Posts tagged ‘bailout’

Air Bags Deployed to Cushion Bank Crashes

In recent years, COVID and a ZIRP (Zero Interest Rate Policy) caused out-of-control inflation to swerve the economy in the wrong direction. However, the Federal Reserve and its Chairman, Jerome Powell, slammed on the brakes last year by instituting the most aggressive interest rate hiking policy in over four decades.

At the beginning of last year, interest rates (Federal Funds Rate target) stood at 0% (at the low end of the target), and today the benchmark interest rate stands at 5.0% (at the upper-end of the target) – see chart below.

Source: Trading Economics

Unfortunately, this unparalleled spike in interest rates contributed to the 2nd and 3rd largest bank failures in American history, both occurring in March. The good news is the Federal Reserve and banking regulators (the Treasury and FDIC – Federal Deposit Insurance Corporation) deployed some safety airbags last month. Most notably, the Fed, FDIC, and Treasury jointly announced the guarantee of all deposits at SVB, shortly after the bank failure. Moreover, the Fed and Treasury also revealed a broader emergency-lending program to make more funds available for a large swath of banks to meet withdrawal demands, and ultimately prevent additional runs on other banks.

Investors were generally relieved by the government’s response, and the financial markets reacted accordingly. The S&P 500 rose +3.5% last month, and the technology-heavy NASDAQ index catapulted even more (+6.7%). But not everyone escaped unscathed. The KBW Bank Index got pummeled by -25.2%, which also injured the small-cap and mid-cap stock indexes, which declined -5.6% (IJR) and -3.5% (IJH), respectively.

Nevertheless, as mentioned earlier, slamming on the economic brakes too hard can lead to unintended consequences, for example, a bank failure or two. Well, that’s exactly what happened in the case of Silicon Valley Bank (SVB), the 2nd largest bank failure in history ($209 billion in assets), and cryptocurrency-heavy Signature Bank, the 3rd largest banking collapse in history – $110 billion in assets (see below).

Source: The Wall Street Journal

How did this Silicon Valley Bank failure happen? In short, SVB suffered a bank run, meaning bank customers pulled out money faster than the bank could meet withdrawal requests. Why did this happen? For starters, SVB had a concentrated customer base of financially frail technology start-ups. With a weak stock market last year, many of the start-ups were bleeding cash (i.e., shrinking their bank deposits) and were unable to raise additional funds from investors.

As bank customers began to lose confidence in the liquidity of SVB, depositors began to accelerate withdrawals. SVB executives added gasoline to the fire by making risky investments long-term dated government bonds. Essentially, SVB was making speculative bets on the direction of future interest rates and suffered dramatic losses when the Federal Reserve hiked interest rates last year at an unprecedented rate. This unexpected outcome meant SVB had to sell many of its government bond investments at steep losses in order to meet customer withdrawal requests.

It wasn’t only the large size of this bank failure that made it notable, but it was also the speed of its demise. It was only three and a half weeks ago that SVB announced a $1.8 billion loss on their risky investment portfolio and the subsequent necessity to raise $2.3 billion to fill the hole of withdrawals and losses. The capital raise announcement only heightened depositor and investor anxiety, which led to accelerated bank withdrawals. Within a mere 24-hour period, SVB depositors attempted to withdraw a whopping $42 billion.

Other banks, such as First Republic Bank (FRB), and a European investment bank, Credit Suisse Group (CS), also collapsed on the bank crashing fears potentially rippling through other financial institutions around the globe. Fortunately, a consortium of 11 banks provided a lifeline to First Republic with a $30 billion loan. And Credit Suisse was effectively bailed out by the Swiss central bank when Credit Suisse borrowed $53 billion to bolster its liquidity.

While stockholders and bondholders lost billions of dollars in this mini-banking crisis, financial vultures swirled around the remains of the banking sector. More specifically, First Citizens BancShares (FCNA) acquired the majority of Silicon Valley Bank’s assets with the assistance of the FDIC, and UBS Group (UBS) acquired Credit Suisse for more than $3 billion, thereby providing some stability to the banking sector during a volatile period.

