Marathon Market Gets a Cramp

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2015). Subscribe on the right side of the page for the complete text.

“Anyone can run a hundred meters, it’s the next forty-two thousand and two hundred that count.”

Investing is a lot like running a marathon…but it’s not a sprint to the retirement finish line. The satisfaction of achieving your long-term goal can be quite rewarding, but attaining ambitious objectives does not happen overnight. Along the hilly and winding course, there can be plenty of bumps and bruises mixed in with the elation of a runner’s high. While stocks have been running at a record pace in recent years, prices have cramped up recently as evidenced by the -2.6% decline of the S&P 500 stock index last month.

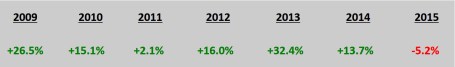

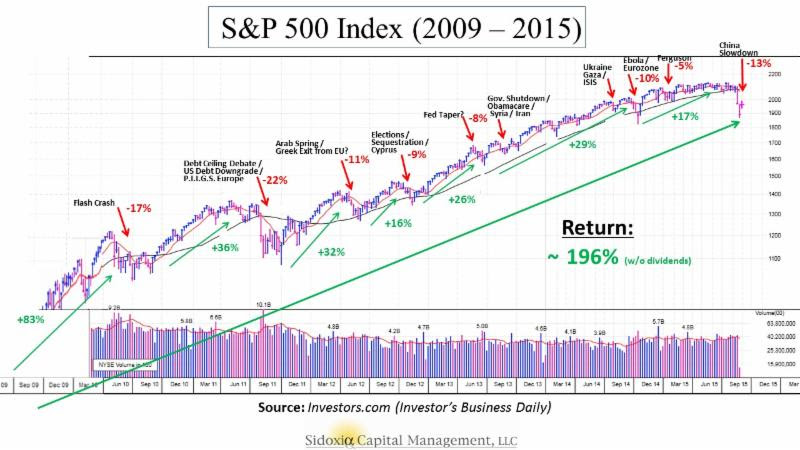

But the recent correction should be placed in the proper perspective as you approach and reach retirement. Since the end of the 2008 Financial Crisis the stock market has been racing ahead at a brisk rate, as you can see from the total return performance below (excluding 2015):

This performance is more indicative of a triumph than a catastrophe, but if you turned on the TV, listened to the radio, or surfed the web, you may come to a more frightening conclusion.

What’s behind the recent dip? These are some of the key concerns driving the recent price volatility:

- China: Slowing growth in China and collapse in Chinese stock market. China is suffering from a self-induced slowdown designed to mitigate corruption, prick the real estate bubble, and shift its export-driven economy to a more consumer-driven economy. These steps diminish short-term growth (albeit faster than U.S. growth), but nevertheless the measures should be constructive for longer-term growth.

- Interest Rates: Uncertainty surrounding the timing of a 0.25% target interest rate increase by the Federal Reserve. The move from 0% to 0.25% is like walking from the hardwood floor onto the rug…hardly noticeable. The inevitable move by the Fed has been widely communicated for months, and given where interest rates are today, the move will have a negligible impact on corporate borrowing costs. Like removing a Band-Aid, the initial action may cause some pain, but should be comfortably received shortly thereafter.

- Politics: Potential government shutdown / sequestration. The epic political saga will never end, however, as I highlighted in “Who Said Gridlock is Bad?,” political discourse in Washington has resulted in positive outcomes as it relates to our country’s fiscal situation (limited government spending and declining deficits). The government shutdown appears to have been averted for now, but it looks like we will be blanketed with brinkmanship nonsense again in a few months.

- Biotech/Pharmaceuticals: Politics over lofty drug prices and the potential impact of future regulation on the biotech sector. Given the current Congressional balance of power, any heavy-handed Democratic proposals is likely to face rigorous Republican opposition.

- Emerging Markets: Emerging market weakness, especially in Latin America (e.g., Brazil). These developments deserve close monitoring, but the growth in the three largest economic regions (U.S., Europe, and China) will have a much larger effect on the direction of global economic expansion.

- Middle East: Destabilized Middle East and Syria. Terrorist extremism and cultural animosity between various Middle East populations has existed for generations. There will be no silver bullet for a peaceful solution, so baby steps and containment are critical to maintain healthy global trade activity with minimal disruptions.

Worth noting, this current list of anxieties itemized above is completely different from six months ago (remember the Greece crisis?), and the list will change again six months into the future. Investing, like any competitive challenge, does not come easy…there is always something to worry about in the land of economics and geopolitics.

Here’s what the world’s top investor Warren Buffett said a few decades ago (1994) on the topic of politics and economics:

“We will continue to ignore political and economic forecasts which are an expensive distraction for investors and businessmen. Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%.”

In a world of 7.3 billion people and 196 countries there will never be a shortage of fear, uncertainty, and doubt (F.U.D.) – see events chart in The Bungee Market. In an ever-increasing, globally connected world, technology and the media continually amplify molehills into mountains, thereby making the next imagined Armageddon a simple click of a mouse or swipe of a smartphone away.

Today’s concerns are valid but in the vast majority of cases the issues are completely overblown, sensationalized and over-emphasized without context. Context is an integral part to investing, but unfortunately context usually cannot be explained in a short soundbite or headline. On the flip side, F.U.D. thrives in the realm of soundbites and headlines.

While investors may feel fatigued from a strong flow of headline headwinds, financial market race participants should take a break at the water stop to also replenish themselves with a steady tailwind of positive factors, including the following:

- Employment: The unemployment rate has been cut from a recession peak of 10.0% down to 5.1%, and the economy has been adding roughly +200,000 new monthly jobs on a fairly consistent basis. On top of that, there are a record 5.8 million job openings versus 3.7 million two years ago – a sign that the economy continues to hum along.

- Housing/Commercial Real Estate/Mortgage Rates: Housing prices have rebounded by about +30% from the 2012 lows; Housing starts have increased by +25% in the past year and 120% in the past four years; and 30-Year Fixed mortgage interest rates sit at 3.85% – a highly stimulative level within a spitting distance from record lows.

