Posts tagged ‘debt’

The Next Looming Bailout…Muni Bonds

Government politicians and voters have made it clear they do not want to bail out “fat-cat” bankers in the private sector, but what about bailing out “fat-cat” state pensioners in the public sector? States and cities across the country are increasingly under economic strain with deficits widening and debt-loads stacking up. California’s statewide budget problems have been well publicized, but you are now also hearing about more scandalous financial problems at the city level (read about the multi-million dollar malfeasance in the city of Bell).

Why Worry?

Well if a 2010 $1.3 trillion federal deficit is not enough to tickle your fancy, then how does another $137 billion in state deficits over fiscal 2011 and 2012 sound to you (National Governors Association)? Unfortunately, the states have made no meaningful structural improvements. If you layer on general economic “double dip” recession fears with excess pension liabilities, then you have a recipe for a major unresolved financial predicament.

Despite the dire financial state of the states, municipal bond prices have generally survived the 2008-2009 financial crisis unscathed. With unacceptably poor state budget risks, muni bond prices have continued to rise in 2010. The downside…new investors must accept a pitiful yield of 2.75% on 10-year municipal debt, according to Financial Advisor Magazine.

One investor who is not buying into the strength of the tax-free municipal bond market is famed investor and CEO of Berkshire Hathaway (BRKA/BRKB), Warren Buffett. Here is what he wrote about munis in his legendary annual shareholder letter last year:

“Insuring tax-exempts, therefore, has the look today of a dangerous business…Local governments are going to face far tougher fiscal problems in the future than they have to date.”

Buffett has this to say about rating muni bonds:

“I mean, if the federal government will step in to help them [municipalities], they’re triple-A. If the federal government won’t step in to help them, who knows what they are?”

Safety Net Disappears

Like a high wire artist dangling high in the air without a safety net below, the states are currently borrowing money with little to no protection from the bond insurance providers. The shakeout of the subprime debt defaults has battered the insurers from many perspectives, leaving a much smaller market in the wake of the financial crisis. In 2007 about 50% of new municipal bonds were issued with bond insurance, while today only approximately 7% carry it (UBS Wealth Management Research). With decreased insurance coverage, the silver lining for muni investors is the necessity for them to perform more comprehensive research on their bond holdings.

Defaults on the Rise

On the whole, less insurance will result in more defaults. Although defaults are expected to decline in 2010, non-payments totaled $6.9 billion in 2009, up from $526 million in 2007 (Distressed Debt Securities). Even though the numbers sounds large, the recent default rate only represents a 0.25% default rate on the hefty $2.8 trillion market. That muni default rate compares to a more intimidating corporate bond default rate of 11% in 2009.

Bigger Bark Than Bite?

James T. Colby, senior municipal strategist at Van Eck Global, understands the severity of the states’ budget crisis but he believes a lot of the doomsday headlines are bogus. Riva Atlas, writer for Financial Advisor Magazine, summarizes Colby’s thoughts:

“Even those states in the worst straits like California and Illinois have provisions in their constitutions or statutes requiring them to pay their debts. In California, the state’s constitution says bondholders come second only to the school system, so the state would have to empty its jails before it stopped paying its teachers.”

Certainly municipalities could raise taxes to compensate for any budget shortfalls, but we all know most politicians are reluctant to raise taxes, because guess what? Tax increases may result in fewer votes – the main motivator driving most politicians.

If the states decide to not raise taxes, they still have other ways to weasel out of obligations. For starters, they can just stick it to the insurance company (if coverage exists). If that option is not available, the municipalities can look to the federal government for a bailout. Irresponsible actions have their consequences, and like consumers walking away from payments on their mortgages, municipalities will effectively be preventing themselves from future access to borrowing. Either way, the bark is less than the bite for investors since the insurance company or federal government will be making them whole.

BABs and Taxes Add Fuel to the Fire

A glut of Build America Bonds (BABs) issued by municipalities, driven by demand from yield hungry pension funds, along with expected tax hikes for the wealthy have created a scarcity of tax-free munis.

In the first half of 2010 BABs accounted for more than 25% of municipal bonds issued, which was a significant contributing factor to the robust muni market. The BABs tailwinds aiding muni prices won’t last forever, as the bond issuance program is expected to expire at the end of 2010.

On the tax front, the wealthy are likely to see higher federal tax rates in the future – upwards of 36% – 40%. If you include the double tax-exempt benefits in states like New York and California, the relative attractiveness becomes even that much better. Combined, these factors have elevated muni prices.

Despite higher defaults, scarier headlines, and the lack of insurance, the municipal bond market remains robust. General interest rate declines caused by macroeconomic fears have caused investors to flock to the perceived “safe haven” status of Treasuries and Munis, but as we have all witnessed, the fickle pendulum of emotions never sits still for long.

