Posts filed under ‘Themes – Trends’

Curing Our Ills with Innovation

Fareed Zakaria thoughts have blanketed both traditional and internet media outlets, spanning everything from Newsweek to Time, and the New York Times to CNN. With an undergraduate diploma from Yale and his PhD from Harvard, Dr. Zakaria has built up quite a following, especially when it comes to foreign affairs.

In his latest Time magazine article, Can America Keep Pace?, Zakaria addresses the role of innovation in the U.S., “Innovation is as American as apple pie.” The innovation lead the U.S. maintains over the rest of the world will not evaporate over night because this cultural instinct is bred into our DNA – innovation is not something you one can learn directly from a textbook, Wikipedia, or Google (GOOG). With that said, the innovation gap is narrowing between developed and developing countries. New York Times columnist Tom Friedman captured this sentiment when he stated the following:

“French voters are trying to preserve a 35-hour work week in a world where Indian engineers are ready to work a 35-hour day.”

The fungibility of labor has pressured industries by transferring jobs abroad to much lower-cost regions like China and India, and that trend is only expanding further into countries with even lower labor cost advantages. Zakaria agrees:

“America’s future growth will have to come from new industries that create new products and processes. Older industries are under tremendous pressure.”

The good news is the United States maintains a significant lead in certain industries. For instance, we Yankees have a tremendous lead in fields such as biotechnology, entertainment, internet technologies, and consumer electronics.

The poster child for innovation is Apple Inc. (AAPL), which arose from the ashes of death ten years ago with its then ground-breaking new product, the iPod. Since then, Apple has introduced many innovative products and upgrades as a result of its research and development efforts, including the recently launched iPad.

The Education Engine

Where we are falling short is in education, which is the foundation to innovation. In a country with a high school system that Microsoft Corp.’s (MSFT) founder Bill Gates calls “obsolete,” society is left with one-third of the students not graduating and nearly half of the remaining graduates unprepared for college. In this instant gratification society we live in, the long-term critical education issue has been pushed to the backburner. Other emerging countries like China and India are churning out more college graduates by the millions, and also dominating us in the key strategic count of engineering degrees.

Government’s Role

With the massive debt and deficits our country currently faces, an ongoing debate about the size and role of government persists. Zakaria makes the case that government must place a significant role when it comes to innovation. Unfortunately, the U.S. wastes billions on pork-barrel projects and suboptimal subsidies while dilly-dallying in political gridlock over critical investments in education, infrastructure spending, basic research, and energy policies. In the meantime, our fellow competing countries are catching up to us, and in certain cases passing us (e.g., alternative energy investments – see Electric Profits).

Zakaria makes this point on the subject:

“The fastest-growing economies are all busy using government policy to establish commanding leads in one industry after another. Google’s Eric Schmidt points out that ‘the fact of the matter is, other countries are putting a lot more money into nurturing new industries than we are, and we are not going to win unless we do something like what they’re doing.’”

As a matter of fact, an ITIF (Information Technology & Innovation Foundation) study measuring innovation improvement from 1999 to 2009, as it related to government funding for basic research, education and corporate-tax policies, ranked the U.S. dead last out of 40 countries.

Not All is Lost – Pie Slice Maintained

Although the outlook may sounds bleak, not all is lost. In a recent Wall Street Journal interview with Bob Doll Chief Equity Strategist at the world’s largest money management company (BlackRock has $3.6 trillion in assets under management), he makes the case that the U.S. remains the leading source of technological innovation and home to the greatest universities and the most creative businesses in the world. He sees this trend persisting in part because of our country’s relative demographic advantages:

“Over the next 20 years, the U.S. work force is going to grow by 11%, Europe’s going to fall by five, and Japan’s going to fall by 17. This alone tells me the U.S. has a huge advantage over Europe and a bigger one over Japan for growth.”

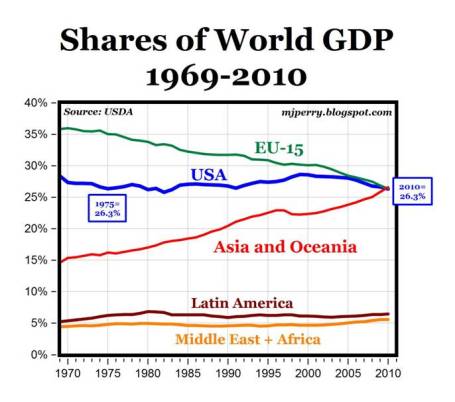

So while emerging markets, like those in Asia, continue to gain a larger slice of the global GDP pie, Mark Perry at Carpe Diem shows how the U.S has maintained its proportional slice of a growing global economic pie, over the last four decades.

Growth is driven by innovation, and innovation is driven by education. If America wants to maintain its greatness, the focus needs to be placed on innovation-led growth. The world is moving at warp speed, and our neighbors are moving swiftly, whether we come along for the ride or not. The current, sour conversations regarding deficits, debt ceilings, entitlements, wars, and unemployment are all essential discussions, but more importantly, if these debates can be refocused on accelerating innovation, the country will be well on its way to curing its ills.

See also Our Nation’s Keys to Success

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, GOOG, and AAPL, but at the time of publishing SCM had no direct position in MSFT, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Economic Tug-of-War as Recovery Matures

Excerpt from No-Cost June 2011 Sidoxia Monthly Newsletter (Subscribe on right-side of page)

With the Rapture behind us, we can now focus less on the end of the world and more on the economic tug of war. As we approach the midpoint of 2011, equity markets were down -1.4% last month (S&P 500 index) and are virtually flat since February – trading within a narrow band of approximately +/- 5% over that period. Investors are filtering through data as we speak, reconciling record corporate profits and margins with decelerating economic and employment trends.