- Auto Sales: Surged to a post-recession record of 17.8 million units in August.

- Interest Rates: Massively stimulative and near generational lows, even if the Fed hikes its interest rate target by 0.25% in October, December or sometime in 2016.

- Capital Goods Orders: Up for three consecutive months.

- Rail Shipments/Truck Tonnage: Both these metrics are rising by about 3-4%.

- Retail Sales: Rising at a very respectable pace of 7% over the last six months.

- Low Energy & Commodity Prices: Inflation has remained largely in check thanks to plummeting commodity prices. Low oil and gas prices are benefiting consumers in numerous ways, including the contribution to car sales, home sales, and/or debt reduction.

While the -10% dip in stock prices from mid-August might feel like a torn knee ligament, long-term investors know -10% corrections historically occur about one-time per year, on average. So, even though you may be begging for a wheelchair, the best course of action is to take a deep breath, stick to your long-term investment plan, rebalance your portfolio if necessary, and continue staying on course towards your financial finish line.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Coast is Clear Until 2019

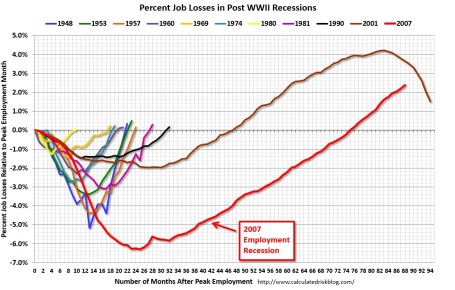

The economic recovery since the Great Financial Crisis of 2008-09 has been widely interpreted as the slowest recovery since World War II. Bill McBride of Calculated Risk captures this phenomenon incredibly well in his historical job loss chart (see red line in chart below):

History tells us that the economy traditionally suffers from an economic recession twice per decade, but we are closing in on seven years since the last recession with little evidence of impending economic doom.

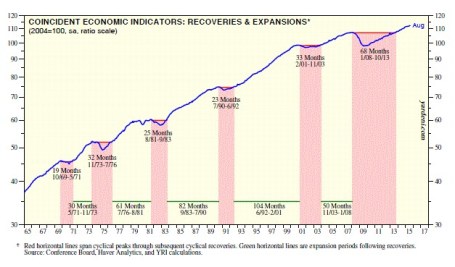

So, are we due for another recession? Logic would dictate that since this recovery has been the slowest in a generation, the duration of this recovery should also be the longest. Strategist Ed Yardeni of Dr. Ed’s Blog uses data from historical economic cycles and CEI statistics (Coincident Economic Indicators) to make the same case. Based on his analysis, Yardeni does not see the next recession arriving until March 2019 (see chart below). If you take a look at the last five previous cycle peaks, recoveries generally last for an additional five and a half years (roughly 65 months). Since the last rebound to a cyclical peak occurred in October 2013, 65 months from then would imply the next downturn would begin in March 2019.

Typically, an economy loses steam and enters a recession after a phase of over-investment, tight labor conditions, and an extended period of tight central bank monetary policies. Over the last seven years, we have experienced quite the opposite. Corporations have been very slow to invest or hire new employees. For those employees hired, many of them are “under-employed” (i.e., working part-time), or in other words, these workers want more work hours. Our country’s slower-than-expected growth has created an output gap. Scott Grannis at Calafia Beach Pundit estimates this gap to approximate $2.8 trillion (see chart below). The CBO expects a smaller gap estimate of about $580 billion to narrow over the next few years. By Grannis’s calculations, there is a reservoir of 5 – 10 million jobs that could be tapped if the economy was operating more efficiently.

Bolstering his argument, Grannis points out that the risk of a recession rises when there are significant capacity constraints and tight money. He sees the opposite happening – an enormous supply of unused capacity remains underutilized as he describes here:

“Today, money is abundant and resources are abundant. Even energy is abundant, because its price has fallen by over 50% in the past year or so. Corporate profits are near record highs, the supply of labor is virtually unconstrained, energy is suddenly cheap, and productive capacity is relatively abundant.”

While new uncertainties have been introduced (e.g., slowing China, potential government shutdown/sequestration, emerging market weakness), the reality remains there is always uncertainty. Even if you truly believe there is more uncertainty today relative to yesterday, the economy has some relatively strong shock absorbers to ride out the volatility.

There are plenty of potentially bad things to worry about, but if it’s a cyclical recession that you are worried about, then why don’t you grab a seat, order a coconut drink with an umbrella, and wait another three and a half years until you reach the circled date of March 2019 on your calendar.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

To Test or Retest?

In Shakespeare’s tragedy Hamlet, the main character Prince Hamlet raises the existential question to himself, “To be, or not to be, that is the question?” With the recent -13% correction in the S&P 500 index, and subsequent mini-rebound, a lot of investors have also been talking to themselves and asking the fundamental question, “To test or retest, that is the question?” The inability of Fed Chairwoman dove, Janet Yellen, to increase the Federal Funds interest rate target by 0.25% after nine years only increased short-term uncertainty.

For investors playing in the stock market, uncertainty and corrections are par for the course. Howard Getson at Capitalogix recently pointed out the following.

Since 1900, on average, we’ve experienced…

- -5% market corrections: 3 times/year.

- -10% market corrections: 1 time/ year.

- -20% market corrections: 1 time/3.5 years.

However, no market correction is the same. Sure it would be nice if, during every bull market, the pain from any -10% correction lasted a second – similar to ripping off a Band-Aid. Unfortunately, when you live through such rapid and violent corrections, as we just did, volatility tends to stick around for a while. And in many instances, any brief rebound in stock prices is met with another downdraft in prices that retests the recent lows in prices.

In the recent correction example, a retest of the lows would mean another -5% drop, on top of Friday’s -2% cut, to a level of 1,867 on the S&P 500 index. This is definitely a realistic probability (see chart below).

