Posts tagged ‘depression’

Turn Off TV – Emperor Media Has No Clothes!

Famous Danish author Hans Christian Andersen told a renowned fairy tale of an emperor who was conned into believing he is wearing an invisible suit. The crowd was too embarrassed to acknowledge his nakedness, so they pretend to not notice – until a young boy shouted, “The emperor has no clothes!”

Much like the fairy tale, when it comes to pointing out the many shortcomings of the financial media, I have no problem yelling, “The Emperor Media has no clothes!”

Media Spreads Fear and Misinformation

Mark Twain famously stated, “If you don’t read the newspaper, you’re uninformed. If you read the newspaper, you’re misinformed.” That sentiment rings especially true amid today’s swirl of alarming headlines. Here’s a sampling of recent media-induced worries:

- Global trade war caused by tariffs

- Declining value of the U.S. dollar

- Rising interest rates due to foreign debt sales

- Doubts over the U.S. dollar’s global reserve currency status

- Recession anxiety

- Stagflation fears

- Concerns about Executive Branch overreach

- Threats to remove the Federal Reserve Chairman

Is the sky falling? Is now the time to sell stocks, as the media often implies? Or are these risks being overstated and distorted by media outlets that chase monetary gains?

Issues are More Gray Than Black or White

Journalists – most of whom have little investing experience – like to authoritatively paint economic issues in black-or-white terms. But most reasonable people understand that these matters are complex, and the truth lies somewhere in the gray. To claim the media offers a balanced view of both the positives and negatives of complicated financial topics would be disingenuous.

I have been investing for over 30 years, and while I’ve never faced a global rebalancing of trade impacting trillions in economic activity, I’ve lived through far more uncertain times. Not only have my investments survived those volatile periods, but they have also thrived – repeatedly hitting new record highs.

F.U.D. Sells!

Does the media want you to believe the accurate, long-term stock market prosperity story? Hardly. As the saying goes, “If it bleeds, it leads.” Fear, uncertainty, and doubt (F.U.D.) sell more ads, subscriptions, newspapers, and magazines. The more blood, sweat, and anxiety in the headlines, the more money the media makes from distressed readers.

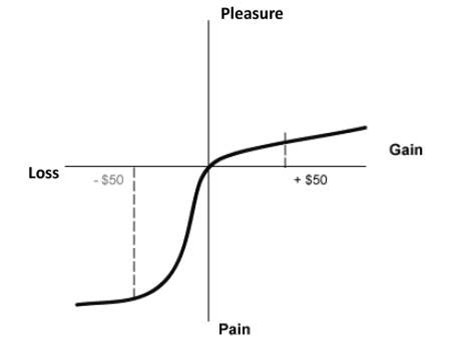

Behavioral finance pioneers, Nobel Prize winner Daniel Kahneman and Amos Tversky, showed that losses feel twice as painful as the pleasure of gains (see the Pleasure/Pain diagram below). Their Prospect Theory remains just as relevant today as when it was introduced in the late 1970s.

The greatest investor of all-time, Warren Buffett, once said, “Be fearful when others are greedy, and greedy when others are fearful.” Unfortunately, the media pushes the opposite mantra: “sell fear and buy greed.” When markets fall, they sell Armageddon. When markets soar, they sell nirvana. During periods of over-optimism, they also exploit FOMO (Fear of Missing Out) by feasting on investors’ emotional cycle of excitement.

Reassuring long-term investors that everything will be okay—or that dips are buying opportunities—doesn’t generate as much media profits and ad sales. Fear does.

History Doesn’t Repeat Itself, But It Often Rhymes

Too many investors suffer from short-term thinking and goldfish-like memory. But as Mark Twain wisely stated, “History doesn’t repeat itself, but It often rhymes.” And history has shown that listening to the media during times of extreme market volatility often leads to poor decisions.

Let’s take a look at some key examples where media-driven fear was more misleading than helpful over the decades:

The Nifty Fifty Collapse (1973-1974)

In the early 1970s, long before the “Magnificent 7” stocks came to the fore, we had the “Nifty Fifty” stocks. These large-cap blue chip stocks traded at lofty P/E (Price-Earnings) ratios and were seen as invincible before they came crashing down in 1973-1974. Suffice it to say, the media headlines were horrific during this period.