Here are some of the issues investors are digesting:

Profits Continue Chugging Along: There are many crosscurrents swirling around the economy, but corporations are sitting on fat profits and growing cash piles owing success to several factors:

Profits Continue Chugging Along: There are many crosscurrents swirling around the economy, but corporations are sitting on fat profits and growing cash piles owing success to several factors:

- International Expansion: A weaker dollar has made domestic goods and services more affordable to foreigners, resulting in stronger sales abroad. The expansion of middle classes in developing countries is leading to the broader purchasing power necessary to drive increasing American exports.

- Rising Productivity: Cheap labor, new equipment, and expanded technology adoption have resulted in annualized productivity increases of +2.9% and +1.6% in the 4th quarter and 1st quarter, respectively. Eventually, corporations will be forced to hire full-time employees in bulk, as bursting temporary worker staffs and stretched employee bases will hit output limitations.

- Deleveraging Helps Spending: As we enter the third year of the economic recovery, consumers, corporations, and financial institutions have become more responsible in curtailing their debt loads, which has led to more sustainable, albeit more moderate, spending levels. For instance, ever since mid-2008, when recessionary fundamentals worsened, consumer debt in the U.S. has fallen by more than $1 trillion.

Fed Running on Empty: The QE2 (Quantitative Easing Part II) government security purchase program, designed to stimulate the economy by driving interest rates lower, is concluding at the end of this month. If the economy continues to stagnate, there’s a possibility that the tank may need to be re-filled with some QE3? Maintaining the 30-year fixed rate mortgage currently around 4.25%, and the 10-year Treasury note yielding around 3.05% will be a challenge after the program expires. Time will tell…

Fed Running on Empty: The QE2 (Quantitative Easing Part II) government security purchase program, designed to stimulate the economy by driving interest rates lower, is concluding at the end of this month. If the economy continues to stagnate, there’s a possibility that the tank may need to be re-filled with some QE3? Maintaining the 30-year fixed rate mortgage currently around 4.25%, and the 10-year Treasury note yielding around 3.05% will be a challenge after the program expires. Time will tell…

Slogging Through Mud: Although corporate profits are expanding smartly, economic momentum, as measured by real Gross Domestic Product (GDP) growth, is struggling like a vehicle spinning its wheels in mud. Annualized first quarter GDP growth registered in at a meager +1.8% as the economy weans itself off of fiscal stimulus and adjusts to more normalized spending levels. An elevated 9% unemployment rate and continued weak housing market is also putting a lid on consumer spending. Offsetting the negative impacts of the stimulative spending declines have been the increasing tax receipts achieved as a consequence of seven consecutive quarters of GDP growth.

Slogging Through Mud: Although corporate profits are expanding smartly, economic momentum, as measured by real Gross Domestic Product (GDP) growth, is struggling like a vehicle spinning its wheels in mud. Annualized first quarter GDP growth registered in at a meager +1.8% as the economy weans itself off of fiscal stimulus and adjusts to more normalized spending levels. An elevated 9% unemployment rate and continued weak housing market is also putting a lid on consumer spending. Offsetting the negative impacts of the stimulative spending declines have been the increasing tax receipts achieved as a consequence of seven consecutive quarters of GDP growth.

Mixed Bag – Euro Confusion: Germany reported eye-popping first quarter GDP growth of +5.2%, the steepest year-over-year rise since reunification in 1990, yet lingering fiscal concerns surrounding the likes of Greece, Portugal, and Italy have intensified. Fitch, for example, recently cut its rating on Greece’s long-term sovereign debt three notches, from BB+ to B+ plus, and placed the country on “rating watch negative” status. These fears have pushed up two-year Greek bond yields to over 26%. Regarding the other countries mentioned, Standard & Poor’s, another credit rating agency, cut Italy’s A+ rating, while the European Union and International Monetary Fund agreed on a $116 billion bailout program for Portugal.

Mixed Bag – Euro Confusion: Germany reported eye-popping first quarter GDP growth of +5.2%, the steepest year-over-year rise since reunification in 1990, yet lingering fiscal concerns surrounding the likes of Greece, Portugal, and Italy have intensified. Fitch, for example, recently cut its rating on Greece’s long-term sovereign debt three notches, from BB+ to B+ plus, and placed the country on “rating watch negative” status. These fears have pushed up two-year Greek bond yields to over 26%. Regarding the other countries mentioned, Standard & Poor’s, another credit rating agency, cut Italy’s A+ rating, while the European Union and International Monetary Fund agreed on a $116 billion bailout program for Portugal.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

It’s the Earnings, Stupid

Political strategist James Carville famously stated, “It’s the economy stupid,” during the 1992 presidential campaign. Despite a historic record approval rating of 90 by President George H.W. Bush after the 1991 Gulf War victory, Bush Sr. still managed to lose the election to President Bill Clinton because of a weak economy. President Barack Obama would serve himself well to pay attention to history if he wants to enter the “two-termer” club. Pundits are placing their bets on Obama due to his large campaign war chest, a post-Osama bin Laden extinguishment approval bump, and a cloudy Republican candidate weather forecast. If however, the unemployment rate remains elevated and the current administration ignores the spending/debt crisis, then the President’s re-election hopes may just come crashing down.

