Posts filed under ‘Trading’

Invisible Costs of Trading

You can feel them, but you can’t see them. I’m talking about invisible trading costs. Although some single transaction trading costs can run as high as hundreds of dollars at the large brokerage firms, investors are generally aware of the bottom-basement commissions paid on trades executed at discount brokerage firms like Scottrade, TD Ameritrade (AMTD), E-Trade (ETFC), and Charles Schwab (SCHW) – generally less than $10 per trade. Unfortunately, these commissions are estimated to only account for 20% of total trading costs1. What most investors are unaware of are the host of invisible trading costs and expenses associated with active trading.

Here are some of the invisible costs:

Bid-Ask Spread: Besides the explicit commissions charged, traders must incur the implicit costs of the bid-ask spread. Let’s suppose you have a stock trading at $12.50 per share (ask price) and $12.25 per share (bid price). If you were to immediately buy one share for $12.50 (ask) and sell immediately for $12.25 (ask), then you would be -2% in the hole instantly – more than double the $7.95 commission paid on a $1,000 investment. Effectively, the investor would already be down about -3% the instant the small investment was made.

Impact Costs: The issue of impact costs is a bigger problem for larger institutional investors, although thinly traded stocks (those securities with relatively small trading volume) can even become expensive for retail investors. Suppose the same stock mentioned previously initially traded at $12.50 per share before you transacted, but reached $13.00 per share upon completion (with an average $12.75 price paid). The $.25 cent increase (average price minus initial price) translates into another -2% increase in the costs.

Taxes: It’s not what you make that matters, but rather what you keep that makes the difference. If you make a decent amount of money actively trading, but end up giving Uncle Sam more than potentially 40% of the gains, then your bank account may grow less than expected.

While my examples may shed some light on the costs of trading, an in-depth study using data from Morningstar and NYSE was conducted by three astute professors (Roger Edelen [University of California, Davis], Richard Evans [University of Virginia], and Gregory Kadlec [Virginia Polytechnic Institute]) showing that an average fund’s annual trading costs were estimated to be 1.44%, higher than an average fund’s overall expense ratio of 1.21%.

Unfortunately from an investor’s standpoint, as much as 30% of all trading costs can be attributed to money naturally pouring in and out of funds, due to fund share purchases and redemptions. Therefore, wildly popular or out-of-favor funds will have a detrimental impact on performance. I know firsthand the costs of managing a large fund, much like captaining a supertanker – you create a lot of waves and it can take a while to change directions. Smaller funds, however, can navigate trades more nimbly, much like a speedboat leaving behind smaller cost waves in its wake.

Style can also have an impact on trading costs. Value-based funds that sell into strength or buy into weakness can be considered liquidity providers, and therefore will experience lower trading costs. On the flip side, momentum strategies effectively pour gasoline on hot stocks purchases and pile on damaging sales to cratering losers.

Emotional Costs of Trading

More impactful, but more difficult to quantify, are the emotional trading costs of greed and fear (i.e., chasing extended winners out of greed and panicking out of losing positions due to fear). Constantly hounding winners and capitulating your losers may work in a few instances, but can lead to disastrous results in the long-run. Even if an investor is correct on the sale of a security, the investor must also be right on the subsequent buy transaction (no easy feat).

With that said, there are no hard and fast rules when buying/selling stocks. Buying a stock that has doubled or tripled in and of itself is not necessarily a bad idea, as long as you have credible assumptions and data to support adequate earnings/cash flow growth and/or multiple expansion. Consistent with that thought process, a plummeting stock is not reason enough to buy, and does not automatically mean the price will subsequently rebound. Reversion to the mean can be a powerful force in security selection, but you need a disciplined process to underpin those investment decisions.

Spiritual Savings

As I have stated in the past, investing is like a religion (read more Investing Religion). Most investors stubbornly believe their financial religion is the right way to make money. I personally believe there is more than one way to make money, just as I believe different religions can coexist to achieve their spiritual goals. Through academic research, and a lot of practical experience, my religion believes in the implementation of low-cost, tax efficient products and strategies used over longer-term time horizons. I use a blend of active and passive management that leverages my professional experience (see Sidoxia’s Fusion product), but I would fault nobody for pursuing a purely passive investment strategy. As John Bogle shows, and has proven with the financial success of his company Vanguard, passive investing by and large materially outperforms professional mutual fund managers (see Hammered Investors article).