Here is some context for this period:

- The U.S. was exiting the Vietnam War

- Economy was undergoing a major recession

- Watergate scandal and presidential resignation

- 9% unemployment

- The Arab Oil Embargo

- Surging inflation

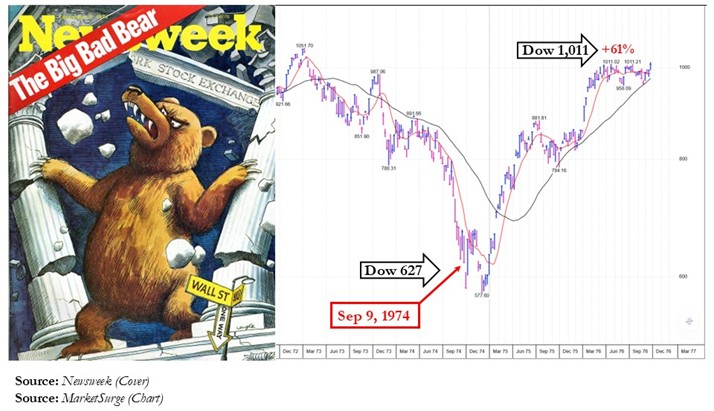

The media’s response? Doom and gloom. Here’s an example of this sentiment from the Newsweek cover, “The Big Bad Bear,” published on September 9, 1974.

For those who sold in fear, the results were disastrous. The Dow bottomed shortly after the magazine was released and the market rebounded +61% in less than two years. Panic was the wrong move.

“The Death of Equities” (1979)

Inflation plagued the 1970s, and just before one of the longest bull markets in history, BusinessWeek declared “The Death of Equities” on its now-infamous September 1979 cover. Once again, the media acted as a perfect contrarian indicator with the Dow quadrupling over the next decade.

Dot-Com Bubble: “The Hottest Market Ever” (2000)

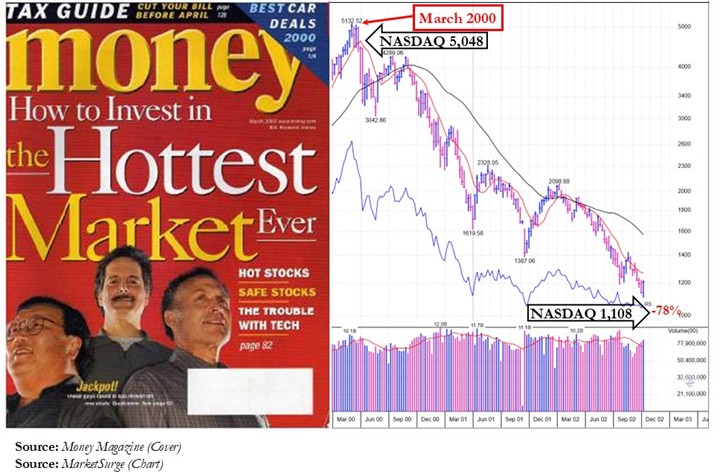

In March 2000, at the peak of the tech bubble, Money magazine ran a cover story: “How to Invest in the Hottest Market Ever.” Weeks later, the bubble burst. Suboptimal timing once again.

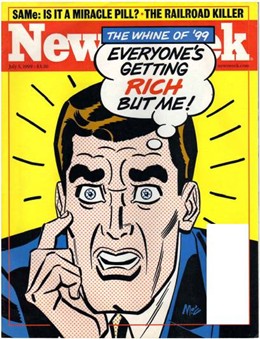

In that same timeframe, Newsweek captured the essence of FOMO with its July 5, 1999 cover: “Everyone Is Getting Rich but Me.” Right when risk was at its peak, most investors were blind to it and got sucked into the downdraft.

Source: NewsWeek

Financial Crisis – Depression 2.0 (2008)

In October 2008, the Time magazine cover encapsulated the zeitgeist of the period with a 1929 photo that included a line of desperate people waiting for food donations at a soup kitchen. Many feared a second Great Depression. Yet it was one of the best times in history to buy stocks with the Dow tripling over the next decade.

