Posts filed under ‘Trading’

Walking on Egg Shells

The recent stock market rally has investors walking on egg shells. “Nervous Nelly” investors panicked on the way down last year, and now they are fearful and skeptical about the sustainability of the fierce six-month rally. The S&P 500 is up about 60% from the latest bear market lows, but I think the recent New Jersey Business News (NJBN) article captures the investor sentiment perfectly, “I’m scared, I’m scared, I’m scared,” investor Dania Leon said. “Why are we up, especially with unemployment as high as it is? I don’t feel great because I worry that we could have a 500- or 600-point drop in a day and I won’t be quick enough to pull out of it in time.”

Will investors ever be comfortable? Well yes, of course, exactly at the right time to sell. Calm and complacency will most likely settle in once the economic headlines are on a clear path to recovery. At that point, the market, like a game of chess, will likely have already anticipated the recovery.

Until then, the whipsaw syndrome seems to have taken effect on investors. The NJBN article goes onto expand on investors’ emotional scars:

“They’ve been traumatized twice,” said Michal Strahilevitz, a business professor at Golden Gate University who studies the psychology of individual investors. “First they lost a lot and got out. And now they’ve watched it climb up. It’s a lot of regret, and for people who are investing for their family, it’s a lot of guilt.”

Trillions of low yielding cash continues to sit on the sidelines, waiting for the inevitable 10% “pullback.” Strategist Laszlo Birinyi sees little evidence for an imminent correction, “Give me the evidence…in 1982 we went 424 days before we had a correction. In 2000, we went seven years before we had a 10% correction. In 2002, we went three or four years.” (For more on Mr. Birinyi, see http://is.gd/3xS5u)

At the end of the day, as great growth investor Peter Lynch said, it’s the direction of corporate earnings that will ultimately drive the market higher or lower. “People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.” Right now based on the strength of the rally, the market is telling us that third quarter corporate earnings should come in better than analyst expectations. Perhaps we get a yawner response (sell on the news reaction), or if improvement outright stalls, perhaps we will get the mother of all expected corrections?

All these mind games make for an extremely tiresome investing mental tug-of-war. I choose not to get caught up in this game of market timing, but rather I choose to let the investment opportunity-set drive my investment decisions. I have taken some chips off the table during this rebound but I am still finding plenty of other fertile opportunities to redeploy capital. As others nervously walk on egg shells, I opt to clean up the mess and look for a clearer investment path.

Read the Full NJBN Article Here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Action Dan (Poker King) and Professional Investing

As I write in my book (How I Managed $20,000,000,000.00 by Age 32), successful investing requires skillful use of both art and science. What I find so fascinating is that the same principles apply to poker playing. Like investing, poker is also a game of skill that rewards a player who adequately understands the mathematical probabilities (science) while still able to appropriately read the behavior of his or her opponents (art). Take for example professional poker player and 1995 WSOP champ Dan Harrington. In 2003 he finished 3rd at the World Series of Poker Main Event (the Super Bowl of poker) out of a pool of 839 players. In 2004, the following year, despite the pool more than tripling to 2,576 participants, Mr. Harrington managed to finish 4th and take home a cool $1.5 million in prize money. Did luck account for this success? I think not. Odds, if left to chance, would be 1 in 25,000 for repeating this feat, according to the Economist.

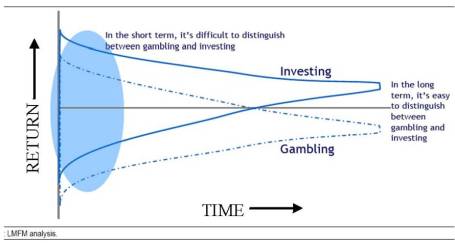

In the short-run, random volatility and luck can make the average investor look like Warren Buffett, but because of the efficiency of the market, that same average investor will look like a schmuck over the long-run. Legg Mason Funds Management put out an incredible chart that I believe so elegantly captures the incoherent and meaningless, short-term noise that the media attempts to interpret daily. What appears like outperformance in the short-run may merely be the lucky performance of a reckless speculator.

