Lily Pad Jumping & Term Paper Cramming

Article is an excerpt from previously released Sidoxia Capital Management’s complementary December 3, 2012 newsletter. Subscribe on right side of page.

Over the last year, investors’ concerns have jumped around like a frog moving from one lily pad to the next. From the debt ceiling debate to the European financial crisis, and then from the presidential election to now the “fiscal cliff.” With the election behind us (Obama winning 332 electoral votes vs 206 for Romney; and Obama 50.8% of the popular vote vs 47.5% for Romney), the frog’s bulging eyes are squarely focused on the fiscal cliff. For the uninformed frogs that have been swimming underwater, the fiscal cliff is the roughly $600 billion in automatic tax hikes and spending cuts that are scheduled to be triggered by the end of this year, if Congress cannot come to some type of agreement (for more fiscal cliff information see videos here). The mathematical consequences are clear: Congress + No Deal = Recession.

While political brinksmanship and theater are nothing new, the explosive amount of data is something new. In our mobile world of 6 billion cell phones (more than the number of toothbrushes on our planet) and trillions of text messages sent annually, nobody can escape the avalanche of global data. Google (GOOG), Facebook (FB), Twitter, and millions of blogs (including this one) didn’t exist 15 years ago, therefore fiscal boogeymen like obscure Greek debt negotiations and Chinese PMI figures wouldn’t have scared pre-internet generations underneath their beds like today’s investors. The fact of the matter is our country has triumphed over plenty of significant issues (many of them scarier than today’s headlines), including wars, assassinations, currency crises, banking crises, double digit inflation, SARS, mad cow disease, flash crashes, Ponzi schemes, and a whole lot more.

Although today’s jumpy investors may worry about the lily pads of a double-dip recession in the US, a financial meltdown in Europe, and/or a hard landing in China, fiscal frogs will undoubtedly be worried about different lily pads (concerns) twelve months from now. This may not be an insightful observation for day traders, but for the other 99% of investors, taking a longer term view of the daily news cycle may prove beneficial.

Fiscal Cliff Term Paper Due on Friday December 21st

As a college student, chugging Jolt Cola, in combination with a couple dosages of NoDoz, was part of the routine procrastination process the day before a term paper was due. Apparently Congress has also earned a PhD in procrastination, judging by the last minute conclusion of the debt ceiling negotiations last summer. There are only a few more weeks until politicians break for the Christmas holiday break, therefore I am setting an Investing Caffeine mandated fiscal cliff due date of December 21st. Could Congress turn in its term paper early? Anything is possible, but unfortunately turning in the assignment early is highly unlikely, especially when politically bashing your opponent is perceived as a better re-election tactic compared to bipartisan negotiation.

A higher probability scenario involves Americans stuck listening to Nancy Pelosi, Harry Reid, John Boehner, and Mitch McConnell on a daily basis as these politicians finger-point and call the other side obstructionists. While I’m not alone in believing a deal will ultimately get done before Christmas, how credible and substantive the announcement will be depends on whether the politicians seriously face entitlement and tax reforms. Regardless, any deal announced by Investing Caffeine’s December 21st due date will likely be received well by the market, as long as a framework for entitlement and tax reform is laid out for 2013.

Frog News Bites

Source: Photobucket

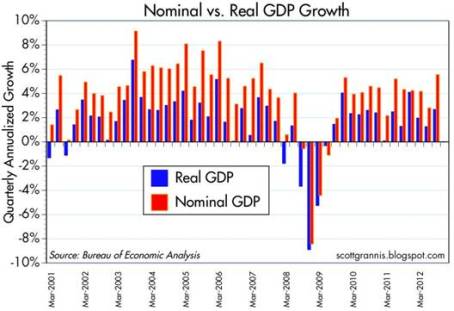

GDP Revised Higher: Despite all the gloom and uncertainties, the barometer of the economy’s health (i.e., Real Gross Domestic Product), was revised higher to 2.7% growth for the third quarter (from 2.0%). Nominal growth, a related measurement that includes inflation, reached a five-year high of 5.55%. In the wake of Superstorm Sandy, which caused upwards of $50 billion in damage, fourth quarter GDP numbers are likely to be artificially depressed. The silver lining, however, is first quarter 2013 figures may get an economic boost from reconstruction efforts.

Source: Calafia Beach Pundit

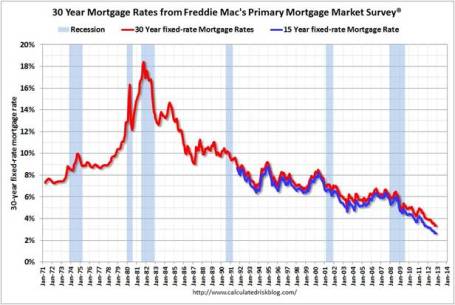

Housing Recovery Continues: Buoyed by record low interest rates (30-yr fixed mortgages < 3.5%), housing sales and prices continue on an upward trajectory. New home sales came in at 368,000 in October, below expectations, but sales are still up around +20% from 2011 (Calculated Risk).

Source: Calculated Risk

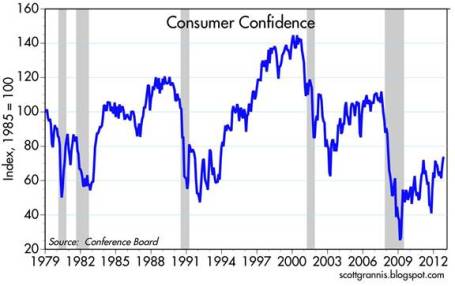

Confidence Still Low but Climbing: The recently reported consumer confidence figures reached the highest level in more than four years, but as Scott Grannis highlights, this is nothing to write home about. These current confidence levels match where we were during the 1990-91 and 1980-82 recessions.

Source: Calafia Beach Pundit

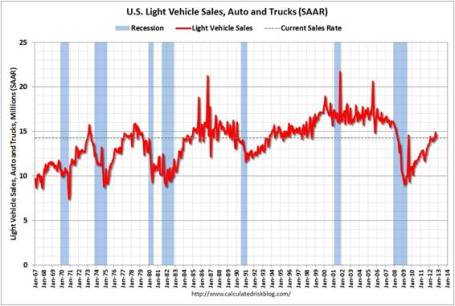

Car Sales Picking Up: Fiscal cliff discussions haven’t discouraged consumers from buying cars. As you can see from the chart below, car and truck sales reached 14.3 million annualized units in October. November sales are expected to rise about +13% on a year-over-year basis, reaching approximately 15.3 million units.

Source: Calculated Risk

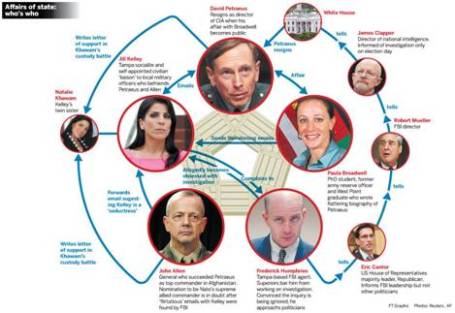

CIA Chief Fired in Sex Scandal: If you didn’t get enough of the Lindsay Lohan bar brawl dirt in New York, never fear, there was plenty of salacious details emanating from Washington DC this month. A complicated web of Florida socialites, a biographer, email chains, and a bare-chested FBI agent led to the firing of CIA director David Petraeus.

Source: The Financial Times

Death to Twinkies: After lining stomachs with golden cream-filled cakes for more than 80+ years, Hostess Brands was forced to halt production of Twinkies, Ding Dongs, and Ho Hos. Negotiations with union bakers crumbled, which led to Hostess Brands’ Chapter 7 bankruptcy and liquidation proceedings. My financial brain understands, but my sweet tooth is still grieving (see also Twinkie Investing).

Source: Photobucket

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in FB, Twitter or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Top 10 (or so) Things I’m Thankful For

With the holidays now upon us, this period provides me the opportunity to briefly escape the daily investment rat race, and reflect on the numerous aspects of my life for which I am grateful. There is so much to be thankful for, but it’s easy to lose sight of what’s important, especially when time is flying by in the blink of an eye. As the old saying goes, “Life is like a roll of toilet paper. The closer you get to the end, the faster it goes.” The proliferation of gray hair, coupled with my sprouting kids, is a constant reminder that life is not slowing down for me, but actually speeding up.

As I lay here like a slug on the couch, which is slowly absorbing me, I take no shame in unbuttoning my top pant button to relieve the belly-busting pressure of excessive turkey and mash potato consumption. The cranberry sauce on my chin and pumpkin pie crust on my shirt does not distract me from the football game or prevent me from reflecting upon my life’s gifts.

In that vein, here is a list of my top 10 things for which I am grateful:

10. Sugar: Without sweets, being relegated to a life of bread, water, and broccoli would be a boring challenge. Thankfully, once I became a grown adult earning a paycheck, I also earned the right to eat Cap’n Crunch (with Crunch Berries) for breakfast; peanut butter-Nutella & banana sandwich for lunch; apple fritter & milk for dinner; and some Double Stuf Oreos for dessert (yes, only one ‘f’ in Stuf!).

9. College Sports: Watching professional sports is fun, but when A-Rod earns $275 million for the NY Yankees and rides the pine during the playoffs, the business aspects take a little allure away from the sport. Although college athletes may sneak a few bucks under the table, they are nonetheless a lot less corrupted, and the electric atmosphere of a live college event cannot be replicated. The opportunities are fewer due to adult responsibilities, but nothing beats a crisp fall afternoon on the couch with a bowl of hot chili, a frosty beverage, and a remote control, while flipping through a series of college football games.

8. Gadgets: Seems like yesterday when I was introduced to my first computer, a 1983 Compaq Portable computer that weighed 28 pounds; had a 9 inch green screen; integrated two 320k drives; and retailed originally for about $3,500….ouch! Today, my iPhone 5 is more than 99% lighter, stores 100,000 times more information, and costs a fraction of the price. If you add my iPad, Kindle, Roku video streaming box, my DVR set-top box, my GPS, and other electronic gadgets, it’s hard to imagine how I could have lived a life without these luxuries five years ago.

7. Cards: I analyze numbers, probabilities, and emotions in my day job every day, it’s no wonder that I somehow need to do the same thing in my leisure time. No-Limit Texas Hold ‘Em is the name of the game, and I was introduced to it by world champion “poker brat” Phil Helmuth when he personally taught a group of us at an investment conference in 2003. I haven’t entered the $10,000 World Series of Poker in Las Vegas yet, but it’s on my bucket list.

6. Challenges: I’m a washed up basketball hack after an insignificant high school career and about 12 years of old-man basketball leagues, but my competitive juices keep flowing today. In hopes of not turning to a fully gelatinous blob, I have periodically pushed myself to some competitive athletic challenges, including a hike to the peak of Mt. Whitney; a couple half marathons; a sprint triathlon; a Colorado bike trip; and a few seasons of indoor co-ed soccer. Next up, I’m training for a “century” bike ride – a 100 mile race in early 2013 near Santa Barbara. I guess I better work off some of that stuffing, mash potatoes, and gravy.

5. Good Books: I pretty much read for a living on average 8-12 hours per day, but I suppose I’m a glutton for punishment. Given all my other interests and responsibilities, it’s tough to find the free time to curl up to a good book, but if I can squeeze in a book every quarter, I give myself a pat on the back. Nothing beats true, real-life experiences, but I’ve learned a tremendous amount through all the books I’ve read (for leisure and schooling). Regrettably diversity has gotten the short end of the stick, since about half the books I read are investment related, including a few that I’ve reviewed here on my blog like The Big Short, Too Big to Fail, The Greatest Trade Ever, and Winning the Loser’s Game (to name a few). Currently, I’m reading a fascinating New York Times Bestseller on world religions, called Religious Literacy, which leads me to my next Top 10 item…

4. Spirituality: While I am probably a lot more apathetic and ignorant in the area of religion as compared to the average person, nevertheless I have learned to appreciate the importance and benefits of religion and spirituality through my life experiences. From Judaism to Islam, and Buddhism to Christianity, there is no denying the moral lessons and spiritual balance these religions provide billions of people around the globe. I have a long way to go on my spiritual journey, but I’m slowly learning and progressing. On days where the Dow plummets a few hundred points or when the share price of a top holding tanks, I’m quickly reminded of the importance of spiritual balance.

3. Travel: While many people have hardly ventured from their hometown during their lifetime, I have been blessed with the fortune of seeing many places around the world. Not only have I lived on the East Coast, West Coast, and in the Midwest, but I have also traveled to five different continents. Appreciating different cultures and viewpoints is what truly makes life more interesting for me.

2. Friends: The digital age has not only brought friends closer together through social networks like Facebook (FB) and LinkedIn (LNKD), but has also pushed us further apart because vicariously spying on someone online is much easier than calling someone or grabbing coffee with them. Thankfully, I have a core set of friends that I can share my life’s ups and downs.

1a. Investing: Enough said. I’ve been investing for close to 20 years, and this blog is evidence of the blood, sweat, and tears I’ve dedicated to this endeavor. Various investments will go in and out of favor, and economic cycles will go up and down, but one trend that I know will persist is that I will be investing for the rest of my life.

1b. Health: It goes without saying, but if I don’t have my own good health, then very little on my top 10 list is possible. I’ve outlived two close family members of mine, so needless to say, I am very thankful to be breathing and living.

1c. Family: Having all these great experiences, including al the highs and lows, means absolutely nothing, if you have nobody to share them with. My family means the world to me, and days like Thanksgiving remind me of how lucky I really am.

Although this list was originally scheduled for 10 items, it looks like it has unintentionally expanded to a few more. But how can you blame me? I’ve had some tough times like everyone, but it is virtually impossible to not be thankful for the life I get to live now. Not only do I get to do what I love, but I also get paid to do it.

Last but not least, a special thanks needs to also go out to you, my devoted blog reader. I know you’re devoted, because you have made it to the end of this lengthy article. Without you, I wouldn’t have the motivation to continually scribble down my random thoughts.

Happy Thanksgiving and happy holidays!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), AMZN, and AAPL, and a short position in NFLX. At the time of publishing SCM had no direct positions in LNKD, FB, HPQ or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Twinkie Investing – Sweet but Unhealthy

It’s a sad day indeed in our history when the architect of the Twinkies masterpiece cream-filled sponge cakes (Hostess Brands) has been forced to close operations and begin bankruptcy liquidation proceedings. Food snobs may question the nutritional value of the artery-clogging delights, but there is no mistaking the instant pleasure provided to millions of stomachs over the 80+ years of the Twinkies dynasty. Most consumers understand that a healthy version of an organic Twinkie will not be found on the shelves of a local Whole Foods Market (WFM) store anytime soon. The reason people choose to consume these 150-calorie packages of baker bliss is due to the short-term ingestion joy, not the vitamin content (see Nutritional Facts below). Most people agree the sugar high gained from devouring half a box of Twinkies outweighs the long-term nourishing benefits reaped by eating a steamed serving of alfalfa sprouts.

Much like dieting, investing involves the trade-offs between short-term impulses and long-term choices. Unfortunately, the majority of investors choose to react to and consume short-term news stories, very much like the impulse Twinkie gorging, rather than objectively deciphering durable trends that can lead to outsized gains. Day trading and speculating on the headline du jour are often more exciting than investing, but these emotional decisions usually end up being costlier to investors over the long-run. Politically, we face the same challenges as Washington weighs the simple, short-term decisions of kicking the fiscal debt and deficits down the road, versus facing the more demanding, long-term path of dealing with these challenges.

With controversial subjects like the fiscal cliff, entitlement reform, taxation, defense spending, and gay marriage blasting over our airwaves and blanketing newspapers, no wonder individuals are defaulting to reactionary moves. As you can see from the chart below, the desire for a knee jerk investment response has only increased over the last 70 years. The average holding period for equity mutual funds has gone from about 5 years (20% turnover) in the mid 1960s to significantly less than 1 year (> 100% turnover) in the recent decade. Advancements in technology have lowered the damaging costs of transacting, but the increased frequency, coupled with other costs (impact, spread, emotional, etc.), have been shown to be detrimental over time, according to John Bogle at the Vanguard Group.

During volatile periods, like this post-election period, it is always helpful to turn to the advice of sage investors, who have successfully managed through all types of unpredictable periods. Rather than listening to the talking heads on TV and radio, or reading the headline of the day, investors would be better served by following the advice of great long-term investors like these:

“In the short run the market is a voting machine. In the long run it’s a weighing machine.” -Benjamin Graham (Famed value investor)

“Excessive short-termism results in permanent destruction of wealth, or at least permanent transfer of wealth.” -Jack Gray (Grantham, Mayo, Van Otterloo)

“The stock market serves as a relocation center at which money is moved from the active to the patient.” – Warren Buffett (Berkshire Hathaway)

“It was never my thinking that made big money for me. It always was my sitting.” – Jesse Livermore (Famed trader)

“The farther you can lengthen your time horizon in the investment process, the better off you will be.”- David Nelson (Legg Mason)

“The growth stock theory of investing requires patience, but is less stressful than trading, generally has less risk, and reduces brokerage commissions and income taxes.” T. Rowe Price (Famed Growth Investor)

“Time arbitrage just means exploiting the fact that most investors…tend to have very short-term time horizons.” -Bill Miller (Famed value investor)

“Long term is not a popular time-horizon for today’s hedge fund short-term mentality. Every wiggle is interpreted as a new secular trend.” -Don Hays (Hays Advisory – Investor/Strategist)

A legendary growth investor who had a major impact on how I shaped my investment philosophy is Peter Lynch. Mr. Lynch averaged a +29% return per year from 1977-1990. If you would have invested $10,000 in his Magellan fund on the first day he took the helm, you would have earned $280,000 by the day he retired 13 years later. Here’s what he has to say on the topic of long-term investing:

“Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

“My best stocks performed in the 3rd year, 4th year, 5th year, not in the 3rd week or 4th week.”

“The key to making money in stocks is not to get scared out of them.”

“Worrying about the stock market 14 minutes per year is 12 minutes too many.”

It is important to remember that we have been through wars, assassinations, banking crises, currency crises, terrorist attacks, mad-cow disease, swine flu, recessions, and more. Through it all, our country and financial markets most have managed to survive in decent shape. Hostess and its iconic Twinkies brand may be gone for now, but removing these indulgent impulse items from your diet may be as beneficial as eliminating detrimental short-term investing urges.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in WFM, BRKA/B, LM, TROW or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Chewing on Some Apple Pie

Apple pie is an unrivaled American dessert that optimally mixes the elements of dough, sugar, cinnamon, and apples. With Thanksgiving just around the corner, I can already taste that Costco (COST) apple pie that is about to snap my belt buckle open as I proceed to eat pie for breakfast, lunch, and dinner. A different dessert of the stock variety, Apple Inc. (AAPL), recently received a sour reception after reporting its 3rd quarter financial results.

Despite reporting +27% year-over-year revenue growth and +23% earnings growth, investors have continued to spew the stock out as the share price has fallen from $700 per share down to $600 per share in about a month. With all this indigestion, is now the time to reach for the Tums or should we serve ourselves up another helping of some tasty Apple pie? Not everybody loves this particular fruity dessert, so let’s cut into the Apple pie stock and see if there is any dough to be made here.

Point #1 (Cash Giant): Apple Inc. is a profit machine with a fortress balance sheet. More specifically, Apple has around $121 billion dollars in cash in its checking account and generated over $42 billion in free cash flow in fiscal 2012. And by free cash flow, I mean the excess cash Apple gets to stuff in its pockets after ALL expenses have been paid AND after spending more than $8 billion in capital expenditures (including spending for their new 2.8 million sq. foot spaceship campus expected to open in 2015 and house 13,000 employees).

Point #2: (Brand): A brand has value that will not show up on a balance sheet, and according to Forbes, Apple’s brand is rated #1 on a global basis, outstripping iconic brands like IBM, McDonald’s (MCD) and Microsoft (MSFT). BrandZ, a division of advertising giant WPP, values Apple’s 2012 brand value at approximately $183 billion.

Point #3 (Product Pipeline): Apple is no one-trick pony. Apple’s iPhone sales account for about half of the company’s sales, but a whole new slate of products positions them well for the critical calendar fourth quarter period. Apple’s iPhone 5, iPad 3 (aka, “New iPad”), and iPad Mini should translate into robust holiday sales for Apple. What’s more, a +39% increase in Apple’s fiscal 2012 R&D (research and development) should mean a continued healthy pipeline of new products, including the ever-rumored new integrated version of Apple TV that could be coming in 2013.

Point #4 (Mobile & Tablets): Apple is at the center of the mobile revolution. There are approximately 5 billion cell phones globally, and about 2 billion new phones are sold each year. Of that 2 billion, Apple sold a paltry 125 million units (tongue firmly in cheek) with the market growing faster in Apple iPhone’s key smart phone market. As the approximately 500 million smart phone market grows to about 5 billion units over the next decade, Apple is uniquely positioned to capitalize on this trend. Beyond cell phones, the table market is bursting as traditional personal computer growth declines. Although Apple has made computers for 36 years, the company impressively generated +40% more revenue from fiscal 2012 iPad tablet sales, relative to Apple desktop and laptop sales.

Point #5 (Valuation): With all these positives, what type of premium would you pay for Apple’s stock? Does a +100% premium sound reasonable? OK, maybe a tad high, so how about a +50% premium? Alright, alright, I know you want a good bargain, so surely a +20% premium is warranted? Well in fact, if you account for Apple’s $121 billion cash hoard, Apple’s stock is currently trading at about a -22% DISCOUNT to the average S&P 500 stock on a P/E basis (Price-Earnings). You heard that correctly, a significant discount. If Apple is trading at a P/E discount, surely mature staple stocks like Procter & Gamble (PG) and Colgate Palmolive (CL), which both reported negative Q3 revenue declines coupled with meager bottom-line growth of 5%, deserve even steeper discounts…right? WRONG. These stocks trade at a 70-80% PREMIUM to Apple and a 35-40% PREMIUM to the overall market. Toilet paper and toothpaste I guess are a lot more popular than consumer electronics these days. Clear as mud to me.

Risks: I understand that Apple is not a risk-free Treasury security. Research in Motion’s (RIMM) rapid collapse over the last two years serves as a fresh reminder that in technology land, competition and obsolescence risks play a much larger role compared to other industries. Apple must still deliver on its product visions, and as the king of the hill Apple will have a big bulls-eye on its back from both competitors and regulators. Hence, we will continue to read overblown headlines about map application glitches and photographic purple haze.

In the end, a significant amount of pessimism is already built into Apple’s stock price (yes, I did say “pessimism” – even with the stock’s share price up +49% this year). If Apple can uphold the quality of its products and maintain modest growth, then I’m confident shareholders will happily eat another slice of Apple pie.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and AAPL, but at the time of publishing SCM had no direct positions in COST, IBM, MCD, CL, PG, MSFT, WPP, RIMM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

USA Inc.: Buy, Hold or Sell?

If the U.S. was a company, would you buy, hold, or sell the stock? A voluminous report put out last year by Mary Meeker sought to answer that very question. Since we’re in the thick of the presidential elections, why not review the important financial state of our great nation.

For those of you who may not know who she is, Mary Meeker is the well-known partner at Kleiner Perkins Caufield & Byers, who is also affectionately known as the “Queen of Internet.” Apparently, beyond her renowned expertise in analyzing and valuing tech companies and start-ups, she also has the knack of dissecting government statistics and distilling wonky numbers down to understandable terms for the masses. “Distilling” may be a generous term, given the massive size of her 460-page report, USA Inc., but nevertheless, I am going to attempt to synthesize this gargantuan report even further.

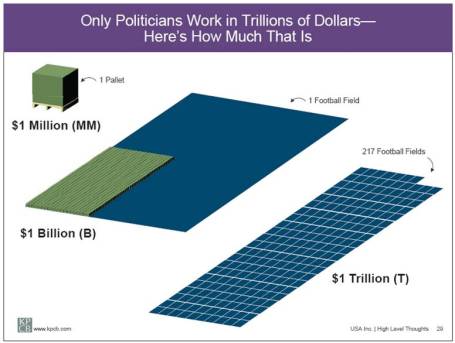

As a visual learner, I think some key cherry-picked slides from her report will help put our multi-trillion debts and deficits in context, so here goes…

The Scope of the Problem

If one spends a few hundred billion dollars here, and a few hundred billion dollars there, before you know it, a trillion dollars will have piled up. Currently our government has run $1 trillion+ budget deficits for three years, and the estimated deficit is for another trillion dollar deficit this fiscal year. If you have ever wondered how many football fields it takes to fill with a trillion dollars of cash, then today is your lucky day. The answer: 217 football fields.

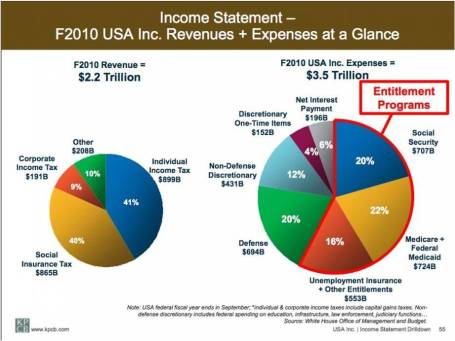

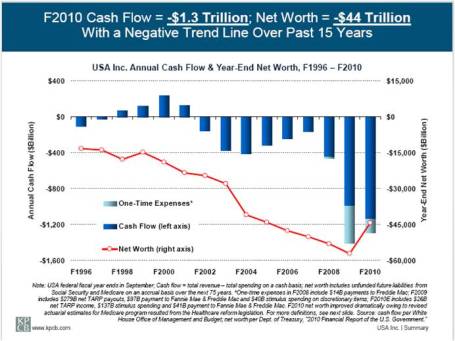

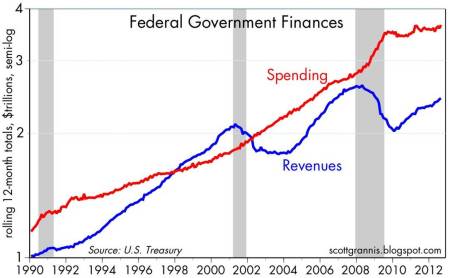

Financial Statements: The Health Thermometer

In order to determine the relative health of USA Inc., Meeker created financial statements for our country, starting with the income statement. As you can see from the chart below, unfortunately USA Inc.’s expenses have been significantly larger than its revenues, creating a “discouraging” trend of negative cash flows (deficits). An entity that takes in $2.2 trillion in revenue and spends $3.5 trillion, cannot sustainably continue this trend for long, before significant financial problems arise. The largest contributing factor to our country’s losses (deficits) has been the exploding costs of entitlements, including Medicare, Medicaid, and Social Security.

As the pie chart shows, the major categories of entitlements comprise a whopping 58% of USA Inc.’s 2010 total expenditures.

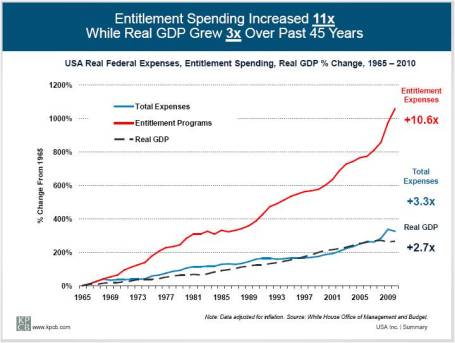

Why Entitlement Spending is a Problem

Why are entitlements such a massive problem? The plain and simple answer to why entitlements are a major issue is that government expenditures are growing too fast. You can’t have expenses growing significantly faster than revenues for 45 years and expect to be in happy financial place.

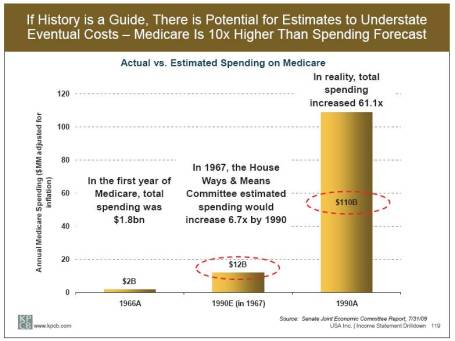

Another reason for the abysmal spending record is due to politicians horrendous forecasting abilities. Future promises are made by politicians to garner votes today, and when they make overly rosy estimates about the costs of those promises, future generations are left holding the underfunded bag. Meeker points out that when Medicare was instituted in 1966, total future spending of $110 billion turned out to be about 10x more expensive (see chart below) than originally planned…ouch!

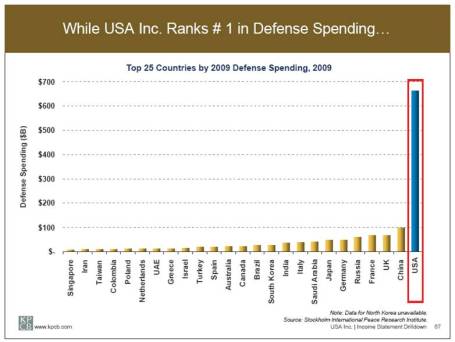

No Defense for Defense

Trillion dollar deficits and debts can’t be solely blamed on entitlements, but $700 billion in annual defense expenditures is not exactly chump change. The inopportune timing of the financial crisis in 2008-2009 didn’t help either, while two unfunded wars were being fought. Even if you strip out the wars, defense spending is still obscenely high. Given our poor state of financial affairs, we cannot afford to be the globe’s babysitter (see Impoverished Global Babysitter). Legacy Cold War spending on obsolete ground warfare needs to be reprioritized to 21st Century threats (i.e. focus on unmanned drones and coordinated intelligence). When a government spends more than the top 25 countries combined (see chart below), that country can certainly find some defense fat to trim.

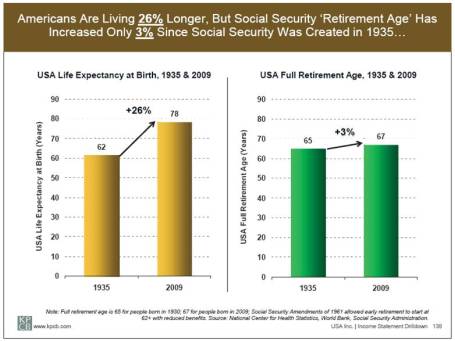

Demographic Headwinds

The out-of-control gluttonous government spending is a threat to our national security, and although I wish I could say time alone will heal our fiscal wounds, unfortunately the opposite is true. Time is our enemy because the ticking demographic time bomb is about to explode, unless government acts to solve our spending problems. For starters, Americans are living longer, which means entitlement spending has accelerated faster than revenues collected, and life expectancy consistently continues to rise. As you can see below, life expectancy has outpaced Social Security age adjustments by +23% over a 74 year period.

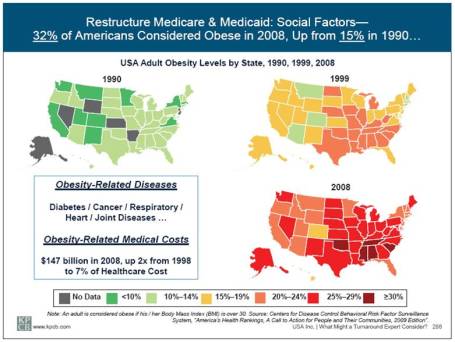

Another self inflicted problem contributing to our colossal health care costs is the obesity epidemic. Over an 18 year period, the rate of obesity more than doubled to 32%. Individuals can and should shoulder more of the burden for these belt-busting costs, and government should spend more on prevention and education in this area. Bad drivers pay higher premiums for their auto insurance, so why not have bad eaters pay higher premiums? Genetics certainly can play a role in obesity, but so to do eating habits. The same accountability principle should be applied to smokers who overly burden our healthcare system too.

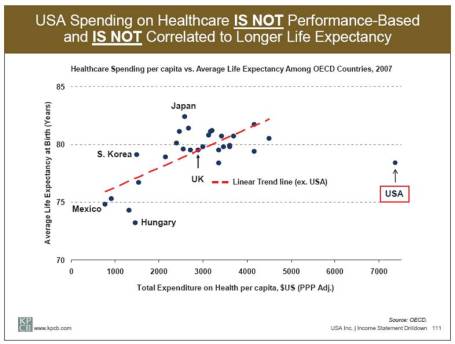

The USA spends more on healthcare than all OECD countries combined and 3x the OECD per capita average, yet as you can see from the chart below, the USA is not getting a life expectancy bang for its buck. The argument that the U.S. has the best healthcare in the world may be true in some instances, but the overall data doesn’t support that assertion.

The Rubber Hits the Road

The problem is easy to identify: Government spending going out the door is running faster than the revenues coming in via taxes. The solution is easy to identify too: Politicians need to cut spending, increase taxes, and/or do a combination of the two options. Like dieting, the solutions are easy to identify but difficult to execute.

Almost everyone wants the government to spend less, but at the same time nobody wants their benefits cut. You can’t have your cake and eat it too. Citing two different studies, Meeker shows how 80% of Americans want a balanced budget as a national priority, but only 12% are willing to cut spending on Medicare and Social Security.

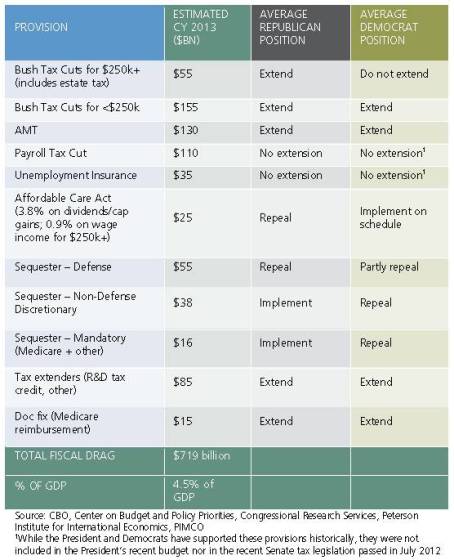

The rubber will hit the road in the next few months when politicians in a post-presidential election period will be forced to face these difficult “Fiscal Cliff” choices – $700 billion+ in tax hikes and spending increases that jeopardize the current recovery and our fiscal future.

As market maven Mary Meeker recognizes, our fiscal situation is quite “discouraging”. With that said, although USA Inc. may have earned a current “Sell” rating, Meeker acknowledges that our country can become a positive turnaround situation. If voters actively push politicians to making difficult but necessary financial decisions to lower deficits and debt, investors around the globe will be ready to “Buy” USA Inc.’s stock.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Google Caught Naked: Their Loss, Your Gain?

Google Inc. (GOOG) got caught naked yesterday with the early release of its lackluster numbers and “Pending Larry Quote,” but is Google’s loss your gain? An endless number of bloggers and media outlets were quick to jump on the bandwagon, highlighting the sophomor-ish early dissemination of quarterly results, and then simultaneously headlines were blasted about a -20% drop in profits.

I love these sensationalist headlines that I hear chirped in the local Starbucks (SBUX), on the elevator, or at the grocery store. The Armageddon headlines and cascading minute-by-minute charts make for entertaining viewing, but the gaudy $40 billion in cash piling up on Google’s balance sheet, including the measly $3 billion it added in the quarter, may also be news-worthy. Fear sells more than greed, which may explain why there is little mention of Google’s +45% revenue growth (equally misleading because of the Motorola deal). Let me remind you, the $3 billion of cold hard cash created in a single 90 day period is the equivalent size of many large established companies – companies like Groupon Inc. (GRPN), Tesla Motors Inc. (TSLA), and Weight Watchers International Inc. (WTW).

If people could take off their panic caps for a minute, they would be able to see the explosion in smart phones (now around 1 billion) is on pace to swell to 5 billion over the next decade. What will that mean for a market leader like Google with over ½ billion Android devices that is activating 1.3 million more every day? I don’t know for sure, but I’m willing to venture it is going to mean a lot of dough for Google. What further inspires my confidence? Well, the fact that Google’s mobile related revenues have gone from $2.5 billion run rate last year to over $8 billion today indicates they are on the right track.

Google got caught naked with its press release flub, and the frail Motorola acquisition may cause a little indigestion in the coming quarters, but any short-run Google losses may be your opportunity for long-term gains.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and GOOG, but at the time of publishing SCM had no direct positions in SBUX, TSLA, GRPN, WTW, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sleeping Through Bubbles and Decade Long Naps

We have lived through many investment bubbles in our history, and unfortunately most investors sleep through the early wealth-creating inflation stages. Typically, the average investor wakes up later to a hot idea once every man, woman, and child has identified the clear trend…right as the bubble is about burst. Sadly, the masses do a great job of identifying financial bubbles at the end of a cycle, but have a tougher time realizing the catastrophic consequences of exiting a tired winner. Or as strategist Jim Stack states, “Bubbles, for the most part, are invisible to those trapped inside the bubble.” The challenge of recognizing bubbles explains why they are more easily classified as bubbles after a colossal collapse occurs. For those speculators chasing a precise exit point on a bubblicious investment, they may be better served by waiting for the prick of the bubble, then take a decade long nap before revisiting the fallen angel investment idea.

Even for the minority of pundits and investors who are able to accurately identify these financial bubbles in advance, a much smaller number of these professionals are actually able to pinpoint when the bubble will burst. Take for example Alan Greenspan, the ex-Federal Reserve Chairman from 1987 to 2006. He managed to correctly identify the technology bubble in late-1996 when he delivered his infamous “irrational exuberance” speech, which questioned the high valuation of the frothy, tech-driven stock market. The only problem with Greenspan’s speech was his timing was massively off. Stated differently, Greenspan was three years premature in calling out the pricking of the bubble, as the NASDAQ index subsequently proceeded to more than triple from early 1997 to early 2000 (the index exploded from about 1,300 to over 5,000).

One of the reasons bubbles are so difficult to time during their later stages is because the deflation period occurs so quickly. As renowned value investor Howard Marks fittingly notes, “The air always goes out a lot faster than it went in.”

Bubbles, Bubbles, Everywhere

Financial bubbles do not occur every day, but thanks to the psychological forces of investor greed and fear, bubbles do occur more often than one might think. As a matter of fact, famed investor Jeremy Grantham claims to have identified 28 bubbles in various global markets since 1920. Definitions vary, but Webster’s Dictionary defines a financial bubble as the following:

A state of booming economic activity (as in a stock market) that often ends in a sudden collapse.

Although there is no numerical definition of what defines a bubble or collapse, the financial crisis of 2008 – 2009, which was fueled by a housing and real estate bubble, is the freshest example in most people minds. However, bubbles go back much further in time – here are a few memorable ones:

Dutch Tulip-Mania: Fear and greed have been ubiquitous since the dawn of mankind, and those emotions even translate over to the buying and selling of tulips. Believe it or not, some 400 years ago in the 1630s, individual Dutch tulip bulbs were selling for the same prices as homes ($61,700 on an inflation adjusted basis). This bubble ended like all bubbles, as you can see from the chart below.

British Railroad Mania: In the mid-1840s, hundreds of companies applied to build railways in Britain. Like all bubbles, speculators entered the arena, and the majority of companies went under or got gobbled up by larger railway companies.

Roaring 20s: Here in the U.S., the Roaring 1920s eventually led to the great Wall Street Crash of 1929, which finally led to a nearly -90% plunge in the Dow Jones Industrial stock index over a relatively short timeframe. Leverage and speculation were contributors to this bust, which resulted in the Great Depression.

Nifty Fifty: The so-called Nifty Fifty stocks were a concentrated set of glamour stocks or “Blue Chips” that investors and traders piled into. The group of stocks included household names like Avon (AVP), McDonald’s (MCD), Polaroid, Xerox (XRX), IBM and Disney (DIS). At the time, the Nifty Fifty were considered “one-decision” stocks that investors could buy and hold forever. Regrettably, numerous of these hefty priced stocks (many above a 50 P/E) came crashing down about 90% during the1973-74 period.

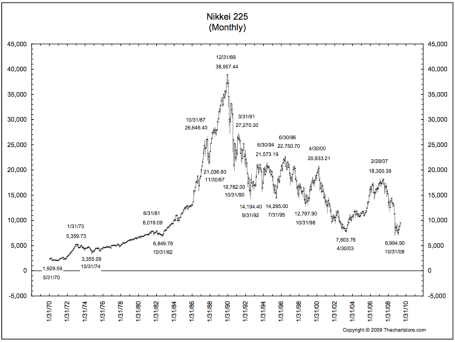

Japan’s Nikkei: The Japanese Nikkei 225 index traded at an eye popping Price-Earnings (P/E) ratio of about 60x right before the eventual collapse. The value of the Nikkei index increased over 450% in the eight years leading up to the peak in 1989 (from 6,850 in October 1982 to a peak of 38,957 in December 1989).

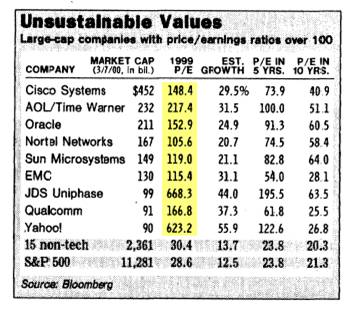

The Tech Bubble: We all know how the technology bubble of the late 1990s ended, and it wasn’t pretty. PE ratios above 100 for tech stocks was the norm (see table below), as compared to an overall PE of the S&P 500 index today of about 14x.

The Next Bubble

What is/are the next investment bubble(s)? Nobody knows for sure, but readers of Investing Caffeine know that long-term bonds are one fertile area. Given the generational low in yields and rates, and the near doubling of long-term Treasury prices over the last twelve years, it can be difficult to justify heavy allocations of inflation losing bonds for long time-horizon investors. Gold, another asset class that has increased massively in price (over 6-fold rise since about 2000) and attracted swaths of speculators, is another target area. However, as we discussed earlier, timing bubble bursts is extremely challenging. Nevertheless, the great thing about long-term investing is that probabilities and valuations ultimately do matter, and therefore a diversified portfolio skewed away from extreme valuations and speculative sectors will pay handsome dividends over the long-run.

Many traders continue to daydream as they chase performance through speculative investment bubbles, looking to squeeze the last ounce of an easily identifiable trend. As the lead investment manager at Sidoxia Capital Management, I spend less time sucking the last puff out of a cigarette, and spend more time opportunistically devoting resources to less popular growth trends. As demonstrated with historical examples, following the trend du jour eventually leads to financial ruin and nightmares. Avoiding bubbles and pursuing fairly priced growth prospects is the way to achieve investment prosperity…and provide sweet dreams.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and are short TLT, but at the time of publishing SCM had no direct positions in AVP, MCD, XRX, IBM, DIS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Robotic Chain Saw Replaces Paul Bunyan

The world is rapidly changing and so is the profile of jobs. Technology is advancing at an accelerating pace, and this is having enormous impacts on the look, feel, and shape of global workforce dynamics. If lumberjack Paul Bunyan and his blue ox Babe were alive today, the giant would not be chopping down trees with a plain old steel axe, but more likely Mr. Bunyan would be using a 20 inch, 8 horse-power chain saw with side-mounted tensioner purchased from ChainSawsDirect.com.

But productivity in logging is not the only industry in which output has dramatically increased over the last generation. A recent New York Times article published by John Markoff explores how robots and automation are displacing humans across many different companies and industries around the world.

In China, manufacturers have exploited the value of cheap labor in the name of low-priced exports, but with millions of workers now moving to job-filled cities, workers are now demanding higher wages and better working conditions. Besides rising wages, higher transportation costs have eaten away labor expense advantages too. One way of getting around the issues of labor costs, labor relations, and transportations costs is to integrate robots into your workplace. A robot won’t ask for a raise; it always shows up on time; you don’t have to pay for its healthcare; it can work 24/7/365 days per year; it doesn’t belong to a union; dependable quality consistency is a given; it produces products near your customers; and it won’t sue you for discrimination or sexual harassment. The initial costs of a robot may be costlier than hiring a human being by a factor of five times an annual salary, but that hasn’t stopped companies everywhere from integrating robots into their operations.

The Orange Box on Wheels

One incredible example of robot usage (not covered by Markoff) is epitomized through Amazon.com Inc.’s (AMZN) $750 million acquisition of Kiva Systems Inc. last year. In some cases, Kiva uses hundreds of autonomous mobile robots in a warehouse to create a freeway-like effect of ecommerce fulfillment that can increase worker productivity four-fold. Amazon is a true believer of the technology as evidenced by the use of Kiva robots in two of its major websites, shoe-retailer Zappos.com and baby-products site Diapers.com, but Kiva’s robots have also been used by other major retailers including Crate & Barrel, Staples Inc (SPLS), and Gap Inc (GPS). The orange square robots on wheels, which can cost in the range of $2 – $20 million per system, travel around a warehouse tracking the desired items and bring them back to a warehouse worker, ready to then be packed and shipped to a customer. Larger warehouses can use up to 1,000 of the Kiva robots. To see how this organized chaos works, check out the video below to see the swarm of orange machines dancing around the warehouse floor.

The Next Chapter

The auto and electronics industry have historically been the heaviest users of robots and automation, but those dynamics are changing. Healthcare, food, aviation, and other general industries are jumping on the bandwagon. And these trends are not just happening in developed markets, but rather emerging markets are leading the charge – even if penetration rates are lower there than in the richer countries. The robotic usage growth is rapid in emerging markets, but the penetration of robotic density per 10,000 workers in China, Brazil and India is less than 10% of that in Japan and Germany (< 20% penetration of the U.S.), according to IFR World Robotics. As a matter of fact, IFR is forecasting that China will be the top robot market by 2014.

What does this mean for jobs? Not great news if you are a low-skilled worker. Take Foxconn, the company that manufactures and assembles those nifty Apple iPhones (AAPL) that are selling by the millions and generating billions in profits. The harsh working conditions in these so-called massive sweatshops have resulted in suicides and high profile worker backlashes. Related to these issues, Foxconn dealt with at least 17 suicides over a five year period. What is Foxconn’s response? Well, besides attempting to respond to worker grievances, Foxconn chairman Terry Gou announced plans to produce 1 million robots in three years , which will replace about 500,000 jobs….ouch!

As the New York Times points out, the “Rise of Machines” is not about to result in Terminator-like robots taking over the world anytime soon:

“Even though blue-collar jobs will be lost, more efficient manufacturing will create skilled jobs in designing, operating and servicing the assembly lines, as well as significant numbers of other kinds of jobs in the communities where factories are.”

Many companies see this trend accelerating and are investing aggressively to profit from the robotic automation and productivity benefits. In today’s day and age, Paul Bunyan would have surely taken advantage of these trends, just as I plan to through Sidoxia Capital Management’s opportunistic investments in the robotic sector.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), AMZN, and AAPL, but at the time of publishing SCM had no direct positions in Foxconn/Hon Hai, Crate & Barrel, SPLS, GPS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.