Posts tagged ‘chatgpt’

As We Give Thanks, AI and Mag 7 Take Cash to the Bank

Market volatility resurfaced last month as speculation intensified over whether an AI bubble may be forming—and potentially bursting. Yet despite the jitters, equity markets remain solidly positive for the year (S&P 500 +16.5%, NASDAQ +21.0%, Dow +12.2%) – see S&P 500 chart below. A significant portion of the gains have been powered in large part by ongoing strength in the Magnificent 7. Standouts such as NVIDIA (+31.8%) and Alphabet (+68.1%) have been instrumental in carrying the broader indices higher.

Even with these sizable year-to-date gains, memories of the 2000 Tech Bubble and 2008 Financial Crisis resurfaced and prompted investors to temporarily tap the brakes. Mid-month, the NASDAQ retreated roughly -9% from its October peak. After a month-end bounce, the S&P 500 finished essentially flat (+0.1%), the NASDAQ slipped -1.5%, and the Dow eked out a +0.3% increase.

OpenAI and the $1.4 Trillion Question

At the center of the AI controversy sits OpenAI, parent of the three-year-old technology toddler, ChatGPT (Generative Pre-trained Transformer), which now boasts more than 800 million global users (see chart below). The company reportedly runs at a $20 billion annual revenue pace, yet faces difficult questions about how it intends to fund its staggering $1.4 trillion AI infrastructure commitments.

Those concerns came to a head when tech investor Brad Gerstner pressed CEO Sam Altman on his podcast last month. Instead of answering how OpenAI plans to underwrite such an enormous buildout, Altman childishly shot back defensively:

“If you want to sell your shares, I’ll find you a buyer.” (See clip here — or full interview here)

Source: Digital Information World

OpenAI is a key player, but just one component in the vast—and rapidly expanding—web of global AI infrastructure. Gartner, a global research and advisory firm, forecasts $2 trillion of AI investment in 2026, while NVIDIA CEO Jensen Huang recently said:

“Over the next five years, we’re going to scale into… effectively a $3 to $4 trillion AI infrastructure opportunity.”

These provocative “Is this a bubble?” questions make for great headlines, but to truly evaluate AI sustainability, it’s wise to follow the classic Watergate guidance from of All the President’s Men character, Deep Throat (FBI Associate Director, Mark Felt), who tells journalist Bob Woodward to “follow the money,” if he wants to get to the bottom of the Watergate scandal.

The same principle applies to investors who follow the money – the picture looks very different from past bubbles.

Forget Pets.com—Today’s AI Buildout Is Being Funded by Cash-Rich Titans

Unlike the flimsy, profitless internet startups of the late 1990s—companies that raised billions based on “eyeballs” and cocktail-napkin business plans—the current AI buildout is being financed largely by profitable cash-generating giants.

Yes, some firms like Oracle (ORCL) are leaning on debt financing for data-center expansion. But the overwhelming majority of AI capex is being funded by customers and by the cash flow of the Magnificent 7, a group with the financial firepower to sustain multi-year spending without relying heavily on capital markets.

This dynamic alone separates today’s environment from classic bubble conditions.

Do the Magnificent 7 Really Deserve a $22 Trillion Valuation?

The Mag 7 represent only 1% of S&P 500 constituents yet account for a massive 35% of the index’s market value. That concentration understandably raises eyebrows, evoking historical parallels to the “Nifty Fifty” of the 1970s or the “Four Horsemen” of the 1990s.

But headline concentration can be misleading—because the fundamentals tell a very different story. Here are some of the major disparities:

1.) Mag 7 Share of Profits Matches Their Share of Market Value: The Mag 7 collectively contribute $22 trillion of the S&P 500’s $58 trillion total value (below). Said differently, the market values and weightings of the Mag 7 equate to about $22 trillion and 37% of the S&P 500, respectively:

· Nvidia Corp: $4.3T & 7.0%

· Apple Inc.: $4.1 T & 6.7%

· Alphabet Inc.: $3.9 T & 6.3%

· Microsoft Corp.: $3.7 T & 5.9%

· Amazon.com Inc.: $2.5 T & 4.0%

· Meta Platforms Inc.: $1.6T & 2.6%

· Tesla Inc.: $1.4T & 2.3%

· TOTAL: $22T / 37%

Source: Slickcharts

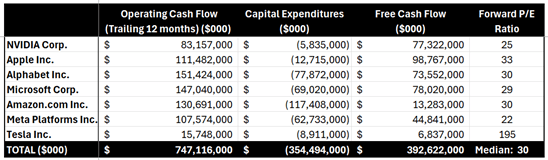

Conveniently (and importantly), the Mag 7’s roughly $747 billion in annual cash flow (see table below) is a good proxy for their profit contribution to the $2 trillion in S&P profits.

