Posts tagged ‘corporate profits’

The Treadmill Market – Jogging in Place

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (April 1, 2014). Subscribe on the right side of the page for the complete text.

After the stock market raced ahead to about a +30% gain last year, it became clear this meteoric trend was not sustainable into perpetuity. Correct investing should be treated more like a marathon than a sprint. After dashing ahead by more than +100% over the last handful of years, 2014 stock prices took a breather by spending the first quarter jogging in place. Like a runner on the treadmill, year-to-date returns equated to a -0.7% for the Dow Jones Industrial Average index, and +1.3% for the S&P index. Digesting the large gains from previous years, despite making no discernable forward progress this quarter, is a healthy exercise that builds long-term portfolio endurance. As far as I’m concerned, nothing in life worthwhile comes easy, and the first three months of the year have demonstrated this principle.

As I’ve written in the past (see Series of Unfortunate Events), there is never a shortage of issues to worry about. The first few months of 2014 have been no exception. Vladimir Putin’s strong armed military backed takeover of Crimea, coupled with the Federal Reserve’s unwinding $30 billion of the $85 billion of its “Quantitative Easing” bond buying program (i.e. tapering) have contributed to investors’ nervousness. When the “Fairy Godmother of the Bull Market,” Federal Reserve Chair Janet Yellen, hinted at potentially raising interest rates in about 12 months, the mood soured further.

The unseasonably cold winter back east (a.k.a., Polar Vortex) has caused some additional jitters due to the dampening effects on economic conditions. More specifically, economic growth as measured by GDP (Gross Domestic Product) is expected to come in around a meager +2.0% rate during the first quarter of 2014, before picking up later in the year.

And if that isn’t enough, best-selling author Michael Lewis, whose books include Money Ball, The Blind Side, and Liar’s Poker, just came out on national television and sparked a debate with his controversial statement that the “stock market is rigged.” (read and listen more here)

Runners High

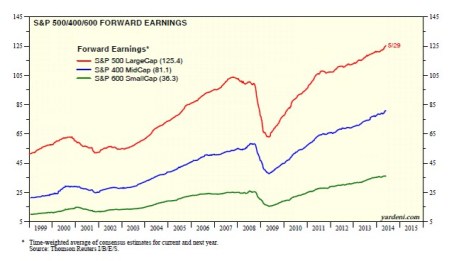

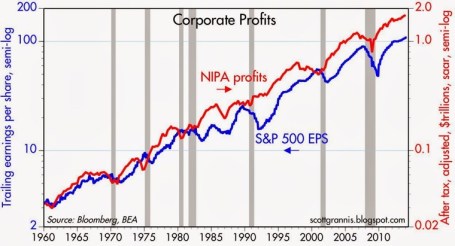

But as always, not everything is gloom and doom. Offsetting the temporary price fatigue, resilient record corporate profits have supported the surprising market stamina. Like a runner’s high, corporations are feeling elated about historically elevated profit margins. As you can see from the chart below, the reason it’s prudent for most to have some U.S. equity exposure is due to the clear, upward multi-decade trend of U.S. corporate earnings.

While the skeptics wait for these game-ending dynamics to take root, core economic fundamentals in areas like these remain strong:I didn’t invent the idea of profits impacting the stock market, but the concept is simple: stock prices generally follow earnings over long periods of time (see It’s the Earnings, Stupid). In other words, as profits accelerate, so do stock prices – and the opposite holds true (decelerating earnings leads to price declines). This direct relationship normally holds over the long-run as long as the following conditions are not in place: 1) valuations are stretched; 2) a recession is imminent; and/or 3) interest rates are spiking. Fortunately for long-term investors, there is no compelling evidence of these factors currently in place.

Employment Adrenaline

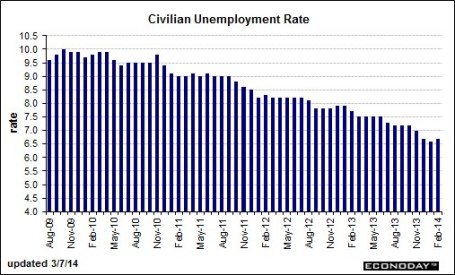

The employment outlook received a boost of adrenaline last month. Despite the slight upward nudge in the unemployment rate to 6.7%, total nonfarm payroll jobs increased by +175,000 in February versus a +129,000 gain in January and an +84,000 gain in December. Not only was last month’s increase better than expectations, but the net figures calculated over the previous two months were also revised higher by +25,000 jobs. As you can see below, the improvement since 2009 has been fairly steady, but as the current rate flirts with the Fed’s 6.5% target, Chair Yellen has decided to remove the quantitative objective. The rising number of discouraged workers (i.e., voluntarily opt-out of job searching) and part-timers has distorted the numbers, rendering arbitrary numeric targets less useful.

Source: Barron’s Online

Housing Holding Strong

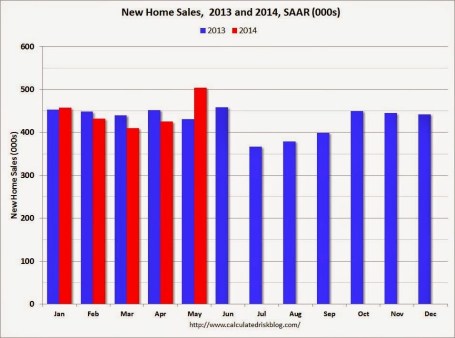

In the face of the severe winter weather, the feisty housing market remains near multi-year highs as shown in the 5-month moving average housing start figure below. With the spring selling season upon us, we should be able to better gauge the impact of cold weather and higher mortgage rates on the housing market.

