Posts tagged ‘debt’

2012 Investing Caffeine Greatest Hits

Between Felix Baumgartner flying through space at the speed of sound and the masses flapping their arms Gangnam style, we all still managed to survive the Mayan apocalyptic end to the world. Investing Caffeine also survived and managed to grow it’s viewership by about +50% from last year.

Thank you to all the readers who inspire me to spew out my random but impassioned thoughts on a somewhat regular basis. Investing Caffeine and Sidoxia Capital Management wish you a healthy, happy, and prosperous New Year in 2013!

Here are some of the most popular Investing Caffeine postings over the year:

Explaining how billions of dollars in stock selling can lead to doubling in stock prices.

2) Uncertainty: Love It or Hate It?

Source: Photobucket

Good investors love ambiguity.

3) USA Inc.: Buy, Hold or Sell?

What would you do if our country was a stock?

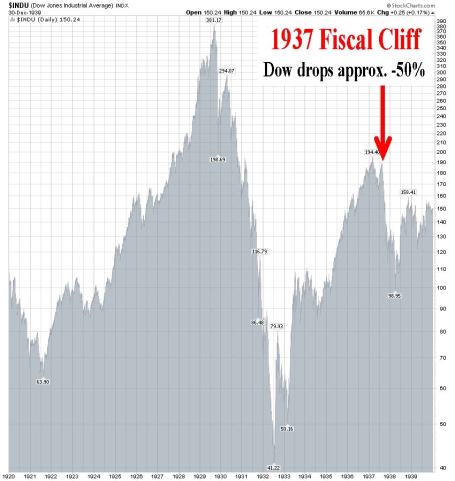

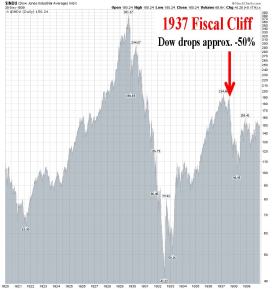

4) Fiscal Cliff: Will a 1937 Repeat = 2013 Dead Meat?

Source: StockCharts.com

Determining whether history will repeat itself after the presidential elections.

5) Robotic Chain Saw Replaces Paul Bunyan

How robots are changing the face of the global job market.

6) Floating Hedge Fund on Ice Thawing Out

Lessons learned from Iceland four years after Lehman Brothers.

7) Sidoxia’s Investor Hall of Fame

Continue reading at IC & perhaps you too can become a member?!

8) Broken Record Repeats Itself

It appears that the cycle from previous years is happening again.

9) The European Dog Ate My Homework

Explaining the tight correlation of European & U.S. markets, and what to do about it.

10) Cash Security Blanket Turns into Tourniquet

Stock market returns are beginning to make change perceptions about holding cash.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Autumn, Elections and Replacement Refs

Article is an excerpt from previously released Sidoxia Capital Management’s complementary October 1, 2012 newsletter. Subscribe on right side of page.

As September has come to a close, the grand finale of our annual seasons has commenced… autumn. How do we know autumn is here? Well, for starters, the leaves are changing colors; the weather is about to cool; and the NFL replacement referees are watching Sunday football games from their couches.

While 2012 is split into quarters, football games and investment seasons are also divided into four quarters. Right now, the economic fourth quarter has just started and the home team is winning. As we can see from the stock market scoreboard, the S&P 500 index is up +15% this year (+6% in Q3) and the NASDAQ index has catapulted +20% through September (+6% also in Q3). The U.S. home team is winning, but a fumble, blocked kick, or interception could mean the difference between an exciting win and a devastating loss.

Another game divided into four parts is the game of presidential politics. However, presidential elections are divided into four years – not four quarters. Five weeks from now, we’ll find out if our Commander in Chief Obama will get to lead our team for another game lasting four years, or whether backup quarterback Mit Romney will be called into the game. The fans are getting restless due to anemic growth and lingering joblessness, but for now, the coach is keeping the president in the starting lineup. Both President Obama and Governor Romney will take some head-to-head practice snaps against each other in the first of three scheduled presidential debates beginning this week.

Bernanke Changes Rules

The New York Jets have Tim Tebow for their secret weapon (1 for 1 yesterday!), and the United States economy has Ben Bernanke. Although our home team may be winning, it has required some monetary rule-changing policies to be instituted by Federal Reserve Chairman Ben Bernanke to keep our team in the lead. Just a few weeks ago, Mr. Bernake instituted QE3 (3rd round of quantitative easing), which is an open-ended mortgage buying program designed to lower home buying interest rates and stimulate the economy (see Helicopter Ben to QE3 Rescue). The short-term benefits of the $40 billion monthly bond buying binge are relatively clear (lower borrowing costs for homebuyers), but the longer-term costs of inflation are stewing patiently on the backburner.

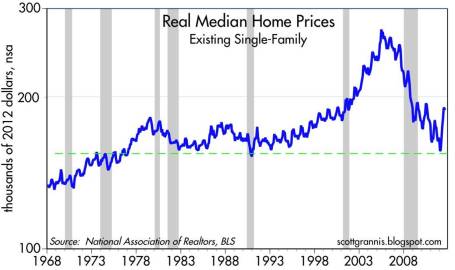

As you can see from the chart above, August median home prices are up +10% for existing single-family homes over the last year. Housing affordability is at extremely attractive levels, and although the bank loan purse strings are tight, a modest loosening is beginning to unfold.

Economy Playing Injured

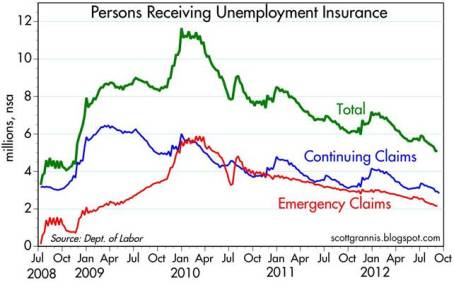

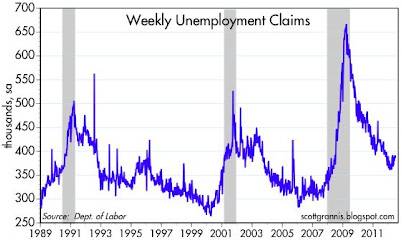

Our starters may still be playing, but many are injured, just like the jobless are limping through the employment market. Encouragingly, although unemployment remains stubbornly high, the number of people collecting unemployment checks is a lot lower (-1.25 million fewer than a year ago). Not great news, but at least we are hobbling in the right direction (see chart below).