Source: SEC Filings & MarketSurge

The $747 billion in Mag 7 cash flows divided by the $2 trillion in S&P 500 coincidentally also equates to 37% ($747B/$2T).

These calculations of the Mag 7 are not bubble math—these calculation comparisons are rational math. Arguments could be made that Mag 7 market values are actually undervalued (not in bubble territory) and should appreciate to a higher percentage of the S&P 500 weightings because these 7 stocks are growing sales and profits faster than compared to the other “absentee” 493 stocks in the index.

2.) Mag 7 are Swimming in Cash: That $747 billion in annual cash flow is on track to hit a jaw-dropping $1 trillion, giving these firms ample capital to fund AI buildouts without substantially accessing the equity or credit markets. The ability to self-fund a multi-trillion-dollar infrastructure expansion is the opposite of bubble behavior.

3.) Valuations Are Elevated—but Far from Bubble Territory: During the 2000 Tech Bubble, many leading tech names traded at 100x+ earnings (See also: Rational or Irrational Exuberance. Today, the Mag 7 trade at a median forward P/E around 30x. Expensive? Historically, yes, versus long-term averages, but nowhere near historical extremes. Relative to growth, profitability, and cash flow, valuations are far more grounded today than during prior manias.

The bottom line is there is plenty to be thankful for and bubble fears are overstated. Despite pockets of AI froth, the underlying economic engine powering AI adoption is real, profitable, and well-capitalized. When investors follow the money, they discover:

· The Mag 7 generate over one-third of S&P 500 profits

· They generate and hold hundreds of billions in cash

· They largely fund their own AI capital expenditures

· Valuations remain far below bubble-era extremes

Investors have a lot to be thankful for. And while volatility will likely continue, the ingredients for a classic, catastrophic AI bubble are noticeably absent. For disciplined, long-term investing strategies like those employed at Sidoxia Capital Management, this environment still offers abundant opportunity—without the need to fear a pricked AI balloon anytime soon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Dec. 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN, META, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in ORCL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

