50% less relative to the U.S. dollar. This is a scary developing trend, but Argentina is no stranger to currency problems. In fact, during 2002 the value of the Argentina peso declined by -75% almost overnight compared to the dollar.

Each country has unique nuances regarding their specific financial currency pickles, but at the core, each of these countries share a mixture of these debt, deficit, and currency reserve problems. As I have stated numerous times in the past, money ultimately moves to the place(s) it is treated best, and right now that includes the United States. In the short-run, this state of affairs has strengthened the value of the U.S. dollar and increased the appetite for U.S. Treasury bonds, thereby pushing up our bond prices and lowering our longer-term interest rates.

Their Cold is Our Warm

Overall, besides the benefits of lower U.S. interest rates, weaker foreign currencies lead to a stronger dollar, and a stronger U.S. currency means greater purchasing power for Americans. A stronger dollar may not support our exports of goods and services (i.e., exports become more expensive) to our trading partners, however a healthy dollar also means individuals can buy imported goods at cheaper prices. In other words, a strong dollar should help control inflation on imported goods like oil, gasoline, food, cars, technology, etc.

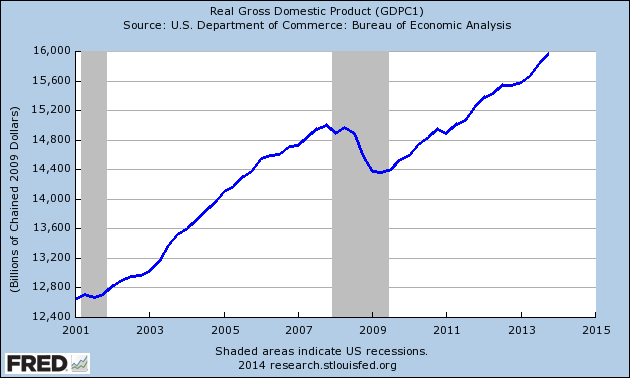

While emerging markets have cooled off fairly quickly, the temperature of our economic porridge in the U.S. has been quite nice. Most recently, the broadest barometer of economic growth (Real GDP) showed a healthy +3.2% acceleration in the 4th quarter to a record of approximately $16 trillion (see chart below).

|

| Source: Crossing Wall Street |

Moreover, corporate profits continue to come in at decent, record-setting levels and employment trends remain healthy as well. Although job numbers have been volatile in recent weeks and discouraged workers have shrunk the overall labor pool, nevertheless the unemployment rate hit a respectable 6.7% level last month and the positive initial jobless claims trend remains at a healthy level (see chart below).

Skeptics of the economy and stock market assert the Fed’s continued retrenchment from quantitative easing will only exacerbate the recent volatility experienced in emerging market currencies and ultimately lead to a crash. If history is any guide, the growl from this emerging market bear may be worse than the bite. The last broad-based, major currency crisis occurred in Asia during 1997-1998, yet the S&P 500 was up +31% in 1997 and +27% in 1998. If history serves as a guide, the past may prove to be a profitable prologue. So rather than running and screaming in panic from the three bears, investors still have some time to enjoy the nice warm porridge and take a nap. The Goldilocks economy and stock market won’t last forever though, so once the masses are dying to jump in the comfy investment bed, then that will be the time to run for the hills and leave the latecomers to deal with the bears.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in AGG, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

What’s Going on with This Crazy Market?!

The massive rally of the stock market since March 2009 has been perplexing for many, but the state of confusion has reached new heights as the stock market has surged another +2.0% in May, surpassing the Dow 15,000 index milestone and hovering near all-time record highs. Over the last few weeks, the volume of questions and tone of disbelief emanating from my social circles has become deafening. Here are some of the questions and comments I’ve received lately:

“Wade, why in the heck is the market up so much?”; “This market makes absolutely no sense!”; “Why should I buy at the peak when I can buy at the bottom?”; “With all this bad news, when is the stock market going to go down?”; “You must be shorting (betting against) this market, right?”

