Posts filed under ‘Themes – Trends’

The Great Rotation

There are many styles of investing, and many ways to make money in the stock market. Just like the styles of men’s ties or women’s dresses come in and out of fashion, so too do the styles of investing. Some stick around for a long time, while other fads flop in short order, leading consumers to rotate into new fashions. I’m still waiting for my Bermuda shorts and pleated pants to come back in style. At this year’s Olympics, the broad array of styles has been on full display.

Growth & Tech in Style

The stock market has been on a one-way freight train riding on the coattails of large capitalization growth stocks, primarily technology stocks, especially those associated with technology and artificial intelligence (AI). You can see the dominance of the Growth style over Value in the 30-year chart below.

Source: Yardeni.com

When the blue line is sloping upwards, that means Growth stocks are outperforming Value stocks, and when sloping downwards, Value stocks are outperforming Growth Stocks. For most of the 1990s, Growth was dominant, and ever since the aftermath of the 2008 Financial Crisis, Growth stocks have once again overshadowed Value stocks a majority of the time (2022 being a short-lived reprieve for Value stocks).

This mega-Growth trend reversed last month (at least temporarily), and investors decided to rotate out of large winners into the previously shunned areas of the market, including Small Cap and Value stocks. You can see in the chart below that Small Caps (S&P 600) have underperformed Large Caps (S&P 500) over the last six years.

Source: Yardeni.com

Is this rotation sustainable? At this point, I’d say it’s too early to tell, but during periods like these, when Wall Street darlings like NVIDIA Corp (NVDA) suffer a large hit (e.g., down -17% for NVDA since the June peak), diversification benefits are pushed to the forefront. The lesson of the year 2000 technology bubble bursting taught a generation of investors that getting overly concentrated in a single sector of technology stocks can be seriously dangerous to your wealth and financial well-being. By selecting a diversity of eggs in your basket, like Value and Small Cap stocks, you can protect your nest egg when there are substantial rotations like we experienced last month. Diversification is a core tenet of our investment philosophy at Sidoxia.

In order to place the recent rotation in perspective, let’s look at how a range of indexes performed last month. The Dow Jones Industrial Average increased a hefty +4.4%, while the S&P 500 finished up modestly +1.1%. As investors rotated out of technology (-3.3% – Technology Select Sector SPDR Fund / XLK), a good chunk of those sales rotated into small cap stocks (+10.3% – iShares Russell 2000 ETF / IWM) and value stocks (+5.1% – iShares Russell 1000 Value ETF / IWD).

Despite concerns over global geopolitics, political election madness, and a slowing economy, investors are more focused on the positive prospect of future interest rate cuts by the Federal Reserve, starting in September with a probability exceeding 90% (see chart below).

Source: CME Group

Some investors got caught up in the dizzying rotation last month, but timing these rotations is nearly impossible and one month does not make a long-term trend. Rather than getting caught up in a fool’s errand, make sure your investment portfolio is diversified and built to withstand volatile rotations.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Quickly Out of the Gate

The race into 2024 has begun, and the U.S. market is off to a quick start. The S&P 500 jumped out of the gates by +1.6%, and the technology and AI (Artificial Intelligence) – heavy NASDAQ index raced out by +1.2%. The bull market rally broadened out at the end of 2023, but 2024 returned to the leaders of last year’s pack, the Magnificent 7 (see also Mission Accomplished). Out front, in the lead of the Mag 7, is Nvidia with a +24% gain in January.