Many pundits have been predicting the U.S. economy to crash into a recession as a result of the aggressive, interest rate tightening policy of the Federal Reserve. So far, Mark Twain would probably agree that the death of the U.S. economy has been greatly exaggerated. Currently, the first quarter measurement of economic activity, GDP (Gross Domestic Product), is estimated to measure approximately +2.0% after closing 2022’s fourth quarter at +2.6% (see chart below). As you probably know, a definition of a recession is two consecutive quarters of negative GDP growth.

Source: Trading Economics

Regardless of the economic outcome, investors are now predicting the Federal Reserve to be at the end or near the end of its interest rate hiking cycle. Presently, there is roughly a 50/50 chance of one last 0.25% interest rate increase in May (see chart below), and then investors expect at least one interest rate cut by year-end.

Source: CME Group

Last year was a painful year for most investors, but stocks as measured by the S&P 500 have bounced approximately +18% since the October 2022 lows. Market participants are still worried about a possible recession crashing the economy later this year, but hopefully last year’s stock market collision and subsequent banking airbag protections put in place will protect against any further financial pain.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Apr. 3, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in SIVB, FCNA, UBS, FRB, CS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

New Year’s Resolutions and Vaccine Distributions

Many people were ready to flush 2020 down the toilet after the novel coronavirus (COVID-19) global pandemic dominated the daily headlines, but panic eventually turned into optimism. With last year and a new year celebration now behind us, the annual tradition of creating a New Year’s resolution to better one’s life will be a challenge for many in 2021. Why? Well, from a financial perspective, the stock market, as measured by the S&P 500 index, finished the year at another mind-boggling, all-time record high (+16% for the year), making 2020 a tough act to follow.

One area of the stock market performed exceptionally well. With millions of employees, students, and bored Americans locked down for much of the year, demand for computers, mobile phones, and internet-connected televisions swelled. Due to a flood of sales into devices, gadgets, equipment, and software, technology stocks became huge beneficiaries in 2020. The performance of this sector can be gauged by the results of the tech-heavy NASDAQ index, which skyrocketed an astounding +44%.

Countering the Confusion

Given this unexpected surge in stock prices, many casual observers are asking how is it possible the Dow Jones Industrial Average capped off a year above the 30,000 level (best ever) after a year when 80 million people contracted COVID-19 and almost 2 million humans died from the virus?

This month, we will try to answer this confusing question. We shall explore the factors behind the unprecedented collapse early in the year and the subsequent recovery in stock prices surrounding this perplexing virus.

We’ve experienced a lot over the last year: death, destruction, an emotionally divisive presidential election, social distancing, face-coverings, Amazon deliveries, Netflix binging, DoorDash food deliveries, hand-sanitizer stocking, toilet-paper runs, and endless pants-less Zoom video sessions. After all this insanity, here are some reasons for why your and my investment accounts and 401(k) balances still managed to appreciate significantly last year:

- A COVID Cure: Although roughly only 4 million doses of the COVID-19 vaccine have been administered to date (after a 20 million goal), the government has contracted for the delivery of 400 million vaccine doses from Pfizer Inc. (PFE) and Moderna Inc. (MRNA) by summertime. With these two FDA (Food and Drug Administration) approvals alone, these doses should be enough to vaccinate all but about 60 million of the roughly 260 million adult Americans who are eligible to be inoculated. Even better, each of these cures appear to be over 90% effective. What’s more, in the not-too-distant future, additional relief is on its way in the form of further vaccine approvals by the likes of Johnson & Johnson (JNJ), Novavax Inc. (NVAX), AstraZeneca (AZN), and the Sanofi (SNY) / GlaxoSmithKline (GSK).

- Fed Firemen to the Rescue: As the COVID flames are blazing with record numbers of cases, hospitalizations, and deaths, the Federal Reserve firemen have come to an economic rescue by providing accommodative monetary policies. By effectively setting the benchmark Fed Funds Rate to 0% (see chart below), our central bank is not only stimulating loan activity for businesses, but also lowering the cost of mortgages and credit cards for consumers. In addition, the Fed has been providing support to financial markets and invigorating the economy through its asset purchases. More specifically, the Fed outlined its activities in its most recent December statement:

“The Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.“

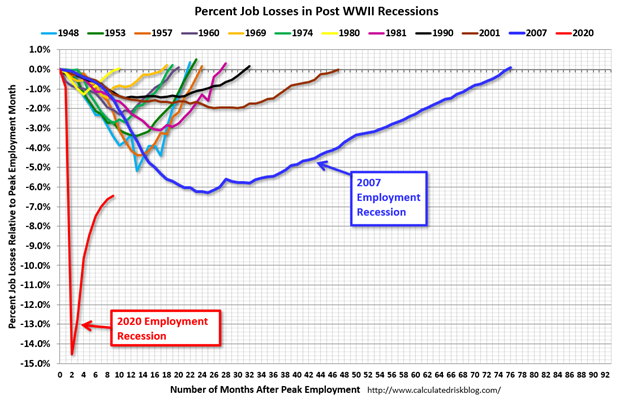

- Economic Recovery is Well on its Way: In addition to the unmatched monetary policy stimulus from the Federal Reserve, we have also experienced an unparalleled $4 trillion in fiscal stimulus to trigger a sharp rebound in economic activity (see red line in chart below). There have been multiple rounds of PPP (Paycheck Protection Program) loans given to small businesses, millions of direct checks distributed to unemployed individuals, along with a host of other programs covering the healthcare, education, and infrastructure industries. As a result of these measures, coupled with the vaccines unleashing massive amounts of pent-up demand, pundits are forecasting above-trendline economic GDP growth in 2021 approximately 4% – 5% (e.g., Merrill Lynch +4.6%, Goldman Sachs +5.9%, and the Federal Reserve +3.7% to +5.0%).

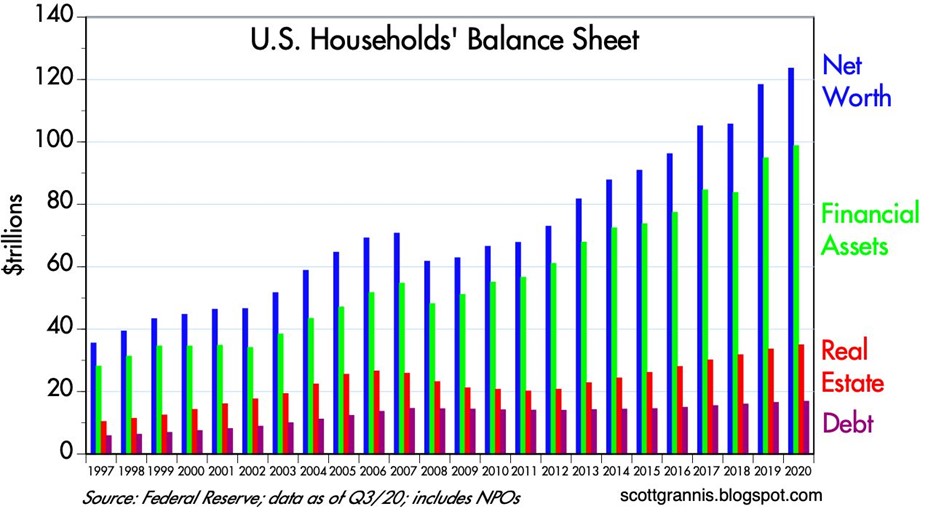

As part of the recovery, the banner year in stocks has also helped catapult consumer household balance sheets to over $120 trillion dollars, while simultaneously reducing debt (leverage) ratios (see chart below).

Flies in the Ointment

It’s worth noting that not all is well in COVID-land. Unemployment rates remain at elevated recessionary levels and industries such as travel, leisure, and restaurants persist in devastation by the pandemic. Politically, the hotly contested 2020 presidential election has largely been resolved, but a Georgia runoff vote this week for two Senate seats could swing full control of Congress to the Democrats. With the stock market at fresh new highs, a Democrat sweep in Georgia would likely be interpreted as a mandate for President-elect Biden to increase taxes for many people and businesses. Under this scenario, a temporary downdraft in the market should come as no surprise to any investor. However, any potential tax hikes on corporations and the wealthy should be accompanied with more infrastructure spending and fiscal spending, which could offset the drag of taxes to varying degrees.

Although Sidoxia Capital Management is still finding plenty of opportunities in the stock market while considering these record low interest rates (yield on 10-year Treasury Note of only 0.92%), areas of vulnerability still exist in recent high-flying, money-losing IPOs (Initial Public Offerings) such as Snowflake Inc. (SNOW), Airbnb Inc (ABNB), and DoorDash Inc (DASH).