Price Follows Earnings

The similarly vital relationship between the economy and politics applies to the relationship of earnings and the equity markets too. Instead of the key phrase, “It’s the economy stupid,” in the stock market, “It’s all about the earnings stupid” is the crucial guideline. The balance sheet may play a role as well, but at the end of the day, the longer-term trend in stock prices eventually follows earnings and cash flows (i.e., investors will pay a higher price for a growing stream of earnings and a lower price for a declining or stagnant stream of earnings). Ultimately, even value investors pay more attention to earnings in the cases where losses are deteriorating or hemorrhaging (e.g. a Blockbuster or Enron). Another main factor in stock price valuations is interest rates. Investors will pay more for a given stream of earnings in a low interest rate environment relative to a high interest rate environment. Investors lived through this in the early 1980s when stocks traded at puny 7-8x P/E ratios due to double-digit inflation and a Federal Funds rate that peaked near 20%.

Bears Come Out of Hibernation

Today, earnings portray a different picture relative to the early eighties. Not only are S&P 500 operating earnings growing at a healthy estimated rate of +17% in 2011, but the 10-year Treasury note is also trading at a near-record low yield of 3.06%. In spite of these massively positive earnings and cash flow dynamics occurring over the last few years, the recent -3% pullback in the S&P 500 index from a month ago has awoken some hibernating bears from their caves. Certainly a slowing or pause in the overall economic indicators has something to do with the newfound somber mood (i.e., meager Q1 real GDP growth of +1.8% and rising unemployment claims). Contributing to the bears’ grumpy moods is the economic debt hangover we are recovering from. However, a large portion of the fundamental economic expansion experienced by corporate America has not been fueled by the overwhelming debt still being burned off throughout the financial sector and eventually our federal and state governments. Companies have become leaner and meaner – not only paying down debt, but also increasing dividends, buying back stock, and doing more acquisitions. The corporate debt-free muscle is further evidenced by the $100 billion in cash held by the likes of IBM, Microsoft Corp. (MSFT), and Google Inc. (GOOG) – and still growing.

At a 13.5x P/E multiple of 2011 earnings, perhaps the stock market is pricing in an earnings slowdown? But as of last week, about 70% of the S&P 500 companies reporting Q1 earnings have exceeded expectations. If this trend continues, perhaps we will see James Carville on CNBC rightfully shouting the maxim, “It’s the earnings, stupid!”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing SCM had no direct position in IBM, MSFT, Blockbuster, Enron, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

End of the World Put on Ice

Our 3.5 billion year old planet has received a temporary reprieve, at least until the next Mayan Armageddon destroys the world in 2012. Sex, money, and doom sell and Arnold, Oprah, and the Rapture have not disappointed in generating their fair share of advertising revenue clicks.

With 2 billion people connected to the internet and 5 billion people attached to a cell phone, every sneeze, burp, and fart around the world makes daily headline news. The globalization cat is out of the bag, and this phenomenon will only accelerate in the years to come. In 1861 the Pony Express took ten days to deliver a message from New York to San Francisco, and today it takes a few seconds to deliver a message across the world over Twitter or Facebook.

The equity markets have more than doubled from the March 2009 lows and even previous, ardent bulls have turned cautious. Case in point, James Grant from the Interest Rate Observer who was “bullish on the prospects for unscripted strength in business activity” (see Metamorphosis of Bear into Bull) now sees the market as “rich” and asserts “nothing is actually cheap.” Grant rubs salt into the wounds by predicting inflation to spike to 10% (read more).

Layer on multiple wars, Middle East/North African turmoil, gasoline prices, high unemployment, mudslinging presidential election, uninspiring economic growth, and you have a large pessimistic poop pie to sink your teeth into. Bearish sentiment, as calculated by the AAII Sentiment Survey, is at a nine-month high and currently bears outweigh bulls by more than 50%.

The Fear Factor

I think Cullen Roche at Pragmatic Capitalism beautifully encapsulates the comforting blanket of fear that is permeating among the masses through his piece titled, “In Remembrance of Fear”:

“The bottom line is, stay scared. Do not let yourself feel confident, happy or wealthy. You are scared, poor and miserable. You should stay that way. You owe it to yourself. The media says so. And more importantly, there are old rich white men who need to sell books and if you’re not scared by them you’ll never buy their books. So, do yourself a favor. Buy their books and services and stay scared. You deserve it.”

Here is Cullen’s prescription for dealing with all the doom and gloom:

“Associate with people who are more scared than you. That way, you can all sit in bunkers and talk about the end of days and how screwed we all are. Think about how much better that will make you feel. Misery loves company. Do it.”

All is Not Lost

While inflation and gasoline price concerns weigh significantly on economic growth expectations, some companies are taking advantage of record low interest rates. Take for example, Google Inc.’s (GOOG) recent $3 billion bond offerings split evenly across three-year, five-year, and ten-year notes with an average interest rate of 2.3%. Although Google has languished relative to the market over the last year, the market blessed the internet giant with the next best thing to free money by pricing the deal like a AAA-rated credit. Cash-heavy companies have been able to issue low cost debt at a frantic pace for accretive EPS shareholder-friendly activities, such as acquisitions, share buybacks, and organic growth initiatives. Cash rich balance sheets have afforded companies the ability to offer shareholders a steady diet of dividend increases too.

