Posts tagged ‘china’

Nuclear Knee-Jerk Reaction

It’s amazing how quickly the long-term secular growth winds can reverse themselves. Just a week ago, nuclear energy was thought of as a safe, clean, green technology that would assist the gasoline pump pain in our wallets and purses. Now, given the events occurring in Japan, “nuclear” has become a dirty word equated to a life-threatening game of Russian roulette.

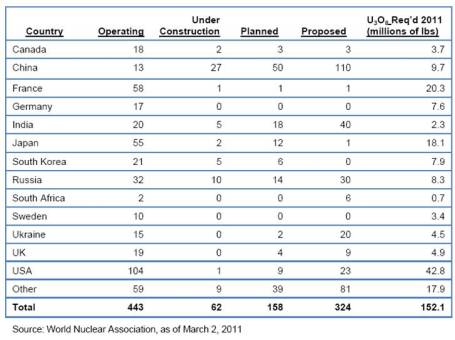

Despite the spotty information filtering in from the Dai-Ichi plant in Japan, we are already absorbing knee-jerk responses out of industrial heavyweight countries like Germany and China. Germany has temporarily closed seven nuclear power centers generating about a quarter of its nuclear capacity, and China has instituted a moratorium on all new facilities being built. How big a deal is this? Well, China is one country, and it alone currently accounts for 44% of the 62 global nuclear reactor projects presently under construction (see chart below).

As a result of the damaged Fukushima reactors, coupled with various governmental announcements around the globe, Uranium prices have dropped a whopping -30% within a month – plunging from about $70 per pound to around $50 per pound today.

Where does U.S. Nuclear Go from Here?

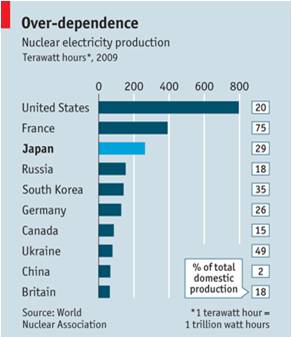

As you can see from the chart below, the U.S. is the largest producer of nuclear energy in the world, but since our small population is such power hogs, this relatively large nuclear capability only accounts for roughly 20% of our country’s total electricity needs. France, on the other hand, manages about half the reactors as we do, but the French derive a whopping 75% of their total electricity needs from nuclear power. According to the Nuclear Energy Institute, Japanese reliance on nuclear power falls somewhere in between – 29% of their electricity demand is filled by nuclear energy. Like Japan, the U.S. imports most of its energy needs, so if nuclear development slows, guess what, other resources will need to make up the difference. OPEC and various other oil-rich, dictators in the Middle East are licking their chops over the future prospects for oil prices, if a cost-effective alternative like nuclear ends up getting kicked to the curb.

As I alluded to above, there is, however, a silver lining. As long as oil prices remain elevated, any void created by a knee-jerk nuclear backlash will only create heightened demand for alternative energy sources, including natural gas, solar, wind, biomass, clean coal, and other creative substitutes. While we Americans may be addicted to oil, we also are inventive, greedy capitalists that will continually look for more cost-efficient alternatives to solve our energy problems (see also Electrifying Profits). Unlike other countries around the world, it looks like the private sector will have to do the heavy lifting to solve these resources on their own dime. Limited subsidies have been introduced, but overall our government has lacked a cohesive energy plan to kick-start some of these innovative energy alternatives.

Déjà Vu All Over Again

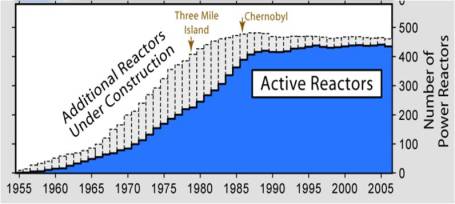

We saw what happened on our soil in March 1979 when the Three Mile Island nuclear accident in Pennsylvania consumed the hearts and minds of the country. Pure unadulterated panic set in and new nuclear production ground to a virtual halt. When the subsequent Chernobyl incident happened in April 1986 insult was added to injury. As you can see from the chart below, nuclear reactor capacity has plateaued for some twenty years now.

