Consumer Wallets Strong, Rate Hikes Long, What Could Go Wrong?

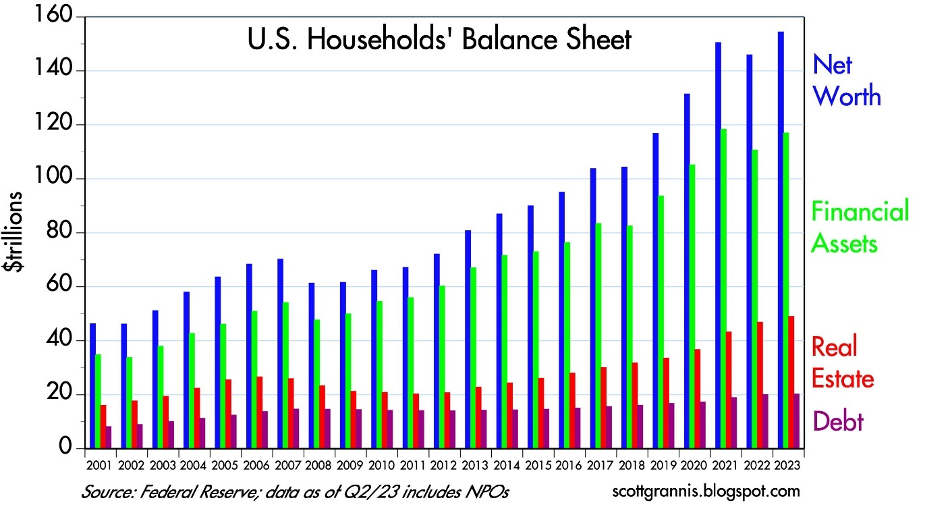

Consumer wallets and balance sheets remain flush with cash as employment remains near record-high levels. Cash in consumer wallets and money in the bank help the economy keep chugging along at a healthy clip. More specifically, as you can see in the chart below, the net worth of U.S. households has reached a record $154.3 trillion dollars in the most recent month, thanks to appreciation in stocks, gains in real estate, and relatively stable levels of debt.

Source: Calafia Beach Pundit

Unemployment Remains Low

In addition, the unemployment rate is sitting at 3.8%, near multi-decade lows (see chart below).

Source: Trading Economics

As long as consumers continue to hold a job, they will continue spending to buoy economic activity – remember, consumer spending accounts for roughly 70% of our country’s economic activity. Case in point are the most recently released GDP (Gross Domestic Product) forecasts by the Atlanta Federal Reserve, which show 3rd quarter GDP growth estimated at a 4.9% rate (see chart below).

Rates Up, Housing Prices Up?

Yes, it’s true, despite a dramatic surge in mortgage rates over the last few years, the housing market remains strong due to a very tight supply of homes available for sale. Most homeowners with a mortgage have refinanced to a rate in the range of 3% (or in some cases even lower), so selling and moving into a new home with a mortgage at current rates of 7.3% is not that appealing. In other words, if you decide to move, your monthly mortgage payment could potentially go up by more > 50%, which could equate to thousands of dollars per month. Under this scenario, you are likely to stay put and not sell your home.

Source: Trading Economics

The embedded economic disincentive of selling a home with a mortgage has really put a real crimp on the supply of homes available for sale (chart below). As you can see, the inventory of homes has dramatically collapsed from a peak of about four million homes, circa the 2008 Financial Crisis, to around one million homes today.

Source: Trading Economics

In the face of this mixed data, the stock market finished a hot summer with a cool whimper last month, in large part due to a 0.49% increase in the 10-Year Treasury Note yield to 4.58% (see chart below). The S&P 500 index fell -4.9% for the month, the technology-heavy NASDAQ index dropped even further by -5.8%, while the Dow Jones Industrial Average outperformed, down -3.5% for the month. Worth noting, however, the Dow has significantly underperformed the other indexes so far this year.

Source: Trading Economics

Inflation on the Mend

The Fed continues to talk tough about fighting inflation after taking interest rates from 0% to 5.5% over the last two years, nevertheless inflation continues to come down. The Fed’s go-to Core PCE inflation datapoint that came out last Friday at +0.1% is consistent with the downward inflation trend we have been witnessing for many months now (see chart below). As you can see, inflation on annualized basis has reached 2.2%, nearly achieving the Federal Reserve’s target of 2.0%.