AI Revolution and Debt Ceiling Resolution

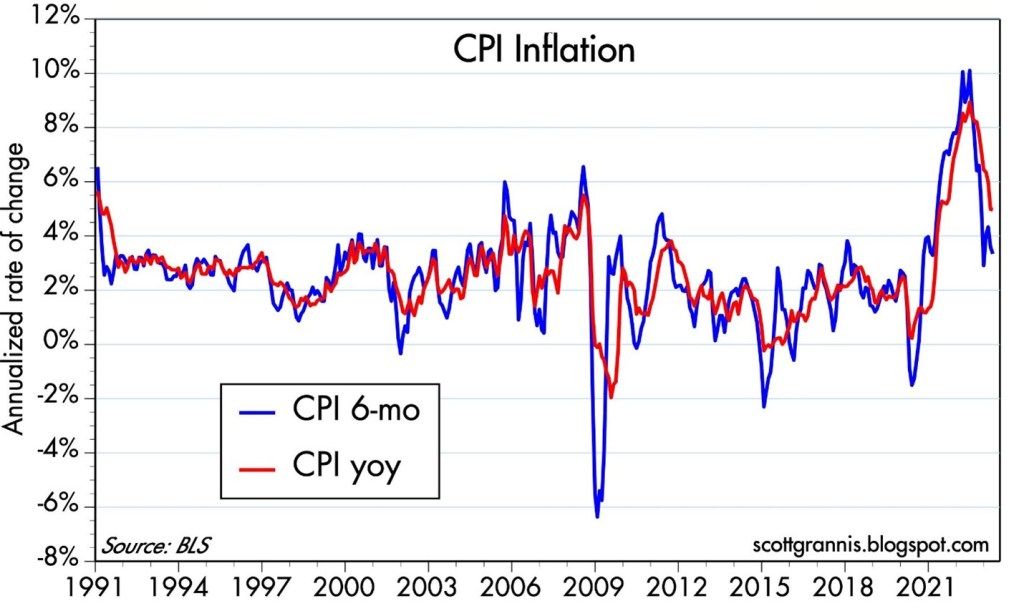

On the surface, last month’s performance of the stock market as measured by the S&P 500 index (+0.3%) seemed encouraging, but rather pedestrian. Fears of sticky-high inflation, more potential Federal Reserve interest rate hikes, contagion uncertainty surrounding a mini-banking crisis, along with looming recession concerns led to a -3.5% monthly decline in the Dow Jones Industrial Average (-1,190 points). The good news is that inflation is declining (see chart below) and currently the Federal Reserve is expected to pause from increasing interest rates in June (the first time in more than a year).

Source: Calafia Beach Pundit

Overall stock market performance has been a mixed-bag at best. Adding to investor anxiety, if you haven’t been living off-the-grid in a cave, is the debt ceiling negotiations. Essentially, our government has maxed out its credit card spending limit, but Republicans and Democrats have agreed in principle on a resolution for an expanded credit line. More specifically, the House of Representatives just approved to raise the debt ceiling by a resounding margin of 314 – 117. If all goes well, after months of saber rattling and brinksmanship, the bill should be finalized by the Senate and signed by the President over the next two days.

Beyond the Washington bickering, and under the surface, an artificial intelligence (AI) revolution has been gaining momentum and contributed to the technology-heavy NASDAQ catapulting +5.8% for the month and +23.6% for 2023. At the center of this disruptive and transformational AI movement is NVIDIA Corp., a leading Silicon Valley chip manufacturer of computationally-intensive GPUs (graphics processing units), which are used in generative AI models such as OpenAI’s ChatGPT (see NVIDIA products below). Adoption and conversations surrounding NVIDIA’s AI technology have been spreading like wildfire across almost every American industry, resulting in NVIDIA’s stratospheric stock performance (+36% for the month, +159% for the year, +326% on a 3-year basis).

Source: NVIDIA Corp. – the computing engines behind the AI revolution.

Why Such the Fuss Over AI?

Some pundits are comparing AI proliferation to the Industrial Revolution – on par with productivity-enhancing advancements like the steam engine, electricity, personal computers, and the internet. The appetite for this new technology is ravenous because AI is transforming a large swath of industries with its ability to enhance employee efficiency. By leveraging machine learning algorithms and massive amounts of data, generative AI enables businesses to automate repetitive tasks, streamline processes, and unlock new levels of productivity. A study released by MIT researchers a few months ago showed that workers were 37% more efficient using ChatGPT.

If you have created an account and played around with ChatGPT at all you can quickly realize there are an endless number of potential applications and use-cases across virtually all industries and job functions. Already, application of generative AI systems is disrupting e-commerce, marketing, customer service, healthcare, robotics, computer vision, autonomous vehicles, and yes, even accounting. Believe it or not, ChatGPT recently passed the CPA exam! Maybe ChatGPT will do my taxes next year?

Other industries are quickly being disrupted too. Lawyers may feel increased pressure when contracts or briefs can be created with a click of the button. Schools and teachers are banning ChatGPT too in hopes of not creating lazy students who place cheating and plagiarism over critical thinking.

At one end of the spectrum, some doomsday-ers believe AI will become smarter than humans, replace everyone’s job, and AI robots will take over the world (see Elon Musk warns AI could cause “civilization destruction”). At the other end of the spectrum, others see AI as a transformational tool to help worker productivity. As generative AI continues to advance, its impact on employee efficiency will only grow, optimizing processes, driving innovation, and reshaping industries for a more productive future. Embracing this transformative technology will be critical for businesses seeking to thrive in the new digital age.