Managing the Munis

As is evident from the municipal bond discussion, states and cities across the country have been plagued by the same deficit and debt issues as the country faces on a federal level. Tough structural expense issues, and revenue generating tax policies need to be scrutinized in order to prevent federal taxpayer bailouts of municipalities across the country.

From a municipal bond investor perspective, it’s best to focus on general obligation bonds (GOs) because those bonds are backed by the taxing authority of the municipal government. On the flip side, it’s best to stray away from revenue bonds or privately issued municipals because revenue streams from these bond channels are not guaranteed by the municipality, meaning the risk of default is larger.

While Congress sorts out financial regulatory reform with respect to banking bailouts and “too big to fail” corporations, our federal government should not lose sight of the widespread municipality problems our country faces today. If not, get ready to pull out the checkbook to pay for another taxpayer-led bailout…

Read the Complete Financial Advisor Magazine Article: The Muni Minefield

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including CMF), but at the time of publishing SCM had no direct position in BRKA/B or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

From Bearded Monks to Greek Decline

Noted author Michael Lewis has sold millions of books and written on topics ranging from professional baseball to Wall Street and Iceland to Silicon Valley. Now, he has decided to tackle the gripping but nebulous Greek financial crisis through the eyes and bearded mouths of Greek monks in a recently released article from Vanity Fair.

At the heart of the story is a Christian monastery (Vatopaidi), located on a northeastern peninsula of Greece. This ten-century old sanctuary has helped expose the tenuous state of the Greek economy, which is estimated to be sitting on $1.2 trillion in debt (representing $.25 million per working Greek adult) – a massive number considering the relatively petite size of the country. Beyond interviewing the Vatopaidi monks, Lewis trolled through the country interviewing various politicians, businessmen, government officials, and natives in order to make sense of this Mediterranean mess.

The Scandal Genesis

Starting in 2008, news filtered out that Vatopaidi had somehow acquired a practically worthless lake and swapped it for 73 different government properties, including a 2004 Olympics center. The Vatopaidi monastery effectively created an estimated $1 billion+ commercial real estate portfolio from nothing, thanks to one of the key Vatopaidi monks negotiating a fishy, behind-the-door government exchange scheme. This scandal, among other issues, ultimately lead to the collapse of the prior Greek ruling party and sent Prime Minister Kostas Karamanlis packing his bags.

The Greek crisis did not happen overnight, but rather decades. A casual observer may mistake the caustic Greek media headlines as proof to blame Greece as the reason behind the global financial meltdown, Rather, the challenges faced by this island-based country are more symptomatic of the weak global credit standards and the undisciplined disregard for excessive debt levels. Even with an embarrassingly high debt/GDP ratio (Gross Domestic Product) of about 130%, Greece’s desperate financial situation is a relatively minor blemish in the whole global scheme of things. More specifically, the $300 billion or so in Greek GDP represents the equivalent of a pubescent pimple on the face of a $60 plus trillion global economy.

The Greek Concern

The Vatopaidi scandal is still being investigated, but how did this broader debt-induced, Greek fiscal catastrophe occur?

Lax tax collection, absence of legal enforcement, and simple corruption are a few of the contributing reasons. Lewis describes the situation as follows:

“Everyone is pretty sure everyone is cheating on his taxes, or bribing politicians, or taking bribes, or lying about the value of his real estate. And this total absence of faith in one another is self-reinforcing. The epidemic of lying and cheating and stealing makes any sort of civic life impossible; the collapse of civic life only encourages more lying, cheating, and stealing.”

A tax collector and real estate agent from the article had this to say:

“If the law was enforced, every doctor in Greece would be in jail.” AND

“Every single member of the Greek Parliament is lying to evade taxes.”

The Greek government also did an incredible job of distorting the reported economic data and swept reality under the rug:

“How in the hell is it possible for a member of the euro area to say the deficit was 3 percent of G.D.P. when it was really 15 percent?” a senior I.M.F. (International Monetary Fund) representative asked.

The Greek debacle was not an isolated incident. The significant dislocations occurring around the earth’s small and dark corners have directly impacted our lives here in the U.S. Take for example Iceland, the country that New York Times columnist Thomas Friedman called a converted “hedge fund with glaciers.” Not only did this historically tiny fishing island do dynamic damage to its southern neighbors in Europe, but damage from its collapsing banks extended all the way to busted condominium developments in Beverly Hills, California. Or consider Dubai and the multi-billion dollar debt restructuring at Nakheel Development that held the world breathless as people around the world watched in trepidation.

These examples, coupled with the Greek financial crisis highlight how widespread the collateral damage of cheap credit proliferated. The cost of money is still dangerously low, as governments around the globe attempt to stimulate demand, however the regulators and banking industry must remain vigilant in maintaining loan and capital deployment discipline. The hot debates over financial regulatory reform in the U.S., along with the recent Basel III banking requirement discussions are evidence of the need to restore balance and stability to the global financial playing field.

