Is the Stock Market Rigged? Yes…In Your Favor

Is the Market Rigged? The short answer is “yes”, but unlike gambling in Las Vegas, investing in the stock market rigs the odds in your favor. How can this be? The market is trading at record highs; the Federal Reserve is artificially inflating stocks with Quantitative easing (QE); there is global turmoil flaring up everywhere; and author Michael Lewis says the stock market is rigged with HFT – High Frequency Traders (see Lewis Sells Flash Boys Snake Oil). I freely admit the headlines have been scary, but scary headlines will always exist. More importantly for investors, they should be more focused on factors like record corporate profits (see Halftime Adjustments); near generationally-low interest rates; and reasonable valuation metrics like the price-earnings (P/E) ratios.

Even if you were to ignore these previously mentioned factors, one can use history as a guide for evidence that stocks are rigged in your favor. In fact, if you look at S&P 500 stock returns from 1928 (before the Great Depression) until today, you will see that stock prices are up +72.1% of the time on average.

If the public won at such a high rate in Las Vegas, the town would be broke and closed, with no sign of pyramids, Eiffel Towers, or 46-story water fountains. There’s a reason Las Vegas casinos collected $23 billion in 2013 – the odds are rigged against the public. Even Shaquille O’Neal would be better served by straying away from Vegas and concentrating on stocks. If Shaq could have improved his 52.7% career free-throw percentage to the 72.1% win rate for stocks, perhaps he would have earned a few more championship rings?

Considering a 72% winning percentage, conceptually a “Buy-and-Hold” strategy sounds pretty compelling. In the current market, I definitely feel this type of strategy could beat most market timing and day trading strategies over time. Even better than this strategy, a “Buy Winners-and-Hold Winners” strategy makes more sense. In other words, when investing, the question shouldn’t revolve around “when” to buy, but rather “what” to buy. At Sidoxia Capital Management we are primarily bottom up investors, so the appreciation potential of any security in our view is largely driven by factors such as valuation, earnings growth, and cash flows. With interest rates near record lows and a scarcity of attractive alternatives, the limited options actually make investing decisions much easier.

Scarcity of Alternatives Makes Investing Easier

U.S. investors moan and complain about our paltry 2.42% yield on the 10-Year Treasury Note, but how appetizing, on a risk-reward basis, does a 2.24% Irish 10-year government bond sound? Yes, this is the same country that needed a $100 billion+ bailout during the financial crisis. Better yet, how does a 1.05% yield or 0.51% yield sound on 10-year government treasury bonds from Germany and Japan, respectively? Moreover, what these minuscule yields don’t factor in is the potentially crippling interest rate risk investors will suffer when (not if) interest rates rise.

Fortunately, Sidoxia’s client portfolios are diversified across a broad range of asset classes. The quantitative results from our proprietary 5,000 SHGR (“Sugar”) security database continue to highlight the significant opportunities in the equities markets, relative to the previously discussed “bubblicious” parts of the fixed income markets. Worth noting, investors need to also remove their myopic blinders centered on U.S. large cap stocks. These companies dominate media channel discussions, however there are no shortage of other great opportunities in the broader investment universe, including such areas as small cap stocks, floating-rate bonds, real estate, commodities, emerging markets, alternative investments, etc.

I don’t mind listening to the bearish equity market calls for stock market collapses due to an inevitable Fed stimulus unwind, mean reverting corporate profit margins, or bubble bursting event in China. Nevertheless, when it comes to investing, there is always something to worry about. While there is always some uncertainty, the best investors love uncertainty because those environments create the most opportunities. Stocks can and eventually will go down, but rather than irresponsibly flailing around in and out of risk-on and risk-off trades to time the market (see Market Timing Treadmill), we will continue to steward our clients’ money into areas where we see the best risk-reward prospects.

For those other investors sitting on the sidelines due to market fears, I commend you for coming to the proper conclusion that stock markets are rigged. Now you just need to understand stocks are rigged for you (not against you)…at least 72% of the time.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold a range of exchange traded fund positions, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Psst…Do You Want to Join the Club?

#2. Don’t waste your time listening to the media.

Like dieting, the framework is simple to understand, but difficult to execute. Theoretically, if you follow Rule #1, you don’t have worry about Rule #2. Unfortunately, many people have no rules or discipline in place, and instead let their emotions drive all investing decisions. When it comes to following the media, Mark Twain stated it best:

“If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.”

