Posts tagged ‘debt’

Bashful Path to Female Bankruptcy

The unrelenting expansion in bankruptcies does not discriminate on gender – you either have the money or you do not. Naomi Wolf, author of Give Me Liberty: A Handbook for American Revolutionaries, recently shed light on the underbelly of those suffering severe financial pain in this economic crisis…middle-class women.

How bad is it for middle class women?

“A new report shows that a million American middle-class women will find themselves in bankruptcy court this year. This is more women than will ‘graduate from college, receive a diagnosis of cancer, or file for divorce,’ according to the economist Elizabeth Warren.”

Wolf explores multiple factors in trying to explain this phenomenon. Surprisingly, higher education levels does not appear to prevent a higher percentage of bankruptcies in this large demographic.

If education levels are not a contributing factor, then what is? Here are some Wolf’s findings:

1) Awash in Debt: One explanation for the extra debt reliance is many of these positions occupied by this class of women are lower-paying, which requires women to tap credit lines more frequently. Also, many women have been targeted by luxury-goods manufacturers and credit-card companies. Repeated contacts by the marketers have led to more women succumbing to the consumerism messages shoveled to them.

2) Credit Card Legislation: Wolf makes the case that financial credit card legislation introduced in 2005 disproportionately negatively impacts divorced wives because credit card companies get priority in the repayment line over critical child support payments. In other words, child support payments go to the credit card company rather than to the child, thereby creating an undue financial burden on the female caregiver.

3) Skewed Emotional Beliefs about Money: The biggest issue regarding the emotional connection to finances is working-women “find it embarrassing to talk about money.” The article even acknowledges that many current generation women earn more than previous generations, but financial security has largely not improved because of the “money taboo.” I discover this taboo dynamic in my practice all the time. Part of the blame should be placed on the financial industry’s use of endless acronyms as smoke and mirrors to confuse and intimidate clients on the subject of money. I believe the better way to financial success is to empower clients through education and understanding, not deception and misinformation.

Wolf goes onto explain some of the confused financial thought processes held by this segment of women:

- Negotiating salary increases is difficult for these women because it makes them feel “unfeminine.”

- This class often fails to save because they falsely assume marriage will save them financially.

Unfortunately, the lack of financial literacy and dependence on the spouse leaves these women vulnerable to divorce and widowhood.

Working Class Women Better Prepared

Interestingly, Wolf’s findings point to working class women being much more financially literate and prepared in part because they have erased the notion of a knight in shining armor saving the day from their financial responsibilities. Bolstering her argument, Wolf references the success of the micro-finance programs being instituted to lower-class, working women in developing countries.

Wolf’s Solution

How do middle-class working women break this negative financial cycle? Wolf delivers the medicine directly by directing these women to break the “social role that casts middle-class women as polite, economically vague, underpaid, shopping-dazed dependents.” Opening their eyes to these issues will not erase all of the contributing factors, but women will be better equipped to deal with their financial problems.

From my perspective, there is no quick fix for immediate financial literacy. For those interested in learning more, I encourage you to read my article on personal finance, What to Do Now? Time to Get Your House in Order.

Regardless of your financial knowledge maturity, like any discipline, the more time you put in to it, the more benefits you will receive.

Read Complete Naomi Wolf Article Here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in any company mentioned in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Getting Debt Binge Under Control

Given the endless daily reminders about our federal government’s insatiable appetite for debt, the inevitable collapse of the dollar, and the potential for civil unrest, the average citizen might be surprised to find out the overall debt situation has actually improved. While our federal debt has been exploding (see also Investing Caffeine D-E-B-T article), households and businesses have been tightening their belts and cutting down on the debt binge of recent years. In fact, the overall debt for the U.S. grew at the slowest rate in a decade according to The Business Insider.

As you can see from the nitty-gritty in the Federal Reserve chart below, total Nonfinancial Debt grew at +2.8% in the 3rd quarter of 2009 (comprised of -2.6% Household Debt; -2.6% Business Debt; +5.1% State & Local Government Debt; and +20.6% Federal Debt).

What does this all mean? Not surprisingly, we are seeing the same trends in the debt figures that we are seeing in the components of our GDP (Gross Domestic Product). We learned from our Economics 101 class that the equation for GDP = C + I + G + (NX), which explains the components of economic growth.