The global financial crisis has spooked billions of people around the world. Like a mysterious boogeyman, the crisis has turned cheap and easy credit into the public’s worst nightmare. The mysticism and general opacity surrounding the inner-workings of Wall Street and global financial markets attacks at investors’ inherent emotional vulnerabilities. Michael Lewis has once again helped turn what on the exterior seems extremely complex and confusing and boiled the essence of the problem down into terms the masses can digest and put into perspective.

Bearded monks loading up on government-swapped commercial real estate may have provided valuable lessons and insights into the global financial crisis, however now I can hardly wait for Michael Lewis’s next topic…perhaps balding nuns in South African gold mines?

Read the whole Vanity Fair article written by Michael Lewis

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Private Equity: Hitting Maturity Cliff

Wow, those were the days when money was as cheap and available as that fragile, sandpaper-like toilet paper you find at gas stations. Private equity took advantage of this near-free, pervasive capital and used it to the greatest extent possible. The firms proceeded to lever up and gorge themselves on a never-ending list of target companies with reckless abandon (see also Private Equity Shooting Blanks). Now the glory days of abundant, ultra-cheap capital are history.

Rather than rely on low-cost bank debt, private equity firms are now turning to the fixed income markets – specifically the high yield market (a.k.a. junk bonds). As The Financial Times points out, more than $170 billion of junk bonds have been issued this year, in large part to refinance debt issued in the mid-2000s that has gone sour due to overoptimistic projections and a flailing U.S. economy. In special instances, private equity owners are fattening their own wallets by declaring special dividends for themselves.

Even though some of these over-levered, private equity portfolio companies have received a temporary reprieve from facing the harsh economic realities thanks to these refinancings, the cliff of maturing debt in 2012 is fast approaching. Some have estimated that $1 trillion in maturing debt will roll through the market in the 2012-2014 timeframe. Either the economy (or operating performance) improves enough for these companies to service their debt, or these companies will find themselves falling off these maturity cliffs into bankruptcy.

Junk is Not Risk-Free

Driving this trend of loan recycling is risk aversion to stocks and a voracious appetite for yield in a yield desert. Stuffing the money under the mattress, earning next to nothing on CDs (Certificates of Deposit) and money market accounts, will not help in meeting many investors’ long-term objectives. The “uncertain uncertainty” swirling around global equity markets has nervous investors flocking to bonds. The opening of liquidity in the high yield markets has served as a life preserver for these levered companies desperate to refinance their impending debt. This high-yield debt refinancing window is also an opportunity for companies to lower their interest expense burden because of the current, near record-low interest rates.

But as the name implies, these “junk bonds” are not risk free. For starters, embedded in these bonds is interest rate risk – with a Federal Funds rate at effectively zero, there is only one upward direction for interest rates to go (bad for bond prices). In addition, credit risk is a concern as well. In the midst of the financial crisis, many of these high-yield bonds corrected by more than -40% from their highs in 2008 until the bottom achieved in early 2009. If the economy regresses back into a double-dip recession, many of these bonds stand to get pummeled as default rates escalate (see also, bond risks).

Pace Not Slowing

Does the appetite for high yield appear to be slowing? Au contraire. In the most recent week, Dealogic noted $15.4 billion in junk bonds were sold. The FT sees the pace of junk deals handily outpacing the record of $185.4 billion set in 2006.

The Wall Street Journal used the following deals to provide a flavor of how companies are using high-yield debt in the present market:

“First Data Corp. sold $510 million of 10-year notes this week, at 9.125%, to pay down bank debt due in 2014. Peabody Energy sold $650 million of 6.5%, 10-year notes to pay off the same amount of higher-priced debt due in three years. MultiPlan Inc., a health-care cost-management provider, sold $675 million of notes this week, at 9.875%, to help fund a buyout of the company. Cott Corp., a maker of store-branded soft drinks, sold $375 million of debt at 8.125% to fund its purchase of another company, Cliffstar Corp.”

The roads on the junk bond highway appear to be pothole free at the moment, however a cliff of debt is rapidly approaching over the next few years, so high-yield investors should travel carefully as conditions in the junk market potentially worsen. As we witnessed in 2008-2009, it can take a while to hit rock bottom in the riskier areas of the credit spectrum.

Read full Financial Times and Wall Street Journal articles on the high yield market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including HYG and JNK), but at the time of publishing SCM had no direct position in First Data Corp., Peabody Energy (BTU), MultiPlan Inc., Cott Corp. (COT), Cliffstar Corp., or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Blushing Pinocchio – The Half Trillion Lie

When in doubt, or when in debt by half a trillion dollars, why not just make some crazy stuff up? This is the exact strategy California pension administrators used when implementing +50% increases in union member benefits earlier this decade. The pension plans decided to take a break from reality and enter fantasyland when they projected the Dow Jones Industrial Average would hit 25,000 by the end of the decade and 28,000,000 by 2099, a forecast that would even make Pinocchio blush.