It’s fine to be informed, as long as the deluge of data doesn’t enslave you into bad, knee-jerk decision-making. You’ve seen those friends, family members and co-workers who are glued to their cell phones or TVs while insatiably devouring real-time data from CNBC, CNN, or their favorite internet blog. The grinding teeth and sweaty palms should be a dead giveaway that these habits are not healthy for investment account balances or blood pressure.

Thanks to the endless scary headlines and stream of geopolitical turmoil (fear sells), millions of investors have missed out on one of the most staggering bull market rallies in history. More specifically, the S&P 500 index (large capitalization companies) has almost tripled in value from early 2009 (666 to 1,931) and the S&P 600 index (small capitalization companies) almost quadrupled from 181 to 645.

The Challenge

Becoming a member of the Successful Investors Club (SIC) is no easy feat. As I’ve written in the past, the human brain has evolved dramatically over tens of thousands of years, but the troubling, emotionally-driven amygdala tissue mass at the end of the brain stem (a.k.a., “Lizard Brain“) still remains. The “Lizard Brain” automatically produces a genetic flight response to perceived worrisome stimuli surrounding us. In other words, our “Lizard Brain” often interprets excessively sensationalized current events as a threat to our financial security and well-being.

It’s no wonder amateur investors have trouble dealing with the incessantly changing headlines. Yesterday, investors were panicked over the P.I.I.G.S (Portugal, Italy, Ireland, Greece, Spain), the Arab Spring (Tunisia, Egypt, Iran, etc.), and Cyprus. Today, it’s Ukraine, Argentina, Israel, Gaza, Syria, and Iraq. Tomorrow…who knows? It’s bound to be another fiscally irresponsible country, terrorist group, or autocratic leader wreaking havoc upon their people or enemies.

During the pre-internet or pre-smartphone era, the average person couldn’t even find Ukraine, Syria, or the Gaza Strip on a map. Today, we are bombarded 24/7 with frightening stories over these remote regions that have dubious economic impact on the global economy.

Take the Ukraine for example, which if you think about it is a fiscal pimple on the global economy. Ukraine’s troubled $177 billion economy, represents a mere 0.29% of the $76 trillion global GDP. Could an extended or heightened conflict in the region hinder the energy supply to a much larger and significant European region? Certainly, however, Russian President Vladimir Putin doesn’t want the Ukrainian skirmish to blow up out of control. Russia has its own economic problems, and recent U.S. and European sanctions haven’t made Putin’s life any easier. The Russian leader has a vested economic interest to keep its power hungry European customers happy. If not, the U.S.’s new found resurgence in petroleum supplies from fracking will allow our country to happily create jobs and export excess reserves to a newly alienated EU energy buyer.

The Solution

Rather than be hostage to the roller coaster ride of rising and falling economic data points, it’s better to follow the sage advice of investing greats like Peter Lynch, who averaged a +29% return per year from 1977 – 1990.

Here’s what he had to say about news consumption:

“If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.”

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Rather than fret about the direction of the market, at Sidoxia Capital Management we are focused on identifying the best available opportunities, given any prevailing economic environment (positive or negative). We assume the market will go nowhere and invest our client assets (and personal assets) accordingly by focusing on those areas we see providing the most attractive risk-adjusted returns. Investors who try to time the market, fail miserably over the long-run. If timing the market were easy, you would see countless people’s names at the tops of the Forbes billionaire list – regrettably that simply is not the case.

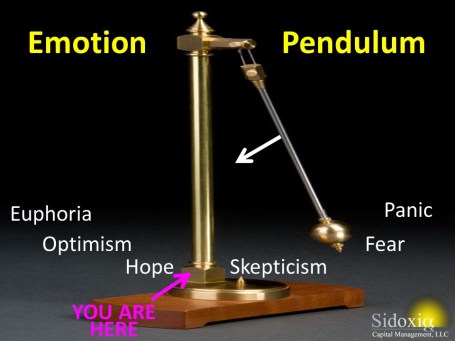

Since “fear” sells in the media world, it’s always important to sift through the deluge of data to gain a balanced perspective. During panic periods, it’s important to find the silver linings. When everyone is euphoric, it’s vital to discover reasons for caution.

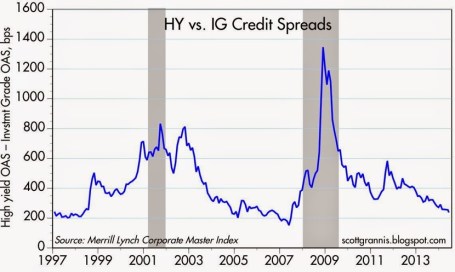

While a significant amount of geopolitical turmoil occurred last month, it’s essential to remember the underlying positive fundamentals propelling the stock market to record highs. The skeptics of the recovery and record stock market point to the Federal Reserve’s unprecedented, multi-trillion dollar money printing scheme (Quantitative Easing – QE) and the inferior quality of the jobs created. Regarding the former point, if QE has been so disastrous, I ask where is the run-away inflation (see chart below)? While the July jobs report may show some wage pressure, you can see we’re still a long ways away from the elevated pricing levels experienced during the 1970s-1980s.