If all the concerns about the Benghazi tragedy, IRS conservative targeting, and Federal Reserve bond “tapering” are warranted, then it begs the question, “How can the Dow Jones and other indexes be setting new all-time highs?” In short, here are a few reasons:

You hear a lot of noise on TV and read a lot of blathering in newspapers/blogs, but what you don’t hear much about is how corporate profits have about tripled since the year 2000 (see red line in chart above), and how the profit recovery from the recent recession has been the strongest in 55 years (Scott Grannis). The profit collapse during the Great Recession was closely chronicled in nail-biting detail, but a boring profit recovery story sells a lot less media advertising, and therefore gets swept under the rug.

II.) Reasonable Prices (Comparing Apples & Oranges):

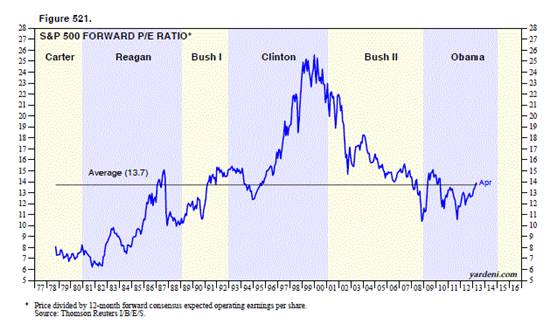

Source: Dr. Ed’s Blog

The Price-Earnings ratio (P/E) is a general barometer of stock price levels, and as you can see from the chart above (Ed Yardeni), current stock price levels are near the historical average of 13.7x – not at frothy levels experienced during the late-1990s and early 2000s.

Comparing Apples & Oranges:

At the most basic level of analysis, investors are like farmers who choose between apples (stocks) and oranges (bonds). On the investment farm, growers are generally going to pick the fruit that generates the largest harvest and provide the best return. Stocks (apples) have historically offered the best prices and yielded the best harvests over longer periods of time, but unfortunately stocks (apples) also have wild swings in annual production compared to the historically steady crop of bonds (oranges). The disastrous apple crop of 2008-2009 led a massive group of farmers to flood into buying a stable supply of oranges (bonds). Unfortunately the price of growing oranges (i.e., buying bonds) has grown to the highest levels in a generation, with crop yields (interest rates) also at a generational low. Even though I strongly believe apples (stocks) currently offer a better long-term profit potential, I continue to remind every farmer (investor) that their own personal situation is unique, and therefore they should not be overly concentrated in either apples (stocks) or oranges (bonds).

Source: Dr. Ed’s Blog

Regardless, you can see from the chart above (Dr. Ed’s Blog), the red line (stocks) is yielding substantially more than the blue line (bonds) – around 7% vs. 2%. The key for every investor is to discover an optimal balance of apples (stocks) and oranges (bonds) that meets personal objectives and constraints.

III.) Skepticism (Market Climbs a Wall of Worry):

Source: Calafia Beach Pundit

Although corporate profits are strong, and equity prices are reasonably priced, investors have been withdrawing hundreds of billions of dollars from equity funds (negative blue lines in chart above – Calafia Beach Pundit). While the panic of 2008-2009 has been extinguished from average investors’ psyches, the Recession in Europe, slowing growth in China, Washington gridlock, and the fresh memories of the U.S. financial crisis have created a palpable, nervous skepticism. Most recently, investors were bombarded with the mantra of “Selling in May, and Going Away” – so far that advice hasn’t worked so well. To buttress my point about this underlying skepticism, one need not look any further than a recent CNBC segment titled, “The Most Confusing Market Ever” (see video below):

It’s clear that investors remain skittish, but as legendary investor Sir John Templeton so aptly stated, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” The sentiment pendulum has been swinging in the right direction (see previous Investing Caffeine article), but when money flows sustainably into equities and optimism/euphoria rules the day, then I will become much more fearful.

Being a successful investor or a farmer is a tough job. I’ll stop growing apples when my overly optimistic customers beg for more apples, and yields on oranges also improve. In the meantime, investors need to remember that no matter how confusing the market is, don’t put all your oranges (bonds) or apples (stocks) in one basket (portfolio) because the financial markets do not need to get any crazier than they are already.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bin Laden Killing Overshadows Royal Rally

Excerpt from No-Cost May Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Before the announcement of the killing of the most wanted terrorist in the world, Osama bin Laden, the royal wedding of Prince William Arthur Philip Louis and Catherine Middleton (Duke and Duchess of Cambridge) grabbed the hearts, headlines, and minds of people around the world. As we exited the month, a less conspicuous royal rally in the U.S. stock market has continued into May, with the S&P 500 index climbing +2.8% last month as the economic recovery gained firmer footing from the recession of 2008 and early 2009. As always, there is no shortage of issues to worry about as traders and speculators (investors not included) have an itchy sell-trigger finger, anxiously fretting over the possibility of losing gains accumulated over the last two years.