Time for Fiscal Cliff Hail Mary?

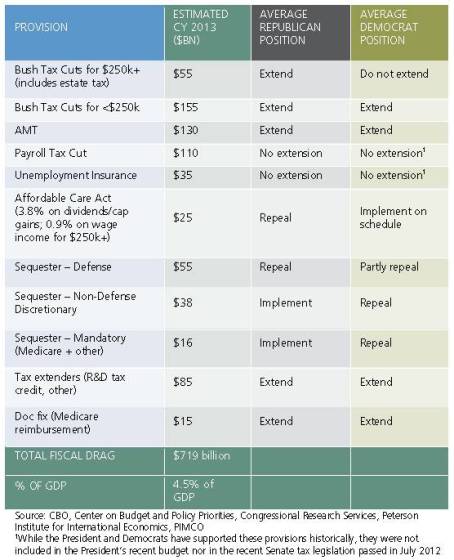

If a team is losing at the end of a game, a “Hail Mary” pass might be necessary. We are quickly nearing this fiscal Armageddon situation as the approximately $700 billion “fiscal cliff” (a painful combo of spending cuts and tax hikes) kicks in at the end of the year (see PIMCO chart below via The Reformed Broker).

Running trillion dollar deficits in perpetuity is not a sustainable strategy, so for most people, a combination of spending cuts and/or tax hikes makes sense to narrow the gap (see chart below). Last year’s recommendations from the bipartisan Simpson-Bowles commission, which were ignored, are not a bad place to start. What happens in the lame-duck session of Congress (after the elections) will dramatically impact the score of the current economic game, and decide who wins and who loses.

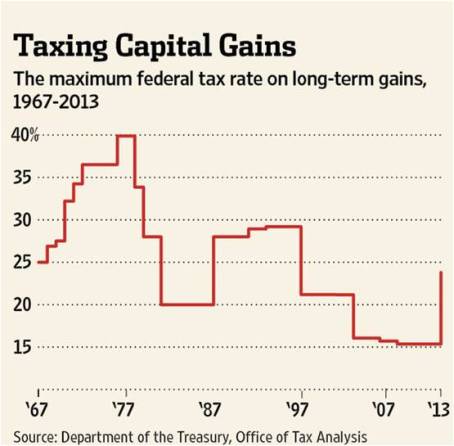

Heated debates continue on how the gap between expenses and revenues will be narrowed, but regardless, Democrats will continue to push for capital gains tax hikes on the rich (see tax chart below); and the Republicans will push to cut spending on entitlements, including untenable programs like Medicare and Social Security.

The game is not quite over, but the fourth quarter promises to be a bloody battle. So while the replacement refs may be back at home, the experienced returning refs have been known to blow calls too. Let’s just hope that autumn, the season of bounteous fecundity, ends up being a continued trend of sweet market success, rather than a political period of botched opportunities.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fiscal Cliff: Will a 1937 Repeat = 2013 Dead Meat?

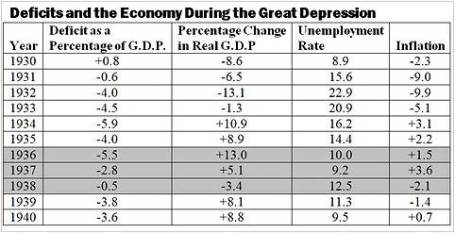

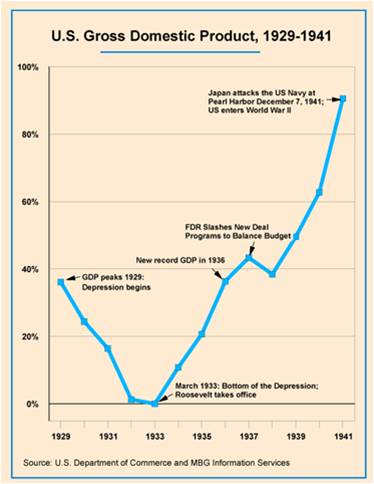

The presidential election is upon us and markets around the globe are beginning to factor in the results. More importantly, in my view, will be the post-election results of the “fiscal cliff” discussions, which will determine whether $600 billion in automated spending cuts and tax increases will be triggered. Similar dynamics in 1937 existed when President FDR (Franklin Delano Roosevelt) felt pressure to balance the budget after his 1933 New Deal stimulus package began to rack up deficits and lose steam.

What’s Similar Today

Just as there is pressure to cut spending today by Republicans and “Tea-Party” Congressmen, so too there was pressure for FDR and the Federal Reserve in 1937 to unwind fiscal and monetary stimulus. At the time, FDR thought self-sustaining growth had been restored and there was a belief that the deficits would become a drag on expansion and a source of future inflation. What’s more, FDR’s Treasury Secretary, Henry Morgenthau, believed that continued economic growth was dependent on business confidence, which in turn was dependent on creating a balanced budget. History has a way of repeating itself, which explains why the issues faced in 1937 are eerily similar to today’s discussions.

The Results

FDR was successful in dramatically reducing spending and significantly increasing taxes. Specifically, federal spending was reduced by -17% over two years and FDR’s introduction of a Social Security payroll tax contributed to federal revenues increasing by a whopping +72% over a similar timeframe. The good news was the federal deficit fell from -5.5% of GDP to -0.5%. The bad news was the economy went into a tail-spinning recession; the Dow crashed approximately -50%; and the unemployment rate burst higher by about +3.3% to +12.5%.