Dealing with the Problem

Governor Arnold Schwarzenegger and his economic advisors attempted to take on the unions. Unfortunately, not everyone got the message. On the day the Governor struck a deal with the unions, California Public Employees’ Retirement System (CalPERS) ordered a hike of $4 billion to the annual pension payments to its members.

The financial woes of California have been well documented as the state looks to lower its $19.1 billion deficit and an estimated one-half trillion dollars in unfunded pension liabilities – a level equal to about seven times the state’s total debt level. Even after multiple years of severe cuts, Schwarzenegger has had to resort to drastic measures, including his most recent desperate move to get some 200,000 state workers to accept slashes in pay to a $7.25/hour minimum wage.

Facing Reality

As I have discussed in the past, dealing with excessive debt requires a gut check. Cutting debt is similar to dieting – easy to understand, but difficult to execute (see my Debt Control article).

Whether Republican candidate Meg Whitman or Democratic candidate Jerry Brown wins the thankless position of California Governor, they will have to face the elephant in the room, but hopefully they will not resort to fuzzy accounting or predictions of Dow 28 million that would make even Pinocchio blush.

Read Full Related Article from Vincent Fernando at Business Insider

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Debt Control: Turn Off Costly Sprinklers When Raining

By living in Southern California, I am acutely aware of the water shortage issues we face in this region of the country. We all have our pet peeves, and one that eats at me repeatedly occurs when I drive by a neighbor’s house and notice they are blasting the sprinklers in the pouring rain. I get the same sensation when I read about out-of control government spending confronting our current and future generations in light of the massive debt loads we presently carry.

I, like most people, love free stuff, whether it comes in the form of tooth-pick skewered, teriyaki meatball samples at Costco Wholesale Corp. (COST), or free government education from our school systems. But in times of torrential downpours, at a minimum, we need to be a little more cost conscious of our surroundings and turn off the spending sprinklers.

Certainly, when it comes to government spending, there’s no getting around the entitlement elephant in the room, which accounts for the majority of our non-discretionary government spending (see D-E-B-T: New Four Letter Word article). Unfortunately, layering on new entitlements on top of already unsustainable promises is not aiding our cause. For example, showering our Americans with free drugs as part of Medicare Part D program, and paying for tens of millions into a fantasy-based universal healthcare package (purported to save money…good luck) only serves to fatten up the elephant squeezed into our room.

Reform is absolutely necessary and affordable healthcare should be made available to all, but it is important to cut spending first. Then, subsequently, we will be in a better position to serve the needy with the associated savings. Instead, what we chose appears to have been a jamming of a massive, complex, divisive bill through Congress.

Slome’s Spending Rules

In an effort to guide ourselves back onto a path of sensibility, I urge our government legislators to follow these basic rules as a first step:

Rule #1 – Don’t Pay Dead People: I know we have an innate maternal/paternal instinct to help out others, but perhaps our government could stop doling out taxpayer dollars to buried individuals underground or those people incarcerated in jail? Over the last three years the government sent $180 million in benefit checks to 20,000 corpses, and also delivered $230 million to 14,000 convicted felons (read more).

Rule #2 – Pay for Our Own First: Before we start spending money on others outside our borders, I propose we tend to our flock first. For starters, our immigration policies are a disaster. As I wrote earlier (read Our Nation’s Keys to Success), I am a big proponent of legal immigration for productive, higher-educated individuals – not elitist, just practical. If you don’t believe me, just count the jobs created by the braniac immigrant founders at the likes of Google Inc. (GOOG), Intel Corp. (INTC), and Yahoo! Inc. (YHOO). These are the people who will create jobs and out-battle scrappy, resourceful international competitors that want to steal our jobs and our economic leadership position in the world. What I don’t support is illegal immigration – paying for the healthcare and education of foreign criminals with our country’s maxed-out credit cards. This is the equivalent of someone breaking into my house, and me making their bed and feeding them breakfast…ridiculous. I do not support the immigration law passed in Arizona, but this unfortunate chain of events thankfully puts a spotlight on the issue.

Rule #2a. – Stop Being the Globe’s Free Police: If we are going to comb the caves of Tora Bora as part of funding two wars and chasing terrorists all over the world, then we not only should be spending our defense budget more efficiently (non-Cold War mentality), but also charging freeloaders for our services (directly or indirectly). We are spending a whopping 20 cents of each federal tax dollar on defense, so let’s spend it wisely and charge those outside our borders benefiting from our monetary and physical sacrifices. And, oh by the way, sending $400 million to the territory controlled by Hamas (read more) doesn’t sound like the brightest decision given our fiscal and human challenges at home. I sure hope there are some tangible, accountable benefits accruing to the right people when we have 25 million people here in the U.S. unemployed, underemployed, or discouraged from finding a job.

Rule #3: Put the Obese Elephant on a Diet – As I alluded to above, our government doesn’t need to serve our overweight, entitlement-fed elephant more chocolate, pizza, and ice cream in the form of more entitlements we are not capable of funding. Let’s cut our spending first before we buy off the voters with new spending.