Source: Calafia Beach Pundit

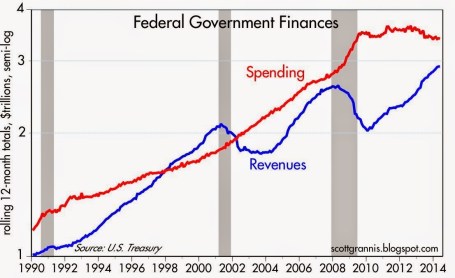

A final point worth contemplating as it relates to the unparalleled Fed Policy actions was highlighted by strategist Scott Grannis. If achieving real economic growth through money printing was so easy, how come Zimbabwe and Argentina haven’t become economic powerhouses? The naysayers also fail to acknowledge that the Fed has already reversed the majority of its stimulative $85 billion monthly bond buying program (currently at $25 billion per month). What’s more, the Federal Open Market Committee has already signaled a rate hike to 1.13% in 2015 and 2.50% in 2016 (see chart below).

Source: Financial Times

The rise in interest rates from generationally low levels, especially given the current status of our improving economy, as evidenced by the recent robust +4.0% Q2-GDP report, is inevitable. It’s not a matter of “if”, but rather a matter of “when”.

On the latter topic of job quality, previously mentioned, I can’t defend the part-time, underemployed nature of the employment picture, nor can I defend the weak job participation rate. In fact, this economic recovery has been the slowest since World War II. With that said, about 10 million private sector jobs have been added since the end of the Great Recession and the unemployment rate has dropped from 10% to 6.1%. However you choose to look at the situation, more paychecks mean more discretionary dollars in the wallets and purses of U.S. workers. This reality is important because consumer spending accounts for 70% of our country’s economic activity.

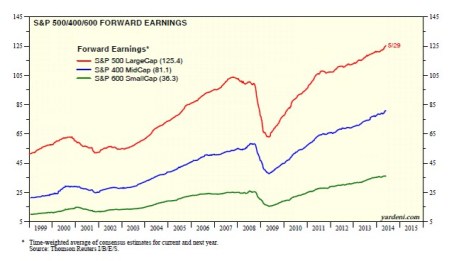

While there is a correlation between jobs, interest rates, and the stock market, less obvious to casual observers is the other major factor that drives stock prices…record corporate profits. That’s precisely what you see in the chart below. Not only are trailing earnings at record levels, but forecasted profits are also at record levels. Contrary to all the hyped QE Fed talk, the record profits have been bolstered by important factors such as record manufacturing, record exports, and soaring oil production …not QE.

Join the Club

Those who have been around the investing block a few times realize how challenging investing is. The deafening information noise instantaneously accessed via the internet has only made the endeavor of investing that much more challenging. But the cause is not completely lost. If you want to join the bull market and the SIC (Successful Investors Club), all you need to do is follow the two top secret rules. Creating a plan and sticking to it, while ignoring the mass media should be easy enough, otherwise find an experienced, independent investment advisor like Sidoxia Capital Management to help you join the club.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds ans securities, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Day Trading Your House

By several measures, this economic recovery has been the slowest, most-challenging expansion since World War II. Offsetting the painfully slow recovery has been a massive bull market in stocks, now hovering near all-time record highs, after about tripling in value since early 2009. Unfortunately, many investors have missed the boat (see Markets Soar – Investors Snore and Gallup Survey) with stock ownership near a 15-year low.

But it’s not too late for the “sideliners” to get in…is it? (see Get out of Stocks!*). Milfred and Buford are asking themselves that same question (see Investor Wake-Up Call). Milfred and Buford are like many other individuals searching for the American Dream and are looking for ways to pad their retirement nest egg. The seasoned couple has been around the block a few times and are somewhat familiar with one get-rich-quick strategy…day trading stocks. Thankfully, they learned that day trading stocks didn’t work out too well once the technology boom music ended in the late 1990s. Here’s what the SEC has to say about day trading on their government site:

Be prepared to suffer severe financial losses. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. Given these outcomes, it’s clear: day traders should only risk money they can afford to lose. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading.