Although corrections are quite common, violent corrections are less common. Scott St. Clair, an analyst at MarketSmith, a division of William O’Neil & Co., recently did a study examining the frequency of 10%+ corrections occurring in four days or less across the three major indices (Dow Jones Industrial, S&P 500, and NASDAQ). Before the latest -15% decline in the NASDAQ from August 19th to August 24th, St. Clair only identified drops of -10% or more (in four trading sessions) eight previous times since the Great Depression (six of the eight periods are listed below).

- DJIA May 1940 -26% in eight days

- DJIA May 1962 -16% in 10 days

- S&P 500 Aug 1998 -15% in five days

- S&P 500 July 2002 -25% in 13 days

- S&P 500 October 2008 -33% in 15 days.

- S&P 500 August 2011 -19% in 13 days

Following all these corrections, the market always rebounded, but what St. Clair showed was in many cases stock prices had to retest the previous lows before advancing again.

As Mark Twain said, “History doesn’t repeat itself but it often rhymes,” which explains why this study is a useful historical exercise to prepare investors for potential future downdrafts. With that said, for long-term investors, much of this utility is marginal at best and useless at worst.

If you can’t handle the volatility, you need a more diversified portfolio, or you need to park your money in a savings account or CD and watch it melt away to inflation.

In reviewing corrections, famed growth investor Peter Lynch said it best:

“I can’t recall ever once having seen the name of a market timer on Forbes’ annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think somebody would have made billions by doing it.”

Whether the August 24th low was the only test of this correction, or investors retest it again, is a moot point. Ignoring irrelevant headlines and focusing your attention on a low-cost, tax-efficient, globally diversified investment portfolio is a better use of your time. That is a tenet for which Hamlet would certainly be willing to die.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Oxymoron: Shrewd Government Refis Credit Card

With the upcoming Federal Reserve policy meetings coming up this Wednesday and Thursday, investors’ eyes remain keenly focused on the actions and words of Federal Reserve Chairwoman Janet Yellen.

If you have painstakingly filled out an IRS tax return or frustratingly waited in long lines at the DMV or post office, you may not be a huge fan of government services. Investors and liquidity addicted borrowers are also irritated with the idea of the Federal Reserve pulling away the interest rate punch bowl too soon. We will find out early enough whether Yellen will hike the Fed Funds interest rate target to 0.25%, or alternatively, delay a rate increase when there are clearer signs of inflation risks.

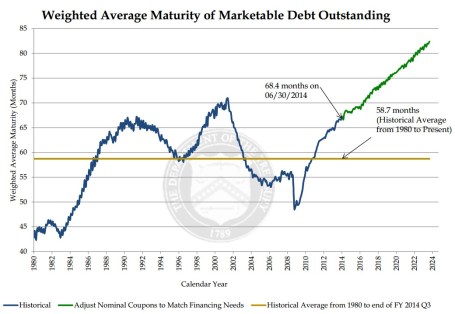

Regardless of the Fed decision this week, with interest rates still hovering near generational lows, it is refreshing to see some facets of government making shrewd financial market decisions – for example in the area of debt maturity management. Rather than squeezing out diminishing benefits by borrowing at the shorter end of the yield curve, the U.S. Treasury has been taking advantage of these shockingly low rates by locking in longer debt maturities. As you can see from the chart below, the Treasury has increased the average maturity of its debt by more than 20% from 2010 to 2015. And they’re not done yet. The Treasury’s current plan based on the existing bond issuance trajectory will extend the average bond maturity from 70 months in 2015 to 80 months by the year 2022.

If you were racking up large sums of credit card debt at an 18% interest rate with payments due one month from now, wouldn’t you be relieved if you were given the offer to pay back that same debt a year from now at a more palatable 2% rate? Effectively, that is exactly what the government is opportunistically taking advantage of by extending the maturity of its borrowings.

Most bears fail to acknowledge this positive trend. The typical economic bear argument goes as follows, “Once the Fed pushes interest rates higher, interest payments on government debt will balloon, and government deficits will explode.” That argument definitely holds up some validity as newly issued debt will require higher coupon payments to investors. But at a minimum, the Treasury is mitigating the blow of the sizable government debt currently outstanding by extending the average Treasury maturity (i.e., locking in low interest rates).

It is worth noting that while extending the average maturity of debt by the Treasury is great news for U.S. tax payers (i.e., smaller budget deficits because of lower interest payments), maturity extension is not so great news for bond investors worried about potentially rising interest rates. Effectively, by the Treasury extending bond maturities on the debt owed, the government is creating a larger proportion of “high octane” bonds. By referring to “high octane” bonds, I am highlighting the “duration” dynamic of bonds. All else equal, a lengthening of bond maturities, will increase a bond’s duration. Stated differently, long duration, “high octane” bonds will collapse in price if in interest rates spike higher. The government will be somewhat insulated to that scenario, but not the bond investors buying these longer maturity bonds issued by the Treasury.

All in all, you may not have the greatest opinion about the effectiveness of the IRS, DMV, and/or post office, but regardless of your government views, you should be heartened by the U.S. Treasury’s shrewd and prudent extension of the average debt maturity. Now, all you need to do is extend the maturity and lower the interest rate on your personal credit card debt.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Bungee Market

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (September 1, 2015). Subscribe on the right side of the page for the complete text.