The driving force behind the plateauing nuclear facilities is the NIMBY (Not In My Back Yard) phenomenon. The Three Mile Island incident is still fresh in people’s minds, which explains why only one nuclear plant is currently under construction in our country, on top of a base of 104 U.S. reactors in 31 states. I point this out as an ambivalent NIMBY-er since I work 30 miles away from one of the riskiest, 30-year-old nuclear plants in the country (San Onofre).

Unintended Consequences

The Sendai disaster is home to the worst Japanese earthquake in 140 years, by some estimates, but history will prove once again what unintended consequences can occur when impulsive knee-jerk decisions are made. Just consider what has happened to oil prices since the moratorium on offshore drilling (post-BP disaster) was instituted. Sure we have witnessed a dictator or two topple in the Middle East, and there currently is adequate supply to meet demand, but I would make the case that we should be increasing domestic oil supplies (along with alternative energy sources), not decreasing supplies because it is politically safe.

Time will tell if the Japanese earthquake/tsunami-induced nuclear disaster will create additional unintended consequences, but I am hopeful the recent events will at a minimum create a serious dialogue about a comprehensive energy policy. If the comfortable, knee-jerk reaction of significantly diminishing nuclear production is broadly adopted around the world, then an urgent alternative supply response needs to occur. Otherwise, you may just need to enjoy that bike ride to work in the morning, along with that nice, romantic candle-lit dinner at night.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and alternative energy securities, but at the time of publishing SCM had no direct position in BP, URRE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Another Year, Another Decade

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Dealing Currency Drug to Export Addicts

With the first phase of the post-financial crisis global economic bounce largely behind us, growth is becoming scarcer and countries are becoming more desperate – especially in developed countries with challenged exports and high unemployment. The United States, like other expansion challenged countries, fits this bill and is doing everything in its power to stem the tide by blasting foreigners’ currency policies in hopes of stimulating exports.

Political Hot Potato

The global race to devalue currencies in many ways is like a drug addict doing whatever it can to gain a short-term high. Sadly, the euphoric short-term benefit form lower exchange rates will be fleeting. Regardless, Ben Bernanke, the Chairman of the Federal Reserve, has openly indicated his willingness to become the economy’s drug dealer and “provide additional accommodation” in the form of quantitative easing part two (QE2).

Unfortunately, there is no long-term free lunch in global economics. The consequences of manipulating (depressing) exchange rates can lead to short-term artificial export growth, but eventually results convert to unwanted inflation. China too is like a crack dealer selling cheap imports as a drug to addicted buyers all over the world – ourselves included. We all love the $2.99 t-shirts and $5.99 toys made in China that we purchase at Wal-Mart (WMT), but don’t consciously realize the indirect cost of these cheap goods – primarily the export of manufacturing jobs overseas.

Global Political Pressure Cooker

Congressional mid-term elections are a mere few weeks away, but a sluggish global economic recovery is creating a global political pressure cooker. While domestic politicians worry about whining voters screaming about unemployment and lack of job availability, politicians in China still worry about social unrest developing from a billion job-starved rural farmers and citizens. The Tiananmen Square protests of 1989 are still fresh in the minds of Chinese officials and the government is doing everything in its power to keep the restless natives content. In fact, Premier Wen Jiabao believes a free-floating U.S.-China currency exchange rate would “bring disaster to China and the world.”

While China continues to enjoy near double-digit percentage economic growth, other global players are not sitting idly. Like every country, others would also like to crank out exports and fill their factories with workers as well.