Source: The Wall Street Journal and Commerce Department

There is never a shortage of investor concerns. Today, worries include Federal Reserve policy; restarting of school loan repayments (after a three-year hiatus); a potential government shutdown; an auto and Hollywood strike; higher oil prices; and a presidential election that is heating up. Many of these worries are nothing new. The bull market took a pause for the month, but consumer wallets remain fat, the economy keeps chugging, the employment picture remains strong, and stock prices remain up +12% for the year (S&P 500). For the time being, betting on a soft economic landing over an imminent recession could be a winning use for that cash in your wallet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 2, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Register with Zoom for Our Upcoming Webinar!

Register now for our upcoming Zoom webinar, “Hot Summer, Hotter Market – Economic & Investment Update” presented by Wade W. Slome, CFA, CFP on Wednesday, September 27th @ 12:00 p.m.!

In order to ensure access to the webinar, please don’t forget to register:

Thank you for choosing to join us. We can’t wait to see you on Wednesday, September 27th @ 12:00 p.m.!

Hollywood Shuts Down & Market Goes Uptown

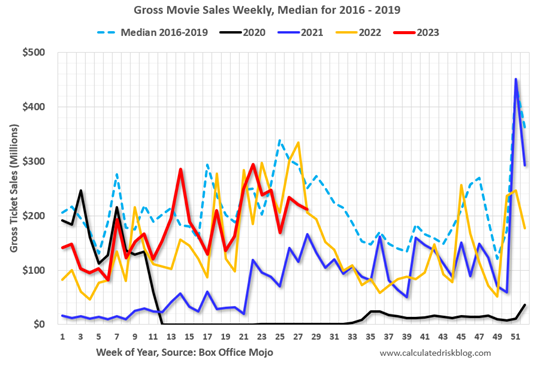

According to scientists, July set a record as the hottest month in 120,000 years. In order to beat the scorching heat, millions of Americans made the pilgrimage to their local air-conditioned movie theaters to watch the combo-blockbuster “Barbenheimer” (Barbie and Oppenheimer), which has raked in sales of more than $1 billion globally in the first two weeks of its release. Thankfully, in the short-run, Barbenheimer has given a shot in the arm to the beleaguered movie industry that suffered dramatically during the pandemic. The chart below (before Barbenheimer) shows industry sales have recovered (red line) somewhat, almost to pre-pandemic averages (dashed light blue line), but still has some ground to gain before industry sales consistently outpaces pre-pandemic levels.

Source: Calculated Risk

Movie Strike Explained

If movies are your gig, you better race to the theaters now because Hollywood has come to a grinding halt, thanks to a dual strike of Hollywood acting unions (SAG-AFTRA) and the Writers Guild of America (WGA) union. The feud between the unions and the movie/television studios centers around demands for higher pay, better working conditions, and protections from AI (Artificial Intelligence) technologies, which could theoretically replace actors and writers. Combined, the unions almost carry an estimated 200,000 members, which means a broad strike like equals no new movies, tv shows, or streaming content. The last time there was a “double strike” like this occurred in 1960 when former President Ronald Reagan was running SAG. Until the dispute is resolved, you better pace your media binging consumption habits because with no new content currently being created, the dispute may begin to eat into your show backlog on Netflix and disrupt your happy couch-streaming time.

Stocks on Fire

But scorching heat and red-hot popular movies were not the only things on fire last month. The stock market continued its fiery, blistering pace with the S&P 500 boiling higher by +3.1%, making the seven-month total gain of 2023 a spicy +20% (see chart below). The Dow Jones Industrial Average joined in on the fun too. Not only did the Dow increase by +3.4% for the month, the index rose for 13 consecutive days, the longest streak of daily advances since 1987. Bubbling up to the top of the performance table, however, is the technology-heavy NASDAQ index (home of the largest Magnificent 7 technology stocks – see also Fight the Fed) with a sizzling +4.1% return for the month, and a scalding +37% rise for the year, so far. The pace of gains is not sustainable forever, so it’s important to have a disciplined process in place to manage the risk of over-extended, over-valued investments, which is exactly what we do at Sidoxia Capital Management.

