Posts filed under ‘Uncategorized’

Separating Hype from Reality: Sidoxia 2026 AI and Market Update – Wednesday 1/28/2026 at 12:00pm

Cut through the noise surrounding artificial intelligence and learn how AI is transforming investment strategy. Wade Slome, CFA, CFP, and founder of Sidoxia Capital Management, provides his 2026 market outlook, highlighting key economic trends, opportunities, and risks shaping the year ahead.

Economic & Inflation Information Create Market Jubilation

Ever since the Federal Reserve went on a crusade to increase interest rates and slow the progression of inflation at the beginning of 2022, investors have been cheering for a Goldilocks-type of economic “soft landing.” Last month, this narrative remained intact.

The S&P 500 index surged +3.5% for the month, the technology-heavy NASDAQ rocketed +6.0% (fueled by NVIDIA and other AI-related companies), and the Dow Jones Industrial Average a more modest +1.1% move thanks to the contribution of older economy stocks.

Despite the looming presidential election this November and the recent debate, the stock market has continued on a +56% bull market tear since the October 2023-low, eight months ago (see chart below). The not-too-hot, not-too-cold economic data have provided comfort to investors. For example, growth in Gross Domestic Product (GDP), the broadest measurement of economic activity, was positive (+1.4%) during the first quarter and it is expected to modestly accelerate in the second quarter (+2.2%), as forecasted by the Federal Reserve Bank of Atlanta.

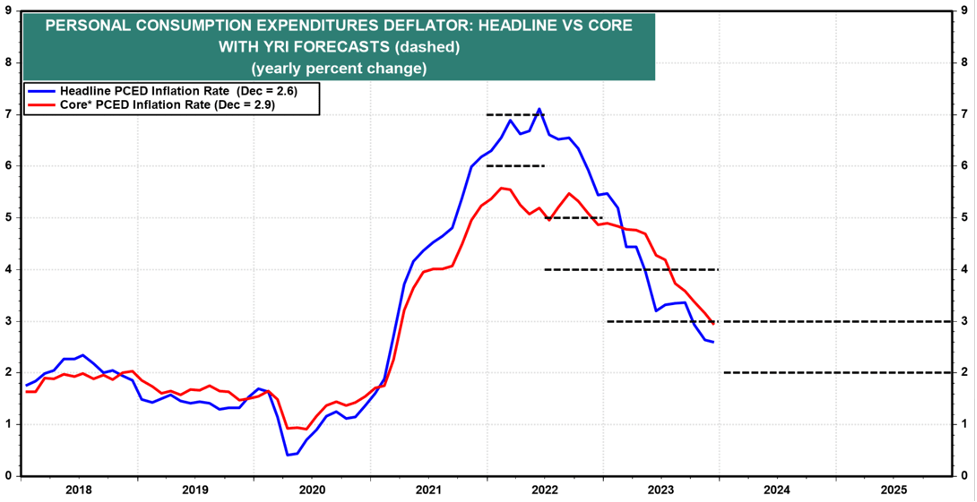

In addition, the job and inflation stories are staying consistent with the “soft landing” plot line, as well. The unemployment rate has been creeping higher, but currently remains near multi-decade lows at 4.0%. Inflation also continued its downward trend as evidenced by last week’s Core PCE inflation data (the Federal Reserve’s favorite inflation gauge), which came in at +2.6%, the lowest level since March of 2021 (see chart below).

Gasoline and food costs are significant inputs to the overall declining inflation dynamics. The two largest crops in the United States are corn and soybeans, and with those prices down significantly year-over-year (see chart below), it should come as no surprise that consumers are finally seeing some relief in skyrocketing food prices. Declining gasoline prices have also chipped-in to the improving inflation outlook.

With all these economic statistics harmoniously aligning with a “soft landing” scenario, investors are currently comfortable in forecasting one interest rate cut over the next six months, and three and a half interest rate cuts over the next 12 months (see chart below).