Investing can be thrilling and exciting, but like a leaky faucet, the relatively small and apparently harmless list of trading costs have a way of collecting over the long-run before sinking long-term performance returns. Sure, there are some high-frequency traders that make a living by amassing a large sums of rebates for providing short-term liquidity, but for most investors, excessive exposure to invisible trading costs will lead to visible underperformance.

Read more about trading cost study here1

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including Vanguard funds), but at the time of publishing SCM had no direct position in AMTD, ETFC, SCHW, Scottrade, MORN, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Waiting for the Hundred Minute Flood

Investors have been scarred over the last decade and many retirees have seen massive setbacks to their retirement plans. We have witnessed the proverbial “100 year flood” twice in the 2000s in the shape of a bursting technology and credit bubble in 2000 and 2008, respectively. The instantaneous transmission of data around the globe, facilitated by 24/7 news cycles and non-stop internet access, has only accelerated investor panic attacks – the 100 year flood is now expected every 100 minutes.

If drowning in the 100 year flood of events surrounding Bear Stearns, Lehman Brothers, Washington Mutual, AIG, Fannie Mae, Freddie Mac, TARP bank bailouts, Bernie Madoff’s Ponzi scheme, and Eliot Spitzer’s prostitute appreciation activities were not enough in 2008, investors (and many bearish bloggers) have been left facing the challenge of reconciling an +80% move in the S&P 500 index and +100% move in the NASDAQ index with the following outcomes (through the bulk of 2009 and 2010):

- Flash crash, high frequency traders, and “dark pools”

- GM and Chrysler’s bankruptcies

- Dubai debt crisis

- Goldman Sachs – John Paulson hearings

- Tiger Woods cheating scandal

- Greece bailout

- BP oil spill

- Healthcare reform

- China real estate bubble concerns

- Congressional leadership changes

- European austerity riots

- North Korea – South Korea provocations

- Insider trading raids

- Ireland bailout

- Next: ?????

With all this dreadful news, how in the heck have the equity markets about doubled from the lows of last year? The “Zombie Bears,” as Barry Ritholtz at The Big Picture has affectionately coined, would have you believe this is merely a dead-cat bounce in a longer-term bear-market. Never mind the five consecutive quarters of GDP growth, the 10 consecutive months of private job creation, or the record 2010 projected profits, the Zombie Bears attribute this fleeting rebound to temporary stimulus, short-term inventory rebuild, and unsustainable printing press activity by Federal Reserve Chairman Ben Bernanke.

Perhaps the Zombie Bears will change their mind once the markets advance another 25-30%? Regardless of the market action, individual investors have taken the pessimism bait and continue to hide in their caves. This strategy makes sense for wealthy retirees with adequate resources, but for the vast majority of Americans, earning next to nothing on their nest egg in cash and overpriced Treasuries isn’t going to help much in achieving your retirement goals. Unless of course, you like working as a greeter at Wal-Mart in your 80s and eating mac & cheese for breakfast, lunch, and dinner.

This Time is Different

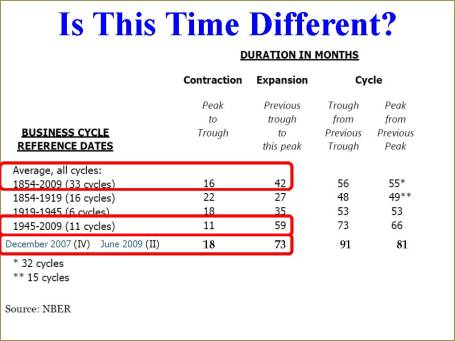

The Zombies would also have you believe this time is different, or in other words, historical economic cycles do not apply to the recent recession. I’ll stick with French novelist Alphonse Karr (1808-1890) who famously stated, “The more things change, the more things stay the same.”

As you can see from the data below, the recent recession lasted two months longer than the 16 month cycle average from 1854 – 2009. We have had 33 recessions and 33 recoveries, so I am going to go out on a limb and say this time will not be any different. Could we have a double dip recession? Sure, but odds are on our side for an average five year expansion, not the 18 month expansion experienced thus far.

The Grandma Sentiment Indicator

I love all these sentiment indicators, surveys, and various ratios that constantly get thrown around the blogosphere because it is never difficult to choose one matching a specific investment thesis. Strategists urge us to follow the actions of the “smart money” and do the opposite (like George Costanza) when looking at the “dumb money” indicators. The bears would also have you believe the world is coming to an end if you look at the current put/call data (see Smart Money Prepares for Sell Off). Instead, I choose to listen to my grandma, who has wisely reminded me that actions speak louder than words. Right now, those actions are screaming pure, unadulterated fear – a positive contrarian dynamic.