Source: TradingEconomics.com

Inflation Moving in the Right Direction

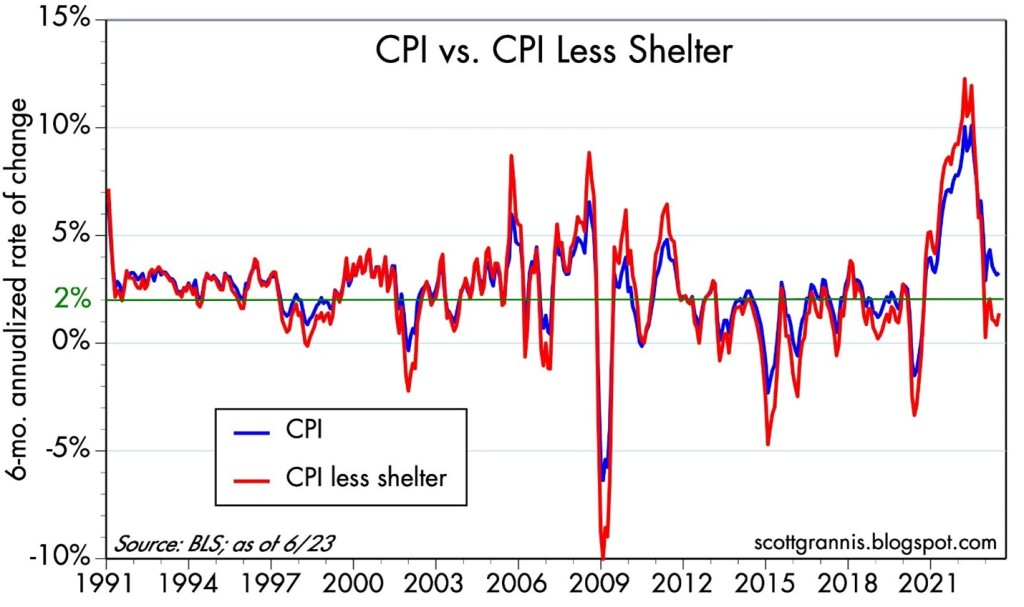

After such a lousy 2022 in the financial markets, why such a searing return for 2023? The biggest reason can be summed up with three words: inflation, inflation, and inflation. More specifically, it’s the pace of “disinflation” we are witnessing that is getting people so excited. As you can see from the chart below, annualized inflation as measured by the Consumer Price Index (CPI) has declined dramatically to 3.3% (blue line), while CPI less shelter (red line) has dropped to 1.4%, which is below the Federal Reserve’s 2% target (green line). These trends have gotten investors excited because they believe Jerome Powell, the Fed Chairman, is closer to ending this year-and-a-half long interest rate hiking cycle. In fact, investors are currently betting for multiple interest rate cuts in 2024.

Source: Calafia Beach Pundit

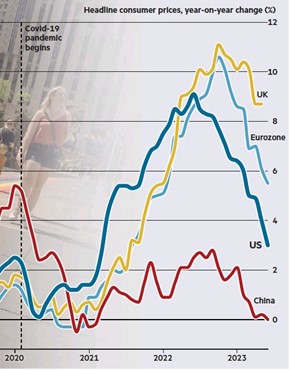

And the disinflation phenomenon is just not limited to U.S. borders – we are witnessing the same disinflationary trends across our borders (see chart below).

Source: The Financial Time (FT)

Confident Consumers

While many economists and traders have incorrectly been calling for a recession for some two years, a more resilient U.S. economy just reported better-than-expected growth for the 2nd quarter (+2.4% – Gross Domestic Product [GDP] growth). The stronger economy along with the improving inflation dynamics mentioned previously have buoyed Consumer Confidence too, as you can see from the chart below.

Source: Calafia Beach Pundit

Everything isn’t perfect (it never is). We continue to experience geopolitical risk as a result of the destabilized war between Russia and Ukraine; growth in China has stalled and not recovered from the pandemic; complacency is beginning to filter into investor attitudes; and we live with a dysfunctional Washington political process. But the economy remains strong, inflation appears to be cooling, and short-term interest rates could be close to peaking. Your air-conditioning bill may be going up this summer, but so will your stock market portfolio, if your investments are being properly managed.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fight the Fed… Or Risk Your Account Going Dead!

Throughout history the prominent Wall Street mantra has been, “Don’t fight the Fed.” In essence, the credo instructs investors to sell stocks when the Federal Reserve increases its Federal Funds interest rate target and buy stocks when the Fed cuts its benchmark objective. The pace of interest rate increases since early 2022 has increased at the fastest rate in over four decades (see chart below). Unfortunately for those following this overly simplistic guidance of not opposing the Fed, investor portfolio balances have been harmed dramatically during 2023 by missing a large bull market run. Despite this year’s three interest rate hikes and an 87% probability of another increase next month by the Federal Reserve, the S&P 500 index surged +6.5% last month and has soared +15.9% for 2023, thus far.