The latest high profile devaluation effort has come from Japan. The Japanese Prime Minister post has become a non-stop revolving door and their central bank has become desperate, like ours, by nudging its target interest rate to zero. In addition, the Japanese have been aggressively selling currency in the open market in hopes of lowering the value of the Yen. Japan hasn’t stopped there. The Bank of Japan recently announced a plan to pump the equivalent of approximately $60 billion into the economy by buying not only government bonds but also short-term debt and securitized loans from banks and corporations.

Europe is not sitting around sucking its thumb either. The ECB (European Central Bank) is scooping up some of the toxic bonds from its most debt-laden member countries. Stay tuned for future initiatives if European growth doesn’t progress as optimistically planned.

Dealing with Angry Parents

When it comes to the United States, the Obama administration campaigned on “change,” and the near 10% unemployment rate wasn’t the type of change many voters were hoping for. The Federal Reserve is supposed to be “independent,” but the institution does not live in a vacuum. The Fed in many ways is like a grown adult living away from home, but regrettably Bernanke and the Fed periodically get called by into Congress (the parents) to receive a verbal scolding for not following a policy loose enough to create jobs. Technically the Fed is supposed to be living on its own, able to maintain its independence, but sadly a constant barrage of political criticism has leaked into the Fed’s decision making process and Bernanke appears to be willing to entertain any extreme monetary measure regardless of the potential negative impact on long-term price stability.

Just over the last four months, as the dollar index has weakened over 10%, we have witnessed the CRB Index (commodities proxy) increase over 10% and crude oil increase about 10% too.

In the end, artificially manipulating currencies in hopes of raising economic activity may result in a short-term adrenaline boost in export orders, but lasting benefits will not be felt because printing money will not ultimately create jobs. Any successful devaluation in currency rates will eventually be offset by price changes (inflation). Finance ministers and central bankers from 187 countries all over the world are now meeting in Washington at the annual International Monetary Fund (IMF) meeting. We all want to witness a sustained, coordinated global economic recovery, but a never-ending, unanimous quest for devaluation nirvana will only lead to export addicts ruining the party for everyone.

See also Arbitrage Vigilantes

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sachs Prescribes Telescope Over Microscope

Jeffrey Sachs, Professor at Columbia University and one of Time magazine’s “100 most influential people” recommends that our country takes a longer-term view in handling our problems (read Sachs’s full bio). Instead of analyzing everything through a microscope, Sachs realizes that peering out over the horizon with a telescope may provide a clearer path to success versus getting sidetracked in the emotional daily battles of noise.

I do my fair share of media and politician bashing, but every once in a while it’s magnificent to discover and enjoy a breath of fresh common sense, like the advice coming from Sachs. Normally, I become suffocated with a wet blanket of incessant, hyper-sensitive blabbering that comes from Washington politicians and airwave commentators. With the advent of this thing we call the “internet,” the pace and volume of daily information (see TMI “Too Much Information” article) crossing our eyeballs has only snowballed faster. Rather than critically evaluate the fear-laced news, the average citizen reverts back to our Darwinian survival instincts, or to what Seth Godin calls the “Lizard Brain. ”

Sachs understands the lingering nature to our country’s problems, so in pulling out his long-term telescope, he created a broad roadmap to recovery – many of the points to which I agree. Here is an abbreviated list of his quotes:

On Short-Termism:

“Despite the evident need for a rise in national saving after 2008, President Barack Obama tried to prolong the consumption binge by aggressively promoting home and car sales to already exhausted consumers, and by cutting taxes despite an unsustainable budget deficit. The approach has been hyper short-term, driven by America’s two-year election cycle. It has stalled because US consumers are taking a longer-term view than the politicians.”

On Differences between China and the U.S.:

“China saves and invests; the US talks, consumes, borrows, and talks some more.”

On Why Tax Cuts and Stimulus Alone Won’t Work:

“Short-term tax cuts or transfers on top of America’s $1,500bn budget deficit are unlikely to do much to boost demand, while they would greatly increase anxieties over future fiscal retrenchment. Households are hunkering down, and many will regard an added transfer payment as a temporary windfall that is best used to pay down debt, not boost spending.”

