Posts filed under ‘Themes – Trends’

Dow Déjà Vu – Shining Rainbow or Bad Nightmare?

Excerpt from Free January Sidoxia Monthly Newsletter (Subscribe on right-side of page)

The Dow Jones Industrial Average is sitting at 11,577 points. Dick Fuld is still CEO of Lehman Brothers, AIG is still trading toxic CDS derivative contracts, and the $700 billion TARP bailout is a pre-idea about to be invented in the brain of Treasury Secretary Hank Paulson. Oops, wait a second, this isn’t the Dow 11,577of September 2008, but rather this is the Dow 11,577 of December 2010 (+11% for the year, excluding dividends). Was the -50% drop we experienced in the equity markets during 2008-2009 all just a bad dream? If not, how in the heck has the stock market climbed spectacularly? Most people don’t realize that stocks have about doubled over the last 21 months (and up roughly +20%-25% in the last 6 months) – all in the face of horrendously depressing news swirling around the media (i.e., jobs, debt, deficits, N. Korea, Iran, “New Normal,” etc.). Market volatility often does not make intuitive sense, and as a result, many market observers have been caught flat-footed.

Here are a few basic factors that average investors have not adequately appreciated:

1) Headlines are in Rearview Mirror: News that everyone reads in newspapers and magazines and hears on the television and radio is all backward looking. It’s always best to drive while looking forward through the windshield and try to anticipate what’s around the corner – not obsess with backward looking activity in the rearview mirror. That’s how the stock market works – tomorrow’s news (not yesterday’s or today’s) is what drives prices up or down. As the economy teetered on the verge of a “Great Depression-like” scenario in 2008-2009, investors became overly pessimistic and stocks became dramatically oversold. More recently, news has been perking up. Previous recessions have seen doubters slowly convert to believers and push prices higher – eventually stocks become overbought and euphoria slows the bull market. I believe we are in phase II of this three-part economic recovery.

2) Ignore Emerging Markets at Own Peril: We Americans tend to wear blinders when it comes to focusing on domestic issues. We focus more on healthcare reform and political issues, such as “Don’t Ask, Don’t Tell,” rather than the billions of foreigners chasing us as they climb the global economic ladder. Citizens in emerging markets are more concerned about out-competing and out-innovating us through educated workforces, so they can steal our jobs and buy more toasters, iPods, and cars – things we Americans have already taken for granted. The insatiable appetite of the expanding global middle class for a better standard of living is also driving ballooning commodity prices – everything from coal to copper and corn to cotton (the 4 Cs). This universal sandbox that we play in offers tremendous opportunities to grasp and tremendous threats to avoid, if investors open their eyes to these emerging market trends.

3) Capital Goes Where it’s Treated Best: Many voters are fed-up with the political climate in Washington and the sad state of economic affairs. The great thing about the global capitalistic marketplace we live in is that it does not discriminate – capital flows to where it is treated best. On a macro basis, money flows to countries that are fiscally responsible, support pro-growth initiatives, harbor educated work forces, control valuable natural resources, and honor the rule of law. On a micro basis, money flows to companies that are attractively priced and/or capable of sustainably growing earnings and cash flow. Voters and politicians will ultimately figure it out, or capital will go where it’s treated best.

Today’s Dow 11,577 is no bad dream, but rather resembles the emergence of a bright shining rainbow after a long, cold, and dark storm. The rainbow won’t stick around forever, but if investors choose to ignore the previously mentioned factors, like so many investors have overlooked, portfolio performance may turn into an ugly nightmare.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL, and an AIG derivative security, but at the time of publishing SCM had no direct position in GS, any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Electrifying Profits from Car Prophet

Some people can talk the talk, and others can walk the walk. Well, Shai Agassi is a walker, and this 42 year old wunderkind has a modest goal: change the world radically by 2020. For a youngster who moved to California in 1995 to partner with Apple Inc. (AAPL), and who subsequently sold a company for $110 million before becoming first in line as next CEO at software giant SAP, no idea is too big for Agassi.

Electrifying Idea

When faced with the challenge to crush the world’s polluted addiction to oil powered cars, it didn’t take long for Israeli President Shimon Peres to convince Agassi there actually is a way to convert the world’s 600 million carbon-dirty, gas guzzling cars to electric vehicles (EVs). In 2007 Agassi quit his job at SAP and formed his new electric vehicle company, Better Place.