Milfred & Buford Day Trade House

Milfred: “Now, Buford, I know we lost of our IRA retirement money day trading tech stocks, but if technical analysis works and all the financial news shows and talking babies on TV say it will make us a lot of cabbage, maybe we should try day trading our house?”

Buford: “Now I know why I married you 60 years ago – it’s that brilliant mind of yours that complements that sexy figure!”

Veteran readers of Investing Caffeine know I’ve been a skeptic of technical analysis (see Technical Analysis: Astrology or Lob Wedge), but a successful investor has to be open to new ideas, correct? So, if technical analysis works for stocks, then why not for houses? The recovery in housing prices hasn’t been nearly as robust as we’ve seen in stocks, so perhaps there’s more upside in housing. If I can get free stock charting technicals from my brokerage firm or online, there’s no reason I couldn’t access free charting technicals from Zillow (or Trulia) to make my fortunes. Case in point, I think I see a double-bottom and reverse head-and-shoulders pattern on the home price chart of Kim Kardashian’s house:

Of course, day trading isn’t solely dependent on random chart part patterns. Pundits, bloggers, and brokerage firms would also have you believe instant profits are attainable by trading based on the flow of news headlines. This is how Milfred and Buford would make their millions:

Milfred: “Snookums, it’s time for you to pack up all our stuff.”

Buford: “Huh? What are you talking about honey buns?”

Milfred: “Didn’t you see?! The University of Michigan consumer confidence index fell to a level of 81.3 vs. Wall street estimates of 83.0, bringing this measure to a new 4-month low.”

Buford: “I can’t believe I missed that. Nice catch ‘hun’. I’ll start packing, but where will we stay after we sell the house?”

Milfred: “We can hang out at the Motel 6, but it shouldn’t be long. I’m expecting the Philly Fed Manufacturing index to come in above 23 and I also expect a cease fire in Ukraine and Gaza. We can buy a new house then.”

I obviously frame this example very tongue-in-cheek, but buying and selling a house based on squiggly lines and ever-changing news headlines is as ridiculous as it sounds for trading stocks. The basis for any asset purchase or sale should be primarily based on the cash flow dynamics (e.g., rent, dividends, interest, etc., if there are any) of the asset, coupled with the appreciation/depreciation expectations based on a rigorous long-term analysis.

When Day Trading Works

Obviously there are some differences between real estate and stocks (see Stocks & Real Estate), including the practical utility of real estate and other subjective factors (i.e., proximity to family, schools, restaurants, beach, crime rates, etc.). Real estate is also a relatively illiquid and expensive asset to buy or sell compared to stocks. – However, that dynamic is rapidly changing. Like we witness in stocks, technology and the internet is making real estate cheaper and easier to match buyers and sellers.

Does day trading a stock ever work? Sure, even after excluding the factor of luck, having a fundamental information advantage can lead to immediate profits, but one must be careful how they capture the information. Raj Rajaratnam used this strategy but suffered the consequences of his insider trading conviction. Furthermore, the information advantage game can be expensive, as proven by Steven Cohen’s agreement to pay $1.2 billion to settle criminal charges. While I remain a day trading and technical analysis skeptic, I have noted a few instances when I use it.

Whatever your views are on the topics of day trading and technical analysis, do Milfred and Buford a favor by leading by example…invest for the long-term.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds, but at the time of publishing SCM had no direct position in Z, TRLA, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Thrill of the Chase

Men (and arguably women to a lesser extent) enjoy the process of hunting for a mate. Chasing the seemingly unattainable event aligns with man’s innate competitive nature. But the quest for the inaccessible is not solely limited to dating. When it comes to other aspirational categories, humans also want what they cannot have because they revel in a challenge. Whether it’s a desirable job, car, romantic partner, or even an investment, people bask in the pursuit.

For many investment daters and trading speculators, 2008-2009 was a period of massive rejection. Rather than embracing the losses as a new opportunity, many wallowed in cash, CDs, bonds, and/or gold. This strategy felt OK until the massive 5-year bull market went on a persistent, upward tear beginning in 2009. Now, as the relentless bull market has continued to set new all-time record highs, the negative sentiment cycle has slowly shifted in the other direction. Back in 2009, many investors regretted owning stocks and as a result locked in losses by selling at depressed prices. Now, the regret of owning stocks has shifted to remorse for not owning stocks. Missing a +23% annual return for five years, while getting stuck with a paltry 0.25% return in a savings account or 3-4% annual return achieved in bonds, can harm the psyche and make savers bitter.

