Posts tagged ‘bear’

Even Winning Teams Occasionally Lose

The stock market has been a winning team for years, generating outsized returns for investors. But so far this year, the winning streak appears to be coming to an end. For 2022, the S&P 500 index is down -21%, including -8% last month. However, since 2008, the stock market has generally been on a consistent tear racking up a record of 10 wins, 2 losses (2015 and 2018), and one tie (2011). In recent years, the U.S. stock market has been winning by a large margin (2019: +29%, 2020: +16%, 2021: +27%) and a significant contributor to the team’s win streak has been the Federal Reserve, or the designated hitter (DH).

Jerome Powell, the Fed Chair, has been a very effective clean-up hitter for the stock market, not only leading the stock market team to victories, but also appreciation in almost all global-risk asset classes. By keeping interest rates (the Federal Funds Rate target) essentially at 0% over the last few years, since the initial COVID pandemic outbreak, many investors are blaming Mr. Powell for elevated inflation rates. If that were truly the case, then we probably wouldn’t see the ubiquitous inflation globally, as we do now. Just as you would expect with any baseball team, any single player does not deserve all the credit for wins, nor should any single player receive all the blame for losses – the same principle applies to the Federal Reserve.

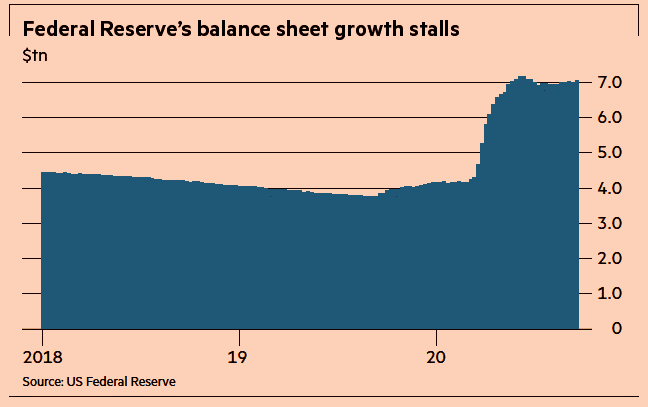

Regardless, the stock market’s best hitter is now injured. In addition to pushing interest rates higher, the Fed is hurting the team through its monetary policy of quantitative tightening or QT (i.e., selling bonds off the Fed’s balance sheet). Theoretically, QT should cause interest rates to move higher, all else equal, and thereby slow down growth in the economy, and help tame out-of-control inflation.

The stock market was also thrown a curve ball when Russia invaded Ukraine, which added gasoline to an already flaming inflation fire. Globally, consumers and businesses have witnessed exploding oil/gasoline prices, in addition to escalated food prices caused by a lack of grain and other commodity exports out of Ukraine.

Lastly, a wild pitch has been thrown at the U.S. stock market by China with its zero-COVID policy, which has essentially shut down the world’s 2nd largest economy and further delayed the full reopening of the global economic game. As a result of China’s hardline lockdown stance, global supply chain disruptions have intensified and import prices have mushroomed higher.

Although this all sounds like horrible news, in the game of investing, nobody wins all the time. As history teaches us, the stock market is generally up around 70% of the time. It just happens to be that we are in the middle of a 30% losing period.

Bad News Does Not Mean Bad Stock Market

The majority of economists, strategists, and talking heads on television are forecasting a recession in our economy, either this year or next. This should come as no surprise to any experienced investor, as history teaches us that recessions occur on average about twice every decade. Long-term investors also understand that stock prices do not always just go up on good news and down on bad news. Stocks can go down on good news, and up on bad news. In fact, over the last 13 years, since the bottom of the 2008-2009 financial crisis, the stock market has increased about six-fold (even after this year’s -21% correction) in the face of some horrendously scary headlines (also see chart below):

· Ukraine-Russia

· COVID

· Elections / Capitol Insurrection

· Exit from Afghanistan

· Impeachment

· China Trade War & Tariffs

· Inverted Yield Curves

· N. Korea Missile Launches

· Brexit

· ISIS in Iraq

· Ebola

· Russia Takeover of Crimea

· Double Dip Recession Fears

· Eurozone Debt Crisis

S&P 500 Index (1997 – 2022)

Despite the recent headwinds in the stock market, not all the news is bad. Here are some tailwinds:

- PROFITS: Corporate profits remain at or near record levels.

- INFLATION: Inflation appears to be cooling as evidenced by declining commodity prices (TR Commodities CRB Index).

CRB Commodities Index (2022)

- PRICES: Valuations have come down significantly – Price/Earnings ratio of 15.9 (i.e., stock prices are on sale).

