Posts tagged ‘covid’

Pedal to the Metal Leads to Record Rebound

Like a race car pushing the pedal to the metal, the stock market sped to its best quarterly stock market gains in decades. The +20% rebound in the 2nd quarter S&P 500 index was the best result achieved since 1998. Moreover, the Dow Jones Industrial Average saw its largest quarterly gain (+18%) since 1987, and the technology-heavy NASDAQ index (+31%) saw the most appreciation since 2001. While a snap-back after a shockingly dismal 1st quarter should come as no surprise to many investors, the pace of this rebound is unlikely to be sustainable at this trajectory, given the challenging economic backdrop and COVID public health crisis.

Racing Ahead Via Re-Opening

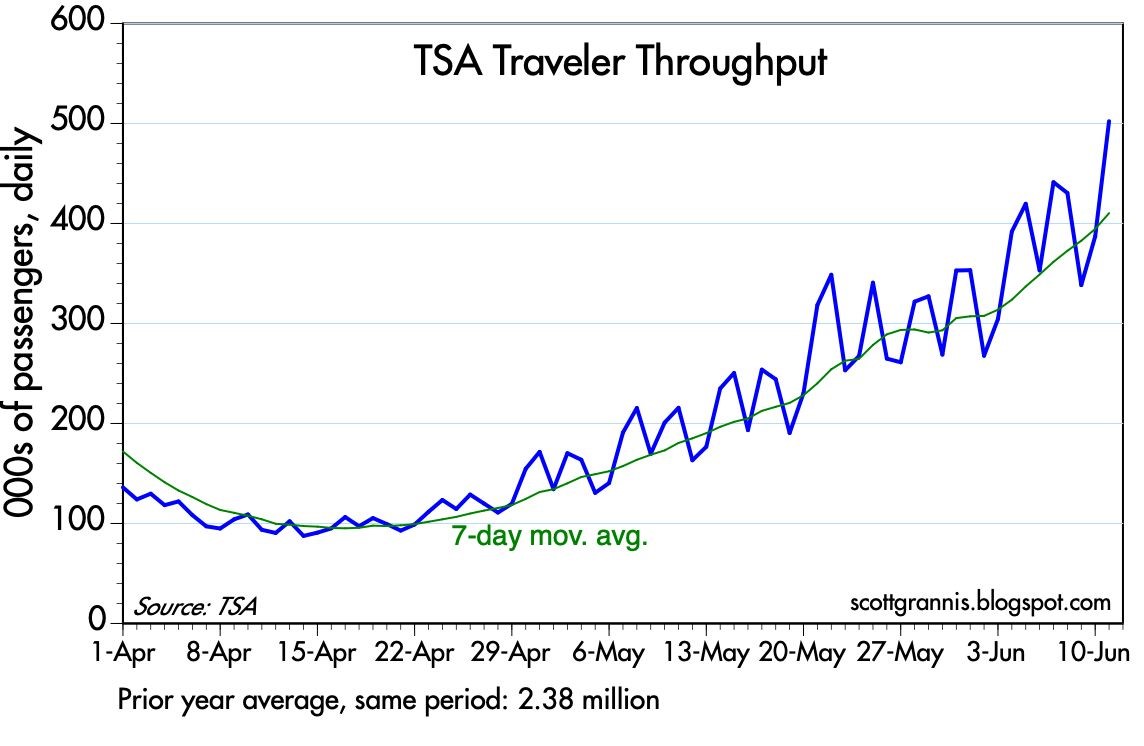

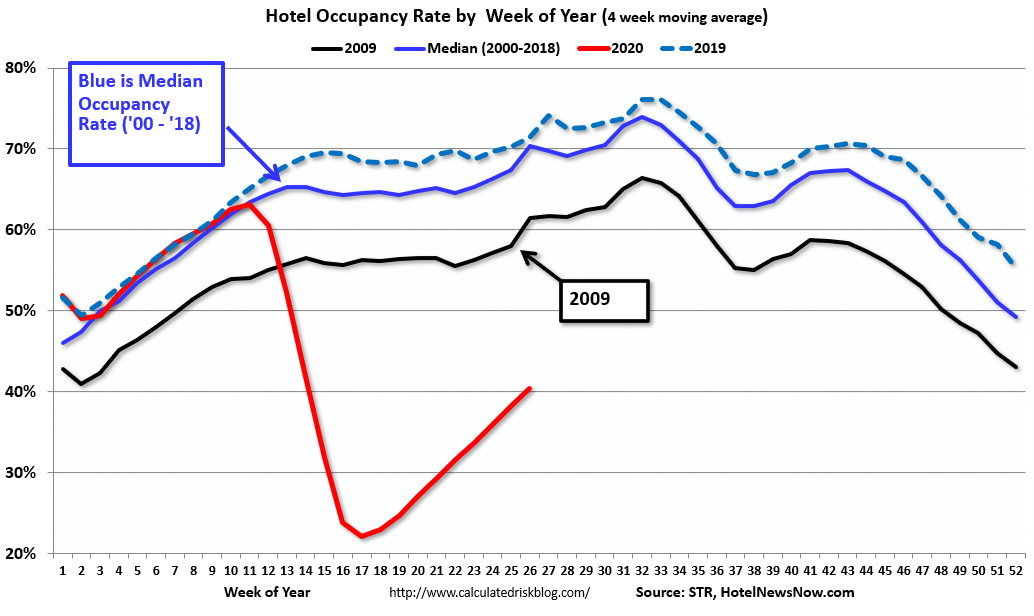

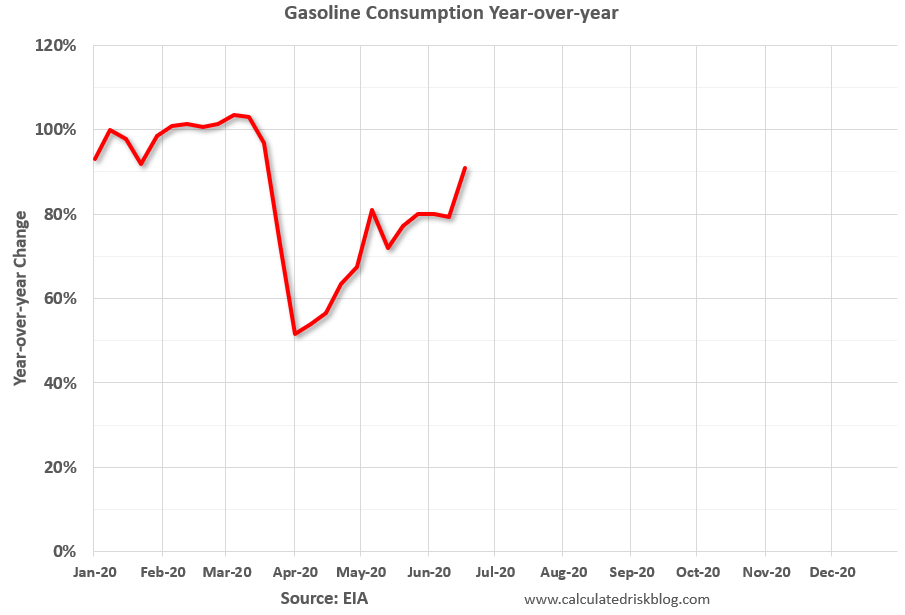

After experiencing six months of the coronavirus pandemic, the country has been re-opening across all 50 states at differing paces. We can see the benefits of a V-shaped recovery in various indicators, such as the following:

- Airline Traffic

- Hotel Occupancy

- Gasoline Consumption

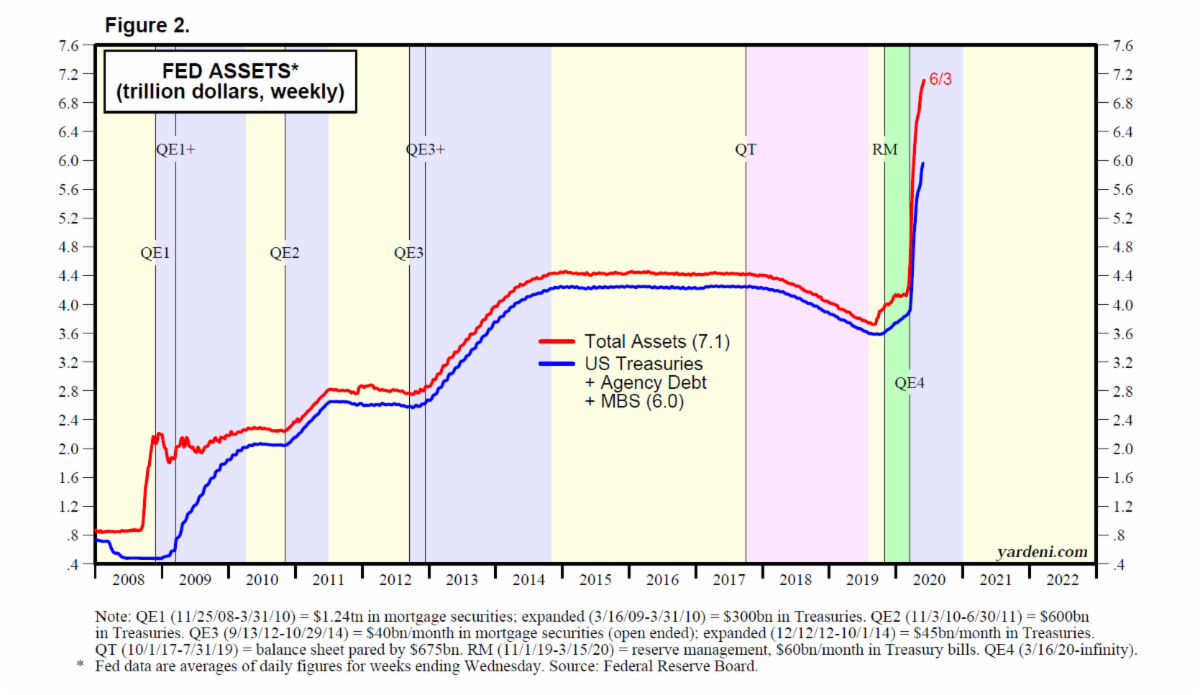

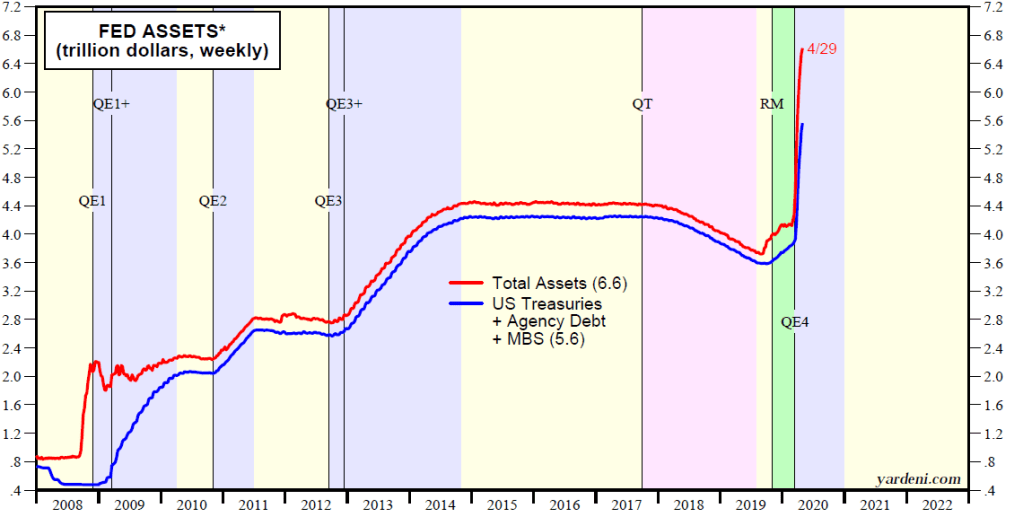

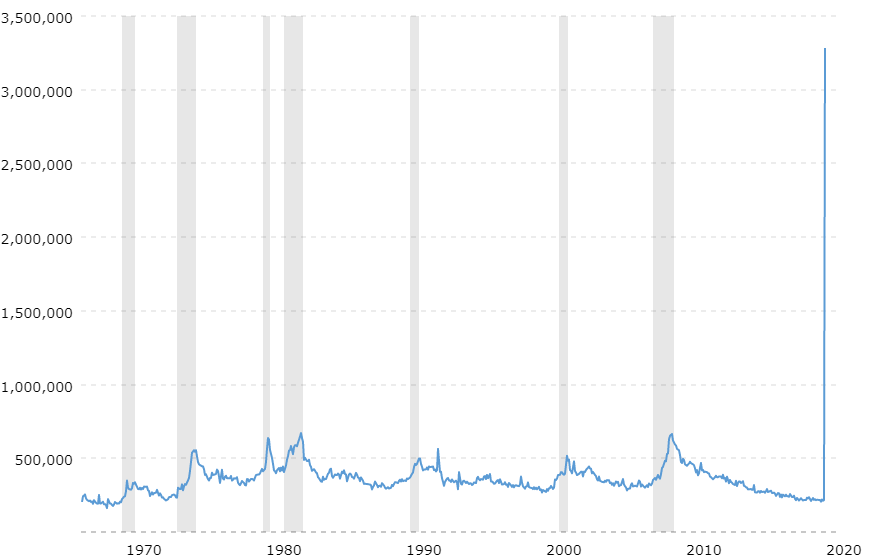

Thanks to unprecedented support from the Federal Reserve in the form of trillions of dollars in stimulative money printing that has been injected into the economy (see chart below), and trillions of government support (including 4.8 million PPP [Payroll Protection Program] loans totaling $519 billion), the economic benefits of the re-openings have been tangible. Not only did the economy unexpectedly add 2.5 million jobs last month, but economic growth is also projected to rebound in the back-half of 2020. More specifically, Treasury Secretary Steven Mnuchin recently testified in front of Congress that 3rd quarter economic growth (GDP – Gross Domestic Product) is currently projected at +17%, and 4th quarter at +9%.

The Stubborn Virus Remains

Many Americans feel liberated from the lifting of stay-at-home orders, but if the re-openings are not handled with proper precautions, the consequences can result in an economic equivalent of serious speeding tickets or jail time. We have experienced this phenomenon firsthand as a surge of new COVID-19 infections has spread predominately across the Southern and Western states, skewed towards younger Americans.

Now that the economic genie has been released out of the bottle, it’s going to be very difficult for state governors and city mayors to stuff the genie back in. Even if the new surge in COVID-19 cases continues, we are more likely to see required health guidelines instituted (e.g., mandatory mask wearing) or rollbacks in certain re-opening phases (e.g., closures of bars, restaurants, and other large gathering establishments). For instance, Disneyland (ticker: DIS) hit some speed bumps when the company just announced its re-opening originally scheduled for mid-July has been delayed indefinitely.

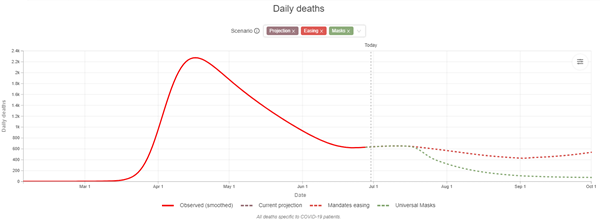

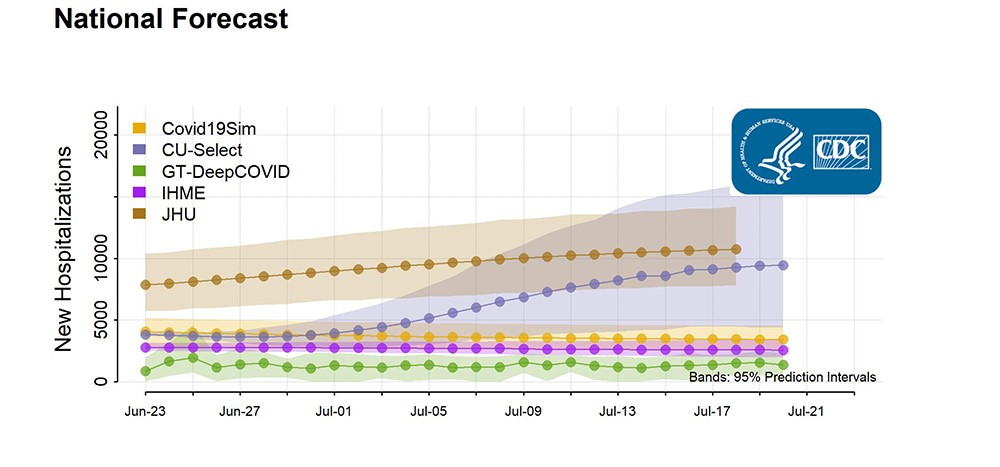

Although COVID infections have been on the rise, driven in part by complacent or irresponsible younger individuals not adhering to social distancing and mask-wearing recommendations, the healthcare treatment regimens have kept the level of deaths at a flat rate (see chart below) and national hospitalization rates at a relatively stable level (see chart below).