Dan Harrington, and so many other talented professionals know this fact all too well when an inexperienced “donkey” over-bets a clearly inferior hand, only to nail an inside-straight card on the “river” (last card of the round) out of pure luck – thereby knocking out a superior professional player. Over the long-run these out-of-control players end up losing all their money and professionals relish the opportunity of playing against them.

Talk to professionals and ask them what the biggest mistake new players make? The predominate answer: novices simply play too many hands. In the world of investing, the same can be said for excessive trading. Commissions, transactions costs, taxes and most importantly, ill-timed, emotionally driven trades lead the average investor to significantly underperform. I’ve referenced it before, and I’ll reference it again, John Bogle’s 1984-2002 study shows the significant drag the aforementioned costs have on professionals’ performance, and especially the average fund investor that underperformed the passive (a.k.a., “Do Nothing” strategy) S&P 500 return by more than a whopping 10% annually!

I consider myself an above average player, and I’ve won a few small tournaments, but match me up against a professional like “Action Dan” Harrington and I’ll get destroyed in the long-run. Investing, like professional poker, can lead to excess returns with the proper integration of patience and a disciplined systematic approach. I strongly believe that all great long-term investors successfully implement a strategy that marries the art and science aspects of investing. Don’t hold your breath if you expect to see me on ESPN, it may be a while before you see me at the Final Table with Dan Harrington at the World Series of Poker.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and at the time of publishing had no direct positions in LM, DIS, or BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Stock Market Nirvana: Butter in Bangladesh

Hallelulah to Jason Zweig at The Wall Street Journal for tackling the subject of data mining through his interview with David Leinweber, author of Nerds on Wall Street. All this talk about Goldman Sachs, High Frequency Trading (HFT) and quantitative models is making my head spin and distorting the true value of data modeling. Quantitative modeling should serve as a handy device in your tool-box, not a robotic “black box” solely relied on for buy and sell recommendations. As the article points out, all types of sites and trading platforms are hawking their proprietary tools and models du jour.

The problem with many of these models, even for the ones that work, is that financial market behavior and factors are constantly changing. Therefore any strategy exploiting outsized profits will eventually be discovered by other financial vultures and exploited away. As Mr. Leinweber points out, these models become meaningless if the data is sliced and diced to form manipulated relationships and predictive advice that make no sense.

Butter in Bangladesh: To drive home the shortcomings of data mining, Leinweber uses a powerful example in his book, Nerds on Wall Street, of butter production in Bangladesh. In searching for the most absurd data possible to explain the returns of the S&P 500 index, Leinweiber discovered that butter production in Bangladesh was an excellent predictor of stock market returns, explaining 75% of the variation of historical returns. The Wall Street Journal goes onto add:

By tossing in U.S. cheese production and the total population of sheep in both Bangladesh and the U.S., Mr. Leinweber was able to “predict” past U.S. stock returns with 99% accuracy.

For some money managers, the satirical stab Leinweber was making with the ridiculous analysis was lost in translation – after the results were introduced Leinweber had multiple people request his dairy-sheep model. “A distressing number of people don’t get that it was a joke,” Leinweber sighed.

Super Bowl Crystal Ball: Leinweber is not the first person to discover the illogical use of meaningless factors in quantitative models. Industry observers have noticed stocks tend to perform well in years the old National Football league team wins the Super Bowl. Unfortunately, this year we had two “old” NFL teams play each other (Pittsburgh Steelers and Arizona Cardinals). Oops, I guess we need to readjust those models again.

Other bizarre studies have been done linking stock market performance to the number of nine-year-olds living in the U.S. and another linking positive stock market returns to smog reduction.

Data Mining Avoidance Rules:

1) Sniff Test: The data results have to make sense. Correlation between variables does not necessarily equate to causation.