Greed hasn’t fully set in like we witnessed in the late period of the 1990s tech boom, but nevertheless, some of the previous overly cautious “sideliners” feel compelled to now get into the stock game (see Get Out of Stocks!*) or increase their equity allocation. Like a desperate, testosterone-amped teen chasing a prom date, some speculators are chasing stocks, regardless of the price paid. As I’ve noted before, the overall valuation of the stock market seems quite reasonable (see PE ratio chart in Risk Aversion Declining – S. Grannis), despite selective pockets of froth popping up in areas like biotech stocks, internet companies, and junk bonds.

Even if chasing is a bad general investment practice, in the short-run, chasing stocks (or increasing equity allocations) may work because overall prices of stocks remain about half the price they were at the 2000 bubble peak (see Siegel Bubblicious article). How can stocks be -50% off when stock prices today (S&P 500) are more than +25% higher today than the peak in 2000? Plain and simply, it’s the record earnings (see It’s the Earnings Stupid). In the latest Sidoxia newsletter we highlighted the all-time record corporate profits, which are conveniently excluded from most stock market discussions in the blogosphere and other media outlets.

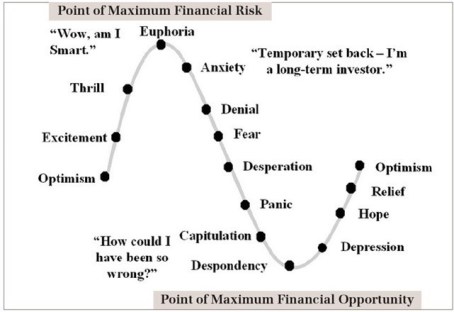

The Investor’s Emotional Roller Coaster (Perceived Risk vs Actual Risk)

The “Thrill of the Chase” is but a single emotion on the roller coaster sentiment spectrum (see Barry Ritholtz chart in Sentiment Cycle of Fear and Greed). The problem with the above chart is many investors confuse actual risk from perceived risk. Many investors perceive the “euphoric” stage of an economic cycle (top of the chart) as low-risk, when in actuality this point reflects peak risk. One can look back to the late 1990s and early 2000 when technology shares were priced at more than 100x years in earnings and every hairdresser, cabdriver and relative were plunging their life savings into stocks. The good news from my vantage point is we are a ways from that euphoric state (asset fund flows and consumer confidence are but a few data points to support this assertion).

The key to reversing the sentiment roller coaster is to follow the thought process of investment greats who learned to avoid euphoria in up markets:

“I’m always more depressed by an overpriced market in which many stocks are hitting new highs every day than by a beaten-down market in a recession.” -Peter Lynch

“Be fearful when others are greedy, and be greedy when others are fearful.” –Warren Buffett

While the “Thrill of the Chase” can seem exciting and a rational strategy at the time, successful long-term investors are better served by remaining objective, unemotional, and numbers-driven. If you don’t have the time, interest, or emotional fortitude to be disciplined, then find an experienced investment manager or advisor to assist you. That will make your emotional roller coaster ride even more thrilling.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sports & Investing: Why Strong Earnings Can Hurt Stock Prices

With the World Cup in full swing and rabid fans rooting for their home teams, one may notice the many similarities between investing in stocks and handicapping in sports betting. For example, investors (bettors) have opposing views on whether a particular stock (team) will go up or down (win or lose), and determine if the valuation (point spread) is reflective of the proper equilibrium (supply & demand). And just like the stock market, virtually anybody off the street can place a sports bet – assuming one is of legal age and in a legal betting jurisdiction.

Soon investors will be poring over data as part of the critical, quarterly earnings ritual. With some unsteady GDP data as of late, all eyes will be focused on this earnings reporting season to reassure market observers the bull advance can maintain its momentum. However, even positive reports may lead to unexpected investor reactions.

So how and why can market prices go down on good news? There are many reasons that short-term price trends can diverge from short-run fundamentals. One major reason for the price-fundamental gap is this key factor: “expectations”. With such a large run-up in the equity markets (up approx. +195% from March 2009) come loftier expectations for both the economy and individual companies. For instance, just because corporate earnings unveiled from companies like Google (GOOG/GOOGL), J.P. Morgan (JPM), and Intel (INTC) exceed Wall Street analyst forecasts does not mean stock prices automatically go up. In many cases a stock price correction occurs due to a large group of investors who expected even stronger profit results (i.e., “good results, but not good enough”). In sports betting lingo, the sports team may have won the game this week, but they did not win by enough points (“cover the spread”).

Some other reasons stock prices move lower on good news:

- Market Direction: Regardless of the underlying trends, if the market is moving lower, in many instances the market dip can overwhelm any positive, stock- specific factors.