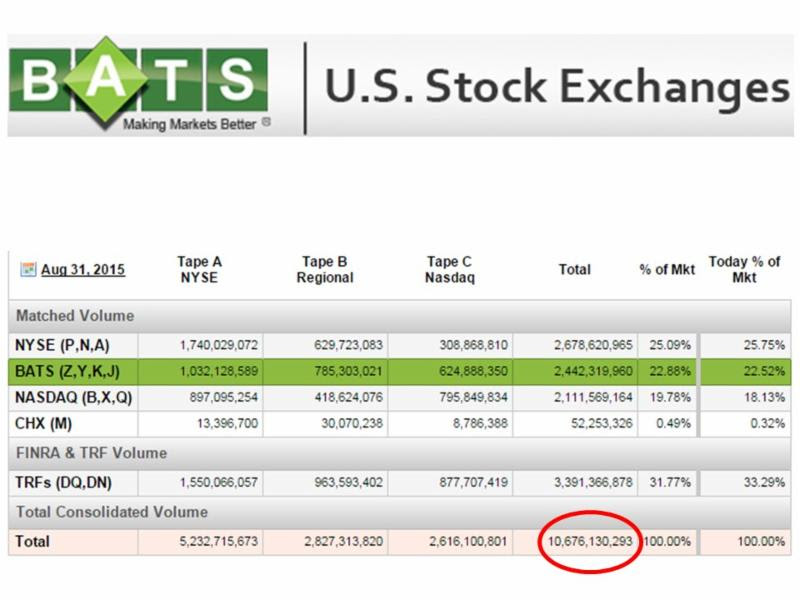

Are you an adrenaline junkie? You may be one and not even know it. If you are an investor in the stock market, you may have noticed a sinking feeling in your investment portfolio before a sharp bounce-back, much like a bungee jump. Before the recent drop of -6.6% in the Dow during August, some stock investors got lulled into a state of complacency, considering a tripling in stock prices over the last six years.

Almost any current or future news headline has the capability of potentially triggering a short-term bungee jump in stock prices. Now, worries over the health of the Chinese economy and financial markets, coupled with concerns of an impending rate hike by the Federal Reserve have created some tension for global financial markets. The slowdown in China should not be ignored, but as famed investor Bill Nygren pointed out, its impact should be placed in the proper context. China only represents 15% of global economic activity and U.S. exports to China only account for 0.7% of our GDP.

- 5% market corrections, 3 times per year on average (“correction” = price decline);

- 10% market corrections, 1 time per year on average; and

- 20% market corrections, 1 time every 3.5 years on average.

Welcome Back Volatility! Mini Flash Crash

- Economic growth revised higher (Q2 GDP raised to +3.7% from +2.3%)

- Unemployment rate continues to drop ( at 5.3%, a 7-year low)

- Interest rates near historic lows (3.95%, 30-year mortgage rate), which will remain massively stimulative even if the Fed modestly increases short-term rates

- U.S. corporate profits are near record highs (despite dampening effect of the strong U.S. dollar on exports)

- Reasonable valuations (improved after latest index price declines)

- Housing market on a steady recovery (existing home sales at multi-year highs and pricing up +6% vs. July of last year)

- Massively accommodative central banks around the globe (e.g., European Central Bank and People’s Bank of China)

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Have Peripheral Colds Caused a U.S. Recession Flu?

At the trough of the recent correction, which was underscored by a brief but sharp -1,100 point drop in the Dow Jones Industrial Average, the Dow had temporarily corrected by -16.2% from its peak in May, earlier this year. Whether we retest or break below the 15,370 level again is debatable, but with the Dow almost reaching “bear market” (-20%) territory, it begs the question of whether the U.S. has caught a recessionary flu from the ill international markets’ colds?

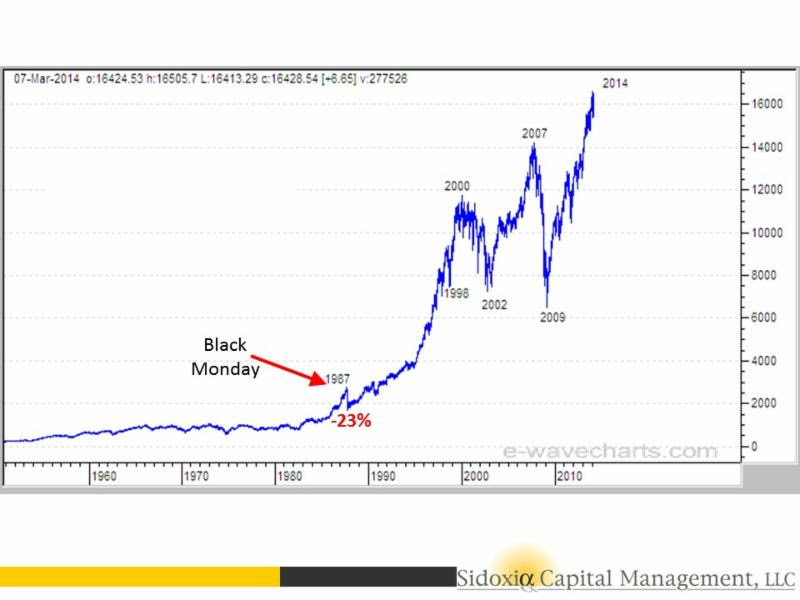

Certainly, several factors have investors concerned about a potential recession, including the following: slowing growth and financial market instability in China; contraction of -0.4% in Japan’s Q2 GDP growth; and turmoil in emerging markets like Russia and Brazil. With stock prices down more than double digits, it appears investors factored in a significant chance of a recession occurring. Although the Tech Bubble of 2000 and generational Great Recession of 2008-2009 were no ordinary recessions, your more garden variety recessions like the 1980 and 1990 recessions resulted in peak to trough declines in the Dow Jones Industrial Average of -20.5% and -22.5%, respectively.

In other words, with the Dow recently down -16.2% in three months, investors were awfully close to factoring in a full blown U.S. recession. Should this be the case? In answering this question, one must certainly understand the stock market is a predicting or discounting mechanism. However, if we pull out our economic thermometers, right now there are no definitive indicators sending us to the recessionary doctor’s office. Here are a number of the indicators to review.

Yield Curve Indicator

For starters, let’s take a look at the yield curve. Traditionally, in a normally expanding economy, we would normally expect inflationary expectations and a term premium for holding longer maturity bonds to equate to a positively shaped yield curve (e.g., shorter term 2-Year Treasuries with interest rates lower than 30-Year Treasuries). Interestingly, historically an inverted yield curve (shorter term interest rates are higher than longer term rates) has been an excellent leading indicator and warning signal for unhealthy stock market conditions forthcoming.

As you can see in the charts below, before the two preceding recessions, in the years 2000 and 2007, we experienced an inverted yield curve that served as a tremendous warning signal in advance of significant downdrafts in stock prices. If you fast forward to today, the slope of the yield curve is fairly steeply sloped – nowhere close to inverted. When the yield curve flattens meaningfully, I will become much more cautious.