There are obviously a wide ranging set of economic, political, and even religious perspectives on the best ways of managing our hefty debt and deficits. I do not pretend to have all the answers, but what I do know is it is not wise to blast the sprinklers when it is pouring rain outside.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and GOOG, but at the time of publishing SCM had no direct positions in COST, YHOO, INTC, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Cockroach Consumer Cannot be Exterminated

We’re told that cockroaches would inherit the earth if a nuclear war were to occur, due to the pests’ impressive resiliency. Like a cockroach, the American consumer has managed to survive its own version of a financial nuclear war, as a result of the global debt binge and bursting of the real estate bubble. Although associating a consumer to a disease-carrying cockroach is not the most flattering comparison, I suppose it is okay since I too am a consumer (cockroach).

Confidence Cuisine

Cockroaches enjoy feasting on food, but they have been known to live close to a month without food, two weeks without water, and a half hour without air while submerged in water. On the other hand, consumers can’t live that long without food, water, and oxygen, but what really feeds buyer purchasing patterns is confidence. The April Consumer Confidence number from the Confidence Board showed the April reading reaching the highest level since September 2008. On a shorter term basis, the April figure measured in at 57.9, up from 52.3 in the previous month.

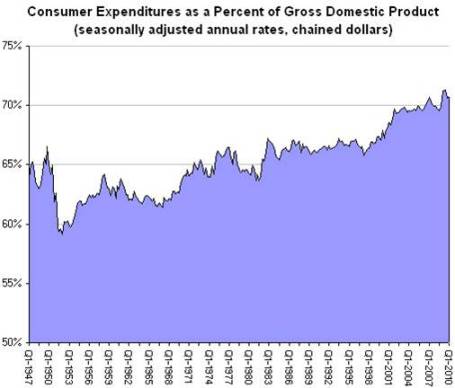

Where is all this buying appetite coming from? What we’re witnessing is merely a reversal of what we experienced in the previous years. In 2008 and 2009 more than 8 million jobs were shed and the fear-induced spiraling of confidence pushed consumers’ buying habits into a cave. With +290,000 new jobs added in April, the fourth consecutive month of additions, the tide has turned and consumers are coming out to see the sun and smell the roses. Recently the Bureau of Economic Analysis (BEA) revealed real personal consumption expenditures grew +3.6% in the first quarter – the largest quarterly increase in consumer spending since the first quarter of 2007.

Sure, there still are the “double-dippers” predicting an impending recession once the sugar-high stimulus wears off and tax increases kick-in. From my perch, it’s difficult for me to gauge the timing of any future slowing, other than to say I have not been surprised by the timing or magnitude of the rebound (I was writing about the steepening yield curve and the end of the recession last June and July, respectively). Sometimes, the farther you fall, the higher you will bounce. Rather than try to time or predict the direction of the market (see market timing article), I look, rather, to exploit the opportunities that present themselves in volatile times (e.g., your garden variety Dow Jones -1,000 point hourly plunge).

Will the Trend End?

Can this generational rise in consumer spending continue unabated? Probably not. To some extent we are victims of our own success. As about 25% of global GDP and only 5% of the world’s population, changing directions of the U.S.A. supertanker is becoming increasingly more difficult.

However, more nimble, resource-rich developing countries have fewer demographic and entitlement-driven debt issues like many developed countries. In order to build on an envious standard of living, our country needs to build on our foundation of entrepreneurial capitalism by driving innovation to create higher paying jobs. With those higher paying jobs will come higher spending. Of course, if uncompetitive industries cannot compete in the global marketplace, and a mirage of spending is re-created through drug-like credit cards and excess leveraged corporate lending, then heaven help us. Even the impressively resilient cockroach will not be able to survive that scenario.

Read full New York Times article here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

General Motor’s Amazing Debt Trick

Now you see it, and now you don’t. General Motors claims that it has pulled off an amazing trick – the CEO of the troubled automaker, Ed Whitacre, claims in a recently released nationwide commercial, “We have repaid our government loan, in full, with interest, five years ahead of the original schedule.” (See video BELOW):

Blushing Pinocchio

Even Pinocchio would blush after listening to those statements. The loan that GM is claiming victory over is roughly $7-8 billion in TARP (Troubled Asset Relief Program) loans made from the U.S. and Canada. What Mr. Whitacre failed to acknowledge was how investors will be made whole on the whopping balance of around $45 billion.

How did GM miraculously pay off this debt? Whitacre would like taxpayers to believe booming sales or an operational turnaround has funded the debt repayment. Rather, these debt repayments were funded through other government TARP loans held in escrow with U.S. Treasury oversight. Effectively, GM has paid down one Mastercard (MA) bill with another Visa (V) credit card, and then gone on to brag about this financial shell game through a multi-million dollar advertising campaign. It’s bad enough that politicians and so-called media pundits attempt to “spin” facts into warped truths, but when a government-owned entity steps onto a national loudspeaker and spouts out blatantly distorted sound-bites, there should be consequences to these actions. American taxpayers deserve more honest accountability and transparency regarding their tax outlays rather than quarter truths.