The Bridge to a Vaccine

Despite the recent rise in COVID-19 cases, investors have been focused more on the half-glass full developments relating to the pandemic. Approved therapeutics, such as remdesivir by Gilead Sciences Inc. (GILD) and dexamethasone, have proven effective in treating COVID. In addition, ventilator and PPE (Personal Protective Equipment) supplies have become plentiful; virus testing has risen dramatically (see also COVID Comeback); and contact tracing is slowly improving. If you layer in the more than 100 vaccines being developed, including expected Phase 3 trials this year by Pfizer Inc. (PFE), Moderna Inc. (MRNA), Astrazeneca PLC (AZN), Glaxosmithkline PLC (GSK), and Johnson & Johnson (JNJ), there is room for optimism. With all these developments, coupled with more stringent guidelines by governors/federal government/health agencies, and more responsible behavior by individuals (i.e., social distancing, personal hygiene, mask wearing), especially in hot spot regions, there is a credible bridge to managing the virus until a vaccine is approved.

The stock market has been racing ahead at an amazing pace in recent months (+41% since late-March), but with the COVID public health crisis starting to overheat the engine with rising COVID cases, investors should not be shocked to see the driver tap the economic brakes a little in the coming months. For long-term investors like my clients, Sidoxia Capital Management will continue to take advantage of opportunities, while pushing to safely avoid the risky potholes, during these highly volatile times. In periods like these, when your race car has created a large lead, it’s perfectly okay to reassess your circumstances and temporarily take your foot off the pedal before the next turn.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD, MRNA, PFE, JNJ, AZN, GSK, and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The COVID Comeback

Rocky Balboa (“The Italian Stallion”) the underdog boxer from the movie, Rocky, was down and out until he was given the opportunity to fight World Heavyweight Champion, Apollo Creed. Like the stock market during early 2020, Rocky was up against the ropes and got knocked down, but eventually he picked himself up and rebounded to victory in his rematch with Creed.

The stock market comeback also persisted last month as the COVID-19 pandemic health situation continued to stabilize and the broader economy accelerated business re-openings. For the month, the Dow Jones Industrial Average increased +4.3% (+1,037 points to 25,383), while the S&P 500 index bounced+5.3%, and the NASDAQ catapulted the most by +6.8%.

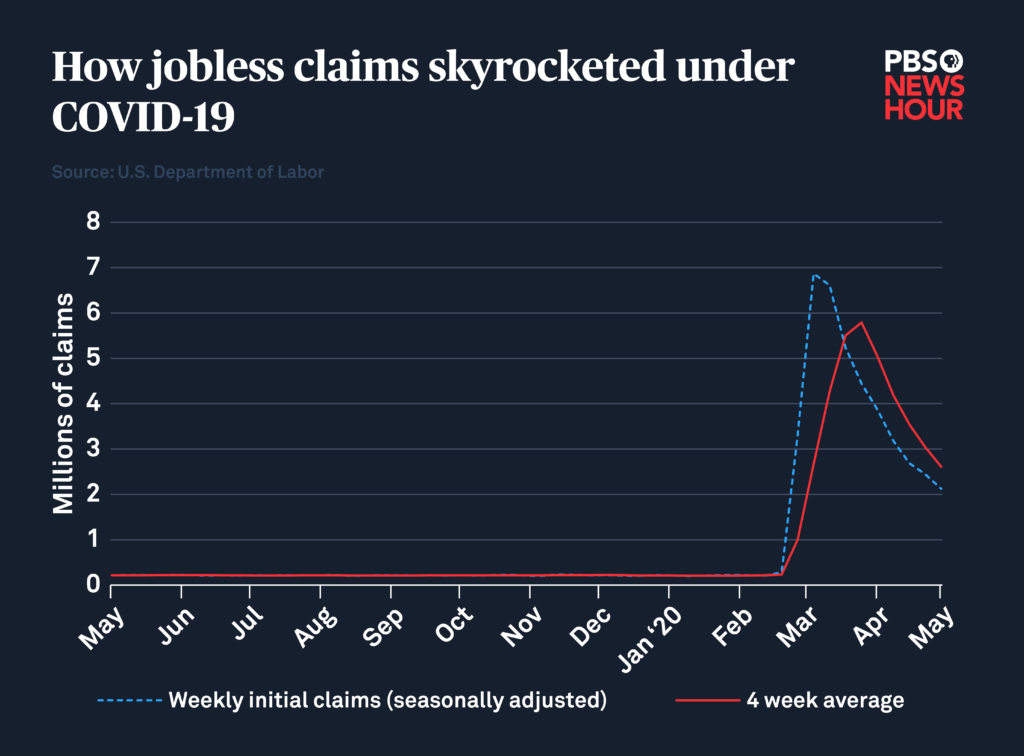

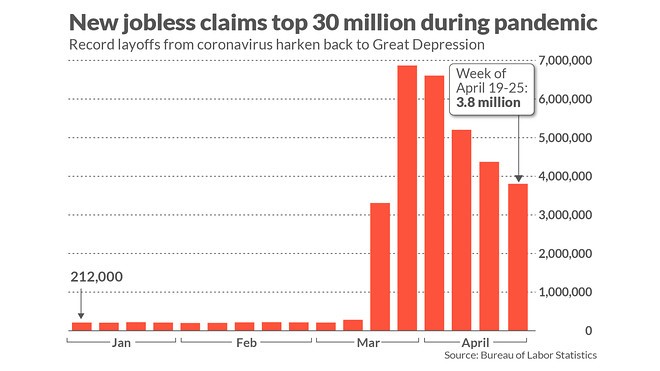

How can the stock market (i.e., the Dow) rebound +39%, or more than 7,100 points, from the March 2020 lows? The large move is even more surprising once you consider 41 million people have lost their jobs since the epidemic hit American soil (see chart below), and COVID-19 related deaths have climbed to over 100,000 people.

Getting Back to Fighting Shape

By the time we reached Rocky VI, Rocky Balboa was retired and recovered from brain damage. But Rocky is no quitter, and he trained himself into championship fighting condition and got back into the boxing ring. With unemployment rates approaching Great Depression levels, the U.S. economy has been experiencing challenging circumstances as well – a self-induced coma (shutdown). Fortunately, our country has been slowly recovering day-by-day, and week-by-week. The economy may not be back to peak fighting shape, but activity is slowly and consistently getting better.

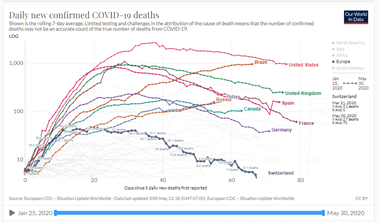

There are many different perspectives in looking at this extremely complex, unprecedented coronavirus pandemic. The speed and pace of selling stocks during February and March reached radically-high panic levels, as measured by objective indicators like the Volatility Index (i.e., the VIX – or Fear Gauge). However, like a coiled spring, the stock market sprung back up during April and May as stay-at-home orders and quarantine measures around the world significantly bent the curve of COVID-19 infections and deaths (see chart below). As you can see, with the exception of a few countries globally (e.g., Brazil and Russia), the number of daily confirmed deaths has been broadly declining for many weeks.

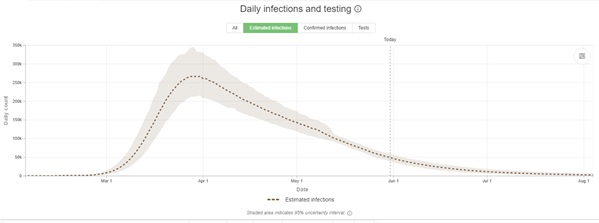

Estimated infections have been coming down as well, according to the Institute for Health Metrics and Evaluation (IMHE). IMHE estimates also show the number of daily infections has consistently been coming down over the last couple months.

