Posts tagged ‘Case Shiller’

Consumer Confidence Flies as Stock Market Hits New Highs

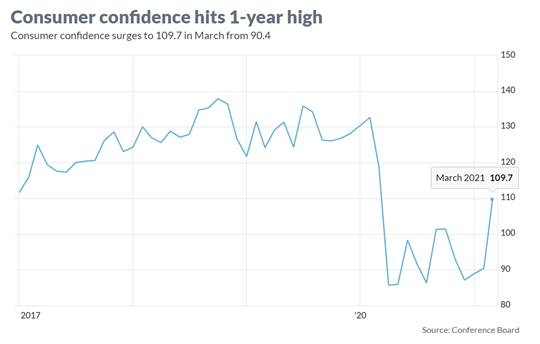

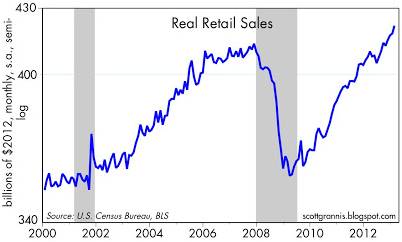

As the economy starts reopening from a global pandemic that is improving, consumers and businesses are beginning to see a light at the end of the tunnel. The surge in the recently reported Consumer Confidence figures to a new one-year high (see chart below) is evidence the recovery is well on its way. A stock market reaching new record highs is further evidence of the reopening recovery. More specifically, the Dow Jones Industrial Average catapulted 2,094 points higher (+6.2%) for the month to 32,981 and the S&P 500 index soared +4.2%. A rise in interest rate yields on the 10-Year Treasury Note to 1.7% from 1.4% last month placed pressure on technology growth stocks, which led to a more modest gain of +0.4% in the tech-heavy NASDAQ index during March.

Comeback from COVID

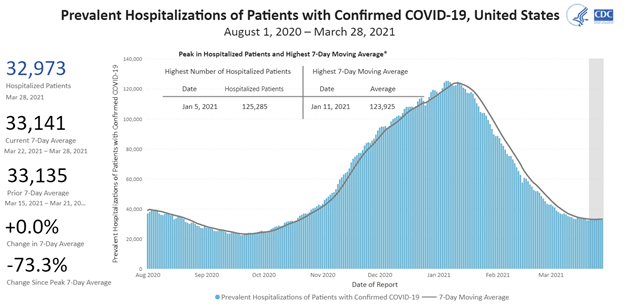

With a combination of 150 million vaccine doses administered and 30 million cumulative COVID cases, the U.S. population has creeped closer toward herd immunity protection against the virus and pushed down hospitalizations dramatically (see chart below).