On Malaise Hampering Businesses:

“Businesses, for their part, are distressed by the lack of direction….Uncertainty is a real killer.”

On 5-Point Plan to a U.S. Recovery:

1) Increased Clean Energy Investments: The recovery needs “a significant boost in investments in clean energy and an upgraded national power grid.”

2) Infrastructure Upgrade: “A decade-long program of infrastructure renovation, with projects such as high-speed inter-city rail, water and waste treatment facilities and highway upgrading, co-financed by the federal government, local governments and private capital.”

3) Further Education: “More education spending at secondary, vocation and bachelor-degree levels, to recognize the reality that tens of millions of American workers lack the advanced skills needed to achieve full employment at the salaries that the workers expect.”

4) Infrastructure Exports to the Poor: “Boost infrastructure exports to Africa and other low-income countries. China is running circles around the US and Europe in promoting such exports of infrastructure. The costs are modest – essentially just credit guarantees – but the benefits are huge, in increased exports, support for African development and a boost in geopolitical goodwill and stability.”

5) Deficit Reduction Plan: “A medium-term fiscal framework that will credibly reduce the federal budget deficit to sustainable levels within five years. This can be achieved partly by cutting defense spending by two percentage points of gross domestic product.”

Rather than succumb to the nanosecond, fear-induced headlines that rattle off like rapid fire bullets, Sachs supplies thoughtful long-term oriented solutions and ideas. The fact that Sachs mentions the word “decade” three times in his Op-ed highlights the lasting nature of these serious problems our country faces. To better see and deal with these challenges more clearly, I suggest you borrow Sachs’s telescope, and leave the microscope in the lab.

Read Full Financial Times Article by Jeffrey Sachs

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Google vs. China: Running Away from 660 Million Eyeballs?

Wait, let me get this straight. Google, the $185 billion behemoth that wants to take over the world is seriously considering turning its back on a rapidly growing cluster of 660 million eyeballs (330 million Chinese internet users according to BusinessWeek)? After hitting their head on an obscenely high market share in the U.S. (67% search share based on Nielsen data) and looking for new geographies to expand, I’m supposed to believe Google will walk away from the third largest economy on this planet (see China: Trade of the Century)? The explanation given for Google’s capitulation is discontent related to unknown hackers and censorship concerns. If that’s not enough, this alleged saint-like posturing comes after Google sold its censorship soul for years, before seeing the free speech light. Although the company’s mission is to “do no evil,” Google had no qualms aggressively poaching Microsoft (MSFT) miracle maker, Kai-Fu Lee, to kick-start their Chinese presence. If free speech is truly at the root of the Google’s unease, then why wait four whole years and a hack-attack before laying down an ultimatum on the Chinese government?

I Smell a Rat

In a blog post written by Google’s Chief Legal Officer, David Drummond, the company explains how their iron curtain digital defense was bent but not broken:

“We have evidence to suggest that a primary goal of the attackers was accessing the Gmail accounts of Chinese human rights activists. Based on our investigation to date we believe their attack did not achieve that objective. Only two Gmail accounts appear to have been accessed, and that activity was limited to account information (such as the date the account was created) and subject line, rather than the content of emails themselves.”

I’m no exterminator, but I smell a rat. All this feels a lot more like politics and business tactics then it does an altruistic display of free-speech martyrdom. The Chinese government and Google executives know what is at risk, as they both play a high stakes game of “chicken.”

Google goes onto say:

“As part of our investigation we have discovered that at least twenty other large companies from a wide range of businesses–including the Internet, finance, technology, media and chemical sectors–have been similarly targeted.”

I’m confused. These unknown hackers attacked 20 different companies and only unsuccessfully cracked two Gmail accounts. The evidence sounds pretty harmless on the surface, if this language is representative of reality. Maybe I’m wrong, and a foiled cyber-attack is reason enough to cease operations in a country inhabiting a potential 1.3 billion customers.

