M&A Bankers Away as Elephant Hunters Play

With trillions in cash sitting in CEO and private equity wallets, investment bankers have been chasing mergers & acquisitions with a vengeance. Unfortunately for the bankers, investor skittishness has slowed merger activity in the boardroom. Rather than aggressively stalk corporate prey, bidders look more like deer in headlights. However, animal spirits are not completely dead. Some board members have seen the light and realize the value-destroying characteristics of idle cash in a near-zero interest rate environment, so they have decided to go elephant hunting. During a nine day period alone in the first quarter of 2013, a total of $87.7 billion in elephant deals were announced:

- HJ Heinz Company (HNZ – $27.4 billion) – February 14, 2013 – Bidder: Berkshire Hathaway (BRKA)/ 3G Capital Partners.

- Virgin Media Inc. (VMED – $21.9 billion) – February 6, 2013 – Bidder: Liberty Global Inc. (LBTYA).

- Dell Inc. (DELL – $21.8 billion) – February 5, 2013 – Bidder: Silver Lake Partners LP, Michael Dell, Carl Icahn.

- NBCUniversal Media LLC 49% Stake (GE- $17.6 billion) – February 12, 2013 – Bidder: Comcast Corp. (CMCSA).

These elephant deals helped the overall M&A deal values in the United States increase by +34% in Q1 from a year ago to $167 billion (see Mergermarket report). Unfortunately, the picture doesn’t look so good on a global basis. The overall value for global M&A deals in Q1 registered $418 billion, down -7% from the first quarter of 2012. On a transaction basis, there were a total of 2,621 deals during the first three months of the year, down -20% from 3,262 deals in the comparable period last year.

With central banks across the globe pumping liquidity into the financial system and the U.S. stock market near record highs, one would think buyers would be writing big M&A checks as they wrote poems about rainbows, puppy dogs, and flowers. This is obviously not the case, so why such the sour mood?

The biggest scapegoat right now is Europe. While the U.S. economy appears to be slowly-but-surely plodding along on its economic recovery, Europe continues to dig a deeper recessionary hole. Austerity-driven fiscal policies are hindering growth, and concerns surrounding a Cypriot contagion continue to grab headlines. Although the U.S. dollar value of deals was up substantially in Q1, the number of transactions was down significantly to 703 deals from 925 in Q1-2012 (-24%). Besides buyer nervousness, unfriendly tax policy could have accelerated deals into 2012, and stole business from 2013.

Besides lackluster global M&A volume, the record low EBITDA multiples on private equity exit prices is proof that skepticism on the sustainability of the economic recovery remains uninspired. With exit multiples at a meager level of 8.2x globally, many investors are holding onto their companies longer than they would like.

While merger activity has been a mixed bag, a bright spot in the M&A world has been the action in emerging markets. In 2012, the value of global transactions was essentially flat, yet emerging market deal values were up approximately +9% to $524 billion. This value exceeded the pre-crisis M&A activity level in 2007 by $73 billion, a feat not achieved in the other regions around the globe. Although emerging markets also pulled back in Q1, this region now account for 23% of total global M&A deal values.

Elephant buyout deals in the private equity space (skewed heavily by the Heinz & Dell deals) caused results to surge in this segment during the first quarter. Private equity related buyouts accounted for the highest share of global M&A activity (~21%) since 2007. However, like the overall U.S. M&A market, the number of Q1 transactions in the buyout space (372 transactions) declined to the lowest count in about four years.

Until skepticism turns into confidence, elephant deals will continue to distort results in the M&A sector (Echostar’s [DISH] play for Sprint [S] is further evidence). However, the existence of these giant transactions could be a leading indicator for more activity in the coming quarters. If bankers want to generate more fees, they may consider giving Warren Buffett a call. Here’s what he had to say after the announcement of the Heinz deal:

“I’m ready for another elephant. Please, if you see any walking by, just call me.”

Despite the weak overall M&A activity, the hunters are out there and they have plenty of ammunition (cash).

See also: Mergermarket Monthly M&A Insider Report (April 2013)

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and CMCSA, but at the time of publishing SCM had no direct position in HNZ, BRKA, VMED, LBTYA, DELL, GE, DISH, S or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Central Bank Dog Ate My Homework

It’s been a painful four years for the bears, including Peter Schiff, Nouriel Roubini, John Mauldin, Jimmy Rogers, and let’s not forget David Rosenberg, among others. Rosenberg was recently on CNBC attempting to clarify his evolving bearish view by explaining how central banks around the globe have eaten his forecasting homework. In other words, Ben Bernanke is getting blamed for launching the stock market into the stratosphere thanks to his quantitative easing magic. According to Rosenberg, and the other world-enders, death and destruction would have prevailed without all the money printing.