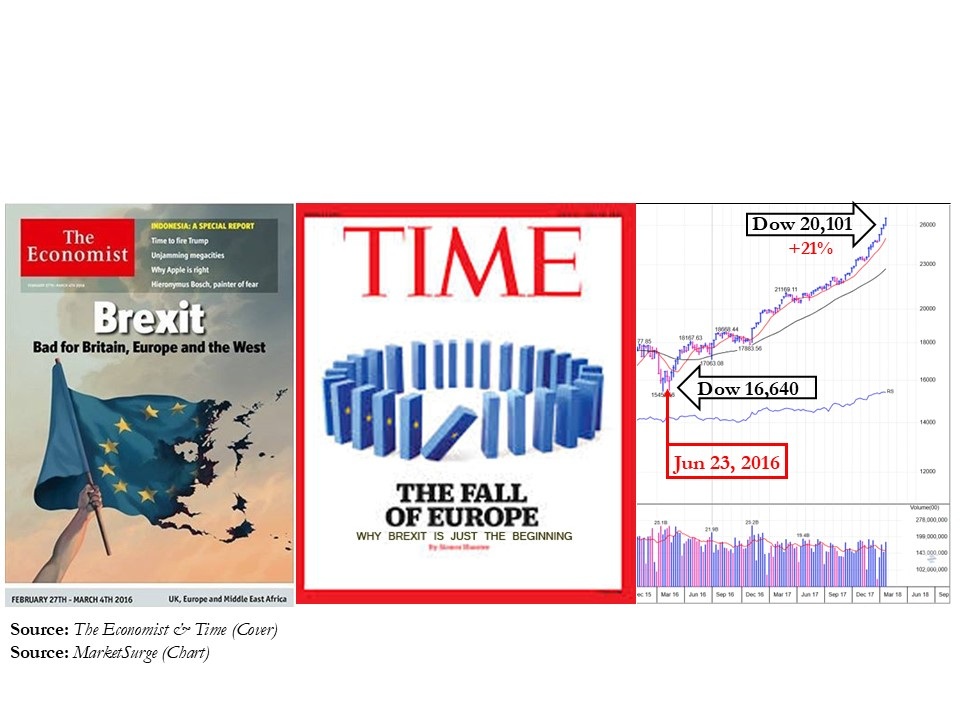

Brexit Panic (2016)

Media coverage around the U.K.’s Brexit vote to leave the EU (European Union) painted a picture of imminent recession and contagion. Instead, the media blitz surrounding Brexit turned out to be more molehill than mountain. Markets rebounded strongly and reached new highs in the subsequent months.

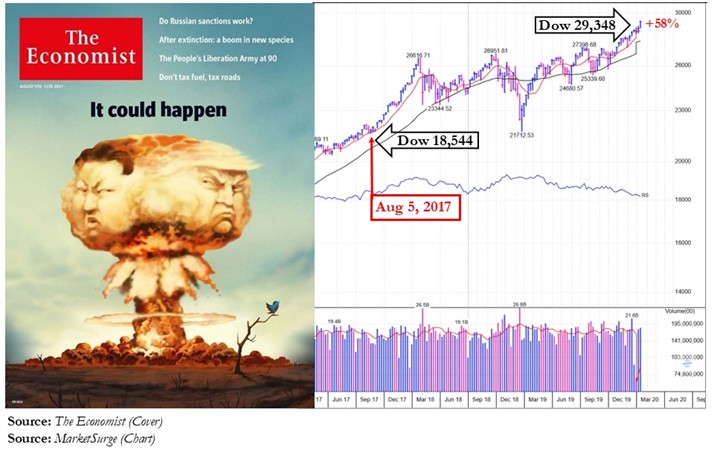

“Rocketman” and North Korea Missiles (2017)

Tensions flared in 2017 as North Korea tested missiles and President Trump threatened retaliation against dictator Kim Jong Un by bombing Pyongyang and “Rocket Man”. The media went into overdrive regarding the nuclear unease, but the market brushed it off and continued climbing +58% over the next few years.

COVID-19 Pandemic (2020)

With over 3 million deaths worldwide and a grinding halt to the global economy, markets initially fell roughly -35%. But as consumers stockpiled toilet paper, fast vaccine development and stimulus sparked a powerful rebound, with stocks finishing the year up +16%. Over the next two years, the Dow almost doubled.