Source: Barron’s Online

Even though stock market investors found themselves jogging in place during the first quarter of the year, long-term investors are building up endurance as corporate profits and the economy continue to consistently grow in the background. Successful investors must realize stock prices cannot sustainably sprint for long periods of time without eventually hitting a wall and collapsing. Those who recognize investing as a marathon sport, rather than a mad dash, will be able to jump off the treadmill and ultimately reach their financial finish line.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Markets Soar and Investors Snore

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (August 1, 2013). Subscribe on the right side of the page for the complete text.

If you haven’t been paying close attention, or perhaps if you were taking a long nap, you may not have noticed that the stock market was up an astounding +5% in July (+78% if compounded annualized), pushing the S&P 500 index up +18% for the year to near all-time record highs. Wait a second…how can that be when that bald and grey-bearded man at the Federal Reserve has hinted at bond purchase “tapering” (see also Fed Fatigue)? What’s more, I thought the moronic politicians were clueless about our debt and deficit-laden economy, jobless recovery, imploding eurozone, Chinese real estate bubble, and impending explosion of inflation – all of which are expected to sink our grandchildren’s grandchildren into a standard of living not seen since the Great Depression. Okay, well a dash of hyperbole and sarcasm never hurt anybody.

This incessant stream of doom-and-gloom pouring over our TVs, newspapers, and internet devices has numbed Americans’ psyches. To prove my point, the next time you are talking to somebody at the water cooler, church, soccer game, or happy hour, gauge how excited your co-worker, friend, or acquaintance gets when you bring up the subject of the stock market. If my suspicions are correct, they are more likely to yawn or pass out from boredom than to scream in excitement or do cartwheels.

You don’t believe me? Reality dictates the wounds from the 2008-2009 financial crisis are still healing. Panic and fear may have disappeared, but skepticism remains in full gear, even though stocks have more than doubled in price in recent years. Here is some data to support my case there are more stock detractors than defenders:

Record Savings Deposits

|

| Source: Calafia Beach Pundit |

Although there are no signs of an impending recession, defensive cash hoarded in savings deposits has almost increased by $3 trillion since the end of the financial crisis.

Blah Consumer Confidence

|

| Source: Calafia Beach Pundit |

As you can see from the chart above, Consumer Confidence has bounced around quite a bit over the last 30+ years, but there is no sign that consumer sentiment has turned euphoric.

15-Year Low Stock Market Participation

|

|

Source: Gallup Poll

|

There has been a trickling of funds into stocks in 2013, yet participation in the stock market is at a 15-year low. Investors remain nervous.

Lack of Equity Fund Buying

|

| Source: ICI & Calafia Beach Pundit |

After a short lived tax-driven purchase spike in January, the buying trend quickly turned negative in the ensuing months. Modest inflows resumed into equity funds during the first few weeks of July (source: ICI), but the meager stock fund investments represent < 95% of 2012 positive bond flows ($15 billion < $304 billion, respectively). Moreover, these modest stock inflows pale in comparison to the hundreds of billions in investor withdrawals since 2008. See also Fund Flows Paradox – Investing Caffeine.

Decline in CNBC Viewership

In spite of the stock market more than doubling in value from the lows of 2009, CNBC viewer ratings are the weakest in about 20 years (source: Value Walk). Stock investing apparently isn’t very exciting when prices go up.

The Hater’s Index:

And if that is not enough, you can take a field trip to the hater’s comment section of my most recent written Seeking Alpha article, The Most Hated Bull Market Ever. Apparently the stock market more than doubling creates some hostile feelings.

JOLLY & JOVIAL MEMO

Keeping the previous objective and subjective data points in mind, it’s clear to me the doom-and-gloom memo has been adequately distributed to the masses. Less clear, however, is the dissemination success of the jolly-and-jovial memo. I think Ron Bailey, an author and science journalist at Reason.com (VIDEO), said it best, “News is always bad news. Good news is simply not news…that is our [human] bias.” If you turn on your local TV news, I think you may agree with Ron. Nevertheless, there are actually plenty of happier news items to report, so here are some positive bullet points to my economic and stock market memo:

16th Consecutive Positive GDP Quarter*

|

| Source: Quartz.com |

The broadest measure of economic activity, GDP (Gross Domestic Product), was reported yesterday and came in better than expected in Q2 (+1.7%) for the 16th straight positive reported quarter (*Q1-2011 was just revised to fractionally negative). Obviously, the economists and dooms-dayers who repeatedly called for a double-dip recession were wrong.