While there is no question high oil prices have put a wet towel over consumer spending, the largest component of corporate check books is labor costs, which accounts for roughly two-thirds of corporate spending. With unemployment rate at 9.0%, this is one area with no inflation pressure as far as the eye can see. Money losing companies that go bankrupt lay-off employees, while profitable companies with stable input costs (labor) will hire more – and that’s exactly what we’re seeing today. Despite all the economic slowing and collapse anxiety, S&P 500 operating earnings, as of last week, are estimated to rise +17% in 2011. Healthy corporations coupled with a growing, deleveraged workforce will have to carry the burden of growth, as deficit and debt direction will ultimately act as a drag on economic growth in the immediate and intermediate future.

Fear and pessimism sell news, and technology is only accelerating the proliferation of this trend. The good news is that you have another 18 months until the next apocalypse on December 21, 2012 is expected to destroy the human race. Rather than attempting to time the market, I urge you to follow the advice of famed investor Peter Lynch who says, “Assume the market is going nowhere and invest accordingly.” For all the others addicted to “pessimism porn,” I’ll let you get back to constructing your bunker.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing SCM had no direct position in Twitter, Facebook, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Bin Laden Killing Overshadows Royal Rally

Excerpt from No-Cost May Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Before the announcement of the killing of the most wanted terrorist in the world, Osama bin Laden, the royal wedding of Prince William Arthur Philip Louis and Catherine Middleton (Duke and Duchess of Cambridge) grabbed the hearts, headlines, and minds of people around the world. As we exited the month, a less conspicuous royal rally in the U.S. stock market has continued into May, with the S&P 500 index climbing +2.8% last month as the economic recovery gained firmer footing from the recession of 2008 and early 2009. As always, there is no shortage of issues to worry about as traders and speculators (investors not included) have an itchy sell-trigger finger, anxiously fretting over the possibility of losing gains accumulated over the last two years.

Here are some of the attention-grabbing issues that occurred last month:

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Skyrocketing Silver Prices: Silver surged ahead +28% in April, the largest monthly gain since April 1987, and reached a 30-year high in price before closing at around $49 per ounce at the end of the month. Speculators and investors have been piling into silver as evidenced by activity in the SLV (iShares Silver Trust) exchange traded fund, which on occasion has seen its daily April volume exceed that of the SPY (iShares SPDR S&P 500) exchange traded fund.

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain commodity and S&P 500 exchange traded funds, but at the time of publishing SCM had no direct position in SLV, SPY, TWX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Rebuilding after the Political & Economic Tsunami

Excerpt from Free April Sidoxia Monthly Newsletter (Subscribe on right-side of page)

The Start of the Arab Uprising

The Arab uprising grew its roots from an isolated and disgraced Tunisian fruit vendor (26- year-old Mohammed Bouazizi) who burned himself to death in protest of the persistent, deep-seeded corruption prevalent throughout the government (view excellent 60 Minutes story on Tunisia uprising). The horrific death ultimately led to the swift removal of Egypt’s 30-year President Hosni Mubarak, whose ejection was spurred by massive Facebook-organized protests. Technology has flattened the world and accelerated the sharing of powerful ideas, which has awoken Arab citizens to see the greener grass across other global democratic nations. Facebook, Twitter, and LinkedIn can be incredible black-holes of productivity destroyers (I know firsthand), but as recent events have proven, these social networking services, which handle about 1 billion users globally, can also serve valuable purposes.

As the flames of unrest have been fanned across the Middle East and Northern Africa, autocratic dictators haven’t had the luxury of idly sitting on their hands. Instead, these leaders have been pushed to relent to the citizens’ wishes by addressing previously taboo issues, such as human rights, corruption, and economic opportunity. These fresh events feel like new-found changes, but these major social tectonic shifts have been occurring throughout history, including our lifetimes (e.g., Tiananmen Square massacre and the fall of the Berlin Wall).

Good News or Bad News?

Recent headlines have created angst among the masses, and the uncertainty has investors asking a lot of questions. Besides radioactive concerns in both Japan and the Middle East (one actual, one figurative), the “worry list” of items continues to stack higher. Oil prices, inflation, the collapsing dollar, exploding deficits, a China bubble, foreclosures, unemployment, quantitative easing (QE2), mountainous debt, 2012 elections, and the end of the world among others, are worries crowding people’s brains. Incredibly, somehow the market still manages to grind higher. More specifically, the Dow Jones Industrial Average has climbed a very respectable +6.4% for 2011.

With the endless number of worries, how on earth could the major market indexes still advance, especially after a doubling in value from 24 months ago? For one, these political and economic shocks are nothing new. History has shown us that democratic, capitalistic markets ultimately move higher in the face of wars, assassinations, banking crises, currency crises, and various other stock market frauds and scandals. I’m willing to go out on a limb and say these worrisome events will continue this year, next year, and even over the next decade.

Most baby boomers living in the early 1980s remember when 30-year mortgage rates on homes reached 18.5%, inflation hit 14.8%, and the Federal Funds interest rate peaked near 20%. Boomers also survived Vietnam, Watergate, the Middle East oil embargo, Iranian hostage crisis, 1987 Black Monday, collapse of the S&L banks, the rise and fall of the Cold War, Gulf War I/II, yada, yada, yada. Despite all these cataclysmic events, from the last birth of the Baby Boomers (1964), the Dow Jones Industrial catapulted from about 890 to 12,320. This is no April Fool’s joke! The market has increased a whopping 14-fold (without dividends) in the face of all this gruesome news. You won’t find that story on the front-page of The Wall Street Journal.