In reality, the S&P 500 has climbed over +140% and is setting all-time record highs since the market bottomed in early 2009. Despite the large volume of erroneous predictions by Rosenberg and his bear buddies, that development has not slowed the pace of false forecasts. When you’re wrong, one could simply admit defeat, or one could get creative like Rosenberg and bend the truth. As you can tell from my David Rosenberg article from 2010 (Rams Butting Heads), he has been bearish for years calling for outcomes like a double-dip recession; a return to 11% unemployment; and a collapse in the market. So far, none of those predictions have come to fruition (in fact the S&P is up about +40% from that period, if you include dividends). After being incorrect for so long, Rosenberg has switched his mantra to be bullish on pullbacks on selective dividend-paying stocks. When pushed whether he has turned bullish, here’s what Rosenberg had to say,

“So it’s not about is somebody bearish or is somebody bullish or whether you’re agnostic, it’s really about understanding what the principle driver of this market is…it’s the mother of all liquidity-driven rallies that I’ve seen in my lifetime, and it’s continuing.”

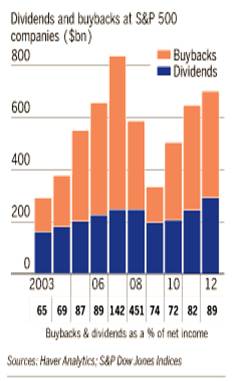

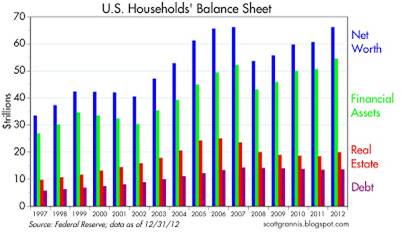

Rosenberg isn’t the only bear blaming central banks for the unexpected rise in equity markets. As mentioned previously, fear and panic have virtually disappeared, but these emotions have matured into skepticism. Record profits, cash balances, and attractive valuations are dismissed as artificial byproducts of a Fed’s monetary Ponzi Scheme. The fact that Japan and other central banks are following Ben Bernanke’s money printing lead only serves to add more fuel to the bears’ proverbial fire.

Speculative bubbles are not easy to identify before-the-fact, however they typically involve a combination of excessive valuations and/or massive amounts of leverage. In hindsight we experienced these dynamics in the technology collapse of the late-1990s (tech companies traded at over 100x’s earnings) and the leverage-induced housing crisis of the mid-2000s ($100s of billions used to speculate on subprime mortgages and real estate).

I’m OK with the argument that there are trillions of dollars being used for speculative buying, but if I understand correctly, the trillions of dollars in global liquidity being injected by central banks across the world is not being used to buy securities in the stock market? Rather, all the artificial, pending-bubble discussions should migrate to the bond market…not the stock market. All credit markets, to some degree, are tied to the trillions of Treasuries and mortgage-backed securities purchased by central banks, yet many pundits (i.e., see El-Erian & Bill Gross) choose to focus on claims of speculative buying in stocks, and not bonds.

While bears point to the Shiller 10 Price-Earnings ratio as evidence of a richly priced stock market, more objective measurements through FactSet (below 10-year average) and Wall Street Journal indicate a forward P/E of around 14. A reasonable figure if you consider the multiples were twice as high in 2000, and interest rates are at a generational low (see also Shiller P/E critique).

The news hasn’t been great, volatility measurements (i.e., VIX) have been signaling complacency, and every man, woman, and child has been waiting for a “pullback” – myself included. The pace of the upward advance we have experienced over the last six months is not sustainable, but when we finally get a price retreat, do not listen to the bears like Rosenberg. Their credibility has been shot, ever since the central bank dog ate their homework.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Organizing Your Investment Basket

With the Easter bunny relaxing after a busy holiday, kids from all over are given the task of organizing the candy and money collected during their hunts. Investors are also constantly reminded that their portfolio eggs should not be solely placed in one basket either. Instead, investors are told to diversify their investments across a whole host of asset classes, geographies, styles, and sizes. In other words, this means investors should be spreading their money across commodity, real estate, international, emerging market, value, growth, small-cap, and large-cap investments. As Jason Zweig, journalist from a the Wall Street Journal points out, much of the diversification benefits can be achieved with relatively small change in the position count of a portfolio:

“As many studies have shown, at least 40% of the variability in returns can be reduced by moving from a single company to 20. Once a portfolio contains 20 or 30 stocks, adding more does little to damp the fluctuations in wealth over time.”

But wait. Going from one banking stock to 20 banking stocks is not going to provide you with the proper diversification you want or need. Rather, what is as important as investing across asset class, geography, style, and size, is to follow the individual stock strategies of guru Peter Lynch. In order to put his performance into perspective, Lynch’s Fidelity Magellan fund averaged +29% per year from 1977 – 1990 – almost doubling the return of the S&P 500 index for that period.