The Oil Price Indicator

There is substantial interest and focus on the recessionary conditions in the energy sector, and more specifically the high yield (junk bond) issuers that could suffer. It is true that high yield energy credit spreads have widened, but typically this sector’s pain has been the economy’s gain, and vice versa. The chart below shows that the gray shaded recessionary time periods have classically been preceded by spikes upward in oil prices. As you know, we currently are experiencing the opposite trend. Over the last 12 months, WTI oil prices have been chopped by more than half to $45 per barrel. This is effectively a massive tax for consumers, which should help support the economy.

Other Macro Statistics

Toward the top of any recession-causing, fear factor list right now is China. Slowing economic growth and an unstable Shanghai stock market has investors nervously biting their nails. Although China is the 2nd largest global economy behind the U.S., China still only accounts for about 15% of overall global economic activity, and U.S. exports to the region only account for about 0.7% of our GDP, according to veteran Value investor Bill Nygren. If on top of the China concern you layer a fairly strong U.S. labor market, an improving housing market (albeit slowly), and a recently revised higher GDP statistics, you could probably agree the economic dashboard is not signaling bright red flashing lights.

There is never a shortage of concerns to worry about, including most recently the slowing growth and stock market turbulence in China. While volatility may be implying sickness and international markets may be reaching for the Kleenex box, the yield curve, oil prices, and other macroeconomic indicators are signaling the outlook for U.S. stock remains relatively healthy.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Art of Catching Falling Knives

“In the middle of every difficulty lies an opportunity.” ~Albert Einstein

It was a painful week for bullish investors in the stock market as evidenced by the -1,018 point drop in the Dow Jones Industrial Average, equivalent to approximately a -6% decline. The S&P 500 index did not fare any better, and the loss for the tech-heavy NASDAQ index was down closer to -7% for the week.

The media is attributing much of the short-term weakness to a triple Chinese whammy of factors: 1) Currency devaluation of the Yuan; 2) Weaker Chinese manufacturing data registering in at the lowest level in over six years; and 3) A collapsing Chinese stock market.

As the second largest economy on the planet, developments in China should not be ignored, however these dynamics should be put in the proper context. With respect to China’s currency devaluation, Scott Grannis at Calafia Beach Pundit puts the foreign exchange developments in proper perspective. If you consider the devaluation of the Yuan by -4%, this change only reverses a small fraction of the Chinese currency appreciation that has taken place over the last decade (see chart below). Grannis rightfully points out the -25% collapse in the value of the euro relative to the U.S. dollar is much more significant than the minor move in the Yuan. Moreover, although the move by the People’s Bank of China (PBOC) makes America’s exports to China less cost competitive, this move by Chinese bankers is designed to address exactly what investors are majorly concern about – slowing growth in Asia.

Although the weak Chinese manufacturing data is disconcerting, this data is nothing new – the same manufacturing data has been very choppy over the last four years. On the last China issue relating to its stock market, investors should be reminded that despite the massive decline in the Shanghai Composite, the index is still up by more than +50% versus a year ago (see chart below)

Fear the Falling Knife?

Given the fresh carnage in the U.S. and foreign markets, is now the time for investors to attempt to catch a falling knife? Catching knives for a living can be a dangerous profession, and many investors – professionals and amateurs alike – have lost financial fingers and blood by attempting to prematurely purchase plummeting securities. Rather than trying to time the market, which is nearly impossible to do consistently, it’s more important to have a disciplined, unemotional investing framework in place.

Hall of Fame investor Peter Lynch sarcastically highlighted the difficulty in timing the market, “I can’t recall ever once having seen the name of a market timer on Forbes‘ annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think somebody would have made billions by doing it.”

Readers of my blog, Investing Caffeine understand I am a bottom-up investor when it comes to individual security selection with the help of our proprietary S.H.G.R. model, but those individual investment decisions are made within Sidoxia’s broader, four-pronged macro framework (see also Don’t be a Fool, Follow the Stool). As a reminder, driving our global views are the following four factors: a) Profits; b) Interest rates; c) Sentiment; and Valuations. Currently, two of the four indicators are flashing green (Interest rates and Sentiment), and the other two are neutral (Profits and Valuations).

- Profits (Neutral): Profits are at record highs, but a strong dollar, weak energy sector, and sluggish growth internationally have slowed the trajectory of earnings.

- Valuation (Neutral): At an overall P/E of about 18x’s profits for the S&P 500, current valuations are near historical averages. For CAPE investors who have missed the tripling in stock prices, you can reference prior discussions (see CAPE Smells Like BS). I could make the case that stocks are very attractive with a 6% earnings yield (inverse P/E ratio) compared to a 2% 10—Year Treasury bond, but I’ll take off my rose-colored glasses.

- Interest Rates (Positive): Rates are at unambiguously low levels, which, all else equal, is a clear-cut positive for all cash generating asset classes, including stocks. With an unmistakably “dovish” Federal Reserve in place, whether the 0.25% interest rate hike comes next month, or next year will have little bearing on the current shape of the yield curve. Chairman Yellen has made it clear the trajectory of rate increases will be very gradual, so it will take a major shift in economic trends to move this factor into Neutral or Negative territory.

- Sentiment (Positive): Following the investment herd can be very dangerous for your financial health. We saw that in spades during the late-1990s in the technology industry and also during the mid-2000s in the housing sector. As Warren Buffett says, it is best to “buy fear and sell greed” – last week we saw a lot of fear.

In addition to the immense outflows out of stock funds (see also Great Rotation) , panic was clearly evident in the market last week as shown by the Volatility Index (VIX), a.k.a., the “Fear Gauge.” In general, volatility over the last five years has been on a declining trend, however every 6-12 months, some macro concern inevitably rears its ugly head and volatility spikes higher. With the VIX exploding higher by an amazing +118% last week to a level of 28.03, it is proof positive how quickly sentiment can change in the stock market.