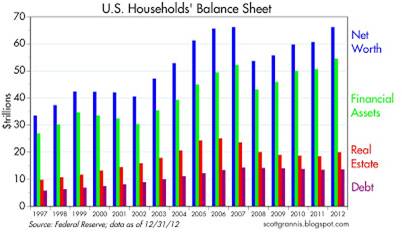

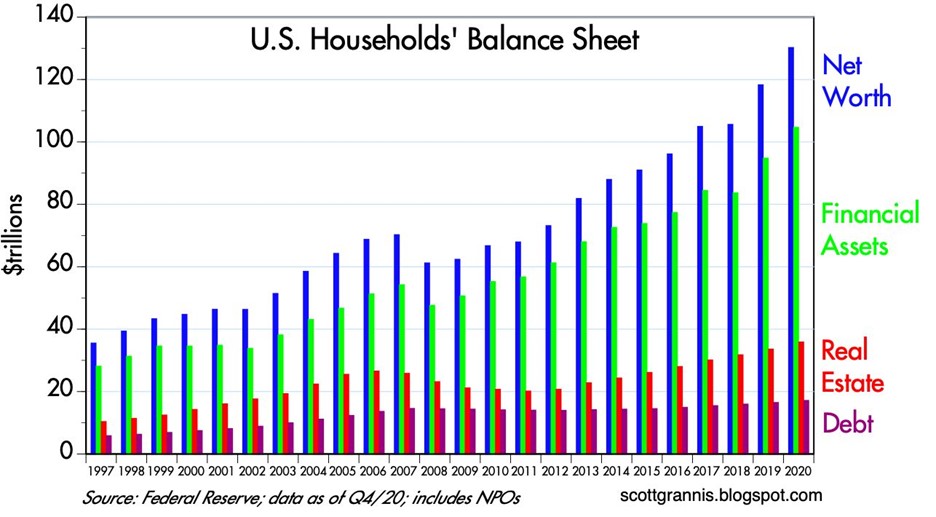

Also contributing to investor optimism have been the rising values of investments and real estate assets thanks to an improving economy and COVID case count. As you can see from the chart below, the net worth of American households has more than doubled from the 2008-2009 financial crisis to approximately $130 trillion dollars, which in turn has allowed consumers to responsibly control and manage their personal debt. Unfortunately, the U.S. government hasn’t been as successful in keeping debt levels in check.

Spending and Paying for Infrastructure Growth

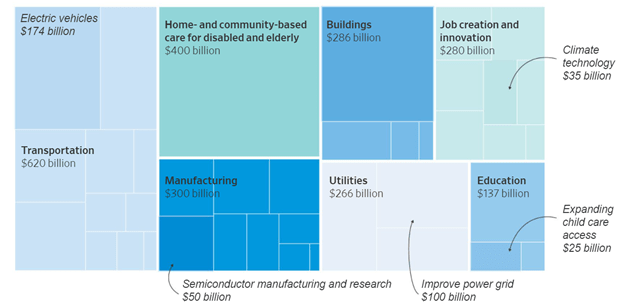

Besides focusing on positive COVID trends, investors have also centered their attention on the passage of a $1.9 trillion stimulus bill last month and a new proposed $2.3 trillion infrastructure bill that President Biden unveiled details on yesterday. At the heart of the multi-trillion dollar spending are the following components (see also graphic below):

- $621 billion modernize transportation infrastructure

- $400 billion to assist the aging and disabled

- $300 billion to boost the manufacturing industry

- $213 billion to build and retrofit affordable housing

- $100 billion to expand broadband access

With over $28 trillion in government debt, how will all this spending be funded? According to The Fiscal Times, there are four main tax categories to help in the funding:

Corporate Taxes: Raising the corporate tax rate to 28% from 21% is expected to raise $730 billion over 10 years

Foreign Corporate Subsidiary Tax: A new global minimum tax on foreign subsidiaries of American corporations is estimated to raise $550 billion

Capital Gains Tax on Wealthy: Increasing income tax rates on capital gains for wealthy individuals is forecasted to raise $370 billion

Income Tax on Wealthy: Lifting the top individual tax rate back to 39.6% for households earning more than $400,000 per year is seen to bring in $110 billion