More specifically, to achieve these heroic returns, Lynch divided the stocks in his fund into the following categories:

Slow Growers: This group of stocks wasn’t Lynch’s favorite because these companies typically operate in mature industries with limited expansion opportunities. For these single-digit EPS growers, Lynch focused more on identifying high dividend-paying stocks that were trading at attractive valuations. In particular, he paid attention to a dividend-adjusted PEG ratio (Price-to-Earnings Growth). A utility company would be an example of a “Slow Grower.”

Stalwarts: These are large established companies that still have the ability to achieve +10% to +12% annual earnings growth regardless of the economic cycle. Lynch liked these stocks especially during recessions and downturns. Valuations are still very important for Stalwarts, and many of them pay dividends. An investor may not realize a “home run” with respect to returns, but a +30% to 50% return over a few years is not out of the question, if selected correctly. Former examples of “Stalwarts” include Coca Cola (KO) and Procter & Gamble (PG).

Fast Growers: This categorization applies to small aggressive firms averaging about +20% to +25% annual earnings growth. While “Fast Growers” offer the most price appreciation potential, these stocks also offer the most risk, especially once growth/momentum slows. If timed correctly, as Lynch adeptly achieved, these stocks can increase multi-fold in value. The great thing about these “Fast Growers” is they don’t have to reside in fast growth industries. Lynch actually preferred market share gainers in legacy industries.

Cyclicals: These companies tend to see their sales and profits rise and fall with the overall economic cycle. The hyper-sensitivity to economic fluctuations makes the timing on these stocks extremely tricky, leading to losses and tears – especially if you get in too late or get out too late. To emphasize his point, Lynch states, “Cyclicals are like blackjack: stay in the game too long and it’s bound to take all your profit.” The other mistake inexperienced investors make is mistaking a “Cyclical” company as a “Stalwart” at the peak of a cycle. Examples of cyclical industries include airline, auto, steel, travel, and chemical industries.

Turnarounds: Lynch calls these stocks, “No Growers,” and they primarily of consist of situations like bail-outs, spin-offs, and restructurings. Unlike cyclical stocks, “Turnarounds” are usually least sensitive to the overall market. Even though these stocks are beaten down or depressed, they are enormously risky. Chyrysler, during the 1980s, was an example of a favorable Lynch turnaround.

Asset Plays: Overlooked or underappreciated assets such as real estate, oil reserves, patented drugs, and/or cash on the balance sheet are all examples of “Asset Plays” that Lynch would consider. Patience is paramount with these types of investments because it may take considerable time for the market to recognize such concealed assets.

Worth noting is that not all stocks remain in the same Lynch category. Apple Inc. (AAPL) is an example of a “Fast Grower” that has migrated to “Stalwart” or “Slow Grower” status, therefore items such as valuation and capital deployment (dividends and share buyback) become more important.

Peter Lynch’s heroic track record speaks for itself. Traditional diversification methods of spreading your eggs across various asset class baskets is useful, but this approach can be enhanced by identifying worthy candidates across Lynch’s six specific stock categories. Hunting for these winners is something Lynch and the Easter bunny could both agree upon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and AAPL, but at the time of publishing SCM had no direct position in KO, PG, Chrysler, Fidelity Magellan, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

March Madness Brings Productivity Sadness

You feel that scratchy throat coming on? Taking a long lunch to discuss business? Has there been a death in the family? Don’t feel bad about calling in sick or being unproductive during March Madness, the multi-week annual NCAA college basketball tournament, because you are not alone. According to Challenger, Gray and Christmas, 3.0 million people plan to watch up to three hours of basketball games during work hours, costing companies and the economy at least $134 million in lost wages during the first two days of the tournament. What’s more, March Madness tends to attract other unproductive habits in the form of illegal gambling to the tune of $2.5 billion each year (source: FBI).

While I don’t have the time to spend hours filling out a 64-team bracket, I can’t do all the finger-pointing – I too participate in my fair share of unproductive lollygagging. I’ve been known to throw away hours of my time scrolling through my Twitter news feed (twitter.com/WadeSlome) or paging through my Flipboard timelines. Heck, if you really want to talk about unproductive, the President of the United States even filled out a bracket (click here) – so far, so good, but his Wisconsin pick didn’t help his cause.

If you need more proof of our country’s collective lack of productivity, then consider the following:

- Fantasy Fun: In 2008, there were 35 million people (mostly men) participating in fantasy football at a cost of $6.5 billion over a 17-week NFL season (source: Challenger, Gray and Christmas).

- The Juice: The 1995 O.J. Simpson verdict cost the country $480 million in lost output and the New York Stock Exchange trading volume plummeted by 41% during the half hour surrounding the reading of the verdict (source: Alan Dershowitz’s America on Trial).