- SENTIMENT: Sentiment remains fearful – a contrarian buy indicator (an elevated VIX – Volatility Index can signal buying opportunities). As Warren Buffett says, “Be fearful when others are greedy, and greedy when others are fearful.”

VIX – Volatility Index (2021 – 2022)

Even though the U.S. stock market has been a long-term winner, investors have been betting against the winning team by selling stocks. As mentioned earlier, recessions, if we get one, are common and nothing new. The -21% correction in stock prices is already factoring in a mild recession, so we have already suffered near-maximum pain. Could prices go lower? Certainly. But should you quit a 26-mile marathon at mile 25 because the pain is too intense? In most instances, the answer should absolutely be “no” (see also No Pain, No Gain). Eventually, the Fed will stop raising interest rates, inflation will cool, the Russia-Ukraine war will be resolved, and solid growth will return. While many people are betting the stock market will lose this year, many long-term investors recognize betting on stock market success is a winning strategy over the long-run, especially when prices are on sale.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BRKA/B or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Pain, No Gain

Long-term success is rarely achieved without some suffering. In other words, you are unlikely to enjoy gains without some pain. Last month was certainly painful for stock market investors. On the heels of concerns over the Russia-Ukraine war, Federal Reserve interest rate hikes, China-COVID lockdowns, inflation/supply chain disruptions, and a potential U.S. recession, the S&P 500 index declined -8.8% for the month, while the technology-heavy NASDAQ index fell -13.3%, and the Dow Jones Industrial Average weakened by -4.9%.

For long-term stock investors who have reaped the massive +520% rewards from the March 2009 lows, they understand this gargantuan climb was not earned without some rocky times along the way. As you can see from the chart below, there have been no shortage of issues and events to worry about over the last 15 years (2007 – 2022):

- 2008-2009: Financial Crisis

- 2010: Flash Crash (electronic trading collapse)

- 2011: Debt Ceiling – Eurozone Collapse

- 2012: Greek Debt Crisis – Arab Spring (anti-government protests)

- 2012: Presidential Elections – Sequestration (automatic spending cuts) – Cyprus Financial Crisis

- 2013: Federal Reserve Taper Tantrum (threat of removing monetary policy accommodation)

- 2014: Ebola Virus Outbreak

- 2015: China Economic Slowdown

- 2018: China Trade Tariffs – Federal Reserve Interest Rate Hikes

- 2020: COVID-19 Global Pandemic – Recession

- 2022: Russia-Ukraine War -Federal Reserve Interest Rate Hikes – Inflation/Supply Chain – Slowing China

So, that’s the bad news. The good news is that after the stock market eventually bottomed (S&P 500) around each of these events, one year later, stock prices rebounded on average approximately +32%, and prices moved even higher in the following two years. Suffice it to say, in most instances, patiently waiting and taking advantage of heightened volatility usually results in handsome rewards for investors over the long-run. As Albert Einstein stated, “In the middle of every difficulty lies an opportunity.”

There have been plenty of false recession scares in the past, and this could prove to be the case again. Although I have noted some of the key headwinds the economy faces above, it is worth noting that current corporate profits remain at/near all-time record highs (see chart below) and the 3.6% unemployment rate effectively stands at/near generationally record low levels. What’s more, housing remains strong, and consumer balance sheets remain very healthy as a result of elevated savings rates that occurred during COVID.

The S&P 500 is already off -14% from its highest levels experienced at the beginning of the year. Although there are no clear signs of a looming recession presently, if history is a guide, much of the pessimism is likely already discounted in current stock prices. Stated differently, even if the economy were to suffer a garden-variety recession, we may already be closer to a bottom than the potential gains from a subsequent rebound. The 15-year chart shows that stock prices have become significantly more attractively valued in recent months.

Panic is rarely a profitable strategy, so now is probably not the best time to knee-jerk react to the price declines. Peter Lynch, arguably one of the greatest all-time investors (see Inside the Brain of an Investing Genius), said it best when he stated, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Market corrections are never comfortable, but successful, long-term investing comes with a price…no pain, no gain!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 2, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Politics & COVID Tricks