Source: Yardeni Research

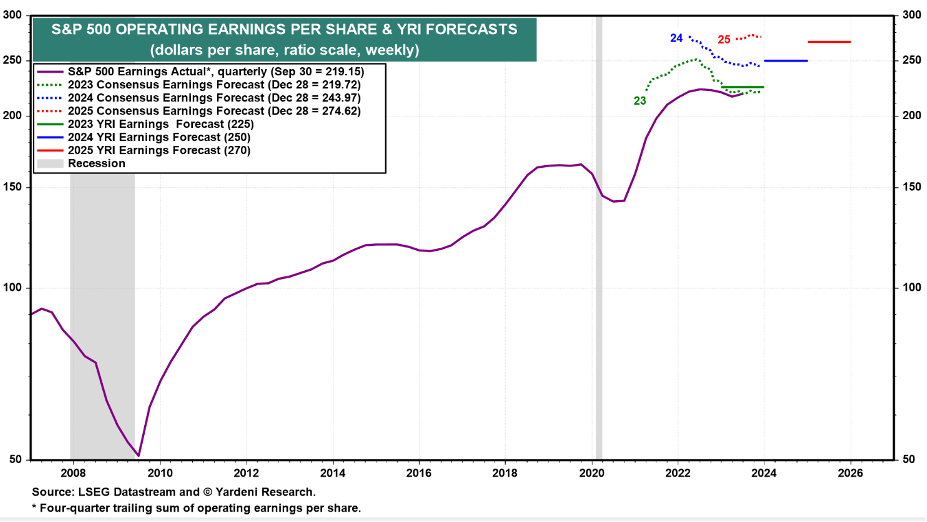

But a bull market cannot survive on interest rate cut expectations alone. Over the long-run, stock prices generally follow the direction of corporate profits, and as the chart below indicates (red line), fortunately, the path of profits has been rising after a period of stagnation last year.

Source: Yardeni Research

The last eight months have been an exhilarating ride in the overall stock market, which has been propelled by the multi-trillion dollar technology companies participating in the A.I. (Artificial Intelligence) buildout revolution (i.e., NVIDIA, Microsoft, Alphabet-Google, Apple, Meta Platforms, Amazon, et.al.). However, neither trees nor stock markets can grow, uninterrupted, to the sky forever. The recent environment has been jubilant for investors, but party participants cannot go on forever without experiencing a hangover. The best advice is to celebrate responsibly, while managing the risk of your investment portfolio, because eventually the cops will arrive and the party will come to an end.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, MSFT, GOOGL, AAPL, META, and AMZN but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Upcoming Live Webinar: Dow to 40 Thou, What Now?

Wed, Jun 19, 2024, 12:00 PM – 1:00 PM

The Dow Jones Industrial Average recently reached the 40,000 milestone, but what does that mean for investors? There are plenty of questions to explore. With the looming elections, elevated inflation, and a cryptic Federal Reserve, should you be running for cover, or jumping on the bull market bandwagon? Sidoxia Capital Management Founder, Wade W. Slome, CFA, CFP®, has more than 30 years of investment experience to answer these questions and review the current economic climate. In addition to explaining the current upside and downside risks in the macroeconomic environment, Mr. Slome will also address specific investment themes and opportunities that are being exploited for the benefit of Sidoxia’s clients and hedge fund.

We utilize Zoom webinars. Please use the Zoom registration link to access the discussion: https://us06web.zoom.us/webinar/register/WN_KJJ7GaCTQ1es617q-qC3DQ

Bad News is Good News?

Remember that global pandemic back in 2020 called COVID-19 that killed over 350,000 people in the U.S.? That same year, the unemployment rate reached a sky-high level of 14.9% (vs. 3.9% most recently) and the economy went into recession with GDP (Gross Domestic Product) declining by -2.2%. With the whole population locked in their homes and 9.4 million businesses closed, this debacle doesn’t sound like a real great environment for the stock market. What did the stock market actually do in 2020? The S&P 500 surged +16.3% (see chart below). Bad economic news turned out to be good news for stocks.

On the flip side, during 2022, the economy was firing on all cylinders. GDP was advancing at a reasonable +1.9% growth rate, and the unemployment rate stood at a near generationally low rate of 3.6%. What did the stock market do? It fell -19%. This time around, good economic news meant bad news for stock prices, primarily because the Federal Reserve was slamming the brakes on the economy by increasing the Federal Funds interest rate target.