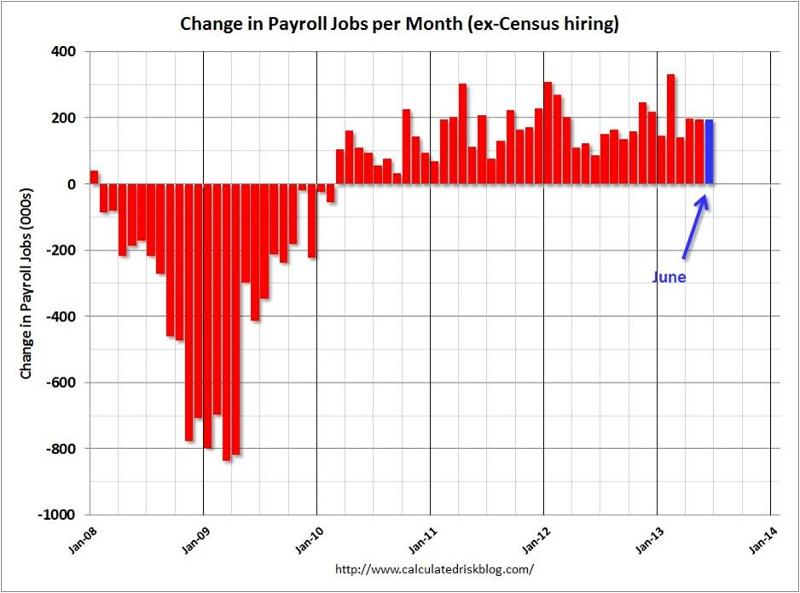

40 Consecutive Months & 7 Million Jobs

Source: Calculated Risk

The economic recovery has been painfully slow, but nevertheless, the U.S. has experienced 40 consecutive months of private sector job additions, representing +7.2 million jobs created. With about -9 million jobs lost during the most recent recession, there is still plenty of room for improvement. We will find out if the positive job creation streak will continue this Friday when the July total non-farm payroll report is released.

Housing on the Mend

|

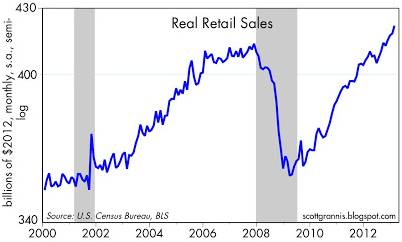

| Source: Calafia Beach Pundit |

New home sales are up significantly from the lows; housing starts have risen about 40% over the last two years; and Case Shiller home prices rose by +12.2% in the latest reported numbers. The housing market foundation is firming.

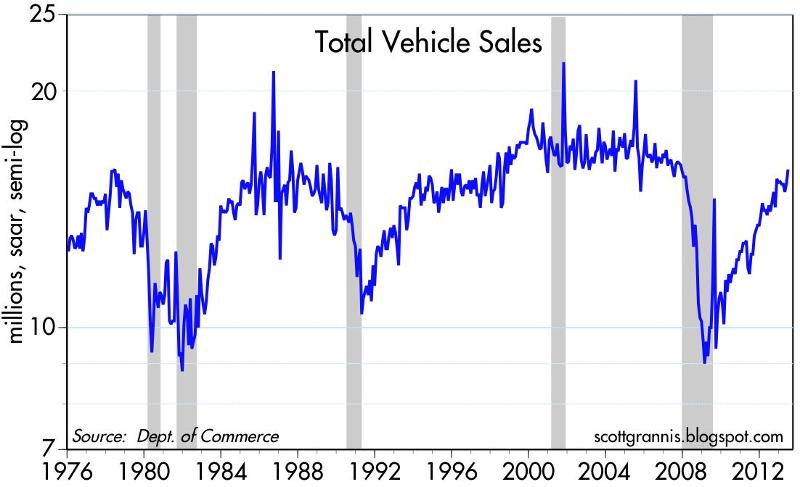

Auto Sales Rebound

|

| Source: Calafia Beach Pundit |

Auto sales remain on a tear, reaching an annualized level of 15.9 million vehicles, the highest since November 2007, and up +12% from June 2012. Car sales have almost reached pre-recessionary levels.

Record Corporate Profits

|

| Source: Dr. Ed’s Blog |

Optimistic forecasts have been ratcheted down, nonetheless corporate profits continue to grind to all-time record highs. As you can see, operating earnings have more than doubled since 2003. Given reasonable historical valuations in stocks, as measured by the P/E (Price Earnings) ratio, persistent profit growth should augur well for stock prices.

Bad Banks Bounce Back

Europe on the Comeback Trail

|

| Source: Calafia Beach Pundit |

There are signs of improvement in the Eurozone after years of recession. Talks of a European Armageddon have recently abated, in part because of Markit manufacturing manager purchasing statistics that are signaling expansion for the first time in two years.

Overall, corporations are achieving record profits and sitting on mountains of cash. The economy is continuing on a broad, steady recovery, however investors remain skeptical. Domestic stocks are at historic levels, but buying stocks solely because they are going up is never the right reason to invest. Alternatively, bunkering away excessive cash in useless, inflation depreciating assets is not the best strategy either. If nervousness and/or anxiety are driving your investment strategy, then perhaps now is the time to create a long-term plan to secure your financial future. However, if your goal is to soak up the endless doom-and-gloom and watch your money melt away to inflation, then perhaps you are better off just taking another nap.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investing with the Sentiment Pendulum

Article is an excerpt from Sidoxia Capital Management’s complementary May 2012 newsletter. Subscribe on right side of page.

The last five years have been historic in many respects. Not only have governments and central banks around the world undertaken unprecedented actions in response to the global financial crisis, but investors have ridden an emotional rollercoaster in response to historically unparalleled uncertainties.