Sure China represents a relatively small portion of Google’s revenues (estimated at less than $1 billion and a single digit percentage of revenues), but Google would be insane to walk away from this massive long-term growth market, even if Baidu (BIDU) is currently eating their lunch. Although Google has a smaller #2 position in China, it still has a respectable 35.6% search market share (according to BusinessWeek).

Not Just About Search – Cell Phones Too

Even if they claimed they were throwing in the white towel on their Chinese search business, I don’t think they really want to flush their newly minted cell phone prospects down the toilet. Even if 275 million or so cell phone users in the U.S. is fertile ground for Google to target their new Android-based phones, I’m guessing they have penciled out the gigantic mobile potential of the rapidly expanding 700 million+ Chinese mobile phone user market.

While I can’t take the scenario of Google ceasing China operations off the table, I consider the chance of Google shutting its doors in China significantly less than 50%. While the bold Google statement of feasibility review regarding their Chinese business existence has gained a lot of attention, I think calmer heads will eventually prevail and Google will resume their targeting of 660 million Chinese eyeballs. Who knows, the high stake game of “chicken” may even benefit their bottom-line as they win the hearts and minds of more future free-speech users.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own GOOG shares and China based exchange traded funds at the time of this article’s publishing, but did not have a direct position in MSFT and BIDU shares. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

China Executes Wall Street Solution

China is taking an innovative approach to white collar crime…execution. Yang Yanming, a rogue securities trader, completed his death sentence this week for embezzling $9.52 million (a daily rounding error for Goldman Sachs, I might add). Not exactly a cheery topic for the holiday season, but nonetheless, apparently an effective technique for cracking down on illegal behavior. Last I heard, there has been no mention of a $65 billion Chinese version of the Madoff Ponzi scheme? I wonder what kind of risks the financial division of AIG would have undertaken, if involuntary death sentences were considered as viable options in the back of their minds? China in fact carries out more annual executions (via lethal injection and gun) than any other country in the world.

Part of the recent financial crisis can be attributed to the culture of Wall Street and the investment industry, which centers on exploiting “OPM,” an acronym I use to describe “other people’s money.” Often, industry professionals (I use the term loosely) assume undue amounts of risk in hopes of securing additional income, no matter the potential impact on the client. The thought process generally follows: “Why should I risk my own capital to make a mega-bonus, when I can swing for the fences using someone else’s?” And if OPM cannot be secured from individuals, perhaps the capital can be borrowed from the banks – at least before the bailouts occurred.

OPM does come with some caveats, however. Say for example the OPM comes from the government. When TARP (Troubled Asset Relief Program) funds got crammed down the throats of the banking industry, the auspice of reduced bonuses didn’t sit very well with many of the fat-cat Wall Street executives. Financial institutions prefer their OPM with few strings and little to no accountability. Goldman Sachs (GS), JP Morgan (JPM), and Morgan Stanley (MS) weren’t big fans of the government’s pay scale, so these banks paid back the TARP funds at mid-year. Citigroup (C) is still negotiating with the U.S. Treasury and regulators to remove the scarlet phrase of “exceptional assistance” from their chests.

This subject of accountability brings up additional doses of blame to distribute. Not only are the gun-slinging bankers and advisers the ones to blame, but in many cases the clients themselves shoulder some of the responsibility. Either the clients’ start drinking the speculative “Kool-Aid” of their advisor or they neglect to ask a few basic questions for accountability. Just as Ronald Reagan stressed in his conversations with the Soviets, it is also imperative for clients to “trust but verify” the relationship with their advisor (read how to get your financial house in order).

One thing we learned from the crisis of 2008-2009 is that trust is a scarce resource. Investors can “luck” into a trustworthy relationship, but more often than not, just like anything else, it takes time and effort to build a worthy partnership.