What’s Different This Time?

For starters, one difference between 1937 and 2012 is the level of unemployment. In 1937, unemployment was +14.3%, and today it is +8.1%. Objectively, today there could be higher percentage of the population “under-employed,” but nonetheless the job market was in worse shape back then and labor unions had much more power.

Another major difference is the stance carried by the Fed. Today, Ben Bernanke and the Fed have made it crystal clear they are in no hurry to take away any of the monetary stimulus (see Hekicopter Ben QE3 article), until we have experienced a long-lasting, sustainable recovery. Back in early 1937, the Fed increased banks’ reserve requirements twice, doubling the requirement in less than a year, thereby contracting monetary supply drastically.

Furthermore, we live in a much more globalized world. Today, central banks and governments around the world are doing their part to keep growth alive. Emerging markets are large enough now to move the needle and impact the growth of developed markets. For example, China, the #2 global superpower, continues to cut interest rates and has recently implemented a $158 billion infrastructure spending program.

Net-Net

Whether you’re a Republican or Democrat, everyone generally agrees that job creation is an important common objective, which is consistent with growing our economy. The disagreement between parties stems from the differing opinions on what are the best ways of creating jobs. From my perch, the frame of the debate should be premised on what policies and incentives should be structured to increase competitiveness. Without competitiveness there are no jobs. At the end of the day, money and capital are agnostic. Cold hard cash migrates to the countries in which it is treated best. And where the money goes is where the jobs go.

There is no single silver bullet to solve the competiveness concerns of the United States. Like baseball (since playoffs are quickly approaching), winning is not based solely on hitting, pitching, defense, or base-running. All of these facets and others are required to win. The same principles apply to our country’s competitiveness.

In order to be a competitive leader in the 21st century, here are few necessary areas in which we must excel:

Education: Chicago school unions have been in the news, and I have no problems with unions, if accountability can be structured in. Unfortunately, however, it is clear to me that for now our system is broken (a must see: Waiting for Superman). We cannot compete in the 21st century with an illiterate, uneducated workforce. Our colleges and universities are still top-notch, but as Bill Gates has stated, our elementary schools and high schools are “obsolete”.

Entitlements: Social safety nets like Social Security and Medicare are critical, but unsustainable promises that explode our debt and deficits will not make us more competitive. Politicians may gain votes by making promises in the short-run, but when those promises can’t be delivered in the medium-run or long-run, then those votes will disappear quickly. The sworn guarantees made to the 76 million Baby Boomers now entering retirement are a disaster waiting to happen. Benefits need to be reduced and or criteria need to be adjusted (i.e., means-testing, increase age requirements). The problems are clear as day, so Americans cannot walk away from this sobering reality.

Strategic Government Investment: – Government played a role in building our country’s railways, highways, and our military – a few strategic areas of our economy that have made our nation great. Thoughtful investments into areas like energy infrastructure (e.g., smart grid), internet infrastructure (e.g., higher speed super highway), and healthcare (e.g., human genome research) are a few examples of how jobs can be created while simultaneously increasing our global competitiveness. The great thing about strategic government investments is that government does NOT have to do all the heavy lifting. Rather than write all the checks and do all the job creation from Washington, government can implement these investments and create these jobs by providing incentives for the private sector. Strategic public-private partnerships can generate win-win results for government, businesses, and job seekers. If, however, you’re convinced that our government is more efficient than the private sector, then I highly encourage you to go visit your local DMV, post office, or VA to better appreciate the growth-sucking bureaucracy and inefficiency.

Taxes / Regulations / Laws: Taxes come from profits, and businesses create profits. In order to have a strong and competitive government, we need strong and competitive businesses. Higher taxes, excessive regulations, and burdensome laws will not create stronger and more competitive businesses. I acknowledge that reckless neglect and consumer exploitation will not work either, but reasonable protections for consumers and businesses can be instituted without multi-thousand page regulations. Reducing ridiculous subsidies and loopholes, while tightening tax collection processes and punishing tax dodgers makes perfect sense…so why not do it?

Politics are sharply polarized at both ends of the spectrum, but no matter who wins, our problems are not going away. We may or may not have a new president of the United States this November, but perhaps more important than the elections themselves will be the outcome of the “fiscal cliff” legislation (or lack thereof). If we want to maintain our economic power as the strongest in the world, solving this “fiscal cliff” is the key to improving our competiveness. Avoiding a messy 1937 (and 2011) political repeat will prevent us from becoming dead meat.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Digesting the Anchovy Pizza Market

Article is an excerpt from previously released Sidoxia Capital Management’s complementary July 2012 newsletter. Subscribe on right side of page.

I love pizza, and most fellow connoisseurs have difficulty refusing a hot, fresh slice of heaven too. Pizza is so universally appreciated that people consider pizza like ice cream – it’s good even when it’s bad (I agree). However, even the biggest, diehard pizza-lover will sheepishly admit their fondness for the flat and circular cheesy delight changes when you integrate anchovies into the mix. Not many people enjoy salty, slimy, marine creatures layered onto their doughy mozzarella and marinara pizza paradise.

With all the turmoil and uncertainty going on in the global financial markets, prudently investing in a widely diversified portfolio, including a broad range of equity securities, is viewed as palatable as participating in an all-you-can-eat anchovy pizza contest. Why are investors’ appetites so salty now? Hmmm, let me think. Oh yes, here are a few things that come to mind:

- Presidential Election Uncertainty

- European Financial Crisis

- Impending Fiscal Cliff (tax cut expirations, automatic spending cuts, termination of stimulus, etc.)

- Unsustainable Fiscal Debt & Deficits

- Slowing Subpar Domestic Economic Growth

- Partisan Politics and Gridlock in Washington

- High Unemployment

- Fears of a Hard Economic Landing in China

Doesn’t sound too appealing, does it? So, what are most investors doing in this unclear market? Rather than feasting on a pungent pie of anchovies, investors are flocking to the perceived safety of low yielding asset classes, no matter the price. In other words, the short-term warmth and comfort of CDs, money market, checking, and fixed income assets are being gobbled up like nicotine-laced pepperoni pizzas selling for $29.95/each + tax. The anchovy alternative, like stocks, is much more attractively priced now. After accounting for dividends, earnings, and cash flows, the anchovy/stock option is currently offering a 2-for-1 special with breadsticks and a salad…quite the bargain!