Not much in the investing world works exactly like science, but buying stocks during previous fear spikes, when the VIX level exceeds 20, has been a very lucrative strategy. As you can see from the chart below, there have been numerous occasions over the last five years when the over-20 level has been breached, which has coincided with temporary stock declines in the range of -8% to -22%. However, had you held onto stocks, without adding to them, you would have earned an +84% return (excluding dividends) in the S&P 500 index. Absent the 2011 period, when investors were simultaneously digesting a debt downgrade, deep European recession, and domestic political fireworks surrounding a debt ceiling, these periods of elevated volatility have been relatively short-lived.

Whether this will be the absolute best time to buy stocks is tough to say. Stocks are falling like knives, and in many instances prices have been sliced by more than -10%, -20%, or -30%. It’s time to compile your shopping list, because valuations in many areas are becoming more compelling and eventually gravity will run its full course. That’s when your strategy needs to shift from avoiding the falling knives to finding the bouncing tennis balls…excuse me while I grab my tennis racket.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including emerging market/Chinese ETFs, but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Inside the Brain of an Investing Genius

Those readers who have frequented my Investing Caffeine site are familiar with the numerous profiles on professional investors of both current and prior periods (See Profiles). Many of the individuals described have a tremendous track record of success, while others have a tremendous ability of making outrageous forecasts. I have covered both. Regardless, much can be learned from the successes and failures by mirroring the behavior of the greats – like modeling your golf swing after Tiger Woods (O.K., since Tiger is out of favor right now, let’s say Jordan Spieth). My investment swing borrows techniques and tips from many great investors, but Peter Lynch (ex-Fidelity fund manager), probably more than any icon, has had the most influence on my investing philosophy and career as any investor. His breadth of knowledge and versatility across styles has allowed him to compile a record that few, if any, could match – outside perhaps the great Warren Buffett.

Consider that Lynch’s Magellan fund averaged +29% per year from 1977 – 1990 (almost doubling the return of the S&P 500 index for that period). In 1977, the obscure Magellan Fund started with about $20 million, and by his retirement the fund grew to approximately $14 billion (700x’s larger). Cynics believed that Magellan was too big to adequately perform at $1, $2, $3, $5 and then $10 billion, but Lynch ultimately silenced the critics. Despite the fund’s gargantuan size, over the final five years of Lynch’s tenure, Magellan outperformed 99.5% of all other funds, according to Barron’s. How did Magellan investors fare in the period under Lynch’s watch? A $10,000 investment initiated when he took the helm would have grown to roughly $280,000 (+2,700%) by the day he retired. Not too shabby.

Background

Lynch graduated from Boston College in 1965 and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968. Like the previously mentioned Warren Buffett, Peter Lynch shared his knowledge with the investing masses through his writings, including his two seminal books One Up on Wall Street and Beating the Street. Subsequently, Lynch authored Learn to Earn, a book targeted at younger, novice investors. Regardless, the ideas and lessons from his writings, including contributing author to Worth magazine, are still transferable to investors across a broad spectrum of skill levels, even today.

The Lessons of Lynch

Although Lynch has left me with enough financially rich content to write a full-blown textbook, I will limit the meat of this article to lessons and quotations coming directly from the horse’s mouth. Here is a selective list of gems Lynch has shared with investors over the years:

Buy within Your Comfort Zone: Lynch simply urges investors to “Buy what you know.” In similar fashion to Warren Buffett, who stuck to investing in stocks within his “circle of competence,” Lynch focused on investments he understood or on industries he felt he had an edge over others. Perhaps if investors would have heeded this advice, the leveraged, toxic derivative debacle occurring over previous years could have been avoided.

Do Your Homework: Building the conviction to ride through equity market volatility requires rigorous homework. Lynch adds, “A company does not tell you to buy it, there is always something to worry about. There are always respected investors that say you are wrong. You have to know the story better than they do, and have faith in what you know.”

Price Follows Earnings: Investing is often unnecessarily made complicated. Lynch fundamentally believes stock prices will follow the long-term trajectory of earnings growth. He makes the point that “People may bet on hourly wiggles of the market, but it’s the earnings that waggle the wiggle long term.” In a publicly attended group meeting, Michael Dell, CEO of Dell Inc. (DELL), asked Peter Lynch about the direction of Dell’s future stock price. Lynch’s answer: “If your earnings are higher in 5 years, your stock will be higher.” Maybe Dell’s price decline over the last five years can be attributed to its earnings decline over the same period? It’s no surprise that Hewlett-Packard’s dramatic stock price outperformance (relative to DELL) has something to do with the more than doubling of HP’s earnings over the same time frame.

Valuation & Price Declines: “People Concentrate too much on the P (Price), but the E (Earnings) really makes the difference.” In a nutshell, Lynch believes valuation metrics play an important role, but long-term earnings growth will have a larger impact on future stock price appreciation.

Two Key Stock Questions: 1) “Is the stock still attractively priced relative to earnings?” and 2) “What is happening in the company to make the earnings go up?” Improving fundamentals at an attractive price are key components to Lynch’s investing strategy.

Lynch on Buffett: Lynch was given an opportunity to write the foreword in Buffett’s biography, The Warren Buffett Way. Lynch did not believe in “pulling out flowers and watering the weeds,” or in other words, selling winners and buying losers. In highlighting this weed-flower concept, Lynch said this about Buffett: “He purchased over $1 billion of Coca-Cola in 1988 and 1989 after the stock had risen over fivefold the prior six years and over five-hundredfold the previous sixty years. He made four times his money in three years and plans to make a lot more the next five, ten, and twenty years with Coke.” Hammering home the idea that a few good stocks a decade can make an investment career, Lynch had this to say about Buffett: “Warren states that twelve investments decisions in his forty year career have made all the difference.”

You Don’t Need Perfect Batting Average: In order to significantly outperform the market, investors need not generate near perfect results. According to Lynch, “If you’re terrific in this business, you’re right six times out of 10 – I’ve had stocks go from $11 to 7 cents (American Intl Airways).” Here is one recipe Lynch shares with others on how to beat the market: “All you have to do really is find the best hundred stocks in the S&P 500 and find another few hundred outside the S&P 500 to beat the market.”