The suppliers of OPM have gotten smarter and more skeptical after the crisis, however the managers of OPM haven’t discarded risk from their toolboxes. In addition to the general rebound in domestic equities, we have seen emerging markets, commodities, high-yield bonds, and foreign currencies (to name a few areas), also vault higher.

Regulatory reform for the financial industry is a hot topic for discussion, although virtually nothing substantive has been implemented yet. Incentives, accountability, and adequate capital requirements need to be put in place, so excessive risk-taking (like we saw at the AIG division handling Credit Default Swaps) doesn’t compromise the safety of our financial system. Also, traders need to be incentivized for making responsible decisions and punished adequately for participating in illegal activities. I know the President has a lot on his plate right now, but perhaps the Obama administration could set up a brief meeting with the capital punishment committee in Beijing. I’m confident the Chinese could assist us in “executing” a financial regulatory system solution.

Read Full Reuters Article on Rogue Chinese Trader

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (VFH) and BAC, but at time of publishing had no direct positions in GS, AIG, JPM, MS and C. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

China: The Trade of the Century?

So it goes, Britain was the country of the 19th century, the United States was the country of the 20th century, and China will be the country of the 21st century. Is investment in China hype or reality? Here are some points in China’s favor:

- Large Labor Force: With a population exceeding 1.3 billion people, China has plenty of labor available to expand GDP (Gross Domestic Product).

- No Nonsense Government: An authoritarian government has its advantages. While pornography (see article) and unrest may be problems, infrastructure projects are not.

- Education: Chinese culture values education. As a result, China is slowly shifting away from its roots as the globe’s manufacturing and piracy capital. Intellectual property is appreciated more now that China is becoming a leader in emerging technology areas, such as solar power.

- Trade Surplus & Currency Reserves: Must be nice to have trade surpluses and massive currency reserves (~$2.3 trillion). This is what happens when you are in a position to export more than you import.

- Manageable Debt: China’s Debt/GDP ratio is less than 25%. You can compare that to the U.S. at around 100% and Japan at over 200%. Disciplined fiscal management provides the Chinese government with more options in dealing with the global slowdown (e.g., stimulus).

- Long Runway of Growth (Read More): China’s long runway of growth has allowed it, and should continue to allow it, to grow at above average growth rates – in the 3rd quarter of 2009 the Chinese economy grew at a very healthy +8.9% rate.

With all these positives, it’s no wonder China is the darling of the world. Given the constructive outlook, how can investors take advantage of the Far East opportunity in China? Our good friend at Investing Caffeine (figuratively speaking), Burton Malkiel (Princeton Professor of Economics and Chief Investment Officer at AlphaShares), is bullish about China and is sharing his preferred participation method…an all-cap China exchange traded fund (ticker: YAO) – Read more about Malkiel and Active vs. Passive Investing (12/8/09 Post).

Just how bullish is Professor Malkiel?

“I think China will continue to have the highest growth rate of any major country in the world, and within 20 years, China will be the world’s leading economic power.”

And he puts his money where his mouth is. Last year the professor shared his Chinese exposure in his personal portfolio:

“My portfolio is probably 20 percent Chinese, and that includes not only indices but also individual companies.”

Risks: The Price to Play

Professor Malkiel is not blindly diving into China – he researched the markets for years before taking the plunge. In an article from last year (From Wall Street to the Great Wall), he highlighted some of the inherent risks:

1) Foreign Neighbors: China continues to have tense, although cordial, relations with some of its neighbors like Taiwan and Japan. Their dealings are stable now, but the future is uncertain.

2) Social Unrest: An uneven distribution of income can lead to serious social unrest, especially in the rural parts of the country. If the government can’t keep the economy humming along, those left behind may fight back.

3) Environmental Degradation: China is building nuclear, wind, and solar projects at a frenetic pace, but China is also the globe’s largest emitter of greenhouse gases (relies on dirty coal for 70% of its energy), according to CNN. If China becomes an irresponsible power hog, there could be damaging effects to the economy.