Here are some of the attention-grabbing issues that occurred last month:

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Skyrocketing Silver Prices: Silver surged ahead +28% in April, the largest monthly gain since April 1987, and reached a 30-year high in price before closing at around $49 per ounce at the end of the month. Speculators and investors have been piling into silver as evidenced by activity in the SLV (iShares Silver Trust) exchange traded fund, which on occasion has seen its daily April volume exceed that of the SPY (iShares SPDR S&P 500) exchange traded fund.

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain commodity and S&P 500 exchange traded funds, but at the time of publishing SCM had no direct position in SLV, SPY, TWX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Bears Hibernate During Melt-Up

Here we are 719 days from the market bottom of March 2009, and the S&P 500 has more than doubled from its index low value of 666 to 1343 today. Noticeably absent during the meteoric rise have been the hibernating bears, like economist Nouriel Roubini (aka “Dr. Doom”) or Peter Schiff (see Emperor Schiff Has No Clothes), who blanketed the airwaves in 2008-2009 when financial markets were spiraling downwards out of control. The mere fact that I am writing about this subject may be reason enough to expect a 5-10% correction, but with a +100% upward move in stock prices I am willing to put superstition aside and admire the egg on the face of the perma-bears.

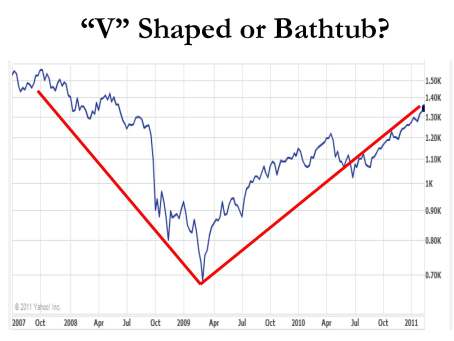

Shape of Recovery

After it became clear that the world was not coming to an end, in late 2009 and throughout 2010, the discussion switched from the likelihood of a “Great Depression” to a debate over the shape of the alphabet letter economic recovery. Was the upturn going to be an L-shaped, V-shaped, square root-shaped, or what Roubini expected – a U-shaped (or bathtub-shaped) recovery? You be the judge — does six consecutive quarters of GDP expansion with unemployment declining look like a bathtub recovery to you?

This picture above looks more like a “V” to me, and the recently reported Institute for Supply Management’s (ISM) manufacturing index figure of 60.8 in January (the highest reading in seven years) lends credence to a stronger resurgence in the economy. Apparently the PIMCO bear brothers, Mohamed El-Erian and Bill Gross, are upwardly adjusting their view of a “New Normal” environment as well. Just recently, the firm raised its 2011 GDP forecast by 40-50% to a growth rate of 3-3.5% in 2011.

The Bears’ Logic

Bears continually explain away the market melt-up as a phenomenon caused by excessive and artificial liquidity creation (i.e., QE2 money printing, and 0% interest rate policy) Bernanke has provided the economy. Similar logic could be used to describe the excessive and artificial debt creation generated by individuals, corporations, and governments during the 2008-2009 meltdown. Now that leveraged positions are beginning to unwind (banks recapitalizing, consumers increasing savings rate, state and government austerity and tax measures, etc.), the bears still offer little credit to these improving trends.

Are we likely to experience another +100% upward move in stock prices in the broader indexes over the next two years? Unlikely. Our structural government debt and deficits, coupled with elevated unemployment and fiercer foreign competition are all factors creating economic headwinds. Moreover, inflation is starting to heat up and a Federal Funds rate policy cannot stay at 0% forever.

The Shapes of Rebounds

To put the two-year equity market recovery in historical perspective, the Financial Times published a 75-year study which showed the current market resurgence (solid red line) only trailing the post-Great Depression rebound of 1935-1938.