These examples are powerful reminders that the direction of economic trends does not necessarily move in tandem with the direction of the stock market. Just this last month, investors experienced this same phenomenon when GDP growth figures were revised lower from +1.6% to +1.3%, and pending home sales dropped by -7.7% to the lowest level in four years during the pandemic. What did the stock market do last month? The S&P climbed +4.8% and the NASDAQ soared +6.9%. Once again, bad news has equaled good news due to higher hopes for Fed interest rate cuts.

For the year, the S&P has already appreciated a very respectable +10.6%. This stellar performance has come despite heated election concerns, persistent wars overseas, nervousness over the Federal Reserve’s monetary policy, and wild volatility in the cryptocurrency markets.

Fighting against these headwinds has been the tsunami of corporate investing dollars piling into the Artificial Intelligence (AI) spending tidal wave. I have been writing about this trend for a while (see AI World) and NVIDIA Corp (NVDA) confirmed this trend a couple weeks ago, when the AI juggernaut reported its fiscal first quarter financial results. Not only did NVIDIA more than triple its revenue above $26 billion for the three-month period compared to last year, but the company also increased its net profit by more than seven-fold to almost $15 billion for the quarter, in addition to announcing a 10-for-1 stock split (see chart below).

What these examples teach you is that it is a fruitless effort for investors to try to time the market based on economic news headlines. Yet, every day you turn on the television or comb through the avalanche of news headlines through various media outlets, there is always some Armageddon story about an impending market crash, or some other speculative, get-rich-quick scheme. As Warren Buffett states, “Investing is like dieting. Easy to understand, but difficult to execute.”

In other words, there is no simple solution to investing. It requires patience, discipline, and financial emotional wherewithal to allow the power of long-term compounding to grow your retirement nest egg. Short-term news cycle headlines shouldn’t drive portfolio decision-making, but rather your personal objectives, goals, and risk tolerance. These items are not static, and can change over time, therefore it’s important to revisit your asset allocation periodically as financial circumstances and life events change your objectives.

Of course, improving economic news can also lead to rising stock prices, just as deteriorating economic news can result in declining prices. Regardless, attempting to time the market is a fool’s errand. Rather than trying to maneuver in and out of the stocks, long-term investors should focus more intently on the four key factors that drive the direction of the stock market: corporate profits, interest rates, valuations, and investor sentiment (see also Don’t Be a Fool, Follow the Stool). If you understand the stock market doesn’t logically follow the daily headlines, and instead you follow the key fundament factors driving equity markets, then your investment portfolio should be blessed with plenty of good news.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 3, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA,, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Quickly Out of the Gate

The race into 2024 has begun, and the U.S. market is off to a quick start. The S&P 500 jumped out of the gates by +1.6%, and the technology and AI (Artificial Intelligence) – heavy NASDAQ index raced out by +1.2%. The bull market rally broadened out at the end of 2023, but 2024 returned to the leaders of last year’s pack, the Magnificent 7 (see also Mission Accomplished). Out front, in the lead of the Mag 7, is Nvidia with a +24% gain in January.

Inflation dropping (see chart below), the Federal Reserve signaling a decline in interest rates, low unemployment (3.7%), and healthy economic growth (+3.3% Q4 – GDP) have all contributed to the continuing bull market run.

Source: Yardeni.com

Consumer spending is the number one driver of economic growth, and consumers remain relatively confident about future prospects as seen in the recently released Conference Board Consumer Confidence numbers released this week (see chart below).

Source: Conference Board

But the race isn’t over yet, and there are always plenty of issues to worry about. The world is an uncertain place. Here are some of the concerns du jour:

– Red Sea conflict led by the Yemen-based, rebel group, Houthis

– Gaza war between Israel and Hamas

– Anxiety over November presidential election

– Ukraine – Russia war

Money Goes Where It is Treated Best

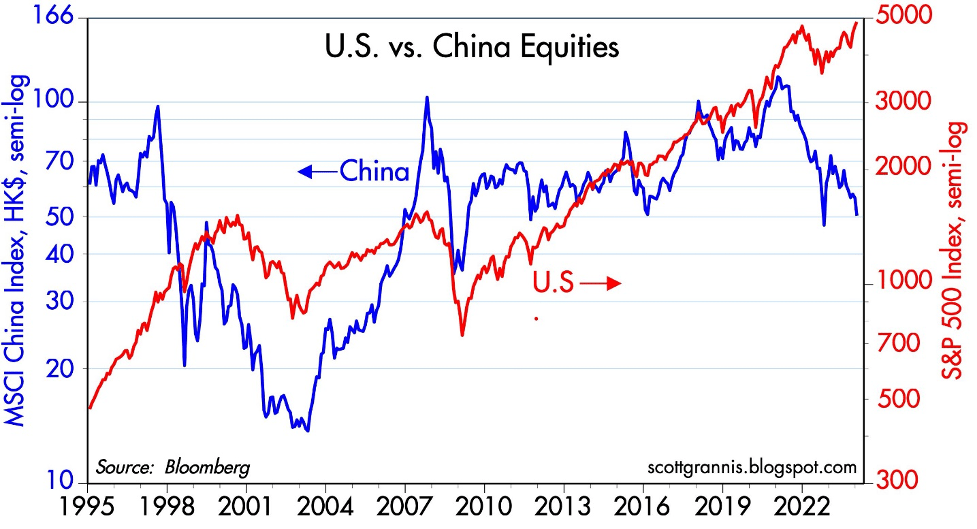

There are plenty of domestic concerns regarding government debt, deficit levels, and political frustrations on both sides of the partisan aisle remain elevated. When it comes to the financial markets, money continues to go where it is treated best. Sure, we have no shortage of problems or challenges, but where else are you going to put your life savings? China? Europe? Russia? Japan?

Well, as you can see in the chart below, anti-democratic, anti-American business, and confrontational military policies instituted by China have not benefitted investors – the U.S. stock market (S&P 500) has trounced the Chinese stock market (MSCI) over the last 30 years.

Source: Calafia Beach Pundit

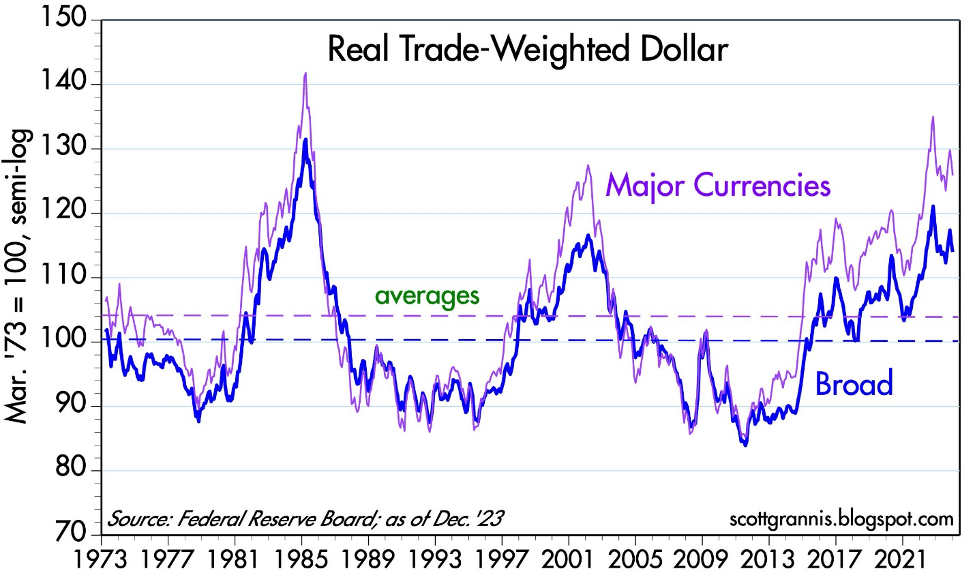

For years, market critics and pessimists have been screaming doom-and-gloom as it relates to the United States. The story goes, the U.S. is falling apart, government spending and debt levels are out of control, politicians are corrupt, and we’re going into recession, thanks in part to higher interest rates and inflation. Well, if that’s the case, then why has the value of the U.S. dollar increased over the last 10 years (see chart below)? And why is the stock market at all-time record-highs?