Over the last few years there has been more than $250 billion in equity outflows according to data from the Investment Company Institute (ICI). Bond funds on the other hand have taken in an unprecedented $376 billion in 2009 and about another $216 billion in 2010 through August.

As investment guru Sir John Templeton famously stated, “Bull markets are born on pessimism and they grow on skepticism, mature on optimism, and die on euphoria.” Judging by the asset outflows, I would say we haven’t quite reached the euphoria phase quite yet. I won’t complain though because the more fear out there, the more opportunity for me and my investors.

As I have consistently stated, I have no clue what equity markets are going to do over the next six to twelve months, nor does my bottom-up philosophy rely upon making market forecasts to succeed. Evaluating investor sentiment and timing economic cycles are difficult skills to master, but judging by the panicked actions and bond heavy asset inflows, investors are nervously awaiting another 100 year flood to occur in the next hundred minutes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, WMT, and AIG derivative security, but at the time of publishing SCM had no direct position in Bear Stearns, Lehman Brothers, JPM, Washington Mutual, Fannie Mae, Freddie Mac, GS, BP, GM, Chrysler, and any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Insider Trading Interview with Sidoxia Capital Management

I am recovering from one too many servings of turkey and pumpkin pie, so perhaps you can enjoy an interview I conducted with CNBC’s Erin Burnett on the subject of insider trading earlier this week (Minute 2:00).

Once I awake from the food-induced coma, I promise to return with a more typical article on Investing Caffeine’s site.

I hope everyone had a wonderful holiday…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Shrewd Research or Bilking the System?

Information is power and some hedge funds, mutual funds, and investment managers will go to great lengths to obtain the lowdown.

Integrity of the financial markets is key and recently several hedge funds (Level Global Investors LP, Diamondback Capital Management LLC and Loch Capital Management LLC) have been raided by the Federal Bureau of Investigation (FBI). Other large investment players, including SAC Capital Advisors, Janus Capital Group Inc. (JNS) and Wellington Management Co. have also received inquiries as part of what some journalists are calling rampant industry insider trading activity. Even investment bank Goldman Sachs (GS) is allegedly being examined for potential unlawful leakage of merger information. Little is known about the allegations, so it is difficult to decipher whether this is the tip of the iceberg or standard investigative work?

Regardless of the scope of the investigation, there is a fine line between what scoop is considered fair versus illegal. The distinction becomes even more difficult to pinpoint with the evolution of faster and more voluminous trading (i.e., high frequency trading). The internet has accelerated the speed of information transfer faster than a politician’s promise to cut spending. Data is chewed up and spit out so quickly, meaning tradable information has a very short shelf life before it is profitably exploited by someone. In the old days of snail mail and private back-office meetings, security prices would require time for information to be completely reflected.

Expert Networks Questioned

Another ingredient introduced over the last decade is the advent of the “expert network,” which are firms that connect fund managers to industry specialists, in many cases as part of a “channel check” to gauge the health of a particular industry. About 10 years ago Regulation FD (Fair Disclosure) was introduced to prevent selective disclosure of “material non-public” information (tips that will likely cause security prices to go significantly up or down) by senior company officials and investor relation professionals to investor types. Greedy (and/or ingenious) institutional investors are Darwinian and as a result figured out a loophole around the system. Hedge funds and other investment managers figured out if the senior executives won’t cough up the good info, then why not target the junior executives and squeeze the inside story from them like informants? Expert networks (read thorough description here) serve as an informational channel to service this demand. Although I’m sure there have been a minority of cases where mid-level managers or junior executives have leaked material information (intentionally or unintentionally), I’m very confident that it is the exception more than the rule. In many instances when the beans were spilled, Regulation FD protects both the person disseminating the information and the investor receiving the information.

Rigged Game for Individuals?

OK sure…hedge funds and institutional managers may occasionally have privileged access to executive teams and can afford access to industry experts. I should know, since I managed a multi-billion fund and consistently had access to the upper rank of corporate executives. Hearing directly from the horse’s mouth and trying to interpret body language can provide insights and instill confidence in a trade, but these executives are not stupid enough to risk prison time by selectively disclosing material non-public information. This dynamic of privileged access will never change as long as CEOs and CFOs are allowed to communicate with investors. Corporate executives will naturally prioritize their limited investor communications towards the larger players.