Nonetheless, the plain and expensive pepperoni/bond option remains the choice du jour and there are no immediate signs of a pepperoni hangover just quite yet. However, this risk aversion addiction cannot last forever. The bond gorging buffet has gone on relatively unabated for the last three decades, as you can see from the chart below. In spite of this, the bond binging game is quickly approaching a mathematical terminal end-game, as interest rates cannot logically go below zero.

Since my firm (Sidoxia Capital Management) is based in Newport Beach, next to PIMCO’s global headquarters, we get to follow the progression of the bond binging game firsthand. I’ve personally learned that if I manage close to $2 trillion in assets under management, I too can construct a 23-story Taj Mahal-esque headquarters that overlooks the Pacific Ocean from a stones-throw away.

Beyond glorified headquarters, there is evidence of other low-risk appetite examples. Here are some reinforcing pictures:

The Bond Binge

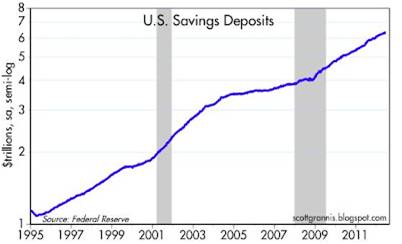

Cash Hoarding

Source (Calafia Beach Pundit): Stuffing money under the mattress has accelerated in recent years as fear, uncertainty, and doubt have reigned supreme.

The Anchovy Special

Even though anchovy pizza, or a broadly diversified portfolio across asset class, size, geography, and style may not sound appealing, there are plenty of reasons to fight the urges of caving to fear and skepticism. Here are a few:

1) Growth Rolls On: Despite the aforementioned challenges occurring domestically and abroad, growth has continued unabated for 11 consecutive quarters, albeit at a rate less than desired. We are not immune to global recessionary forces, but regardless of European forces, the U.S. has been resilient in its expansion.

2) Jobs and Housing on the Upswing: Unemployment remains high, but our country has experienced 27 consecutive months of private creation, leading to more than 4 million new jobs being added to our workforce. As you can see from the clear longer-term downward trend in unemployment claims, we are moving in the right direction.

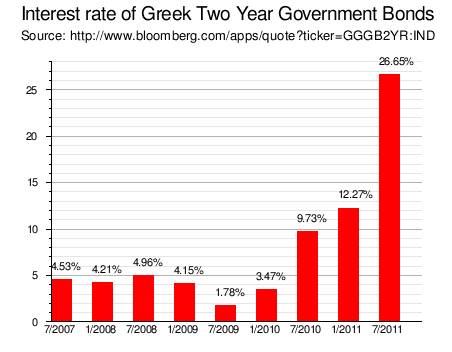

3) Eurozone Slowly Healing its Wounds: The Greek political and fiscal soap opera is grabbing all the headlines, but quietly in the background there are signs that the eurozone is slowly healing the wounds of the financial crisis. If you look at the 2-year borrowing costs of Europe’s troubled countries (ex-Greece), there is an unambiguous and beneficial decline. There is no doubt that Spain and Italy play a larger role than Portugal and Ireland, but at least some seeds of change have been planted for optimism.

4) Record Corporate Profits: Investors are not the only people reading uncertain newspaper headlines and watching CNBC business television. CEOs are reading the same gloomy sensationalistic stories, and as a result, corporations have been cautious about dipping their short arms into their deep pockets. Significant expense reductions and a reluctance to hire have led to record profits and cash hoards. As evidenced by the chart below, profits continue to rise, and these earnings are being applied to shareholder friendly uses like dividends, share buybacks, and accretive acquisitions.

5) Attractive Valuations (Pricing): We have already explored the lofty prices surrounding bonds and $30 pepperoni pizzas, but counter-intuitively, stock prices are trading at a discount to historical norms, despite record low interest rates. All else equal, an investor should pay higher prices for stocks when interest rates are at a record low (and vice versa), but currently we are seeing the opposite dynamic occur.

Even though the financial markets may look, smell, and taste like an anchovy pizza, the price, value, and return benefits may outweigh the fishy odor. And guess what…anchovies are versatile. If you don’t like them on your pizza, you can always take them off and put them on your Caesar salad or use them for bait the next time you go fishing. The gloom-filled headlines haven’t been spectacular, but if they were, the return opportunities would be drastically reduced. Therefore you are much better off by following investor legend Warren Buffett’s advice, which is to “buy fear and sell greed.”

Investing has never been more difficult with record low interest rates, and it has also never been more important. Excluding a small minority of late retirees and wealthy individuals, efficiently investing your retirement dollars has become even more critical. The safety nets of Social Security and Medicare are likely to be crippled, which will require better and more prudent investing by individuals. Inflation relating to food, energy, healthcare, gasoline, and entertainment is dramatically eroding peoples’ nest eggs.

Digesting a pepperoni pizza may sound like the most popular and best option given the gloomy headlines and uncertain outlook, but if you do not want financial heartburn you may consider alternative choices. Like the healthier and less loved anchovy pizza, a more attractively valued strategy based on a broadly diversified portfolio across asset class, size, geography, and style may be the best financial choice to satiate your long-term financial goals.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

U.S. – Best House in Bad Global Neighborhood

Article below represents a portion of free December 1, 2011 Sidoxia monthly newsletter (Subscribe on right-side of page)

There is no shortage of issues to worry about in our troubled global neighborhood, but then again, anybody older than 25 years old knows the world is always an uncertain place. Whether we are talking about wars (Vietnam, Cold War, Iraq); presidential calamities (Kennedy assassination, Nixon resignation/impeachment proceedings); international turmoil (dissolution of Soviet Union, 9/11 attacks, Arab Spring); investment bubbles (technology, real estate); or financial crises (S&L crisis, Long Term Capital, Lehman Brothers bankruptcy), investors always have a large menu of concerns from which they can order.

