Posts tagged ‘ai’

Fed Injects Rate Cut Adrenaline

There were a lot of injections, of the COVID vaccine variety, four years ago, but now the Federal Reserve is injecting some financial adrenaline through stimulative interest rate cuts. Expectations are for seven more -0.25% cuts over the next 12 months, but this cycle started two weeks ago when the FOMC (Federal Open Market Committee) initiated a larger -0.50% reduction in the benchmark federal funds rate target (see chart below). For now, investors have enjoyed the boost of adrenaline, which should help lower consumer interest rates on things like home mortgages, credit cards, and car loans.

Source: Yardeni.com

For the month, the S&P 500 climbed +2.0%, the Dow Jones Industrial +1.9%, and the NASDAQ index +2.7%. The monthly gains are adding to a 2024 that is shaping up to be a potentially banner year. With one quarter left in the year, the S&P has catapulted +21% higher, the Dow Jones Industrial Average +12%, and the NASDAQ index +21% for the first nine months.

Economy Strong, So Why Cut Now?

Before the Fed’s last action a couple weeks ago, the last Fed rate cut occurred in 2020 (a -1.50% cut) in the midst of a global pandemic with the aim of boosting financial activity while the brick-and-mortar economy had effectively been shut down. But compared to today, the economy is performing much better. Second quarter GDP growth came in at +3.0% with 3rd quarter GDP growth forecasts coming in at +3.1%.

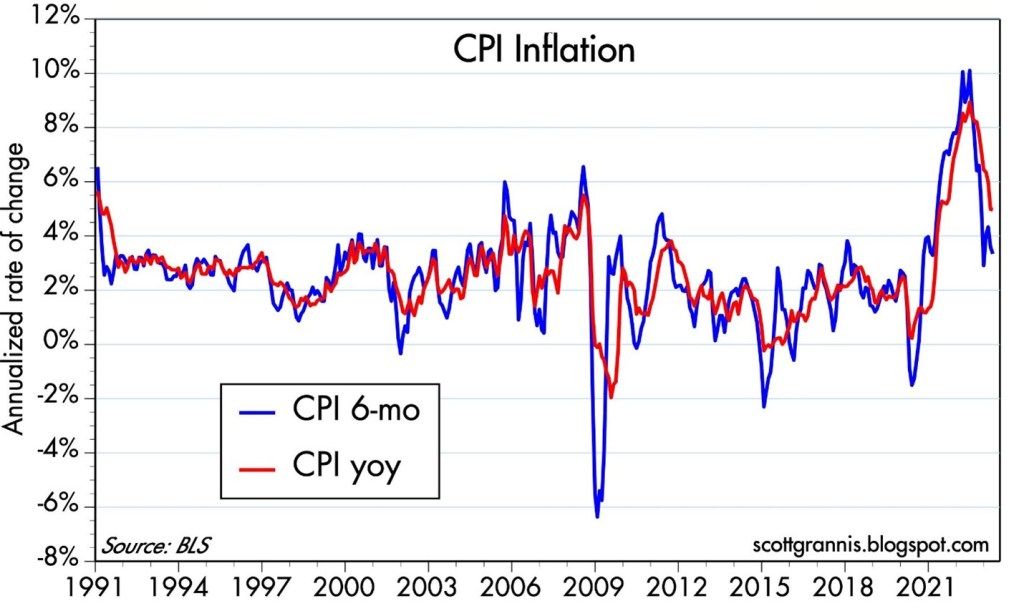

So, if things look so great, why would the Fed be cutting rates to stimulate the economy now? In short, inflation has been coming down (see chart below) from a peak of 9.1% a couple years ago to 2.5% last month (near the Fed’s long-term 2.0% target). And although the current unemployment rate is low at 4.2%, it has nevertheless weakened and climbed substantially from a 3.4% level last year).

Source: Trading Economics

China Chugs Higher

While the U.S. economy has been leading developed countries during the post-COVID recovery period, China’s financial system has been struggling due to a collapsing real estate market and deteriorating consumer spending. As a result, the Chinese stock market has been drastically underperforming other foreign markets, until Beijing just recently announced a number of stimulus initiatives last week in hopes of buoying economic growth closer to its 5% target.

Here are some of the Chinese government measures:

- China plans to issue 2 trillion yuan in special sovereign bonds

- China’s central bank cut its reserve requirement ratio by 50 basis points

- Fiscal policies to focus on increasing consumer subsidies and controlling government debt

- Shanghai, Shenzhen plan to lift key home purchase restrictions

Investors cheered the announcements by binge-buying Chinese stocks, as you can see from the CSI 300 China index, which rocketed +21% higher last month – the largest monthly gain since 2008.

AI Revolution Continues

While economic headwinds and tailwinds continue to swirl, the AI (Artificial Intelligence) revolution has persisted in the background. While some traders have solely focused on AI juggernaut NVIDIA Corp. (NVDA), which has steamrolled its way into becoming a three trillion-dollar valued company, there are other tech titan companies like Oracle Corp. (ORCL), which are also riding the AI wave. Just last month, Oracle’s billionaire founder, Larry Ellison, stated, “We have 162 data centers now. I expect we will have 1,000 or 2,000 or more data centers…around the world.” Each large-scaled data center can cost in the hundreds of millions or multi-billion-dollar range. With hundreds of billions (if not trillions) of dollars to be spent on the multi-year AI infrastructure buildout, as you can imagine, there is a large, diverse ecosystem of other companies that stand to benefit. At Sidoxia Capital Management (www.Sidoxia.com), we have identified a wide swath of AI investments that have benefited our investors and stand to do so in the future.

Flies in the Ointment

By simply judging the performance of the U.S. stock market, one might think there is nothing for investors to worry about. But as is always the case, there still remain some flies in the ointment. With a tight, hotly-contested presidential election just one month away, coupled with escalated wars in the Mideast and Ukraine, future volatility or a correction in the stock market should come as no surprise to anyone, especially in light of the rich gains already registered this year. Another concern is the risk of rising inflation, which could rear its ugly head again if the Federal Reserve misjudges its rate-cutting program and overheats the economy.

Normally, interest rate cuts are reserved by the Fed for periods when the economy is headed towards a recession or there are major systemic disruptions in the financial system, which affect market liquidity and/or bank lending. That’s not the case today. Thanks to declining inflation and a robust but weakening job market, the Fed has been equipped to provide investors with a healthy injection of adrenaline through an early round of interest rate cuts, which has contributed to the powerful stock market gains. So far, the adrenaline is doing its job.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including AMZN, MSFT, META, GOOGL, NVDA, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Economic & Inflation Information Create Market Jubilation

Ever since the Federal Reserve went on a crusade to increase interest rates and slow the progression of inflation at the beginning of 2022, investors have been cheering for a Goldilocks-type of economic “soft landing.” Last month, this narrative remained intact.

The S&P 500 index surged +3.5% for the month, the technology-heavy NASDAQ rocketed +6.0% (fueled by NVIDIA and other AI-related companies), and the Dow Jones Industrial Average a more modest +1.1% move thanks to the contribution of older economy stocks.

Despite the looming presidential election this November and the recent debate, the stock market has continued on a +56% bull market tear since the October 2023-low, eight months ago (see chart below). The not-too-hot, not-too-cold economic data have provided comfort to investors. For example, growth in Gross Domestic Product (GDP), the broadest measurement of economic activity, was positive (+1.4%) during the first quarter and it is expected to modestly accelerate in the second quarter (+2.2%), as forecasted by the Federal Reserve Bank of Atlanta.

In addition, the job and inflation stories are staying consistent with the “soft landing” plot line, as well. The unemployment rate has been creeping higher, but currently remains near multi-decade lows at 4.0%. Inflation also continued its downward trend as evidenced by last week’s Core PCE inflation data (the Federal Reserve’s favorite inflation gauge), which came in at +2.6%, the lowest level since March of 2021 (see chart below).

Gasoline and food costs are significant inputs to the overall declining inflation dynamics. The two largest crops in the United States are corn and soybeans, and with those prices down significantly year-over-year (see chart below), it should come as no surprise that consumers are finally seeing some relief in skyrocketing food prices. Declining gasoline prices have also chipped-in to the improving inflation outlook.

With all these economic statistics harmoniously aligning with a “soft landing” scenario, investors are currently comfortable in forecasting one interest rate cut over the next six months, and three and a half interest rate cuts over the next 12 months (see chart below).

Source: Yardeni Research

But a bull market cannot survive on interest rate cut expectations alone. Over the long-run, stock prices generally follow the direction of corporate profits, and as the chart below indicates (red line), fortunately, the path of profits has been rising after a period of stagnation last year.

Source: Yardeni Research

The last eight months have been an exhilarating ride in the overall stock market, which has been propelled by the multi-trillion dollar technology companies participating in the A.I. (Artificial Intelligence) buildout revolution (i.e., NVIDIA, Microsoft, Alphabet-Google, Apple, Meta Platforms, Amazon, et.al.). However, neither trees nor stock markets can grow, uninterrupted, to the sky forever. The recent environment has been jubilant for investors, but party participants cannot go on forever without experiencing a hangover. The best advice is to celebrate responsibly, while managing the risk of your investment portfolio, because eventually the cops will arrive and the party will come to an end.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, MSFT, GOOGL, AAPL, META, and AMZN but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bad News is Good News?

Remember that global pandemic back in 2020 called COVID-19 that killed over 350,000 people in the U.S.? That same year, the unemployment rate reached a sky-high level of 14.9% (vs. 3.9% most recently) and the economy went into recession with GDP (Gross Domestic Product) declining by -2.2%. With the whole population locked in their homes and 9.4 million businesses closed, this debacle doesn’t sound like a real great environment for the stock market. What did the stock market actually do in 2020? The S&P 500 surged +16.3% (see chart below). Bad economic news turned out to be good news for stocks.

On the flip side, during 2022, the economy was firing on all cylinders. GDP was advancing at a reasonable +1.9% growth rate, and the unemployment rate stood at a near generationally low rate of 3.6%. What did the stock market do? It fell -19%. This time around, good economic news meant bad news for stock prices, primarily because the Federal Reserve was slamming the brakes on the economy by increasing the Federal Funds interest rate target.

These examples are powerful reminders that the direction of economic trends does not necessarily move in tandem with the direction of the stock market. Just this last month, investors experienced this same phenomenon when GDP growth figures were revised lower from +1.6% to +1.3%, and pending home sales dropped by -7.7% to the lowest level in four years during the pandemic. What did the stock market do last month? The S&P climbed +4.8% and the NASDAQ soared +6.9%. Once again, bad news has equaled good news due to higher hopes for Fed interest rate cuts.

For the year, the S&P has already appreciated a very respectable +10.6%. This stellar performance has come despite heated election concerns, persistent wars overseas, nervousness over the Federal Reserve’s monetary policy, and wild volatility in the cryptocurrency markets.

Fighting against these headwinds has been the tsunami of corporate investing dollars piling into the Artificial Intelligence (AI) spending tidal wave. I have been writing about this trend for a while (see AI World) and NVIDIA Corp (NVDA) confirmed this trend a couple weeks ago, when the AI juggernaut reported its fiscal first quarter financial results. Not only did NVIDIA more than triple its revenue above $26 billion for the three-month period compared to last year, but the company also increased its net profit by more than seven-fold to almost $15 billion for the quarter, in addition to announcing a 10-for-1 stock split (see chart below).

What these examples teach you is that it is a fruitless effort for investors to try to time the market based on economic news headlines. Yet, every day you turn on the television or comb through the avalanche of news headlines through various media outlets, there is always some Armageddon story about an impending market crash, or some other speculative, get-rich-quick scheme. As Warren Buffett states, “Investing is like dieting. Easy to understand, but difficult to execute.”

In other words, there is no simple solution to investing. It requires patience, discipline, and financial emotional wherewithal to allow the power of long-term compounding to grow your retirement nest egg. Short-term news cycle headlines shouldn’t drive portfolio decision-making, but rather your personal objectives, goals, and risk tolerance. These items are not static, and can change over time, therefore it’s important to revisit your asset allocation periodically as financial circumstances and life events change your objectives.

Of course, improving economic news can also lead to rising stock prices, just as deteriorating economic news can result in declining prices. Regardless, attempting to time the market is a fool’s errand. Rather than trying to maneuver in and out of the stocks, long-term investors should focus more intently on the four key factors that drive the direction of the stock market: corporate profits, interest rates, valuations, and investor sentiment (see also Don’t Be a Fool, Follow the Stool). If you understand the stock market doesn’t logically follow the daily headlines, and instead you follow the key fundament factors driving equity markets, then your investment portfolio should be blessed with plenty of good news.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 3, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA,, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Art of Maximizing Gains and Minimizing Taxes in a World of AI

The AI Wave

The weather may be cold during winter, but stocks were scorching hot last month, fueled in part by the surge in performance from AI (Artificial Intelligence) stocks. More specifically, the Dow Jones Industrial Average was up +2.2% to 38,996. The S&P 500 surged +5.2% to 5,096. And the AI-heavy Nasdaq index climbed the most by +6.1% to 16,092.

Leading the bull market brigade higher was NVIDIA Corp (NVDA), which saw its stock launch higher by +29% for the month after reporting eye-popping quarterly revenues of $22 billion, more than tripling versus last year’s comparable quarter. Customers of NVIDIA, like Meta Platforms, Inc. (META), are also benefiting from the rising tide of investor sentiment.

To put this AI wave into perspective, you need look no further than to the comments made by Meta CEO Mark Zuckerberg, who stated by the end of 2024, the company should have 350,000 of NVIDIA’s H100 graphics processing units (GPUs) as part of the company’s AI infrastructure. At roughly $25,000 to $30,000 per GPU, the total cost is likely approaching $10 billion for just this one NVIDIA customer. Also, Dell Technologies’ (DELL) stock price opened more than +30% higher today after reporting quarterly financial results that exceeded forecasts due to robust demand for AI servers, which led to their backlog almost doubling in three months to $2.9 billion.

When you have corporate America in addition to the large cloud data center providers (think Amazon Web Services, Microsoft Azure, and Google Cloud) all battling to secure NVIDIA chips for their generative AI, machine learning initiatives, you can understand why NVIDIA’s stock is up +250% in one year to a company value of $2 trillion.

Japan’s Nikkei & Dow Both Break 39,000 Record Concurrently

Not only did the Dow hit an all-time record high of 39,000 last month, but a stunning coincidence also occurred in Japan. The Nikkei 225, which is like the Japanese equivalent of the Dow Jones Industrial Average, also hit a record high of 39,000 last month. What’s the big difference between these two indexes simultaneously surpassing a record 39,000 in the same month?

It took the Nikkei over 34 years to surpass its previous record peak, which was last achieved in 1989 when Japan experienced a massive bursting of an asset bubble. On the other hand, it merely took the Dow just one month to break its previous record…not four decades. Worth noting, so far in 2024, the Nikkei has been the world’s best-performing major index surging 19%, almost triple the gain of the S&P 500 index.

Tax Time

April is fast approaching, which means it’s that time of the year when Uncle Sam will come knocking on your door with your tax bill. Perhaps your taxes have already been prepaid and a refund is coming your way. Regardless, the goal of long-term investing is to master the art of maximizing returns and limiting taxes subject to your risk tolerance.

How does one create an investment masterpiece? One way to maximize return is to lower costs, including lower management fees, fund fees, and transaction costs. You can think of these investment costs as a leaky faucet. In the short-run, most people do not care about or are unaware of a leak.

The same principle applies to investment fees/costs. Investors can ignore these fees in the short-term, but over months or years, these costs can become enormous and destructive. I experienced this firsthand. Recently, normal monthly water bill was $40, but one leaky toilet resulted in an $800 monthly bill…ouch! Just imagine what unknown leaky costs on your investments could mean for your retirement. Do you want high or unknown investment fees to delay your retirement by years? I think not. Focus on lower costs because quite simply, the less you pay, the more you keep, and the earlier you can retire.

Another way to maximize your investment performance is to benefit from the power of compounding. This phenomenon can only be achieved via the snowball-effect of long-term investing. This is why Albert Einstein called compounding the “8th Wonder of the World.” At Sidoxia Capital Management, we have experienced this marvel on many of our investments, including our exponential gains in Amazon.com, which we first purchased in 2008 at s split-adjusted price of about $2.95 per share. The stock price recently closed at $177, a 60-fold increase from our initial purchase.

The risk-adjusted aspect of your nest-egg is also important because most people should consider decreasing risk as you more closely approach retirement age, especially if you are planning to tap your investments for liquidity. If risk wasn’t a consideration, going to the Las Vegas roulette table and betting your life savings on black might be a good idea. Sure, you might have a chance of doubling your money instantly, but you could also lose it all in a blink of an eye.

Another way of thinking about risk, since we are in the heart of ski season, is to contemplate a ski instructor’s advice for an 80-year-old beginner vs. an experienced Olympic downhill gold medalist. It wouldn’t make sense for the 80-year-old beginner to train on the steep, advanced black diamond runs. Similarly, it wouldn’t make sense for the gold-medalist Olympian to train on the flat beginner runs. The same concept holds true for investing. Young investors generally can take on more risk, while retirees often should be more conservative in their asset allocation, especially if they need liquidity from their investments to fund their living expenses and lifestyle.

Although it would be nice to have ChatGPT create a luxurious retirement for you with a click of a button, unfortunately life is not that simple. You certainly can, and should, take advantage of the AI revolution in your investment portfolio to support your retirement goals, but successful investing requires more than that. With over 30 years of investment experience under my belt, at Sidoxia, we understand there are multiple facets to successful investing. In a diversified portfolio that that takes account of your risk tolerance, we strongly believe low-cost, tax-efficient, long-term investing is the best way to create your retirement masterpiece.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, including NVDA, META, GOOGL, AMZN, MSFT, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in DELL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

AI Revolution and Debt Ceiling Resolution

On the surface, last month’s performance of the stock market as measured by the S&P 500 index (+0.3%) seemed encouraging, but rather pedestrian. Fears of sticky-high inflation, more potential Federal Reserve interest rate hikes, contagion uncertainty surrounding a mini-banking crisis, along with looming recession concerns led to a -3.5% monthly decline in the Dow Jones Industrial Average (-1,190 points). The good news is that inflation is declining (see chart below) and currently the Federal Reserve is expected to pause from increasing interest rates in June (the first time in more than a year).

Source: Calafia Beach Pundit

Overall stock market performance has been a mixed-bag at best. Adding to investor anxiety, if you haven’t been living off-the-grid in a cave, is the debt ceiling negotiations. Essentially, our government has maxed out its credit card spending limit, but Republicans and Democrats have agreed in principle on a resolution for an expanded credit line. More specifically, the House of Representatives just approved to raise the debt ceiling by a resounding margin of 314 – 117. If all goes well, after months of saber rattling and brinksmanship, the bill should be finalized by the Senate and signed by the President over the next two days.

Beyond the Washington bickering, and under the surface, an artificial intelligence (AI) revolution has been gaining momentum and contributed to the technology-heavy NASDAQ catapulting +5.8% for the month and +23.6% for 2023. At the center of this disruptive and transformational AI movement is NVIDIA Corp., a leading Silicon Valley chip manufacturer of computationally-intensive GPUs (graphics processing units), which are used in generative AI models such as OpenAI’s ChatGPT (see NVIDIA products below). Adoption and conversations surrounding NVIDIA’s AI technology have been spreading like wildfire across almost every American industry, resulting in NVIDIA’s stratospheric stock performance (+36% for the month, +159% for the year, +326% on a 3-year basis).

Source: NVIDIA Corp. – the computing engines behind the AI revolution.

Why Such the Fuss Over AI?

Some pundits are comparing AI proliferation to the Industrial Revolution – on par with productivity-enhancing advancements like the steam engine, electricity, personal computers, and the internet. The appetite for this new technology is ravenous because AI is transforming a large swath of industries with its ability to enhance employee efficiency. By leveraging machine learning algorithms and massive amounts of data, generative AI enables businesses to automate repetitive tasks, streamline processes, and unlock new levels of productivity. A study released by MIT researchers a few months ago showed that workers were 37% more efficient using ChatGPT.

If you have created an account and played around with ChatGPT at all you can quickly realize there are an endless number of potential applications and use-cases across virtually all industries and job functions. Already, application of generative AI systems is disrupting e-commerce, marketing, customer service, healthcare, robotics, computer vision, autonomous vehicles, and yes, even accounting. Believe it or not, ChatGPT recently passed the CPA exam! Maybe ChatGPT will do my taxes next year?

Other industries are quickly being disrupted too. Lawyers may feel increased pressure when contracts or briefs can be created with a click of the button. Schools and teachers are banning ChatGPT too in hopes of not creating lazy students who place cheating and plagiarism over critical thinking.

At one end of the spectrum, some doomsday-ers believe AI will become smarter than humans, replace everyone’s job, and AI robots will take over the world (see Elon Musk warns AI could cause “civilization destruction”). At the other end of the spectrum, others see AI as a transformational tool to help worker productivity. As generative AI continues to advance, its impact on employee efficiency will only grow, optimizing processes, driving innovation, and reshaping industries for a more productive future. Embracing this transformative technology will be critical for businesses seeking to thrive in the new digital age.

2023 Stock Performance Explained – Index Up but Most Stocks Down

Although 2022 was a rough year for the stock market (i.e., S&P 500 down -19%), stock prices have rebounded by +20% from the October 2022 lows, and +9% this year. This surge can be in large part attributed to the lopsided performance of the top 1% of stocks in the S&P 500 index (Apple Inc., Microsoft Corp., Amazon.com Inc., NVIDIA Corp., and Alphabet-Google), which combined account for almost 25% of the index’s total value. These top 5 consumer and enterprise technology companies have appreciated on average by an astounding +60% in the first five months of the year and represent a whopping $9 trillion in value. It gets a little technical, but it’s worth noting these larger companies have a disproportionate impact on the calculation of the return percentages, and vice versa for the smaller companies. To put these numbers in context, Apple’s $2.8 trillion company value is greater than the Gross Domestic Product (GDP) of many entire countries, including Italy, Canada, Australia, South Korea, Brazil, and Russia.

On the other hand, if we contrast the other 99% of the S&P 500 index (495 companies), these stocks are down -1% each on average for 2023 (vs +60% for the top 5 mega-stocks). If you look at the performance summary below, you can see that basically every other segment of the stock market outside of technology (e.g., small-cap, value, mid-cap, industrial) is down for the year.

2023 Year-To-Date Performance (%)

S&P 500: +8.9%

S&P 500 (Equal-Weight): -1.2%

S&P Small-Cap Index: -2.3%

Russell 1000 Value Index: -2.0%

S&P Mid-Cap Index: -0.7%

Dow Jones Industrial: -0.7%

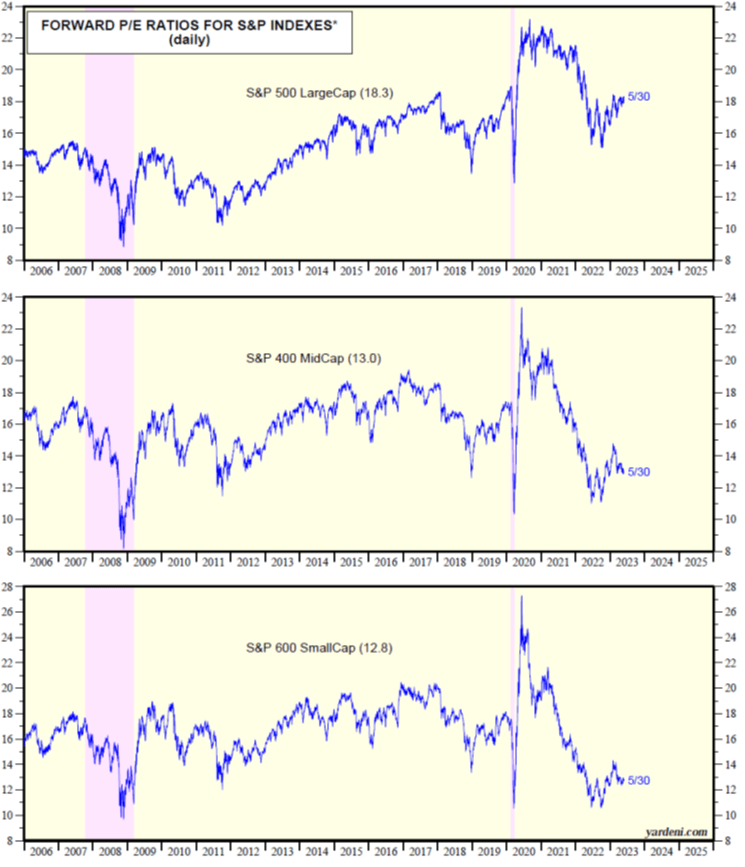

While most stocks have dramatically underperformed technology stocks this year, this phenomenon can be explained in a few ways. First of all, smaller companies are more cyclically sensitive to an economic slowdown, and do not have the ability to cut costs to the same extent as the behemoth companies. The majority of stocks have factored in a slowdown (or mild recession) and this is why valuations for small-cap and mid-cap stocks are near multi-decade lows (12.8x and 13.0x, respectively) – see chart below.

Source: Yardeni.com

The stock market pessimists have been calling for a recession for going on two years now. Not only has the recession date continually gotten delayed, but the severity has also been reduced as corporate profits remain remarkably resilient in the face of numerous economic headwinds. Regardless, investors can stand on firmer ground now knowing we are upon the cusp of an AI revolution and near the finish line of a debt ceiling resolution.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.