So with the big-wig managers gaining access to the big-wig executives, has the game become rigged for the individual investors? The short answer is “no.” Over the last decade individual investors have experienced a tremendous leveling of the playing field versus institutional investors. While institutions have privileged access and have pushed to exploit HFT and expert networks, individual investors have gained access to institutional quality research (e.g., SEC filings, real-time conference calls, Wall Street reports, etc.) for free or affordable prices. With the ubiquity of technology and the internet, I only see that gap narrowing more over time.

There will always be cheaters who stretch themselves beyond legal boundaries and should be prosecuted to the full extent of the law. However, for the vast majority of institutional investors, they are using technology and other tools (i.e., expert networks) as shrewd resources to compete in a difficult game. I will reserve full judgment on the names pasted all over the press until the FBI and SEC reveal all their cards. So far there appears to be more noise than smoke coming from the barrel tip of the insider trading gun.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, SAC Capital Advisors, Janus Capital Group Inc. (JNS), Wellington Management Co., or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sentiment Indicators: Reading the Tea Leaves

Market commentators and TV pundits are constantly debating whether the market is overbought or oversold. Quantitative measures, often based on valuation measures, are used to support either case. But the debate doesn’t stop there. As a backup, reading the emotional tea leaves of investor attitudes is relied upon as a fortune telling stock market ritual (see alsoTechnical Analysis article). Generally these tools are used on a contrarian basis when deciding about purchase or sale timing. The train of thought follows excessive optimism is tied to being fully invested, therefore the belief is only one future direction left…down. The thought process is also believed to work in reverse.

Actions Louder Than Words

When it comes to investing, I believe actions speak louder than words. For example, words answered in a subjective survey mean much less to me in gauging optimism or pessimism than what investors are really doing with their cool, hard cash. Asset flow data indicates where money is in fact going. Currently the vast majority of money is going into bonds, meaning the public hates stocks. That’s fine, because without pessimism, there would be fewer opportunities.

Most sentiment indicators are an unscientific cobbling of mood surveys designed to check the pulse of investors. How is the data used? As mentioned above, the sentiment indicators are commonly used as a contrarian tool…meaning: sell the market when the mood is hot and buy the market when it is cold.

Here are some of the more popular sentiment indicators:

1) Sentiment Surveys (AAII/NAAIM/Advisors): Each measures different bullish/bearish opinions regarding the stock market.

2) CBOE Volatility Index (VIX): The “fear gauge” developed using implied option volatility (read also VIX article).

3) Breadth Indicators (including Advanced-Decline and High-Low Ratios): Measures the number of up stocks vs. down stocks. Used as measurement device to identify extreme points in a market cycle.

4) NYSE Bullish Percentage: Calculates the percentage of bullish stock price patterns and used as a contrarian indicator.

5) NYSE 50-Day and 200-Day Moving Average: Another technical price indicator that is used to determine overbought and oversold price conditions.

6) Put/Call Ratio: The number of puts purchased relative to calls is used by some to measure the relative optimism/pessimism of investors.

7) Volume Spikes: Optimistic or pessimistic traders will transact more shares, therefore sentiment can be gauged by tracking volume metrics versus historical averages.

Sentiment Shortcomings

From a ten thousand foot level, the contrarian premise of sentiment indicators makes sense, if you believe as Warren Buffett does that it is beneficial to buy fear and sell greed. However, many of these indicators are more akin to reading tea leaves, than utilizing a scientific tool. Investors enjoy black and white simplicity, but regrettably the world and the stock market come in many shades of gray. Even if you believe mood can be accurately measured, that doesn’t account for the ever-changing state of human temperament. For instance, in a restaurant setting, my wife will change her menu choice four times before the waiter/waitress takes her order. Investor sentiment can be just as fickle depending on the Dubai, Greece, Swine Flu, or foreclosure headline du jour.

Other major problems with these indicators are time horizon and degree of imbalance. Yeah, an index or stock may be oversold, but by how much and over what timeframe? Perhaps a security is oversold on an intraday chart, but dramatically overbought on a monthly basis? Then what?

The sentiment indicators can also become distorted by a changing survey population. Average investors have fled the equity markets and have followed the pied piper Bill Gross to fixed income nirvana. What we have left are a lot of unstable high frequency traders who often change opinions in a matter of seconds. These loose hands are likely to warp the sentiment indicator results.

Strange Breed

Investors are strange and unique animals that continually react to economic noise and emotional headlines in the financial markets. Despite the infinitely complex world we live in, people and investors use everything available at their disposal in an attempt to make sense of our endlessly random financial markets. One day interest rate declines are said to be the cause of market declines because of interest rate concerns. The next day, interest rate declines due to “quantitative easing” comments by Federal Reserve Chairman Ben Bernanke are attributed to the rise in stock prices. So, which one is it? Are rate declines positive or negative for the market?