4) Corruption: This continues to be a problem, but Malkiel points out the case of Zheng Xiaoyu, a former director of China’s FDA (Food and Drug Administration) equivalent. In 2007, he was executed after being found guilty of taking bribes.

5) Banking System: Malkiel notes that China continues to have a fragile banking system with a lot of bad loans. Due to political reasons, certain government owned entities may receive risky loans in the name of creating jobs – even if it means keeping unhealthy zombie banks alive.

Trading Strategies:

Beyond investing in AlphaShare ETFs (YAO), Malkiel advocates considering the other options, such as the “A”, “H”, and “N” shares. Unfortunately, the more inefficient “A” shares, which trade in Shanghai and Shenzen, are largely unavailable to investors outside of China. However, the “H” shares and “N” shares are available to international investors. “H” shares are listed on the Hong Kong Stock Exchange and the listed companies follow globally accepted accounting principles. The “N” shares come from companies registering with the SEC (Securities and Exchange Commission) and trade either on the NYSE (New York Stock Exchange) or NASDAQ exchanges.

Lastly, Malkiel knows he is not the only investor to pick-up on the China growth story. Multinationals are investing heavily in China, and these domestically based companies can serve as indirect investment vehicles to benefit from the attractive fundamentals as well.

Professor Malkiel calls China the “growth story of the world.” Simple math shows us that this Asian juggernaut (the third largest country in the world by GDP) will soon pass Japan in the number two position and the U.S. is likely only a few decades ahead after that. Having explored and studied China firsthand, I concur with many of Malkiels conclusions, which opens the possibility that China could reasonably be the top country (and top trade) of the 21st century?

Full Malkiel Article: From Wall Street to the Great Wall – Investment Opportunities in China

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, like FXI, at the time of publishing. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Clashing Views with Dr. Roubini

The say keep your friends close, and your enemies even closer. Nouriel Roubini, professor of economics and international business at the NYU Stern School of Business, is not an enemy, but I think his fluctuating views (see previous story) and Armageddon expectations are off base. Perma-bears like Roubini and Peter Schiff (view article) have gloated and danced in the media limelight due to their early but eventually right calls. Over the last seven months or so, their forecasts on the U.S. economy and markets have been off the mark. With that said, even those with competing views at times can find common ground. For Nouriel and I, we currently share similar beliefs on gold (see my article on gold).

Here’s what Professor Roubini has to say:

“ I don’t believe in gold. Gold can go up for only two reasons. [One is] inflation, and we are in a world where there are massive amounts of deflation because of a glut of capacity, and demand is weak, and there’s slack in the labor markets with unemployment peeking above 10 percent in all the advanced economies. So there’s no inflation, and there’s not going to be for the time being.The only other case in which gold can go higher with deflation is if you have Armageddon, if you have another depression. But we’ve avoided that tail risk as well. So all the gold bugs who say gold is going to go to $1,500, $2,000, they’re just speaking nonsense. Without inflation, or without a depression, there’s nowhere for gold to go. Yeah, it can go above $1,000, but it can’t move up 20-30 percent unless we end up in a world of inflation or another depression. I don’t see either of those being likely for the time being. Maybe three or four years from now, yes. But not anytime soon.”

My thoughts on oil are less bearish, but nonetheless more cautious given the massive price bounce to around $80 per barrel. Could I see prices coming down to $50 like Roubini feels is appropriate? Certainly. With the $100+ per barrel swing we saw last year, I cannot discount completely the possibility of that scenario. However, unlike gold, oil has a much stronger utility value, and based on the slow adoption of more expensive alternative energies, this commodity will be in strong demand for many years to come. The pace of global economic recovery, especially in countries like China, India, and Brazil provide an underlying demand for the petroleum product. In order to understand the underlying bid for this economic lubricant, all one has to do is look at the appetite of emerging economies like China when it comes to this black gold (see my article on China).