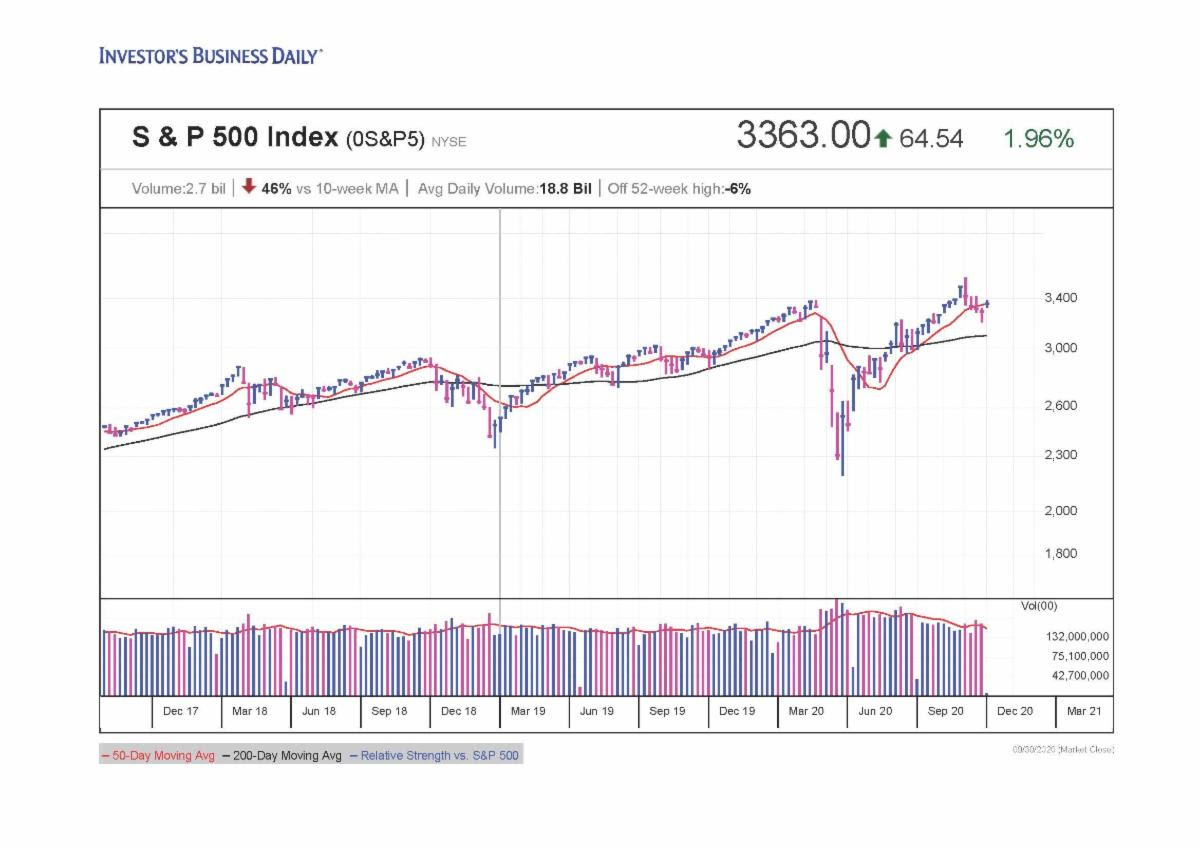

Thanks to a global epidemic, trillions of dollars instantly disappeared during the first quarter of this year, and then, abracadabra…the losses turned into gains and magically reappeared in the subsequent two quarters. After a stabilization in the spread of the COVID-19 virus earlier this year, the stock market rebounded for five consecutive months, at one point rebounding +64% (from late March to early September) – see chart below. However, things became a little bit trickier for the recent full month as concerns heightened over the outcome of upcoming elections; uncertainty over a potential coronavirus-related stimulus package agreement; and fears over a fall resurgence in COVID-19 cases. Although the S&P 500 stock index fell -3.9% and the Dow Jones Industrial Average slipped -2.3% during September, the same indexes levitated +8.5% and +7.6% for the third quarter, respectively.