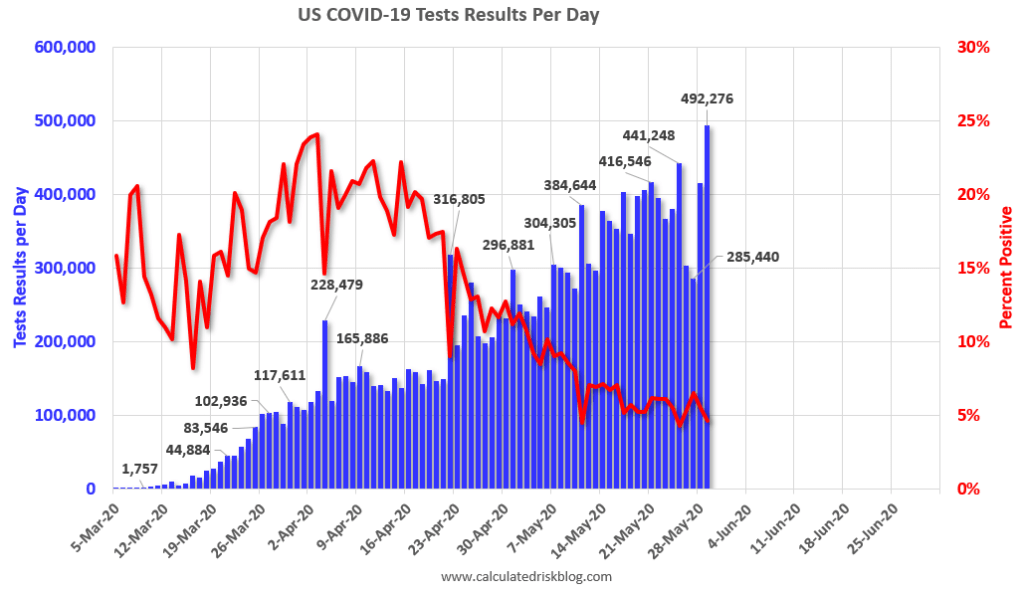

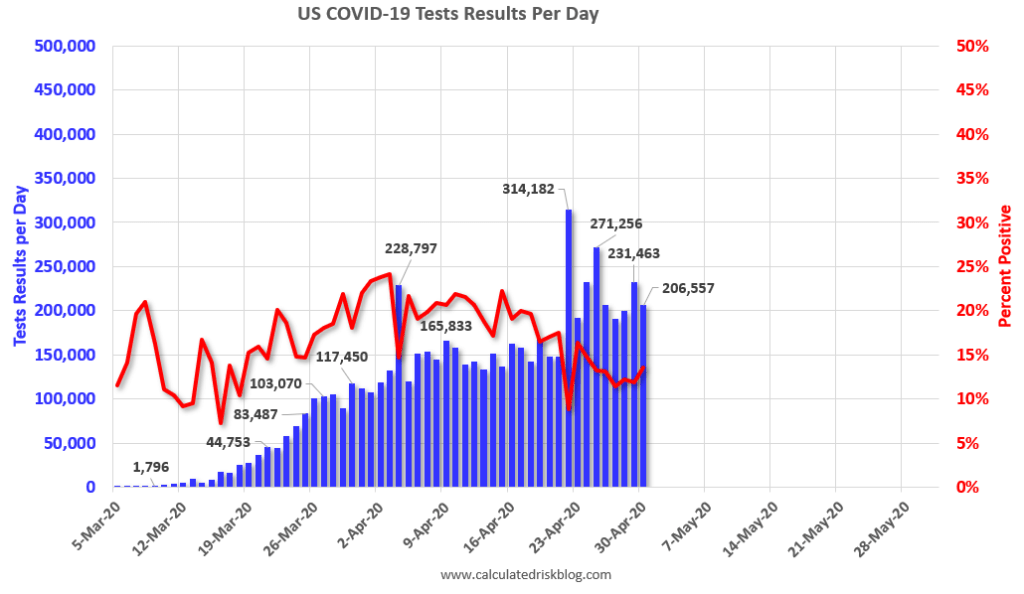

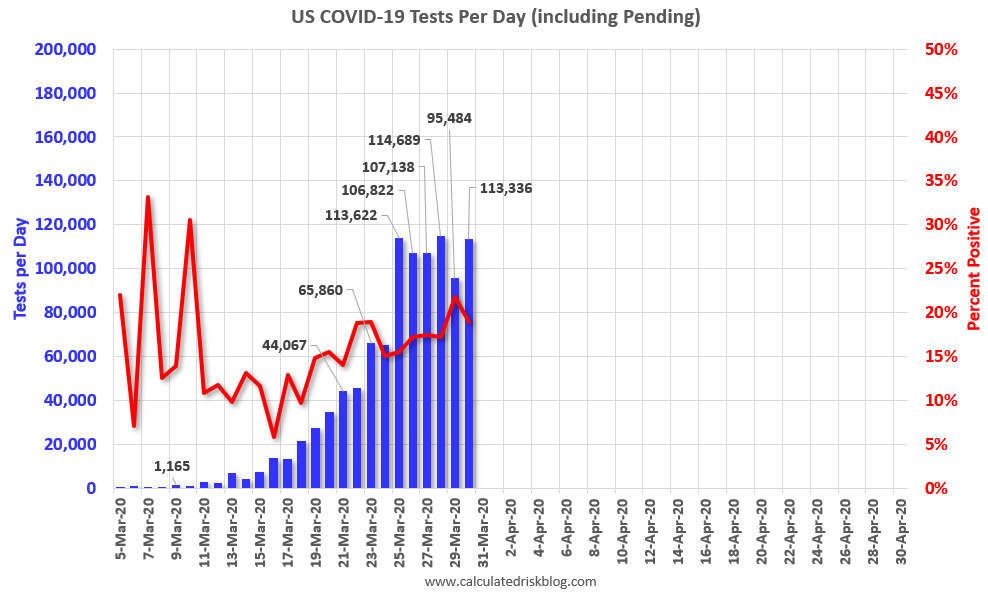

In addition to the stay-at-home orders and social distancing protocols, what has also contributed to the declines in COVID-19 deaths and infections? Two words…”increased testing.” Although, arguably COVID-19 testing got off to a rough start, as seen in the chart below, nevertheless daily tests have risen dramatically over the last couple months from about 100,000 per day to roughly 500,000 per day (see chart below). Increased testing capacity has and will continue to help better control the spread (or lack thereof) of the virus.

Not only has the spread of the coronavirus been substantially mitigated, but the fighting economy has also received an adrenaline shot in the form of trillions of dollars of fiscal and monetary support as I described in my previous article ( see also Recovering from the Coma).

Investors Need to Keep Guard Up

Like Rocky Balboa, the U.S. is a strong, respected fighter but even though strength is being regained, the economy and stock market is susceptible to a surprise upper-cut punch or hook. What could potentially hurt the financial comeback?

- Flare Ups & Second Wave: As cities, counties, and states carry on with expanded business openings, we could experience “flare ups” of COVID-19 infections or a “second wave.” But the good news is, we should be in much better shape to handle these scenarios thanks to expanded stockpiles of ventilators; larger supplies of PPE (Personal Protective Equipment) for frontline workers; increased production of therapeutic drugs like remdesivir from Gilead Sciences Inc. (GILD); and improved contact tracing from the magnified number of tests. And this analysis doesn’t even contemplate the more than 100 vaccines being developed (i.e., a potential cure) for COVID-19, which could be available in limited quantities as early as the end of this year.

- Social Unrest: The death of George Floyd, an African-American man who died after a Minneapolis police officer forcefully restrained George by keeping his knee on his neck, which triggered lethal complications to the victim. As a result, nationwide racial injustice protests and disruptive violence have erupted, thereby forcing government intervention with the hope of limiting violence and damage caused by non-peaceful protesters.

- Strained Relations with China Due to Actions in Hong Kong: Recent political actions mandated by the Chinese government to strip autonomy from Hong Kong has strained relations with the United States, and progress made with the previous U.S. – China trade deal could erode.

- Inflation: Despite no near-term evidence of rising prices, the unparalleled increase of trillions of dollars in fiscal debt and deficits has the credible long-term potential of creating incendiary inflation that could burn through consumers’ buying power.

Rocky Balboa faced many formidable foes in the boxing ring, including Clubber Lang (Mr. T) and Russian Ivan Drago, but Rocky survived and persevered. The stock market is bound to face future punches from unforeseen challengers in the form of impending known and unknown threats, but the alarmist calls for a COVID knockout appear to be overstated.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

What the Heck & What Now?

The Covid-19 viral pandemic that hit our shores in early 2020 shut down the economy to a virtual halt, and unemployment has skyrocketed to an estimated 19%, as 30 million people have now filed for unemployment benefits over the last six weeks (see chart below). Shockingly, we have not seen joblessness levels this high since the Great Depression. All this destruction has investors asking themselves, “What the heck, and what now?