Although we are absolutely not out of the economic woods and contrarian sentiment indicators (i.e., Volatility Index and Put-Call ratio) are screaming for a pullback, the foundation of a sustainable global recovery has firmed despite the persisting chaos occurring in the Middle East. Fourth quarter 2010 corporate profits (and revenues) once again exceeded expectations, valuations remain attractive, and floods of itchy retail cash still remain on the sidelines just waiting to jump in and chase the upward march in equity prices. Although the trajectory of stock prices over the next two years is unlikely to look like the last two years, there is still room for optimism (as I outlined last year in Genesis of Cheap Stocks). The low-hanging equity fruit has been picked over the last few years, and I’m certain that bears like Roubini, Schiff, El-Erian, Gross, et.al. will eventually come out of hibernation. For those investors not fully invested, I believe it would be wise to wait for the inevitable growls of the bears to resurface, so you can take further advantage of attractive market opportunities.

Click Here for More on the PIMCO Downhill Marathon Machine

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Does Double-Dip Pass Duck Test?

If it looks like a duck, walks like a duck, and quacks like a duck, then chances are it is a duck. Regrettably, not everything passes the common “duck test” when it comes to judging the state of the economy. The prevailing opinion is the economy is on the brink of falling into another double-dip recession. Driving this sentiment has been the relentless focus on the softening short-term data (e.g., weekly jobless claims, monthly retail sales, daily dollar index, etc.). I’m no prophet or Nostradamus when it comes to picking the direction of the market, but if you consider the status of the steep Treasury yield curve, the perceived sitting duck economy may actually just be something completely different – perhaps one of those oily birds recovering from the BP oil spill.

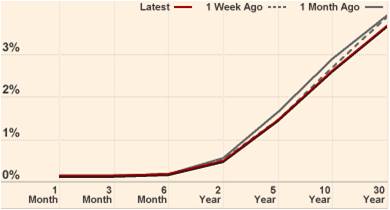

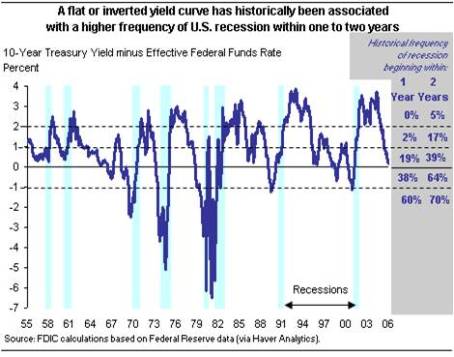

Pictures Worth Thousands of Words

Despite all the talk of “double-dip”, the curve’s extreme slope is still near record levels achieved over the last quarter century. Here’s what the Treasury snapshot looks like now:

Does this look like an inverted yield curve, which ordinarily precedes an economy falling into recession? Quite the opposite – this picture looks more like a ramp from which Evel Knievel is about to jump. Maybe Federal Reserve Chairman Ben Bernanke is actually the daredevil himself by setting artificially low interest rates for extended periods of time? If so, it’s possible the economy will suffer a fate like Mr. Knievel’s at Caesar’s Palace, but my guess is we are closer to the take-off than landing based on the yield curve.

I’ve recently harped on the wide range of “double-dip” guesses made by economists and strategists (see “Probably” Wrong article), but if that was not enough for you, here are a few more cheery views taken from this weekend’s Barron’s magazine and a few other publications of choice:

Kopin Tan (Barron’s): “The Treasuries camp is expecting another recession… In reality, with retailers and customers alike eyeing a second recession this year, it’s a season of anxiety.”

John Crudele (NY Post): “We’ll get a correction that’ll put the words ‘double-dip’ back into the headlines… When the final figures are produced years from now, historians might just decide that this was just one long downturn — not a series of dips.”

Jeremy Cook (Chief Economist-World First): “This will further heighten fears that the US economy is careening into the dreaded double-dip recession.”

How can the double-dippers be wrong? For starters, as I alluded to earlier, we are nowhere near an inverted yield curve. The 10-Year Treasury Note currently yields 2.62% while the T-Bill a measly 0.15%, creating a spread of about +2.47% (a long distance from negative).

As this chart implies, and others confirm, over the last 50 years or so, the yield curve has turned negative (or near 0% in the late 1950s and early 1960s) before every recession. Admittedly, before the soft-patch in economic data-points, the steepness was even greater than now (closer to 3.5%). Maybe the double-dippers are just more prescient than history has been as a guide, but until we start flirting with sub-1% spreads, I’ll hold off on sweating bullets. Less talked about now is the possibility of stagflation (stagnant inflation). I’m not in that camp, but down the road I see this as a larger risk than the imminent double-dip scenario.