Better Place’s first challenge is converting two million cars to electric in Israel to get the ball rolling. Before executing this electrifying idea, Agassi needed to raise capital and secure a major auto manufacturing partner. In 2008, after knocking on all the major car makers’ doors at the World Economic Forum in Davos, the only person to answer was Carlos Ghosn, CEO Renault-Nissan Alliance. Not only was Ghosn committed to becoming a partner with Agassi, but Renault-Nissan was willing to pony up over $1.5 billion in capital to see the vision turn to reality.

If you haven’t heard of Shai Agassi or have not heard him speak, do yourself a favor and listen to this must see recent interview with Charlie Rose (approximately 28 minutes).

The Problem

The problem is fairly obvious. The U.S. imports about 2/3 of its oil, which translates into about $1 billion per day. Even if you are not a tree-hugger and do not care about the 33% of the country’s CO2 spewed into the air by cars and trucks, our ballooning trade deficits and our financing of countries harboring terrorists are reasons enough to move towards oil independence. So far, the introduction of hybrids has been a feeble attempt of denting the 98% of transportation vehicles powered by oil. The Toyota Prius has been around for about 15 years and hybrids have gained less than 2% of the overall automobile market share. For the electric car market to really take off, electric cars must cost $5,000 less than a comparable gas guzzler and also be just as, if not more, convenient and fast according to Agassi. What makes this oil addiction even scarier is the finite nature of this depleting resource. Fortunately the same cannot be said about alternative energy – we have virtually endless amounts of wind, solar and other biofuels.

The Solution

When it comes to politics, it was James Carville who famously quoted “It’s the economy, stupid” when referring to the 1992 Presidential election between George H.W. Bush and Bill Clinton. In other words, citizens vote with their wallets. Agassi feels the same way about consumers when it comes to car purchases. At the end of the day, car buyers vote with their wallets too and will not pay more for a car just because it is environmentally designed.

Better Place believes electric cars need to be $5,000 cheaper, faster, and more convenient. In forming the company, Agassi took a page from the cell phone industry in order to make his dream become a reality. Rather than sell a traditional hybrid car to consumers for a premium (like $35,000-$40,000 for a Prius), Better Place is subsidizing the hardware (i.e., phone or car) to attract the mass market buyers and then charge for the usage (i.e., collect for the minutes used or miles driven). If Agassi can execute this cell phone-like subsidization model, he is confident that 98% of car buyers will move to electric vehicles – predominantly for the reason of saving money (not altruism).

Logistically, a Better Place will design a network of “charge spots” that are placed across the country at workplaces, in public parking lots, and along urban streets so that EV drivers have convenient access to energy in addition to their homes. In addition to the charge spots, Better Place will also be installing “switching stations” that resemble car washes. At the switching stations, EV owners drive in and have drained batteries automatically replaced with fresh ones.

Besides environmental benefits, how would Agassi’s Better Place technology stack up on cost, speed, and convenience?

- EV is Faster: An electric car is two-times faster on acceleration versus a traditional combustible engine car equivalent. The electric car may not reach the top speeds of traditional gasoline cars, but out of the gate, EVs can leave traditional cars in the dust. Since EVs have no gears, instant acceleration is achieved.

- Improving Battery Technology: The cost of lithium-ion batteries has come down by over 75% in the past decade, creating a cost-effective, high-performance solution for EVs. The batteries are expected to perform for over 8 years and 2,000 recharges. If each charge gets 100 miles, the battery is projected to last 200,000 miles.

- Declining Cost Curve: Battery technology is improving at the pace of Moore’s Law, which means a doubling of battery performance every two years (i.e., speed, power, and battery life). For example, over the last 35 years battery life has traditionally doubled every 5-7 years. Now, the cost per unit of energy and number of cycles on a battery is doubling every two years. The consumer benefits because some of the cost savings are passed on to lower the cost of the car. On a total cost per mile basis, the cars built for Agassi can be 70% lower than a gas-powered vehicle in some markets, even after accounting for the amortized cost of the battery.

- Convenient Networks: The most common type of charge spot will provide a standard charge, which will take anywhere from 4-8 hours to fully recharge a typical EV lithium-ion battery, depending on the amount of charge remaining in the existing battery. As far as battery switching, in many cases the process will take less than a minute. At a minimum, there will be no more trips to gas stations and since Better Place will be selling miles to the EV owner, there will not be the traditional volatility in gasoline prices.