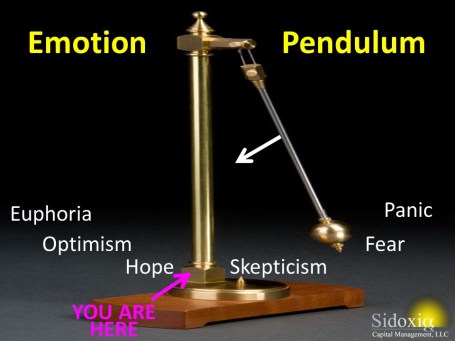

While the nature of this past crisis has been unique, experienced investors know these fears continually manifest themselves in different forms over various cycles in time. Despite the more than doubling in equity market values over the last few years, as measured by the S&P 500 index, the emotional pendulum of investor sentiment has only partially corrected. Investor temperament has thankfully swung away from “Panic,” but has only moved closer to “Fear” and “Skepticism.” Here are some of the issues contributing to investors’ current sour mood:

The Next European Domino: The fear of the Greek domino toppling the larger Spanish and Italian economies has investors nervously chewing their finger-nails, and political turmoil in France and the Netherlands isn’t creating any additional warm and fuzzies.

Job Additions Losing Steam: New job creation here in the U.S. weakened to a lethargic monthly rate of +120,000 new jobs in March, while the unemployment rate remains stubbornly high at an 8.2% level.

Domestic Growth Losing Mojo: GDP (Gross Domestic Product) growth of +2.2% during the first quarter of 2012 also opened the door for the pessimists. Consumers are still spending (+2.9% growth), but government spending, business investment, and housing are taking wind out of the economy’s sails.

Emerging Markets Submerging: Unspectacular growth in the U.S. is not receiving any favors from slowing emerging markets like China and Brazil, which took fiscal and monetary actions to slow inflation and housing speculation in 2011.

Humpty Dumpty Politics: Presidential elections, tax policy, and deficit reduction are all concerns that carry the possibility of pushing the economic Humpty Dumpty off the wall, and as a result potentially lead to a great fall. The determination of Humpty Dumpty’s fate will likely have to wait until year-end or 2013.

Any student of history knows these fears and other concerns never go away – they simply change. But like supply and demand, gravitational forces eventually swing the emotional pendulum in the opposite direction. As Sir John Templeton so aptly stated, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” Or in other words, escalating bull markets must climb the proverbial “Wall of Worry” in order to sustain upward momentum. If there was nothing to worry about, then all the buyers would already be in the markets. We are nowhere close to experiencing “Euphoria” like we saw in stocks during the late-1990s or in the housing market around 2005.

Positively Climbing the “Wall of Worry”

With all this bad news out there, surprisingly there are some glimmers of hope chipping away at the “Wall of Worry.” Here are some of the positive factors helping turn pessimist frowns upside down:

Slow & Steady Wins the Race: The economic recovery has been weaker than hoped, but I can think of worse scenarios than 11 consecutive quarters of GDP growth and 25 straight months of private job creation, which has reduced the unemployment rate from 10.0% in October 2009 to 8.2% last month.

Earnings Machine Keeps Chugging Along: With the majority of S&P 500 companies having reported their quarterly results for the first quarter, three-fourths of the companies are beating forecasted earnings, which are currently registering in at a respectable +7.1% rate (Thomson Reuters). One company epitomizing this trend is Apple Inc. (AAPL). The near doubling in Apple’s profits during the quarter, thanks to explosive iPhone sales, pushed Apple’s shares over $600 and helped drive the NASDAQ index to its best day of the year.

Super Ben to the Rescue: The Federal Reserve has already stated their intention of keeping interest rates near 0% until 2014. The potential of additional monetary stimulus spearheaded by Federal Reserve Chairman Ben Bernanke, in the form of QE3 (Quantitative Easing Part III), may provide further needed support to the stock market (a.k.a., the “Bernanke Put”).

Return of the IPO: Initial Public Offerings (IPOs) have gained steam versus last year with more than 53 already coming to market in the first four months of 2012. This is no 1999, but a good number of deals have done quite well over the last month. For example, data analysis company Splunk Inc. (SPLK) share price is already up around 100% and the value of leisure luggage company TUMI Holdings (TUMI) has climbed over +40%. In a few weeks, the highly anticipated blockbuster Facebook (FB) IPO is expected to begin trading its shares, so we can see if the chronicled deal can live up to all the hype.

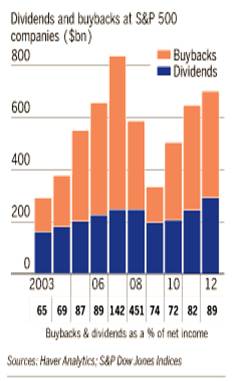

Dividends Galore: Dividend payments to stockholders are flowing at an extraordinary rate so far in 2012. Companies like IBM (increased its dividend by +13%), Exxon Mobil – (XOM +21%); Goldman Sachs – (GS +31%) are but just a few of the dividend raisers this year. Through the first three months of the year, the number of companies increasing their dividend payments was up +45% as compared to the comparable number for all of 2011.

Emerging Growth Not Dead: While worriers fret over slowing growth in China, companies like Apple grew by more than +100% in this region and collected nearly 20% of its revenues from this Asian country (~$8 billion). Coincidentally, China is expected to surpass an incredible one billion mobile connections in May – many of those iPhones. In other related news, Starbucks Corp. (SBUX) plans to triple its workforce and number of stores in China over the next three years. China has also helped fuel a backlog of Caterpillar Inc. (CAT) that is more than triple the level of 2009. Emerging markets may have slowed down in 2011, but with inflation beginning to stabilize, emerging market central banks and governments are now beginning to ease policies and reduce red-tape. For example, Brazil and India have started to lower key benchmark interest rates, and China has started to reverse capital flow restrictions.