- Profit Taking: Many times investors holding a long position will have price targets or levels, if achieved, that will trigger selling whether positive elements are in place or not.

- Interest Rates: Certain valuation techniques (e.g. Discounted Cash Flow and Dividend Discount Model) integrate interest rates into the value calculation. Therefore, a climb in interest rates has the potential of lowering stock prices – even if the dynamics surrounding a particular security are excellent.

- Quality of Earnings: Sometimes producing winning results is not enough (see also Tricks of the Trade article). On occasion, items such as one-time gains, aggressive revenue recognition, and lower than average tax rates assist a company in getting over a profit hurdle. Investors value quality in addition to quantity.

- Outlook: Even if current period results may be strong, on some occasions a company’s outlook regarding future prospects may be worse than expected. A dark or worsening outlook can pressure security prices.

- Politics & Taxes: These factors may prove especially important to the market this year, since this is a mid-term election year. Political and tax policy changes today may have negative impacts on future profits, thereby impacting stock prices.

- Other Exogenous Items: Natural disasters and security attacks are examples of negative shocks that could damage price values, irrespective of fundamentals.

Certainly these previously mentioned issues do not cover the full gamut of explanations for temporary price-fundamental gaps. Moreover, many of these factors could be used in reverse to explain market price increases in the face of weaker than anticipated results.

If you’re traveling to Las Vegas to place a wager on the World Cup, betting on winning favorites like Germany and Argentina may not be enough. If expectations are not met and the hot team wins by less than the point spread, don’t be surprised to see a decline in the value of your bet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, GOOG, and GOOGL, but at the time of publishing had no direct positions in JPM and INTC. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Only Thing to Fear is the Unknown Itself

Martin Luther King, Jr. famously stated, “The only thing we have to fear is fear itself,” but when it comes to the stock market, the only thing to fear is the “unknown.” As much as people like to say, “I saw that crisis coming,” or “I knew the bubble was going to burst,” the reality is these assertions are often embellished, overstated, and/or misplaced.

How many people saw these events coming?

- 1987 – Black Monday

- Iraqi War

- Thai Baht Currency Crisis

- Long-Term Capital Management Collapse & Bailout

- 9/11 Terrorist Attack

- Lehman Brothers Bankruptcy / Bear Stearns Bailout

- Flash Crash

- U.S. Debt Downgrade

- Arab Spring

- Sequestration Cuts

- Cyprus Financial Crisis

- Federal Reserve (QE1, QE2, QE3, Operation Twist, etc.)

Sure, there will always be a prescient few who may actually get it right and profit from their crystal balls, but to assume you are smart enough to predict these events with any consistent accuracy is likely reckless. Even for the smartest and brightest minds, uncertainty and doubt surrounding such mega-events leads to inaction or paralysis. If profiting in advance of these negative outcomes was so easy, you probably would be basking in the sun on your personal private island…and not reading this article.

Coming to grips with the existence of a never-ending series of future negative financial shocks is the price of doing business in the stock market, if you want to become a successful long-term investor. The fact of the matter is with 7 billion people living on a planet orbiting the sun at 67,000 mph, the law of large numbers tells us there will be many unpredictable events caused either by pure chance or poor human decisions. As the great financial crisis of 2008-2009 proved, there will always be populations of stupid or ignorant people who will purposely or inadvertently cause significant damage to economies around the world.

Fortunately, the power of democracy (see Spreading the Seeds of Democracy) and the benefits of capitalism have dramatically increased the standards of living for hundreds of millions of people. Despite horrific outcomes and unthinkable atrocities perpetrated throughout history, global GDP and living standards continue to positively march forward and upward. For example, consider in my limited lifespan, I have seen the introduction of VCRs, microwave ovens, mobile phones, and the internet, while experiencing amazing milestones like the eradication of smallpox, the sequencing of the human genome, and landing space exploration vehicles on Mars, among many other unimaginable achievements.

Despite amazing advancements, many investors are paralyzed into inaction out of fear of a harmful outcome. If I received a penny for every negative prediction I read or heard about over my 20+ years of investing, I would be happily retired. The stock market is never immune from adverse events, but chances are a geopolitical war in Ukraine/Iraq; accelerated Federal Reserve rate tightening; China real estate bubble; Argentinian debt default; or other current, worrisome headline is unlikely to be the cause of the next -20%+ bear market. History shows us that fear of the unknown is more rational than the fear of the known. If you can’t come to grips with fear itself, I fear your long-term results will lead to a scary retirement.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Shiller CAPE Peaches Smell Like BS

If something sounds like BS, looks like BS, and smells like BS, there’s a good chance you’re probably eyeball-deep in BS. In the investment world, I encounter a lot of very intelligent analysis, but at the same time I also continually step into piles of investment BS. One of those piles of BS I repeatedly step into is the CAPE ratio (Cyclically Adjusted Price-to-Earnings) created by Robert Shiller. For those who are not familiar with Shiller, he is a Nobel Prize winner in economics who won the award in 2013 for his work on the “empirical analysis of asset prices.” Shiller vaulted into fame in large part due to the timing of his book, Irrational Exuberance, which was published during the 2000 technology market peak. He gained additional street-credibility in the mid-2000s when he spoke about the bubble developing in the real estate markets.