As mentioned previously, Better Place is leaning on Renault-Nissan to make this vision become a reality. Better Place has chosen to use Renault’s larger Fluence model in the full-scale Israeli network rollout. In total, Renault-Nissan is committed to rolling out nine different car models and producing 100,000 electric vehicles in the first year.

The Future

As stated earlier, Agassi walks the walk when it comes executing his vision. Besides Israel, Better Place has secured commitments from Denmark, Australia, Japan, Canada and the U.S. In the U.S., electric car networks will be built in Hawaii and California with further expansions in the works.

Agassi is not afraid to talk the talk either. Here are several bold predictions as it relates to the Israel network build out: 1) The nationwide Israeli network will be operational by January 1, 2012; 2) By 2015, more than 50% of new cars sold in Israel will be electric; and 3) By 2017 about 90% of new cars sold will be electric.

His bold predictions don’t stop there – he believes this technology will spread like wildfire. For instance, in 10 years he believes China will make and sell 40 million electric cars per year and the electricity for the car batteries will be generated from rings of solar power (not coal) surrounding various Chinese cities.

Shai Agassi has accomplished a lot in his young professional career, but his ambitions have grown even grander. So far he has been able to walk the talk, and if he is able to pull off this miraculous global electric vehicle conversion by 2020 as he plans, this is one electric prophet you do not want to ignore.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AAPL, but at the time of publishing SCM had no direct position in SAP, Renault-Nissan, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Opal Conference: Hedge Fund Heaven and Regulatory Rules

The recent Alternative Investment Summit held December 5-7 at the Ritz-Carlton in Laguna Niguel, California provided a little bit of everything for attendees – including a slice of hedge fund heaven and a less appetizing dollop of regulatory rules. If you are going to work hard, why not do it in an unrivaled, picturesque setting along the sandy shores of Dana Point? The well-attended conference, which was hosted by Opal Financial Group, was designed to address the interests of a broad set of constituents in the alternative investment food-chain, including representatives of hedge funds, fund of funds, endowments, consulting firms, private equity firms, venture capital firms, commodity trading advisors (CTAs), law firms, family offices, pension funds, along with various other vendors and service providers.

Although the topics and panel experts covered diverse areas, I found some interesting common themes emanating from the conference:

1) Waterboard Your Manager: In the wake of the Bernie Madoff Ponzi scheme and the recent sweeping insider trading investigations, institutional investors are having recurring nightmares. Consultants and other service-based intermediaries are feeling the heat in a fever-pitched litigation environment that is driving defensive behavior to avoid “headline risk” at any cost. As a result, institutional investors and fund of funds are demanding increased transparency and immediate liquidity in addition to conducting deeper, more thorough due diligence. One consultant jokingly said they will “waterboard” managers to obtain information, if necessary. In the hedge fund world, this risk averse stance is leading to a concentrated migration of funds to large established funds – even if those actions may potentially compromise return opportunities. In response to a question about insider trading investigations as they relate to client fund withdrawals, one nervous panel member advised clients to “shoot first, and ask questions later.”

2) Lurking Mountain of Maturity: Default rates in the overall bond markets have been fairly tame in the 2.0 – 2.5% range, however a mountain of previously issued debt is expected to mature over the next few years, meaning many of those corporate issuers will need to refinance the existing debt and issues longer term debt. For the most part, capital markets have been accommodating a large percentage of issuers, due to investors’ yield-hungry appetite. If the capital markets seize up and the banks continue lending like the Grinch, then the default rate could certainly creep up.

3) CLO Market Gaining Steam: The collateralized loan obligation market is still significantly below pre-crisis levels, however an estimated $3.5 billion 2010 new issue market is expected to gain even more momentum into 2011. New issuance levels are expected to register in at a more healthy $5.0 billion level next year.

4) Less Fruit in Debt Markets: The general sense among fund managers was that previously attractive bond prices have risen and bond yield spreads have narrowed. The low hanging fruit has been picked and earning similarly attractive returns will become even more challenging in the coming year, despite benign default rates. Even though bonds face a tough challenge of potential future interest rate increases, many managers believe selective opportunities can still be found in more illiquid, distressed debt markets.

5) Fund of Funds vs. Consultants: Playing in the sandbox is getting more crowded as some consultants are developing in-house investment solutions while fund of funds are advancing their own internal capabilities to target institutional investors directly. By doing so, the fund of funds are able to cut out the middle-man/woman consultant and keep more of the profit pie to themselves. From a plan sponsor perspective, institutional investors struggle with the trade-offs of investing in a diversified fund of funds vehicle versus aggregating the unique alpha generating capabilities of individual hedge fund managers.