Hostage to Our Lizard Brain

Why are we so susceptible to the sensationalist tendencies of the media? Evolution holds the answer. Humans’ DNA and brains are hard-wired to flee prey. The small almond-shaped tissue in our brain called the amygdala—or what author Seth Godin calls the “lizard brain”—evolved to respond instantly to danger. When headlines scream “crash” or “war,” our emotional brain overrides our logical one, which leads to poor long-term results. As Seth Godin explains, we’re wired to react, not reflect (Watch here). And the media knows it.

Headlines Change but the Long-Term Market Trend Doesn’t

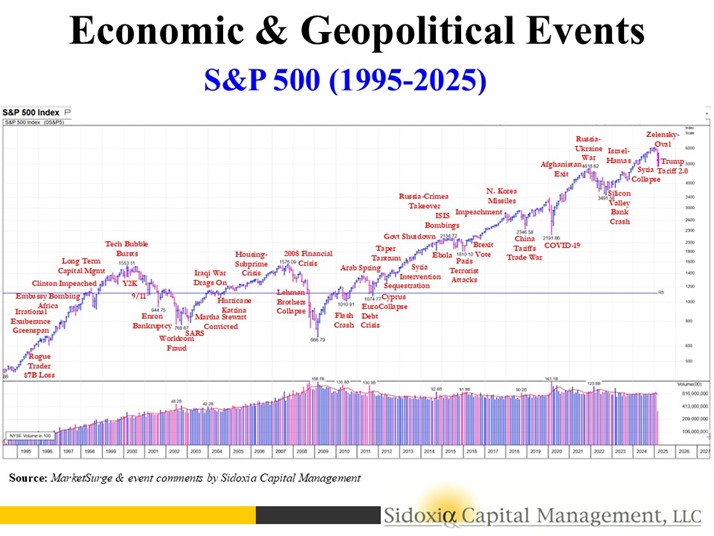

Despite a barrage of negative headlines, stocks have remained resilient over the long run. The market has overcome wars, assassinations, currency crises, banking failures, terrorist attacks, pandemics, natural disasters, impeachments, tax hikes, recessions, restrictive Fed policies, debt downgrades, inflation, and yes, even tariffs (see chart below). Since WWII, we’ve had 12 recessions—each followed by a full recovery to new record highs. In baseball terms, the economy has batted a perfect 1.000 (12-for-12) with recession recoveries.

How to Survive the Avalanche of Media Headlines

Here are five key strategies:

- Turn off the TV: Don’t obsess over headlines. Emotional reactions result in poor decisions.

Buying high (greed) and selling low (fear) is not a recipe for long-term investment success.

- Diversify Your Investments: A well-balanced portfolio across asset classes helps reduce panic.

- Invest According to Time Horizon: Are you young? Assuming more risk and higher exposure to the stock market is generally fine. Are you near retirement? Don’t jeopardize your retirement goals – de-risk accordingly.

- Ignore Talking Heads: Most pundits don’t invest and their credibility is compromised by monetary conflicts of interest. It’s much more beneficial to follow seasoned professionals with real track records through multiple bull and bear markets.

- Avoid the Herd: Continually following the herd into the most popular investments often leads to underperformance. The grass is greener, and the food sources are more plentiful, off the beaten path trampled by the herd. Contrarian thinking works even though it can feel scary.

In the age of constant connectivity, headlines and the 24/7 news cycle are addictive. But if you’re tired of being a pawn in the media’s game, I invite you to join my fight by acknowledging that the Emperor Media has no clothes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

What the Heck & What Now?

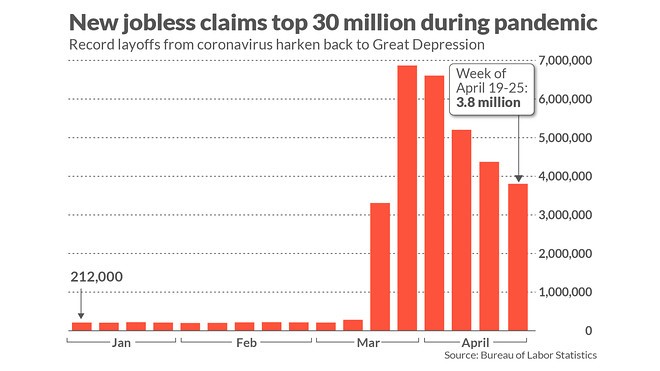

The Covid-19 viral pandemic that hit our shores in early 2020 shut down the economy to a virtual halt, and unemployment has skyrocketed to an estimated 19%, as 30 million people have now filed for unemployment benefits over the last six weeks (see chart below). Shockingly, we have not seen joblessness levels this high since the Great Depression. All this destruction has investors asking themselves, “What the heck, and what now?