Source: Calafia Beach Pundit

Global investors are discerning in which countries they invest their hard-earned money. Global capital will flow to those countries with a rule of law, financial transparency, prudent tax policy, lower inflation, higher profit growth, lower interest rates, sensible fiscal and monetary policies, among other pragmatic business practices. There’s a reason they call it the “American Dream” and not the “Chinese Dream.” Our capitalist economy is far from perfect, but finding another country with a better overall investing environment is nearly impossible. There’s a reason why venture capitalists, private equity managers, sovereign wealth funds, hedge funds, and foreign institutions are investing trillions of their dollars in the United States. Money goes where it is treated best!

As money sloshes around the world, the 2024 investing race has a long way before it’s over, but at least the stock market has quickly gotten out of the gate and built a small lead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia Webinar: The Keys to ’23 & What’s in Store for ’24 – Market Update

Unlock valuable insights at our upcoming webinar:

The Keys to ’23 & What’s in Store for ’24!

Tuesday, January 30th at 12:00 PM

Click the Zoom link below to register:

https://sidoxia.link/Webinar-Registration

Don’t miss out on the latest trends and expert discussions.

We will delve into a comprehensive market update. Register now!

The Douglas Coleman Show Interviews Wade Slome

Wade Slome, President and Founder of Sidoxia Capital Management, recently had the pleasure of being featured on The Douglas Coleman Show hosted by Douglas Coleman.

Drawing from professional and personal life lessons, Wade shares his knowledge about navigating market trends, building investment strategies, and also discuss the books he has authored.

If you are interested in learning more about the books Wade has authored, please visit: https://www.sidoxia.com/wades-books

My Future Business Interviews Wade Slome

Wade Slome, President and Founder of Sidoxia Capital Management, recently had the pleasure of being featured on My Future Business hosted by Rick Nuske. Wade shares his knowledge about the financial markets, his investing philosophy, and experiences that have shaped both his professional career and personal life. Tune in to the interview below!

This Baby Bull Has Time to Grow

You may have witnessed some fireworks on New Year’s Eve, but those weren’t the only fireworks exploding. The last two months of 2023 finished with a bang! More specifically, over this short period, the S&P 500 index skyrocketed +13.7%, NASDAQ +16.8%, and the Dow Jones Industrial Average +14.0%. The gains have been even more impressive for the cheaper, more interest-rate-sensitive small-cap stocks (IJR +21.8%), which I have highlighted for months (see also AI Revolution).

For the full year, the bull market was on an even bigger stampede: S&P 500 +24%, NASDAQ +43%, and Dow +14%.

Although 2023 closed with a festive explosion, 2022 ended with a bearish growl. Effectively, 2023 was a reverse mirror image of 2022. In 2022, the stock market fell -19% (S&P) due to a spike in inflation. Directionally, interest rates followed inflation higher as the Fed worked through the majority of its 0% to 5.5% Federal Funds rate hiking cycle.

To sum it up simply, the last two years have been like riding a rollercoaster. For the year just ended, much of the year felt like a party, but 2022 felt more like a funeral. When you add the two years together, it was more of a lackluster result. For 2022-2023 combined, results registered at a meager +0.1% for the S&P, +3.7% for the Dow, and -4.0% for the NASDAQ (see chart below).