On a daily basis, the media outlets are arrogant enough to act like they have all the answers to any price movement, rather than chalking up the true reason to random market volatility, sensationalistic noise, or simply more sellers than buyers. Virtually any news event will be handicapped for its market impact. If Ben Bernanke farts, people want to know what he ate and what impact it will have on Fed policy.

Sentiment indicators are some of the many tools used by professionals and non-professionals alike. While these indicators pose some usefulness, overreliance on reading these sentiment tea leaves could prove hazardous to your fortune telling future.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Doing the Opposite – Slow Frequency Trading

The business of robot trading, or so-called high-frequency trading (HFT) has grabbed a lot of headlines recently. The recent exposé released by 60 Minutes on the subject has only fanned the flames, which have been blazing harder since the May 6th “flash crash” earlier this year. The SEC is still working through proposed rule changes and regulatory reforms in hopes of preventing a similar crash that saw the Dow Jones Industrial Index almost fall 1,000 points in fifteen minutes, only to recover much of those losses minutes later.

The debate will rage on about the fairness of HFT (read more), but let’s not confuse active day-trading with high-frequency trading. In the case of HFT, the traders are actually getting paid to trade with the assistance of “liquidity rebates.” In exchange for the service of providing liquidity, these computer-based trading companies are earning cold, hard cash. Wouldn’t that be nice if individual day traders got paid money too for trading, rather than flushing commissions down the toilet?

Rather than warn unsuspecting working class Americans of the dangers of trading, discount brokerages and other trading firms peddle talking babies, loud music, back-testing voodoo software, and the prospect of discovering a profit elixir. As it turns out, investing is like weight loss…easy to understand, but difficult to execute. There’s no such thing as a miracle drug or chocolate diet that will shed pounds off your frame, just like there is no miracle trading system that will instantaneously generate millions in profits.

Doing the Opposite

Rather than succumb to the vagaries of the market, investors would be better served by following the mantra of character George Costanza from the hit, comedic television show Seinfeld. In the classic episode, astutely captured by Josh Brown (The Reformed Broker) and also cataloged in chapter four of my book, George realizes that all his instincts are wrong and discovers the road to success can be achieved by doing everything in an opposite fashion. George goes on to flaunt his contrarian approach when he runs into a blonde bombshell at the diner. Rather than boast about his accomplishments, George fesses up to his professional shortcomings by revealing his unemployment status and admitting that he lives at home with his parents. No need to worry, this strategy captivates her and results in George immediately getting the girl. George doesn’t stop there; during the same episode he gets his way with New York Yankee owner, George Steinbrenner, by telling him off. Before long, George is generating big bucks and making key decisions for the organization.

The same contrarian instincts of George apply to the investing world. Resisting the urge to follow the herd is key. The grass is greener and the eating more abundant away from animal pack. Investor extraordinaire Warren Buffett encapsulates the idea in the following advice, “Be fearful when others are greedy, and be greedy when others are fearful.”

There will constantly be an urge to trade frequently and chase performance, whether you’re talking about technology stocks during the boom, real estate five years ago, or the perceived safe-haven of Treasuries and gold today. The melody sounds so beautiful, until the music stops and prices come crashing back down to Earth. If you want to win in the losing game of the financial markets, do yourself a favor and become a slow frequency trader – George would be proud of you doing the opposite.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Questioning the Death of Buy & Hold Investing

In the midst of the so-called “Lost Decade,” pundits continue to talk about the death of “buy and hold” (B&H) investing. I guess it probably makes sense to define B&H first before discussing it, but like most amorphous financial concepts, there is no clear cut definition. According to some strict B&H interpreters, B&H means buy and hold forever (i.e., buy today and carry to your grave). For other more forgiving Wall Street lexicon analysts, B&H could mean a multi-year timeframe. However, with the advent of high frequency trading (HFT) and supercomputers, the speed of trading has only accelerated further to milliseconds, microseconds, and even nanoseconds. Pretty soon B&H will be considered buying a stock and holding it for a day! Average mutual fund turnover (holding periods) has already declined from about 6 years in the 1950s to about 11 months in the 2000s according to John Bogle.

Technology and the lower costs associated with trading advancements is obviously a key driver to shortened investment horizons, but even after these developments, professionals success in beating the market is less clear. Passive gurus Burton Malkiel and John Bogle have consistently asserted that 75% or more of professional money managers underperform benchmarks and passive investment vehicles (e.g., index funds and exchange traded funds).

