Posts filed under ‘Themes – Trends’

Digesting the Anchovy Pizza Market

Article is an excerpt from previously released Sidoxia Capital Management’s complementary July 2012 newsletter. Subscribe on right side of page.

I love pizza, and most fellow connoisseurs have difficulty refusing a hot, fresh slice of heaven too. Pizza is so universally appreciated that people consider pizza like ice cream – it’s good even when it’s bad (I agree). However, even the biggest, diehard pizza-lover will sheepishly admit their fondness for the flat and circular cheesy delight changes when you integrate anchovies into the mix. Not many people enjoy salty, slimy, marine creatures layered onto their doughy mozzarella and marinara pizza paradise.

With all the turmoil and uncertainty going on in the global financial markets, prudently investing in a widely diversified portfolio, including a broad range of equity securities, is viewed as palatable as participating in an all-you-can-eat anchovy pizza contest. Why are investors’ appetites so salty now? Hmmm, let me think. Oh yes, here are a few things that come to mind:

- Presidential Election Uncertainty

- European Financial Crisis

- Impending Fiscal Cliff (tax cut expirations, automatic spending cuts, termination of stimulus, etc.)

- Unsustainable Fiscal Debt & Deficits

- Slowing Subpar Domestic Economic Growth

- Partisan Politics and Gridlock in Washington

- High Unemployment

- Fears of a Hard Economic Landing in China

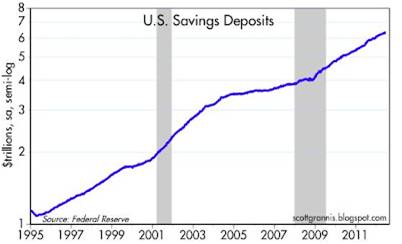

Doesn’t sound too appealing, does it? So, what are most investors doing in this unclear market? Rather than feasting on a pungent pie of anchovies, investors are flocking to the perceived safety of low yielding asset classes, no matter the price. In other words, the short-term warmth and comfort of CDs, money market, checking, and fixed income assets are being gobbled up like nicotine-laced pepperoni pizzas selling for $29.95/each + tax. The anchovy alternative, like stocks, is much more attractively priced now. After accounting for dividends, earnings, and cash flows, the anchovy/stock option is currently offering a 2-for-1 special with breadsticks and a salad…quite the bargain!

Nonetheless, the plain and expensive pepperoni/bond option remains the choice du jour and there are no immediate signs of a pepperoni hangover just quite yet. However, this risk aversion addiction cannot last forever. The bond gorging buffet has gone on relatively unabated for the last three decades, as you can see from the chart below. In spite of this, the bond binging game is quickly approaching a mathematical terminal end-game, as interest rates cannot logically go below zero.

Since my firm (Sidoxia Capital Management) is based in Newport Beach, next to PIMCO’s global headquarters, we get to follow the progression of the bond binging game firsthand. I’ve personally learned that if I manage close to $2 trillion in assets under management, I too can construct a 23-story Taj Mahal-esque headquarters that overlooks the Pacific Ocean from a stones-throw away.

Beyond glorified headquarters, there is evidence of other low-risk appetite examples. Here are some reinforcing pictures:

The Bond Binge

Cash Hoarding

Source (Calafia Beach Pundit): Stuffing money under the mattress has accelerated in recent years as fear, uncertainty, and doubt have reigned supreme.

The Anchovy Special

Even though anchovy pizza, or a broadly diversified portfolio across asset class, size, geography, and style may not sound appealing, there are plenty of reasons to fight the urges of caving to fear and skepticism. Here are a few:

1) Growth Rolls On: Despite the aforementioned challenges occurring domestically and abroad, growth has continued unabated for 11 consecutive quarters, albeit at a rate less than desired. We are not immune to global recessionary forces, but regardless of European forces, the U.S. has been resilient in its expansion.

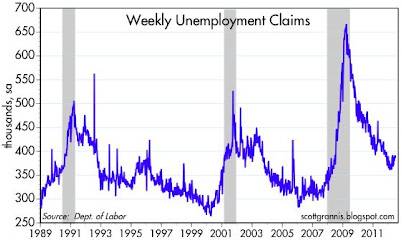

2) Jobs and Housing on the Upswing: Unemployment remains high, but our country has experienced 27 consecutive months of private creation, leading to more than 4 million new jobs being added to our workforce. As you can see from the clear longer-term downward trend in unemployment claims, we are moving in the right direction.

3) Eurozone Slowly Healing its Wounds: The Greek political and fiscal soap opera is grabbing all the headlines, but quietly in the background there are signs that the eurozone is slowly healing the wounds of the financial crisis. If you look at the 2-year borrowing costs of Europe’s troubled countries (ex-Greece), there is an unambiguous and beneficial decline. There is no doubt that Spain and Italy play a larger role than Portugal and Ireland, but at least some seeds of change have been planted for optimism.

4) Record Corporate Profits: Investors are not the only people reading uncertain newspaper headlines and watching CNBC business television. CEOs are reading the same gloomy sensationalistic stories, and as a result, corporations have been cautious about dipping their short arms into their deep pockets. Significant expense reductions and a reluctance to hire have led to record profits and cash hoards. As evidenced by the chart below, profits continue to rise, and these earnings are being applied to shareholder friendly uses like dividends, share buybacks, and accretive acquisitions.

5) Attractive Valuations (Pricing): We have already explored the lofty prices surrounding bonds and $30 pepperoni pizzas, but counter-intuitively, stock prices are trading at a discount to historical norms, despite record low interest rates. All else equal, an investor should pay higher prices for stocks when interest rates are at a record low (and vice versa), but currently we are seeing the opposite dynamic occur.

Even though the financial markets may look, smell, and taste like an anchovy pizza, the price, value, and return benefits may outweigh the fishy odor. And guess what…anchovies are versatile. If you don’t like them on your pizza, you can always take them off and put them on your Caesar salad or use them for bait the next time you go fishing. The gloom-filled headlines haven’t been spectacular, but if they were, the return opportunities would be drastically reduced. Therefore you are much better off by following investor legend Warren Buffett’s advice, which is to “buy fear and sell greed.”