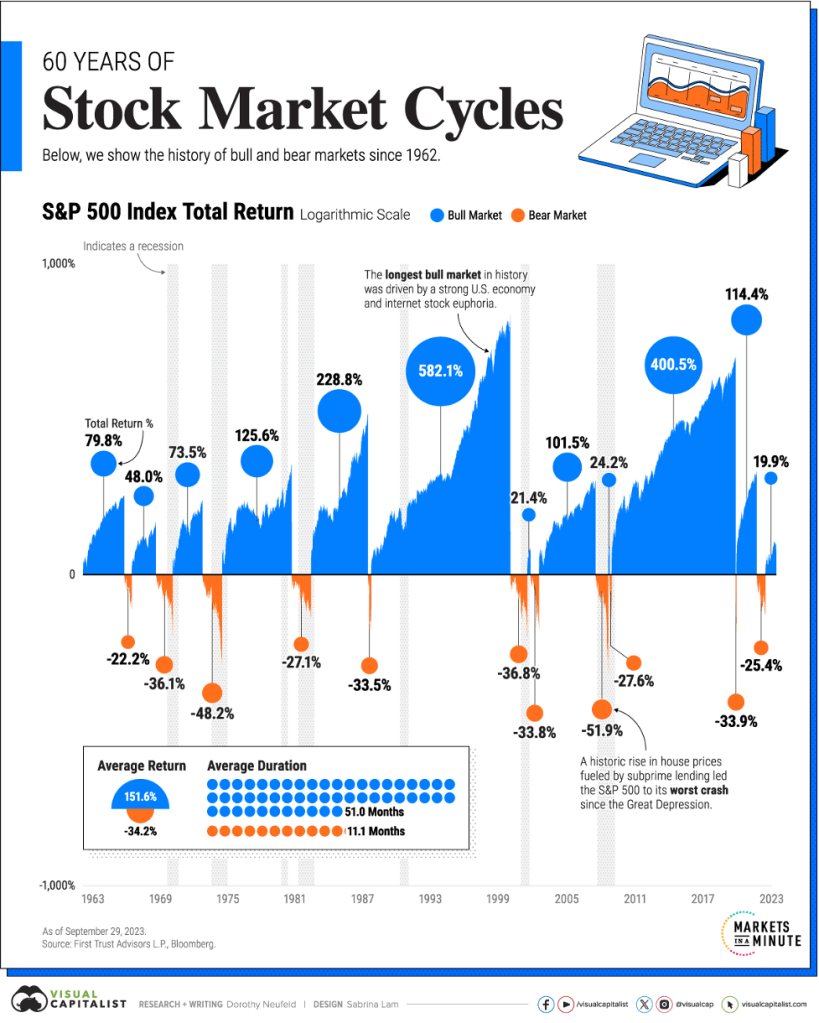

For those saying the good times of 2023 cannot continue, investors should understand that history paints a different picture. As you can see from the stock market cycles chart (below) that spans back to 1962, the average bull market lasts 51 months (i.e., 4 years, 3 months), while the average bear market persists a little longer than 11 months. This data suggests the current one-year-old baby bull market has plenty of room to grow more.

Source: Visual Capitalist

Why So Bullish?