- Shop until You Drop: “Cyber Monday” is one of the largest online shopping days of the year, which occurs shortly after Thanksgiving’s “Black Friday”. Workers wasted $488 million of their time in 2007, and that number has undoubtedly increased significantly since then (source: Challenger, Gray and Christmas).

- Summer Sport: In 2012, Captivate Network found out that workers watching the Summer Olympics at the office resulted in a productivity loss of $650 million.

- Hangover Hammer: Super Bowl Sunday is one of the largest alcohol consumption evenings of the year. The U.S. Center for Disease Control estimates that hangovers cost our nation about $160.5 billion annually.

- Social Media Profit Black Hole: Are you addicted to Facebook (FB), Twitter, LinkedIn (LNKD) or other social media network of choice? A report by LearnStuff shows that Americans spend as much time collectively on social media in one day as they do watching online movies in a year. The cost? A whopping 4.4% of GDP or $650 billion.

Investor Madness

One of the biggest black hole productivity drains for investors is the endless deluge of foreboding news items – each story potentially becoming the next domino to collapse the global economy. The most productive use of time is an offensive strategy focused on identifying the best investment opportunities that meet lasting financial objectives. Reading prospectuses, annual reports, and quarterly financial results may not be as sexy as scanning the latest Twitter-worthy headline, but detailed research and questioning goes a long way towards producing superior long-term returns.

On the other hand, news-driven fears that cause investment paralysis can cause irreparable damage. A counter greed-driven performance chasing strategy will lead to tears as well. It’s OK to read the newspaper in order to be informed about long term trends and economic shifts, but as Mark Twain says, “If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.”

While March Madness may not be the most productive time of the year, when your sore throat clears or you get back from that late lunch, it behooves you to become more productive with your investment strategies. Picking the wrong investment players on your portfolio team may turn March Madness into investor sadness.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in FB, LNKD, Twitter, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Damned if You Do, and More Damned if You Don’t

In the stock market you are damned if you do, and more damned if you don’t.

There are a million reasons why the market should or can go down, and the press, media, and bears come out with creative explanations every day. The “Flash Crash,” debt ceiling debate, credit downgrades, elections, and fiscal cliff were all credible events supposed to permanently crater the market. Now we have higher taxes (capital gains, income, and payroll), sequester spending cuts, and a nagging recession in Europe. What’s more, the pessimists point to the unsustainable nature of elevated corporate profit margins, and use the ludicrous Robert Shiller 10-year Price-Earnings ratio as evidence of an expensive market (see also Foggy Rearview Mirror). If an apple sold for $10 ten days ago and $0.50 today, would you say, I am not buying an apple today because the 10-day average price is too high? If you followed Robert Shiller’s thinking, this logic would make sense.

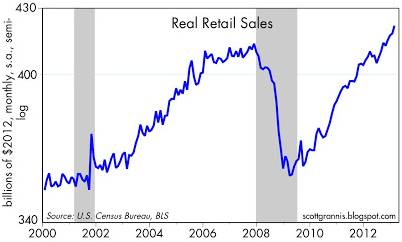

Despite the barrage of daily concerns and excuses, the market continues to set new record highs and the S&P 500 is up by more than +130% since the 2009 lows – just a tad higher than the returns earned on cash, gold, and bonds (please note sarcasm). Cash has trickled into equities for the first few months of 2013 after years of outflows, but average investors have only moved from fear to skepticism (see also Investing with the Sentiment Pendulum ). With cash and bonds earning next to nothing; gold underperforming for years; and inflationary pressures eroding long-term purchasing power, the vice is only squeezing tighter on the worrywarts.

Are there legitimate reasons to worry? Certainly, and the opportunities are not what they used to be a few years ago (see also Missing the Pre-Party). Although an endangered species, long-term investors understand backwards looking economic news is useless. Or as Peter Lynch wisely stated, “If you spend 13 minutes a year on economics, you’ve wasted 10 minutes.” The fact remains that the market is up 70% of the time, on an annual basis, and has been a great place to beat inflation over time. It’s a tempting endeavor to avoid the down markets that occur 30% of the time, but those who try to time the market fail miserably over the long-run (see also Market Timing Treadmill).

Equity investors would be better served by looking at their investment portfolios like real estate. Homeowners implicitly know the value of their home changes on a daily basis, but there are no accurate, real-time quotes to reference your home value on a minute by minute basis, as you can with stocks. Most property owners know that real estate is a cyclical asset class that is not impacted by daily headlines, and if purchased at a reasonable price, will generally go up in value over many years. Unfortunately, for many average investors, equity portfolios are treated more like gambling bets in Vegas, and get continually traded based on gut instincts.