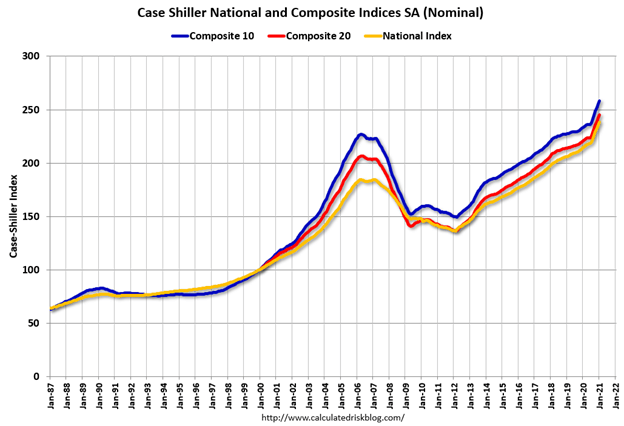

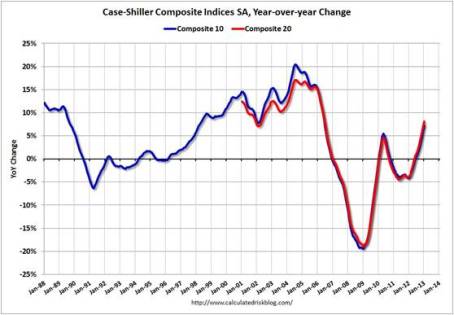

Besides the economy being supported by government spending, growth and appreciation in the housing market are contributing to GDP growth. The recently released housing data shows housing prices accelerating significantly above the peak levels last seen before the last financial crisis (see chart below).

Although the economy appears to be on solid footing and stock prices have marched higher to new record levels, there are still plenty of potential factors that could derail the current bull market advance. For starters, increased debt and deficit spending could lead to rising inflation and higher interest rates, which could potentially choke off economic growth. Bad things can always happen when large financial institutions take on too much leverage (i.e., debt) and speculate too much (see also Long-Term Capital Management: When Genius Failed). The lesson from the latest, crazy blow-up (Archegos Capital Management) reminds us of how individual financial companies can cause billions in losses and cause ripple-through effects to the whole financial system. And if that’s not enough to worry about, you have rampant speculation in SPACs (Special Purpose Acquisition Companies), Reddit meme stocks (e.g., GameStop Corp. – GME), cryptocurrencies, and NFTs (Non-Fungible Tokens).

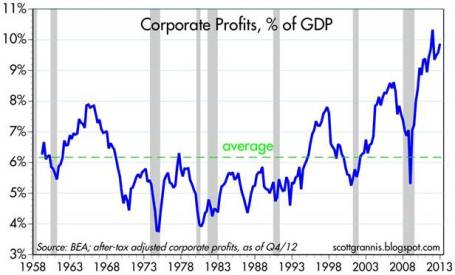

Successful investing requires a mixture of art and science – not everything is clear and you can always find reasons to be concerned. At Sidoxia Capital Management, we continue to find attractive opportunities as we strive to navigate through areas of excess speculation. At the end of the day, we remain disciplined in following our fundamental strategy and process that integrates the four key legs of our financial stool: corporate profits, interest rates, valuations, and sentiment (see also Don’t Be a Fool, Follow the Stool). As long as the balance of these factors still signal strength, we will remain confident in our outlook just like consumers and investors are currently.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