GM’s Future

As Jedi Master Yoda’s famously quotes, “Uncertain, the future is,” and “Always in motion is the future.” GM is not out of the woods yet – the company lost $3.4 billion in the 4th quarter of 2009 alone and remains 70% government-owned. Nobody is certain how much (if any) of the $43 billion will be repaid by General Motors. For reference purposes, GM lost $88 billion from 2004 until 2009 when they declared bankruptcy (see AP article) If all goes according to plan, the former debt holders (now equity holders) and government stockholders will get a return on their capital infusions if and when GM does an equity offering to the public sometime later in 2010. If achieved, the company will have come full circle: public to bankrupt; bankrupt to private; and private to public.

While executives at GM are confident in their repayment capabilities, less convinced are certain branches of our federal government. Maybe these government agencies have taken note of the horrific train wreck occurring in the automotive industry over the last few decades (see GM Fatigue) Take for example the Office of Management and Budget, and the nonpartisan Congressional Budget Office (CBO) – they see TARP losses exceeding $100 billion, including about $30 billion from the auto companies…ouch.

The probability of success will no doubt hinge on some of the dramatic transformations made over the last year. First of all, GM has axed the number of brands in half (from eight to four), cutting Pontiac, Saturn, Hummer, and Saab. Cutting costs is great, but chopping expenses to prosperity cannot last forever – at some point you need compelling products that will drive sales. The rubber will hit the road late this year when GM is scheduled to release the “Volt,” a plug-in hybrid, which the company is using as a launching pad for new products.

TARP on Right Track but Not to Finish Line

Given the heightened political sensitivity in Washington regarding the banks and Wall Street it’s not too surprising that many of the banks wanted to be out of the governments crosshairs and pay back TARP as soon as possible. Beyond political pressure, banks have accelerated TARP repayments in part due to the massively steep and profitable yield curve, along with signs of an improving economy. According to the Treasury Department less than $200 billion in bailout money is outstanding for what originally started out as a $700 billion fund ($36 billion of automaker bailouts is estimated as uncollectible). Even though there has been progress on TARP collections, unfortunately non-TARP losses associated with AIG, Fannie Mae (FNM), and Freddie Mac (FRE) are expected to add more than $150 billion in bleeding.

I don’t believe anyone is happy about the bailouts, although some are obviously more irate. Accountability and transparency are important bailout factors as taxpayers and investors look to recover capital contributions. The next trick GM and Ed Whitacre need to pull off is paying off tens of billions in taxpayer money with the benefit of sustained profits – now that’s a television commercial I want to see.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and in a security derived from an AIG subsidiary, but at the time of publishing SCM had no direct positions in General Motors, AIG, FNM, FRE, MA, V, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

EBITDA: Sniffing Out the Truth

Financial analysts are constantly seeking the Holy Grail when it comes to financial metrics, and to some financial number crunchers EBITDA (Earnings Before Interest Taxes Depreciation and Amortization – pronounced “eebit-dah”) fits the bill. On the flip side, Warren Buffett’s right hand man Charlie Munger advises investors to replace EBITDA with the words “bullsh*t earnings” every time you encounter this earnings metric. We’ll explore the good, bad, and ugly attributes of this somewhat controversial financial metric.

The Genesis of EBITDA

The origin of the EBITDA measure can be traced back many years, and rose in popularity during the technology boom of the 1990s. “New Economy” companies were producing very little income, so investment bankers became creative in how they defined profits. Under the guise of comparability, a company with debt (Company X) that was paying interest expense could not be compared on an operational profit basis with a closely related company that operated with NO debt (Company Z). In other words, two identical companies could be selling the same number of widgets at the same prices and have the same cost structure and operating income, but the company with debt on their balance sheet would have a different (lower) net income. The investment banker and company X’s answer to this apparent conundrum was to simply compare the operating earnings or EBIT (Earnings Before Interest and Taxes) of each company (X and Z), rather than the disparate net incomes.

The Advantages of EBITDA

Although there is no silver bullet metric in financial statement analysis, nevertheless there are numerous benefits to using EBITDA. Here are a few:

- Operational Comparability: As implied above, EBITDA allows comparability across a wide swath of companies. Accounting standards provide leniency in the application of financial statements, therefore using EBITDA allows apples-to-apples comparisons and relieves accounting discrepancies on items such as depreciation, tax rates, and financing choice.

- Cash Flow Proxy: Since the income statement traditionally is the financial statement of choice, EBITDA can be easily derived from this statement and provides a simple proxy for cash generation in the absence of other data.