Volatility is at six-year lows, and investors are getting less uncomfortable with owning stocks. Although everybody and their mother has been waiting for a pullback (myself included), don’t get too myopically focused. For the vast majority of investors, who should have more than a ten year time horizon, you should understand that volatility is normal and recessions will cause stocks to gown significantly, twice every ten years on average. If you are a long-term investor, like you should be, and you understand these dynamics, then you will also understand that you will be more damned if you don’t invest in equities as part of a diversified portfolio.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fine Tuning Your Stock Fishing Skills

If you are one of those fishing hobbyists crowded among a large group while hunting for a big fish, mathematics dictates your odds of reeling in a grand prize are significantly diminished. Expert fishermen are generally the first to arrive because they understand once the masses appear the opportunities will disappear. Like big fish, colossal stocks are rarely discovered by a large herd of investors. Financial bubbles occur in this manner, however these periods are usually short-lived and the investor pack often ends up losing more money on the way down relative to the profits earned on the way up. Successful investors are usually the ones following a disciplined systematic approach that is often contrarian in nature. In other words, not chasing performance requires patience, an elusive quality in these fast-paced, frenetic financial markets.

More prevalent in these markets are impulsive day-traders, unruly high frequency traders, and tempestuous hedge funds. Why own stocks, if you can rent them? Like a fisherman who constantly casts his/her bait in and out of the water, a short-sighted investor cannot realize outsized gains, unless the bait is given sufficient time to lure (find) the next winning idea.

Like many professions, experts often optimally mix the quantitative science and behavioral art of their craft. Whether it’s a teacher, doctor, accountant, attorney, or bus driver, the people who excel in their profession are the ones who move beyond the statistical and procedural basics of their trade. Practicing and understanding the nuts and bolts of your job is important, but developing those intangible, artistic skills only comes with experience. Unfortunately, many investing hobbyists don’t appreciate these artistic nuances and as a result go on destroying their portfolios, even though they act as if they were experts.

On the flip-side, decisions purely based on gut instincts will also lead to sub-par outcomes. The fisherman who does not account for the wind, temperature, geography, light, and seasonal differences will be at a distinct disadvantage to those who have studied these scientific factors.

In the fishing world, there is no miracle GPS device that will guide fish onto your hook, and the same is true for stocks. No software package or technical pattern will be a panacea for profits, however having some type of scientific tool to assist in the identification of investment opportunities should be exploited to its fullest. For us at Sidoxia Capital Management (www.Sidoxia.com), our tool is called SHGR (pronounced “SUGAR”), or Sidoxia Holy Grail Ranking. The name was created tongue-in-cheek; however its purpose is crucial. Following a quantitative system like SHGR ensures that a healthy dosage of discipline and objectivity is factored into our investment decisions, so inherent biases do not creep into our process and detract from performance. Specifically, our proprietary SHGR model incorporates multiple factors, including valuation, growth, sentiment indicators, profitability, and other qualitative measurements.

Although we use a “Holy Grail” ranking system, the fact of the matter is there are none in existence – for fishermen or investors. Experience teaches us the best opportunities are found where few are looking, and if proper quantitative tools are integrated into a multi-pronged process, then you will be uniquely positioned to catch a big fish.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and CMCSA, but at the time of publishing SCM had no direct position in BRKB, HNZ, HRL, UL, T, VZ, CAR, ZIP, AMR, LCC, ORCL, APKT, DELL, MSFT, RDSA, Repsol, ODP, OMX, HLF, BUD, STZ, GE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

“Se-Frustration” Medicine Tough to Swallow

Article is an excerpt from previously released Sidoxia Capital Management’s complementary March 1, 2013 newsletter. Subscribe on right side of page.

Over the last few years, the Washington D.C. fear du jour has migrated from debt ceiling to elections and now from fiscal cliff to sequestration. A better term for the $85 billion triggering of automatic spending cuts (sequestration) may be “se-frustration” due to Congress’s annoying inability to agree on a responsible approach to reducing our country’s burdensome debt and deficits. The forced cuts getting crammed down our government’s throat taste like bitter medicine, especially when the economy is limping its way back to a slow recovery (revised 4th quarter GDP growth of a meager +0.1%). Although the $1.2 trillion in cuts over 10 years may gag growth to an intensified slowdown, the good news is that the cuts will assist with the long-term health of the economy – even though most reasonable people agree there are more appropriate medicinal regimens to be offered.

The Se-Frustration / Sequestration Breakdown

As you can see from the pie chart above, the $85 billion in spending cuts (small slivers) associated with the sequester represent a relatively small fraction of our country’s total $3.6 trillion federal budget. More specifically, the expenditure reductions equate to a meager 2.4% of 2013’s total spending tab.How is the $85 billion in painful spending medicine being administered? If Congress continues with this flawed solution, more than half of the cuts (~$43 billion) will come from defense spending (see also Impoverished Global Babysitter). For the balance of the cutbacks, discretionary spending is bearing the largest brunt of the austerity moves (~$29 billion). The main discretionary programs hit include scientific and medical research, national parks, education, food inspections, federal employee pay, law enforcement, grants to state and local governments, and the Head Start pre-school program. Notable exceptions to the reductions include military personnel, and Social Security beneficiaries. To a lesser extent, Medicare dollars will decline by about $10 billion, and a final miscellaneous mandatory program category will drop by approximately $4 billion.