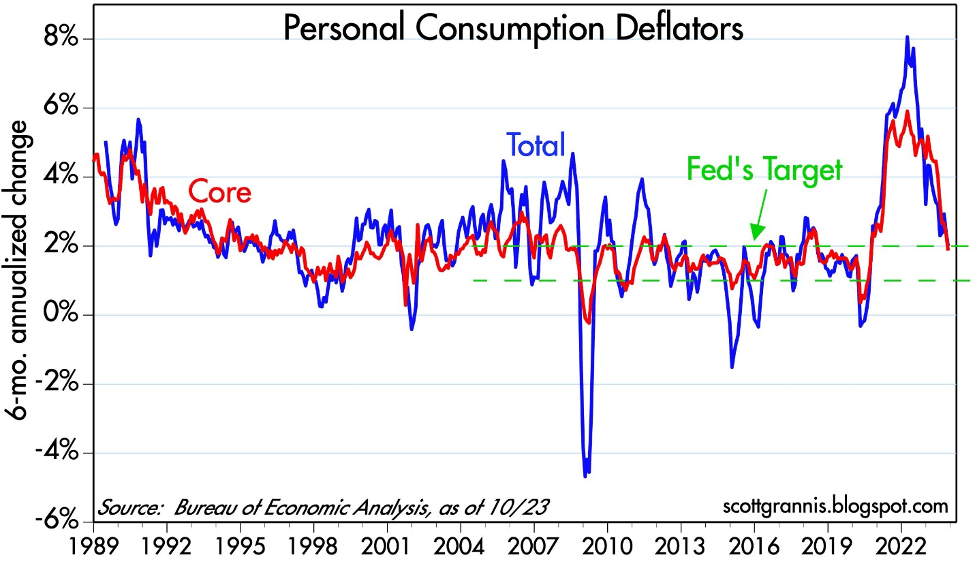

What has investors so jazzed up in recent months? For starters, inflation has been on a steady decline for many months. With China’s stagnating economy, it has helped our inflationary cause by exporting deflationary goods to our country. As you can see from the Personal Consumption Deflator chart below, this broad inflation measure has declined to the Federal Reserve’s 2% target level. Jerome Powell, the Federal Reserve Chairman has been paying attention to these statistics, as evidenced by the central bank’s forecast at the Fed’s recent policy meeting last month on December 13th for three interest rate cuts in 2024. This so-called “Powell Pivot” is a reversal in tone by the Fed, which had been on a relentless rampage of interest rate hikes, over the last two years.

Source: Calafia Beach Pundit

This interest rate cycle headwind has turned into a tailwind as investors now begin to discount the probability of future rate cuts in 2024. The relief of lower interest rates can be felt immediately, whether you consider declining mortgage and car loan rates for consumers, or credit line and corporate loan rates for businesses. This trend can be seen in the benchmark 10-Year Treasury Note yield, which has declined from a peak of 5.0% a few months ago to 3.9% today (see chart below).

Source: Trading Economics

Declining inflation and interest rates explain a lot of investor optimism, but there are additional reasons to be sanguine. The economy remains strong, unemployment remains low, AI (Artificial Intelligence) applications are improving worker productivity, trillions of potential stock market dollars remain on the sidelines in money market accounts, and corporate profits have resumed rising near all-time record levels (see chart below).

Source: Yardeni.com

What could go wrong? There are always plenty of unforeseen issues that could slow or reverse our economic train. Geopolitical events in Russia or the Middle East are always difficult to predict, and we have a presidential election in 2024, which could always negatively impact sentiment. This new bull market had a great start in 2023, but in historical terms, it is only a baby. Time will tell if 2024 will make this baby cry, but whatever the market faces, declining inflation and interest rates should act as a pacifier.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Did Santa Claus Come Early This Year?

With all this potential recession talk that has lasted two years, you would expect a lump of coal to arrive in your Christmas stocking this year. But quite the contrary, Santa Claus appears to have arrived early this year as evidenced by the +8.9% spike in prices last month, the largest monthly increase in 10 years. The NASDAQ fared slightly better with a +10.7% rise, and the Dow Jones Industrial Average lagged by a tad with an +8.0% monthly increase.

Different prognosticators have suggested the recent surge in stock prices is a precursor for a “Santa Claus rally.” I do not consider myself a superstitious person, but many traders will act upon this Christmas holiday phase that tends to coincide with an upswing in stock prices. The only problem with this assertion is there is no clearly defined period for this so-called Santa Claus phenomenon. Some say this period occurs in the week after Christmas, while others protest this trend happens in the week before the winter holiday. Looser interpretations place the beginning of the Santa Claus rally right after Thanksgiving.

Regardless of Santa Claus’s rally timing, the gloomy sentiment that dragged the stock market down roughly -11% in recent months from its July highs quickly reversed itself higher during November. How could that be? Here are some key reasons for the latest upturn:

- Inflation is Cooling (see chart below): The Federal Reserve’s preferred measure to track the pace of inflation (Core Personal-Consumption Expenditures) was released yesterday showing inflation has decreased dramatically last month to 2.5% (on a 6-month basis), within spitting distance of the Fed’s 2% target.

Source: Wall Street Journal

- Interest Rates are Coming Down: Generally, there is a strong correlation between inflation and interest rates, so last month we also saw the yields on the 10-Year Treasury Note fall dramatically to 4.25% (4.35% yesterday) after tickling 5.0% briefly at the end of October. The downward movement in rates means lower and more attractive borrowing costs for business loans, mortgages, auto loans, credit cards and other debt vehicles.