- Debt Coverage Ratios: In many lender contracts certain debt provisions require specific levels of income cushion above the required interest expense payments. Evaluating EBITDA coverage ratios across companies assists analysts in determining which businesses are more likely to default on their debt obligations.

The Disadvantages of EBITDA

While EBITDA offers some benefits in comparing a broader set of companies across industries, the metric also carries some drawbacks.

- Overstates Income: To Charlie Munger’s point about the B.S. factor, EBITDA distorts reality. From an equity holder’s standpoint, in most instances, investors are most concerned about the level of income and cash flow available AFTER all expenses, including interest expense, depreciation expense, and income tax expense.

- Neglects Working Capital Requirements: EBITDA may actually be a decent proxy for cash flows for many companies, however this profit measure does not account for the working capital needs of a business. For example, companies reporting high EBITDA figures may actually have dramatically lower cash flows once working capital requirements (i.e., inventories, receivables, payables) are tabulated.

- Poor for Valuation: Investment bankers push for more generous EBITDA valuation multiples because it serves the bankers’ and clients’ best interests. However, the fact of the matter is that companies with debt or aggressive depreciation schedules do deserve lower valuations compared to debt-free counterparts (assuming all else equal).

Wading through the treacherous waters of accounting metrics can be a dangerous game. Despite some of EBITDA’s comparability benefits, and as much as bankers and analysts would like to use this very forgiving income metric, beware of EBITDA’s shortcomings. Although most analysts are looking for the one-size-fits-all number, the reality of the situation is a variety of methods need to be used to gain a more accurate financial picture of a company. If EBITDA is the only calculation driving your analysis, I urge you to follow Charlie Munger’s advice and plug your nose.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Digging a Debt Hole

Little did I know when I signed up for a recent “distressed” debt summit (see previous article) that a federal official and state treasurer would be presenting as keynote speakers? After all, this conference was supposed to be catering to those professionals interested in high risk securities. Technically, California and the U.S. government are not classified as distressed yet, but nonetheless government heavy-hitters Matthew Rutherford (Deputy Assistant Secretary, Federal Finance at the U.S. Department of Treasury), and Bill Lockyer (Treasurer for the State of California) shared their perspectives on government debt and associated economic factors.

Why have government officials present at a distressed debt conference? After questioning a few organizers and attendees, I was relieved to discover the keynote speaker selections were made more as a function as a sign of challenging economic times, rather than to panic participants toward debt default expectations. As it turns out, the conference organizers packaged three separate conferences into one event – presumably for cost efficiencies (Distressed Investments Summit + Public Funds Summit + California Municipal Finance Conference).

The U.S. Treasury Balancing Act

Effectively operating as the country’s piggy bank, the Treasury has a very complex job of constantly filling the bank to meet our country’s expenditures. Deputy Assistant Secretary Matthew Rutherford launched the event by speaking to domestic debt levels and deficits along with some the global economic trends impacting the U.S.

- Task at Hand: Rutherford spoke to the Treasury’s three main goals as part of its debt management strategy, which includes: 1) Cash management (to pay the government bills); 2) Attempt to secure low cost financing; and 3) Promote efficient markets. With more than a few hundred auctions held each year, the Treasury manages an extremely difficult balancing act.

- Debt Limit Increased: The recent $1.9 trillion ballooning in the U.S. debt ceiling to $14.3 trillion gives the Treasury some flexibility in meeting the country’s near-term funding needs. The Treasury expects to raise another $1.5 trillion in debt in 2010 (from $1.3 trillion in ’09) to fund our government initiatives, but that number is expected to decline to $1.0 – $1.1 trillion in 2011.

- Funding Trillions at 0.16%: Thanks to abnormally low interest rates, an investor shift to short-term safety (liquidity), and a temporary rush to the dollar, the U.S. Treasury was able to finance their borrowing needs at a mere 16 basis points. Clearly, servicing the U.S.’ massive debt load at these extremely attractive rates is not sustainable forever, and the Treasury is doing its best to move out on the yield curve (extend auctions to lengthier maturities) to lock in lower rates and limit the government’s funding risk should short-term rates spike.

- Chinese Demand Not Waning: Contrary to recent TIC (Treasury International Capital) data that showed Japan jumping to the #1 spot of U.S. treasury holders, Rutherford firmly asserted that China remains at the top by a significant margin of $140 billion, if you adjust certain appropriate benchmarks. He believes foreign ownership at over 50% (June 2009) remains healthy and steady despite our country’s fiscal problems.

- TIPS Demand on the Rise: Appetite for Treasury Inflation Protection Securities is on the rise, therefore the Treasury has its eye on expanding its TIP offerings into longer maturities, just last week they handled their first 3-year TIPS auction.