Investing has never been more difficult with record low interest rates, and it has also never been more important. Excluding a small minority of late retirees and wealthy individuals, efficiently investing your retirement dollars has become even more critical. The safety nets of Social Security and Medicare are likely to be crippled, which will require better and more prudent investing by individuals. Inflation relating to food, energy, healthcare, gasoline, and entertainment is dramatically eroding peoples’ nest eggs.

Digesting a pepperoni pizza may sound like the most popular and best option given the gloomy headlines and uncertain outlook, but if you do not want financial heartburn you may consider alternative choices. Like the healthier and less loved anchovy pizza, a more attractively valued strategy based on a broadly diversified portfolio across asset class, size, geography, and style may be the best financial choice to satiate your long-term financial goals.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Floating Hedge Fund on Ice Thawing Out

These days, pundits continue to talk about how the same financial crisis plaguing Greece and its fellow PIIGS partners (Portugal, Ireland, Italy & Spain) is about to plow through the eurozone and then ultimately the remaining global economy with no mercy. If all the focus is being placed on a diminutive, calamari-eating, Ouzo-drinking society like Greece, whose economy matches the size of Maryland, then why not evaluate an even more miniscule, PIIGS prequel country…Iceland.

That’s right, the same Iceland that just four years ago people were calling a “hedge fund on ice.” You know, that frozen island that had more foreign depositors investing in their banks than people living in the country. Before Icelandic banks became more than 75% of the overall stock market, and Gordon Gekko became the country’s patron saint, Iceland was more known for fishing. The fishing industry accounted for about half of Iceland’s exports, and the next largest money maker may have been Bjork, the country’s famed and quirky female singer.

In looking back at the financial crisis of 2008-2009, as it turned out, Iceland served as a canary in the global debt binging coal mine. In order to attract the masses of depositors to Icelandic banks, these financial institutions offered outrageous, unsustainable interest rates to yield-starved customers. How did the Icelandic bankers offer such high rates? Well of course, it was those can’t-lose American subprime mortgages that were offering what seemed like irresistibly high yields. Of course, what seemed like a dream at the time, eventually turned into a nightmare once the scheme unraveled. Ultimately, it became crystal clear that the subprime borrowers could not pay the outrageous rates, especially after rates unknowingly reset to untenable levels for many borrowers.

At the peak of the crisis, the Icelandic banks were holding amounts of debt exceeding six times the Icelandic GDP (Gross Domestic Product) and these lenders suffered more than $100 billion in losses. One of the Icelandic banks was even funding a large condominium project in my neighboring Southern California city of Beverly Hills. When the excrement hit the fan after Lehman Brothers went bankrupt, it didn’t take long for Iceland’s stock market to collapse by more than -95%; Iceland’s Krona to crumple; and eventually the trigger of Iceland’s multi-billion bailout by numerous constituents, including the IMF (International Monetary Fund).

Bitter Medicine First, Improvement Next

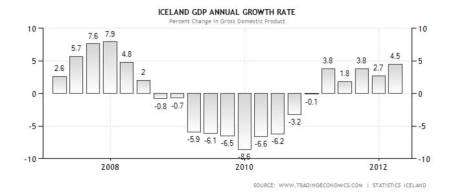

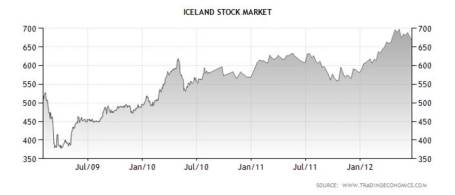

Today, four years after the subprime implosion and Lehman debacle, the hedge fund on ice known as Iceland is beginning to thaw, and their economic picture is looking much brighter (see charts below). GDP growth is the highest it has been in four years (4.5% recently); the stock market has catapulted upwards (almost doubling from the lows); and the Iceland unemployment rate has declined from over 9% a few years ago to about 7% today.

Re-jiggering a phony economy with a faulty facade cannot be repaired overnight. However, now that the banking system has been allowed to clear out its excesses, Iceland can move forward. One tailwind behind the economy has been Iceland’s weaker currency, which has led to a +17% increase in foreign tourist nights at Icelandic hotels through April this year. What’s more, tourist traffic at Iceland’s airport hit a record in May. Iceland has taken its bitter medicine, adjusted, and is currently reaping some of the rewards.

Although the detrimental effects of austerity experienced by the economies and banks of Greece, Spain, and Italy crowd out most of today’s headlines, Iceland is not the only country to make painful changes to its fiscal ways and then taste the sweetness of progress. Let’s not forget the Guinness drinking Irish. Ireland, like Greece, Portugal, and Spain received a bailout, but Ireland’s banking system was arguably worse off than Spain’s, yet Ireland has seen its borrowing costs on its 10-year bond decrease dramatically from 9.2% at the beginning of 2011 to about 7.4% this month (still high, but moving in the right direction). The same can be said for the United States. Our banks were up against the ropes, but after some recapitalization, tighter oversight, and stricter lending standards, our banks have gotten back on track and have helped assist our economy grow for 11 consecutive quarters (albeit at uninspiring growth rates).

The austerity versus growth debate will no doubt continue to circulate through media circles. In my view, these arguments are too simplistic and one dimensional. Every country has its unique culture and distinct challenges, but even countries with massive financial excesses can steer themselves back to a path of growth. A floating hedge fund on ice to the north of us has proven that fact to us, as we witness brighter days beginning to thaw Iceland’s chilly economy to expansion again.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in Lehman Brothers, Guinness, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Rates Dance their Way to a Floor

The globe is awash in debt, deficits are exploding, and the Euro is about to collapse…right? Well, then why in the heck are six countries out of the G-7 seeing their 10-year sovereign debt trade at 2.5% or lower on a consistent downward long-term trajectory? What’s more, three of the six countries witnessing their rates plummet are from Europe, despite pundits continually calling for the demise of the eurozone.