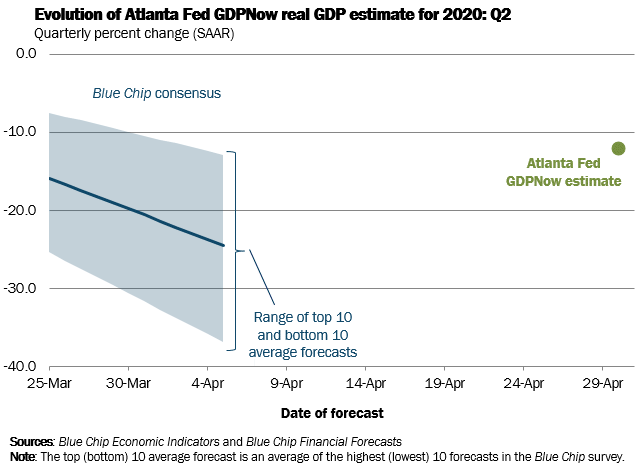

Forecasts for 2nd quarter economic activity (Gross Domestic Product) are estimating an unprecedented decline of -12% (see chart below) with some projections plummeting as low as -34%. Despite the dreadful freefall in the stock market during March, along with the pessimistic economic outlook, the major stock indexes came back with a vengeance during April. More specifically, the Dow Jones Industrial Average soared +2,428 points, or +11% for the month. The other major indexes, S&P 500 and NASDAQ, catapulted higher over the same period by +13% and +15%, respectively.

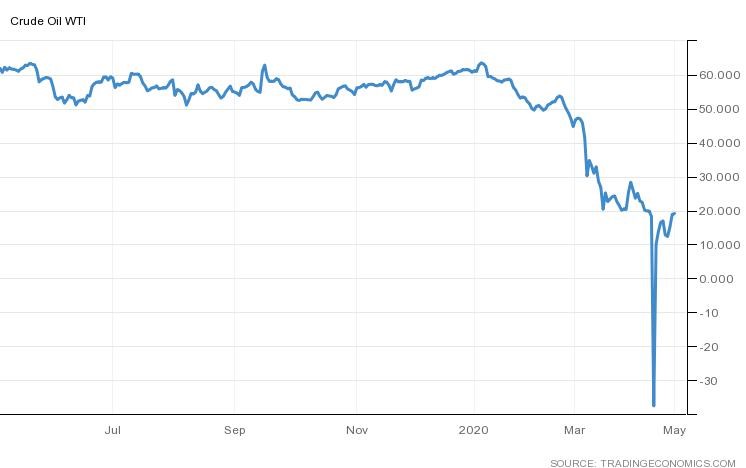

Certainly, there have been some industries hurt by Covid-19 more than others. At the top of the misery list are travel related industries such as airlines, cruise lines, and hotels. Retailers like Neiman Marcus, Pier 1, and JCPenney are filing for bankruptcy or on the verge of closing. Restaurants have also been pummeled (partially offset by the ability to offer pickup and delivery services), and entertainment industries such as sporting arenas, concert venues, movie theaters, and theme parks have all painfully come to a screeching halt as well. Let’s not forget energy and oil companies, which are battling for their survival life in an environment that has witnessed oil prices plunge from $61 per barrel at the beginning of the year to $19 per barrel today (with a brief period at negative -$37…yes negative!) – click here for an explanation and see the chart below.

What the Heck?!

With all this horrifying economic data financially crippling millions of businesses and families coupled with an epidemic that has resulted in a U.S. death count surpassing 60,000, how in the heck can the stock market be up approximately +34% from the epidemic lows experienced just five short weeks ago?