Despite the doom and gloom dominating the media airwaves, and the lackluster performance of equities experienced over the last decade, the Dow Jones Industrial Average and the S&P 500 index are both up more than 20-fold since the 1970s (those gains also exclude the positive impact of dividends).

Times Have Changed

Just a few decades ago, nobody would have talked or cared about small economies like Iceland, Dubai, and Greece. Today, technology has accelerated the forces of globalization, resulting in information travelling thousands of miles at the click of a mouse, often creating scary financial mountains out of meaningless molehills. As a result of these trends, news of Italian bond auctions, which normally would be glossed over on the evening news, instantaneously clogs our smart phones, computers, radios, and televisions. The implications of all these developments mean investing has become much more difficult, just as its importance has never been more crucial.

How has investing become more critical? For starters, interest rates are near 60-year lows and Treasury bond prices are at record highs, while inflation (food, energy, healthcare, leisure, etc.) is shrinking the value of people’s savings. Next, entitlement and pension reliability are decreasing by the minute – fiscal imbalances and unrealistic promises have contributed to a less certain retirement outlook. Layer on hyper-manic volatility of daily, multi-hundred point swings in the Dow Jones Industrial index and a less experienced investor quickly realizes investing can become an overwhelming game. Case in point is the VIX volatility index (a.k.a., the “Fear Gauge”), which has registered a whopping +57% increase in 2011.

December to Remember?

After an explosive +23% return in the S&P 500 index for 2009 (excluding dividends) and another +13% return in 2010, equity investors have taken a breather thus far in 2011 – the Dow Jones Industrial Average is up modestly (+4%) and the S&P 500 index is down fractionally (-1%). We still have the month of December to log, but in the short-run the European tail has definitely been wagging the rest of the global dog.

Although the United States knows a thing or two about lack of political leadership and coordination, herding the 17 eurozone countries to resolve the European debt financial crisis has proved even more challenging. As you can see below in the performance figures of the major global equity markets, the U.S. remains the best house in a bad neighborhood:

Our fiscal house undeniably needs some work (i.e., unsustainable deficits and bloated debt), but record corporate profits, record levels of cash, voracious consumer spending, improving employment data, and attractive valuations are all contributing to a domestic house that makes opportunities in our backyard look a lot more appealing to investors than prospects elsewhere in the global neighborhood.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and VGK, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Plumbers & Cops: Can the Debt Ceiling be Fixed?

The ceiling is leaking, but it’s unclear whether it will be repaired? Rather than fix the seeping fiscal problem, Democrats and Republicans have stared at the leaky ceiling and periodically applied debt ceiling patches every year or two by raising the limit. Nanosecond debt ceiling coverage has reached a nauseating level, but this issue has been escalating for many months. Last fall, politicians feared their long-term disregard of fiscally responsible policies could lead to a massive collapse in the financial ceiling protecting us, so the President called in the bipartisan plumbers of Alan Simpson & Erskine Bowles to fix the leak. The commission swiftly identified the problems and came up with a deep, thoughtful plan of action. Unfortunately, their recommendations were abruptly dismissed and Washington fell back into neglect mode, choosing instead to bicker like immature teenagers. The result: poisonous name calling and finger pointing that has placed Washington politicians one notch above Cuba’s Fidel Castro, Venezuela’s Hugo Chavez, and Iran’s Mahmoud Ahmadinejad on the list of the world’s most hated leaders. Strategist Ed Yardeni captured the disappointment of American voters when he mockingly states, “The clowns in Washington are making people cry rather than laugh.”

Although despair is in the air and the outlook is dour, our government can redeem itself with the simple passage of a debt ceiling increase, coupled with credible spending reduction legislation (and possibly “revenue enhancers” – you gotta love the tax euphimism).

The Elephant in the Room

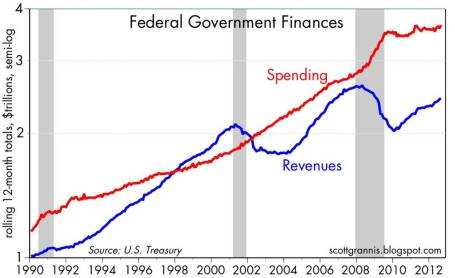

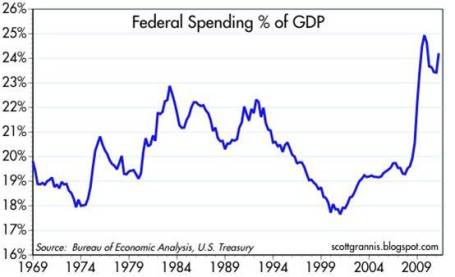

Our country’s spending problems is nothing new, but the 2008-2009 financial crisis merely amplified and highlighted the severity of the problem. The evidence is indisputable – we are spending beyond our means:

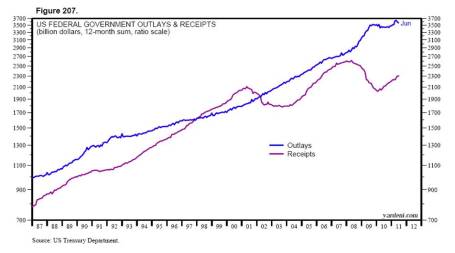

If the federal spending to GDP chart is not convincing enough, then review the following graph:

You don’t need to be a brain surgeon or rocket scientist to realize government expenditures are massively outpacing revenues (tax receipts). Expenditures need to be dramatically reduced, revenues increased, and/or a combination thereof. Applying for a new credit card with a limit to spend more isn’t going to work anymore – the lenders reviewing those upcoming credit applications will straightforwardly deny the applications or laugh at us as they gouge us with prohibitively high borrowing costs. The end result will be the evaporation of entitlement programs as we know them today (including Medicare and Social Security). For reference of exploding borrowing costs, please see Greek interest rate chart below. The mathematical equation for the Greek financial crisis (and potentially the U.S.) is amazingly straightforward…Loony Spending + Looney Politicians = Loony Interest Rates.