Here is a snapshot of 10-year sovereign debt yields for the majority of the G-7 countries over the last few decades:

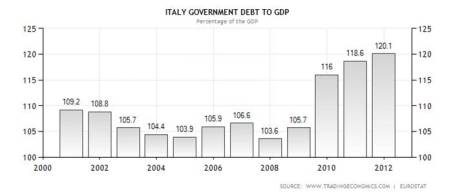

The sole G-7 member missing from the bond yield charts above? Italy. Although Italy’s deficits are not massive (Italy actually has a smaller deficit than U.S. as % of GDP: 3.9% in 2011), its Debt/GDP ratio has been large and rising (see chart below):

As the globe has plodded through the financial crisis of 2008-2009, investors have flocked to the perceived stability of these larger developed countries’ bonds, even if they are merely better homes in a bad neighborhood right now. PIMCO likes to call these popular sovereign bonds, “cleaner dirty shirts.” Buying sovereign debt from these less dirty shirt countries, without sensitivity to price or yield, has been a lucrative trade that has worked consistently for quite some time. Now, however, with sovereign bond yields rapidly approaching 0%, it becomes mathematically impossible to fall lower than the bottom rate floor that developed countries are standing on.

Bond bears have been wrong about the timing of the inevitable bond price reversal, myself included, but the bulls are skating on thinner and thinner ice as rates continue moving lower. The bears may prolong their bragging rights if interest rates continue downward, or persist at these lower levels for extended periods of time. Eventually the “buy the dips” mentality dies, as we so poignantly experienced in 2000 when the technology dips turned into outright collapse.

The Flies in the Bond Binging Ointment

As long as equities remain in a trading range, the “risk-off” bond binging arguments will continue holding water. If corporate earnings remain elevated and stock buybacks carry on, the pain of deflating real returns will eventually become too unbearable for investors. As the insidious rising prices of energy, healthcare, food, leisure, and general costs keep eating away everyone’s purchasing power, even the skeptics will become more impatient with the paltry returns they are currently earning. Earning negative real returns in Treasuries, CDs, money market accounts, and other conservative investments, is not going to help millions of Americans meet their future financial goals. Due to the laundry list of global economic concerns, large swaths of investors are still running and hiding, but this is not a sustainable strategy longer term. The danger from these so-called “safe,” low-yielding asset classes is actually riskier than the perceived risk, in my view.

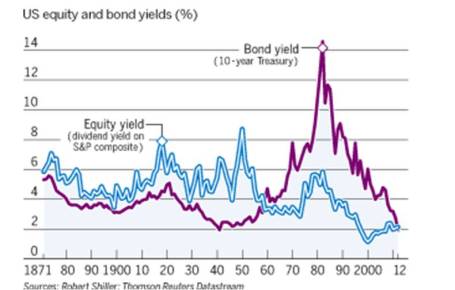

With that said, I’ve consistently held there are a subset of investors, including a significant number of my Sidoxia Capital Management clients, who are in the later stage of retirement and have a rational need for capital preservation and income generating assets (albeit low yielding). For this investor segment, portfolio construction is not executed due to an opportunistic urge of chasing potential outsized rates of return, but more-so out of necessity. Shorter time horizons eliminate the prudence of additional equity exposure because of the extra associated volatility. Unfortunately, many of the 76 million Baby Boomers will statistically live another 20 – 30 years based on actuarial life expectations and under-save, so the risks of being too conservative can dramatically outweigh the risks of increasing equity exposure. This is all stated in the context of stocks paying a higher yield than long-term Treasuries – the first time in a generation.

Short-term risks and uncertainties remain high, with Greek election outcomes unknown; a U.S. Presidential election in flux; and an impending domestic fiscal cliff that needs to be addressed. But with interest rates accelerating towards 0% and investors’ fright-filled buying of pricey, low-yielding asset classes, many of these risks are already factored into current valuations. As it turns out, the pain of panic can be more detrimental than being stuck in over-priced assets, driven by rates dancing near an absolute floor.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Broken Record Repeats Itself

Article is an excerpt from previously released Sidoxia Capital Management’s complementary June 2012 newsletter. Subscribe on right side of page.

Traditional music records have been replaced with CDs (compact discs) and digital downloads. Although the problem of a broken record repeating itself is no longer an issue, our financial markets have not conquered the problem of repetition. More specifically, the timing of the -6.3% stock market decline during May (as measured by the S&P 500 index), coincides with the same broken sell-offs we have temporarily experienced over the last two summers. First, we had the “Flash Crash” in the summer of 2010, and then the debt ceiling debate and credit downgrade of 2011.

So far, the “Sell in May and go away” mantra has followed the textbook lessons over the last few years, but as you can see from the chart below, the short-lived seasonal sell-offs have been followed by significant advances (up +33% from 2010 lows and up +29% from the 2011 lows). Given the global challenges, a two-steps forward, one-step back pattern in equity markets should not be seen as overly surprising by investors.

Although the late-spring and summer doldrums have not been a joy-ride in recent years, these overly simplistic seasonal trading rules of thumb have not been exceedingly reliable either. For example, even though the months of May in 2010-2012 produced negative returns, the previous 25 Mays going back to 1985 produced positive returns more than 2/3 of the time. Rather than fiddle with these unreliable, unscientific trading rules, individuals would be better served by listening to famous Jedi Master Yoda from Star Wars, who so astutely noted, “Uncertain, the future is.”

Voting Machines and Scales

Given the spread of globalization and technology, the speed of news dissemination has never been faster. With the 2008-2009 financial crisis still burned into investors’ minds, the default response to any scary news item is to shoot first and ask questions later. Renowned long-term investing legend Ben Graham famously highlighted, “In the short run the market is a voting machine. In the long run it’s a weighing machine.”

As it relates to short-run current events, here are some of the items that investors were voting on (no pun intended) this month:

Europe, Europe, Europe: This problem has been with us for some time now, and there are no signs it will disappear anytime soon. In a game of chicken between the EU (European Union) and Greek legislators, fresh elections are taking place on June 17th, which will ultimately determine if Greece will exit the Euro monetary union or stick to the bitter medicine of austerity prescribed by the key European decision-makers in Germany. As Greece attempts to clean up its own mess, European politicians and G-20 leaders around the globe are scrambling to create plans that ring-fence countries like Spain and Italy from succumbing to a Greek-born contagion.