Source: Investors.com

Washington Worries

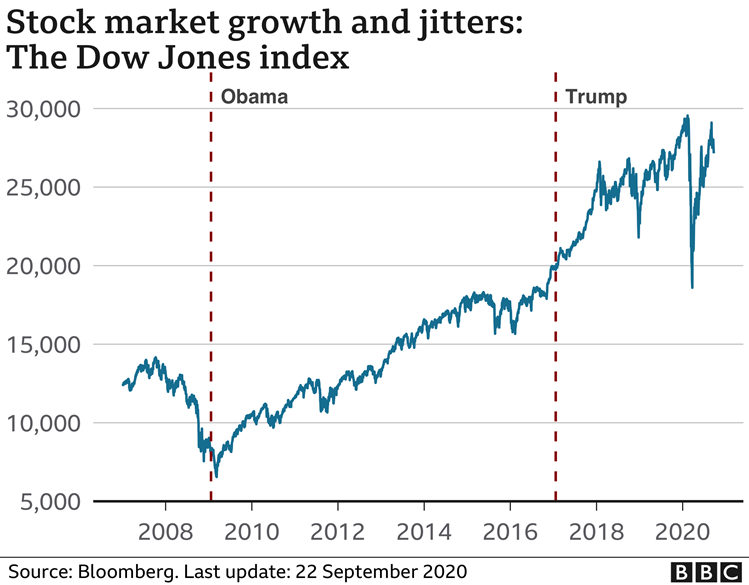

Anxiety over politics is nothing new, and as I’ve written extensively in my Investing Caffeine blog, history teaches us that politics have little to do with the long-term performance of the overall stock market (e.g., see Politics & Your Money). Nobody knows with certainty how the elections will impact the financial markets and economy (myself included). But what I do know is that many so-called experts said the stock market would decline if Barack Obama won the presidential election…in reality the stock market soared. I also know the so-called experts said the stock market would decline if Donald Trump won the presidential election… in reality the stock market soared. So, suffice it to say, I don’t place a lot of faith into what any of the so-called political experts say about the outcome of upcoming elections (see the chart below).

COVID Coming Back?

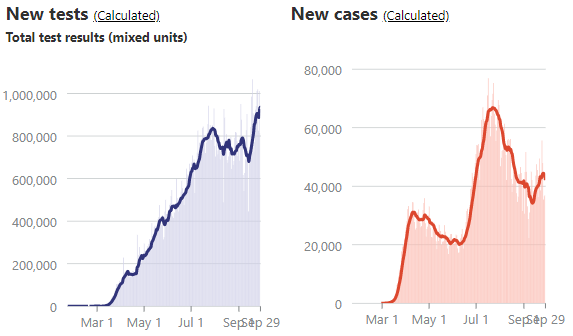

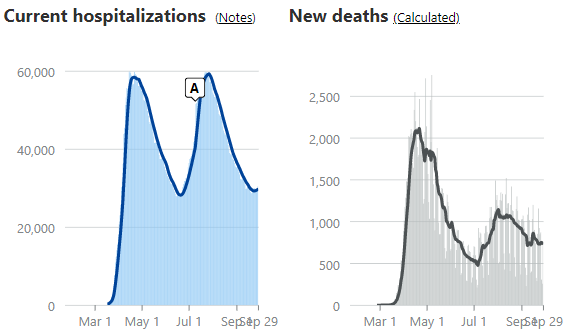

One of the reasons stock prices have risen more than 50%+ is due to a stabilization in COVID-19 virus trends. As you can see from the charts below, new tests, hospitalizations, and death rates are generally on good trajectories, according to the COVID Tracking Project. However, new COVID cases have bumped higher in recent weeks. This recent, troubling trend has raised the question of whether another wave of cases is building in front of a dangerous, seasonally-cooler fall flu season. Traditionally, it’s during this fall period in which contagious viruses normally spread faster.

Source: The COVID Tracking Project

Regardless of the trendline in new cases, there is plenty of other promising COVID developments to help fight this pandemic, such as the pending approvals of numerous vaccines, along with improved therapies and treatments, such as therapeutics, steroids, blood thinners, ventilators, and monoclonal antibodies.