Stay Off the Trampled Path

The mantra of “Sell in May and go away” always gets a lot of playtime around this period of the year. Over the last few years, the temporary spring/summer sell-offs have only been followed by stronger price appreciation. Individuals attempting to time the market (see also Getting Off the Treadmill) generally end up in tears. And for those traders who boast about their excellent timing (like those suspicious friends who brag about always winning in Las Vegas), we all know the truth – nobody buys at the lows and sells at the highs…except for liars.

With all the noise and cross-currents flooding the airwaves, investing for individuals without assistance has never been so difficult. But before hiding in your cave or reacting to the next scary headline about Europe, the economy, or politics, do yourself a favor by reminding yourself these chilling news items are nothing new and are often great contrarian indicators (see also Back to the Future). The emotional pendulum is constantly swinging from fear to greed and investors stand to prosper by adjusting sentiment and actions in the opposite direction. To survive in the investing wild, it is best to realize that the grass is greener and the eating more abundant when you stay off the trampled path of the herd.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AAPL, but at the time of publishing SCM had no direct position in SPLK, TUMI, IBM, XOM, GS, SBUX, CAT, FB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Markets Race Out of 2012 Gate

Article includes excerpts from Sidoxia Capital Management’s 2/1/2012 newsletter. Subscribe on right side of page.

Equity markets largely remained caged in during 2011, but U.S. stocks came racing out of the gate at the beginning of 2012. The S&P 500 index rose +4.4% in January; the Dow Jones Industrials climbed +3.4%; and the NASDAQ index sprinted out to a +8.0% return. Broader concerns have not disappeared over a European financial meltdown, high U.S. unemployment, and large unsustainable debts and deficits, but several key factors are providing firmer footing for financial race horses in 2012:

• Record Corporate Profits: 2012 S&P operating profits were recently forecasted to reach a record level of $106, or +9% versus a year ago. Accelerating GDP (Gross Domestic Product Growth) to +2.8% in the fourth quarter also provided a tailwind to corporations.

• Mountains of Cash: Companies are sitting on record levels of cash. In late 2011, U.S. non-financial corporations were sitting on $1.73 trillion in cash, which was +50% higher as a percentage of assets relative to 2007 when the credit crunch began in earnest.

• Employment Trends Improving: It’s difficult to fall off the floor, but since the unemployment rate peaked at 10.2% in October 2009, the rate has slowly improved to 8.5% today. Data junkies need not fret – we have fresh new employment numbers to look at this Friday.

• Consumer Optimism on Rise: The University of Michigan’s consumer sentiment index showed optimism improved in January to the highest level in almost a year, increasing to 75.0 from 69.9 in December.

• Federal Reserve to the Rescue: Federal Reserve Chairman, Ben Bernanke, and the Fed recently announced the extension of their 0% interest rate policy, designed to assist economic expansion, through the end of 2014. In addition, Bernanke did not rule out further stimulative asset purchases (a.k.a., QE3 or quantitative easing) if necessary. If executed as planned, this dovish stance will extend for an unprecedented six year period (2008 -2014).

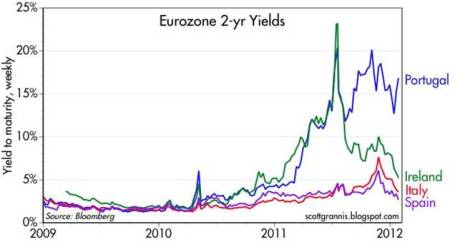

Europe on the Comeback Trail?

Europe is by no means out of the woods and tracking the day to day volatility of the happenings overseas can be a difficult chore. One fairly easy way to track the European progress (or lack thereof) is by following the interest rate trends in the PIIGS countries (Portugal, Ireland, Italy, Greece, and Spain). Quite simply, higher interest rates generally mean more uncertainty and risk, while lower interest rates mean more confidence and certainty. The bad news is that Greece is still in the midst of a very complex restructuring of its debt, which means Greek interest rates have been exploding upwards and investors are bracing for significant losses on their sovereign debt investments. Portugal is not in as bad shape as Greece, but the trends have been moving in a negative direction. The good news, as you can see from the chart above (Calafia Beach Pundit), is that interest rates in Ireland, Italy and Spain have been constructively moving lower thanks to austerity measures, European Central Bank (ECB) actions, and coordination of eurozone policies to create more unity and fiscal accountability.

Political Horse Race

The other horse race going on now is the battle for the Republican presidential nomination between former Massachusetts governor Mitt Romney and former House of Representatives Speaker Newt Gingrich. Some increased feistiness mixed with a little Super-Pac TV smear campaigns helped whip Romney’s horse to a decisive victory in Florida – Gingrich ended up losing by a whopping 14%. Unlike traditional horse races, we don’t know how long this Republican primary race will last, but chances are this thing should be wrapped up by “Super Tuesday” on March 6th when there will be 10 simultaneous primaries and caucuses. Romney may be the lead horse now, but we are likely to see a few more horses drop out before all is said and done.

Flies in the Ointment

As indicated previously, although 2012 has gotten off to a strong start, there are still some flies in the ointment:

• European Crisis Not Over: Many European countries are at or near recessionary levels. The U.S. may be insulated from some of the weakness, but is not completely immune from the European financial crisis. Weaker fourth quarter revenue growth was suffered by companies like Exxon Mobil Corp (XOM), Citigroup Inc. (C), JP Morgan Chase & Co (JPM), Microsoft Corp (MSFT), and IBM, in part because of European exposure.