Presidential Politics: If you haven’t been living in a cave for the last six months, you probably know that 2012 is a presidential election year. Regardless of your politics, there are big questions surrounding the economy, jobs, deficits, debt, taxes, entitlements, defense, gay marriage, and other important issues. Answers to many of these questions will remain unclear until we get closer to the elections. The financial markets do not like uncertainty, so probabilities would indicate volatility will remain par for the course for the foreseeable future.

Facebook Folly: Despite my warnings, Facebook’s initial public offering (IPO) failed to live up to the social media giant’s hype – the share price has fallen -22% since the shares originally priced. Great companies do not always make great stocks, especially when a relatively new kid on the block has his company’s stock initially valued at a hefty price-tag of more than a $100 billion. Finger pointing is being spread liberally on the botched Facebook deal (e.g., Morgan Stanley, NASDAQ, Facebook), but no need to shed a tear for 28-year-old founder Mark Zuckerberg since his ownership stake in the company is still valued at around $15 billion – enough to cover a European trip to McDonald’s with his newlywed wife.

Dimon in a Rough Spot: Jamie Dimon, the poster child of the banking industry (and CEO of JP Morgan Chase – JPM), dropped a bomb on the investment community earlier in the month by explaining how a rogue “whale” trader racked up $2 billion in initial losses (and growing) by taking excessive risk and throwing controls into the wind.

Chinese Dragon Losing Steam: The #2 global economy has been losing some steam as witnessed by slowing industrial production and GDP growth (Gross Domestic Product). In turn, the self correcting economic forces of supply and demand have provided relief to consumers and corporations in the form of lower fuel, energy, and commodity prices. Chinese leaders are not sitting still – there are plans of accelerating infrastructure spending and assisting banks in the form of capital injections and lower reserve requirements.

As I discussed in a previous Investing Caffeine article (see The European Dog Ate My Homework), although the current headlines remain gloomy, that will always be the case. Just a few years ago, Bear Stearns, Lehman Brothers, AIG, CDS (credit default swaps), and subprime mortgages were the boogeymen. In the 1980s, we had the Savings & Loan financial crisis and the infamous 1987 Crash. During the 1970s, the Vietnam War, Nixon’s impeachment proceedings, and rising inflation were the dominating issues. Since then, the equity markets are up over 20x-fold – time will always reward those patient long-term investors. Despite all the doom and gloom, stock markets have roughly doubled over the last three years and all the major indexes remain solidly in the black for the year. Choppy waters are likely to remain as we approach this year’s elections, but for those who understand broken records often repeat themselves, there’s a good chance the music will eventually sound much better.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including commodities, inflation protection, floating rate bonds, real estate, dividend, and alternative investment ETFs), but at the time of publishing SCM had no direct position in FB, MCD, JPM, MS, NDAQ, AIG, Lehman Brothers, Bear Stearns, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The European Dog Ate My Homework

I never thought my daily routine would be dominated by checking European markets before our domestic open, but these days it is appearing like the European tail is wagging the global dog. Tracking Spanish bond yields from the Tesoro Publico and the Italia Borsa index is currently having a larger bearing on my portfolio than U.S. fundamentals. When explaining short term performance to others, I feel a little like an elementary school student making an excuse that my dog ate my homework.

Although the multi-year European saga has gone on for years, this too shall pass. What’s more, despite the bailouts of Portugal, Ireland, and Greece in recent years, the resilient U.S. economy has recorded 11 consecutive quarters of GDP (Gross Domestic Product) growth and added more than 4 million jobs, albeit at a less than desirable pace.

Could it get worse? Certainly. Will it get worse before it gets better? Probably. Is worsening European fundamentals and a potential Greek eurozone exit already factored into current stock prices? Possibly. The truth of the matter is that nobody knows the answers to these questions with certainty. At this point, the probability of an unknown or unexpected event in a different geography is more likely to be the cause of our economic downfall than a worsening European crisis. As sage investor and strategist Don Hays aptly points out, “When everyone is concerned about a problem, that problem is solved.” That may be overstating the truth a bit, but I do believe the issues absent from current headlines are the matters we should be most concerned about.

The European financial crisis may drag on for a while longer, but nothing lasts forever. Years from now, worries about the PIIGS countries (Portugal, Ireland, Italy, Greece, Spain) will switch to others, like the BRICs (Brazil, Russia, India, China) or other worry geography du jour. The issues of greatest damage in 2008-2009, like Bear Stearns, Lehman Brothers, AIG, CDS (credit default swaps), and subprime mortgages, didn’t dominate the headlines for years like the European crisis stories of today. As compared to Europe’s problems, these prior pains felt like Band Aids being quickly ripped off.

Correlation Conundrum

Eventually European worries will be put on the backburner, but until some other boogeyman dominates the daily headlines, our financial markets will continue to correlate tightly with European security prices. How does one fight these tight correlations? For starters, the correlations will not stay tight forever. If an investor can survive through the valley of strong security association, then the benefits will eventually accrue.

Although the benefits from diversification may disappear in the short-run, they should not be fully forgotten. Bonds, cash, and precious metals (i.e., gold) proved to be great portfolio diversifiers in 2008 and early 2009. Commodities, inflation protection, floating rate bonds, real estate, and alternative investments, are a few asset classes that will help diversify portfolios. Risk is defined in many circles as volatility (i.e., standard deviation) and combining disparate asset classes can lower volatility. But risk, defined as the potential of experiencing permanent losses, can also be controlled by focusing on valuation. By in large, large cap dividend paying stocks have struggled for more than a decade, despite equity dividend yields for the S&P 500 exceeding 10-year Treasury yields (the first time in more than 50 years). Investing in large companies with strong balance sheets and attractive growth prospects is another strategy of lowering portfolio risk.

Politics & Winston Churchill

Some factors however are out of shareholders hands, such as politics. As we know from last year’s debt ceiling melee and credit downgrade debacle, getting things done in Washington is very challenging. If you think achieving consensus in one country is difficult, imagine what it’s like in herding 17 countries? That’s the facts of life we are dealing with in the eurozone right now.