Source: TradingEconomics.com

The technology-heavy NASDAQ index has skyrocketed even more by +31.7% this year, thanks in part to Apple Inc. (AAPL) surpassing the $3 trillion market value (+49.3%), thereby exceeding the total gross domestic product (GDP) of many large individual countries like France, Italy, Canada, Brazil, Russia, South Korea, Australia, Mexico, and Spain.

But Apple’s strong performance only explains part of the technology sector’s impact on stock returns this year. The lopsided influence of technology stocks can be seen through the performance of the largest seven mega-stocks in the S&P 500 (a.k.a., The Magnificent 7), which have averaged an eye-popping return of +89%. Artificial intelligence (AI) juggernaut, NVIDIA Corporation (NVDA), has led the way by almost tripling in value in the first six months of the year from $146 per share to $423.

GDP & Profits Growing

Economists and skeptical investors have been calling for a recession for well over a year now, however GDP growth and forecasts remain positive, unemployment remains near generationally low levels (below 4%), and corporate profit forecasts are beginning to creep higher (see chart below – red line). You can see, unlike previous recessions, profits have not collapsed and actually have reversed course upwards.

Source: Yardeni.com

These factors, coupled with the cooling of inflation pressures have contributed to this bull market in stocks that has soared +27% higher since the October 2022 bottom in the S&P 500. With this advance in stock prices, we have also seen green shoots sprout in the Initial Public Offering (IPO) market for new publicly traded companies (see chart below) like Mediterranean fast-casual restaurant chain CAVA Group, Inc. (CAVA), which has catapulted +86% in its opening month and thrift store company Savers Value Village, Inc. (SVV) which just recently climbed over +31% in its debut week.

Source: The Financial Times (FT)

Dumb Rules of Thumb

Wall Street is notorious for providing rules of thumb and shortcuts for the masses, but if investing was that easy, I’d be retired on my private island consuming copious amounts of coconut drinks with tiny umbrellas. Case in point, following the guideline to “sell in May and go away” would have cost you dearly last month with prices gushing higher. And although the “January Effect” has been documented by academics as a great period to buy stocks, this so-called phenomenon has failed in three of the last four years. Which brings us back to the Fed. It is true that “not fighting the Fed” worked well last year, given the shellacking stocks took after a steep string of Fed interest rate increases, but following the same strategy this year would have only resulted in a large bath of tears. As is the case with most things investing related, there are no cheap and easy rules to follow that will lead you to financial prosperity. The best recommendation I can provide when it comes to investing advice squawked by the media masses is that the true path to wealth creation often comes from ignoring or disobeying these unreliable and inconsistent rules of thumb. Therefore, contrary to popular belief, fighting the Fed may actually lead to knockout returns for investors.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 3, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CAVA, SVV, or anyother security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

AI Revolution and Debt Ceiling Resolution

On the surface, last month’s performance of the stock market as measured by the S&P 500 index (+0.3%) seemed encouraging, but rather pedestrian. Fears of sticky-high inflation, more potential Federal Reserve interest rate hikes, contagion uncertainty surrounding a mini-banking crisis, along with looming recession concerns led to a -3.5% monthly decline in the Dow Jones Industrial Average (-1,190 points). The good news is that inflation is declining (see chart below) and currently the Federal Reserve is expected to pause from increasing interest rates in June (the first time in more than a year).

Source: Calafia Beach Pundit

Overall stock market performance has been a mixed-bag at best. Adding to investor anxiety, if you haven’t been living off-the-grid in a cave, is the debt ceiling negotiations. Essentially, our government has maxed out its credit card spending limit, but Republicans and Democrats have agreed in principle on a resolution for an expanded credit line. More specifically, the House of Representatives just approved to raise the debt ceiling by a resounding margin of 314 – 117. If all goes well, after months of saber rattling and brinksmanship, the bill should be finalized by the Senate and signed by the President over the next two days.