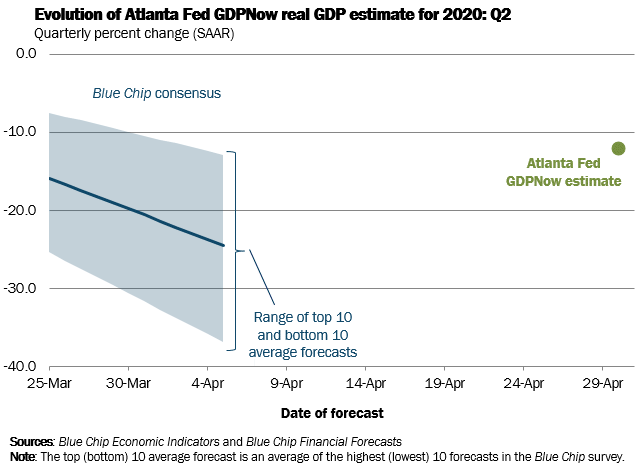

Forecasts for 2nd quarter economic activity (Gross Domestic Product) are estimating an unprecedented decline of -12% (see chart below) with some projections plummeting as low as -34%. Despite the dreadful freefall in the stock market during March, along with the pessimistic economic outlook, the major stock indexes came back with a vengeance during April. More specifically, the Dow Jones Industrial Average soared +2,428 points, or +11% for the month. The other major indexes, S&P 500 and NASDAQ, catapulted higher over the same period by +13% and +15%, respectively.

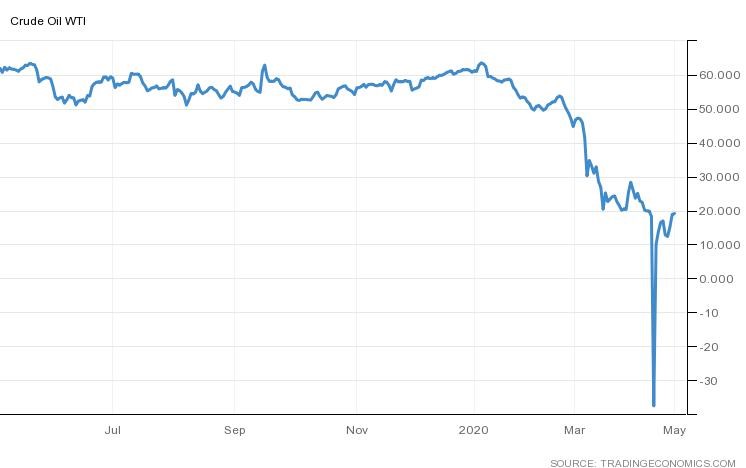

Certainly, there have been some industries hurt by Covid-19 more than others. At the top of the misery list are travel related industries such as airlines, cruise lines, and hotels. Retailers like Neiman Marcus, Pier 1, and JCPenney are filing for bankruptcy or on the verge of closing. Restaurants have also been pummeled (partially offset by the ability to offer pickup and delivery services), and entertainment industries such as sporting arenas, concert venues, movie theaters, and theme parks have all painfully come to a screeching halt as well. Let’s not forget energy and oil companies, which are battling for their survival life in an environment that has witnessed oil prices plunge from $61 per barrel at the beginning of the year to $19 per barrel today (with a brief period at negative -$37…yes negative!) – click here for an explanation and see the chart below.

What the Heck?!

With all this horrifying economic data financially crippling millions of businesses and families coupled with an epidemic that has resulted in a U.S. death count surpassing 60,000, how in the heck can the stock market be up approximately +34% from the epidemic lows experienced just five short weeks ago?

I was optimistic in my Investing Caffeine post last month, but here are some more specific explanations that have contributed to the recent significant rebound in the stock market.

- Virus Curve Flattening: The wave of Covid-19 started in China and crashed all over Europe before landing in the U.S. Fortunately, as you can see from the chart below (U.S. = red line), social distancing and stay-at-home orders have slowed the growth in coronavirus deaths.

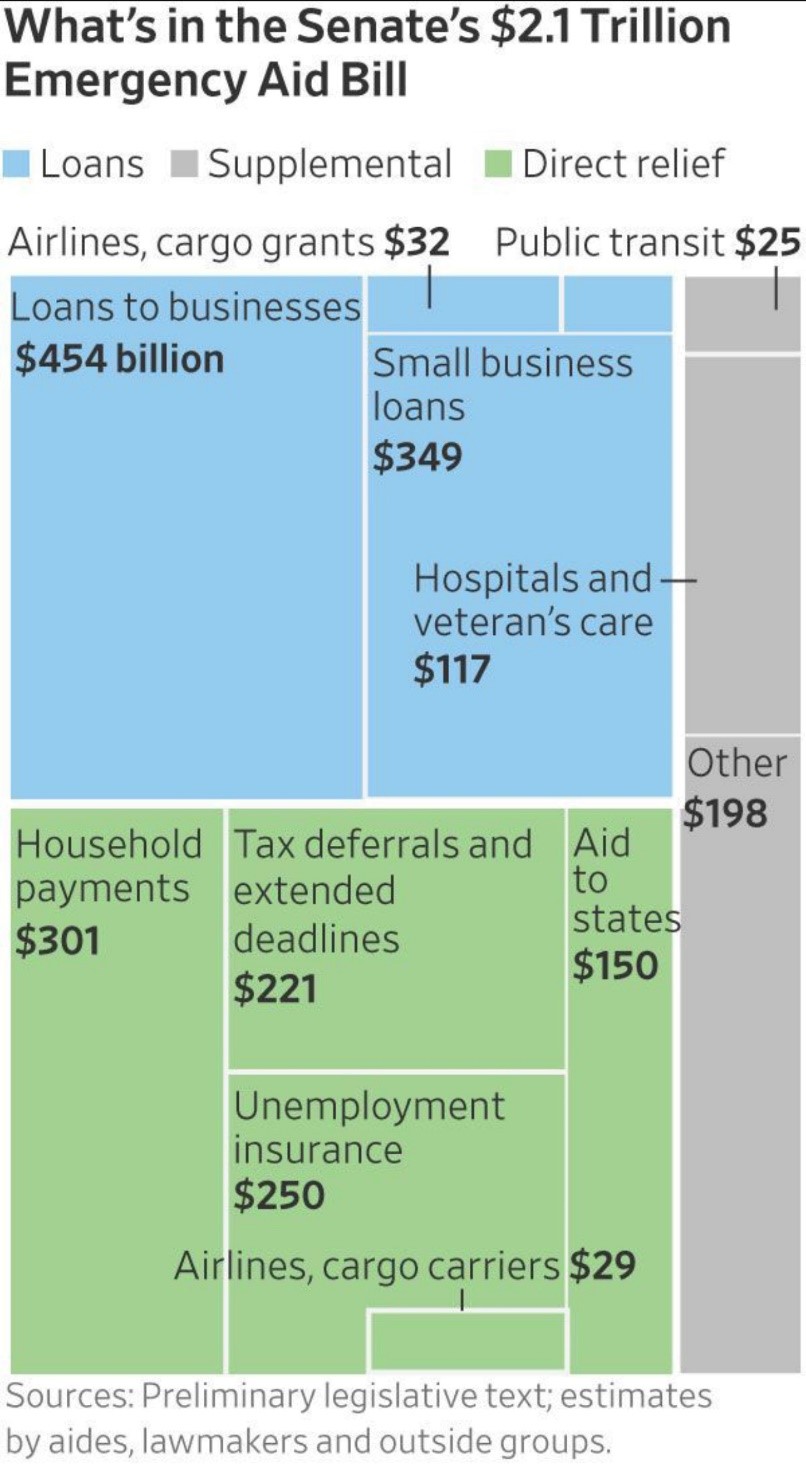

- Fiscal Stimulus: The government fire trucks are coming to the rescue and looking to extinguish the Covid fire by spraying trillions of stimulus and aid dollars to individuals, businesses, and governments. Most recently, Congress passed a $484 billion bill in stimulus funding, including $320 billion in additional funding for the wildly popular Payroll Protection Program (PPP), which is designed to quickly get money in the hands of small businesses, so employers can retain employees rather than fire them. This half trillion program adds to the $2 trillion package Congress approved last month (see also Recovering from the Coma).

- Monetary Stimulus: The Federal Reserve has pulled out another monetary bazooka with the announcement of $2.3 trillion dollars in additional lending to small businesses . This action, coupled with the long menu of actions announced last month brings the total amount of stimulus dollars to well above $6 trillion (see also Recovering from the Coma for a list of Fed actions). You can see in the chart below how the Fed’s balance sheet has ballooned by approximately $3 trillion in recent months. The central bank is attempting to stimulate commerce by injecting dollars into the economy through financial asset purchases.

