Posts tagged ‘china trade’

Tariffs & Free Trade by Wade

Tariffs and trade have dominated the media headlines since the beginning of the year, creating a volatile rollercoaster ride in the financial markets and broader economy. What were screams of fear just last month turned into cheers of optimism after a trade deal between the U.S. and the U.K. was announced earlier this month.

This agreement—combined with hopes for future trade deals and the absence of runaway inflation or economic collapse—sparked a rally in stock prices. The minimum 10% baseline tariff in the U.K. agreement has fueled optimism that a simplified framework might extend to other international trade pacts. For the month, the S&P 500 surged by +6.2%, the Dow Jones Industrial Average climbed +3.9%, and the tech-heavy NASDAQ soared by +9.6%.

However, tariffs and trade haven’t faded into the background. In fact, just this week, a federal court ruled that the president’s tariff policies were illegal, citing misuse of emergency powers under the International Emergency Economic Powers Act (IEEPA) of 1977. Subsequently, the same court has granted the Trump administration a reprieve pending appeal—potentially escalating the issue to the Supreme Court. Even if the ruling stands, the president has alternative avenues to impose tariffs through other legal mechanisms.

So, what is all this fuss over tariffs and trade really about? I’ve previously written extensively on the topic (“Tariff Sheriff”), but some fundamental economic concepts still get lost in the tariff chaos noise.

It’s true that many countries engage in unfair trade practices against the U.S.—including subsidies, currency manipulation, non-tariff barriers, dumping, quotas, complex permitting, and value-added taxes (VAT). However, the powerful benefits of free trade are often underappreciated or poorly explained by the pundits.

Tariffs and Free Trade 101: China & France Experiment

To illustrate, let’s reference an example drawn from an op-ed by Princeton economist Burton Malkiel, author of the legendary finance book A Random Walk Down Wall Street.

Every country enjoys a comparative advantage in producing certain goods. For example, China historically benefits from low labor costs, making it a global manufacturing hub. Meanwhile, the U.S. leads in technological innovation, and countries like Brazil leverage vast land resources to dominate agricultural exports—such as being the world’s top coffee exporter. Let’s consider a simplified example using two countries: China and France, each with 100 labor hours available, and only able to produce T-shirts and wine.

China’s Output (see graphic above) – China’s comparative advantage in making more T-shirts than bottles of wine results in the following:

- 50 hours = 50 T-shirts

- 50 hours = 10 bottles of wine

France’s Output (see graphic above) – France’s comparative advantage in making more bottles of wine than T-shirts results in the following:

- 50 hours = 50 bottles of wine

- 50 hours = 20 T-shirts

Combined Total (China + France): 70 T-shirts + 60 bottles of wine = 130 total units of goods.

Example #2: Production Plan #2 (Each country specializes in their comparative advantage)

China’s Output (T-shirt specialization):

- 100 hours = 100 T-shirts

France’s Output (Wine specialization):

- 100 hours = 100 bottles of wine

Combined Total: 100 T-shirts + 100 bottles of wine = 200 total units of goods.

But here’s the challenge: the Chinese still want wine, and the French still want T-shirts. That’s where free trade comes in – see next example (graphic below).

Example #3: Production Plan #2 + Free Trade

Through free trade, each country can specialize in what they do best and then trade for other goods wanted or needed. If China trades 50 T-shirts for 50 bottles of wine with France, both countries end up with:

- China: 50 T-shirts + 50 bottles of wine

- France: 50 bottles of wine + 50 T-shirts

This plan produces 54% more total goods than the original production plan (200 vs. 130 – Example #1), with no increase in labor hours. China gets 300% more wine, and France gets 150% more T-shirts—a clear win-win.

Today’s Tariff Reality

In 2024, the U.S. trade deficit stood at $918 billion. President Trump’s aggressive tariff strategy aims to reduce this gap by incentivizing domestic manufacturing, increasing exports, and reducing imports. The challenge is that tariffs also raise prices for consumers and disrupt the benefits of free trade.

If the administration succeeds in establishing fairer rules for a level trading field, increasing government revenue, and narrowing the trade deficit, then history will likely view President Trump’s tariff policy favorably. But if tariffs lead to higher prices, inflation, and a weaker economy, the tariff policy may be judged as a costly misstep. The stock market, voters, and time will ultimately serve as the principal judges.

Looking ahead, two key dates are on the calendar:

- July 9 marks the end of the 90-day reciprocal tariff pause. Without new trade agreements, tariffs will spike on imports from many countries — raising costs for consumers.

- July 4 is not only Independence Day, but also the target date for Senate Republicans to pass the “One Big Beautiful Bill”, which packages several of President Trump’s top priorities: tax cuts, welfare reform, energy expansion, and border security. While the bill could stimulate growth, critics warn of its potential to balloon the national deficit.

Most Americans support the idea of fairer global trade. The question is whether aggressive tariffs across the globe are the right tool to achieve that goal — and whether trading partners will agree to new deals. Regardless of the outcome, this crash course in Tariffs & Free Trade 101 underscores the enduring value of specialization and free trade, even amid today’s turbulent tariff battles.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 2, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Investors Give Thanks and Feast on New Record

There were many things to be grateful over the Thanksgiving holiday, including personal finances for many. Stock market investors were especially thankful for the new record highs achieved in the S&P 500 index, which rose a heaping +3.4% last month, bringing 2019 stock market gains to a whopping +25.3%. Any concerns over politics, China trade, global monetary policy, Brexit negotiations, slowing economic growth, and other fears have been overshadowed by record corporate profits, generationally low interest rates, historically low unemployment rates, rising wages, strong consumer confidence, and hopes of an economic recovery abroad.