6) Emerging Frontier Markets: There was plenty of debate about the dour state of global macroeconomic trends, but a healthy dose of optimism was injected into the discussion about emerging markets and the frontier markets. One panel member referred to the frontier markets as the Rodney Dangerfield (see Doug Kass) of the world (i.e., “get no respect”). The frontier markets are like the immature little brothers of the major emerging markets in China, India, Brazil, and Russia. Examples of frontier markets provided include Vietnam, Nigeria, Bangladesh, and Kenya. In general, these markets are heavily dependent on natural resources and will move in unison with supply-demand adjustments in larger markets like China. Of the approximately 80 frontier markets around the globe, 30 were described as uninvestable, with the remaining majority offering interesting prospects.

All in all the Opal Financial Group Alternative Investment Summit was a huge success. Besides becoming immersed in the many facets of alternative investments, I met leading thought leaders in the field, including an unexpected interaction with a world champion and living legend (read here for a hint). Many conferences are not worth the price of admission, but with global economic forces changing at breakneck speed and regulatory rules continually unfolding in response to the financial crisis, for those involved in the alternative investment field, this is one event you should not miss.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) is the General Partner of the Slome Sidoxia Fund, LP, a long-short hedge fund. SCM and some of its clients also own certain exchange traded funds (including emerging market ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Another Year, Another Decade

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Internet: The Fourth Necessity

The basic necessities for human life are food, water, shelter and most importantly…the internet. Imagine a world where you cannot: access your email; text your spouse or significant other in the same house; Twitter the contents of your lunch; or Facebook a YouTube video of a dancing meringue dog (see video). Scary thought.

Many people take the internet for granted, just like the air we breathe, but how important a role does the internet play in people’s lives? Mary Meeker, internet analyst from Morgan Stanley, takes a look at this question in a recently released presentation she completed. Earlier in the decade, Meeker was raked over the coals during the deflation of the internet bubble, but in many respects she has been redeemed in the subsequent years as hundreds of millions of people continue to plug into the internet.

According to the broad base of expert strategists, we apparently are living in an overvalued, “New Normal ” market with subdued growth for as far as the eye can see (check out New Abnormal). In the mean time Meeker shows how the top 15 global internet franchises have nearly quadrupled revenue from $33 billion in 2004 to $126 billion today. Perhaps abnormally outsized opportunities in the corporate internet universe will be the “New Normal” over the coming years?

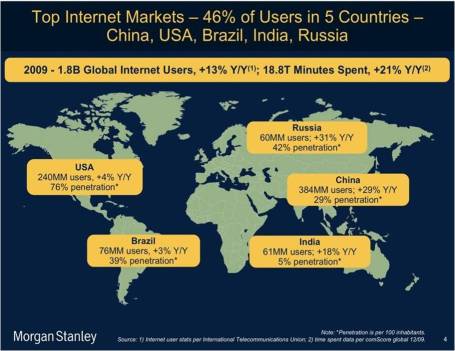

Internet Ubiquity

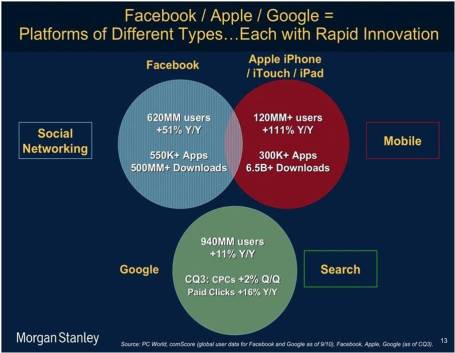

How ubiquitous is the internet becoming? Last year 1.8 billion people accessed this invisible global flattening medium we like to call the internet, and users spent 18.8 trillion minutes online, up +21% over the previous year. Many people are very familiar with the home-bred internet franchises of Facebook (620 million users), Google (940 million users), and Apple (120 million internet device users), but many investors under-appreciate the global scale of international internet franchises like Tencent (637 million users…more than Facebook by the way), Baidu ($40 billion market value), or Alibaba.com ($10 billion market value).

Mobile ubiquity is on the rise too. Connecting through a desktop or laptop is not enough these days, so internet addicts are increasingly attaching a mobile phone umbilical cord for such useful bathroom applications such as this (click here). Lugging a laptop around all over the place can be an inconvenience. So primal is the mobile instinct among internet users, Morgan Stanley expects mobile phone shipments to surpass PC and laptop shipments over the next 24 months.