What is the CAPE?

Besides being a scapegoat for every bear that has missed the tripling of stock prices in the last five years, the CAPE effectively is a simple 10-year average of the P/E ratio for the S&P 500 index. The logic is simple, like many theories in finance and economics, there often are inherent mean-reverting principles that are accepted as rules-of-thumb. It follows that if the current 10-year CAPE is above the 134-year CAPE average, then stocks are expensive and you should avoid them. On the other hand, if the current CAPE were below the long-term CAPE average, then stocks are cheap and you should buy. Here is a chart of the Shiller CAPE:

As you can see from the chart above, the current CAPE ratio of 26x is well above the 134-year average of 16x, which according to CAPE disciples makes the stock market very expensive. Or as a recent Business Insider article stated, the Shiller CAPE is “higher than at any point in the 20th century with the exception of the peaks of 1929 and 2000 – you know what happened after those.”

Problems Behind the Broken CAPE Tool

There are many problems with Shiller’s CAPE analysis, but let’s start with the basics by first asking, how useful has this tool actually been over the last, 10, 20, or 30 years? The short answer…not very. For example, if investors followed the implicit recommendation of the CAPE for the periods when Shiller’s model showed stocks as expensive (see above chart 1990 – 2014), they would have missed a more than quintupling (+469% ex-dividends) in the S&P 500 index. Over a shorter timeframe (2009 – 2014) the S&P 500 is up +114% ex-dividends (+190% since March 2009).

Even if you purchased at the worst time at the peak of the stock market in 2000 when the CAPE was 44 (S&P 500 – 1553), an investor would still have earned a total return of about +45% from 2000 – 2014, despite the CAPE still being 63% higher (more expensive) than the 134-year CAPE average of 16.

Peaches for $.25 Post-Bubble?

To illustrate a point, let’s assume you are a peach lover and due to a bubble in peach demand, prices spiked to an elevated level of $2.60 per pound for 9 years, but in year 10 the price plummeted to $.25 per pound today (see chart below). Assuming the 134-year average for peach prices was $1.60 per pound, would you still want to purchase your beloved peaches for the fire sale price of $.25 per pound? Common sense tells you $.25/lb. is a bargain, but if you asked the same question to Robert Shiller, he would say absolutely “NO”! The 10-year Peach CAPE ratio would be $2.37 ([9 yrs X $2.60] + [1 yr X $.25]) #1, but since the 10-year CAPE is greater than the LT-Average peach price of $1.60 per pound #2, Shiller would say peaches are too expensive, even though you could go to Kroger (KR) and buy a pound of peaches today for $0.25 #3.

This complete neglect of current market prices in the calculation of CAPE makes absolutely no sense, but this same dynamic of ignoring current pricing reality is happening today in the stock market. Effectively what’s occurring is the higher P/E ratios experienced over the last 10 years are distorting the Shiller CAPE ratio, thereby masking the true current value of stocks. In other words the current CAPE of 26x vastly exaggerates the pricey-ness of the actual S&P 500 P/E ratio of 16x for 2014 and 14x for 2015.

There are plenty of other holes to poke into CAPE, but the last major component of Shiller’s ratio I want to address is interest rates. Even if you disregard my previous negative arguments against Shiller’s CAPE, should anyone be surprised that the ratio troughed in the early 1980s of 7x when long-term interest rates peaked. If I could earn 18% on a CD with little risk in 1981, not many people should be dumbfounded that demand for risky stocks was paltry. Today, the reverse environment is in place – interest rates are near record lows. It should therefore come as no surprise, that all else equal, a higher P/E (and CAPE) is deserved when interest rates are this low. Nevertheless, this discussion of P/E and CAPE rarely integrates the critical factor of interest rates.

While I have spent a decent amount of time trashing the CAPE-BS ratio, I want to give my pal Bob Shiller a fair shake. I can do this by looking into a mirror and admitting there are periods when the CAPE ratio can actually work. Although the CAPE is effectively useless during long, multi-year upward and downward trending markets (think bubbles & depressions), the CAPE makes perfect sense in sideway, trendless markets (see chart below).