Other cautionary areas of excess speculation include the hundreds of SPAC (Special Purpose Acquisition Company) deals totaling more than $70 billion in 2020, and the reemergence of Bitcoin froth (up greater than +300% this year). The recent rush into Bitcoin has been fierce, but industry veterans with memory greater than a gnat recall that Bitcoin plummeted more than -80% from its peak to trough in 2018. Suffice it to say, Bitcoin is not for the faint of heart and buyers should beware.While there was a lot of pain and suffering experienced by millions due to the COVID-19 global pandemic, there was a lot to be thankful for as well, including vaccines to cure the global pandemic. Even though we had another record year at Sidoxia Capital Management, there is always room for improvement. At Sidoxia our New Year’s resolution is always the same: Provide superior investment management and financial planning services, as we build sustaining, long-term relationships with our clients.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 4, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AMZN, NFLX, MRNA, ZM, PFE, NVAX, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in DASH, JNJ, AZN, SNY, GSK, SNOW, ABNB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Greece: The Slow Motion, Multi-Year Train Wreck

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2015). Subscribe on the right side of the page for the complete text.

Watching Greece fall apart over the last five years has been like watching a slow motion train wreck. To many, this small country of 11 million people that borders the Mediterranean, Aegean, and Ionian Seas is known more for its Greek culture (including Zeus, Parthenon, Olympics) and its food (calamari, gyros, and Ouzo) than it is known for financial bailouts. Nevertheless, ever since the financial crisis of 2008-2009, observers have repeatedly predicted the debt-laden country will default on its €323 billion mountain of obligations (see chart below – approximately $350 billion in dollars) and subsequently exit the 19-member eurozone currency membership (a.k.a.,”Grexit”).

Now that Greece has failed to repay less than 1% of its full €240 billion bailout obligation – the €1.5 billion payment due to the IMF (International Monetary Fund) by June 30th – the default train is coming closer to falling off the tracks. Whether Greece will ultimately crash itself out of the eurozone will be dependent on the outcome of this week’s surprise Greek referendum (general vote by citizens) mandated by Prime Minister Alexis Tsipras, the leader of Greece’s left-wing Syriza party. By voting “No” on further bailout austerity measures recommended by the European Union Commission, including deeper tax increases and pension cuts, the Greek people would effectively be choosing a Grexit over additional painful tax increases and deeper pension cuts.

Ouch!

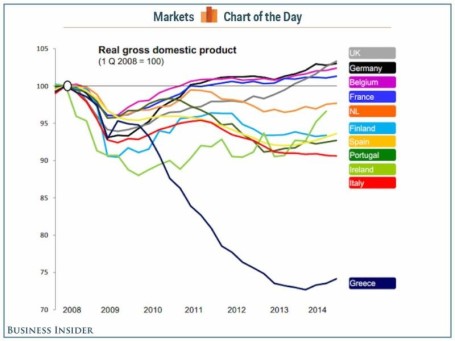

And who can blame the Greeks for being a little grouchy? You might not be too happy either if you witnessed your country experience an economic decline of greater than 25% (see Greece Gross Domestic Product chart below); 25% overall unemployment (and 50% youth unemployment); government worker cuts of greater than 20%; and stifling taxes to boot. Sure, Greeks should still shoulder much of the blame. After all, they are the ones who piled on $100s of billions of debt and overspent on the pensions of a bloated public workforce, and ran unsustainable fiscal deficits.

For any casual history observers, the current Greek financial crisis should come as no surprise, especially if you consider the Greeks have a longstanding habit of not paying their bills. Over the last two centuries or so, since the country became independent, the Greek government has spent about 90 years in default (almost 50% of the time). More specifically, the Greeks defaulted on external sovereign debt in 1826, 1843, 1860, 1894 and 1932.

The difference between now and past years can be explained by Greece now being a part of the European Union and the euro currency, which means the Greeks actually do have to pay their bills…if they want to remain a part of the common currency. During past defaults, the Greek central bank could easily devalue their currency (the drachma) and fire up the printing presses to create as much currency as needed to pay down debts. If the planned Greek referendum this week results in a “No” vote, there is a much higher probability that the Greek government will need to dust off those drachma printing presses.