What’s Next?

The party is just getting started. If you just consider eCommerce (purchases online), which only accounts for 4% of total commerce conducted in the U.S., then there is a lot of headroom for internet purchases to expand. The incredible potential rings true especially if you contemplate old traditional catalog, which peaked at more than 10% of overall commerce according to some industry executives. The rich feature functionality afforded to users through the internet, coupled with the increased convenience of mobility, augur well for future ecommerce sales growth.

The internet has been around for 15 years, but in the whole scheme of things this transformative medium is just a baby – especially if you consider the amount of time it took other revolutions like electricity, the rail network, and automobile proliferation to spread. That is why it is not too late to join the internet party. Food, water, and shelter are human necessities of life, just like exposure to the internet revolution is a necessity for your investment portfolio.

Read the Morgan Stanley Internet Presentation by Mary Meeker

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL and GOOG, but at the time of publishing SCM had no direct position in MS, BIDU, Tencent, Alibaba.com, Facebook, Twitter, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

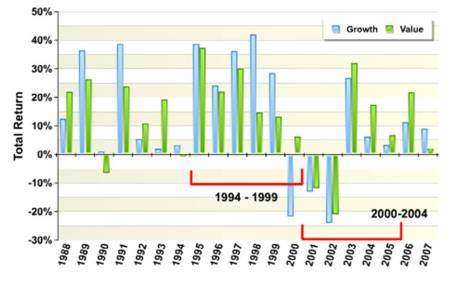

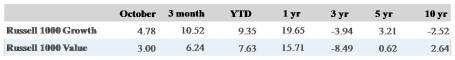

The Cyclical Seasons of Growth and Value

Continually the airwaves rotate through the growth and value managers du jour, and like religious zealots each one explains their philosophy with such confidence that Jersey Shore’s “The Situation” would even call them cocky. The fact of the matter is that styles go in and out of favor like the seasons of the year. What’s more, the consistency of the seasons is erratic and the duration of the style outperformance can in many instances extend for years. A major driver behind the relative outperformance of styles links back to where we stand in the economic cycle. Since these phases can last for years, meticulous precision is not required.

Case in point, take the “Go-Go” 1990s. In the back half of the decade, while the “New Economy” of technology companies propelled GDP to new heights, growth stocks witnessed historic price appreciation and P/E (Price-Earnings) multiple expansion. As members of our growth team high-fived each other on a daily basis, the “Four Horsemen” consistently jumped 2-3% like clockwork. Simultaneously, human resources had to keep sharp objects away from our value team colleagues and make sure the windows were locked shut. As you can see from the chart, growth stocks trounced value stocks during that period.

Karma can be a bi*ch however, because as the technology bubble burst in 2000, the coiled underperforming value stocks sprang to significant outperformance in the first half of the 2000s. The value managers were more than happy to hand over the straightjackets to us growth managers.

Since these style cycles can persist for long periods of time, and we managers get compensated based on performance versus peers, there is a strong incentive to cheat or style drift towards the outperforming style (see also Hail Mary Investing).

The pain threshold is increasing for value managers as the economic expansion matures and growth stocks have handily outperformed value stocks over the last five years. When value managers start piling into Apple Inc. (AAPL), maybe the value cycle will be ready to kick into gear again.

Arbitrary Style Buckets

Understanding the dynamics of style outperformance cycles is important, but understanding how the sausage is made at the micro level is essential too. One must appreciate that style categorizations are determined by arbitrary criteria by self-anointed “bucket deciders” (i.e., S&P, Barra, Russell Investments). Like ping pong balls, individual stocks will bounce around from one style bucket to the other based largely on share price volatility and financial metrics such as Price/Book, Price/Earnings, and EPS growth. Regrettably, these metrics can become temporarily distorted and lead to irrational trading patterns for benchmark hugging managers that become myopically focused on minor deviations from the herd.

Based on the stock bucket decision criteria, some questionable head-scratching stock categorizations may occur. For examples International Business Machines (IBM) is classified as a growth stock in the Russell 1000 Growth Index despite a cheap forward 11x P/E multiple, meager 3% revenue growth, and a 2% dividend. Phillip Morris Intl (PM) is also considered a growth stock even though its revenue growth has recently been even more sluggish at 2%, and has a mouth watering value-like dividend of 4.4%.