Although I am optimistic something will eventually get done, I consider myself a frustrated optimist. I am frustrated because of the gridlock, but optimistic because these problems are not rocket science. Rather these challenges are concepts my first grade child could understand:

• Expenses are running higher than revenues. You must cut expenses, increase revenues, or a combination thereof.

• Adding debt can support growth, but can lead to inflation. Cutting debt can hinder growth, but leads to a more sustainable fiscal state of wellbeing.

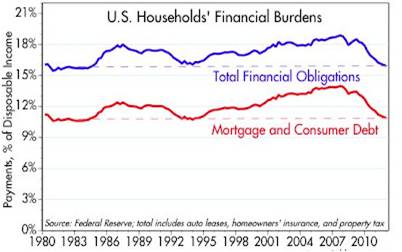

Relieving all the excess global leverage is a long, tortuous process. We saw firsthand here in the U.S. what happened to the U.S. real estate market and associated financial institutions when irresponsible debt consumption took place. Fortunately, corporations and consumers adjusted their all-you-can-eat debt buffet habits by going on a diet. As a matter of fact, corporations today are holding records amounts of cash and debt service loads for consumers has been reduced to levels not seen in decades (see chart below). Unlike governments, luckily CEOs and individuals do not need Congressional approval to adapt to a world of reality – they can simply adjust spending habits.

Governments, on the other hand, generally do need legislative approval to adjust spending habits. Regrettably, cutting the benefits of your constituents is not a real popular political strategy for accumulating votes or brownie points. If you don’t believe me, see what voters are doing to their leaders in Europe. Nicolas Sarkozy is the latest European leader to be booted from office due to austerity backlash and economic frustration. No less than nine European leaders have been cast aside since the financial crisis began.

The fate for U.S. politicians is less clear as we enter into a heated presidential election over the next six months. We do however know how the mid-term Congressional elections fared for the incumbents…not all sunshine and roses. Until elections are completed, we are resigned to the continued mind-numbing political gridlock, with no tangible resolutions to the trillion dollar deficits and gargantuan debt load. Obviously, most citizens would prefer a forward looking strategic plan from politicians (rather than a reactive one), but there are no signs that this will happen anytime soon…in either party.

Realistically though, tough decisions made by politicians only occur during crises, and if this slow-motion train wreck continues along this same path, then at least we have something to look forward to – forced resolution. We are seeing this firsthand in Greece. The “bond vigilantes” (see Plumbers & Cops) and responsible parents (i.e., Germany) have given Greece two options:

1.) Fix your financial problems and receive assistance; or

2.) Leave the EU (return to the Drachma currency) and figure your problems out yourself.

Panic has a way of forcing action, and we are approaching that “when push comes to shove” moment very quickly. I believe the Europeans are currently taking a note from our strategic playbook, which basically is the spaghetti approach – throw lots of things up on the wall and see what sticks. Or as Winston Churchill stated, “You can always count on Americans to do the right thing – after they’ve tried everything else.”

There is no question, the European sovereign debt issue is a complete mess, and there are no clear paths to a quick solution. Until voters force politicians into making tough unpopular decisions, or leaders come together with forward looking answers, the default position will be to keep kicking the fiscal can issues down the road. In the absence of political leadership, eventually the crisis will naturally force tough decisions to be made. Until then, I will go on explaining to others how the European dog ate my homework.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including commodities, inflation protection, floating rate bonds, real estate, dividend, and alternative investment ETFs), but at the time of publishing SCM had no direct position in AIG, JNJ, Bear Stearns, Lehman Brothers, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Investing in a World of Black Swans

In the world of modern finance, there has always been the search for the Holy Grail. Ever since the advent of computers, practitioners have looked to harness the power of computing and direct it towards the goal of producing endless profits. Regrettably, nobody has found the silver bullet, but that hasn’t slowed down people from trying. Wall Street has an innate desire to try to turn the ultra-complex field of finance into a science, just as they do in the field of physics. Even JPMorgan Chase (JPM) and its CEO Jamie Dimon are already on their way to suffering more than $2 billion in losses in the quest for infinite income, due in large part to their over-reliance on pseudo-science trading models.

James Montier of Grantham Mayo van Otterloo’s asset allocation team was recently a keynote speaker at the CFA Institute Annual Conference in Chicago. His prescient talk, which preceded JP Morgan’s recent speculative trading loss announcement, explained why bad models were the root cause of the financial crisis. Essentially these computer algorithms under-appreciate the number and severity of Black Swans (low probability negative outcomes) and the models’ inability to accurately identify predictable surprises.

What are predictable surprises? Here’s what Montier had to say on the topic:

“Predictable surprises are really about situations where some people are aware of the problem. The problem gets worse over time and eventually explodes into crisis.”

Just a month ago, when Dimon was made aware of the rogue trading activities, the CEO strenuously denied the problem before reversing course and admitting the dilemma last week. Unfortunately, many of these Wall Street firms and financial institutions use value-at-risk (VaR) models that are falsely based on the belief that past results will repeat themselves, and financial market returns are normally distributed. Those suppositions are not always true.

Another perfect example of a Black Swan created by a bad financial model is Long Term Capital Management (LTCM). Robert Merton and Myron Scholes were world renowned Nobel Prize winners who single handedly brought the global financial market to its knees in 1998 when LTCM lost $500 million in one day and required a $3.6 billion bailout from a consortium of banks. Their mathematical models worked for a while but did not fully account for trading environments with low liquidity (i.e., traders fleeing in panic) and outcomes that defied the historical correlations embedded in their computer algorithms. The “Flash Crash” of 2010, in which liquidity evaporated due to high frequency traders temporarily jumping ship, is another illustration of computers wreaking havoc on the financial markets.

The problem with many of these models, even for the ones that work in the short-run, is that behavior and correlations are constantly changing. Therefore any strategy successfully reaping outsized profits in the near-term will eventually be discovered by other financial vultures and exploited away.