2023 Stock Performance Explained – Index Up but Most Stocks Down

Although 2022 was a rough year for the stock market (i.e., S&P 500 down -19%), stock prices have rebounded by +20% from the October 2022 lows, and +9% this year. This surge can be in large part attributed to the lopsided performance of the top 1% of stocks in the S&P 500 index (Apple Inc., Microsoft Corp., Amazon.com Inc., NVIDIA Corp., and Alphabet-Google), which combined account for almost 25% of the index’s total value. These top 5 consumer and enterprise technology companies have appreciated on average by an astounding +60% in the first five months of the year and represent a whopping $9 trillion in value. It gets a little technical, but it’s worth noting these larger companies have a disproportionate impact on the calculation of the return percentages, and vice versa for the smaller companies. To put these numbers in context, Apple’s $2.8 trillion company value is greater than the Gross Domestic Product (GDP) of many entire countries, including Italy, Canada, Australia, South Korea, Brazil, and Russia.

On the other hand, if we contrast the other 99% of the S&P 500 index (495 companies), these stocks are down -1% each on average for 2023 (vs +60% for the top 5 mega-stocks). If you look at the performance summary below, you can see that basically every other segment of the stock market outside of technology (e.g., small-cap, value, mid-cap, industrial) is down for the year.

2023 Year-To-Date Performance (%)

S&P 500: +8.9%

S&P 500 (Equal-Weight): -1.2%

S&P Small-Cap Index: -2.3%

Russell 1000 Value Index: -2.0%

S&P Mid-Cap Index: -0.7%

Dow Jones Industrial: -0.7%

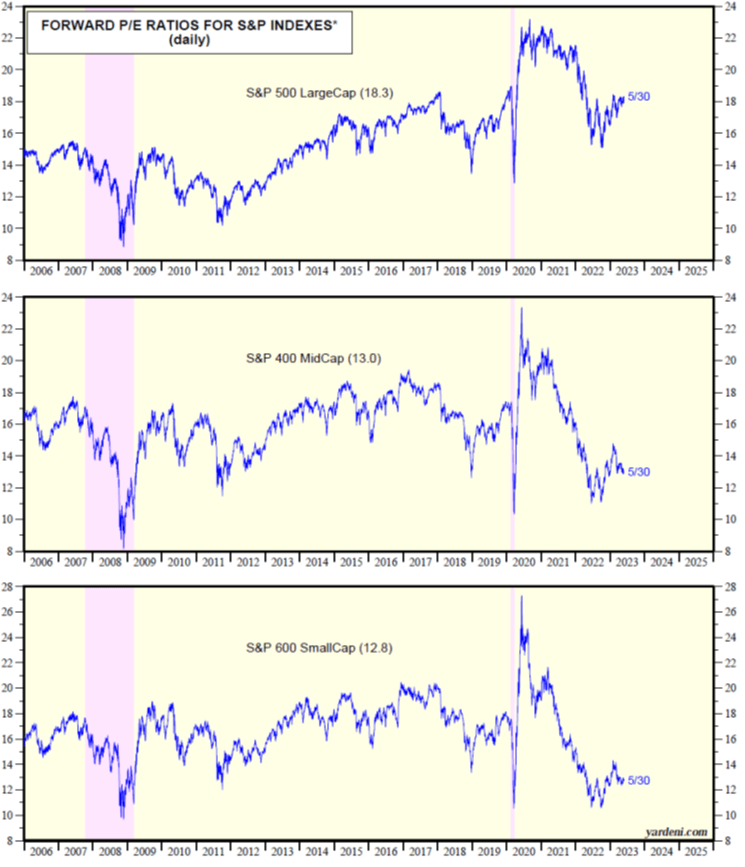

While most stocks have dramatically underperformed technology stocks this year, this phenomenon can be explained in a few ways. First of all, smaller companies are more cyclically sensitive to an economic slowdown, and do not have the ability to cut costs to the same extent as the behemoth companies. The majority of stocks have factored in a slowdown (or mild recession) and this is why valuations for small-cap and mid-cap stocks are near multi-decade lows (12.8x and 13.0x, respectively) – see chart below.

Source: Yardeni.com

The stock market pessimists have been calling for a recession for going on two years now. Not only has the recession date continually gotten delayed, but the severity has also been reduced as corporate profits remain remarkably resilient in the face of numerous economic headwinds. Regardless, investors can stand on firmer ground now knowing we are upon the cusp of an AI revolution and near the finish line of a debt ceiling resolution.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.