“Perspective People”

Protest, riots, defaults, changing governments, and new currencies make for entertaining television viewing, but these events probably don’t hold much significance as it relates to the long-term outlook of your investments and the financial markets. In the case of Greece, I believe it is safe to say the economic bark is much worse than the bite. For starters, Greece accounts for less than 2% of Europe’s overall economy, and about 0.3% of the global economy.

Since I live out on the West Coast, the chart below caught my fancy because it also places the current Greek situation into proper proportion. Take the city of L.A. (Los Angeles – red bar) for example…this single city alone accounts for almost 3x the size of Greece’s total economy (far right on chart – blue bar).

Give Me My Money!

It hasn’t been a fun year for Greek banks. Depositors, who have been flocking to the banks, withdrew about $45 billion in cash from their accounts, over an eight month period (see chart below). Before the Greek government decided to mandatorily close the banks in recent days and implement capital controls limiting depositors to daily ATM withdrawals of only $66.

But once again, let’s put the situation into context. From an overall Greek banking sector perspective, the four largest Greek Banks (Bank of Greece, Piraeus Bank, Eurobank Ergasias, Alpha Bank) account for about 90% of all Greek banking assets. Combined, these banks currently have an equity market value of about $14 billion and assets on the balance sheets of $400 billion – these numbers are obviously in flux. For comparison purposes, Bank of America Corp. (BAC) alone has an equity market value of $179 billion and $2.1 trillion in assets.

Anxiety Remains High

Skeptical bears will occasionally acknowledge the miniscule-ness of Greece, but then quickly follow up with their conspiracy theory or domino effect hypothesis. In other words, the skeptics believe a contagion effect of an impending Grexit will ripple through larger economies, such as Italy and Spain, with crippling force. Thus far, as you can see from the chart below, Greece’s financial problems have been largely contained within its borders. In fact, weaker economies such as Spain, Portugal, Ireland, and Italy have fared much better – and actually improving in most cases. In recent days, 10-year yields on government bonds in countries like Portugal, Italy, and Spain have hovered around or below 3% – nowhere near the peak levels seen during 2008 – 2011.

Other doubting Thomases compare Greece to situations like Lehman Brothers, Long Term Capital Management, and the subprime housing market, in which underestimated situations snowballed into much worse outcomes. As I explain in one of my newer articles (see Missing the Forest for the Trees), the difference between Greece and the other financial collapses is the duration of this situation. The Greek circumstance has been a 5-year long train wreck that has allowed everyone to prepare for a possible Grexit. Rather than agonize over every news headline, if you are committed to the practice of worrying, I would recommend you focus on an alternative disaster that cannot be found on the front page of all newspapers.

There is bound to be more volatility ahead for investors, and the referendum vote later this week could provide that volatility spark. Regardless of the news story du jour, any of your concerns should be occupied by other more important worrisome issues. So, unless you are an investor in a Greek bank or a gyro restaurant in Athens, you should focus your efforts on long-term financial goals and objectives. Ignoring the noisy news flow and constructing a diversified investment portfolio across a range of asset classes will allow you to avoid the harmful consequences of the slow motion, multi-year Greek train wreck.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and BAC, but at the time of publishing, SCM had no direct position in Bank of Greece, Piraeus Bank, Eurobank Ergasias, Alpha Bank or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on ICContact page.

The Next Looming Bailout…Muni Bonds

Government politicians and voters have made it clear they do not want to bail out “fat-cat” bankers in the private sector, but what about bailing out “fat-cat” state pensioners in the public sector? States and cities across the country are increasingly under economic strain with deficits widening and debt-loads stacking up. California’s statewide budget problems have been well publicized, but you are now also hearing about more scandalous financial problems at the city level (read about the multi-million dollar malfeasance in the city of Bell).

Why Worry?

Well if a 2010 $1.3 trillion federal deficit is not enough to tickle your fancy, then how does another $137 billion in state deficits over fiscal 2011 and 2012 sound to you (National Governors Association)? Unfortunately, the states have made no meaningful structural improvements. If you layer on general economic “double dip” recession fears with excess pension liabilities, then you have a recipe for a major unresolved financial predicament.

Despite the dire financial state of the states, municipal bond prices have generally survived the 2008-2009 financial crisis unscathed. With unacceptably poor state budget risks, muni bond prices have continued to rise in 2010. The downside…new investors must accept a pitiful yield of 2.75% on 10-year municipal debt, according to Financial Advisor Magazine.