Another pundit with a firm hold on Wall Street financial models is David Leinweber, author of Nerds on Wall Street. As Leinweber points out, financial models become meaningless if the data is sliced and diced to form manipulated and nonsensical relationships. The data coming out can only be as good as the data going in – “garbage in, garbage out.”

In searching for the most absurd data possible to explain the returns of the S&P 500 index, Leinweiber discovered that butter production in Bangladesh was an excellent predictor of stock market returns, explaining 75% of the variation of historical returns. By tossing in U.S. cheese production and the total population of sheep in Bangladesh, Leinweber was able to mathematically “predict” past U.S. stock returns with 99% accuracy. To read more about other financial modeling absurdities, check out a previous Investing Caffeine article, Butter in Bangladesh.

Generally, investors want precision through math, but as famed investor Benjamin Graham noted more than 50 years ago, “Mathematics is ordinarily considered as producing precise, dependable results. But in the stock market, the more elaborate and obtuse the mathematics, the more uncertain and speculative the conclusions we draw therefrom. Whenever calculus is brought in, or higher algebra, you can take it as a warning signal that the operator is trying to substitute theory for experience.”

If these models are so bad, then why do so many people use them? Montier points to “intentional blindness,” the tendency to see what one expects to see, and “distorted incentives” (i.e., compensation structures rewarding improper or risky behavior).

Montier’s solution to dealing with these models is not to completely eradicate them, but rather recognize the numerous shortcomings of them and instead focus on the robustness of these models. Or in other words, be skeptical, know the limits of the models, and build portfolios to survive multiple different environments.

Investors seem to be discovering more financial Black Swans over the last few years in the form of events like the Lehman Brothers bankruptcy, Flash Crash, and Greek sovereign debt default. Rather than putting too much faith or dependence on bad financial models to identify or exploit Black Swan events, the over-reliance on these models may turn this rare breed of swans into a large bevy.

See Full Article on Montier: Failures of Modern Finance

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in JPM, Lehman Brothers, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Dividend Floodgates Widen

The recently reported lackluster, monthly employment report made stockholders grumpy (as measured by the recent -168 point decline in the Dow Jones Industrial index) and bondholders ecstatic (as measured by the surge in the 10-year Treasury note price and plunge in yield to a meager 1.88% annual rate). Stocks on the other hand are yielding a much more attractive rate of approximately 7.70% based on 2012 earnings estimates (see chart below) and are also offering a dividend yield of about 2.25%.

In my view, either stock prices go higher and drive equity yields lower; bonds sell off and Treasury yields spike higher; or a combination of the two. Either way, there are not many compelling reasons to pile into Treasuries, although I fully understand some Treasuries are needed in many investors’ portfolios for income, diversification, and risk tolerance reasons.

Not only are equity earnings yields beating Treasury yields, but so are dividend yields. It has been a generation, or more than 50 years, since the last time stock dividends were yielding more than 10-year Treasuries (see chart below). If you invested in stocks back when dividend yields outpaced bond yields, and held onto your shares, you did pretty well in stocks (the Dow Jones Industrial index traded around 600 in 1960 and over 13,000 today).

The Dynamic Dividend Payers

The problem with bond payments (coupons), in most cases, is that they are static. I have never heard of a bond issuer sending a notice to a bond holder stating they wanted to increase the size of interest payments to their investors. On the flip side, stocks can and do increase payments to investors all the time. In fact here is a list of some of the longest paying dividend dynamos that have incredible dividend hike streaks:

• Procter & Gamble (PG – 55 consecutive years)

• Emerson Electric (EMR – 54 years)

• 3M Company (MMM – 53 years)

• The Coca-Cola Company (KO – 49 years)

• Johnson & Johnson (JNJ – 49 years)

• Colgate-Palmolive Company (CL – 48 years)

• Target Corporation (TGT – 43 years)

• PepsiCo Inc. (PEP – 39 years)

• Wal-Mart Stores Inc. (WMT – 38 years)

• McDonald’s Corporation (MCD – 35 years)

This is obviously a small number of the long-term consecutive dividend hikers, but on a shorter term basis, more and more players are joining the dividend paying team. So far, in 2012 alone through April, there have been 152 companies in the S&P 500 index that have raised their dividend (a +11% increase over the same period a year ago). Of those 152 companies that increased the dividend this year, the average boost was more than +23%. Some notable names that have had significant dividend increases in 2012 include the following companies:

• Macy’s Inc. (M: +100% dividend increase)

• Mastercard Inc. (MA: +100%)

• Wells Fargo & Company (WFC: +83%)

• Comcast Corp. (CMCSA: +44%)

• Cisco Systems Inc. (CSCO: +33%)

• Goldman Sachs Group Inc. (GS: +31%)

• Freeport McMoran (FCX: +25%)

• Harley Davidson Inc. (HOG: +24%)

• Exxon Mobil Corp. (XOM: +21%)

• JP Morgan Chase & Co. (JPM: +20%)

Lots of Dividend Headroom

The nervous mood of investors is not much different from the temperament of uneasy business executives, so companies have been slow to hire; unhurried to acquire; and deliberate with their expansion plans. Rather than aggressively spend, corporations have chosen to cut costs, hoard cash, grow earnings, buy back shares, and pay out ever increasing dividends from the trillions in cash piling up.

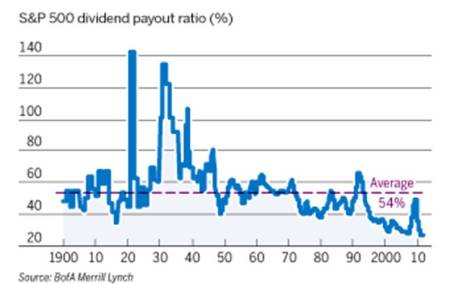

When a company on average is earning an 8% yield on their stock price, there is plenty of headroom to increase the dividend. As a matter of fact, a company paying a 2% yield could increase its dividend by 10% for about 15 consecutive years and still pay a quadrupling dividend with NO earnings growth. Simply put, there is a lot of room for companies to increase dividends further despite the floodgate of dividend increases we have experienced over the last few years. If you look at the chart below, the dividend yield is the lowest it has been in more than a century (1900).