Beyond the Washington bickering, and under the surface, an artificial intelligence (AI) revolution has been gaining momentum and contributed to the technology-heavy NASDAQ catapulting +5.8% for the month and +23.6% for 2023. At the center of this disruptive and transformational AI movement is NVIDIA Corp., a leading Silicon Valley chip manufacturer of computationally-intensive GPUs (graphics processing units), which are used in generative AI models such as OpenAI’s ChatGPT (see NVIDIA products below). Adoption and conversations surrounding NVIDIA’s AI technology have been spreading like wildfire across almost every American industry, resulting in NVIDIA’s stratospheric stock performance (+36% for the month, +159% for the year, +326% on a 3-year basis).

Source: NVIDIA Corp. – the computing engines behind the AI revolution.

Why Such the Fuss Over AI?

Some pundits are comparing AI proliferation to the Industrial Revolution – on par with productivity-enhancing advancements like the steam engine, electricity, personal computers, and the internet. The appetite for this new technology is ravenous because AI is transforming a large swath of industries with its ability to enhance employee efficiency. By leveraging machine learning algorithms and massive amounts of data, generative AI enables businesses to automate repetitive tasks, streamline processes, and unlock new levels of productivity. A study released by MIT researchers a few months ago showed that workers were 37% more efficient using ChatGPT.

If you have created an account and played around with ChatGPT at all you can quickly realize there are an endless number of potential applications and use-cases across virtually all industries and job functions. Already, application of generative AI systems is disrupting e-commerce, marketing, customer service, healthcare, robotics, computer vision, autonomous vehicles, and yes, even accounting. Believe it or not, ChatGPT recently passed the CPA exam! Maybe ChatGPT will do my taxes next year?

Other industries are quickly being disrupted too. Lawyers may feel increased pressure when contracts or briefs can be created with a click of the button. Schools and teachers are banning ChatGPT too in hopes of not creating lazy students who place cheating and plagiarism over critical thinking.

At one end of the spectrum, some doomsday-ers believe AI will become smarter than humans, replace everyone’s job, and AI robots will take over the world (see Elon Musk warns AI could cause “civilization destruction”). At the other end of the spectrum, others see AI as a transformational tool to help worker productivity. As generative AI continues to advance, its impact on employee efficiency will only grow, optimizing processes, driving innovation, and reshaping industries for a more productive future. Embracing this transformative technology will be critical for businesses seeking to thrive in the new digital age.

2023 Stock Performance Explained – Index Up but Most Stocks Down

Although 2022 was a rough year for the stock market (i.e., S&P 500 down -19%), stock prices have rebounded by +20% from the October 2022 lows, and +9% this year. This surge can be in large part attributed to the lopsided performance of the top 1% of stocks in the S&P 500 index (Apple Inc., Microsoft Corp., Amazon.com Inc., NVIDIA Corp., and Alphabet-Google), which combined account for almost 25% of the index’s total value. These top 5 consumer and enterprise technology companies have appreciated on average by an astounding +60% in the first five months of the year and represent a whopping $9 trillion in value. It gets a little technical, but it’s worth noting these larger companies have a disproportionate impact on the calculation of the return percentages, and vice versa for the smaller companies. To put these numbers in context, Apple’s $2.8 trillion company value is greater than the Gross Domestic Product (GDP) of many entire countries, including Italy, Canada, Australia, South Korea, Brazil, and Russia.

On the other hand, if we contrast the other 99% of the S&P 500 index (495 companies), these stocks are down -1% each on average for 2023 (vs +60% for the top 5 mega-stocks). If you look at the performance summary below, you can see that basically every other segment of the stock market outside of technology (e.g., small-cap, value, mid-cap, industrial) is down for the year.

2023 Year-To-Date Performance (%)

S&P 500: +8.9%

S&P 500 (Equal-Weight): -1.2%

S&P Small-Cap Index: -2.3%

Russell 1000 Value Index: -2.0%

S&P Mid-Cap Index: -0.7%

Dow Jones Industrial: -0.7%

While most stocks have dramatically underperformed technology stocks this year, this phenomenon can be explained in a few ways. First of all, smaller companies are more cyclically sensitive to an economic slowdown, and do not have the ability to cut costs to the same extent as the behemoth companies. The majority of stocks have factored in a slowdown (or mild recession) and this is why valuations for small-cap and mid-cap stocks are near multi-decade lows (12.8x and 13.0x, respectively) – see chart below.