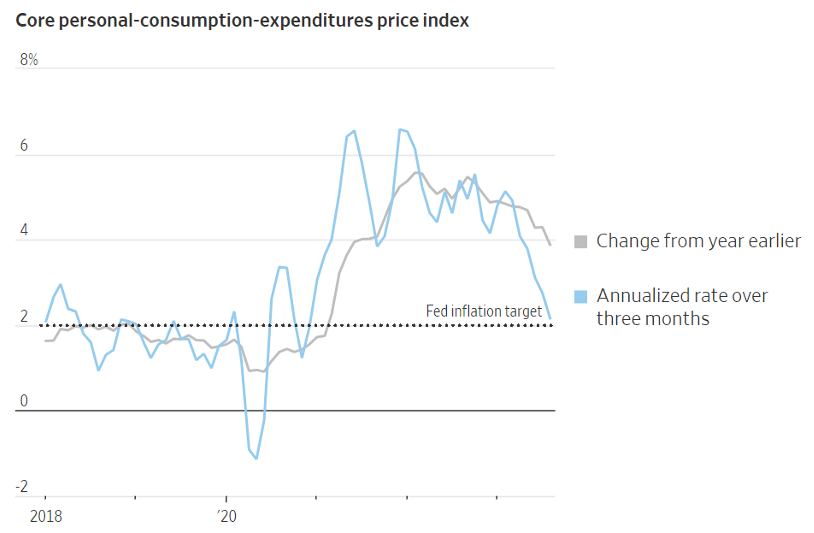

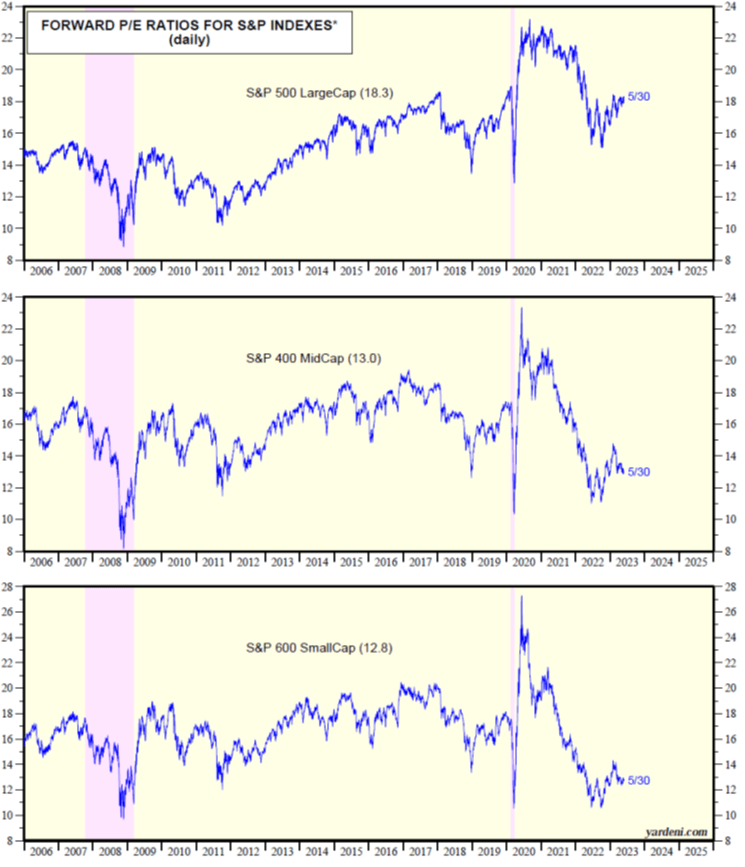

Inflation dropping (see chart below), the Federal Reserve signaling a decline in interest rates, low unemployment (3.7%), and healthy economic growth (+3.3% Q4 – GDP) have all contributed to the continuing bull market run.

Source: Yardeni.com

Consumer spending is the number one driver of economic growth, and consumers remain relatively confident about future prospects as seen in the recently released Conference Board Consumer Confidence numbers released this week (see chart below).

Source: Conference Board

But the race isn’t over yet, and there are always plenty of issues to worry about. The world is an uncertain place. Here are some of the concerns du jour:

– Red Sea conflict led by the Yemen-based, rebel group, Houthis

– Gaza war between Israel and Hamas

– Anxiety over November presidential election

– Ukraine – Russia war

Money Goes Where It is Treated Best

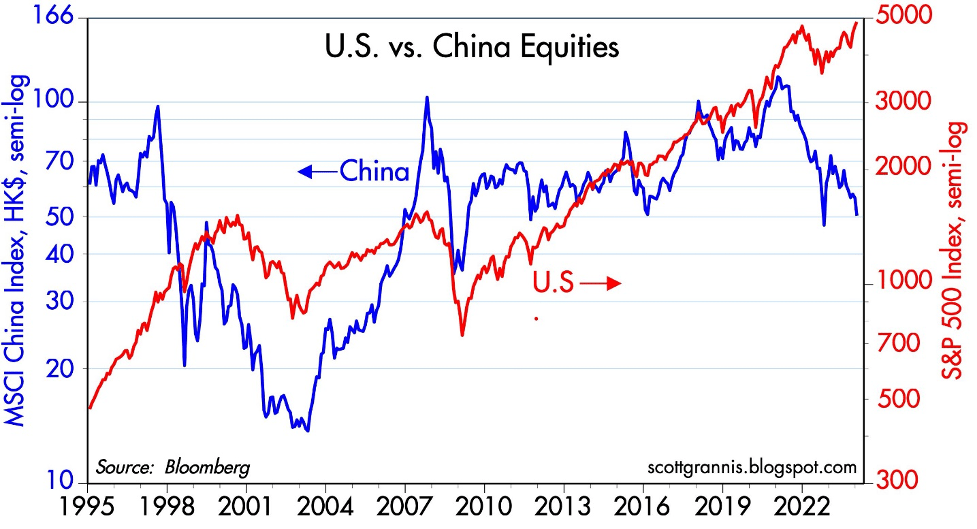

There are plenty of domestic concerns regarding government debt, deficit levels, and political frustrations on both sides of the partisan aisle remain elevated. When it comes to the financial markets, money continues to go where it is treated best. Sure, we have no shortage of problems or challenges, but where else are you going to put your life savings? China? Europe? Russia? Japan?