This is not the first time that B&H has been held for dead. For example, BusinessWeek ran an article in August 1979 entitled The Death of Equities (see Magazine Cover article), which aimed to eradicate any stock market believers off the face of the planet. Sure enough, just a few years later, the market went on to advance on one of the greatest, if not the greatest, multi-decade bull market run in history. People repudiated themselves from B&H back then, and while B&H was in vogue during the 1980s and 1990s it is back to becoming the whipping boy today.

Excuse Me, But What About Bonds?

With all this talk about the demise of B&H and the rise of the HFT machines, I can’t help but wonder why B&H is dead in equities but alive and screaming in the bond market? Am I not mistaken, but has this not been the largest (or darn near largest) thirty year bull market in bonds? The Federal Funds Rate has gone from 20% in 1981 to 0% thirty years later. Not a bad period to buy and hold, but I’m going to go out on a limb and say the Fed Funds won’t go from 0% to a negative -20% over the next thirty years.

Better Looking Corpse

There’s no denying the fact that equities have been a lousy place to be for the last ten years, and I have no clue what stocks will do for the next twelve months, but what I do know is that stocks offer a completely different value proposition today. At the beginning of the 2000, the market P/E (Price Earnings) valued earnings at a 29x multiple with the 10-year Treasury Note trading with a yield of about 6%. Today, the market trades at 13.5 x’s 2010 earnings estimates (12x’s 2011) and the 10-Year is trading at a level less than half the 2000 rate (2.75% today). Maybe stocks go nowhere for a while, but it’s difficult to dispute now that equities are at least much more attractive (less ugly) than the prices ten years ago. If B&H is dead, at least the corpse is looking a little better now.

As is usually the case, most generalizations are too simplistic in making a point. So in fully reviewing B&H, perhaps it’s not a bad idea of clarifying the two core beliefs underpinning the diehard buy and holders:

1) Buying and holding stocks is only wise if you are buying and holding good stocks.

2) Buying and holding stocks is not wise if you are buying and holding bad stocks.

Even in the face of a disastrous market environment, here are a few stocks that have met B&H rule #1:

Maybe buy and hold is not dead after all? Certainly there have been plenty of stinking losing stocks to offset these winners. Regardless of the environment, if proper homework is completed, there is plenty of room to profitably resurrect stocks that are left for a buy and hold death by the so-called pundits.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AAPL, AMZN, ARMH, and NFLX, but at the time of publishing SCM had no direct position in GGP, APKT, KRO, AKAM, FFIV, OPEN, RVBD, BIDU, PCLN, CRM, FLS, GMCR, HANS, BYI, SWN (*2,901% is correct %), CTSH, CMI, ISRG, ESRX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

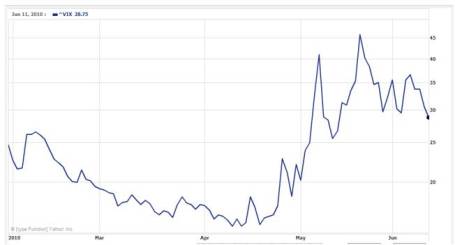

Ray Allen, the VIX, and the Rule of 16

Ray Allen gets paid a lot of money for running into people and bouncing an orange ball around a wooden floor, but even his game can appreciate the importance volatility can play in a high stakes game. First, Allen set an NBA Final’s basketball record of eight three-pointers made (including seven in a row) in Game 2, and then followed up in the next game with an astonishingly dismal “O” for thirteen performance – the second worst shooting performance during a Final’s game in 32 years. The emotional rollercoaster ride for the Celtics fans resembles a volatility chart of the VIX (Volatility Index) in recent weeks.

In the last 40 trading days the VIX has moved more than +/- 5% on 30 different trading sessions (75% of the time), including seventeen +/- 10% trading days. The +32% spike in the VIX on the day of the “Flash Crash” (May 6, 2010) would have even generated a smirk on the face of Ray Allen, not to mention the face changing impact of the other three +/- 30% move days that occurred within a month of the Flash Crash trading debacle. Even though the VIX has settled down from a short-term peak last month (48.20 on May 21st) to a lower level (28.79), the fear gauge still stands at almost double the rate of the multi-year low just a few months ago (15.23 on April 12th).