To illustrate my point further, imagine the government owning a home with a mortgage payment tied to a 2.5% interest rate (a tremendously low, average borrowing cost for the U.S. today). Now visualize the U.S. going bankrupt, which would then force foreign and domestic lenders to double or triple the rates charged on the mortgage payment (in order to compensate the lenders for heightened U.S. default risk). Global investors, including the Chinese, are pointing a gun at our head, and if a political blind eye on spending continues, our foreign brethren who have provided us with extremely generous low priced loans will not be bashful about pulling the high borrowing cost trigger. The ballooning mortgage payments resulting from a default would then break an already unsustainably crippling budget, and the government would therefore be placed in a position of painfully slashing spending. Too extreme a shift towards austerity could spin a presently wobbling economy into chaos. That’s precisely the situation we face under a no-action Congressional default (i.e., no fix by August 2nd or shortly thereafter). To date, the Chinese have collected their payments from us with a nervous smile, but if the U.S. can’t make some fiscally responsible choices, our Asian Pacific pals will be back soon with a baseball bat to collect.

The Cops to the Rescue

Any parent knows disciplining teenagers doesn’t always work out as planned. With fiscally irresponsible spending habits and debt load piling up to the ceiling, politicians are stealing the prospects of a brighter future from upcoming generations. The good news is that if the politicians do not listen to the parental voter cries for fiscal sanity, the capital market cops will enforce justice for the criminal negligence and financial thievery going on in Washington. Ed Yardeni calls these capital market enforcers the “bond vigilantes.” If you want proof of lackadaisical and stubborn politicians responding expeditiously to capital market cops, please hearken back to September 2008 when Congress caved into the $700 billion TARP legislation, right after the Dow Jones Industrial average plummeted 777 points in a single day.

Who exactly are these cops? These cops come in the shape of hedge funds, sovereign wealth funds, pension funds, endowments, mutual funds, and other institutional investors that shift their dollars to the geographies where their money is treated best. If there is a perceived, heightened risk of the United States defaulting on promised debt payments, then global investors will simply take their dollar-denominated investments, sell them, and then convert them into currencies/investments of more conscientious countries like Australia or Switzerland.

Assisting the capital market cops in disciplining the unruly teenagers are the credit rating agencies. S&P (Standard and Poor’s) and Moody’s (MCO) have been watching the slow-motion train wreck develop and they are threatening to downgrade the U.S.’ AAA credit rating. Republicans and Democrats may not speak the same language, but the common word in both of their vocabularies is “reelection,” which at some point will effect a reaction due to voter and investor anxiety.

Nobody wants to see our nation’s pipes burst from excessive debt and spending, and if the political plumbers can repair the very obvious and fixable fiscal problems, we can move on to more important challenges. It’s best we fix our problems by ourselves…before the cops arrive and arrest the culprits for gross negligence.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MCO, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

End of the World Put on Ice

Our 3.5 billion year old planet has received a temporary reprieve, at least until the next Mayan Armageddon destroys the world in 2012. Sex, money, and doom sell and Arnold, Oprah, and the Rapture have not disappointed in generating their fair share of advertising revenue clicks.

With 2 billion people connected to the internet and 5 billion people attached to a cell phone, every sneeze, burp, and fart around the world makes daily headline news. The globalization cat is out of the bag, and this phenomenon will only accelerate in the years to come. In 1861 the Pony Express took ten days to deliver a message from New York to San Francisco, and today it takes a few seconds to deliver a message across the world over Twitter or Facebook.

The equity markets have more than doubled from the March 2009 lows and even previous, ardent bulls have turned cautious. Case in point, James Grant from the Interest Rate Observer who was “bullish on the prospects for unscripted strength in business activity” (see Metamorphosis of Bear into Bull) now sees the market as “rich” and asserts “nothing is actually cheap.” Grant rubs salt into the wounds by predicting inflation to spike to 10% (read more).

Layer on multiple wars, Middle East/North African turmoil, gasoline prices, high unemployment, mudslinging presidential election, uninspiring economic growth, and you have a large pessimistic poop pie to sink your teeth into. Bearish sentiment, as calculated by the AAII Sentiment Survey, is at a nine-month high and currently bears outweigh bulls by more than 50%.

The Fear Factor

I think Cullen Roche at Pragmatic Capitalism beautifully encapsulates the comforting blanket of fear that is permeating among the masses through his piece titled, “In Remembrance of Fear”:

“The bottom line is, stay scared. Do not let yourself feel confident, happy or wealthy. You are scared, poor and miserable. You should stay that way. You owe it to yourself. The media says so. And more importantly, there are old rich white men who need to sell books and if you’re not scared by them you’ll never buy their books. So, do yourself a favor. Buy their books and services and stay scared. You deserve it.”

Here is Cullen’s prescription for dealing with all the doom and gloom:

“Associate with people who are more scared than you. That way, you can all sit in bunkers and talk about the end of days and how screwed we all are. Think about how much better that will make you feel. Misery loves company. Do it.”

All is Not Lost

While inflation and gasoline price concerns weigh significantly on economic growth expectations, some companies are taking advantage of record low interest rates. Take for example, Google Inc.’s (GOOG) recent $3 billion bond offerings split evenly across three-year, five-year, and ten-year notes with an average interest rate of 2.3%. Although Google has languished relative to the market over the last year, the market blessed the internet giant with the next best thing to free money by pricing the deal like a AAA-rated credit. Cash-heavy companies have been able to issue low cost debt at a frantic pace for accretive EPS shareholder-friendly activities, such as acquisitions, share buybacks, and organic growth initiatives. Cash rich balance sheets have afforded companies the ability to offer shareholders a steady diet of dividend increases too.