The Critical Element of Patience: With the explosion of information, expansion of the internet age, and the reduction of trading costs has come the itchy trading finger. This hasty investment principle runs contrary to Lynch’s core beliefs. Here’s what he had to say regarding the importance of a steady investment hand:

- “In my investing career, the best gains usually have come in the third or fourth year, not in the third or fourth week or the third or fourth month.”

- “Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

- “Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100% correlation between the success of a company and the success of its stock. It pays to be patient, and to own successful companies.”

- “The key to making money in stocks is not to get scared out of them.”

Bear Market Beliefs: “I’m always more depressed by an overpriced market in which many stocks are hitting new highs every day than by a beaten-down market in a recession,” says Lynch. The media responds in exactly the opposite manner – bear markets lead to an inundation of headlines driven by panic-based fear. Lynch shares a similar sentiment to Warren Buffett when it comes to the media holding a glass half full view in bear markets.

Market Worries: Is worrying about market concerns worth the stress? Not according to Lynch. His belief: “I’ve always said if you spend 13 minutes a year on economics, you’ve wasted 10 minutes.” Just this last March, Lynch used history to drive home his views: “We’ve had 11 recessions since World War II and we’ve had a perfect score — 11 recoveries. There are a lot of natural cushions in the economy now that weren’t there in the 1930s. They keep things from getting out of control. We have the Federal Deposit Insurance Corporation [which insures bank deposits]. We have social security. We have pensions. We have two-person, working families. We have unemployment payments. And we have a Federal Reserve with a brain.”

Thoughts on Cyclicals: Lynch divided his portfolio into several buckets, and cyclical stocks occupied one of the buckets. “Cyclicals are like blackjack: stay in the game too long and it’s bound to take all your profit,” Lynch emphasized.

Selling Discipline: The rationale behind Lynch’s selling discipline is straightforward – here are some of his thoughts on the subject:

- “When the fundamentals change, sell your mistakes.”

- “Write down why you own a stock and sell it if the reason isn’t true anymore.”

- “Sell a stock because the company’s fundamentals deteriorate, not because the sky is falling.”

Distilling the genius of an investing legend like Peter Lynch down to a single article is not only a grueling challenge, but it also cannot bring complete justice to the vast accomplishments of this incredible investment legend. Nonetheless, his record should be meticulously studied in hopes of adding jewels of investment knowledge to the repertoires of all investors. If delving into the head of this investing mastermind can provide access to even a fraction of his vast knowledge pool, then we can all benefit by adding a slice of this greatness to our investment portfolios.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, including KO, but at time of publishing had no direct positions in DELL, HPQ or any other security mentioned. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Playing the Field with Your Investments

For some, casually dating can be fun and exciting. The same goes for trading and speculating – the freedom to make free- wheeling, non-committal purchases can be exhilarating. Unfortunately the costs (fiscally and emotionally) of short-term dating/investing often outweigh the benefits.

Fortunately, in the investment world, you can get to know an investment pretty well through fundamental research that is widely available (e.g., 10Ks, 10Qs, press releases, analyst days, quarterly conference calls, management interviews, trade rags, research reports). Unlike dating, researching stocks can be very cheap, and you do not need to worry about being rejected.

Dating is important early in adulthood because we make many mistakes choosing whom we date, but in the process we learn from our misjudgments and discover the important qualities we value in relationships. The same goes for stocks. Nothing beats experience, and in my long investment career, I can honestly say I’ve dated/traded a lot of pigs and gained valuable lessons that have improved my investing capabilities. Now, however, I don’t just casually date my investments – I factor in a rigorous, disciplined process that requires a serious commitment. I no longer enter positions lightly.

One of my investment heroes, Peter Lynch, appropriately stated, “In stocks as in romance, ease of divorce is not a sound basis for commitment. If you’ve chosen wisely to begin with, you won’t want a divorce.”

Charles Ellis shared these thoughts on relationships with mutual funds:

“If you invest in mutual funds and make mutual funds investment changes in less than 10 years…you’re really just ‘dating.’ Investing in mutual funds should be marital – for richer, for poorer, and so on; mutual fund decisions should be entered into soberly and advisedly and for the truly long term.”

No relationship comes without wild swings, and stocks are no different. If you want to survive the volatile ups and downs of a relationship (or stock ownership), you better do your homework before blindly jumping into bed. The consequences can be punishing.

Buy and Hold is Dead…Unless Stocks Go Up

If you are serious about your investments, I believe you must be mentally willing to commit to a relationship with your stock, not for a day, not for a week, or not for a month, but rather for years. Now, I know this is blasphemy in the age when “buy-and-hold” investing is considered dead, but I refute that basic premise whole-heartedly…with a few caveats.

Sure, buy-and-hold is a stupid strategy when stocks do nothing for a decade – like they have done in the 2000s, but buying and holding was an absolutely brilliant strategy in the 1980s and 1990s. Moreover, even in the miserable 2000s, there have been many buy-and-hold investments that have made owners a fortune (see Questioning Buy & Hold ). So, the moral of the story for me is “buy-and-hold” is good for stocks that go up in price, and bad for stocks that go flat or down in price. Wow, how deeply profound!

To measure my personal commitment to an investment prospect, a bachelorette investment I am courting must pass another test…a test from another one of my investment idols, Phil Fisher, called the three-year rule. This is what the late Mr. Fisher had to say about this topic:

“While I realized thoroughly that if I were to make the kinds of profits that are made possible by [my] process … it was vital that I have some sort of quantitative check… With this in mind, I established what I called my three-year rule.” Fisher adds, “I have repeated again and again to my clients that when I purchase something for them, not to judge the results in a matter of a month or a year, but allow me a three year period.”

Certainly, there will be situations where an investment thesis is wrong, valuation explodes, or there are superior investment opportunities that will trigger a sale before the three-year minimum expires. Nonetheless, I follow Fisher’s rule in principle in hopes of setting the bar high enough to only let the best ideas into both my client and personal portfolios.