Lost Decade Goes on Sale

The gains over the last four and half decades have been substantial, but much more is said about the recent “Lost Decade.” Although it has generally been a lousy decade for most investors in the stock market, eventually the stock market follows the direction of profits. What the popular press negates to mention is that S&P 500 operating earnings have more than doubled from about $47 in 1999 to an estimated $97 in 2011. Over the same period, the price of the market has been chopped by more than half (i.e., the Price – Earnings multiple has been cut from 29x to 13.5x). With stocks selling at greater than -50% off from 1999, no wonder smart investors like Warren Buffett are buying America – Buffett just spent $9 billion in cash on buying Lubrizol Corp (LZ). Retail investors absolutely loved stocks in 2000 at the peak, believing there was virtually no risk. Now the tables have been turned and while stock prices are trading at a -50% discount, retail investors are intensely skeptical and nervous about the prospects for stocks. Shoppers don’t usually wait for prices to go up 30% and then say, “Oh goody, prices are much higher now, so I think I will buy!” but that is what they are saying now.

I don’t want to oversell my enthusiasm, because the deals were dramatically better in March of 2009. Hindsight is 20-20, but at the nadir of the stock market, stock prices traded at bargain basement levels of 7x times 2011 earnings. We may not see opportunities like that again in our lifetime, so sitting in cash may not be the most advisable positioning.

Although I would argue every investor should have some exposure to equities, an investor’s time horizon, objectives, constraints and risk tolerance should be the key determinants of whether your investment portfolio should have 5% equity exposure or 95% exposure.

So while the economic and political dominoes may appear to be tumbling based on the news du jour, don’t let the headlines and the so-called media pundits scare you into paralysis. Bad news and tragedy will continue, but fortunately when it comes to prosperity, history is on our side. As you attempt to organize and pickup the financial pieces of the last few years, make sure you have a disciplined, long-term investment plan that adapts to changing market and personal conditions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in LZ, Facebook, Twitter, LinkedIn, BRKA/B, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Reasoning with Investment Confusion

Some things never change, and in the world of investing many of the same principles instituted a century ago are just as important today. So while we are dealing with wars, military conflicts, civil unrest, and natural disasters, today’s process of filtering and discounting all these events into stock prices is very similar to the process that George Selden describes in his 1912 book, “Psychology of the Stock Market.”

Snub the Public

Investing in stocks is nowhere close to a risk-free endeavor, and 2008-2009 was a harsh reminder of that fact. Since a large part of the stock market is based on emotions and public opinion, stock prices can swing wildly. Public opinion may explain why the market is peaking or troughing, but Selden highlights the importance of the silent millionaires (today’s billionaires and institutional investors), and that the true measurement of the stock market is dollars (not opinions of the masses):

“Public opinion in a speculative market is measured in dollars, not in population. One man controlling one million dollars has double the weight of five hundred men with one thousand dollars each. Dollars are the horsepower of the markets–the mere number of men does not signify.”

When the overwhelming consensus of participants is bullish, by definition, the small inexperienced investors and speculators are supplied stock from someone else – the silent, wealthy millionaires.

The newspaper headlines that we get bombarded with on a daily basis are a mirror reflection of the general public’s attitudes and when the euphoria or despondency reaches extreme levels, these points in time have been shown to correlate with market tops and bottoms (see Back to the Future Magazine Covers).

In the short-run, professional traders understand this dynamic and will often take a contrarian approach to news flow. Or as Seldon explains:

“A market which repeatedly refuses to respond to good news after a considerable advance is likelely to be ‘full of stocks.’ Likewise a market which will not go down on bad news is usually ‘bare of stock.’”

This contrarian dynamic in the market makes it virtually impossible for the average investor to trade the market based on the news flow of headlines and commentator. Before the advent of the internet, 98 years ago, Selden prophetically noted that the increasing difficulty of responding to sentiment and tracking market information:

“Public opinion is becoming more volatile and changeable by the year, owing to the quicker spread of information and the rapid multiplication of the reading public.”

Following what the so-called pundits are saying is fruitless, or as Gary Helms says, “If anybody really knew, they wouldn’t tell you.”

Selden’s Sage Advice

If trading was difficult in 1912, it must be more challenging today. Selden’s advice is fairly straightforward:

“Stick to common sense. Maintain a balanced, receptive mind and avoid abstruse deductions…After a prolonged advance, do not call inverted reasoning to your aid in order to prove that prices are going still higher; likewise after a big break do not let your bearish deductions become too complicated.”

The brain is a complex organ, but we humans are limited in the amount and difficulty of information we can assimilate.

“When it comes to so complicated a matter as the price of stocks, our haziness increases in proportion to the difficulty of the subject and our ignorance of it.”

The mental somersault that investors continually manage is due to the practice of “discounting.” Discounting is a process that adjusts today’s price based on future expected news. Handicapping sports “spreads” involves a very similar methodology as discounting stock prices (read What Happens in Vegas). But not all events can be discounted, for instance the recent earthquake and tsunami in Japan. When certain factors are over-discounted or under-discounted, these are the situations to profit from on a purchase or shorting basis.

The Dow Jones Industrial Average traded below a value of 100 versus more than 12,000 today, but over that period some things never change, like the emotional and mental aspects of investing. George Selden makes this point clear in his century old writings – it’s better to focus on the future rather than fall prey to the game of mental somersault we call the stock market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Nuclear Knee-Jerk Reaction

It’s amazing how quickly the long-term secular growth winds can reverse themselves. Just a week ago, nuclear energy was thought of as a safe, clean, green technology that would assist the gasoline pump pain in our wallets and purses. Now, given the events occurring in Japan, “nuclear” has become a dirty word equated to a life-threatening game of Russian roulette.