The VIX and the Rule of 16

No, this VIX is not the same as the Vicks vapor rub medication placed on your chest to relieve cough symptoms, rather this VIX indicator calculates inputs from various call and put options to create an approximation of the S&P 500 index implied volatility for the next 30 days. Put simply, when fear is high, the price of insurance catapults upwards as measured by the VIX – just like we saw when the VIX spiked above 80 during the 2008 financial crisis and above 40 during the more fresh Greek debt disaster. I’m not in the position to bust out some differential calculus to explain the nuances of a complex VIX formula, but what I can do is regurgitate a helpful formula relating to the VIX, called the Rule of 16. What the Rule of 16 allows laymans to do is understand the relationship between the VIX and daily volatility.

This is how Jeff Luby of Green Faucet describes the Rule of 16:

• VIX of 16 – 1/3 of the time the SPX will have a daily change of at least 1%

• VIX of 32 – 1/3 of the time the SPX will have a daily change of at least 2%

• VIX of 48 – 1/3 of the time the SPX will have a daily change of at least 3%

To put these VIX numbers in perspective, industry citations put the long-term VIX average around a level of 20. With a VIX hovering around 30 now, we are approaching the 2nd bucket of expectations (2%+ moves in the market 1/3 of the time). The price moves don’t correlate directly with the Dow Jones Industrial Average index, but I think about the current VIX levels equating to about a +/- 200 point move in the Dow one or two times per week…uggh.

Generally, I would prefer lower volatility, but I continually remind myself volatility is not necessarily a bad thing – volatility creates opportunities. I’m not sure if I can apply the Rule of 16 to Ray Allen’s scoring output, however based on last night’s 5-10 shooting performance, perhaps volatility in the market and Ray Allen’s shooting game will begin to normalize toward historical ranges.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including S&P 500-like positions), but at the time of publishing SCM had no direct positions in SPX, VIX-related securities, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Gravity Takes Hold in May

Wile E. Coyote, the bumbling, roadrunner-loving carnivore from Warner Bros.’ Looney Tunes series spends a lot of time in the air chasing his fine feathered prey. Unfortunately for Mr. Coyote his genetic make-up and Acme purchases could not cure the ills caused by gravity (although user error was the downfall of Wile E’s effective Bat-Man flying outfit purchase). Just as gravity hampered the coyote’s short-term objectives, so too has gravity hampered the equity markets’ performance this May.

So far the adage of “Sell in May and walk away” has been the correct course of action. Just one day prior to the end of the month, the Dow Jones Industrial and S&P 500 indexes were on pace of recording the worst May decline in almost 50 years. If the -6.8% monthly decline in the S&P and the -7.8% drop in the S&P remains in place through the end of the month, these declines would mark the worst performance in a May month since 1962.

Should we be surprised by the pace and degree of the recent correction? Flash crash and Greece worries aside, any time a market increases +70-80% within a year, investors should not be caught off guard by a subsequent 10%+ correction. In fact corrections are a healthy byproduct of rapid advances. Repeated boom-bust cycles are not market characteristics most investors crave.

It was a volatile, choppy month of trading for the month as measured by the Volatility Index (VIX). The fear gauge more than doubled to a short-run peak of around 46, up from a monthly low close of about a reading of 20, before settling into the high 20s at last close. Digesting Greek sovereign debt issues, an impending Chinese real estate bubble bursting, budget deficits, government debt, and financial regulatory reform will determine if elevated volatility will persist. Improving macroeconomic indicators coupled with reasonable valuations appear to be factoring in a great deal of these concerns, however I would not be surprised if this schizophrenic trading will persist until we gain certainty on the midterm elections. As Wile E. Coyote has learned from his roadrunner chasing days, gravity can be painful – just as investors realized gravity in the equity markets can hurt too. All the more reason to cushion the blow to your portfolio through the use of diversification in your portfolio (read Seesawing Through Chaos article).

Happy long weekend!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in TWX, VXX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

King of Controversy Reveals Maverick Solution

Mark Cuban, provocative and brash owner of the Dallas Mavericks basketball team and #400 wealthiest person in the world ($2.4 billion net worth), according to Forbes, has never been shy about sharing his opinion. In fact, this multi-billionaire’s opinions have been discouraged on multiple occasions, as evidenced by the NBA (National Basketball Association) slapping Cuban with more than $1.6 million in fines for his outbursts.

Cuban doesn’t only provide his views on basketball, as a serial entrepreneur who cashed in his former company Broadcast.com to Yahoo! (YHOO) for $5.9 billion, he also is providing his thoughts on Wall Street and the 1,000 point “fat finger” trading meltdown from last week. What does Cuban say is the answer to the rampant speculation conducted by idiot financial engineers? “Tax the Hell Out of Wall Street,” says Cuban in his recent blog flagged by TRB’s Josh Brown.