Perhaps we will experience another “Summer Swoon” this year, but for those selective and patient investors that sniff out high-quality, dividend paying stocks, you will be getting “paid to wait” while the dividend floodgates continue to widen.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including Treasury bond ETFs), CMCSA and WMT, but at the time of publishing SCM had no direct position in PG, EMR, MMM, KO, JNJ, CL, TGT, PEP, MCD, M, MA, WFC, CSCO, GS, FCX, HOG, XOM, JPM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Investing with the Sentiment Pendulum

Article is an excerpt from Sidoxia Capital Management’s complementary May 2012 newsletter. Subscribe on right side of page.

The last five years have been historic in many respects. Not only have governments and central banks around the world undertaken unprecedented actions in response to the global financial crisis, but investors have ridden an emotional rollercoaster in response to historically unparalleled uncertainties.

While the nature of this past crisis has been unique, experienced investors know these fears continually manifest themselves in different forms over various cycles in time. Despite the more than doubling in equity market values over the last few years, as measured by the S&P 500 index, the emotional pendulum of investor sentiment has only partially corrected. Investor temperament has thankfully swung away from “Panic,” but has only moved closer to “Fear” and “Skepticism.” Here are some of the issues contributing to investors’ current sour mood:

The Next European Domino: The fear of the Greek domino toppling the larger Spanish and Italian economies has investors nervously chewing their finger-nails, and political turmoil in France and the Netherlands isn’t creating any additional warm and fuzzies.

Job Additions Losing Steam: New job creation here in the U.S. weakened to a lethargic monthly rate of +120,000 new jobs in March, while the unemployment rate remains stubbornly high at an 8.2% level.

Domestic Growth Losing Mojo: GDP (Gross Domestic Product) growth of +2.2% during the first quarter of 2012 also opened the door for the pessimists. Consumers are still spending (+2.9% growth), but government spending, business investment, and housing are taking wind out of the economy’s sails.

Emerging Markets Submerging: Unspectacular growth in the U.S. is not receiving any favors from slowing emerging markets like China and Brazil, which took fiscal and monetary actions to slow inflation and housing speculation in 2011.

Humpty Dumpty Politics: Presidential elections, tax policy, and deficit reduction are all concerns that carry the possibility of pushing the economic Humpty Dumpty off the wall, and as a result potentially lead to a great fall. The determination of Humpty Dumpty’s fate will likely have to wait until year-end or 2013.

Any student of history knows these fears and other concerns never go away – they simply change. But like supply and demand, gravitational forces eventually swing the emotional pendulum in the opposite direction. As Sir John Templeton so aptly stated, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” Or in other words, escalating bull markets must climb the proverbial “Wall of Worry” in order to sustain upward momentum. If there was nothing to worry about, then all the buyers would already be in the markets. We are nowhere close to experiencing “Euphoria” like we saw in stocks during the late-1990s or in the housing market around 2005.

Positively Climbing the “Wall of Worry”

With all this bad news out there, surprisingly there are some glimmers of hope chipping away at the “Wall of Worry.” Here are some of the positive factors helping turn pessimist frowns upside down:

Slow & Steady Wins the Race: The economic recovery has been weaker than hoped, but I can think of worse scenarios than 11 consecutive quarters of GDP growth and 25 straight months of private job creation, which has reduced the unemployment rate from 10.0% in October 2009 to 8.2% last month.

Earnings Machine Keeps Chugging Along: With the majority of S&P 500 companies having reported their quarterly results for the first quarter, three-fourths of the companies are beating forecasted earnings, which are currently registering in at a respectable +7.1% rate (Thomson Reuters). One company epitomizing this trend is Apple Inc. (AAPL). The near doubling in Apple’s profits during the quarter, thanks to explosive iPhone sales, pushed Apple’s shares over $600 and helped drive the NASDAQ index to its best day of the year.

Super Ben to the Rescue: The Federal Reserve has already stated their intention of keeping interest rates near 0% until 2014. The potential of additional monetary stimulus spearheaded by Federal Reserve Chairman Ben Bernanke, in the form of QE3 (Quantitative Easing Part III), may provide further needed support to the stock market (a.k.a., the “Bernanke Put”).

Return of the IPO: Initial Public Offerings (IPOs) have gained steam versus last year with more than 53 already coming to market in the first four months of 2012. This is no 1999, but a good number of deals have done quite well over the last month. For example, data analysis company Splunk Inc. (SPLK) share price is already up around 100% and the value of leisure luggage company TUMI Holdings (TUMI) has climbed over +40%. In a few weeks, the highly anticipated blockbuster Facebook (FB) IPO is expected to begin trading its shares, so we can see if the chronicled deal can live up to all the hype.

Dividends Galore: Dividend payments to stockholders are flowing at an extraordinary rate so far in 2012. Companies like IBM (increased its dividend by +13%), Exxon Mobil – (XOM +21%); Goldman Sachs – (GS +31%) are but just a few of the dividend raisers this year. Through the first three months of the year, the number of companies increasing their dividend payments was up +45% as compared to the comparable number for all of 2011.

Emerging Growth Not Dead: While worriers fret over slowing growth in China, companies like Apple grew by more than +100% in this region and collected nearly 20% of its revenues from this Asian country (~$8 billion). Coincidentally, China is expected to surpass an incredible one billion mobile connections in May – many of those iPhones. In other related news, Starbucks Corp. (SBUX) plans to triple its workforce and number of stores in China over the next three years. China has also helped fuel a backlog of Caterpillar Inc. (CAT) that is more than triple the level of 2009. Emerging markets may have slowed down in 2011, but with inflation beginning to stabilize, emerging market central banks and governments are now beginning to ease policies and reduce red-tape. For example, Brazil and India have started to lower key benchmark interest rates, and China has started to reverse capital flow restrictions.

Stay Off the Trampled Path

The mantra of “Sell in May and go away” always gets a lot of playtime around this period of the year. Over the last few years, the temporary spring/summer sell-offs have only been followed by stronger price appreciation. Individuals attempting to time the market (see also Getting Off the Treadmill) generally end up in tears. And for those traders who boast about their excellent timing (like those suspicious friends who brag about always winning in Las Vegas), we all know the truth – nobody buys at the lows and sells at the highs…except for liars.