There is no “CA” in Greece

State of California Treasurer Bill Lockyer did not sugarcoat California’s fiscal problems, but he was quick to defend some of the comparisons made between Greece and California. First of all, California’s budget deficit represents less than 1% of the state’s GDP (Gross Domestic Product) versus 13% for Greece. Greece’s accumulated debt stands at 109% of GDP – for California debt only represents 4% of the state’s GDP. What’s more, since 1800 Greece has arguably been in default more than not, where as California has never in its history defaulted on an obligation.

The current California picture isn’t pretty though. This year’s fiscal budget deficit is estimated at $6 billion, leaping to $12 billion next year, and soaring to $20 billion per year longer term.

Legislative political bickering is at the core of the problem due to the constitutional inflexibility of a 2/3 majority vote requirement to get state laws passed. The vast bulk of states require a simple majority vote (> than 50%) – California holds the unique super-majority honor with only Arkansas and Rhode Island. Beyond mitigating partisan bickering, Lockyer made it clear no real progress would be made in budget cuts until core expenditures like education, healthcare, and prisons are attacked.

On the subject of bloatedness, depending on how you define government spending per capita, California ranks #2 or #4 lowest out of all states. Economies of scale help in a state representing 13% of the U.S.’ GDP, but Lockyer acknowledged the state could just be less fat than the other inefficient states.

Lockyer also tried to defend the state’s 10.5% blended tax rate (versus the national median of 9.8%), saying the disparity is not as severe as characterized by the media. He even implied there could be a little room to creep that rate upwards.

Finishing on an upbeat note, Lockyer recognized the January state revenues came in above expectations, but did not concede victory until a multi-month trend is established.

After filtering through several days of meetings regarding debt, you quickly realize how the debt culture (see D-E-B-T article), thanks to cheap money, led to a glut across federal governments, state governments, corporations, and consumers. Hopefully we have learned our lesson, and we are ready to climb out of this self created hole…before we get buried alive with risky debt.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including CMF and TIP), but at time of publishing had no direct position on any security referenced. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Money Goes Where Treated Best

“The world is going to hell in a handbasket” seems to be a prevailing sentiment among many investors. Looking back, a lack of fiscal leadership in Washington, coupled with historically high unemployment, has only fanned the flames of restlessness. A day can hardly go by without hearing about some fiscal problem occurring somewhere around the globe. Geographies have ranged from Iceland to Dubai, and California to Greece. Regardless, eventually voters force politicians to take notice, as we recently experienced in the Massachusetts vote for Senator.

Time to Panic?

So is now the time to panic? Entitlement obligations such as Social Security and Medicare, when matched with a rising interest payment burden from our ballooning debt, stands to consume the vast majority of our country’s revenues in the coming decades (if changes are not made). It’s clear to most that the current debt trajectory is not sustainable – see also Debt: The New Four-Letter Word. With that said, historical debt levels have actually been at higher levels before. For example, during World War II, debt levels reached 122% of GDP (Gross Domestic Product). Since promises generally garner votes, politicians have traditionally found it easier to legislate new spending into law rather than cutting back existing spending and benefits.

Money Goes Where it’s Treated Best

If our government leaders choose to ignore the growing upswell in fiscal discontent, then the global financial markets will pay more attention and disapprove less diplomatically. As the globe’s reserve currency, the U.S. Dollar stands to collapse if a different direction is not forged, and interest costs could skyrocket to unpalatable levels. Fortunately, the flat world we live on has created some of these naturally occurring governors to forcibly direct sovereign entities to make better decisions…or suffer the consequences. Right now Greece is paying for the financial sins of its past, which includes widening deficits and untenable debt levels.

As new, growing powers such as China, Brazil, India, and other emerging countries fight for precious capital to feed the aspirational goals of their rising middle classes, money will migrate to where it is treated best. Speculative money will flow in and out of various capital markets in the short-run, but ultimately capital flows where it is treated best. Meaning, those countries with policies fostering fiscal conservatism, financial transparency, prudent regulations, pro-growth initiatives, tax incentives, order of law, and other capital-friendly guidelines will enjoy their fair share of the spoils. The New York Times editorial journalist Tom Friedman coined the term “golden straitjacket” in describing this naturally occurring restraint system as a result of globalization.

Push Comes to Shove

Push will eventually come to shove, but the real question is whether we will self-impose fiscal restraint on ourselves, or will the global capital markets shove us in that direction, like the markets are doing to Greece (and other financially strapped nations) today? I am hopeful it will be the former. Why am I optimistic? Although more government spending has typically lead to more votes for politicians, cracks in the support wall have surfaced through the Massachusetts Senatorial vote, and rising populist sentiment, as manifested through the “Tea Party” movement (previously considered a fringe group).

Political gridlock has traditionally been par for the course, but crisis usually leads to action, so I eventually expect change. I am banking on the poisonous and sour mood permeating through the country’s voter base, in conjunction with the collapse of foreign currencies, to act as a catalyst for financial reform. If not, resident capital and domestic jobs will exodus to other countries, where they will be treated best.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including emerging market-based ETFs), but at time of publishing had no direct positions in securities mentioned in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.