Despite the strong advances, concerns remain over a bubble or a stratospheric stock market. These worries of inflated gains seem overblown, if you consider stocks were down -6.2% in 2018. In other words, if you combine 2018-2019, so far, the two-year period averages an +8.4% annualized return – a more reasonable advance. One thing is for sure, this bull market, which started in early-2009, has been no turkey. Since the S&P 500 bottomed at 666 in March of 2009, the index finished the month at over 3,140 – almost a quintuple in value over a 10-year period (not too shabby).

I get the question a lot, “Wade, don’t you think the stock market is crazy now and it is going to crash soon? It’s gone up so much and is at a record high.” Just because the stock market hits a record level doesn’t mean it will stop going up. In fact, since 2013, the S&P 500 has hit 38 new, monthly record highs (see chart below). For each of these new records, I have listened to anxious investors brace themselves for another crash resembling the 2008 financial collapse. The only problem is the 100-year flood normally doesn’t come every 10 years, and as history often proves, record highs often beget future new record highs.

Be Careful to Whom You Listen

There are always varying opinions about the level and direction of future stock prices, but I always warn investors to be careful about following the judgments of television talking heads, especially when it comes to economists, strategists, and analysts, all of whom typically have very little experience in actually investing. These prognosticators typically are very articulate and persuasive but have little-to-no experience of really managing money. Traders generally fall into the useless camp as well because their opinions are moving at the speed of light based on the everchanging headlines du jour, thereby making this fickle advice worthless and ineffective. Instead, investors should pay attention to successful long-term investors who have proven the ability to make and preserve wealth through years of up-and-down markets. You don’t have to believe me, but when the most successful investor of all-time, Warren Buffett, says the stock market is “ridiculously cheap,” it probably makes sense to pay more attention to his words of wisdom versus the latest political headline or dangerous and speculative day trader advice to buy-buy-buy or sell-sell-sell!

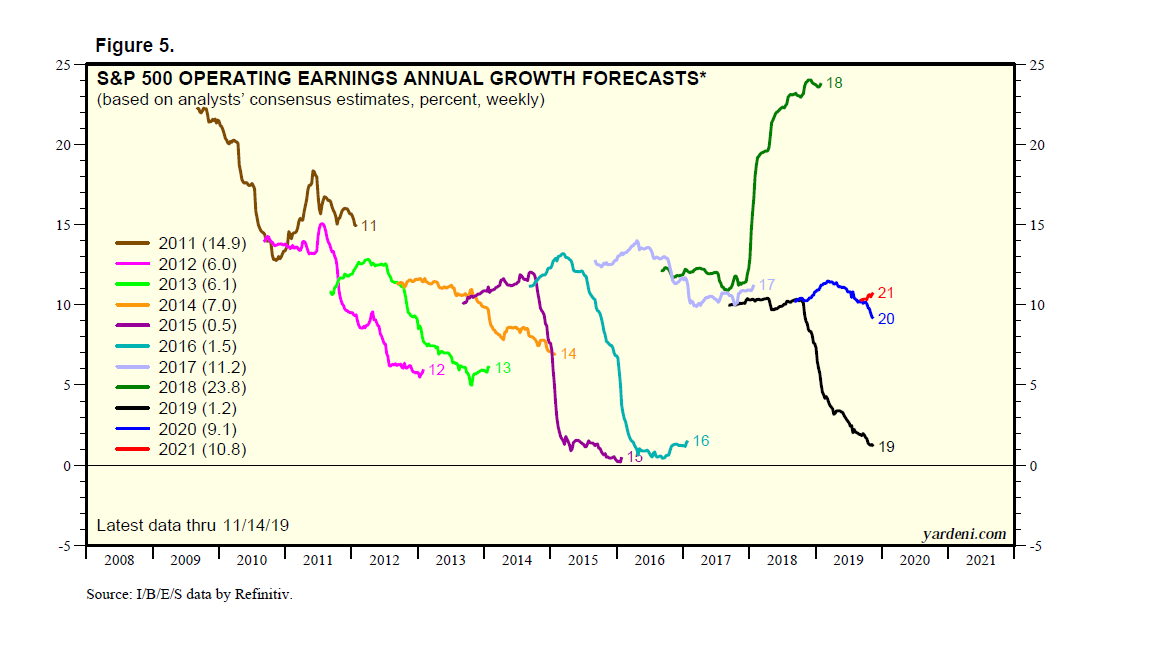

Although Warren Buffett freely provides his opinions, he openly admits he has no idea what direction stock prices will do in the short-run. So, if the greatest investor of all-time cannot predict short-term direction of stocks, then maybe you shouldn’t try to predict either? Case in point, corporate profits were up over 20% in 2018 (see chart below) and stock prices went down, while this year corporate profits have been essentially flat and stock prices have catapulted approximately +25%. This goes to show you that short-term stock movements can be incredibly difficult to predict. You will be much better off by focusing on making sound investments and following a suitable strategy based on your unique objectives and constraints.

Source: Dr. Ed’s Blog

You may have gotten some heartburn by feasting on too much turkey, mashed potatoes, stuffing, and gravy, however investors are feasting on new record stock market highs despite investor anxiety. When the anxiety eventually turns to euphoria and gluttony, from fear and skepticism, then that will be the time to reach for the Tums antacid.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 2, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.