A Taxing Solution

Specifically, Cuban wants to tax investors 25 cents per share (and 5 cents per share for stocks trading at $5 per share or less) in hopes of encouraging myopic speculating traders to become longer-term shareholders. Cuban believes this approach will weed out the day traders and investment renters who in reality “don’t add anything to the markets.” Seems like a reasonable belief to me.

According to Cuban’s math, here are some of the benefits the tax would bring to the financial system:

“If the NYSE, Nasdaq, Amex and OTC are trading 2 Billion shares a day or more, like today, thats $ 500 Million Dollars PER DAY. If there are 260 trading days a year. Thats about 130 Billion dollars a year. If volumes drop because of the tax. It is still 10s of Billions of dollars per year. Thats real money for the US Treasury. Thats also an annual payment towards the next time Wall Street screws up and we have a black swan event that no one planned on.”

Practically speaking, a flat rate 25 cent tax per share is probably not the best way to go if you were to introduce a transaction tax, but the crux of Cuban’s argument essentially would not change. Creating a flat percentage tax (e.g., 1%) would likely make more sense, even if complexity may increase relative to the 25 cent tax. Take for example Citigroup (C) and Berkshire Hathaway Class A (BRKA). Cuban’s plan would result in paying 1.2% tax on a $4.17 share of Citigroup versus only 0.00022% tax for a $116,000.00 share of Berkshire Hathaway. Simple accounting maneuvers such as reverse stock splits and slowing of stock dividends, along with reducing company dilution through share and option issuance, may be methods of circumventing some of the tax burden created under Cuban’s described proposal.

Politically, adding any tax to investing voters could be re-election suicide, so rather than calling it a trading tax, I suppose the politicians would have to come up with some other euphemism, such as “charitable administrative fee for speculative trading.” The financial industry has already become experts in taxing investors with fees (read Fees, Exploitation and Confusion), so maybe Congress could give the banks and fund companies a call for some marketing ideas.

Step 1: Transparency

The murkiness and lack of transparency across derivatives markets is becoming more and more evident by the day. Some recent events that bolster the argument include: a) New CDO (Collateralized Debt Obligation) derivative allegations surfacing against Morgan Stanley (MS); b) The SEC (Securities and Exchange Commission) charges against Goldman Sachs (GS) in the Abacus synthetic CDO deal (see Goldman Sachs article); c) The collapse of AIG’s Credit Default Swap (CDS) department and subsequent push to transfer trading to open exchanges; and d) Now we’re dealing with last week’s cascading collapse of the equity markets within minutes. The brief cratering of multiple indexes points to a potential order entry blunder and/or absence of adequate and consistent circuit breakers across a web of disparate exchanges and ECNs (Electronic Communication Networks).

The mere fact we stand here five days later with no substantive explanation for the absurd trading anomalies (see Making Megabucks 13 Minutes at a Time) is proof positive changes in derivative and exchange transparency are absolutely essential.

Step 2: Incentives

In Freakonomics, the best-selling book authored by Steven Levitt, we learn that “Incentives are the cornerstone of modern life,” and “Economics is, at root, the study of incentives.” Incentives are crucial in that they permeate virtually all aspects of financial markets, not only in assisting economic growth, but also the negative aspects of bursting financial bubbles.

Michael Mauboussin, the Chief Investment Strategist at Legg Mason (read more on Mauboussin), also expands on the role incentives played in the housing collapse:

“Many, if not most, of the parties involved in the mortgage meltdown were doing what makes sense for them—even if it wasn’t good for the system overall. Homeowners got to live in fancier homes, mortgage brokers earned fees on the mortgages they originated without having to worry about the quality of the loans, investment banks earned tidy fees buying, packaging, and selling these loans, rating agencies made money, and investors earned extra yield on so-called AAA securities. So it’s a big deal to watch and unpack incentives.”

Regulation, penalties, and fines are means of creating preventative incentives against improper or unfair behavior. Just as people have no incentive to wash a rental car, nor do high frequency traders have an incentive to invest in equity securities for any extended period of time. Adding a Cuban tax may not be a cure-all for all our country’s financial woes, but as the regulatory reform debate matures in Congress, this taxing idea emanating from the King of Controversy may be a good place to start.

Read full blog article written by Mark Cuban

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and an AIG subsidary structured security, but at the time of publishing SCM had no direct positions in YHOO, C, AIG, LM, GS, BRKA, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.