I was optimistic in my Investing Caffeine post last month, but here are some more specific explanations that have contributed to the recent significant rebound in the stock market.

- Virus Curve Flattening: The wave of Covid-19 started in China and crashed all over Europe before landing in the U.S. Fortunately, as you can see from the chart below (U.S. = red line), social distancing and stay-at-home orders have slowed the growth in coronavirus deaths.

- Fiscal Stimulus: The government fire trucks are coming to the rescue and looking to extinguish the Covid fire by spraying trillions of stimulus and aid dollars to individuals, businesses, and governments. Most recently, Congress passed a $484 billion bill in stimulus funding, including $320 billion in additional funding for the wildly popular Payroll Protection Program (PPP), which is designed to quickly get money in the hands of small businesses, so employers can retain employees rather than fire them. This half trillion program adds to the $2 trillion package Congress approved last month (see also Recovering from the Coma).

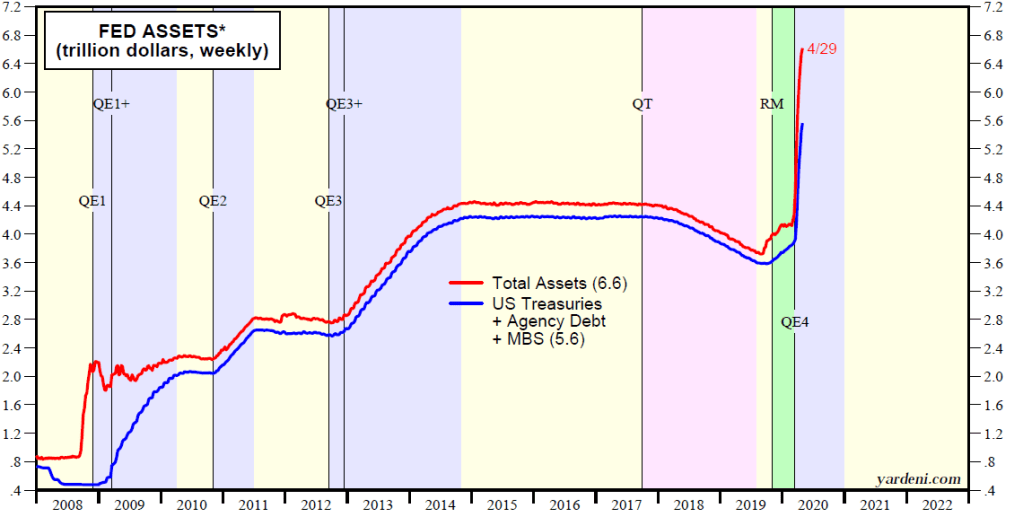

- Monetary Stimulus: The Federal Reserve has pulled out another monetary bazooka with the announcement of $2.3 trillion dollars in additional lending to small businesses . This action, coupled with the long menu of actions announced last month brings the total amount of stimulus dollars to well above $6 trillion (see also Recovering from the Coma for a list of Fed actions). You can see in the chart below how the Fed’s balance sheet has ballooned by approximately $3 trillion in recent months. The central bank is attempting to stimulate commerce by injecting dollars into the economy through financial asset purchases.