• Slowing Profit Growth: Although at record levels, profit growth is slowing and peak profit margins are starting to feel the pressure. Only so much cost-cutting can be done before growth initiatives, such as hiring, must be implemented to boost profits.

• Election Uncertainty: As mentioned earlier, 2012 is a presidential election year, and policy uncertainty and political gridlock have the potential of further spooking investors. Much of these issues is not new news to the financial markets. Rather than reading stale, old headlines of the multi-year financial crisis, determining what happens next and ascertaining how much uncertainty is already factored into current asset prices is a much more constructive exercise.

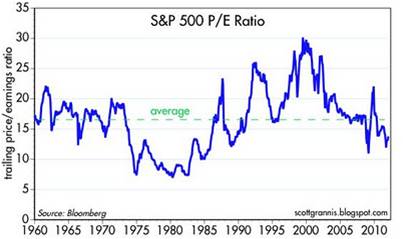

Stocks on Sale for a Discount

A lot of the previous concerns (flies) mentioned is not new news to investors and many of these worries are already factored into the cheap equity prices we are witnessing. If everything was all roses, stocks would not be selling for a significant discount to the long-term averages.

A key ratio measuring the priceyness of the stock market is the Price/Earnings (P/E) ratio. History has taught us the best long-term returns have been earned when purchases were made at lower P/E ratio levels. As you can see from the 60-year chart above (Calafia Beach Pundit), stocks can become cheaper (resulting in lower P/Es) for many years, similar to the challenging period experienced through the early 1980s and somewhat analogous to the lower P/E ratios we are presently witnessing (estimated 2012 P/E of approximately 12.4). However, the major difference between then and now is that the Federal Funds interest rate was about 20% back in the early-’80s, while the same rate is closer to 0% currently. Simple math and logic tell us that stocks and other asset-based earnings streams deserve higher prices in periods of low interest rates like today.

We are only one month through the 2012 financial market race, so it much too early to declare a Triple Crown victory, but we are off to a nice start. As I’ve said before, investing has arguably never been as difficult as it is today, but investing has also never been as important. Inflation, whether you are talking about food, energy, healthcare, leisure, or educational costs continue to grind higher. Burying your head in the sand or stuffing your money in low yielding assets may work for a wealthy few and feel good in the short-run, but for much of the masses the destructive inflation-eroding characteristics of purported “safe investments” will likely do more damage than good in the long-run. A low-cost diversified global portfolio of thoroughbred investments that balances income and growth with your risk tolerance and time horizon is a better way to maneuver yourself to the investment winner’s circle.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in XOM, MSFT, JPM, IBM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Fear & Greed Occupy Wall Street in October

Excerpt from Free November Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Fear and frustration dominated investor psyches during August and September as backlash from political gridlock in the U.S. and worries of European contagion dominated action in volatile investment portfolios. Elevated 9.1% unemployment and a sluggish recovery in the U.S. also led populist Occupy Wall Street protesters to flood our nation’s streets, blaming the bankers and the wealthy as the cause for personal misfortunes and the widening gap between rich and poor. However, in the face of the palpable pessimism, economic Halloween treats and greedy corporate profits scared away bearish naysayers like invisible ghosts during the month of October.

While many investors stayed home for Halloween in the supposed comfort of their inflation-losing savings accounts and bonds, those investors choosing to brave the chilling elements in the frightening equity markets were handsomely rewarded. Stockholders tasted the sweet pleasure of a +11% October return in the S&P 500 index, the largest monthly advance in 20 years.

Of course, as I always advise, investors should not load themselves to the gills in stocks just to chase performance. Rather, investors should construct a diversified portfolio designed to meet one’s objectives, constraints, risk tolerance, and liquidity needs. Within that context, a portfolio should also periodically rebalance by selling pricey investments (i.e., Treasuries) and redeploy those proceeds into unloved investments (i.e., equities).

Glass Half Full

There is never a shortage of reasons to be fearful and a one-month rally in equities is not reason enough to blindly pile on risk, but there are plenty of reasons to counter the endless pessimism pornography peddled by media outlets on a continuous basis. Here are some of the “half-full” reasons:

- Euro Plan in Place: After months of conflicting headlines, European leaders reached an agreement to increase the European Union’s bailout fund to one trillion euros ($1.4 trillion) and negotiated a -50% debt reduction deal with Greek bondholders. In addition, European officials agreed on a plan to increase bank reserves by 106 billion euros to support potential bank losses due to European debt defaults. This plan is not a silver bullet, but it is a start.

- Bulging Corporate Profits: With the majority of S&P 500 companies now having reported their actual third quarter results, profit growth is estimated to exceed +16% for the three month period ending in September. Expectations for fourth quarter earnings are currently forecasted to top a respectable +11% growth rate (Data from Thomson Reuters).

- Tortoise-Like Growth Continues: Even though it’s Halloween, the double-dip recession boogeyman is still hiding. U.S. economic growth actually accelerated its growth to +2.5% in the third quarter on a year-over-year basis, up from +1.3% last quarter. The growth in Gross Domestic Product (GDP) was primarily driven by consumer and business spending.

- Jobs Still on the Rise: The unemployment rate remains stubbornly high, but offsetting the ongoing decline in government jobs has been a 19 consecutive month spurt in private job creation activity, resulting in +2.6 million jobs being added to the economy over the period. This doesn’t make up for the 8 million+ jobs lost during the 2008-2009 recession, but the economy is moving in the right direction.