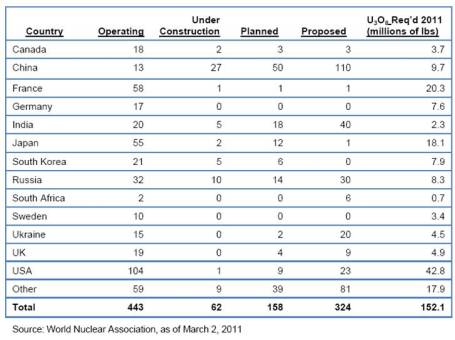

Despite the spotty information filtering in from the Dai-Ichi plant in Japan, we are already absorbing knee-jerk responses out of industrial heavyweight countries like Germany and China. Germany has temporarily closed seven nuclear power centers generating about a quarter of its nuclear capacity, and China has instituted a moratorium on all new facilities being built. How big a deal is this? Well, China is one country, and it alone currently accounts for 44% of the 62 global nuclear reactor projects presently under construction (see chart below).

As a result of the damaged Fukushima reactors, coupled with various governmental announcements around the globe, Uranium prices have dropped a whopping -30% within a month – plunging from about $70 per pound to around $50 per pound today.

Where does U.S. Nuclear Go from Here?

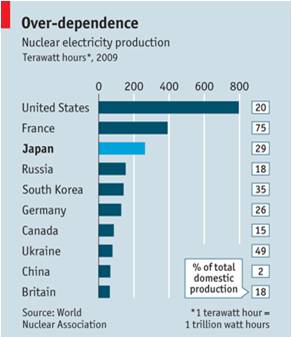

As you can see from the chart below, the U.S. is the largest producer of nuclear energy in the world, but since our small population is such power hogs, this relatively large nuclear capability only accounts for roughly 20% of our country’s total electricity needs. France, on the other hand, manages about half the reactors as we do, but the French derive a whopping 75% of their total electricity needs from nuclear power. According to the Nuclear Energy Institute, Japanese reliance on nuclear power falls somewhere in between – 29% of their electricity demand is filled by nuclear energy. Like Japan, the U.S. imports most of its energy needs, so if nuclear development slows, guess what, other resources will need to make up the difference. OPEC and various other oil-rich, dictators in the Middle East are licking their chops over the future prospects for oil prices, if a cost-effective alternative like nuclear ends up getting kicked to the curb.

As I alluded to above, there is, however, a silver lining. As long as oil prices remain elevated, any void created by a knee-jerk nuclear backlash will only create heightened demand for alternative energy sources, including natural gas, solar, wind, biomass, clean coal, and other creative substitutes. While we Americans may be addicted to oil, we also are inventive, greedy capitalists that will continually look for more cost-efficient alternatives to solve our energy problems (see also Electrifying Profits). Unlike other countries around the world, it looks like the private sector will have to do the heavy lifting to solve these resources on their own dime. Limited subsidies have been introduced, but overall our government has lacked a cohesive energy plan to kick-start some of these innovative energy alternatives.

Déjà Vu All Over Again

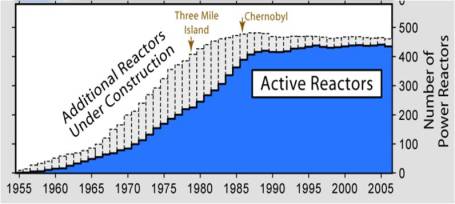

We saw what happened on our soil in March 1979 when the Three Mile Island nuclear accident in Pennsylvania consumed the hearts and minds of the country. Pure unadulterated panic set in and new nuclear production ground to a virtual halt. When the subsequent Chernobyl incident happened in April 1986 insult was added to injury. As you can see from the chart below, nuclear reactor capacity has plateaued for some twenty years now.

The driving force behind the plateauing nuclear facilities is the NIMBY (Not In My Back Yard) phenomenon. The Three Mile Island incident is still fresh in people’s minds, which explains why only one nuclear plant is currently under construction in our country, on top of a base of 104 U.S. reactors in 31 states. I point this out as an ambivalent NIMBY-er since I work 30 miles away from one of the riskiest, 30-year-old nuclear plants in the country (San Onofre).

Unintended Consequences

The Sendai disaster is home to the worst Japanese earthquake in 140 years, by some estimates, but history will prove once again what unintended consequences can occur when impulsive knee-jerk decisions are made. Just consider what has happened to oil prices since the moratorium on offshore drilling (post-BP disaster) was instituted. Sure we have witnessed a dictator or two topple in the Middle East, and there currently is adequate supply to meet demand, but I would make the case that we should be increasing domestic oil supplies (along with alternative energy sources), not decreasing supplies because it is politically safe.

Time will tell if the Japanese earthquake/tsunami-induced nuclear disaster will create additional unintended consequences, but I am hopeful the recent events will at a minimum create a serious dialogue about a comprehensive energy policy. If the comfortable, knee-jerk reaction of significantly diminishing nuclear production is broadly adopted around the world, then an urgent alternative supply response needs to occur. Otherwise, you may just need to enjoy that bike ride to work in the morning, along with that nice, romantic candle-lit dinner at night.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and alternative energy securities, but at the time of publishing SCM had no direct position in BP, URRE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Art of Weather Forecasting and Investing

I’ve lived across the country and traveled around the world and have experienced everything from triple-digit desert heat to sub-zero wind chill. The financial markets experience the same variability over time.