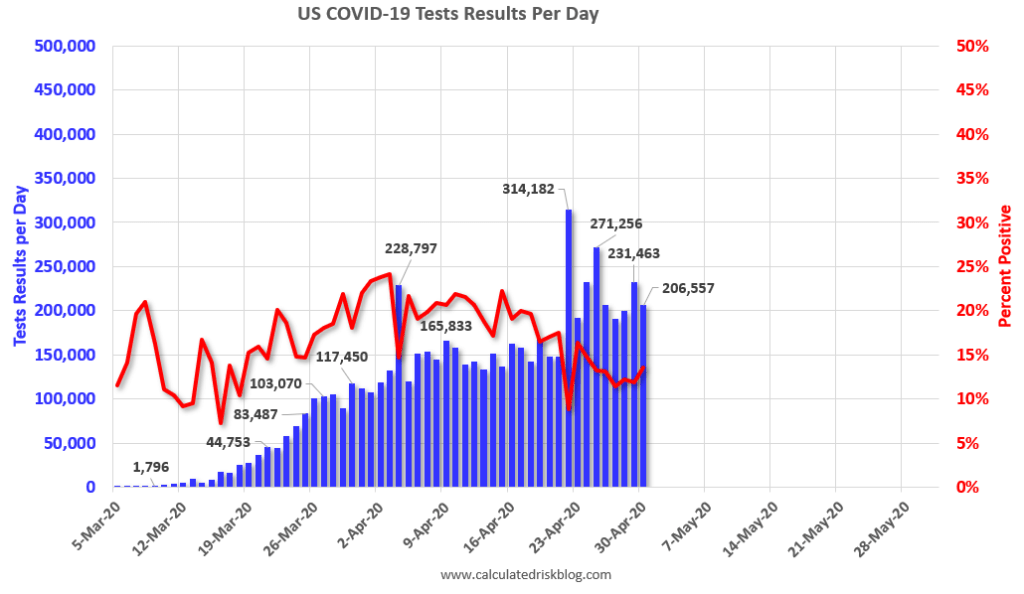

- Improving Healthcare System: Treatments for sick Covid patients has only gotten better, including new therapeutics like the drug remdesivir from Gilead Sciences Inc. (GILD). Dr. Anthony Fauci, the NIAID Director (National Institute of Allergy and Infectious Diseases) stated remdesivir “will be the standard of care.” With 76 vaccine candidates under development, there is also a strong probability researchers could discover a cure for Covid by 2021. With the help of the Defense Production Act (DPA), the government is also slowly relieving critical manufacturing bottlenecks in areas such as ventilators, PPE (Personal Protective Equipment) and Covid test kits. Making testing progress is crucial because this process is a vital component to reopening the economy (see chart below).

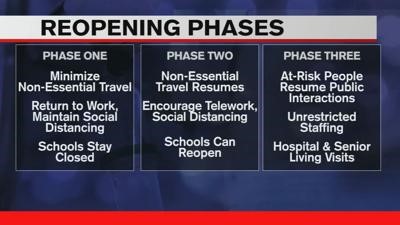

- Economy Reopening: After I have completed all of Netflix, participated in dozens of Zoom Happy Hours, and stocked up on a year’s supply of toilet paper, I have become a little stir crazy like many Americans who are itching to return to normalcy. The government is doing its part by attempting a three-phase reopening of the economy as you can see from the table below. You can’t fall off the floor, so a rebound is almost guaranteed as states slowly reopen in phases.

What Now?!

In the short run, it appears the worst is behind us. Why do I say that? Covid deaths are declining; Congress is spending trillions of dollars to support the economy; the Federal Reserve has effectively cut interest rates to 0% and provided trillions of dollars to provide the economy a backstop; our healthcare preparedness has improved; and global economies (including ours) are in the process of reopening. What’s not to like?!

However, it’s not all rainbows, flowers, and unicorns. We are in the middle of a severe recession with tens of millions unemployed. The Covid-19 epidemic has created a generation of germaphobes who will be hesitant to dive back into old routines. And until a vaccine is found, fears of a resurgence of the virus during the fall is a possibility, even if the masses and our healthcare system are much more prepared for that possibility.

As the world adjusts to a post-Covid 2.0 reality, I’m confident consumer spending will rebound, and pent-up demand will trigger a steady rise of economic demand. However, I am not whistling past the graveyard. I fully understand behavior and protocols will significantly change in a post-Covid 2.0 world, if not permanently, at least for a long period of time. Before the 9/11 terrorist attacks, nobody suspected air travelers would be required to remove shoes, take off belts, place laptops in bins, and carry tiny bottles of mouthwash and shampoo. Nevertheless, a much broader list of social distancing and safety codes of behaviors will be established, which could slow down the pace of the economic recovery.

Regardless of the recovery pace, over just a few short months, we have already placed our hands around the throat of the virus. There are bound to be future setbacks related to the pandemic. Physical and economic wounds will take time to heal. Turbulence will remain commonplace during these uncertain times, but volatility will create opportunities as the recovery continues to gain stronger footing. Although Covid-19 has produced significant damage, don’t let fear and panic infect your long-term investment future.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD, Zoom, Netflix , and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in Neiman Marcus, Pier 1, and JCPenney or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.