Business Bounce

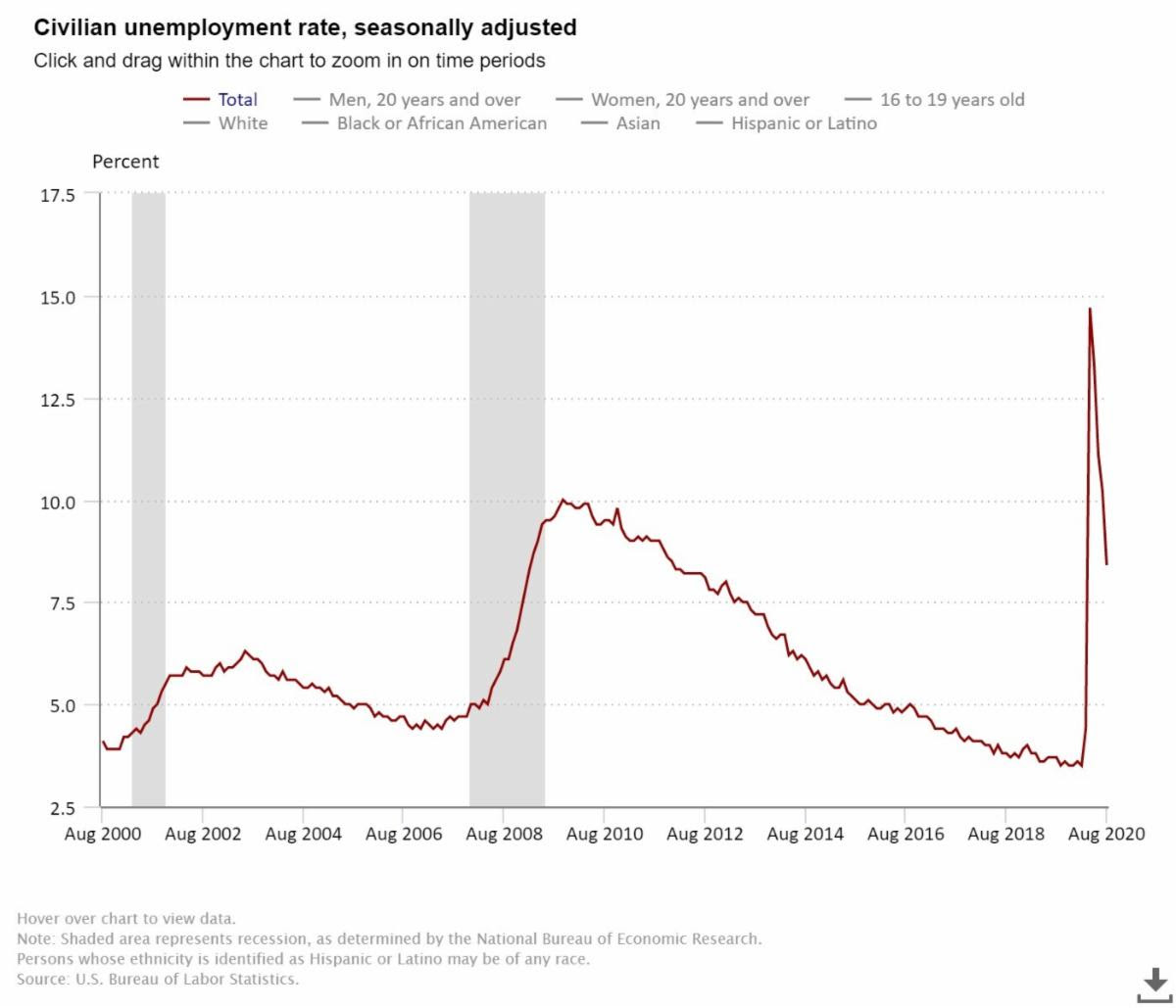

From the 10,000-foot level, despite worries over various political outcomes, the economy is recovering relatively vigorously. As you can see from the chart below, the rebound in employment has been fairly swift. After peaking in April at 14.7%, the most recent unemployment rate has declined to 8.4%, and a closely tracked ADP National Employment Report was released yesterday showing a higher than expected increase in new private-sector monthly jobs (749,000 vs. 649,000 median estimate).