Forecasting the weather is a lot like forecasting the stock market. In the short-run, volatility in patterns can be very difficult to predict, but if efforts are energized into analyzing long-term factors, trends can be identified.

For example, I live here in Southern California, and although weather is fairly homogenous, the variability can be significant on a day-to-day basis. I’m much more likely to be accurate in estimating the long-term climate than the forecast seven days from now. I’m not trying to rub salt in the wounds of those people freezing in Antarctica or the upper-Midwest, but forecasting a climate of 72 degrees, sunny, and blue skies is a good fall-back scenario if you are a television weatherman in Southern California.

Charles Ellis, author of the Winning the Loser’s Game – “WTLG” (see Investing Caffeine article #1 and article #2), highlights the weather analogy more convincingly:

“Weather is about the short run; climate is about the long run – and that makes all the difference. In choosing a climate in which to build a home, we would not be deflected by last week’s weather. Similarly, in choosing a long-term investment program, we don’t want to be deflected by temporary market conditions.”

Ellis adds:

“Like the weather, the average long-term experience in investing is never surprising, but the short-term experience is constantly surprising.”

In the financial markets the weather predicting principle applies to long-term economic forecasts as well. Predicting annual GDP growth can often be more accurate than the expected change in Dow Jones Industrial Index points tomorrow or the next day.

Economic Weathermen

As I outlined in Professional Guesses Probably Wrong, economists and strategists use several means of making their guesses.

- One method is to simply not make forecasts at all, but rather use some big words and current news to explain what currently is happening in the economy and financial markets.

- A second approach used by prognosticators is to constantly change forecasts. Consider a person making a weather forecast every minute…his/her forecast would be very accurate, but it would be changing constantly and not provide much more value than what an ordinary person could gather by looking out their own window.

- Thirdly, some use the “spaghetti approach” – throw enough scenarios out there against the wall and something is bound to stick – regardless of accuracy.

- Lastly, the “extend and pretend” method is often implemented. Forecasters make big bold economic predictions that garner lots of attention, but when the expectations don’t come true, the original forecast is either forgotten by investors or the original forecast just becomes extended further into the future.

Coin Flipping

If the weather analogy doesn’t work for you, how about a coin-flipping analogy? The short-term randomness surrounding the consecutive number of heads and tails may make no sense in the short-run, but will mean revert to an average over time. In other words, it is possible for someone to flip 10 consecutive “tails,” but in the long-run, the number of times a coin will land on “tails” will come close to averaging half of all coin tosses. The same dynamic is observed in the investment world. Often, short-term spikes or declines are short lived and return toward a mean average. IN WTLG, Ellis provides some more color on the topic:

“The manager whose favorable investment performance in the recent past appears to be ‘proving’ that he or she is a better manager is often – not always, but all too often – about to produce below-average results…A large part of the apparently superior performance was not due to superior skill that will continue to produce superior results but was instead due to that particular manager’s sector of the market temporarily enjoying above-average rates of return – or luck.”

Regardless of your interests in weather forecasting or coin-flipping, when it comes to investing you will be better served by following the long-term climate trends and probabilities. Otherwise, the performance outlook for your investment portfolio may be cloudy with a chance of thunderstorms.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Winning the Loser’s Game

Besides hanging out with family and friends, and stuffing my face with endless amounts of food, the other benefit of the holidays is the quality time I’m afforded to dive into a few books. While sinking into the couch in my bloated state, I had the pleasure of reading an incredible, investment classic by Charles Ellis, Winning the Loser’s Game – “WTLG” (click here to view other remarkable book I read [non-investment related]). To put my enthusiasm in perspective, WTLG has even achieved the elite and privileged distinction of making the distinguished “Recommended Reading” list of Investing Caffeine (located along the right-side of the page). Wow…now I know you must be really impressed.

The Man, The Myth, the Ellis

For those not familiar with Charley Ellis, he has a long, storied investment career. Not only has he authored 12 books, including compilations on Goldman Sachs (GS) and Capital Group, but his professional career dates back prior to 1972, when he founded institutional consulting firm Greenwich Associates. Besides earning a college degree from Yale University, and an MBA from Harvard Business School, he also garnered a PhD from New York University. Ellis also is a director at the Vanguard Group and served as Investment Committee chair at Yale University along investment great David Swensen (read also Super Swensen) from 1992 – 2008.

For those not familiar with Charley Ellis, he has a long, storied investment career. Not only has he authored 12 books, including compilations on Goldman Sachs (GS) and Capital Group, but his professional career dates back prior to 1972, when he founded institutional consulting firm Greenwich Associates. Besides earning a college degree from Yale University, and an MBA from Harvard Business School, he also garnered a PhD from New York University. Ellis also is a director at the Vanguard Group and served as Investment Committee chair at Yale University along investment great David Swensen (read also Super Swensen) from 1992 – 2008.

With this tremendous investment experience come tremendous insights. The original book, which was published in 1998, is already worth its weight in gold (even at $1,384 per ounce), but the fifth edition of WTLG is even more valuable because it has been updated with Ellis’s perspectives on the 2008-2009 financial crisis.