As I have written in the past, there are always reasons of why you should not invest for the long-term and instead sell your position, such as: 1) new competition; 2) cost pressures; 3) slowing growth; 4) management change; 5) valuation; 6) change in industry regulation; 7) slowing economy; 8 ) loss of market share; 9) product obsolescence; 10) etc, etc, etc. You get the idea.

Don Hays summed it up best: “Long term is not a popular time-horizon for today’s hedge fund short-term mentality. Every wiggle is interpreted as a new secular trend.”

Peter Lynch shares similar sympathies when it comes to noise in the marketplace:

“Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

Every once in a while there is validity to some of the concerns, but more often than not, the scare campaigns are merely Chicken Little calling for the world to come to an end.

Patience is a Virtue

In the instant gratification society we live in, patience is difficult to come by, and for many people ignoring the constant chatter of fear is challenging. Pundits spend every waking hour trying to explain each blip in the market, but in the short-run, prices often move up or down irrespective of the daily headlines. Explaining this randomness, Peter Lynch said the following:

“Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100% correlation between the success of a company and the success of its stock. It pays to be patient, and to own successful companies.”

Long-term investing, like long-term relationships, is not a new concept. Investment time horizons have been shortening for decades, so talking about the long-term is generally considered heresy. Rather than casually date a stock position, perhaps you should commit to a long-term relationship and divorce your field-playing habits. Now that sounds like a sweet kiss of success.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Investors Take a Vacation

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 3, 2015). Subscribe on the right side of the page for the complete text.

It’s summertime and the stock market has taken a vacation, and it’s unclear when prices will return from a seven month break. It may seem like a calm sunset walk along the beach now that Greek worries have temporarily subsided, but concerns have shifted to an impending Federal Reserve interest rate hike, declining commodity prices, and a Chinese stock market crash, which could lead to a painful sunburn.

If you think about it, stock investors have basically been on unpaid vacation since the beginning of the year, with the Dow Jones Industrial Index (17,690) down -0.7% for 2015 and the S&P 500 (2,104) up + 2.2% over the same time period (see chart below). Despite mixed results for the year, all three main stock indexes rebounded in July (including the tech-heavy NASDAQ +2.8% for the month) after posting negative returns in June. Overall for 2015, sector performance has been muddled. There has been plenty of sunshine on the Healthcare sector (+11.7%), but Energy stocks have been stuck in the doldrums (-13.4%), over the same timeframe.

Source: Yahoo! Finance

Chinese Investors Suffer Heat Stroke

Despite gains for U.S. stocks in July, the overheated Chinese stock marketcaused some heat stroke for global investors with the Shanghai Composite index posting its worst one month loss (-15%) in six years, wiping out about $4 trillion in market value. Before coming back down to earth, the Chinese stock market inflated by more than +150% from 2014.

Driving the speculative fervor were an unprecedented opening of 12 million monthly accounts during spring, according to Steven Rattner, a seasoned financier, investor, and a New York Times journalist. Margin accounts operate much like a credit card for individuals, which allowed these investors to aggressively gamble on the China market upswing, but during the downdraft investors were forced to sell stocks to generate proceeds for outstanding loan repayments. It’s estimated that 25% of these investors only have an elementary education and a significant number of them are illiterate. Further exacerbating the sell-off were Chinese regulators artificially intervening by halting trading in about 500 companies on the Shanghai and Shenzhen exchanges last Friday, equivalent to approximately 18% of all listings.

Although China, as the second largest economy on the globe, is much more economically important than a country like Greece, recent events should be placed into proper context. For starters, as you can see from the chart below, the Chinese stock market is no stranger to volatility. According to Fundstrat Global Advisors, the Shanghai composite index has experienced 10 bear markets over the last 25 years, and the recent downdraft doesn’t compare to the roughly -75% decline we saw in 2007-2008. Moreover, there is no strong correlation between the Chinese stock market. Only 15% of Chinese households own stocks, or measured differently, only 6% of household assets are held in stocks, says economic-consulting firm IHS Global Insight. More important than the question, “What will happen to the Chinese stock market?,” is the question, “What will happen to the Chinese stock economy?,” which has been on a perennial slowdown of late. Nevertheless, China has a 7%+ economic growth rate and the highest savings rate of any major country, both factors for which the U.S. economy would kill.

Source: Yardeni.com

Don’t Take a Financial Planning Vacation

While the financial markets continue to bounce around and interest rates oscillate based on guesswork of a Federal Reserve interest rate hike in September, many families are now returning from vacations, or squeezing one in before the back-to-school period. The sad but true fact is many Americans spend more time planning their family vacation than they do planning for their financial futures. Unfortunately, individuals cannot afford to take a vacation from their investment and financial planning. At the risk of stating the obvious, planning for retirement will have a much more profound impact on your future years than a well-planned trip to Hawaii or the Bahamas.

We live in an instant gratification society where “spend now, save later” is a mantra followed by many. There’s nothing wrong with splurging on a vacation, and to maintain sanity and family cohesion it is almost a necessity. However, this objective does not have to come at the expense of compromising financial responsibility – or in other words spending within your means. Investing is a lot like consistent dieting and exercising…it’s easy to understand, but difficult to sustainably execute. Vacations, on the other hand, are easy to understand, and easy to execute, especially if you have a credit card with an available balance.

It’s never too late to work on your financial planning muscle. As I discuss in a previous article (Getting to Your Number) , one of the first key steps is to calculate an annual budget relative to your income, so one can somewhat accurately determine how much money can be saved/invested for retirement. Circumstances always change, but having a base-case scenario will help determine whether your retirement goals are achievable. If expectations are overly optimistic, spending cuts, revenue enhancing adjustments, and/or retirement date changes can still be made.

When it comes to the stock market, there are never a shortage of concerns. Today, worries include a Greek eurozone exit (“Grexit”); decelerating China economic growth and a declining Chinese stock market; and the viability of Donald’s Trump’s presidential campaign (or lack thereof). While it may be true that stock prices are on a temporary vacation, your financial and investment planning strategies cannot afford to go on vacation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.