While there is no question high oil prices have put a wet towel over consumer spending, the largest component of corporate check books is labor costs, which accounts for roughly two-thirds of corporate spending. With unemployment rate at 9.0%, this is one area with no inflation pressure as far as the eye can see. Money losing companies that go bankrupt lay-off employees, while profitable companies with stable input costs (labor) will hire more – and that’s exactly what we’re seeing today. Despite all the economic slowing and collapse anxiety, S&P 500 operating earnings, as of last week, are estimated to rise +17% in 2011. Healthy corporations coupled with a growing, deleveraged workforce will have to carry the burden of growth, as deficit and debt direction will ultimately act as a drag on economic growth in the immediate and intermediate future.

Fear and pessimism sell news, and technology is only accelerating the proliferation of this trend. The good news is that you have another 18 months until the next apocalypse on December 21, 2012 is expected to destroy the human race. Rather than attempting to time the market, I urge you to follow the advice of famed investor Peter Lynch who says, “Assume the market is going nowhere and invest accordingly.” For all the others addicted to “pessimism porn,” I’ll let you get back to constructing your bunker.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing SCM had no direct position in Twitter, Facebook, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Bin Laden Killing Overshadows Royal Rally

Excerpt from No-Cost May Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Before the announcement of the killing of the most wanted terrorist in the world, Osama bin Laden, the royal wedding of Prince William Arthur Philip Louis and Catherine Middleton (Duke and Duchess of Cambridge) grabbed the hearts, headlines, and minds of people around the world. As we exited the month, a less conspicuous royal rally in the U.S. stock market has continued into May, with the S&P 500 index climbing +2.8% last month as the economic recovery gained firmer footing from the recession of 2008 and early 2009. As always, there is no shortage of issues to worry about as traders and speculators (investors not included) have an itchy sell-trigger finger, anxiously fretting over the possibility of losing gains accumulated over the last two years.

Here are some of the attention-grabbing issues that occurred last month:

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Skyrocketing Silver Prices: Silver surged ahead +28% in April, the largest monthly gain since April 1987, and reached a 30-year high in price before closing at around $49 per ounce at the end of the month. Speculators and investors have been piling into silver as evidenced by activity in the SLV (iShares Silver Trust) exchange traded fund, which on occasion has seen its daily April volume exceed that of the SPY (iShares SPDR S&P 500) exchange traded fund.

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain commodity and S&P 500 exchange traded funds, but at the time of publishing SCM had no direct position in SLV, SPY, TWX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Inflation and the Debt Default Paradox

With the federal government anchored down with over $14 trillion in debt and trillion dollar deficits as far as the eye can see, somehow people are shocked that Standard & Poor’s downgraded its outlook on U.S. government debt to “Negative” from “Stable.” This is about as surprising as learning that Fat Albert is overweight or that Charlie Sheen has a substance abuse problem.

Let’s use an example. Suppose I received a pay demotion and then I went on an irresponsible around-the-world spending rampage while racking up over $1,000,000.00 in credit card debt. Should I be surprised if my 850 FICO score would be reviewed for a possible downgrade, or if credit card lenders became slightly concerned about the possibility of collecting my debt? I guess I wouldn’t be flabbergasted by their anxiety.

Debt Default Paradox?

With the recent S&P rating adjustment, pundits over the airwaves (see CNBC video) make the case that the U.S. cannot default on its debt, because the U.S. is a sovereign nation that can indefinitely issue bonds in its own currency (i.e., print money likes it’s going out of style). There is some basis to this argument if you consider the last major developed country to default was the U.S. government in 1933 when it went off the gold standard.

On the other hand, non-sovereign nations issuing foreign currencies do not have the luxury of whipping out the printing presses to save the day. The Latin America debt defaults in the 1980s and Asian Financial crisis in the late 1990s are examples of foreign countries over-extending themselves with U.S. dollar-denominated debt, which subsequently led to collapsing currencies. The irresponsible fiscal policies eventually destroyed the debtors’ ability to issue bonds and ultimately repay their obligations (i.e., default).

Regardless of a country’s strength of currency or central bank, if reckless fiscal policies are instituted, governments will eventually be left to pick their own poison…default or hyperinflation. One can think of these options as a favorite dental procedure – a root canal or wisdom teeth pulled. Whether debtors get paid 50 cents on the dollar in the event of a default, or debtors receive 100 cents in hyper-inflated dollars (worth 50% less), the resulting pain feels the same – purchasing power has been dramatically reduced in either case (default or hyperinflation).

Of course, Ben Bernanke and the Federal Reserve Bank would like investors to believe a Goldilocks scenario is possible, which is the creation of enough liquidity to stimulate the economy while maintaining low interest rates and low inflation. At the end of the day, the inflation picture boils down to simple supply and demand for money. Fervent critics of the Fed and Bernanke would have you believe the money supply is exploding, and hyperinflation is just around the corner. It’s difficult to quarrel with the printing press arguments, given the size and scale of QE1 & QE2 (Quantitative Easing), but the fact of the matter is that money supply growth has not exploded because all the liquidity created and supplied into the banking system has been sitting idle in bank vaults – financial institutions simply are not lending. Eventually this phenomenon will change as the economy continues to recover; banks adequately build their capital ratios; the housing market sustainably recovers; and confidence regarding borrower creditworthiness improves.

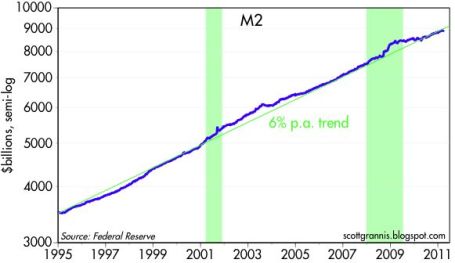

Scott Grannis at the California Beach Pundit makes the point that money supply as measured by M2 has shown a steady 6% increase since 1995, with no serious side-effects from QE1/QE2 yet:

In fact, Grannis states that money supply growth (+6%) has actually grown less than nominal GDP over the period (+6.7%). Money supply growth relative to GDP growth (money demand) in the end is what really matters. Take for instance an economy producing 10 widgets for $10 dollars, would have a CPI (Consumer Price Index) of $1 per widget and a money supply of $10. If the widget GDP increased by 10% to 11 widgets (10 widgets X 1.1) and the Federal Reserve increased money supply by 10% to $11, then the CPI index would remain constant at $1 per widget ($11/11 widgets). This is obviously grossly oversimplified, but it makes my point.