One investor who is not buying into the strength of the tax-free municipal bond market is famed investor and CEO of Berkshire Hathaway (BRKA/BRKB), Warren Buffett. Here is what he wrote about munis in his legendary annual shareholder letter last year:

“Insuring tax-exempts, therefore, has the look today of a dangerous business…Local governments are going to face far tougher fiscal problems in the future than they have to date.”

Buffett has this to say about rating muni bonds:

“I mean, if the federal government will step in to help them [municipalities], they’re triple-A. If the federal government won’t step in to help them, who knows what they are?”

Safety Net Disappears

Like a high wire artist dangling high in the air without a safety net below, the states are currently borrowing money with little to no protection from the bond insurance providers. The shakeout of the subprime debt defaults has battered the insurers from many perspectives, leaving a much smaller market in the wake of the financial crisis. In 2007 about 50% of new municipal bonds were issued with bond insurance, while today only approximately 7% carry it (UBS Wealth Management Research). With decreased insurance coverage, the silver lining for muni investors is the necessity for them to perform more comprehensive research on their bond holdings.

Defaults on the Rise

On the whole, less insurance will result in more defaults. Although defaults are expected to decline in 2010, non-payments totaled $6.9 billion in 2009, up from $526 million in 2007 (Distressed Debt Securities). Even though the numbers sounds large, the recent default rate only represents a 0.25% default rate on the hefty $2.8 trillion market. That muni default rate compares to a more intimidating corporate bond default rate of 11% in 2009.

Bigger Bark Than Bite?

James T. Colby, senior municipal strategist at Van Eck Global, understands the severity of the states’ budget crisis but he believes a lot of the doomsday headlines are bogus. Riva Atlas, writer for Financial Advisor Magazine, summarizes Colby’s thoughts:

“Even those states in the worst straits like California and Illinois have provisions in their constitutions or statutes requiring them to pay their debts. In California, the state’s constitution says bondholders come second only to the school system, so the state would have to empty its jails before it stopped paying its teachers.”

Certainly municipalities could raise taxes to compensate for any budget shortfalls, but we all know most politicians are reluctant to raise taxes, because guess what? Tax increases may result in fewer votes – the main motivator driving most politicians.

If the states decide to not raise taxes, they still have other ways to weasel out of obligations. For starters, they can just stick it to the insurance company (if coverage exists). If that option is not available, the municipalities can look to the federal government for a bailout. Irresponsible actions have their consequences, and like consumers walking away from payments on their mortgages, municipalities will effectively be preventing themselves from future access to borrowing. Either way, the bark is less than the bite for investors since the insurance company or federal government will be making them whole.

BABs and Taxes Add Fuel to the Fire

A glut of Build America Bonds (BABs) issued by municipalities, driven by demand from yield hungry pension funds, along with expected tax hikes for the wealthy have created a scarcity of tax-free munis.

In the first half of 2010 BABs accounted for more than 25% of municipal bonds issued, which was a significant contributing factor to the robust muni market. The BABs tailwinds aiding muni prices won’t last forever, as the bond issuance program is expected to expire at the end of 2010.

On the tax front, the wealthy are likely to see higher federal tax rates in the future – upwards of 36% – 40%. If you include the double tax-exempt benefits in states like New York and California, the relative attractiveness becomes even that much better. Combined, these factors have elevated muni prices.

Despite higher defaults, scarier headlines, and the lack of insurance, the municipal bond market remains robust. General interest rate declines caused by macroeconomic fears have caused investors to flock to the perceived “safe haven” status of Treasuries and Munis, but as we have all witnessed, the fickle pendulum of emotions never sits still for long.

Managing the Munis

As is evident from the municipal bond discussion, states and cities across the country have been plagued by the same deficit and debt issues as the country faces on a federal level. Tough structural expense issues, and revenue generating tax policies need to be scrutinized in order to prevent federal taxpayer bailouts of municipalities across the country.

From a municipal bond investor perspective, it’s best to focus on general obligation bonds (GOs) because those bonds are backed by the taxing authority of the municipal government. On the flip side, it’s best to stray away from revenue bonds or privately issued municipals because revenue streams from these bond channels are not guaranteed by the municipality, meaning the risk of default is larger.

While Congress sorts out financial regulatory reform with respect to banking bailouts and “too big to fail” corporations, our federal government should not lose sight of the widespread municipality problems our country faces today. If not, get ready to pull out the checkbook to pay for another taxpayer-led bailout…

Read the Complete Financial Advisor Magazine Article: The Muni Minefield

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including CMF), but at the time of publishing SCM had no direct position in BRKA/B or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

General Motor’s Amazing Debt Trick

Now you see it, and now you don’t. General Motors claims that it has pulled off an amazing trick – the CEO of the troubled automaker, Ed Whitacre, claims in a recently released nationwide commercial, “We have repaid our government loan, in full, with interest, five years ahead of the original schedule.” (See video BELOW):

Blushing Pinocchio

Even Pinocchio would blush after listening to those statements. The loan that GM is claiming victory over is roughly $7-8 billion in TARP (Troubled Asset Relief Program) loans made from the U.S. and Canada. What Mr. Whitacre failed to acknowledge was how investors will be made whole on the whopping balance of around $45 billion.

How did GM miraculously pay off this debt? Whitacre would like taxpayers to believe booming sales or an operational turnaround has funded the debt repayment. Rather, these debt repayments were funded through other government TARP loans held in escrow with U.S. Treasury oversight. Effectively, GM has paid down one Mastercard (MA) bill with another Visa (V) credit card, and then gone on to brag about this financial shell game through a multi-million dollar advertising campaign. It’s bad enough that politicians and so-called media pundits attempt to “spin” facts into warped truths, but when a government-owned entity steps onto a national loudspeaker and spouts out blatantly distorted sound-bites, there should be consequences to these actions. American taxpayers deserve more honest accountability and transparency regarding their tax outlays rather than quarter truths.

GM’s Future

As Jedi Master Yoda’s famously quotes, “Uncertain, the future is,” and “Always in motion is the future.” GM is not out of the woods yet – the company lost $3.4 billion in the 4th quarter of 2009 alone and remains 70% government-owned. Nobody is certain how much (if any) of the $43 billion will be repaid by General Motors. For reference purposes, GM lost $88 billion from 2004 until 2009 when they declared bankruptcy (see AP article) If all goes according to plan, the former debt holders (now equity holders) and government stockholders will get a return on their capital infusions if and when GM does an equity offering to the public sometime later in 2010. If achieved, the company will have come full circle: public to bankrupt; bankrupt to private; and private to public.

While executives at GM are confident in their repayment capabilities, less convinced are certain branches of our federal government. Maybe these government agencies have taken note of the horrific train wreck occurring in the automotive industry over the last few decades (see GM Fatigue) Take for example the Office of Management and Budget, and the nonpartisan Congressional Budget Office (CBO) – they see TARP losses exceeding $100 billion, including about $30 billion from the auto companies…ouch.

The probability of success will no doubt hinge on some of the dramatic transformations made over the last year. First of all, GM has axed the number of brands in half (from eight to four), cutting Pontiac, Saturn, Hummer, and Saab. Cutting costs is great, but chopping expenses to prosperity cannot last forever – at some point you need compelling products that will drive sales. The rubber will hit the road late this year when GM is scheduled to release the “Volt,” a plug-in hybrid, which the company is using as a launching pad for new products.

TARP on Right Track but Not to Finish Line

Given the heightened political sensitivity in Washington regarding the banks and Wall Street it’s not too surprising that many of the banks wanted to be out of the governments crosshairs and pay back TARP as soon as possible. Beyond political pressure, banks have accelerated TARP repayments in part due to the massively steep and profitable yield curve, along with signs of an improving economy. According to the Treasury Department less than $200 billion in bailout money is outstanding for what originally started out as a $700 billion fund ($36 billion of automaker bailouts is estimated as uncollectible). Even though there has been progress on TARP collections, unfortunately non-TARP losses associated with AIG, Fannie Mae (FNM), and Freddie Mac (FRE) are expected to add more than $150 billion in bleeding.

I don’t believe anyone is happy about the bailouts, although some are obviously more irate. Accountability and transparency are important bailout factors as taxpayers and investors look to recover capital contributions. The next trick GM and Ed Whitacre need to pull off is paying off tens of billions in taxpayer money with the benefit of sustained profits – now that’s a television commercial I want to see.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and in a security derived from an AIG subsidiary, but at the time of publishing SCM had no direct positions in General Motors, AIG, FNM, FRE, MA, V, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Spitzer the Pot Calling the Fed Kettle Black

Eliot Spitzer, whose job as the former Attorney General of New York was to convict criminals, was forced to quit himself as Governor for his illegal solicitation of prostitutes that he funded with secretive ATM withdrawals of government funds. Now, Mr. Spitzer is getting on his soapbox and telling others the Federal Reserve has been committing a Ponzi Scheme.

There are a lot of conspiracy theories floating around regarding the Fed’s motives and questions relating to the benefits of those receiving government bailout funds. Dylan Ratigan’s interview of Mr. Spitzer on MSNBC feeds into these conspiracy views. I can buy into conflicts of interests and the need for more transparency arguments, but let’s be realistic, this is not the DaVinci Code, this is the slow, bureaucratic Federal Government. Even if you buy into this skeptical belief, the Fed isn’t exactly a “black box.” The Fed proactively provides the minutes from its private meetings and systematically releases a full accounting of the Fed’s balance sheet (assets).

Mr. Spitzer and other critics point to the egregious benefits handed down to the banks and financial institutions through the bailouts and monetary system actions. Well, wasn’t that the idea? I thought our banking system (and the global banking system) was on the verge of collapse and we were trying to save the world from impending disaster? So, I think most people get the fact that our financial institutions needed a lifeline to prevent worse outcomes from occurring.

Should the Fed have carte blanche on all financial system decisions? Certainly not, but extreme situations like this generational financial crisis we are slogging through now, requires extreme measures.

Accountability I believe is even more important than the micro-managing transparency details Ron Paul (Republican/Libertarian Congressman from Texas) and others are asking for. If indeed it is the Fed’s job to remain an independent body, then maybe it’s not Congress’ job to question every word and minor decision. However, when it comes to these massive bailouts (AIG, Fannie Mae, Freddie Mac, etc.), additional details and accountability should be provided and seems fair. What we don’t need are more regulatory bodies and committees creating more inefficiencies in an already tangled system of regulatory fiefdoms.

Before Mr. Spitzer starts pointing his finger at the black Fed-kettle, perhaps he should get his illegal decision making pot in order first?

Read Full Daniel Tencer Spitzer-Ponzi Scheme Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

GM Fatigue Setting In

Yaaaawn. Sorry to be cold-hearted and insensitive, but I have to admit all this bankruptcy car talk is making me tired and fatigued. According to the Associated Press, General Motors is cutting 21,000 jobs in North America, about 34% of the total workforce – these cuts include pending dealership, plant, and warehouse closings. Twenty-one thousand certainly is not a minor number, but how do you think the other 6,000,000 Americans feel who have lost their jobs in this economic recession since the beginning of 2008?

Don’t get me wrong, I like every other American do not want to see our historic industry vanish into thin air, but as the chart above shows, we have been witnessing this slow motion train wreck developing for decades. Detroit’s combined market share in 1980 was around 75%, and today that share amounts to less than 50%…ouch. Our auto industry needs to become more competitive, and to do so will require tough decisions like the ones being made today.

Does $65 billion in government bailout feel right? Definitely not, especially vis-a-vis the industry track record of government bailouts (i.e., 1980 Chrysler lifeline). History and current industry trends tell us that the odds of taxpayers earning any reasonable return off our bailout contributions will be extremely challenging to salvage.

Politics and votes always play a role when large numbers of jobs are impacted by government decisions, and this case has proved no different. On the flip side, nobody can say the automakers are not suffering tremendously from this bankruptcy solution. I truly believe the surviving entities will be much leaner and meaner to compete in this dog-eat-dog global economy. Sacrifices have been immense, but we’ll never know the true net economic effect had the administration not bestowed the billions and billions upon this selective slice of industries.

Money goes where it is treated best, and I would have preferred seeing the capital naturally migrating to its most productive use. Perhaps the $65 billion could have provided 65,000 different companies access to $1,000,000 each in financing for creative, and innovative job creating purposes? Only time will tell if our billions in taxes were properly used, but in the mean time I’m going to turn off the CNBC car debate and take a nap. Zzzzzz….