With all the noise and cross-currents flooding the airwaves, investing for individuals without assistance has never been so difficult. But before hiding in your cave or reacting to the next scary headline about Europe, the economy, or politics, do yourself a favor by reminding yourself these chilling news items are nothing new and are often great contrarian indicators (see also Back to the Future). The emotional pendulum is constantly swinging from fear to greed and investors stand to prosper by adjusting sentiment and actions in the opposite direction. To survive in the investing wild, it is best to realize that the grass is greener and the eating more abundant when you stay off the trampled path of the herd.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AAPL, but at the time of publishing SCM had no direct position in SPLK, TUMI, IBM, XOM, GS, SBUX, CAT, FB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Fund Flows Paradox

How is it that the stock market has more than doubled over the last three years, when investors have been dumping stocks like they are going out of style? If you don’t believe me, and you think jovial investors are jacking stocks higher, then please explain to me why billions of dollars are hemorrhaging out of equity funds on a monthly basis over the last five years (see Fund Flow data chart below)?

If by small chance you buy my argument that skeptical investors continue to doubt the sustainability of the three-year doubling in the stock market, then why is the Volatility Index (VIX) trading like investors are sunbathing at the beach while licking lollipops? For those not keeping score on the VIX (see also The VIX and the Rule of 16), typically a reading below 20 is interpreted as investor overconfidence and/or complacency. On the flip side, readings above 20 usually indicate pessimism or fear.

As you can see from the chart below, we have spent a good portion of the last few years on both sides of the 20 mph VIX speed limit, and currently at a reading of about 17, investors have slowed down to enjoy the scenery.

So with massive selling and a cheery reading on the VIX, how can these bipolar data-points be reconciled? Therein lies the “Fund Flows Paradox.”

Take Me Out to the Ballgame

If you equate equity investors to fans at a baseball stadium, the fund flow data clearly shows investors are tired of losing money and have been leaving the game in droves. Instead of staying at the equity baseball stadium, those fatigued stock investors have decided to head over to the adjacent bond arena. The equity stadium will never completely be empty because financial markets always have speculative traders. In baseball terms you can think of these short-term traders as the emotionally volatile die-hard fanatics, who will stick around regardless of whether the home team wins or loses.

So while sentiment gauges like the VIX, or sentiment surveys conducted by AAII (American Association of Individual Investors) may be temporarily flashing contrarian bearish signals, one should be cognizant that these data points do not include the petrified opinions of investors who have raced out of the stadium. Eventually when the home team’s winning streak is long enough, investors will return back to the stadium from the bond arena. While there is no sign of individual investors coming back to the stock game anytime soon, in the meantime patient and disciplined investors have had plenty of opportunities to take advantage of. With massive numbers of individual investors and sellers sitting on the sidelines, the markets require relatively little buying to push prices higher.

Over the last few years, not only have equity valuations been broadly reasonable, volatility spikes during the last few summers have also created amplified opportunities. With the wall of worries currently blanketing traditional and new media headlines (i.e., European crisis, U.S. election uncertainty, unsustainable and slowing profits, pending tax cut expirations, Mideast turmoil, etc.) there is no sense of urgency to pile back in to the equity markets.

The doubling in stock prices have occurred on low volumes, largely on the backs of a smaller institutional investor base, not to mention high frequency traders and speculators. While sentiment surveys may currently provide some insight into short-term equity trader attitudes, don’t let these volatile and unreliable data cloud the true underlying pessimism of the masses who have left the stock stadium in large numbers. Trillions of dollars remain on the sidelines as potential fuel for future equity appreciation, once confidence returns.

Opinions are interesting, but actions speak louder than words. Spend more time looking at the actions of the fund flow data, rather than the opinions of various short-term sentiment surveys or short-term options trader statistics. Adjusting your focus to investor actions and behavior will provide a truer gauge of overall investor sentiment and assist you in solving the “Fund Flows Paradox.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in VXX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Lent: Giving Up the Gold Vice

When it comes to Lent, most Christian denomination followers give up a vice, such as food, alcohol, or now in more modern times…Facebook (FB). Since Lent began on Ash Wednesday this year (February 22, 2012), investors have given up something else – gold (GLD). As a matter of fact, the shiny metal has declined by about -8% since Lent began. Stocks, on the other hand, as measured by the S&P 500, have outperformed gold by more than 10% over this period (the Lent period damage is even worse, if you look at the NASDAQ).

If you go back further in time, the underperformance is more extreme, once you account for dividends, which gold of course does not provide. For example, since the peak of the financial crisis panic in March of 2009, S&P 400, S&P 600, and NASDAQ stocks have outperformed gold by more than +40%. Yet, I am still waiting for the sign-spinning guy at the corner of First St. & Main St. to advertise stock trade-in opportunities. Contrarians may also get a kick out of the top investment CNBC survey too.

Last Friday’s jobs data was nothing to write home about, so gold cheerleaders might wait for more fiat currency debasement to come in the form of QE3 (i.e., quantitative easing or printing press). But once again, while this potential added monetary stimulus may not be bad for gold, let’s not forget that stocks still outperformed gold under QE1 & QE2.

As I have always stated, I can’t disagree with the inflationary pressures that are brewing. Stimulative monetary and fiscal policies, coupled with emerging market expansion and undisciplined government spending don’t paint a pretty inflationary picture. So if that’s the case, why not focus on other commodities that provide real utility besides just shininess (e.g., agricultural goods, copper, aluminum, oil, and even silver).

The gold bugs may still have a little post-Lent party, until rates start going up and panic insurance premiums go down, but once the Fed’s easing policy stance changes (see Paul Volcker Fed Chairman era) and fiscal sanity eventually returns to Washington, investors may look to another vice to gorge on.

See also some other items to gorge on: CLICK HERE

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including small cap ETFs, mid cap ETFs, energy ETFs, commodity ETFs) , but at the time of publishing SCM had no direct position in GLD, FB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.