- Improving Healthcare System: Treatments for sick Covid patients has only gotten better, including new therapeutics like the drug remdesivir from Gilead Sciences Inc. (GILD). Dr. Anthony Fauci, the NIAID Director (National Institute of Allergy and Infectious Diseases) stated remdesivir “will be the standard of care.” With 76 vaccine candidates under development, there is also a strong probability researchers could discover a cure for Covid by 2021. With the help of the Defense Production Act (DPA), the government is also slowly relieving critical manufacturing bottlenecks in areas such as ventilators, PPE (Personal Protective Equipment) and Covid test kits. Making testing progress is crucial because this process is a vital component to reopening the economy (see chart below).

- Economy Reopening: After I have completed all of Netflix, participated in dozens of Zoom Happy Hours, and stocked up on a year’s supply of toilet paper, I have become a little stir crazy like many Americans who are itching to return to normalcy. The government is doing its part by attempting a three-phase reopening of the economy as you can see from the table below. You can’t fall off the floor, so a rebound is almost guaranteed as states slowly reopen in phases.

What Now?!

In the short run, it appears the worst is behind us. Why do I say that? Covid deaths are declining; Congress is spending trillions of dollars to support the economy; the Federal Reserve has effectively cut interest rates to 0% and provided trillions of dollars to provide the economy a backstop; our healthcare preparedness has improved; and global economies (including ours) are in the process of reopening. What’s not to like?!

However, it’s not all rainbows, flowers, and unicorns. We are in the middle of a severe recession with tens of millions unemployed. The Covid-19 epidemic has created a generation of germaphobes who will be hesitant to dive back into old routines. And until a vaccine is found, fears of a resurgence of the virus during the fall is a possibility, even if the masses and our healthcare system are much more prepared for that possibility.

As the world adjusts to a post-Covid 2.0 reality, I’m confident consumer spending will rebound, and pent-up demand will trigger a steady rise of economic demand. However, I am not whistling past the graveyard. I fully understand behavior and protocols will significantly change in a post-Covid 2.0 world, if not permanently, at least for a long period of time. Before the 9/11 terrorist attacks, nobody suspected air travelers would be required to remove shoes, take off belts, place laptops in bins, and carry tiny bottles of mouthwash and shampoo. Nevertheless, a much broader list of social distancing and safety codes of behaviors will be established, which could slow down the pace of the economic recovery.

Regardless of the recovery pace, over just a few short months, we have already placed our hands around the throat of the virus. There are bound to be future setbacks related to the pandemic. Physical and economic wounds will take time to heal. Turbulence will remain commonplace during these uncertain times, but volatility will create opportunities as the recovery continues to gain stronger footing. Although Covid-19 has produced significant damage, don’t let fear and panic infect your long-term investment future.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD, Zoom, Netflix , and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in Neiman Marcus, Pier 1, and JCPenney or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Recovering from the Coma

The patient, the U.S. economy, is sick and remains in a coma. Although the patient was never healthier six weeks ago, now the economy has fallen victim to a worldwide pandemic that has knocked the global economy on its back. On the surface, the physical impact of coronavirus on the health of the 330 million Americans seems relatively modest statistically (4,394 deaths vs. 45,000 estimated common flu deaths this season). However, in order to kill this insidious novel coronavirus, which has spread like wildfire across 200 countries, governments have been forced to induce the economy into a coma, by closing schools, halting sporting events, creating social distancing guidelines, instituting quarantines/lockdowns, and by shutting down large non-essential swaths of the economy (e.g., restaurants, retail, airlines, cruises, hotels, etc.). We have faced and survived other epidemics like SARS (2003-04), H1N1 (2009-10), MERS (2012), and Ebola (2014-16), but the pace of COVID-19 spreading has been extraordinarily rapid and has created dramatic resource drains on healthcare systems around the world (including New York with approximately 75,000 cases alone). The need for test kits, personal protective equipment, and ventilators, among other demands has hit the U.S. caregiving system especially hard.

Given the unique characteristics of this sweeping virus, U.S. investors were not immune from the economic impact. The swift unprecedented downdraft from all-time record highs has not been seen since the October 1987 crash. And although the major indexes experienced an illness this month (Dow Jones Industrial Average -13.7%; S&P 500 -12.5%; NASDAQ -10.1%), the nausea was limited in large part thanks to trillions of dollars in unparalleled government intervention announced in the form of monetary and fiscal stimulus.

Healing the Patient

While the proliferation of the viral outbreak has been painful in many ways from a human and financial perspective, the beneficial impact of the medicine provided to the economic patient by the Federal Reserve and federal government through the Coronavirus Aid, Relief, and Economic Security (CARES) act cannot be overstated. The measures taken will provide a temporary safety net for not only millions of businesses, but also millions of workers and investors. Although last month many investors felt like vomiting when they looked at their investment account balances, gratefully the period ended on an upbeat note with the Dow bouncing +20% from last week’s lows.

Fed Financial Fixes

Here is a partial summary of the extensive multi-trillion dollar emergency measures taken by the Federal Reserve to keep the financial markets and economy afloat:

- Cut interest rates on the benchmark Federal Funds target to 0% – 0.25% from 1% – 1.25%.

- Make $1 trillion available in 14-day loans it is offering every week.

- Make $1 trillion of overnight loans a day available.

- Purchase an unlimited amount of Treasury securities after initially committing to $500 billion.

- Purchase an unlimited amount of mortgage-backed securities after initially committing to at least $200 billion.

- Provide $300 billion of financing to employers, consumers, and businesses. The Department of the Treasury will provide $30 billion in equity to this financing via the Exchange Stabilization Fund (ESF).

- Establish two lending facilities to support credit to large employers – the Primary Market Corporate Credit Facility (PMCCF) for new bond and loan issuance and the Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds.

- Create the Term Asset-Backed Securities Loan Facility (TALF), to support the flow of credit to consumers and businesses, including student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration (SBA).

- Expand the Money Market Mutual Fund Liquidity Facility (MMLF) and the Commercial Paper Funding Facility (CPFF) to include a wider range of securities.

Corona CARE to Country

Here is a limited summary of the sprawling $2.1 trillion bipartisan stimulus legislation that was recently passed by Congress (see summary and table below):

- Direct Payments: Americans who pay taxes will receive a one-time direct deposit of up to $1,200, and married couples will receive $2,400, plus an additional $500 per child. The payments will be available for incomes up to $75,000 for individuals and $150,000 for married couples, and phase out completely at $99,000 and $198,000, respectively.

- Unemployment: The program provides $250 billion for an extended unemployment insurance program and expands eligibility and offers workers an additional $600 per week for four months, on top of what state programs pay. It also extends UI benefits through Dec. 31 for eligible workers. The deal also applies to the self-employed, independent contractors and gig economy workers.

- Payroll Taxes: The measure allows employers to delay the payment of their portion of 2020 payroll taxes until 2021 and 2022.

- Use of Retirement Funds: The bill waives the 10% early withdrawal penalty for distributions up to $100,000 for coronavirus-related purposes, retroactive to Jan. 1. Withdrawals are still taxed, but taxes are spread over three years, or the taxpayer has the three-year period to roll it back in.

- Small Business Relief: $350 billion is being earmarked to preventing layoffs and business closures while workers need to stay home during the outbreak. Companies with 500 employees or fewer that maintain their payroll during coronavirus can receive up to 8 weeks of financial assistance. If employers maintain payroll, the portion of the loans used for covered payroll costs, interest on mortgage obligations, rent, and utilities would be forgiven.

- Large Corporations: $500 billion will be allotted to provide loans, loan guarantees, and other investments, these will be overseen by a Treasury Department inspector general. These loans will not exceed five years and cannot be forgiven. Airlines will receive $50 billion (of the $500 billion) for passenger air carriers, and $8 billion for cargo air carriers.

- Hospitals and Health Care: The deal provides over $140 billion in appropriations to support the U.S. health system, $100 billion of which will be injected directly into hospitals. The rest will be dedicated to providing personal and protective equipment for health care workers, testing supplies, increased workforce and training, accelerated Medicare payments, and supporting the CDC, among other health investments.

- Coronavirus Testing: All testing and potential vaccines for COVID-19 will be covered at no cost to patients.

- States and Local Governments: State, local and tribal governments will receive $150 billion. $30 billion is set aside for states, and educational institutions. $45 billion is for disaster relief, and $25 billion for transit programs.

- Agriculture: The deal would increase the amount the Agriculture Department can spend on its bailout program from $30 billion to $50 billion.