Before you fall to your knees in tears of despair, let’s put this se-frustration into better perspective. While $85 billion sounds like a lot of dough, the fact of the matter is our government is still running a $1 trillion deficit (i.e. spending > tax receipts). Even if we chose to have 10 sequestrations today, our country would still be running a deficit (see chart below):

While the $85 billion in se-frustration pills taste bitter now, this far from ideal medicine will improve our fiscal health nonetheless. The elephant in the room remains our graying Baby Boomer population and associated explosion of Medicare costs, but a little bad medicine is still better than none.

Checkbooks Open as Merger Mania Materialize

Corporations have been flush with trillions in cash over the last five years, but due to the uncertainty surrounding our economic recovery, CEOs (Chief Executive Officers) chose to keep their short arms out of their deep pockets. As we entered 2013 that mindset has begun to change. The inherent drive for companies to grow sales, earnings, and cash flows has finally surpassed the fears of contraction, uncertainty, and recession. How do we know the mindset has changed? One need look no further than the roughly $300 billion in deals announced in the first 60 days of 2013. Here is a partial sample of the higher profile transactions:

-Warren Buffett’s Berkshire Hathaway (BRKB) and private-equity partner 3G Capital agreed to buy ketchup maker H.J. Heinz Company (HNZ) for around $23 billion.

–Dell Inc. (DELL) has offered a private buyout out of the company for $24.4 billion, thanks to a private equity partner and a $2 billion stake from PC partner Microsoft Corp. (MSFT).

–Office Depot Inc. (ODP) offered to buy OfficeMax Inc. (OMX) for $1.3 billion in stock.

–Comcast Corp. (CMCSA) is buying the 49% share of NBCUniversal it doesn’t already own for $16.7 billion from General Electric Co. (GE).

–American Airlines parent AMR Corp. AMR and US Airways Group Inc. (LCC) approved their $11 billion merger.

–Anheuser-Busch InBev (BUD) is in multi-billion dollar discussions to buy Mexican beer brands from Constellation Brands (STZ).

–Oracle Corp. (ORCL) agreed to buy Acme Packet Inc. (APKT) for $2.1 billion.

–Hormel Foods Co. (HRL) closes $700 million Skippy peanut butter acquisition from Unilever PLC (UL).

–AT&T (T) has agreed to acquire 700 MHz B band spectrum from Verizon Communications (VZ) for $1.9 billion.

–Avis Budget Group (CAR) announced acquisition of Zipcar (ZIP) for $500 million.

–Shell-Royal Dutch (RDSA) agreed to buy LNG Assets from Repsol for $6.7 billion, including the assumption of debt.

As you can see, the multi-hundred billion M&A boom of 2013 (mergers and acquisitions) has been on a tear. The fear surrounding executive board rooms has subsided, so the hunger for growth should be strong enough to keep the checkbook out and available for future company purchases.

Cornucopia Corner

Here is a short list from an abundant set of stories over the last month

- Pope Retires: Pope Benedict XVI is resigning his Popemobile and red shoes to focus on reading and prayer. After eight years as an elected pope, the 85-year-old pontiff will be the first pope to resign since Pope Gregory XII, who stepped down in 1415.

- Italian Election Like Messy Meatballs: Inconclusive election results have created a hung parliament with no signals of an imminent resolution. What’s more, former Prime Minister Silvio Berlusconi is currently being investigated over bribery charges, and an Italian blogger/comedian has splintered election results further. One thing is clear, after two years of recession, voters are unhappy and want to reverse the government’s austerity actions.

- When Bernanke Talks, People Listen (Sort Of…): Federal Reserve Chairman Ben Bernanke updated Congress with his semi-annual testimony followed by answers provided to the House Financial Services Committee. I’m not sure what some Fed followers are smoking, but those worried about potential Fed policy changes have not been listening carefully to the Fed chief’s consistent message of accommodative actions. Bernanke explicitly stated monetary stimulus will remain in place until unemployment reaches 6.5% and inflation exceeds 2.5% (neither target has yet been achieved).

- Hedge Fund Managers Duke It Out Over Diet Shakes: Carl Icahn, Chairman of Icahn Enterprises, and junior Bill Ackman, CEO of Pershing Square Capital Management have recently fiercely debated the merits of Herbalife Ltd (HLF). Ackman is short some 20 million shares and Icahn recently reported a 13% stake in Herbalife shares. (see also Herbalife Strife)

- Russian Meteor: About 1,000 people were hurt when a meteor blasted over Russia (See Video).