Source: U.S. Bureau of Labor Statistics

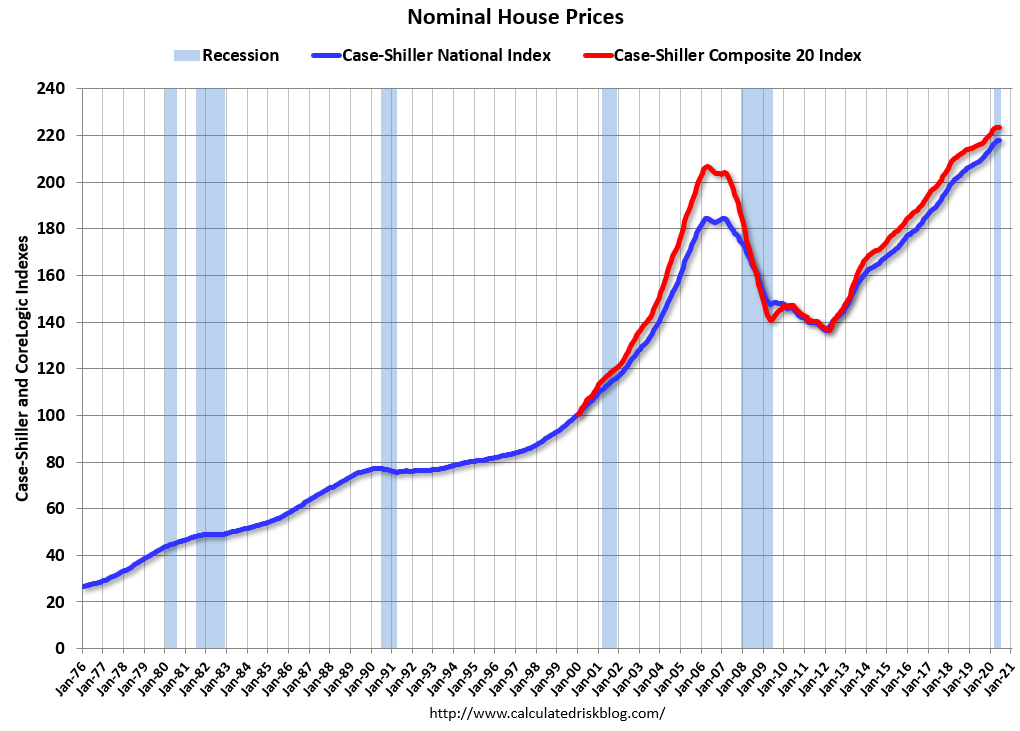

From a housing perspective, house sales have been on fire. Record-low interest rates, mortgage rates, and refinancing rates have been driving higher home purchases and rising prices. Urban flight to the suburbs has also been a big housing tailwind due to the desire for more socially distanced room, additional home office space, and expansive backyards. Adding fuel to the housing fire has been record low supply (i.e., home inventories). The robust demand is evident by the record Case-Shiller home prices (see chart below).

Source: Calculated Risk

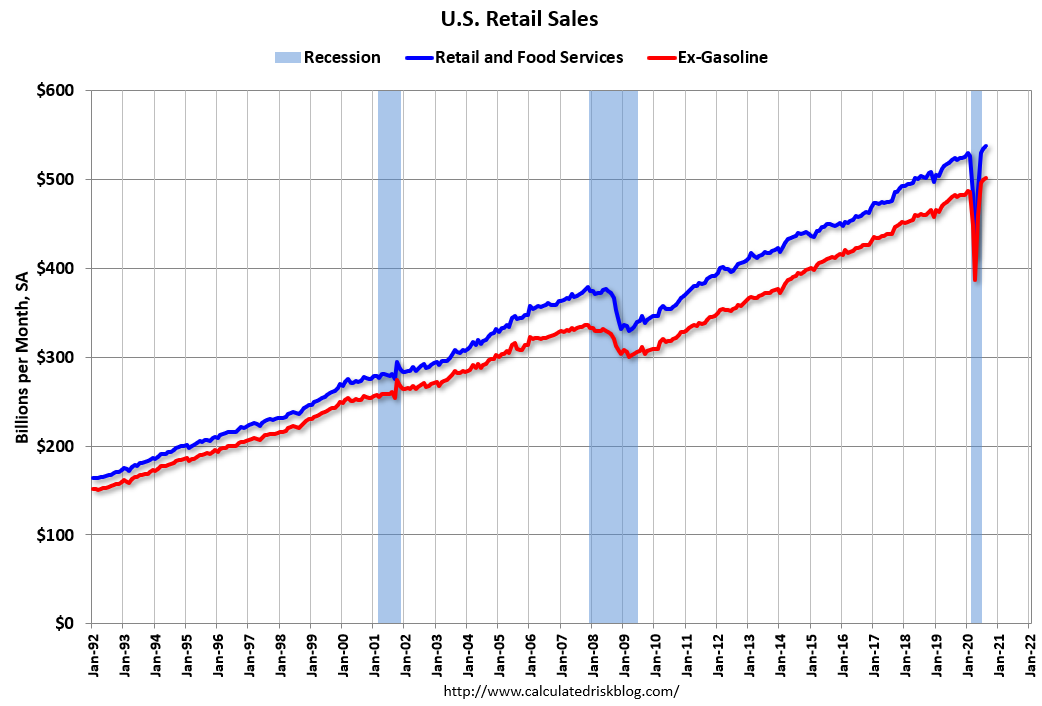

There are plenty of industries hurting, including airlines, cruise lines, hotels, retailers, and restaurants but the economic rebound along with government stimulus (i.e., direct government checks and unemployment relief payments) have led to record retail sales (see chart below). Spending could cool if an additional coronavirus-related stimulus package agreement is not reached, but until the government checks stop flowing, consumers will keep spending.

Source: Calculated Risk

Besides trillions of dollars in fiscal relief injected into the economy, the Federal Reserve has also provided trillions in unprecedented relief (see chart below) through its government and corporate bond buying programs, in addition to its Main Street Lending Program.