And where does Roubini think markets go from here?

“If the recovery of the economy is going to be anemic, sub-par, below-trend and U-shaped, there is going to be a correction. And therefore my view is to stay away from risky assets. Stay in liquid assets. I don’t know when the correction is going to occur, it could be a while longer, but eventually it will be a pretty ugly correction, across many different asset classes.”

Perhaps Roubini’s “double dip” fears will eventually come true – and he leaves himself plenty of room with vague loose language – however, I follow the philosophy of Peter Lynch: ‘‘If you spend more than 14 minutes a year worrying about the market, you’ve wasted 12 minutes.” Great companies don’t disappear in challenging markets – they become cheaper – and new innovative companies emerge to replace the old guard.

As much as I would like to be right all the time, that’s not the case. In order to learn from past mistakes and continually improve my process, it’s important to get the views of others…even from those with clashing perspectives.

Read IndexUniverse.com Interview with Nouriel Roubini Here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management and client accounts do not have direct long or short positions in gold positions, however accounts do have long exposure to certain energy stocks and ETFs. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Timothy Geithner, the Eddie Haskell Dollar Czar

Treasury Secretary Timothy Geithner recently stated after a meeting of G-7 financial officials that “it is very important to the United States that we continue to have a strong dollar.”

With comments like this, why does Timothy Geithner remind me so much of Eddie Haskell (played by Ken Osmond) from the 1950s suburban sitcom Leave It to Beaver? Eddie Haskell plays the scheming trouble maker who is extremely polite on the exterior around adults, but reverts to a crafty conniver once the grown-ups leave the room.

I can just picture the conversations between Treasury Secretary Geithner and President Obama before a high powered meeting with Chinese administration officials:

Geithner: “Barack, the skyrocketing debt will be no problem, we can we shovel plenty of this paper on these Chinese.”

Barack: “Uh, oh…Hu is here for our meeting.”

Geithner: “Oh hello Mr. President Jintao – what a lovely trade surplus you have. We look forward to keeping a very fiscally responsible agenda here in the United States, so you can keep buying our valuable debt.”

Where did Timothy Haskell get his crafty dollar oration skills?

According to David Malpass, president of the research firm Encima Global and deputy assistant Treasury Secretary, Geithner training came from “using a code phrase, a carryover from the Bush administration. It means that the U.S. approves of a constantly weakening dollar but doesn’t want a disruptive collapse.”

These tactics and rhetoric can only work for so long. Exploding deficits and skyrocketing debt levels will eventually lead to a dumping of our debt, rising interest rates, crowding-out of private investments, and a damaging decline in the dollar. Sure, the weakening dollar helps us in the short-run with exports but eventually major U.S. debtholders will no longer buy our sweet talking.

With all the “U.S. dollar is going to collapse” talk, one would think a shift to an SDR (Special Drawing Rights) global currency structure is an inevitable outcome. Just six months ago the governor of China’s central bank argued the U.S. dollar’s role as the world’s reserve currency should be restructured. The SDR model has already been implemented by the IMF (International Monetary Fund), so if the Chinese wanted to create an SDR proxy, they could easily purchase euros, sterling, and yen in proper proportions. Would the Chinese want to make any sudden changes? Certainly not, because any quick adjustments would destroy the value of the Chinese’s existing dollar denominated portfolio. The logistics surrounding a legitimate SDR program would require the IMF or some other international agency to act as a global central bank, which would not only need to determine the appropriate mix of currencies in the SDR, but also decide future global liquidity actions. In order to legitimately run a new SDR program, countries like China would need to give up sovereignty – not a likely scenario.

Until a new SDR regime is agreed upon, dollar-reliant countries will continue to have barks bigger than their bites and Timothy Geithner Haskell will continue to sweet talk U.S. dollar owners.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Hear Eddie (or Treasury Secretary) Speak Here: