Vice Tightens for Those Who Missed the Pre-Party

The stock market pre-party has come to an end. Yes, this is the part of the bash in which an exclusive group is invited to enjoy the fruits of the festivities before the mobs arrive. That’s right, unabated access to the nachos; no lines to the bathroom; and direct access to the keg. For those of us who were invited to the stock market pre-party (or crashed it on their own volition), the spoils have been quite enjoyable – about a +128% rebound for the S&P 500 index from the bottom of 2009, and a +147% increase in the NASDAQ Composite index over the same period (excluding dividends paid on both indexes).

Although readers of Investing Caffeine have received a personal invitation to the stock market pre-party since I launched my blog in early 2009, many have shied away, out of fear the financial market cops may come and break-up the party.

Rather than partake in stock celebration over the last four years, many have chosen to go down the street to the bond market party. Unlike the stock market party, the fixed-income fiesta has been a “major-rager” for more than three decades. However, there are a few signs that this party has gotten out-of-control. For example, crowds of investors are lined up waiting to squeeze their way into some bond indulgence; after endless noise, neighbors are complaining and the cops are on their way to shut the party down; and PIMCO’s Bill Gross has just jumped off the roof to do a cannon-ball into the pool.

Even though the stock-market pre-party has been a blast, stock prices are still relatively cheap based on historical valuation measurements, meaning there is still plenty of time for the party to roll on. How do we know the party has just started? After five years and about a half a trillion dollars hemorrhaging out of domestic funds (see Calafia Beach Pundit), there are encouraging signs that a significant number of party-goers are beginning to arrive to the party. More specifically, as it relates to stocks, a fresh $10 billion has flowed into domestic equity mutual funds during this January (see ICI chart below). This data is notoriously volatile, and can change dramatically from month-to-month, but if this month’s activity is any indication of a changing mood, then you better hurry to the stock party before the bouncer stops letting people in.

Vice Begins to Tighten on Party Outsiders

Many stock market outsiders have either been squeezed into the bond market, hidden in cash, or hunkered down in a bunker with piles of gold. While some of these asset classes have done okay since early 2009, all have underperformed stocks, but none have performed worse than cash. For those doubters sitting on the equity market sidelines, the pain of the vice squeezing their portfolios has only intensified, especially as the economy and employment picture slowly improves (see chart below) and stock prices persist directionally upward. For years, fear-mongering stock skeptics have warned of an imploding dollar, exploding inflation, a run-away deficit/debt, a reckless money-printing Federal Reserve, and political gridlock. Nevertheless, none of these issues have been able to kill this equity bull market.

But for those willing and able investors to enter the stock party today, one must realize this party will only get riskier over time. As we exit the pre-party and enter into the main event, you never know who may join the party, including some uninvited guests who may steal money, get sick on the carpet, participate in illegal activities, and/or ruin the fun by clashing with guests. We have already been forced to deal with some of these uninvited guests in recent years, including the “flash crash,” debt ceiling debate, European financial crisis, fiscal cliff, and lastly, sequestration is about to arrive as well (right after parking his car).

New investors can still objectively join the current equity party, but it is necessary to still be cognizant of not over-staying your welcome. However, for those party-pooping doubters who already missed the pre-party, the vice will continue to tighten, leaving stock cynics paralyzed as they watch additional missed opportunities enjoyed by the rest of us.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in HLF, Japanese ETFs, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia Debuts Video & Goes to the Movies

Article is an excerpt from previously released Sidoxia Capital Management’s complementary February 1, 2013 newsletter. Subscribe on right side of page.

The red carpet was rolled out for the stock market in January with the Dow Jones Industrial Average rising +5.8% and the S&P 500 index up an equally impressive +5.0% (a little higher rate than the 0.0001% being earned in bank accounts). Movie stars are also strutting their stuff down the red carpet this time of the year as they collect shiny statues at ritzy award shows like the Golden Globes and Oscars. Given the vast volumes of honors bestowed, we thought what better time to put on our tuxes and create our own 2013 nominations for the economy and financial markets. If you are unhappy with our selections, you are welcome to cast your own votes in the comments section below.

By award category, here are Sidoxia’s 2013 selections:

Best Drama (Government Shutdown & Debt Ceiling): Washington D.C. has provided no shortage of drama, and the upcoming blockbusters of Shutdown & Debt Ceiling are worthy of its Best Drama nomination. If Congressional Democrats and Republicans don’t vote in favor of a new “Continuing Resolution” by March 27th, then our United States government will come to a grinding halt. At issue is Republican’s desire for additional government spending cuts to lower our deficit, which is likely to exceed $1 trillion for the fifth consecutive year. If you like more heart pumping drama, the Senate has just passed a Debt Ceiling extension through May 18th…mark those calendars!

Best Horror Film (Sequestration): Most people have already seen the scary prequel, The Fiscal Cliff, but the sequel Sequestration deserves the horror film honors of 2013. This upcoming blood-filled movie about broad, automatic, across-the-board government cost cuts will make any casual movie-watcher scream in terror. The $1.2 trillion in spending cuts (over 10 years) are so gory, many viewers may voluntarily leave the theater early. If you are waiting for the release, Sequestration is coming to a theater near you on March 1st, unless Congress, in an unlikely scenario, cancels the launch.

Best Director (Ben Bernanke): Federal Reserve Chairman Ben Bernanke’s film, entitled, The U.S. Economy, had a massive budget of about $16 trillion dollars, based on estimates of last year’s GDP (Gross Domestic Product). Nevertheless, Bernanke managed to do whatever it took (including trillions of dollars in bond buying) to prevent the economic movie studio from collapsing into bankruptcy. While many movie-goers were critical of his directorial debut, inflation has remained subdued thus far, and he has promised to continue his stimulative monetary policies (i.e., keep interest rates low) until the national unemployment rate falls below 6.5% or inflation rises above 2.5%.

Best Foreign Film (China): Americans are not the only people who produce movies globally. A certain country with a population of nearly 1.4 billion people also makes movies too…China. In the most recently completed 4th quarter, China’s economy experienced blockbuster growth in the form of +7.9% GDP expansion. This was the fastest pace achieved by China in two whole years. To put this metric into perspective, compare China’s heroic growth to the bomb created by the U.S. economy, which registered a disappointing -0.1% contraction at the economic box office. China’s popularity should bring in business all around the globe.

Best Special Effects (Japan): After coming out with a series of continuous flops, Japan recently launched some fresh new special effects in the form of a $116 billion emergency stimulus package. The country also has plans to superficially enhance the visual portrayal of its economy by implementing its own faux money-printing program modeled after our country’s quantitative easing actions (i.e., the Federal Reserve stimulus). As a result of these initiatives, the Japanese Nikkei index – their equivalent of our Dow Jones Industrial index – has risen by +29% in less than 3 months to a level of 11,138.66 (click here for chart). But don’t get too excited. This same Nikkei index peaked at 38,957 in 1989, a far cry from its current level.

Best Action Film (Icahn vs. Ackman): This surprisingly entertaining action film features a senile 76-year-old corporate raider and a white-haired, 46-year-old Harvard grad. The investment foes I am referring to are the elder Carl Icahn, Chairman of Icahn Enterprises, and junior Bill Ackman, CEO of Pershing Square Capital Management. In addition to terms such as crybaby, loser, and liar, the 27-minute verbal spat (view more here) between Icahn (his net worth equal to about $15 billion) and Ackman (net worth approaching $1 billion) includes some NC-17 profanity. The clash of these investment titans stems from a decade-old lawsuit, in addition to a recent disagreement over a controversial short position in Herbalife Ltd. (HLF), a nutritional multi-level marketing firm.

Best Documentary (Europe): As with a lot of reality-based films, many don’t receive a lot of attention. So too has been the commentary regarding the eurozone, which has been relatively peaceful compared to last spring. Despite the comparative media silence, European unemployment reached a new high of 11.8% late last year. This European documentary is not one you should ignore. European Central Bank (ECB) President Mario Draghi just stated, “The risks surrounding the outlook for the euro area remain on the downside.”

Best Original Song (National Anthem): We won’t read anything politically into Beyonce’s lip-synced rendition of The Star-Spangled Banner at the presidential inauguration, but she is still worthy of the Sidoxia nomination because music we hear in the movies is also recorded. I’m certain her rapping husband Jay-Z agrees whole-heartedly with this viewpoint.

Best Motion Picture (Sidoxia Video): It may only be three minutes long, but as my grandmother told me, “Great things come in small packages.” I may be a little biased, but judge for yourself by watching Sidoxia’s Oscar-worthy motion picture debut:

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in HLF, Japanese ETFs, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Herbalife Strife: Icahn & Ackman Duke It Out

I have seen a lot of things in my two decades in the investment industry, but seeing a verbal cage fight between a senile 76 year-old corporate raider and a white-haired, 46 year-old Harvard grad makes for surprisingly entertaining viewing. The investment heavyweights I am referring to are the elder Carl Icahn, Chairman of Icahn Enterprises, and junior Bill Ackman, CEO of Pershing Square Capital Management. If getting a few billionaires yelling at each other on live TV is not enough to interest you, then how about adding some tongue-laced f-bombs coupled with blow-by-blow screaming from background traders?

What’s the source of the venomous, spitting hatred between these stock market tycoons? In short, it can be boiled down to a decade old lawsuit (profitable for both I might add), and a disagreement over the short position of a controversial stock, Herbalife (HLF). Regarding the legal spat, in 2003 the SEC was investigating Ackman while his Gotham Partners hedge fund was collapsing, so Ackman asked Icahn to buy shares of Hallwood Realty in hopes of salvaging his fund. Eventually, Icahn bought shares, but a difference in opinion over the transaction led to a lawsuit that Icahn lost, thereby forcing him to pay Ackman $9 million.

Icahn also had a beef with Ackman’s handling of Herbalife: Parading in front of hundreds of investors to self-indulgently create a bear raid on an unsuspecting company is poor form in Icahn’s view, and Carl wanted to make sure Ackman was aware of this investing faux pas.

Normally, investing reporting over cable television is rather mundane, unless you consider entertainers like Jim Cramer yelling “booyah” amusing (see also my article on Mr. Booyah)? On the other hand, if you enjoy billionaires embracing the spirit of the Jerry Springer Show by screaming purple-faced profanities, then you should check out the CNBC cage fight here in its entirety:

If you lack time in your busy schedule to soak in the full bloody battle, then here is a synopsis of my favorite highlights:

Icahn on Ackman the “Crybaby”: “I really sort of have had it with this guy Ackman….I get a call from this Ackman guy. I’m telling you, he’s like the crybaby in the schoolyard. I went to a tough school in Queens. They used to beat up the little Jewish boys. He was like a little Jewish boy crying that the world was taking advantage of him.”

Ackman Referring to Icahn as a “Bully” and Himself as “Roadkill on the Hedge Fund Highway”: “Why did he [Icahn] threaten to sue me? He was a bully. Okay? I was not in a good place in my business career. I was under investigation by Spitzer, winding down my fund. There was negative press about Gotham Partners. I was short MBIA (MBI). They were aggressively attacking me and Carl Icahn thought this guy [Ackman] is roadkill on the hedge fund highway… This is not an honest guy [Icahn] who keeps his word. This is a guy who takes advantage of little people.”

Agitated Icahn Tearing a New One for Scott Wapner (CNBC Commentator): “I didn’t get on to be bullied by you [Wapner]… I’m going to talk about what I want to talk about. Okay? If you want to take that position, I will never go on CNBC. You can say what the hell you want. I’m going to talk about what Ackman just said about me, not about Herbalife. I’ll talk about Herbalife when I want to, not when you ask me. I’m never going on a show with you again, that’s for damn sure. Let’s start with what I want to say. Ackman is a liar.”

Icahn on Another Ackman Rampage: “I will tell you something. As far as I’m concerned, he wanted to have dinner with me and I laughed. I couldn’t figure out if he was the most sanctimonious guy or the most arrogant… the guy takes inordinate risk…I don’t have an investment with Ackman. I wouldn’t have one if you paid me, if Ackman paid me to do it… I made a huge mistake getting involved with him…After he won [the lawsuit], he planted some article in the New York Times pounding his chest telling the world how great he was. You know, as far as I’m concerned the guy is a major loser.”

New CNBC Revenue Stream?

There hasn’t been this much fireworks since Professor Jeremy Siegel took Bill Gross to task on the Pimco Boss’s assessment that the “cult of equity is dying” last July. In retrospect, that minor tiff was child’s play relative to the Icahn vs. Ackman battle. With CNBC viewership down from pre-crisis levels, the network may strongly consider instituting a new pay-per-view revenue stream dedicated to battles between opposing investment enemies. I will even offer up my services to verbally smack down some of the enemies I’ve written about previously. If my phones don’t ring, then I can always offer up my American Investment Idol concept in which I can play Simon Cowell.

This may or may not be the last round of the Carl Icahn and Bill Ackman fight, but the ultimate bragging rights may depend on the ultimate outcome of Ackman’s Herbalife short. If Icahn makes a tender offer for Herbalife, I will anxiously wait for CNBC’s Scott Wapner to invite Carl back on the show. I can hardly wait…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in HLF, MBI, NYT, Hallwood Realty, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Risk of “Double-Rip” on the Rise

Okay, you heard it here first. I’m officially anointing my first new 2013 economic term of the year: “Double-Rip!” No, the biggest risk of 2013 is not a “double-dip” (the risk of the economy falling back into recession), but instead, the larger risk is of a double-rip – a sustained expansion of GDP after multiple quarters of recovery. I know, this sounds like heresy, given we’ve had to listen to perma-bears like Nouriel Roubini, Peter Schiff, John Mauldin, Mohamed El-Erian, Bill Gross, et al shovel their consistently wrong pessimism for the last 14 quarters. However, those readers who have followed me for the last four years of this bull market know where I’ve stood relative to these unwavering doomsday-ers. Rather than endlessly rehash the erroneous gospel spewed by this cautious clan, you can decide for yourself how accurate they’ve been by reviewing the links below and named links above:

Roubini calling for double-dip in 2012

Roubini calling for double-dip in 2011

Roubini calling for double-dip in 2010

Roubini calling for double-dip in 2009

If we switch from past to present, Bill Gross has already dug himself into a deep hole just two weeks into the year by tweeting equity markets will return less than 5% in 2013. Hmmm, I wonder if he’d predict the same thing now that the market is up about +4.5% during the first 18 days of the year?

Why Double-Rip Over Double-Dip?

How can stocks rip if economic growth is so sluggish? If forced to equate our private sector to a car, opinions would vary widely. We could probably agree the U.S. economy is no Ferrari. Faster growing countries like China, which recently reported 4th quarter growth of +7.9% (up from +7.4% in 3rd quarter), have lapped us complacent, right-lane driving Americans in recent years. But speed alone should not be investors’ only key objective. If speed was the number one priority, the only places investors would be placing their money would be in countries like Rwanda, Turkmenistan, and Libya (see Business Insider article). However, freedom, rule of law, and entrepreneurial spirit are other important investment factors to be considered. The U.S. market is more like a Toyota Camry – not very flashy, but it will reliably get you from point A to point B in an efficient and safe manner.

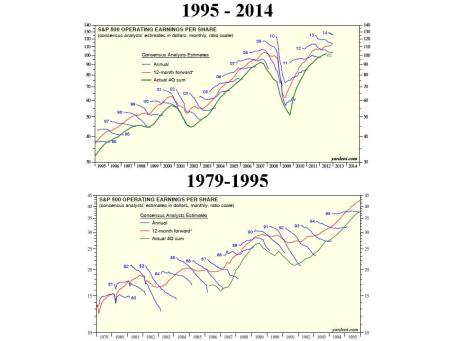

Beyond lackluster economic growth, corporate profit growth has slowed remarkably. In fact, with about 10% of the S&P 500 index companies reporting 4th quarter earnings thus far, earnings growth is expected to rise a measly 2.5% from a year ago (from a previous estimate of 3.0% growth). With this being the case, how can stock prices go up? Shrewd investors understand the stock market is a discounting mechanism of future fundamentals, and therefore stocks will move in advance of future growth. It makes sense that before a turn in the economy, the brakes will often be activated before accelerating into another fast moving straight-away.

In addition, valuation acts like shock absorbers. With generational low interest rates and a below-average forward 12-month P/E (Price-Earnings) ratio of 13x’s, this stock market car can absorb a significant amount of fundamental challenges. The oft quoted message that “In the short run, the market is a voting machine but in the long run it is a weighing machine,” from value icon Benjamin Graham holds as true today as it did a century ago. The recent market advance may be attributed to the voters, but long-term movements are ultimately tied to the sustainable scales of sales, earnings, and cash flows.

If that’s the case, how can someone be optimistic in the face of the slowing growth challenges of this year? What 2013 will not have is the drag of election uncertainty, the fiscal cliff, Superstorm Sandy, and an end-of-the-world Mayan calendar concern. This is setting the stage for improved fundamentals as we progress deeper into the year. Certainly there will be other puts and takes, but the absence of these factors should provide some wind under the economy’s sails.

What’s more, history shows us that indeed stock prices can go up quite dramatically (more than +325% during the 1990s) when consensus earnings forecasts continually get trimmed. We have seen this same dynamic since mid-2012 – earnings forecasts have come down and stock prices have gone up. Strategist Ed Yardeni captures this point beautifully in a recent post on his Dr. Ed’s Blog (see charts below).

What Will Make Me Bearish?

Am I a perma-bull, incessantly wearing rose-colored glasses that I refuse to take off? I’ll let you come to your own conclusion. When I see a combination of the following, I will become bearish:

#1. I see the trillions of dollars parked in near-0% cash start coming outside to play.

#2. See Pimco’s Bill Gross and Mohammed El-Erian on CNBC fewer than 10 times per week.

#3. See money flow stop flooding into sub-3% bonds (Scott Grannis) and actually reverse.

#4. Observe a sustained reversal in hemorrhaging of equity investments (Scott Grannis).

#5. Yield curve flattens dramatically or inverts.

#6. Nouriel and his bear buds become bullish and call for a “triple-rip” turn in the equity markets.

#7. Smarter, more-experienced investors than I, á la Warren Buffett, become more cautious. I arrogantly believe that will occur in conjunction with some of the previously listed items.

Despite my firm beliefs, it is evident the bears won’t go down without a fight. If you are getting tired of drinking the double-dip Kool-Aid, then perhaps it’s time to expand your bullish horizons. If not, just wait 12 months after a market rally, and buy yourself a fresh copy of the Merriam-Webster dictionary. There you can locate and learn about a new definition…double-rip!

Read Also: Double-Dip Guesses are “Probably Wrong”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in Fiat, Toyota, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fence-Sitting: The Elusive Art of More Data and Pullbacks

The world of financial markets is full of fence-sitters, especially in the professional realm. Why? Well, for starters, fence-sitting provides the luxury of never being wrong. If fence-squatting observers do nothing and provide no opinions, then they cannot by definition be wrong or mistaken. Why should a professional put their neck out for an economic, sector, or investment specific forecast, if there is a potential of looking stupid or losing a job?

For many, the consequences of possibly being wrong feel so horrendous that participants choose instead to sit on the non-committal fence. In most cases, the fence posts on any financial issue or investment align along the comfort of consensus thinking. Unfortunately, consensus thinking has a limited shelf life, because the views held by the majority are constantly changing. Repeatedly modifying personal opinions to match consensus views may prevent the bruising of egos, however, this naïve strategy can be destructive to long-term returns. Here are a few examples:

2000

Consensus View: New Normal tech stocks will continue explosive growth; Consensus Outcome: Wrong; Investor Net Result: Losses and/or Lost Profits.

2006

Consensus View: Home prices will rise forever and leverage is beautiful; Consensus Outcome: Wrong; Investor Net Result: Losses and/or Lost Profits.

2010

Consensus View: Greece and European collapse to cause a double-dip global recession; Consensus Outcome: Wrong; Investor Net Result: Losses and/or Lost Profits.

2011

Consensus View: U.S. credit downgrade will be bad for Treasuries and rates; Consensus Outcome: Wrong; Investor Net Result: Losses and/or Lost Profits.

2012

Consensus View: Uncertainty surrounding election bad for equities; Consensus Outcome: Wrong; Investor Net Result: Losses and/or Lost Profits.

2012

Consensus View: China’s slowing growth and real estate bubble expected to cause a global double-dip recession; Consensus Outcome: Wrong; Investor Net Result: Losses and/or Lost Profits.

2012

Consensus View: Impending fiscal cliff bad for equities; Consensus Outcome: Wrong; Investor Net Result: Losses and/or Lost Profits.

2013

Consensus View: Debt ceiling debate bad for equities; Consensus Outcome: ???; Investor Net Result: ???.

2013

Consensus View: Looming sequestration bad for equities; Consensus Outcome: ???; Investor Net Result: ???.

In recent years the market has continued to climb a wall of worry, but will this year be different? We shall soon see.

Placing the concern du jour aside, if consensus fears coalesce around a specific upcoming event, chances are that particular issue is already factored into existing expectations and price structures. Therefore, rather than wasting personal “worry” bandwidth on those fears, investor anxiety should be dedicated to less prevalent but potentially more impactful unknown concerns. Or if you need clarification about the unknowns to worry about, perhaps Donald Rumsfeld can clarify the situation by highlighting the risk of “unknown unknowns”:

I Love Data and Pullbacks!

When faced with apprehension or uncertainty, many fence-sitting investors revert to wanting more data or waiting for a better price. For example, I often hear, “I love stock XYZ, but I want to wait for the earnings to come out,” or analyst day, or share buyback announcement, or merger closing, or restructuring, etc., etc., etc. For strategists and economists, they are famished for the next critically irrelevant weekly jobless claims number, Federal Reserve policy minutes, ISM monthly manufacturing data, or latest consumer confidence figure.

More data for fence sitters is not sufficient. I often listen to stock-pickers say, “I love XYZ stock, but not at the current $52.50 price, but I’ll back up the truck at $51.50!” Okay, so you’re telling me that you think the stock is worth +40% more, but you want to litigate the purchase price over $1?!

Sadly, there is a cost for all this fence-sitting: a) if good news comes out, investment prices catapult higher and the investor is stuck with a pricier investment; b) if bad news comes out, that long-awaited price pullback is usually not acted upon because fundamentals have now deteriorated; or c) in many cases the price grinds higher before the long-awaited jewel of information is disseminated. The net result is further fence-sitting paralysis, which paradoxically is not helped by more information or a price pullback.

The other reason fence-sitters say or do nothing is because articulating a gloomy thesis simply sounds smarter. For instance, saying “The reason I’m on the sidelines is because we are in a secular bear market due to the debasement of our currency as a result of inflationary Fed monetary policies,” sounds smarter and more compelling than “Stocks are cheap and are already factoring in a lot of negativity.”

Investing is an unbelievably challenging endeavor, but for those fence-sitters with an insatiable appetite for more data and elusive pullbacks, I humbly point out, there is an infinite amount of information that regenerates itself daily. In addition, there is nothing wrong with having a disciplined valuation process in place, but if your best investment ideas are predicated on a minor pullback, then enjoy watching your returns wither away…as you sit on your cozy fence.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

2012 Party Train Missed Thanks to F.U.D.

Article is an excerpt from previously released Sidoxia Capital Management’s complementary January 2, 2013 newsletter. Subscribe on right side of page.

There was plenty of fear, uncertainty, and doubt (F.U.D.) in 2012, and the gridlock in Washington has been a contributing factor to investors’ angst. As the saying goes, the stock market climbs a “wall of worry” and that was certainly the case this year with the S&P 500 index rising +13.4% (over +15% including dividends), and the Nasdaq index soaring +15.9% before dividends. Short-term investors had ample worries to fret about throughout the year, including a European financial collapse, the presidential elections, fiscal cliff negotiations, and a Mayan doomsday (see this hilarious clip). Despite these fears dominating the daily airwaves and newspaper headlines, long-term investors holding an adequate equity asset allocation jumped on the non-stop 2012 party train.

While Americans were served a full plate of concerns this year, global investors benefited from European Central Bank intervention by Mario Draghi who promised to do “whatever it takes” to save the euro currency (the European dominated EAFE index rose +13.6% in 2012). Growth here in the U.S. slowed as cautious consumers and businesses horded cash, but a rebound in the domestic housing market provided support to the sluggish economic expansion (3rd quarter GDP growth was revised higher to +3.1% vs. 2011).

Now that the presidential elections are over and we achieved a partial fiscal cliff deal, the amount of F.U.D. going into 2013 will diminish, which should provide a tailwind to economic growth and the financial markets. The impending debt ceiling and deficit reduction talks may slow the train down, but if a sufficient resolution can be accomplished, the economic party train can continue chugging along.

Attention: Grab Your Ear Muffs

Economists and strategists will continue to sound smart and be completely wrong about their 2013 predictions (see Strategist Predictions & MacGyver), but that won’t stop average investors from neglecting their long-term investment plans. Investors have commonly overindulged in certain narrow asset classes like overpriced bonds and gold, which both underperformed equities in 2012. Diversification may sound like an overused finance cliché, but the principle is paramount if you are serious about reducing risk, beating inflation, and smoothing out incessant volatility.

2013 New Year’s Resolution: Avoid Personal Fiscal Cliff

With the New Year upon us, just because politicians have financial problems, it doesn’t mean you have to be fiscally irresponsible too. There is no better time than now to make a financial New Year’s resolution to avoid your own personal fiscal cliff. If you are too heavily parked in cash or over-exposed to low-yielding bonds subject to significant interest rate risk, then now is the time to re-evaluate your investment plan.

There is always something to worry about (see also Uncertainty: Love It?), but in order to prevent working into your 80s, a long-term investment plan needs to be implemented, regardless of economic headlines or market volatility. In other words, investors need to replace their short-term microscope for their long-term telescope. By committing to a disciplined fiscal New Year’s resolution, you can earn a ticket on the 2013 party train!

Monthly News Tidbits

The presidential elections dominated the news cycle in November, but there were a whole host of other tidbits occurring over the last thirty-one days. Here are some of the main storylines:

Congress Approves Mini Fiscal Cliff Deal: After months of debate, Congress painfully and reluctantly agreed upon an estimated $600 billion mini fiscal cliff deal that represents the largest tax increase in two decades. Contrary to a $4 trillion “Grand Bargain” deal, this bill amounts to a more modest reduction in the deficit over 10 years. The Senate passed the bill by a margin of 89-8 and the House of Representatives by a spread of 257-167. The fact that any deal got done is somewhat surprising since the gridlock has been especially rampant in the House. As proof of this assertion, one need only point to the chamber’s meager voting activity record – the House has passed the fewest bills in 60 years during its recent term.

Fiscal Cliff Bill Details: Despite the Senate’s convincing voting margin, large numbers of Congressional Democrats and Republicans were unhappy with the bill’s details. The President made good on his campaign promises by securing revenue-raising taxes from wealthy Americans. More specifically, the law contains provisions including a 39.6% rate on earners above $400,000; a 20% capital gains rate increase from 15%; new exemption/deduction limits; an estate tax increase to 40% from 35%; and a measure to help prevent near-term milk price spikes. There are plenty more details, but I will spare your eyeballs and brain from the painful minutiae. If you haven’t had enough partisan politics, no need to worry, you have the debt ceiling debate to look forward to in a few months.

Quantitative Easing Redux (QE4): Federal Reserve Chairman Ben Bernanke helped orchestrate additional monetary policy stimulus via a fourth round of quantitative easing (a.k.a., QE4). As part of this plan, the Fed will vastly expand its $2.8 trillion balance sheet in 2013 with additional monthly purchases of $45 billion of long-term Treasuries. By executing this invigorating QE4 bond buying program, the Fed pledges to keep interest rates in the cellar until the unemployment rate falls below 6.5% or inflation rises above 2.5%.

Same-Sex Marriage: The Supreme Court tackled a long-debated social issue and declared it would rule on the legality of a law denying benefits to same-sex couples in 2013.

New Female President: Additional hormones were added to the gender-skewed global pool of testosterone-filled leaders as South Korea elected its first female president, Park Geun-hye.

Global Bank Fined: Another greedy financial institution got caught with its hand in the cookie jar. UBS agreed to cough up a $1.5 billion penalty to the U.S., U.K., and Swiss authorities as part of an agreement to resolve its involvement in the manipulation of the London Interbank Offered Rate (LIBOR) – see also Wall Street Meets Greed Street.

Sandy Hook Distressing Disaster: The gun control debate was reignited when 20-year-old Adam Lanza gunned down 20 children and 7 adults (including his mother) at a Connecticut elementary school – Sandy Hook Elementary. Besides the examination of an assault weapons ban, the government needs to revisit the inadequate awareness and resources devoted to the serious issue of mental illness.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including fixed income ETFs, but at the time of publishing SCM had no direct position in EFA, UBS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

2012 Investing Caffeine Greatest Hits

Between Felix Baumgartner flying through space at the speed of sound and the masses flapping their arms Gangnam style, we all still managed to survive the Mayan apocalyptic end to the world. Investing Caffeine also survived and managed to grow it’s viewership by about +50% from last year.

Thank you to all the readers who inspire me to spew out my random but impassioned thoughts on a somewhat regular basis. Investing Caffeine and Sidoxia Capital Management wish you a healthy, happy, and prosperous New Year in 2013!

Here are some of the most popular Investing Caffeine postings over the year:

Explaining how billions of dollars in stock selling can lead to doubling in stock prices.

2) Uncertainty: Love It or Hate It?

Source: Photobucket

Good investors love ambiguity.

3) USA Inc.: Buy, Hold or Sell?

What would you do if our country was a stock?

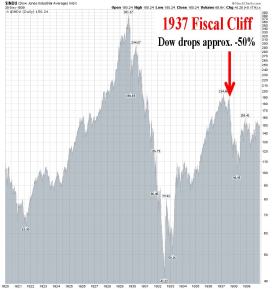

4) Fiscal Cliff: Will a 1937 Repeat = 2013 Dead Meat?

Source: StockCharts.com

Determining whether history will repeat itself after the presidential elections.

5) Robotic Chain Saw Replaces Paul Bunyan

How robots are changing the face of the global job market.

6) Floating Hedge Fund on Ice Thawing Out

Lessons learned from Iceland four years after Lehman Brothers.

7) Sidoxia’s Investor Hall of Fame

Continue reading at IC & perhaps you too can become a member?!

8) Broken Record Repeats Itself

It appears that the cycle from previous years is happening again.

9) The European Dog Ate My Homework

Explaining the tight correlation of European & U.S. markets, and what to do about it.

10) Cash Security Blanket Turns into Tourniquet

Stock market returns are beginning to make change perceptions about holding cash.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Gobbling Up the All-You-Can-Eat Data Buffet

Gorging oneself at an all-you-can eat buffet has its advantages, but managing the associated extra pounds and bloatedness carries its own challenges. In a similar fashion, businesses and consumers are devouring data at an exponential rate, while simultaneously attempting to slice, dice, manage, and store all of this information. Data is quickly becoming as cheap as oxygen, and there are virtually no limitations on the amount consumed.

With the help of my handy smart phone, tablet, and digital camera, I can almost store and watch every moment of my life, very much like the movie The Truman Show. Social media and cloud services, coupled with inexpensive storage, have only made it simpler to digitally archive my life. Pretty soon, with the click of a mouse (or tap of the tablet) everyone will be able to instantaneously access every important moment of their life from cradle to grave.

Consuming Data Bytes at a Time

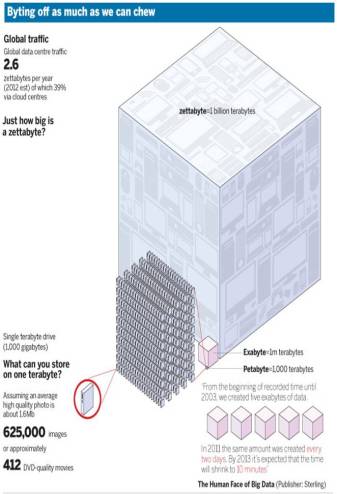

If you are in the mood for consuming free data, there are plenty of free multi-gigabyte services to choose from, including Dropbox, Mozy, and SkyDrive among other. For those chomping on more than 25 gigabytes of data, paid services like Amazon.com’s (AMZN) Simple Storage Service (a.k.a, “S3”) allow users to store a terabyte of data for about $0.01 – $0.05 per month. However, if renting storage is not your gig (no pun intended), you can own your personal storage device for next to nothing. In fact, you can buy a 1 terabyte (equal to 1,000 gigabytes) external hard drive today for less than $70. If that’s too rich for your blood, then just wait 12 months or so and pay $50 bucks. To put a terabyte in context, this amount of storage can hold approximately 625,000 high quality photos or 412 DVD quality movies, according to a Financial Times article talking about “big data.”

A terabyte may sound like a lot, but if we’re going to be honest, this amount of storage is Tiddly Winks. Once we start talking about petabytes (1,000 terabytes), exabytes (1,000,000 terabytes), and zettabytes (1 billion terabytes), things begin to get a little more interesting (see chart below). If you consider that 2012 global data center traffic estimates amount to 2.6 zettabytes (or 2.6 billion terabytes), it doesn’t take long to appreciate the enormity of the data management challenge facing billions of people.

The Financial Times also points out the following:

“From the beginning of recorded time until 2003, we created five exabytes of data. In 2011 the same amount was created every two days. By 2013 it’s expected that the time will shrink to 10 minutes.”

Digital World Driving Data Appetite

What’s driving the global gusher of data growth? There’s not just one answer, but one can start understanding the scope of the issue after contemplating the trillions of annual text messages; 1 billion Facebook (FB) users; 800 million monthly YouTube visitors watching 4 billion hours of videos; six billion cell phones worldwide; and a global 122 million tablet market (IDC).

I certainly wasn’t the first person to discover this megatrend, but I am not hesitating to invest both my client’s money and my money into benefiting from this massive growth trend. Businesses are prospering from the data tidal wave too, as evidenced in part by Oracle Corp’s (ORCL) stellar quarterly earnings results reported just a few days ago. The mass migration of services to the “cloud” (software delivered over the internet) combined with the need to manage and store exploding industry data, resulted in Oracle reporting growth of +18% in its profitable Software License Sales and Cloud Subscriptions segment. With results like these, no wonder Oracle’s founder and CEO Larry Ellison owns a 141-mile square island, a multi-hundred million yacht, and is worth $41 billion according to Forbes (#3 on the Forbes 400 list).

Whether you realize it or not, we are all consuming heaps of all-you-can eat data at the digital buffet. Rather than rolling over into a data consumption coma, you will be much better off figuring out how to profit from the exploding data trends.

See also: The Age of Information Overload

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), GOOG, and AMZN, but at the time of publishing SCM had no direct positions in FB, ORCL, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Betting on Green: Not All Performance is Equal

Not all performance is created equally. Now is the time of year where professional money managers jockey for position before year-end, either with the intent of locking in above-average performance or throwing up a Hail Mary pass in hopes of gaining lost performance ground. Typically, top performing managers are lauded for their eye-popping returns and shrewd investing acumen, when in fact, often these managers have been playing a game of roulette in which a risky, low probability strategy of betting on “green zero” has paid off (a winner about 2.6% of the time).

With tens of thousands hedge fund managers, mutual fund managers, and investment advisors self-reporting their results, even if the performance is accurate, the “Law of Large Numbers” dictates a small percentage will outperform. In other words, short-term luck can often trump long-term skill in the investment world, so investors really need to take a look under the covers to better understand the composition of the results.

Here are some factors contributing to performance distortions and misunderstandings:

Leverage: Adding leverage to your investment strategy is a lot like switching from a bicycle to a motorcycle. The new vehicle may get you to your destination faster, but the risks are lot higher than riding a bike, including death. The same principles apply to investing. A leveraged portfolio may be a fun ride when prices appreciate, but the agony on the downside can be equally painful in reverse. Often, many managers obscure the amount of leverage, and point to absolute returns rather than risk-adjusted returns, which rightfully account for the underlying volatility of the security or investment. To better measure investment performance on an apples-to-apples basis, risk-adjusted ratios such as Sharpe ratios and Treynor ratios should be used.

Concentration/Style Drift: Similarly to playing a game of roulette, putting all your money on black can result in a very handsome payout, but the downside can be just as severe. In the late 1990s growth managers benefited tremendously by concentrating their portfolios into technology stocks because prices appreciated virtually unabated. Many value managers succumbed to style drift by abandoning their value investment mandates and chasing performance. Investors should scrutinize the composition of their portfolios to better comprehend the bets managers are making. Excessive concentration or style drift may lead to a rude awakening.

Benchmark Cherry Picking: Buried in the fine print of an investment prospectus or pitchbook, a performance benchmark, which acts like a measuring stick, can usually be found. The non-standardized game of performance reporting is a lot like a beauty contest in which the investment manager can pick ugly competitors to make themselves look better. Typically a manager compares their performance against the worst performing benchmark or index, and if the benchmark performance improves, a manager can again substitute the old benchmark with a newer, uglier one.

Spaghetti Effect: Another misleading marketing strategy used by many investment firms is what I like to call the “Throwing-Spaghetti-Against-the-Wall” technique, which involves throwing as many strategies at investors as it takes and see what sticks. Famed hedge fund manager John Paulson, who made Herculean profits during the collapse of the subprime crisis, used this strategy in hopes of capitalizing on his sudden fame. The results haven’t been pretty over the last few years as his major funds have massively underperformed and assets have collapsed from about $38 billion at the peak to less than an estimated $20 billion now. Paulson has proved that parlaying one successful bet into many spaghetti throwing strategies (Advantage, Advantage Plus, Partners Fund, Enhanced Fund, Credit Opportunities, and Recovery) can lead to billions in gained assets, albeit shrinking.

Window-Dressing: Portfolio managers are notorious for selling their stinkers and buying the darlings at the end of a quarter, just so they can avoid uncomfortable questions from investors. By analyzing a manager’s portfolio turnover (i.e., the average holding period for a position), an investor can gauge how much shuffling is really going on. Generally speaking, managers performing this value-destroying, smoke and mirrors behavior are doing more harm than good due to all the trading costs and frictions.

While periodically reviewing absolute reported returns is important, more critical than that is analyzing the risk-adjusted returns of a portfolio, so apples-to-apples comparisons can be made. Any and all strategies are bound to underperform for periods of time, but in order to make rational investment decisions investors need to truly understand the underlying strategy and philosophy of the manager(s). Without following all these steps, investors will have better luck putting their money on green.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any Paulson funds or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Uncertainty: Love It or Hate It?

Uncertainty is like a fin you see cutting through the water – many people are uncertain whether the fin sticking out of the water is a great white shark or a dolphin? Uncertainty generates fear, and fear often produces paralysis. This financially unproductive phenomenon has also reared its ugly fin in the investment world, which has led to low-yield apathy, and desensitization to both interest rate and inflation risks.

The mass exodus out of stocks into bonds worked well for the very few that timed an early 2008 exit out of equities, but since early 2009, the performance of stocks has handily trounced bonds (the S&P has outperformed the bond market (BND) by almost 100% since the beginning of March 2009, if you exclude dividends and interest). While the cozy comfort of bonds has suited investors over the last five years, a rude awakening awaits the bond-heavy masses when the uncertain economic clouds surrounding us eventually lift.

The Certainty of Uncertainty

What do we know about uncertainty? Well for starters, we know that uncertainty cannot be avoided. Or as former Secretary of the Treasury Robert Rubin stated so aptly, “Nothing is certain – except uncertainty.”

Why in the world would one of the world’s richest and most successful investors like Warren Buffett embrace uncertainty by imploring investors to “buy fear, and sell greed?” How can Buffett’s statement be valid when the mantra we continually hear spewed over the airwaves is that “investors hate uncertainty and love clarity?” The short answer is that clarity is costly (i.e., investors are forced to pay a cherry price for certainty). Dean Witter, the founder of his namesake brokerage firm in 1924, addressed the issue of certainty in these shrewd comments he made some 78 years ago, right before the end of worst bear market in history:

“Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished.”

Undoubtedly, some investors hate uncertainty, but I think there needs to be a distinction between good investors and bad investors. Don Hays, the strategist at Hays Advisory, straightforwardly notes, “Good investors love uncertainty.”

When everything is clear to everyone, including the novice investing cab driver and hairdresser, like in the late 1990s technology bubble, the actual risk is in fact far greater than the perceived risk. Or as Morgan Housel from Motley Fool sarcastically points out, “Someone remind me when economic uncertainty didn’t exist. 2000? 2007?”

What’s There to Worry About?

I’ve heard financial bears argue a lot of things, but I haven’t heard any make the case there is little uncertainty currently. I’ll let you be the judge by listing these following issues I read and listen to on a daily basis:

- Fiscal cliff induced recession risks

- Syria’s potential use of chemical weapons

- Iran’s destabilizing nuclear program

- North Korean missile tests by questionable new regime

- Potential Greek debt default and exit from the eurozone

- QE3 (Quantitative Easing) and looming inflation and asset bubble(s)

- Higher taxes

- Lower entitlements

- Fear of the collapse in the U.S. dollar’s value

- Rigged Wall Street game

- Excessive Dodd-Frank financial regulation

- Obamacare

- High Frequency Trading / Flash Crash

- Unsustainably growing healthcare costs

- Exploding college tuition rates

- Global warming and superstorms

- Etc.

- Etc.

- Etc.

I could go on for another page or two, but I think you get the gist. While I freely admit there is much less uncertainty than we experienced in the 2008-2009 timeframe, investors’ still remain very cautious. The trillions of dollars hemorrhaging out of stocks into bonds helps make my case fairly clear.

As investors plan for a future entitlement-light world, nobody can confidently count on Social Security and Medicare to help fund our umbrella-drink-filled vacations and senior tour golf outings. Today, the risk of parking your life savings in low-rate wealth destroying investment vehicles should be a major concern for all long-term investors. As I continually remind Investing Caffeine readers, bonds have a place in all portfolios, especially for income dependent retirees. However, any truly diversified portfolio will have exposure to equities, as long as the allocation in the investment plan meshes with the individual’s risk tolerance and liquidity needs.

Given all the uncertain floating fins lurking in the economic background, what would I tell investors to do with their hard-earned money? I simply defer to my pal (figuratively speaking), Warren Buffett, who recently said in a Charlie Rose interview, “Overwhelmingly, for people that can invest over time, equities are the best place to put their money.” For the vast majority of investors who should have an investment time horizon of more than 10 years, that is a question I can answer with certainty.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including BND, but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.