Source:The Financial Times

There has been a lot of political hocus pocus and COVID smoke & mirrors that have much of the population worried about their investments. In every presidential election, you have about half the population satisfied with the winner, and half the population disappointed in the winner…this election will be no different. The illusion of fear and chaos is bound to create some short-term financial market volatility over the next month, but behind the curtains there are numerous positive, contributing factors that are powering the economy and stock market forward. Do yourself a favor by focusing on your long-term financial future and don’t succumb to politics and COVID tricks.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bears Hibernate During Melt-Up

Here we are 719 days from the market bottom of March 2009, and the S&P 500 has more than doubled from its index low value of 666 to 1343 today. Noticeably absent during the meteoric rise have been the hibernating bears, like economist Nouriel Roubini (aka “Dr. Doom”) or Peter Schiff (see Emperor Schiff Has No Clothes), who blanketed the airwaves in 2008-2009 when financial markets were spiraling downwards out of control. The mere fact that I am writing about this subject may be reason enough to expect a 5-10% correction, but with a +100% upward move in stock prices I am willing to put superstition aside and admire the egg on the face of the perma-bears.

Shape of Recovery

After it became clear that the world was not coming to an end, in late 2009 and throughout 2010, the discussion switched from the likelihood of a “Great Depression” to a debate over the shape of the alphabet letter economic recovery. Was the upturn going to be an L-shaped, V-shaped, square root-shaped, or what Roubini expected – a U-shaped (or bathtub-shaped) recovery? You be the judge — does six consecutive quarters of GDP expansion with unemployment declining look like a bathtub recovery to you?

This picture above looks more like a “V” to me, and the recently reported Institute for Supply Management’s (ISM) manufacturing index figure of 60.8 in January (the highest reading in seven years) lends credence to a stronger resurgence in the economy. Apparently the PIMCO bear brothers, Mohamed El-Erian and Bill Gross, are upwardly adjusting their view of a “New Normal” environment as well. Just recently, the firm raised its 2011 GDP forecast by 40-50% to a growth rate of 3-3.5% in 2011.

The Bears’ Logic

Bears continually explain away the market melt-up as a phenomenon caused by excessive and artificial liquidity creation (i.e., QE2 money printing, and 0% interest rate policy) Bernanke has provided the economy. Similar logic could be used to describe the excessive and artificial debt creation generated by individuals, corporations, and governments during the 2008-2009 meltdown. Now that leveraged positions are beginning to unwind (banks recapitalizing, consumers increasing savings rate, state and government austerity and tax measures, etc.), the bears still offer little credit to these improving trends.

Are we likely to experience another +100% upward move in stock prices in the broader indexes over the next two years? Unlikely. Our structural government debt and deficits, coupled with elevated unemployment and fiercer foreign competition are all factors creating economic headwinds. Moreover, inflation is starting to heat up and a Federal Funds rate policy cannot stay at 0% forever.

The Shapes of Rebounds

To put the two-year equity market recovery in historical perspective, the Financial Times published a 75-year study which showed the current market resurgence (solid red line) only trailing the post-Great Depression rebound of 1935-1938.

Although we are absolutely not out of the economic woods and contrarian sentiment indicators (i.e., Volatility Index and Put-Call ratio) are screaming for a pullback, the foundation of a sustainable global recovery has firmed despite the persisting chaos occurring in the Middle East. Fourth quarter 2010 corporate profits (and revenues) once again exceeded expectations, valuations remain attractive, and floods of itchy retail cash still remain on the sidelines just waiting to jump in and chase the upward march in equity prices. Although the trajectory of stock prices over the next two years is unlikely to look like the last two years, there is still room for optimism (as I outlined last year in Genesis of Cheap Stocks). The low-hanging equity fruit has been picked over the last few years, and I’m certain that bears like Roubini, Schiff, El-Erian, Gross, et.al. will eventually come out of hibernation. For those investors not fully invested, I believe it would be wise to wait for the inevitable growls of the bears to resurface, so you can take further advantage of attractive market opportunities.

Click Here for More on the PIMCO Downhill Marathon Machine

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Metamorphosis of a Bear into Bull

James Grant, a self-admitted, “glass half-full kind of fellow,” recently contributed a Wall Street Journal article predicting the economic recovery will be a “bit of a barn burner.” Traditionally a pessimist, he recently experienced the metamorphosis from a bear to a bull. James Grant is a multi-book author who has written for the Interest Rate Observer for more than 25 years with thoughtful observations on economics and interest rates. With a value-tilted investment philosophy, Mr. Grant prides himself as a contrarian and anti-CNBC advocate.