2) Cut Data into Slices: By dividing the data into pieces, you can see how robust the relationships are across the whole data set.

3) Account for Costs: The results may look wonderful, but the model creator must verify the inclusion of all trading costs, fees, and taxes to increase confidence results will work in the real world.

4) Let Data Brew: What looks good on paper might not work in real life. “If a strategy’s worthwhile,” Mr. Leinweber says, “then it’ll still be worthwhile in six months or a year.”

Not everyone has a PhD in statistics, however you don’t need one to skeptically ask tough questions. Doing so will help avoid the buried land mines in many quantitative models. Happy butter churning…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Momentum Investing: Riding the Wave

As famed trader Jesse Livermore (July 26, 1877 — November 28, 1940) stated, “Prices are never too high to begin buying or too low to begin selling.”

For the most part, the momentum trading philosophy dovetails with Livermore’s mantra. The basic premise of momentum investing is to simply buy the outperforming stocks and sell (or short) the underperforming stocks. By following this rudimentary formula, investors can generate outsized returns. AQR Capital Management and Tobias Moskowitz (consultant), professor at Chicago Booth School of Management, ascribe to this belief too. AQR just recently launched the AQR Momentum Funds:

- AQR Momentum Fund (AMOMX – Domestic Large & Mid Cap)

- AQR Small Cap Momentum Fund (ASMOX – Domestic Small Cap)

- AQR International Momentum Fund (AIMOX – International Large & Mid Cap)

Professor Moskowitz Speaks on Bloomberg (Thought I looked young?!)

As I write in my book, How I Managed $20,000,000,000.00 by Age 32, I’m a big believer that successful investing requires a healthy mixture of both art and science. Too much of either will create negative outcomes. Modern finance teaches us that any profitable strategy will eventually be arbitraged away, such that any one profitable strategy will eventually stop producing profits.

A perfect example of a good strategy, gone bad is Long Term Capital Management. Robert Merton and Myron Scholes were world renowned Nobel Prize winners who single handedly brought the global financial markets to its knees in 1998 when it lost $500 million in one day and required a $3.6 billion bailout from a consortium of banks. Their mathematical models weren’t necessarily implementing momentum strategies, however this case is a good lesson in showing that even when smart people implement strategies that work for long periods of time, various factors can reverse the trend.

I wish AQR good luck with their quantitative momentum funds, but I hope they have a happier ending than Jesse Livermore. After making multiple fortunes and surviving multiple personal bankruptcies, Mr. Livermore committed suicide in 1940. In the mean time, surf’s up and the popularity of quantitative momentum funds remains alive and well.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

High Frequency Trading: Buggy Whip Deja Vu

Innovation can be a thorn in the side of dying legacy industries. With the advent of the internal combustion engine from Swiss inventor Isaac de Riva (1807) and the subsequent introduction of Henry Ford’s affordable Model-T automobile (1908), the buggy whip industry came under assault and eventually disappeared. I’m sure the candle lobbyists weren’t too happy either when Thomas Edison first presented the light bulb (1879).

Legacy broker dealers and floor traders are suffering similar pains as those in the buggy whip industry did. New competitors are shrewdly exploiting technology in the field of High Frequency Trading (HFT) and as a result are gaining tremendous market share. Supercomputers and complex mathematical algorithms have now invaded the financial market exchanges, shrinking the profit pools of slow-moving, fat-cat broker dealers (a.k.a., Slow Frequency Traders – SFT) by simply trading faster and smarter than the legacy dealers and exchanges. As Dan Akroyd says to Eddie Murphy in the movie Trading Places, before making millions on the commodities trading floor, “It’s either kill, or be killed.” And right now it’s the traditional broker dealers and floor traders that are getting killed. According to a study by the Tabb Group, 73% of U.S. daily equity volume currently comes from high frequency traders (up from 30% in 2005). And despite only representing 2% of the relevant, actively trading financial institutions, the HFT industry generated an estimated $21 billion in profits last year.