Source: Yardeni.com

The stock market pessimists have been calling for a recession for going on two years now. Not only has the recession date continually gotten delayed, but the severity has also been reduced as corporate profits remain remarkably resilient in the face of numerous economic headwinds. Regardless, investors can stand on firmer ground now knowing we are upon the cusp of an AI revolution and near the finish line of a debt ceiling resolution.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Motel 6 or Four Seasons? Preparing, Not Panicking, for Retirement

Stock prices go up more often than down, and that was the case again last month. The S&P 500, Dow Jones Industrial Average, and the NASDAQ were all up in April. For the year, the S&P has gained +8.6%, Dow +2.9%, and NASDAQ +16.8%. What’s more, these increases are built upon the appreciation experienced in the fourth quarter of last year – the S&P 500 index has rebounded more than +19% since the last lows seen in the middle of last October.

Even when the unemployment rate currently stands at 3.5%, and GDP continues to grow for the third consecutive quarter, there is never a shortage of concerns (see also A Series of Unfortunate Events) as evidenced by worrying questions like these:

- Is the Federal Reserve going to increase interest rates again?

- Has inflation peaked?

- Are we going into a recession?

- Is Silicon Valley Bank and First Republic Bank the beginning or the end of bank failures?

- Will Vladimir Putin use nuclear weapons in Ukraine?

- What is going to happen with the Debt Ceiling deadline and will the U.S. default on its debt?

- How will elections affect the economy?

- Will AI (artificial intelligence) take all our jobs?

Hope is Not a Strategy

We have lived through an endless number of scary headlines in some shape or fashion throughout our lifetimes. These are all interesting and important questions, but preparation for retirement is much more important than panicking over issues you have no control over. For many investors, however, the more important questions to ask and answer relate to your retirement strategy. The answers to your questions should not contain the word hope – hope is not a strategy. Just guessing and waiting out of fear is unlikely to produce optimal results.

Many Americans spend more time planning a vacation than they do preparing for retirement or planning their finances. Rather than constantly scrolling through headlines on your mobile phone news app, here are some areas of focus and questions you should be asking yourself:

· Investment Strategy: What type of investment strategy should you be utilizing to reach your retirement goals? A passive investment strategy with low-cost index funds and ETFs (Exchange Traded Funds)? Or an active investment strategy with individual stocks, bonds, and mutual funds?

· Diversification: How diversified are your investments? Are you overly concentrated in one asset class, sector, or individual security? If you are over-tilted on one side of your financial boat, it could tip over.

· Risk Tolerance: What is your asset allocation? If you are close to retirement, and you have too much exposure to equities, a retrenchment in the stock market could delay your retirement plans by years. This concept highlights the importance of rebalancing your portfolio as you get closer to retirement.

· Fees: What are you paying in advisor fees and/or product fees? Fees are like a leaky faucet. You may not notice a leak over a day or week, but over a period of a month or longer, you are likely to receive huge water bills. Over the long-run, even a small pin-hole leak can cause extreme water damage to floors, ceilings, and walls just like fees could delay retirement or dramatically reduce your nest egg.

· Tax Planning: Are you maximizing your tax-deferred investment accounts? Whether you are contributing the limit to your IRA (Individual Retirement Account), 401(k) retirement plan at work, or pension (for larger business owner contributions), these are tremendous tax-deferral savings vehicles. By squirreling away savings during your prime earnings years, your investments can enjoy the snowballing effect of compounding over the long-term.

· Retirement Timing: When do you plan to retire? Do you have enough money to retire, and what type of liquidity needs will you need during retirement? Figuring out the timing of Social Security can be another variable that may factor into your retirement timing decision (see also Can You Retire? Getting to Your Number).

· DIY or Hire Advisor: When it comes to managing your investments, do you plan on doing it yourself (DIY) or hiring a financial advisor? Many people are not adequately equipped to manage their own investments, however identifying a proper financial advisor still requires significant legwork and research as well. Check out a recent webinar I produced with key questions to ask when looking for a financial advisor (Click here: Questions to Ask When Looking for a Financial Advisor).

In summary, there are a lot of frightening news headlines, but you will be better off focusing on those things you can control. The harsh reality is Americans are not saving sufficiently for retirement. It is true, you can survive off a smaller nest egg, if you plan to subsist off cat food and live in a tent, but most Americans and retirees have become accustomed to a higher standard of living. Also worth noting, we humans are living longer. Thanks to the miracles of modern medicine, lifespans are expanding, with the pandemic caveat. But inflation remains stubbornly high, and you do not want to outlive your savings. Drained savings during retirement may just land you a job as a greeter at Wal-Mart in your 80s.