Current Environment

Markets have transitioned from sheer panic (what Grant calls the “bomb shelter”) to a manageable utter fear – meaning a lot of investors still have cash stuffed under the mattress in low yielding money market and CD (Certificates of Deposit) accounts. This bed cash will ultimately act as dry powder to ignite the market higher, should earnings and macroeconomic variables continue to improve. Despite the approximate 60% index bounce from the March 2009 lows, the S&P 500 still remains more than 30% below the late 2007 highs.

Glass Half Empty Crowd

Skeptics of the market advance generally fall into one of the following buckets:

1) Armageddon is coming, just wait. Our country is choking on too much debt.

2) The stock market advance is merely a bear market rally within a secular bear market.

3) Rally fueled by temporary stimulus, which once it dries up will lead to another recession and bear market.

4) Earnings results that are coming in better than expected are merely coming from unsustainable cost-cutting.

Grant’s Rose-Colored Glasses

James Grant has a different view of the unfolding recovery in light of historical cycle patterns:

“Growth snapped back following the depressions of 1893-94, 1907-08, 1920-21 and 1929-33. If ugly downturns made for torpid recoveries, as today’s economists suggest, the economic history of this country would have to be rewritten.”

Consistent with Mr. Grant’s views, Michael T. Darda, chief economist of MKM Partners stated “The most important determinant of the strength of an economy recovery is the depth of the downturn that preceded it. There are no exceptions to this rule, including the 1929-1939 period.” Grant goes on to compare the current recession with the 1981-82 variety:

“[During] the first three months of 1982, real GDP shrank at an annual rate of 6.4%, matching the steepest drop of the current recession, which was registered in the first quarter of 2009. Yet the Reagan recovery, starting in the first quarter of 1983, rushed along at quarterly growth rates (expressed as annual rates of change) over the next six quarters of 5.1%, 9.3%, 8.1%, 8.5%, 8.0% and 7.1%. Not until the third quarter of 1984 did real quarterly GDP growth drop below 5%.”

Further support for a stronger than anticipated recovery is provided via data supplied by the Economic Cycle Research Institute:

“The institute’s long leading index of the U.S. economy, along with supporting sub-indices, are making 26-year highs and point to the strongest bounce-back since 1983. A second nonconformist, the previously cited Mr. Darda, notes that the last time a recession ravaged the labor market as badly as this one has, the years were 1957-58 —after which, payrolls climbed by a hefty 4.5% in the first year of an ensuing 24-month expansion.”

Mr. Grant does not promise as large a recovery implied by Mr. Darda, but historical standards point in that direction, especially when you factor in vast pools of cash and cautious prognosticators and economists such as Ben Bernanke, Warren Buffett, and Paul Volcker. These financial “giants” have not deterred Mr. Grant’s metamorphosis from a bear to a bull.

Click Here to Read Full Grant WSJ Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and at the time of publishing had no direct positions in BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

“Bye Bye Roubini, Hello Abby”

Bye-bye” Dr. Doom” and hello “Happy Abby.” Abby Joseph Cohen is back in the spotlight with the recent market resurgence and is calling for a sustained bull market rally. The death-like sentiment spread by NYU professor Nouriel Roubini has now swung – it’s time for CNBC to call in the bulls, much like a baseball coach calls in a fresh reliever after a starter has exhausted his strength.

Over the last year, we’ve gone from full-fledged panic, into a healthy level of fear – the decline in the CBOE Volatility Index (VIX) supports this claim. But with cash still piled to the ceiling and broad indices still are about -35% below 2007 peaks, I wouldn’t say sentiment is wildly ebullient quite yet. The low-hanging fruit has been picked and now we need to tread lightly and delay the victory lap for a little longer. Market timing has never been my gig, so gag me any time I attempt a market prediction. Having said that, sentiment comprises the softer art aspects of investing, and therefore it can swing the markets wildly in the short-run. Ultimately in the long-run, profits and cash flows are what drive stock prices higher, and that’s what I pay attention to. Profits and cash flows are currently depressed and unemployment remains high by historical standards, but there are signs of recovery. Cohen highlights easy profit comparisons in the second half of 2009 (versus 2008), coupled with inventory replenishment, as significant factors that can lead to larger than anticipated surges in early economic cycle recoveries. Whether the pending economic advance is sustainable is a question that Cohen would not address.

Investors are emotional creatures, and CNBC realizes this fact. Before investing in that 30-1 leveraged, long-only hedge fund, prudence should reign supreme as we start to see some of the previously bullish strategists begin crawling out of their caves – including perma-bull Abby Joseph Cohen.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.