HFT Controversy: So what’s the big controversy regarding HFT? Critics of these high speed traders (including Joe Saluzzi at Themis Trading) claim the fast traders are unfairly using the technology for selfish, greedy profit motives, and in the process are disadvantaging investors. Screams of “front-running,” effectively using the information obtained from fast computer processes to surreptitiously trade before poor, unassuming individual investors can react, is a foundational argument used by opponents. Also the detractors argue that the additional liquidity (traditionally considered a positive factor by academics) provided by the HFT-ers is “low-quality” liquidity because the fast trades are believed to suck valuable liquidity out of the system and contribute to heightened volatility. HFT participants are equated to aggressive ticket scalpers, who in the real world buy low priced tickets and later gouge legitimate buyers by reselling the original tickets at outrageously high prices.

Rebuttal:

- On HFT Price Impact: If HFT is so damaging for individual investors, then why have price spreads narrowed so dramatically since the existence of this fast style of trading? The computerization and decimalization of trading has made trading more efficient – much like ATM machines and e-mail have made banking and document mailing more efficient. Investors can buy at lower prices and sell at higher prices – sounds like a beneficial trend to me.

- On HFT Volatility: If HFT-ers are demonized for the market crash, then why isn’t anyone patting them on the back or buying them a drink for the ~+50% surge in the equity markets since March of this year? Maybe the investment banks that were levered 30x’s, or the $100s of billions in unregulated mortgage debt stand to shoulder more of the volatility blame?

- On HFT Price Discovery: At the end of the day, if HFT partakers (robots) are actually manipulating prices, then reasonable and greedy capitalists (humans) will stabilize prices by either scooping up irrationally low-priced stocks and/or selling short illogically high priced securities.

On HFT Front-Running and Flash Orders: The New York Times recently ran an article describing a very specific one sided scenario where “flash orders” tipped off HFT traders to unfairly exploit a profitable trade in Broadcom (BRCM) stock. However, trades do not occur in a vacuum. Other scenarios could have easily been drawn up to show HFT-ers losing money on their computer-based strategy. “Quite possibly these flash orders are happening as an unintended consequence of an automated algorithmic trading program,” says Alex Green, Managing Partner at AMG Advisory Group, an institutional trading consulting firm. Flash orders are used when trying to display an order for a small amount of time while waiting to be displayed in the National Best Bid Best Offer (the bid-ask quotes viewable to the public).

In addition, if front-running is indeed occurring, it is happening at prices between the bid-ask spread, thereby incentivizing other market makers to lower their offer price and raise their bid price (a positive development for investors). Any trading occurring outside the bounds of nationally displayed regulated price quotes constitutes illegal activity and can result in time behind bars.

Common Ground – Dark Pools: One area I believe I share common ground with the SFT-ers is on the issue of “dark pools.” In this murky realm, trading occurs in pools of anonymous buyers and sellers where no price quotes are displayed. These pools are bound by the same regulations as other exchanges, but due to their opaqueness are more difficult to police. According to a recent WSJ article, intensified scrutiny has fallen on these dark pools by the SEC because a large number flash orders are routed to them. Although flash orders may not in and of itself be a problem, there is more room for potential abuse in these dark pools.

Conclusion: When all is said and done, it is very clear to me that innovation through technology has translated into a huge gain for individual and institutional investors. It may take a PhD to write the code for a complex high frequency trading algorithm, however it doesn’t take a genius to figure out spreads have narrowed and liquidity has risen dramatically over the last decade – thanks in large part to HFT technological innovation. Certainly technology, globalization, along with the introduction of electronic communication networks (ECNs) like Direct Edge, flash orders, and dark pools have made trading complex. With a denser group of players and structures, it is important that SEC Chairman Mary Schapiro continue to regulate financial market exchanges with the aim of improved transparency and equality. As long as the trends of heightened liquidity and narrowed spreads continue, investors will benefit while the buggy whip lobbyists (legacy broker dealers and floor traders) will continue to scream.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.