I’m not in the business of forecasting the economy, and history books are littered with economists that come and go in glory and humiliation. And although it’s fun guessing on what will or will not happen with the economy, I rather choose to follow the philosophy of the great Peter Lynch (see my profile of Lynch):

“If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.”

Along those same lines, he adds:

“Assume the market [economy] is going nowhere and invest accordingly.”

I choose to spend my time hunting and investing in opportunities all over the map. With fear and anxiety high, fortunately for me and my clients, I am finding more attractive prospects. While some get in the stale debate of stocks versus bonds, there are appealing openings across the whole capital structure, geographies, and the broad spectrum of asset classes. So, as others look to test whether the economic animal is a bear, bull, or duck, I’ll continue sniffing away for opportunities like a bloodhound.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in BP or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Cindy Crawford Economy

Photo source: http://www.joyyoga.blogspot.com

I remember intently examining a few magazine covers that former supermodel Cindy Crawford adorned in my prime high school and collegiate years. Like our economy, the resultant recovery in 2009-2010 feels a little like a more mature version of Cindy Crawford (now 43 years old). Things look pretty good on the surface, but somehow people are more focused on pointing out the prominent mole, rather than appreciating the more attractive features. Many market commentators feel to be making similar judgments about the economy – we’re seeing nice-looking growth (albeit at a slowing pace) and corporations are registering exceptional results (but are not hiring). Even Ben Bernanke, our money-man superhero at the Federal Reserve, has underscored the “unusually uncertain” environment we are currently experiencing.

Certainly, the economy (and Cindy) may not be as sexy as we remember in the 1990s, but nonetheless constant improvement should be our main goal, regardless of the age or stage of recovery. Sure, Cindy chose cosmetic surgery while our government chose a stimulus (along with healthcare and financial regulatory reform) for its economic facelift. But the government must walk a fine line because if it continues to make poor decisions, our country could walk away looking like a scary, cosmetically altered version of Heidi Montag.

Our government in many ways is like Cindy Crawford’s former husband Richard Gere – if the Obama administration doesn’t play its cards right, the Democrats risk a swift divorce from their Congressional majority come this November – the same fate Richard suffered after a four year marriage with Cindy. Like a married couple, we need the federal government like a partner or spouse. Fortunately, our government has a system of checks and balances – if voters think Congress is ugly, they can always decide to break-up the relationship. Voters will make that decision in three months, just like Cindy and Richard voted to separate.

The Superpower Not Completely Washed Up

We may not have the hottest economy, but a few factors still make the equity markets look desirable:

- Corporate profit, margins, and cash levels at or near record levels. S&P profits are estimated to rise +46% in 2010.

- Interest rates are at or near record lows (Fed Funds effectively at 0% and the 10-Year Treasury Note at 2.74%).

- The stock market (as measured by the S&P 500 index) is priced at a reasonably alluring level of 13x’s 2010 profit forecasts and 12x’s 2011 earnings estimates.

Multiple Assets & Swapping

I don’t have anything against the institution of marriage (I’ve been happily married for thirteen years), but one advantage to the financial markets is that it affords you the ability to trade and own multiple assets. If a more mature Cindy Crawford doesn’t fit your needs, you can always swap or add to your current holding(s). For example, you could take more risk with a less established name (asset), for example Karolina Kurkova, or in the case of global emerging markets, Brazil. Foreign markets can be less stable and unpredictable (like Kate Moss), but can pay off handsomely, both from an absolute return basis and from a diversification perspective.

Money ultimately goes to where it is treated best in the long-term, so if Cindy doesn’t fit your style, feel free to expand your portfolio into other asset classes (e.g., stocks, bonds, real estate, commodities, etc.). Just be wary of stuffing all your money under the mattress, earning virtually nothing on your money – certainly Cindy Crawford is a much more appealing option than that.

Wade W. Slome, CFA, CFP®

P.S. For all women followers of Investing Caffeine, I will do my best to even the score, by writing next about the Marcus Schenkenberg economy.

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including those with exposure to Brazil and other emerging markets), but at the time of publishing SCM had no direct position in any other security directly referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.