Source: The Wall Street Journal

Patient Requires Patience

As we enter the new 30-day extension of social distancing guidelines until April 30th, there is good news and bad news for the patient as the economy recovers from its self-induced coma. On the good news front, their appears to be a light at the end of the tunnel with respect to the spread of the virus. Enough data has been collected from countries like China, S. Korea, Italy, and our own, such that statisticians appear to have a better handle on the trajectory of the virus.

More specifically, here are some positive developments:

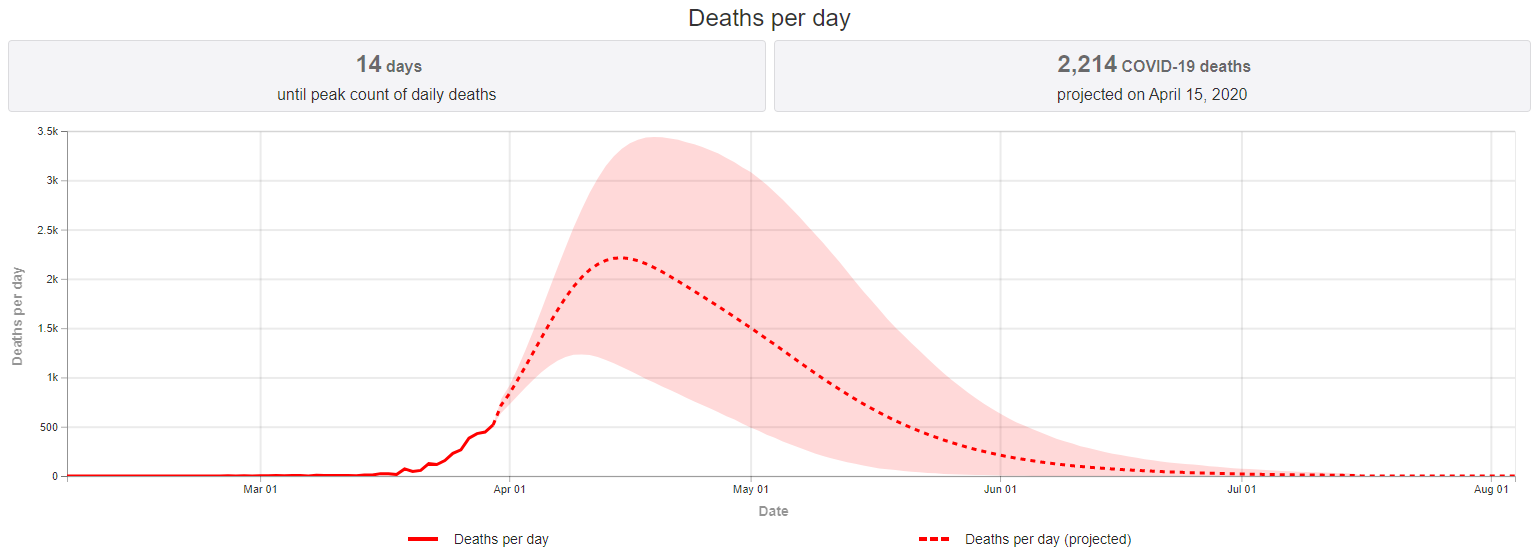

- Peak Seen on April 14th: According to the IMHE model that the White House is closely following, the number of COVID-19 deaths is projected to peak in two weeks.

Source: IHME

- Testing Ramping: The United States definitely got off to a slow start in the virus testing department, but as you can see from the chart below, COVID-19 tests are ramping significantly. Nevertheless, the number of tests still needs to increase dramatically until the percent of “positive” test results declines to a level of 5% or lower, based on data collected from South Korea. In another promising development, Abbott Laboratories (ABT) received emergency approval from the FDA for a rapid point-of-care test that produces results in just five minutes.

Source: Calculated Risk

- Closer to a COVID Cure: There are no Food and Drug Administration (FDA)-approved therapies or vaccines yet, but the FDA has granted emergency use authorization to anti-malarial drugs chloroquine phosphate and hydroxychloroquine sulfate to treat coronavirus patients. Patients are currently using these drugs in conjunction with the antibiotic azithromycin in hopes of achieving even better results. Remdesivir is a promising anti-viral treatment (also used in treating the Ebola virus) manufactured by Gilead Sciences Inc. (GILD), which is in Phase 3 clinical trial testing of the drug. If proven effective, broad distribution of remdesivir could be administered to COVID-19 patients in the not-too-distant future. Another company, Regeneron Pharmaceuticals (REGN), is working on clinical trials of its rheumatoid arthritis antibody drug Kevzara as a hopeful treatment. In addition, there are multiple companies, including Moderna Inc. (MRNA) and Johnson & Johnson (JNJ) that are making progress on coronavirus vaccines, that could have limited availability as soon as early-2021.

Darkest Before the Dawn

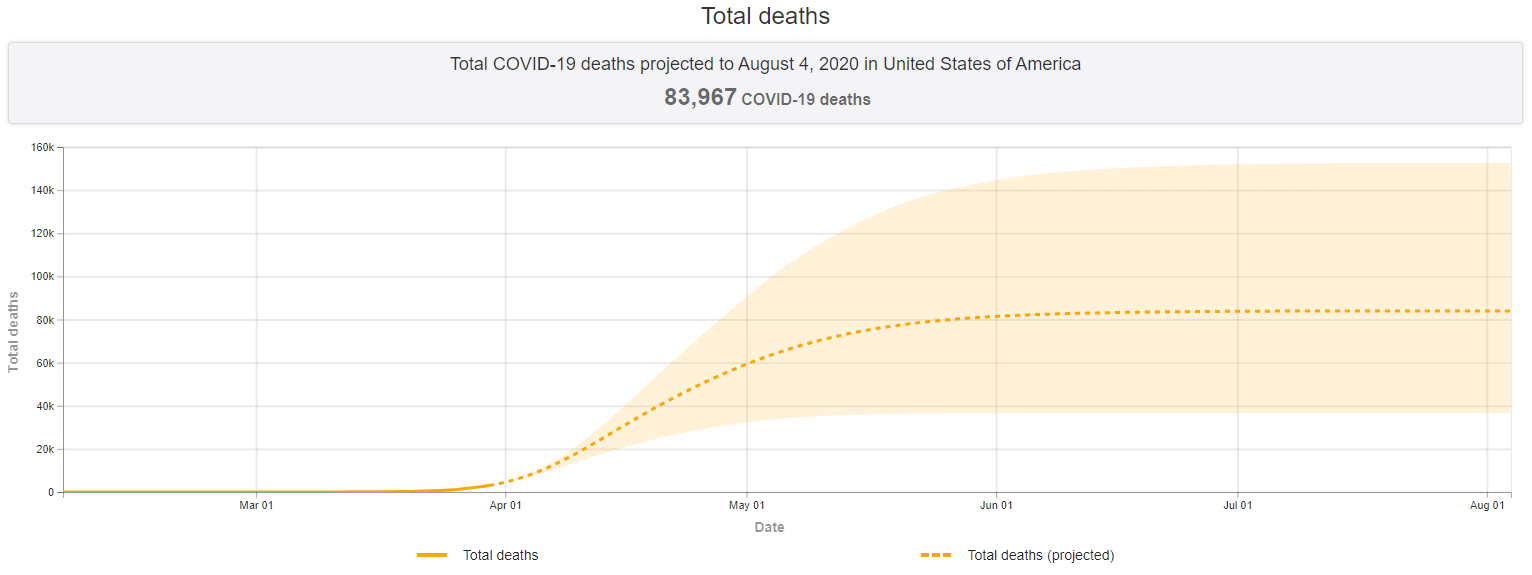

It is always darkest before the dawn, and the same principle applies to this coronavirus epidemic. Despite providing the patient’s medicine in the form of monetary and fiscal stimulus, time and patience is necessary for the prescription to take effect. As you can see from the chart below, the median total deaths projected is expected to rise to over 80,000 deaths by June 1st from roughly 4,000 today.