Gold Bugs Banking on Inflation or Collapse

Gold prices have been on a tear over the last 10 years and current fiscal and monetary policies have “gold bugs” frothing at the mouth. These irresponsible policies will no doubt have an impact on gold demand and gold prices, but many gold investors fail to acknowledge a gold supply response. Take for example Freeport-McMoRan Copper & Gold Inc. (FCX), which just reported stellar quarterly sales and earnings growth today (up 31% and 57%, respectively). FCX more than doubled their capital expenditures to more than $500 million in the quarter, and they are planning to double their exploration spending in fiscal 2011. Is Freeport alone in their supply expansion plans? No, and like any commodity with exploding prices, eventually higher prices get greedy capitalists to create enough supply to put a lid on price appreciation. For prior bubbles you can reference the recent housing collapse or older burstings such as the Tulip Mania of the 1600s. One of the richest billionaires on the planet, Warren Buffett, also has a few thoughts on the prospects of gold.

The recent Standard & Poor’s outlook downgrade on U.S. government debt has caught a lot of press headlines. Fears about a technical default may be overblown, but if fiscal constraint cannot be agreed upon in Congress, the alternative path to hyperinflation will feel just as painful.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in FCX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Will the Fiscal Donkey Fly?

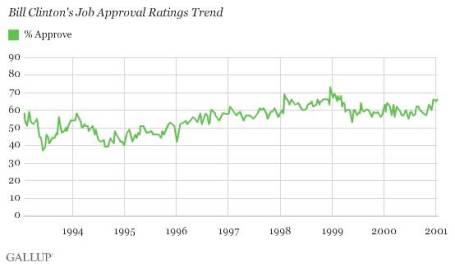

Will Barack Obama become a “one-termer” like somewhat recent Presidents, Democrat Jimmy Carter (1977-1981) and Republican George H.W. Bush #41 (1989-1993)? Or will Obama get the Democratic donkey off the ground like Bill Clinton managed to do after the 1994 mid-term election when Republican Newt Gingrich spearheaded the Contract with America, which led to a similar Republican majority in the House of Representatives. Clinton’s approval ratings were in the dumps at the time, comparable to voter’s current lackluster opinion of Obama and his spending spree (see also Profitless Healthcare).

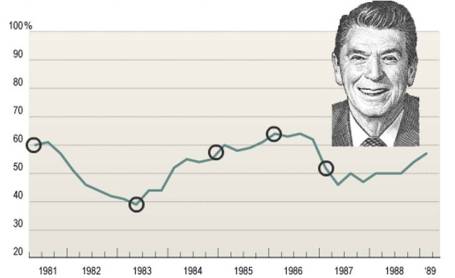

Reagan Rebound

Similarly, Republican Ronald Reagan (1981-1989) was picking up the pieces with his lousy approval rating after the 1982 midterm election. Tax cuts, “trickle-down” supply side economics, and a tough stance on the Russian Cold War turned around the economy and his approval rating and catapulted him to reelection in a landslide victory. Reagan carried 49 states with the help of Reagan Democrats (one-quarter of registered Democrats voted for him).

One should be clear though, popularity is not the only factor that plays into reelection success. George H. W. Bush had the highest average approval rating in five decades (60.9% approval), only superseded by John F. Kennedy (70.1% approval). The economy, international politics, and other external factors also play a large role in the reelection process.

Flying Donkey Time?

If President Obama wants to get the Democratic donkey off the ground and raise his current approval rating of 47% and remedy his self-admitted “shellacking” by the Republicans, then he will need to shift his hard-left political agenda more towards the middle, like Clinton did in 1994. If he leads on ideology alone, then the next two years will likely be a long tough slog for him and his Democratic colleagues.

In order to shift toward the center and gain more Independent voters, Obama will need to find common ground with Republicans and Tea-Partiers. Obama has already conceded in principle to extend the Bush tax cuts, but if he wants to gain more political capital, he will have to gain some ground in the area of fiscal responsibility. With the help of a strong economy, Clinton managed to run surpluses, but front and center today is a $1.3 trillion deficit and over $13 trillion in debt. The first step in building any credibility on the issue will come on December 1st when the president’s bi-partisan commission for deficit reduction will release its report.

It will be interesting which party will show leadership in making unpopular spending cuts, just as the 2012 re-election cycle just begins. The elephants in the room are the entitlements (Medicare and Social Security), and although less talked about, efficient cuts to defense spending should be put on the table. Sure, pork barrel spending, inefficient subsidies, tax loopholes, are gaps that need to be filled, but they alone are rounding errors given our country’s unsustainable current circumstances. Whether or not politicians (red or blue) will point out the unpopular elephants in the room will be interesting to watch.

Financial irresponsibility at the consumer and corporate level were major drivers behind the 2008-2009 financial crisis, and both individuals and businesses are responsibly adjusting their expense structures and balance sheets. Our government has to wake up to reality and adjust its expense structure and balance sheet too. Although foreign countries have reacted (i.e., European austerity), egotistical American politicians on both sides of the aisle haven’t quite woken up and smelled the coffee yet. Thank goodness for the democracy that we live in because citizens are pointing to the elephants in the room and demanding reckless spending and debt levels to come under control. If President Barack Obama doesn’t want to become another one-termer, he’ll have to move more to the center and get the finances of our country under control. If the stubborn donkey refuses to deal with reality and remains flightless, hopefully an elephant or ship-full of tea partiers can get this grass roots call for fiscal sanity off the ground.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.