- C = Consumer spending (or private consumption)

- I = Investment (or business spending)

- G = Government spending

- NX = Net exports (or exports – imports)

Consumer spending has been the biggest driver of growth before the financial crisis (fueled in part by the contribution of debt growth), accounting for more than 2/3 of our GDP. Now, with the consumer retrenching dramatically – spending less and saving more – we are seeing government spending (i.e., stimulus) pick up the slack.

These same dynamics are playing out in the total debt figures. Since the consumer is retrenching, they are saving more and paying down debt. Business owner debt has been chopped too, either by choice or because the banks simply are not lending. Here again, the government is picking up the slack by ramping up the debt growth.

Encouragingly, all is not lost. Economic principles, like the laws of physics, eventually take hold. Fortunately consumers and businesses have gone on a crash diet from debt – and the banks haven’t accommodated the pleading cash-starved either. Now legislators in our nation’s capital must do their part in dealing with the weighty spending. The overall debt progress is heartening, but Uncle Sam still needs to get off the Ho-Hos and Twinkies and start shedding some of that binge-related debt.

Read Full Business Insider Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and equity securities in client and personal portfolios at the time of publishing. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Tips for Survival and Prosperity in Challenging Economic Times

We have all been impacted in some shape or form by the worst financial crisis experienced in a generation. The question now becomes what did we learn from this mess and how can we better prepare for a more prosperous financial future?

Here are some important tips to follow:

Save and Invest: Before paying others, pay yourself first. You can achieve this goal by saving and investing your money. Given the weak state of our government “safety net” programs, such as Medicare and Social Security, it has become more important than ever to save. Life spans are extending as well, meaning a larger “nest egg” is needed for retirement. If you don’t have the time, discipline, or emotional make-up to manage your own money, then seek out a fee-only advisor* who does not have a conflict of interest in regards to building your wealth.

Tighten Belt: In order to save and invest you need to be in a position where you are creating excess income. Cutting costs is one way to generate additional income. Eating out less, buying used, taking more affordable vacations, conserving energy, purchasing private label goods are a few easy ways to save money that will accumulate over time. If those efforts are still not adequate, one should then contemplate adjusting their living situation (i.e., down-size) or pursue additional income opportunities – either through a pay raise or higher paying job alternatives.

Pay Down Debt: If your credit card company is charging you a 15-20% rate on unpaid credit card balances and gouging you for late-fees and cash advances, then look for other sources of affordable financing. A home equity line of credit or second mortgage may make sense for some, if the fees and lower interest rates make economic sense. Contact a financial planner or tax professional to determine the appropriateness of these debt alternatives. Ultimately, the goal is to reduce debt and create more financial flexibility.

Take Free Money: If your employer offers matching payments to your retirement plan contributions, they are effectively offering you free money. Take it! The government offers you some tax deferral savings through IRA (Individual Retirement Account) contributions, so take advantage of that benefit as well.

Form a 6-Month Emergency Fund: The economy may be in a bottoming-out phase; however we are not out of the woods yet. Unemployment is approaching 10% and many companies and industries continue to struggle. Build a protective financial cushion should you or your family hit a bump in the road.

Invest in Yourself: Investing for retirement is crucial, however investing in yourself is just as, if not more, important than traditional investing. What I’m referring to is job training, education, and health awareness. We live in a globalized economy and in order to compete against those starving for our jobs, we need to improve our skills and education. Lastly, we cannot neglect our health. Finances need to be put in perspective. Our health should be a top priority and a disciplined balance between diet and exercise will not only reduce stress, but it will also improve mental health.

Times have been challenging, but when the going gets rough, the tough go saving. Take control of your financial future rather than letting economic circumstances control you. Financial success however should not come at the expense of your health, so also focus on a balanced program of diet and exercise. There are no free lunches in this world, but following these steps will help lead you on a path to prosperity – even in these challenging economic times.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Wade W. Slome, CFA, CFP is President and Founder of Sidoxia Capital Management, LLC (www.Sidoxia.com), a fee-only Registered Investment Advisory firm headquartered in Newport Beach, California.