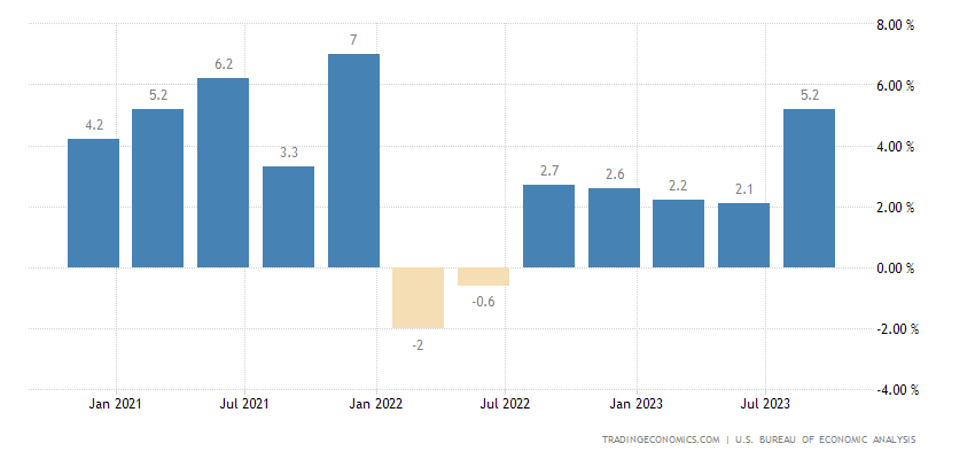

- Economy Remains Healthy: As mentioned earlier, the constant barrage of recession calls over the last two years has been blatantly wrong. In fact, the most recent GDP (Gross Domestic Product) figure for the 3rd quarter came out at a blistering +5.2% growth rate (see chart below).

Source: Trading Economics

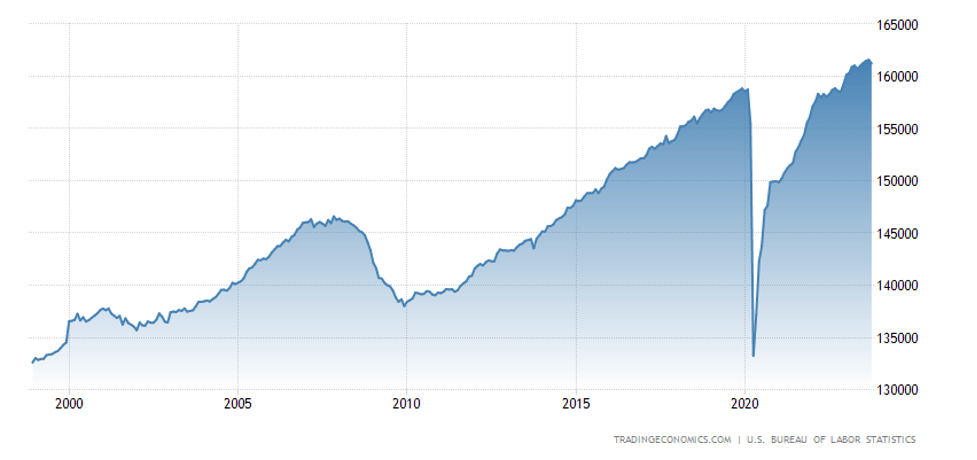

- Employment Strength Continues: The labor picture remains strong, as well. Even though the health of the labor market is usually gauged by the unemployment rate, which at 3.9% remains near record lows, the number of employed persons paints a similarly strong picture. As you can see, employment was on a tear pre-COVID, adding about 20 million jobs from 2010 to 2020. Then, after the COVID-low in workers, employment has exploded upward to an all-time, record high of 161 million employed persons (see chart below).

Source: Trading Economics

Cash Hoards on the Sideline

Despite the Federal Reserve signaling the Federal Funds rate could be peaking due to declining inflation and a weakening economy, overall interest rates remain relatively high. As a result, there is a powder keg of dry powder on the sidelines in the form of $6 trillion in institutional and retail money market funds (see chart below). If and when the economy weakens further, and the Federal Reserve reverses course by cutting interest rates, cash will earn less and will likely return to the stock market in droves.

Source: Ed Yardeni (Yardeni Takes)

Santa did not show up for a rally last December in 2022. The S&P 500 index fell -5.9% for the Christmas month last year and finished 2022 down -19%. So far, this year has looked like a mirror image of last year – the S&P is up +19% in the first 11 months of this year. Investors are hoping gifts keep coming in 2023 in the shape of a Santa Claus rally – let’s hope we are all on the “nice” list and not the “naughty” list.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.