- North Korea Flexing Nuke Muscles: North Korea conducted its 3rd nuclear test and warned of more to come.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and CMCSA, but at the time of publishing SCM had no direct position in BRKB, HNZ, HRL, UL, T, VZ, CAR, ZIP, AMR, LCC, ORCL, APKT, DELL, MSFT, RDSA, Repsol, ODP, OMX, HLF, BUD, STZ, GE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Monitoring the Tricks Hidden Up Corporate Sleeves

As Warren Buffett correctly states, “If you are in a poker game and after 20 minutes, you don’t know who the patsy is, then you are the patsy.” The same principle applies to investing and financial analysis. If you are unable to determine who is cooking (or warming) the books via deceptive practices, then you will be left holding a bag of losses as tears of regret pour down your face. The name of the stock investing game (not speculation game) is to accurately gauge the financial condition of a company and then to correctly forecast the trajectory of future earnings and cash flows.

Unfortunately for investors, many companies work quite diligently to obscure, hide, and distort the accuracy of their current financial condition. Without the ability of making a proper assessment of a company’s financials, an investor by definition will be unable to value stocks.

There are scores of accounting tricks that companies hide up their sleeves to mislead investors. Many people consider GAAP (Generally Accepted Accounting Principles) as the laws or rules governing financial reporting, but GAAP parameters actually provide companies with extensive latitude in the way accounting reports are implemented. Here are a few of the ways companies exercise their wiggle room in disclosing financial results:

Depreciation Schedules: Related to GAAP accounting, adjustments to longevity estimates by a company’s management team can tremendously impact a company’s reported earnings. For example, if a $10 million manufacturing plant is expected to last 10 years, then the depreciation expense should be $1 million per year ($10m ÷ 10 years). If for some reason the Chief Financial Officer (CFO) suddenly changes his/her mind and decides the building should last 40 years rather than 10 years, then the company’s annual expense would miraculously decrease -75% to $250,000. Voila, an instant $750,000 annual gain created out of thin air! Other depreciation tricks include the choice of accelerated or straight-line depreciation.

Capitalizing Expenses: If you were a management team member with a goal of maximizing current reported profitability, would you be excited to learn that you are not required to report expenses on your income statement? For many the answer is absolutely “yes”. A common example of this phenomenon occurs with companies in the software industry (or other companies with heavy research and development), where research expenses normally recognized on the income statement get converted instead to capitalized assets on the balance sheet. Eventually these capitalized assets get amortized (recognized as expenses) on the income statement. Proponents argue capitalizing expenses better matches future revenues to future expenses, but regardless, this scheme boosts current reported earnings, and delays expense recognition.

Stuffing the Channel: No, this is not a personal problem, but rather occurs when companies force their goods on a distributor or customer – even if the goods (or service) are not requested. This deceitful practice is performed to drive up short-term revenue, even if the reporting company receives no cash for the “stuffing”. Ballooning receivables and substandard cash flow generation can be a sign of this cunning, corporate custom.

Accounts Receivable/Loans: Ballooning receivables is a potential sign of juiced reported revenues and profits, but there are more nuanced ways of manipulating income. For instance, if management temporarily lowers warranty expenses and product return assumptions, short-term profits can be artificially boosted. In addition, when discussing financial figures for banks, loans can also be considered receivables. As we experienced in the last financial crisis, many banks under-provisioned for future bad loans (i.e. didn’t create enough cash reserves for misled/deadbeat borrowers), thereby overstating the true, underlying, fundamental earnings power of the banks.

Inventories: As it relates to inventories, GAAP accounting allows for FIFO (First-In, First-Out) or LIFO (Last-In, Last-Out) recognition of expenses. Depending on whether prices of inventories are rising or falling, the choice of accounting method could boost reported results.

Pension Assumptions: Most companies like their employees…but not the expenses they have to pay in order to keep them. Employee expenses can become excessively burdensome, especially for those companies offering their employees a defined benefit pension plan. GAAP rules mandate employers to contribute cash to the pension plan (i.e., retirement fund) if the returns earned on the assets (i.e., stocks & bonds) are below previous company assumptions. One temporary fix to an underfunded pension is for companies to assume higher plan returns in the future. For example, if companies raise their return assumptions on plan assets from 5% to a higher rate of 10%, then profits for the company are likely to rise, all else equal.

Non-GAAP (or Pro Forma): Why would companies report Non-GAAP numbers on their financial reports rather than GAAP earnings? The simple answer is that Non-GAAP numbers appear cosmetically higher than GAAP figures, and therefore preferred by companies for investor dissemination purposes.

Merger Magic: Typically when a merger or acquisition takes place, the acquiring company announces a bunch of one-time expenses that they want investors to ignore. Since there are so many moving pieces in a merger, that means there is also more opportunities to use smoke and mirrors. The recent $8.8 billion write-off of Hewlett-Packard’s (HPQ) acquisition of Autonomy is evidence of merger magic performed.