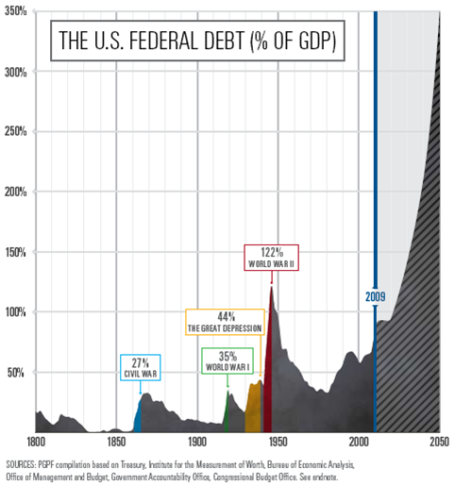

Debt: The New Four-Letter Word

D-E-B-T, our country’s new four-letter word, used to be a fun toy the masses played and danced with to buy all kinds of goods and services. Debt was creatively utilized for all types of things, including, our super-sized McMansions purchased with Option ARM (Adjustable Rate Mortgage) Countrywide loans; our 0% financing car binges (thanks to now-bankrupt Chrysler and General Motors); and our no-payment-for-two-years, big screen plasma TVs (financed at now-bankrupt Circuit City). Eventually consumers, corporations, and governments realized excessive debt creates all kinds of lingering problems – especially in recessionary periods. We are by no means out of the woods yet, but consumers are now spending less than they are taking in, as evidenced by a positive and rising savings rate. This slowdown in spending is bad for short-term demand, but eventually these savings will be recycled into our economy leading to productive and innovative value creating jobs that will jumpstart the economy back on a path to sustainable growth.

Click Here For Excellent Article from the Peterson Foundation

In our hot-cold society, where the pendulum of greed and fear swing dramatically from one side to the next, we are also observing an unhealthy level of risk aversion by financial institutions. This excessive caution is unfortunately choking off the health of legitimate businesses that need capital/debt in order to survive. As we continue to see a pickup in the leading indicators for an economic recovery, banks should loosen up the credit purse strings to provide capital for profitable, growing businesses – even if there are hiccups along the way.

National Debt “Blob” Must Be Slowed

In the famous 1958 sci-fi horror film, “The Blob”, a gelatinous, ever-growing creature from outer space threatens to take over the town of Downingtown, Pennsylvania by methodically engulfing everything in its path. Steve McQueen eventually learns that freezing the Blob will halt its progression. In our country, entitlements, in the form of Medicare and Social Security, serve as our 21st century Blob. As the chart above shows, entitlements have expanded dramatically over the last 40 years and stand to expand faster, as the 76 million Baby Boomers reach retirement and demand more Social Security and Medicare benefits. Clearly the current path we are travelling on is not sustainable, and beyond breakthroughs in technology, the only way we can suitably address this problem is by cutting benefits or raising taxes. We only dug ourselves in a deeper financial hole with the enactment of Medicare Part D (prescription drug benefits for Medicare participants). I must admit I have great difficulty in understanding how we are going to expand health care coverage for the vast majority of Americans in the face of exploding deficits and debt burdens. I eagerly await specifics.

With an enlarging national debt burden and widening deficits, the U.S. is only becoming more reliant on foreign investors to finance our shortcomings. This trend too cannot last forever (see chart below). At some point, foreigners will either balk by not providing us the financing, or demanding prohibitively high interest rates on any funding we request – thereby negatively escalating our already high interest payment streams to bondholders.

Regardless of your political view, the problem pretty simply boils down to elementary school math. The government either needs to cut expenses or raise revenue (taxes or growth initiatives). Politically, the stimulative spending path is easier to rationalize, but as we see in California, eventually the game ends and tough cuts are forced to be made.

Regardless of your political view, the problem pretty simply boils down to elementary school math. The government either needs to cut expenses or raise revenue (taxes or growth initiatives). Politically, the stimulative spending path is easier to rationalize, but as we see in California, eventually the game ends and tough cuts are forced to be made.

Let’s hope the painful lessons learned from this financial crisis will steer us back on path to more responsible borrowing – a point where D-E-B-T is no longer considered a dirty four-letter word.

“Bill, Say It Ain’t So…”

Bond guru and Newport Beach neighbor, Bill Gross, is out with his entertaining monthly PIMCO piece (Click Here). Try to keep a box of tissues close by in case you cry during the read. His views support my stance on short duration bonds and TIPs (Treasury Inflation Protected Securities), but big Bill would NEVER stand to root for equities – especially after his call for Dow 5000 a while back.

In this CNBC piece, he points out the obvious troubles we face from all the debt we’re choking on. As a country, we need the “Heimlich Maneuver!”