Because the breadth of topics covered is so vast and indispensable, I will break the WTLG review into a few parts for digestibility. I will start off with the these hand-picked nuggets:

Defining the “Loser’s Game”

Here is how Charles Ellis describes the investment “loser’s game”:

“For professional investors, “the ‘money game’ we call investment management evolved in recent decades from a winner’s game to a loser’s game because a basic change has occurred in the investment environment: The market came to be dominated in the 1970s and 1980s by the very institutions that were striving to win by outperforming the market. No longer is the active investment manager competing with cautious custodians or amateurs who are out of touch with the market. Now he or she competes with other hardworking investment experts in a loser’s game where the secret to winning is to lose less than others lose.”

Underperformance by Active Managers

Readers that have followed Investing Caffeine for a while understand how I feel about passive (low-cost do-nothing strategy) and active management (portfolio managers constantly buying and selling) – read Darts, Monkeys & Pros. Ellis’s views are not a whole lot different than mine – here is what he has to say while not holding back any punches:

“The basic assumption that most institutional investors can outperform the market is false. The institutions are the market. They cannot, as a group, outperform themselves. In fact, given the cost of active management – fees, commissions, market impact of big transactions, and so forth-85 percent of investment managers have and will continue over the long term to underperform the overall market.”

He goes on to say individuals do even worse, especially those that day trade, which he calls a “sucker’s game.”

Exceptions to the Rule

Ellis’s bias towards passive management is clear because “over the long term 85 percent of active managers fall short of the market. And it’s nearly impossible to figure out ahead of time which managers will make it into the top 15 percent.” He does, however, acknowledge there is a minority of professionals that can beat the market by making fewer mistakes or taking advantage of others’ mistakes. Ellis advocates a slow approach to investing, which bases “decisions on research with a long-term focus that will catch other investors obsessing about the short term and cavitating – producing bubbles.” This is the strategy and approach I aim to achieve.

Gaining an Unfair Competitive Advantage

According to Ellis, there are four ways to gain an unfair competitive advantage in the investment world:

1) Physical Approach: Beat others by carrying heavier brief cases and working longer hours.

2) Intellectual Approach: Outperform by thinking more deeply and further out in the future.

3) Calm-Rational Approach: Ellis describes this path to success as “benign neglect” – a method that beats the others by ignoring both favorable and adverse market conditions, which may lead to suboptimal decisions.

4) Join ‘em Approach: The easiest way to beat active managers is to invest through index funds. If you can’t beat index funds, then join ‘em.

The Case for Stocks

Investor time horizon plays a large role on asset allocation, but time is on investors’ side for long-term equity investors:

“That’s why in the long term, the risks are clearly lowest for stocks, but in the short term, the risks are just as clearly highest for stocks.”

Expanding on that point, Ellis points out the following:

“Any funds that will stay invested for 10 years or longer should be in stocks. Any funds that will be invested for less than two to three years should be in “cash” or money market instruments.”

While many people may feel stock investing is dead, but Ellis points out that equities should return more in the long-run:

“There must be a higher rate of return on stocks to persuade investors to accept risks of equity investing.”

The Power of Regression to the Mean

Investors do more damage to performance by chasing winners and punishing losers because they lose the powerful benefits of “regression to the mean.” Ellis describes this tendency for behavior to move toward an average as “a persistently powerful phenomenon in physics and sociology – and in investing.” He goes on to add, good investors know “that the farther current events are away from the mean at the center of the bell curve, the stronger the forces of reversion, or regression, to the mean, are pulling the current data toward the center.”

The Power of Compounding

For a 75 year period (roughly 1925 – 2000) analyzed by Ellis, he determines $1 invested in stocks would have grown to $105.96, if dividends were not reinvested. If, however, dividends are reinvested, the power of compounding kicks in significantly. For the same 75 year period, the equivalent $1 would have grown to $2,591.79 – almost 25x’s more than the other method (see also Penny Saved is Billion Earned).

Ellis throws in another compounding example:

“Remember that if investments increase by 7 percent per annum after income tax, they will double every 10 years, so $1 million can become $1 billion in 100 years (before adjusting for inflation).”

The Lessons of History

As philosopher George Santayana stated – “Those who cannot remember the past are condemned to repeat it.” Details of every market are different, but as Ellis notes, “The major characteristics of markets are remarkably similar over time.”

Ellis appreciates the importance of history plays in analyzing the markets:

“The more you study market history, the better; the more you know about how securities markets have behaved in the past, the more you’ll understand their true nature and how they probably will behave in the future. Such an understanding enables us to live rationally with markets that would otherwise seem wholly irrational.”

Home Sweet International Home

Although Ellis’s recommendation to diversify internationally is not controversial, his allocation recommendation regarding “full diversification” is a bit more provocative:

“For Americans, this would mean about half our portfolios would be invested outside the United States.”

This seems high by traditional standards, but considering our country’s shrinking share of global GDP (Gross Domestic Product), along with our relatively small share of the globe’s population (about 5% of the world’s total), the 50% percentage doesn’t seem as high at first blush.

Beware the Broker

This is not new territory for me (see Financial Sharks, Fees/Exploitation, and Credential Shell Game), and Ellis warns investors on industry sales practices:

“Those oh so caring and helpful salespeople make their money by convincing you to change funds. Friendly as they may be, they may be no friend to your long-term investment success.”

Unlike a lot of other investing books, which cover a few aspects to investing, Winning the Loser’s Game covers a gamut of crucial investment lessons in a straightforward, understandable fashion. A lot of people play the investing game, but as Charles Ellis details, many more investors and speculators lose than win. For any investor, from amateur to professional, reading Ellis’s Winning the Loser’s Game and following his philosophy will not only help increase the odds of your portfolio winning, but will also limit your losses in sleep hours.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.