On the flip side, stocks like Microsoft Corp. (MSFT) are thrown in the value bucket, although the software king grew revenues +25% and earnings +55% in the recent quarter. Iconic value stock Berkshire Hathaway (BRKA/B) follows many growth stocks by not paying a dividend, and the Buffett controlled entity trades at a sky-high trailing P/E multiple of 20x, and ironically expanded sales and earnings by +21% and +28%, respectively.

All this talk of style seasons and bucket hopping only highlights the boring but crucial principle of diversification. It’s important to understand these cycles and categorizations, especially at extremes, but this does not get rid of the fact that an overly concentrated portfolio concentrated in an outperforming style is setting itself up for failure (see also Riding the Wave). We’ve reviewed cycle dynamics surrounding investment styles, but these varied securities come in all shapes and sizes – we will tackle the relative performance forces of small, mid, and large capitalization stocks during another season.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL and CSCO, but at the time of publishing SCM had no direct position in ORCL, EMC, IBM, PM, MSFT, BRKA/B, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Opening the Broker Departure Floodgates

Even though the equity markets have rebounded massively, investors remain in a sour mood in light of sluggish domestic economic headlines. Technology, for example High Frequency Trading (HFT – read more), along with the harsh realities of financial regulatory reform is creating profit growth challenges for the global financial gargantuans. More specifically, the floodgates have sprung open with respect to broker departures from the big four brokerage firms.

According to Bloomberg, more than 7,300 brokers have left the four largest full-service brokerage firms (Merrill Lynch [BAC], Morgan Stanley Smith Barney [MS], UBS Wealth Management [UBS], and Wells Fargo Advisors [WFC]) since the beginning of 2009. But the brokers have not floated away quietly – more than $1 trillion in assets have fled these major brokerage firms and followed the brokers to their new employers.

Several factors have led to the deluge of departures of bodies and bucks:

1) Mergers: The financial crisis triggered an all-out economic assault on the brokerage firm industry. A subsequent game of musical chairs resulted in the marriage of disparate cultures (e.g., B of A-Merrill; Morgan Stanley-Smith Barney; Wells Fargo-Wachovia). Not only did the clashing cultures rub brokers the wrong way, but the surviving executives were left with redundant and unproductive brokers to cut.

2) Heightened Recruiting: With a shrinking pie and less growth comes more fierce competition. The discount brokerage firms have realized the Darwinian challenges and reacted to them accordingly. Take TD Ameritrade (AMTD) for example. In the first seven months of 2010, the discount brokerage firm added 212 independent advisers to its network, a +44% increase over the previous year. Charles Schwab Corp. (SCHW) with its network of 6,000 independent advisers is also ratcheting up its efforts to poach brokers away from the large brokerage firms.

3) Economics: Would you like 40-50% of profits generated from new clients, or 80-100%? In many instances, the broker from the large branded institution funnels the majority of the commissions to the mother-ship. Sure, the broker receives back-office, marketing, and branding support, but some brokers are now asking themselves is the brand an asset or liability? Wall Street has gotten a large black eye and it will take time to heal their corporate images…if they ever manage to succeed at all.

4) Customer Choice: Lastly, and most importantly, customers are voting with their dollars. As I have indicated in the past, I strongly believe the current system is structurally flawed (see Financial Sharks article). Financial institutions craft incentives designed to line the pockets of brokers (salespeople) and prioritize corporate profits over client wealth creation and preservation. The existing failed industry structure is based upon smoke, mirrors, opacity, and small print. Many independent, fee-only advisors are structuring financial relationships that align with portfolio performance and make transparency a top priority. Customers appreciate these benefits and are shifting dollars away from the brokerage firms.

LPL Loving IPO Life

If you are having a difficult time processing the magnitude of this investment advice shift, then consider the $4.4 billion estimated value being placed on the planned IPO (Initial Public Offering) of LPL Financial, the independent brokerage firm of 12,000+ financial advisors. LPL serves as a conduit for legacy brokers to become independent, and still allow them to benefit from an array of ala carte support services. Growth has been strong too – over the last decade the advisor count at LPL has more than tripled and assets under their umbrella now exceed $250 billion.

The Wall Street broker floodgates have opened, so unless regulatory changes are enacted, the old flawed way of doing things will require a life support raft. If not, independent, fee-only advisors like Sidoxia Capital Management will benefit from the current sinking migration of brokers.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in BAC, MS, UBS, WFC, AMTD, SCHW, LPL Financial or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.