The investing public is always looking for a Holy Grail financial indicator that will magically guide them to riches in both up and down markets. Despite the popularity of Shiller’s CAPE ratio, regrettably no one perfect indicator exists. So before you jump on the bandwagon and chase the hot indicator du jour, make sure to look down and make sure you haven’t stepped in any Shiller CAPE-BS.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds, but at the time of publishing SCM had no direct position in KR, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Get Out of Stocks!*

Get out of stocks!* Why the asterisk mark (*)? The short answer is there is a certain population of people who are looking at alluring record equity prices, but are better off not touching stocks – I like to call these individuals the “sideliners”. The sideliners are a group of investors who may have owned stocks during the 2006-2008 timeframe, but due to the subsequent recession, capitulated out of stocks into gold, cash, and/or bonds.

The risk for the sideliners getting back into stocks now is straightforward. Sideliners have a history of being too emotional (see Controlling the Investment Lizard Brain), which leads to disastrous financial decisions. So, even if stocks outperform in the coming months and years, the sideliners will most likely be slow in getting back in, and wrongfully knee-jerk sell at the hint of an accelerated taper, rate-hike, or geopolitical sneeze. Rather than chase a stock market at all-time record highs, the sideliners would be better served by clipping coupons, saving, and/or finish that bunker digging project.

The fact is, if you can’t stomach a -20% decline in the stock market, you shouldn’t be investing in stocks. In a recent presentation, Barry Ritholtz, editor of The Big Picture and CIO of Ritholtz Wealth Management, beautifully displayed the 20 times over the last 85 years that the stocks have declined -20% or more (see chart below). This equates to a large decline every four or so years.

Strategist Dr. Ed Yardeni hammers home a similar point over a shorter duration (2008-2014) by also highlighting the inherent volatility of stocks (see chart below).

Stated differently, if you can’t handle the heat in the stock kitchen, it’s probably best to keep out.

It’s a Balancing Act

For the rest of us, the vast majority of investors, the question should not be whether to get out of stocks, it should revolve around what percentage of your portfolio allocation should remain in stocks. Despite record low yields and record high bond prices (see Bubblicious Bonds and Weak Competition, it is perfectly rational for a Baby-Boomer or retiree to periodically ring their stock-profit cash register, and reallocate more dollars toward bonds. Even if you forget about the 30%+ stock return achieved last year and the ~6% return this year, becoming more conservative in (or near) retirement with a larger bond allocation still makes sense. For some of our clients, buying and holding individual bonds until maturity reduces the risky outcome associated with a potential of interest rates spiking.

With all of that said, our current stance at Sidoxia doesn’t mean stocks don’t offer good value today (see Buy in May). For those readers who have followed Investing Caffeine for a while, they will understand I have been relatively sanguine about the prospects of equities for some time, even through a host of scary periods. Whether it was my attack of bears Peter Schiff, Nouriel Roubini, or John Mauldin in 2009-2010, or optimistic articles written during the summer crash of 2011 when the S&P 500 index declined -22% (see Stocks Get No Respect or Rubber Band Stretching), our positioning did not waver. However, as stock values have virtually tripled in value from the 2009 lows, more recently I have consistently stated the game has gotten a lot tougher with the low-hanging fruit having already been picked (earnings have recovered from the recession and P/E multiples have expanded). In other words, the trajectory of the last five years is unsustainable.

Fortunately for us, at Sidoxia we’re not hostage to the upward or downward direction of a narrow universe of large cap U.S. domestic stock market indices. We can scour the globe across geographies and capital structure. What does that mean? That means we are investing client assets (and my personal assets) into innovative companies covering various growth themes (robotics, alternative energy, mobile devices, nanotechnology, oil sands, electric cars, medical devices, e-commerce, 3-D printing, smart grid, obesity, globalization, and others) along with various other asset classes and capital structures, including real estate, MLPs, municipal bonds, commodities, emerging markets, high-yield, preferred securities, convertible bonds, private equity, floating rate bonds, and TIPs as well. Therefore, if various markets are imploding, we have the nimble ability to mitigate or avoid that volatility by identifying appropriate individual companies and alternative asset classes.

Irrespective of my shaky short-term forecasting abilities, I am confident people will continue to ask me my opinion about the direction of the stock market. My best advice remains to get out of stocks*…for the “sideliners”. However, the asterisk still signifies there are plenty of opportunities for attractive returns to be had for the rest of us investors, as long as you can stomach the inevitable volatility.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.