- Consumers Opening Wallet: Consumers can be like cockroaches in that they are difficult to kill off when it comes to spending. Consumers whipped out their wallets in September as retail sales advanced at a brisk +7.9% pace (+7.8% excluding auto sales).

- Dividends on the Rise: While nervous Nellies park money in money losing cash and Treasuries (on an inflation-adjusted basis), corporations flush with cash are increasing dividends at a rapid clip. According to Standard & Poor’s rating agency, dividend increases rose over +17% during the third quarter of 2011. As of October 25th, the indicated dividend for the S&P stood at a decent +2.20% rate.

I am fully aware that equity investors are not out of the woods yet, as the European debt crisis has not been resolved, and the structural deficit/debt issues we face in the U.S. still have a long way to go before becoming disentangled. As a matter of fact, fear is building as we approach the looming deficit reduction Super Committee resolution (or lack thereof) later this month – I can hardly wait. If a $1.5 trillion bipartisan debt reduction agreement can’t be reached, some bored Occupy Wall Street protesters can shift priorities and take a tour bus to Washington D.C. to demonstrate. Regardless of the potential grand European or Washington debt plans that may or may not transpire, observers can rest assured fear and greed are two emotions that will remain alive and well when it comes to Wall Street and “Main Street” portfolios.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Soft Patch Creating Hard-Landing Nightmares

Boo! Was that a ghost, or was that just some soft patch talk scaring you during a nightmare? The economic data hasn’t been exactly rosy over the last month, and as a result, investors have gotten spooked and have chosen to chainsaw their equity positions. Since late April, nervous investors had already yanked more than $15 billion from U.S. equity mutual funds and shoved nearly $29 billion toward bond funds (Barron’s). Jittery emotions are evidenced by the recently released June Consumer Confidence numbers (Conference Board), which came in at a dismal 58.5 level – significantly above the low of 25.3 in 2009, but a mile away from the pre-crisis high of 111.9 in 2007.

Economic Monsters under the Bed

Why are investors having such scary dreams? Look no further than the latest terror-filled headlines du Jour referencing one (if not all) of the following issues:

• Inevitable economic collapse of Greece.

• End of QE2 (Quantitative Easing Part II) monetary stimulus program.

• Excessive state deficits, debt, and pension obligations.

• Housing market remains in shambles.

• Slowing in economic growth – lethargic +1.9% GDP growth in Q1.

• Accelerating inflation.

• Anemic auto sales in part caused by Japanese supply chain disruptions post the nuclear disaster.

Surely with all this horrible news, the equity markets must have suffered some severe bloodletting? Wait a second, my crack research team has just discovered the S&P 500 is up +5.0% this year and its sister index the Dow Jones Industrial Average is up +7.2%. How can bad news plus more bad news equal an up market?

OK, I know the sarcasm is oozing from the page, but the fact of the matter is investing based on economic headlines can be hazardous for your investment portfolio health. The flow of horrendous headlines was actually much worse over the last 24 months, yet equity markets have approximately doubled in price. On the flip-side, in 2007 there was an abundant amount of economic sunshine (excluding housing), right before the economy drove off a cliff.

Balanced Viewpoints

Being purely Pollyannaish and ignoring objective soft patch data is certainly not advisable, but with the financial crisis of 2008-2009 close behind us in the rear-view mirror, it has become apparent to me that fair and balanced analysis of the facts by TV, newspaper, radio, and blogging venues is noticeably absent.

Given the fact that the stock market is up in 2011 in the face of dreadful news, are investors just whistling as they walk past the graveyard? Or are there some positive countervailing trends hidden amidst all the gloom?

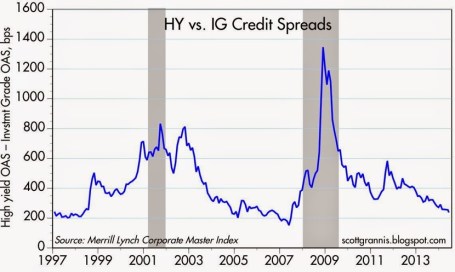

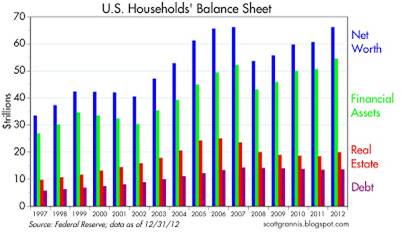

I could probably provide some credible contrarian views to the current pessimistically accepted outlook, but rather than recreating the wheel, why not choose a more efficient method and leave it to a trusted voice of Scott Grannis at the Calafia Beach Report, where he resourcefully notes the market positives:

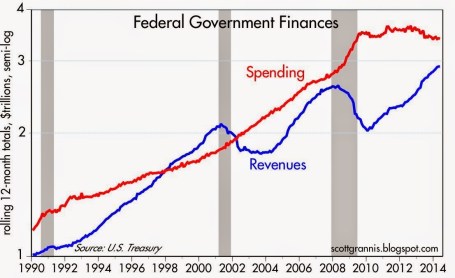

“Corporate profits are very strong; the economy has created over 2 million private sector jobs since the recession low; swap spreads are very low; the implied volatility of equity options is only moderately elevated; the yield curve is very steep (thus ruling out any monetary policy threat to growth); commodity prices are very strong (thus ruling out any material slowdown in global demand); the US Congress is debating how much to cut spending, rather than how much to increase spending; oil prices are down one-third from their 2008 recession-provoking highs; exports are growing at strong double-digit rates; the number of people collecting unemployment insurance has dropped by 5 million since early 2010; federal revenues are growing at a 10% annual rate; households’ net worth has risen by over $9 trillion in the past two years; and the level of swap and credit spreads shows no signs of being artificially depressed (thus virtually ruling out excessive optimism or Fed-induced asset price distortions). When you put the latest concerns about the potential fallout from a Greek default (which is virtually assured and has been known and expected for months) against the backdrop of these positive and powerful fundamentals, the world doesn’t look like a very scary place.”