P/E Binoculars, Not Foggy Rearview Mirror

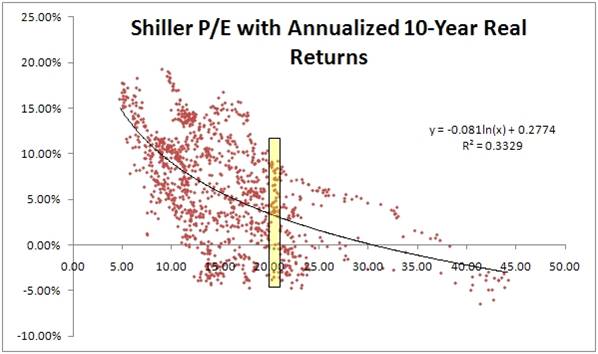

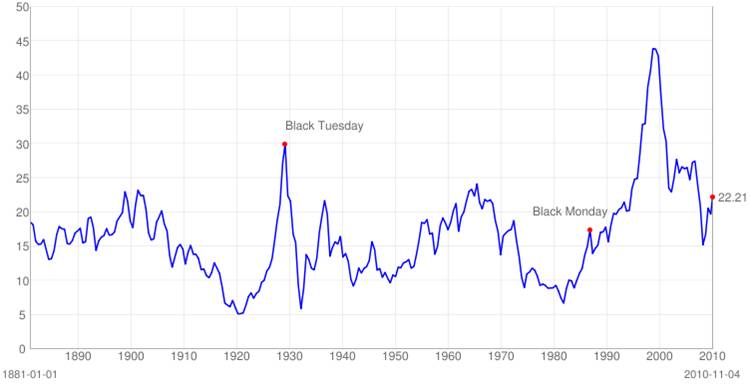

Robert Shiller is best known for his correctly bearish forecasts on the housing market, which we are continually reminded of through the ubiquitous Case-Shiller housing index, and his aptly timed 2000 book entitled Irrational Exuberance. Shiller is also well known for his cyclically adjusted 10-year price-earnings tool, also known as P/E-10. This tool chooses to take a rearview mirror look at the 10-year rolling average of the S&P composite stock index to determine whether the equity market is currently a good or bad buy. Below average multiples are considered to be predictive of higher future returns, and higher than average multiples are considered to produce lower future returns (see scatterplot chart).

Source: http://www.mebanefaber.com (June 2010)

Foggy Mirror

If you were purchasing a home, would the price 10 years ago be a major factor in your purchase decision? Probably not. Call me crazy, but I would be more interested in today’s price and even more interested in the price of the home 10 years into the future. The financial markets factor in forward looking data (not backward looking data). Conventional valuation techniques applied to various assets, take for example a bond, involve the discounting of future cash flow values back to the present – in order to determine the relative attractiveness of today’s asset price. The previous 10-years of data are irrelevant in this calculation.

Although I believe current and future expectations are much more important than stale historical data, I can appreciate the insights that can be drawn by comparing current information with historical averages. In other words, if I was purchasing a house, I would be interested in comparing today’s price to the historical 10-year average price. Currently, the P/E-10 ratio stands at a level around 22x – 38% more expensive than the 16x average value for the previous decade. That same 22x current P/E-10 ratio compares to a current forward P/E ratio of 13x. A big problem is the 22x P/E-10 is not adequately taking into account the dramatic growth in earnings that is taking place (estimated 2010 operating earnings are expected to register in at a whopping +45% growth).

Mean P/E 10 Value is 16.4x Source: http://www.multpl.com

Additional problems with P/E-10:

1) The future 10 years might not be representative of the extreme technology and credit bubble we experienced over the last 10 years. Perhaps excluding the outlier years of 2000 and 2009 would make the ratio more relevant.

2) The current P/E-10 ratio is being anchored down by extreme prices from a narrow sector of technology a decade ago. Value stocks significantly outperformed technology over the last 10 years, much like small cap stocks outperformed in the 1970s when the Nifty Fifty stocks dominated the index and then unraveled.

3) Earnings are rising faster than prices are increasing, so investors waiting for the P/E-10 to come down could be missing out on the opportunity cost of price appreciation. The distorted P/E ratios earlier in the decade virtually guarantee the P/E-10 to drop, absent a current market melt-up, because P/E ratios were so high back then.

4) The tool has been a horrible predictor over very long periods of time. For example, had you followed the tool, the red light would have caused you to miss the massive appreciation in the 1990s, and the green light in the early 1970s would have led to little to no appreciation for close to 10 years.

Shiller himself understands the shortcomings of P/E-10:

“It is also dangerous to assume that historical relations are necessarily applicable to the future. There could be fundamental structural changes occurring now that mean that the past of the stock market is no longer a guide to the future.”

How good an indicator was P/E-10 for the proponent himself at the bottom of the market in February 2009? Shiller said he would get back in the market after another 30% drop in the ratio (click here for video). As we know, shortly thereafter, the market went on a near +70% upwards rampage. I guess Shiller just needs another -55% drop in the ratio from here to invest in the market?

Incidentally, Shiller did not invent the cyclically adjusted P/E tool, as famed value investor Benjamin Graham also used a similar tool. The average investor loves simplicity, but what P/E-10 offers with ease-of-use, it lacks in usefulness. I agree with the P/E-10 intent of smoothing out volatile cycle data (artificially inflated in booms and falsely depressed in recessions), but I recommend investors pull out a pair of binoculars (current and forward P/Es) rather than rely on a foggy rearview mirror.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.