Although the summer travel season is fast approaching, if you feel you are not satisfactorily prepared for retirement, this is a perfect time to invest attention to this important area. Do yourself a favor and devote at least as much time to answering the key retirement questions above as you do in planning your summer vacation. You may be partying like a rock star now, but if you have not been properly saving for retirement, I will ask you the following question: During retirement, do you want to vacation at the Motel 6 off a local freeway or would you prefer vacationing at a Four Seasons somewhere in Europe? I know what my answer is.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Air Bags Deployed to Cushion Bank Crashes

In recent years, COVID and a ZIRP (Zero Interest Rate Policy) caused out-of-control inflation to swerve the economy in the wrong direction. However, the Federal Reserve and its Chairman, Jerome Powell, slammed on the brakes last year by instituting the most aggressive interest rate hiking policy in over four decades.

At the beginning of last year, interest rates (Federal Funds Rate target) stood at 0% (at the low end of the target), and today the benchmark interest rate stands at 5.0% (at the upper-end of the target) – see chart below.

Source: Trading Economics

Unfortunately, this unparalleled spike in interest rates contributed to the 2nd and 3rd largest bank failures in American history, both occurring in March. The good news is the Federal Reserve and banking regulators (the Treasury and FDIC – Federal Deposit Insurance Corporation) deployed some safety airbags last month. Most notably, the Fed, FDIC, and Treasury jointly announced the guarantee of all deposits at SVB, shortly after the bank failure. Moreover, the Fed and Treasury also revealed a broader emergency-lending program to make more funds available for a large swath of banks to meet withdrawal demands, and ultimately prevent additional runs on other banks.

Investors were generally relieved by the government’s response, and the financial markets reacted accordingly. The S&P 500 rose +3.5% last month, and the technology-heavy NASDAQ index catapulted even more (+6.7%). But not everyone escaped unscathed. The KBW Bank Index got pummeled by -25.2%, which also injured the small-cap and mid-cap stock indexes, which declined -5.6% (IJR) and -3.5% (IJH), respectively.

Nevertheless, as mentioned earlier, slamming on the economic brakes too hard can lead to unintended consequences, for example, a bank failure or two. Well, that’s exactly what happened in the case of Silicon Valley Bank (SVB), the 2nd largest bank failure in history ($209 billion in assets), and cryptocurrency-heavy Signature Bank, the 3rd largest banking collapse in history – $110 billion in assets (see below).

Source: The Wall Street Journal

How did this Silicon Valley Bank failure happen? In short, SVB suffered a bank run, meaning bank customers pulled out money faster than the bank could meet withdrawal requests. Why did this happen? For starters, SVB had a concentrated customer base of financially frail technology start-ups. With a weak stock market last year, many of the start-ups were bleeding cash (i.e., shrinking their bank deposits) and were unable to raise additional funds from investors.

As bank customers began to lose confidence in the liquidity of SVB, depositors began to accelerate withdrawals. SVB executives added gasoline to the fire by making risky investments long-term dated government bonds. Essentially, SVB was making speculative bets on the direction of future interest rates and suffered dramatic losses when the Federal Reserve hiked interest rates last year at an unprecedented rate. This unexpected outcome meant SVB had to sell many of its government bond investments at steep losses in order to meet customer withdrawal requests.

It wasn’t only the large size of this bank failure that made it notable, but it was also the speed of its demise. It was only three and a half weeks ago that SVB announced a $1.8 billion loss on their risky investment portfolio and the subsequent necessity to raise $2.3 billion to fill the hole of withdrawals and losses. The capital raise announcement only heightened depositor and investor anxiety, which led to accelerated bank withdrawals. Within a mere 24-hour period, SVB depositors attempted to withdraw a whopping $42 billion.

Other banks, such as First Republic Bank (FRB), and a European investment bank, Credit Suisse Group (CS), also collapsed on the bank crashing fears potentially rippling through other financial institutions around the globe. Fortunately, a consortium of 11 banks provided a lifeline to First Republic with a $30 billion loan. And Credit Suisse was effectively bailed out by the Swiss central bank when Credit Suisse borrowed $53 billion to bolster its liquidity.

While stockholders and bondholders lost billions of dollars in this mini-banking crisis, financial vultures swirled around the remains of the banking sector. More specifically, First Citizens BancShares (FCNA) acquired the majority of Silicon Valley Bank’s assets with the assistance of the FDIC, and UBS Group (UBS) acquired Credit Suisse for more than $3 billion, thereby providing some stability to the banking sector during a volatile period.