Source: IHME

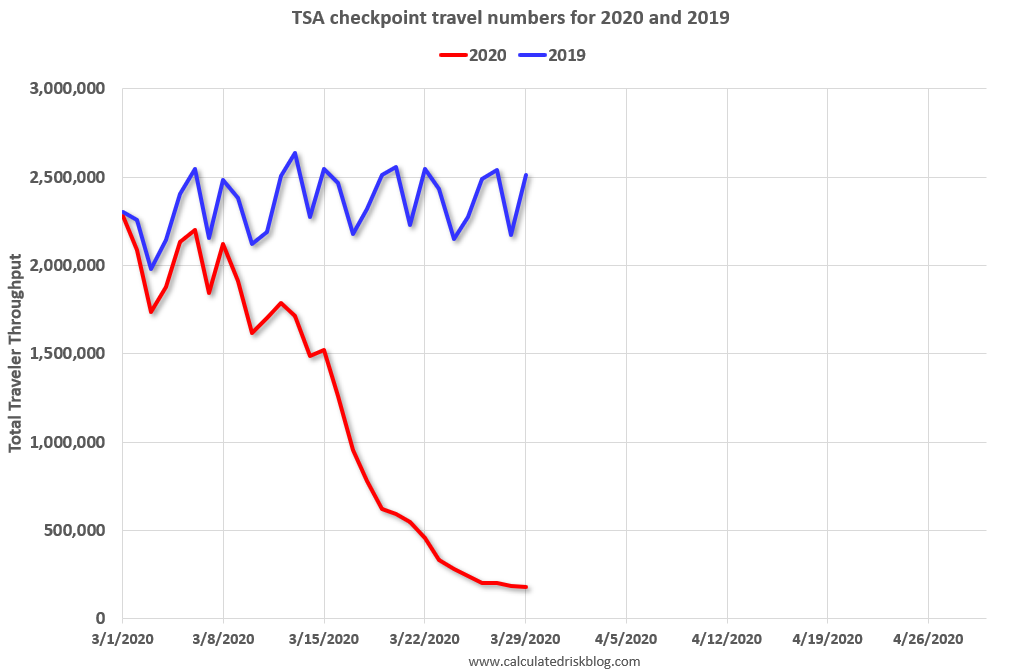

The physical toll will exceedingly become difficult over the next month, and the same can be said economically, especially for the hardest hit industries such as leisure, hospitality, and transportation. Just take a look at the -93% decline in airport travel versus a year ago (see chart below).

Source: Calculated Risk

The closure of restaurants, retail stores, and hotels, coupled with a cratering of travel has resulted in a more than a 1,000% increase in Americans filing for unemployment payments (see chart below – gray shaded regions correspond to recessions), and the unemployment rate is expected to increase from a near record-low 3.5% unemployment to a staggering 10% – 30% unemployment rate.

Source: Macrotrends

The spread of the incredibly debilitating COVID-19 virus has placed the economic patient into a self-induced coma. The financial and physical pain felt by the epidemic will worsen in the coming weeks, but fortunately the monetary stimulus, fiscal emergency relief, and social distancing guidelines are pointing to a predictable recovery in the not-too-distant future. Financial markets have survived wars, assassinations, recessions, impeachments, banking crises, currency crises, housing collapses, and yes, even pandemics. Each and every time, we have emerged stronger than ever…and I’m confident we will achieve the same result once COVID-19 is defeated.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD, MRNA, JNJ, and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in ABT, REGN or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

This Too Shall Pass

Ever since December 31st last year when China alerted the WHO (World Health Organization) about several cases of unusual pneumonia in Wuhan, a port city of 11 million people in the central Hubei province, the dark coronavirus (Covid-19) clouds began to form. Last week, the storm came rumbling through with a vengeance.

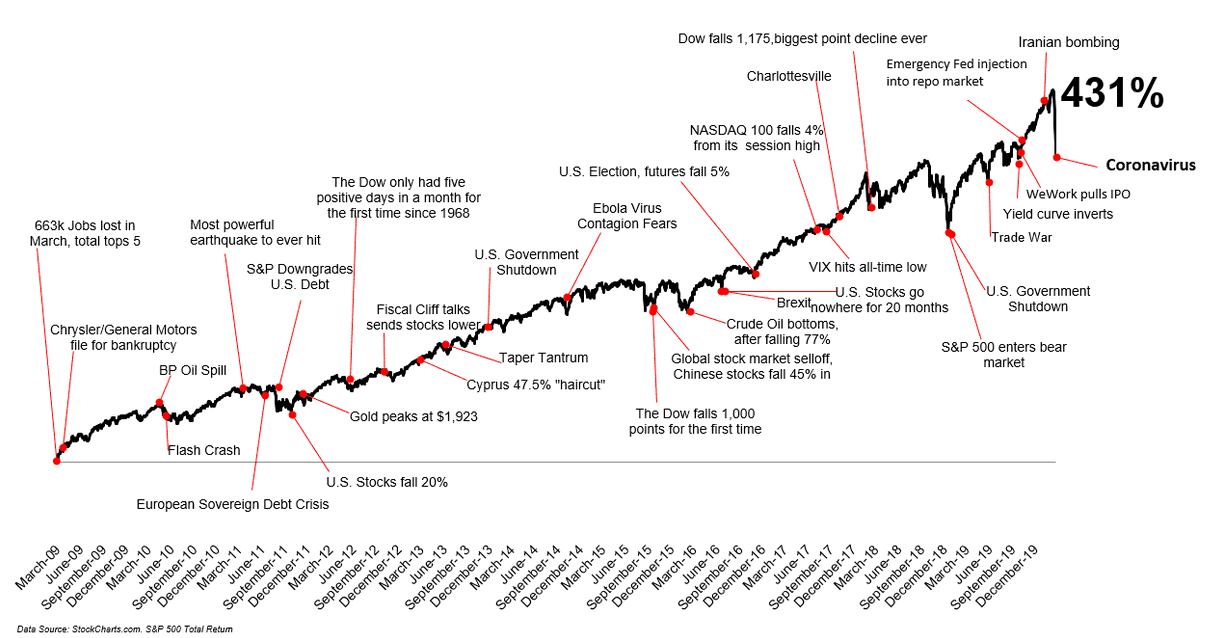

I have been investing for close to 30 years, so facing these temporary bouts of thunder and lightning is nothing new for me. Although the pace of this week’s -3,583 point drop in the Dow Jones Industrial Average was particularly noteworthy, we experienced a more severe -5,000 point correction a little more than a year ago due to China trade war concerns and our Federal Reserve increasing interest rates. What happened after that year-end 2018 drop? Stock prices skyrocketed more than +7,800 points (+36%) to a new record high on February 12th, just a few weeks ago. Over the long-run, stock prices have always eventually moved up to new record highs, but this week reminds us that volatility is a normal occurrence.

This week also reminds us that the best decisions made in life generally are not emotionally panicked ones. The same principle applies to investing. So rather than knee-jerk react to the F.U.D. (Fear, Uncertainty, Doubt), let’s take a look at some of the current facts as it relates to coronavirus (Covid-19):

- The number of deaths this season in the U.S. from the common flu: 18,000. The number of deaths in the U.S. from coronavirus: 2 individuals (both in WA with underlying health conditions).

- The number of new coronavirus cases in China is declining. Confirmed infections have fallen from more than 2,000 per day to a few hundred. People are going back to work and companies like Starbucks are re-opening their China stores for business.

- Coronavirus is relatively benign compared to other contagious pathogens. Roughly 98% of infected individuals fully recover, and deaths are limited to people with weakened immune systems, who in many cases are suffering from other illnesses.

- Previous viral outbreaks, which were significantly more fatal, were all contained, e.g., SARS (2003-04), MERS (2012), and Ebola (2014-16). In each instance, the stock market initially fell, and then subsequently fully recovered.

- Although the coronavirus has accelerated in areas outside of China, there are dozens of different companies currently developing a vaccine. If a working vaccine is discovered, a rebound could occur as fast as the drop.

- Governments and central banks are not sitting on their hands. Coordinated efforts are being instituted to curtail the spread of the virus and also provide liquidity to financial markets.

The actual death toll from the coronavirus is relatively small compared to other pandemics, catastrophes (e.g., 9/11), and wars. However, the hangover effect from the fear, uncertainty, and panic that can manifest in the days, weeks, and months after global events can last for some time. I expect the same to occur in the coming weeks and months as the drip of continued coronavirus headlines blankets social media and the news.

I don’t want to sugar coat the economic impact from a potential pandemic because quarantining 60 million people in China, instituting global travel bans, and closing areas of gathering has and will continue to have a material economic impact. Although history would indicate otherwise, it is certainly possible the current situation could worsen and lead to a global recession. Even if that were the case, I believe we are more likely closer to a bottom, than we are to a top, especially given how low interest rates are now. More specifically, we just hit an all-time record low yield of 1.13% on the 10-Year Treasury. In other words, putting money in the bank isn’t going to earn you much.

In summary, the current situation experienced this week is nothing new – we’ve lived through similar situations many times (see chart above). The short-run headlines can get more painful, but in the meantime, you can wash your hands and bathe in Purell. This too shall pass.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 2, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in SBUX or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.