Wow, that doesn’t sound half bad, but rock throwing Greek vandals, nude politicians Tweeting pictures, and anti-terrorist war campaigns happen to sell more newspapers.

It’s the Earnings Stupid

Grannis’s view on corporate profits supports what I recently wrote in It’s the Earnings, Stupid. What really drives stock prices over the long-term is earnings and cash flows (with a good dash of interest rates). Given the sour stock market sentiment, little attention has been placed on the record growth in corporate profits – up +47% in 2010 on an S&P 500 operating basis and estimated +17% growth in 2011. Few people realize that corporate profits have more than doubled over the last decade (see chart below) in light of the feeble stock market performance. Despite the much improved current profit outlook, cynical bears question the validity of this year’s profit forecasts as we approach the beginning of Q2 earnings reporting season. However, if recent results from the likes of Nike Inc. (NKE), FedEx Corp (FDX), Oracle Corp. (ORCL), Caterpillar Inc. (CAT), and Bed Bath & Beyond Inc. (BBBY) are indicators of what’s to come from the rest of corporate America, then profit estimates may actually get adjusted upwards…not downwards?

There is plenty to worry about and there is never a shortage of scary headlines (see Back to the Future magazine covers), but reacting to news with impulsive emotional trades will produce fewer sweet dreams and more investment nightmares.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and FDX, but at the time of publishing SCM had no direct position in NKE, CAT, ORCL, BBY or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Cindy Crawford Economy

Photo source: http://www.joyyoga.blogspot.com

I remember intently examining a few magazine covers that former supermodel Cindy Crawford adorned in my prime high school and collegiate years. Like our economy, the resultant recovery in 2009-2010 feels a little like a more mature version of Cindy Crawford (now 43 years old). Things look pretty good on the surface, but somehow people are more focused on pointing out the prominent mole, rather than appreciating the more attractive features. Many market commentators feel to be making similar judgments about the economy – we’re seeing nice-looking growth (albeit at a slowing pace) and corporations are registering exceptional results (but are not hiring). Even Ben Bernanke, our money-man superhero at the Federal Reserve, has underscored the “unusually uncertain” environment we are currently experiencing.

Certainly, the economy (and Cindy) may not be as sexy as we remember in the 1990s, but nonetheless constant improvement should be our main goal, regardless of the age or stage of recovery. Sure, Cindy chose cosmetic surgery while our government chose a stimulus (along with healthcare and financial regulatory reform) for its economic facelift. But the government must walk a fine line because if it continues to make poor decisions, our country could walk away looking like a scary, cosmetically altered version of Heidi Montag.

Our government in many ways is like Cindy Crawford’s former husband Richard Gere – if the Obama administration doesn’t play its cards right, the Democrats risk a swift divorce from their Congressional majority come this November – the same fate Richard suffered after a four year marriage with Cindy. Like a married couple, we need the federal government like a partner or spouse. Fortunately, our government has a system of checks and balances – if voters think Congress is ugly, they can always decide to break-up the relationship. Voters will make that decision in three months, just like Cindy and Richard voted to separate.

The Superpower Not Completely Washed Up

We may not have the hottest economy, but a few factors still make the equity markets look desirable:

- Corporate profit, margins, and cash levels at or near record levels. S&P profits are estimated to rise +46% in 2010.

- Interest rates are at or near record lows (Fed Funds effectively at 0% and the 10-Year Treasury Note at 2.74%).

- The stock market (as measured by the S&P 500 index) is priced at a reasonably alluring level of 13x’s 2010 profit forecasts and 12x’s 2011 earnings estimates.

Multiple Assets & Swapping

I don’t have anything against the institution of marriage (I’ve been happily married for thirteen years), but one advantage to the financial markets is that it affords you the ability to trade and own multiple assets. If a more mature Cindy Crawford doesn’t fit your needs, you can always swap or add to your current holding(s). For example, you could take more risk with a less established name (asset), for example Karolina Kurkova, or in the case of global emerging markets, Brazil. Foreign markets can be less stable and unpredictable (like Kate Moss), but can pay off handsomely, both from an absolute return basis and from a diversification perspective.

Money ultimately goes to where it is treated best in the long-term, so if Cindy doesn’t fit your style, feel free to expand your portfolio into other asset classes (e.g., stocks, bonds, real estate, commodities, etc.). Just be wary of stuffing all your money under the mattress, earning virtually nothing on your money – certainly Cindy Crawford is a much more appealing option than that.

Wade W. Slome, CFA, CFP®

P.S. For all women followers of Investing Caffeine, I will do my best to even the score, by writing next about the Marcus Schenkenberg economy.

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including those with exposure to Brazil and other emerging markets), but at the time of publishing SCM had no direct position in any other security directly referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.