Many pundits have been predicting the U.S. economy to crash into a recession as a result of the aggressive, interest rate tightening policy of the Federal Reserve. So far, Mark Twain would probably agree that the death of the U.S. economy has been greatly exaggerated. Currently, the first quarter measurement of economic activity, GDP (Gross Domestic Product), is estimated to measure approximately +2.0% after closing 2022’s fourth quarter at +2.6% (see chart below). As you probably know, a definition of a recession is two consecutive quarters of negative GDP growth.

Source: Trading Economics

Regardless of the economic outcome, investors are now predicting the Federal Reserve to be at the end or near the end of its interest rate hiking cycle. Presently, there is roughly a 50/50 chance of one last 0.25% interest rate increase in May (see chart below), and then investors expect at least one interest rate cut by year-end.

Source: CME Group

Last year was a painful year for most investors, but stocks as measured by the S&P 500 have bounced approximately +18% since the October 2022 lows. Market participants are still worried about a possible recession crashing the economy later this year, but hopefully last year’s stock market collision and subsequent banking airbag protections put in place will protect against any further financial pain.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Apr. 3, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in SIVB, FCNA, UBS, FRB, CS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

From Hard Landing to Soft Landing to No Landing?

I haven’t received my pilot’s license yet, but in trying to figure out whether the economy is heading for a hard landing, soft landing, or no landing, I’m planning to enroll in flight school soon! With the Federal Reserve approaching the tail end of an aggressive interest rate hiking cycle, investors have been bracing for a hard landing. However, with near record-low unemployment (3.4%) and multi-trillion dollars in government stimulus still working its way through the system, others see an economic soft landing. More recently, economic data has been flying in at an accelerating pace, which could mean the economy will stay in the air and have no landing.

For those waiting for an imminent recession, it looks like there could be a delay. In other words, bearish pessimists may be waiting at the gate longer than expected. As you can see in the chart below, economists at the Atlanta Federal Reserve are currently forecasting economic growth (GDP – Gross Domestic Product) to increase to a respectable +2.8% rate for the first quarter.

How have investors been interpreting this confusing array of landing scenarios? The stock market has stabilized and risen since last October (S&P +13.7%) but has also hit a temporary air pocket last month (-2.6%). Similarly, the Dow Jones Industrial Average has rebounded +13.9% since October, but pulled back further in February (-4.2%). As mentioned earlier, investors are having difficulty reading all the economic dials, instruments, and controls in the cockpit because there is no consensus on interest rates, inflation, economic growth, corporate earnings growth, and employment.

At the one end of the spectrum, you have a consumer who remains employed and willing to spend his/her savings accumulated during the pandemic. Case in point, air travel has hit pre-pandemic levels of 2019, despite business travelers staying at home conducting business on Zoom (see red line on chart below).

At the other end of the spectrum, we are witnessing the crippling effects that 7% mortgage rates can have on the $4 trillion real estate industry. As you can see from the chart below, sales of existing homes have plummeted at the fastest rate since the beginning of the 2008 Financial Crisis.

With all of that said, there is a consensus building that inflation is steadily coming down. Even the very skeptical and hawkish Federal Reserve Chairman, Jerome Powell, acknowledged that the “disinflationary process has begun.” We can see that in this inflation expectation chart below (green line), which measures the average anticipated inflation over the next five years by comparing the difference in yields between the five-year Treasury Notes and the five-year TIPS (Treasury Inflation Protection Securities).

Although, currently, there are many financial crosswinds swirling, the good news is that in the near-term, the economy has been maintaining its elevation and there is no imminent sign of a hard landing. We certainly could face the potential of turbulence and changing weather conditions, but that is always the case when you invest in the financial markets. If, however, inflation continues to move in the same direction, and growth continues to surprise on the upside, there may be no landing at all. Under this scenario of maintaining a comfortable altitude, I guess I can put my pilot training on hold.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Mar. 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

10 Ways To Destroy Your Investment Portfolio

Video Replay – February 22nd 2023

Volatility has spiked due to changing concerns over inflation, interest rates, recession fears, geopolitics, and other fear-provoking issues, but how can you grow and protect your retirement nest egg?

Wade W. Slome, CFA®, CFP®, Founder of Sidoxia Capital Management, LLC, will share 10 crucial mistakes made by investors that can destroy your portfolio. Learn how to avoid these missteps and expand your wealth.