EBITDA (Earnings Before Interest Taxes Depreciation & Amortization): Skeptics, like myself, call this metric “earnings before all expenses.” Or as Charlie Munger says, Warren Buffett’s right-hand man, “Every time you see the word EBITDA, substitute it with the words ‘bulls*it earnings’!”

This is only a short-list of corporate accounting gimmicks used to distort financial results, so for the sake of your investment portfolio, please check for any potential tricks up a company’s sleeve before making an investment.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in HPQ/Autonomy, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Beware: El-Erian & Gross Selling Buicks…Not Chevys

As my grandmother always told me, “Be careful where you get your advice!” Or as renowned Wall Street trader Gerald Loeb once said, “The Buick salesman is not going to tell you a Chevrolet will fit your needs.” In other words, when it comes to investment advice, it is important to realize that opinions and recommendations are often biased and steeped with inherent conflicts of interest. Having worked in the financial industry over several decades, I have effectively seen it all.

However, one unique aspect I have grown accustomed to is the nauseating and fatiguing over-exposure of PIMCO’s dynamic bond duo, CEO Mohamed El-Erian and founder Bill Gross. Over the last four years and 13 consecutive quarters of GDP growth (likely 14 after Q4 revisions), I and fellow CNBC viewers have been forced to endure the incessant talk of the “New Normal” of weak economic growth to infinity. Actual results have turned out quite differently than the duet’s cryptic and verbose predictions, which have piled up over their seemingly non-stop media interview schedule. Despite the doomsday rhetoric from the bond brothers, El-Erian and Gross have witnessed a more than doubling in equity prices, which has soundly trounced the performance of bonds over the last four years.

After being mistaken for such a long period, certainly the PIMCO marketing machine would revise their pessimistic outlook, right? Wrong. In true biased fashion, El-Erian cannot admit defeat. Just this week, El-Erian argues stocks are artificially high due to excessive liquidity pumped into the financial system by central banks (see video below). I’m the first one to admit Federal Reserve Chairman Ben Bernanke is explicitly doing his best to force investors into risky assets, but doesn’t generational low interest rates help bond prices too? Apparently that mathematical fact has escaped El-Erian’s bond script.

El-Erian’s buddy, Bill Gross, can’t help himself from jumping on the stock rain parade either. Just six weeks ago Gross followed the bond-pumping playbook by making another dour prediction that the market would rise less than 5% in 2013. Unfortunately for Gross, his crystal ball has also been a little cloudy of late, with the S&P 500 index already up more than +6.5% this year. Since doomsday outlooks are what keeps the $2 trillion PIMCO machined primed, it’s no surprise we hear about the never-ending gloom. For those keeping score at home, let’s please not forget Bill Gross’s infamously wrong Dow 5,000 prediction (see article).

PIMCO Smoke & Mirrors: Stock Funds with NO Stocks

Just when I thought I had seen it all, I came across PIMCO’s Equity-Related funds. Never in my career have I seen “equity” mutual funds that invest solely in “bonds.” Well, apparently PIMCO has somehow creatively figured out how to create stock funds without investing in stocks. I guess that is one strategy for a bond-centric company of getting into the equity fund market? This is either ingenious or bordering on the line of criminal. I fall into the latter camp. How the SEC allows the world’s largest bond company to deceivingly market billions in bond-filled stock funds to individual investors is beyond me. After innocent people got fleeced by unscrupulous mortgage brokers and greedy lenders, in this Dodd-Frank day and age, I can’t help but wonder how PIMCO is able to solicit a StockPlus Fund that has 0% invested in common stocks. You can judge for yourself by reviewing their equity-related funds on their website (see also chart below):

PIMCO Active Equity Funds Struggle

With more than 99% of PIMCO’s $2 trillion in assets under management locked into bonds, company executives have made a half-hearted effort of getting into the equity markets, even though they’ve enjoyed high-fiving each other during the three-decade-long bond bull market (see Downhill Marathon Machine). In hopes of diversifying their bond-heavy revenue stream, in 2009 they hired the head of the high-profile $700 billion, government TARP program (Neil Kashkari). Subsequently, PIMCO opened its first set of actively managed funds in 2010. Regrettably for PIMCO, the sledding has been quite tough. In 2012, all six actively managed equity funds lagged their benchmarks. Moreover, just a few weeks ago, Kashkari their rock star hire decided to quit and pursue a return to politics.

Mohamed El-Erian and Bill Gross have never been camera shy or bashful about bashing stocks. PIMCO has virtually all their bond eggs in one basket and their leaderless equity division is struggling. What’s more, like some car salesmen, they have had a creative way of describing the facts. If it’s a Chevy or unbiased advice you’re looking for, I recommend you steer clear from Buick salesmen and PIMCO headquarters.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in PIMCO funds, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.