Well, as you can see in the chart below, anti-democratic, anti-American business, and confrontational military policies instituted by China have not benefitted investors – the U.S. stock market (S&P 500) has trounced the Chinese stock market (MSCI) over the last 30 years.

Source: Calafia Beach Pundit

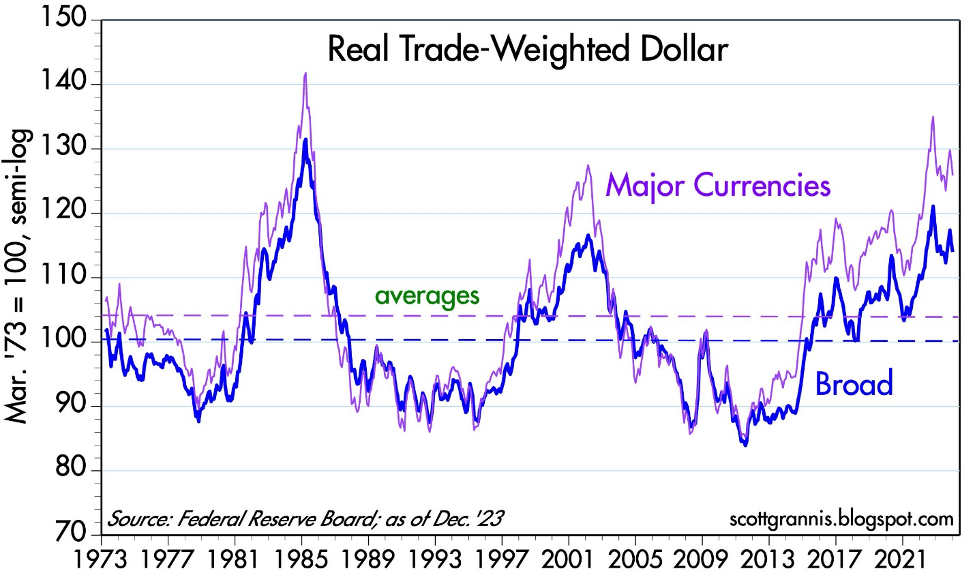

For years, market critics and pessimists have been screaming doom-and-gloom as it relates to the United States. The story goes, the U.S. is falling apart, government spending and debt levels are out of control, politicians are corrupt, and we’re going into recession, thanks in part to higher interest rates and inflation. Well, if that’s the case, then why has the value of the U.S. dollar increased over the last 10 years (see chart below)? And why is the stock market at all-time record-highs?

Source: Calafia Beach Pundit

Global investors are discerning in which countries they invest their hard-earned money. Global capital will flow to those countries with a rule of law, financial transparency, prudent tax policy, lower inflation, higher profit growth, lower interest rates, sensible fiscal and monetary policies, among other pragmatic business practices. There’s a reason they call it the “American Dream” and not the “Chinese Dream.” Our capitalist economy is far from perfect, but finding another country with a better overall investing environment is nearly impossible. There’s a reason why venture capitalists, private equity managers, sovereign wealth funds, hedge funds, and foreign institutions are investing trillions of their dollars in the United States. Money goes where it is treated best!

As money sloshes around the world, the 2024 investing race has a long way before it’s over, but at least the stock market has quickly gotten out of the gate and built a small lead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia Webinar: The Keys to ’23 & What’s in Store for ’24 – Market Update

Unlock valuable insights at our upcoming webinar:

The Keys to ’23 & What’s in Store for ’24!

Tuesday, January 30th at 12:00 PM

Click the Zoom link below to register:

https://sidoxia.link/Webinar-Registration

Don’t miss out on the latest trends and expert discussions.

We will delve into a comprehensive market update. Register now!

The Douglas Coleman Show Interviews Wade Slome

Wade Slome, President and Founder of Sidoxia Capital Management, recently had the pleasure of being featured on The Douglas Coleman Show hosted by Douglas Coleman.

Drawing from professional and personal life lessons, Wade shares his knowledge about navigating market trends, building investment strategies, and also discuss the books he has authored.

If you are interested in learning more about the books Wade has authored, please visit: https://www.sidoxia.com/wades-books

This Baby Bull Has Time to Grow

You may have witnessed some fireworks on New Year’s Eve, but those weren’t the only fireworks exploding. The last two months of 2023 finished with a bang! More specifically, over this short period, the S&P 500 index skyrocketed +13.7%, NASDAQ +16.8%, and the Dow Jones Industrial Average +14.0%. The gains have been even more impressive for the cheaper, more interest-rate-sensitive small-cap stocks (IJR +21.8%), which I have highlighted for months (see also AI Revolution).

For the full year, the bull market was on an even bigger stampede: S&P 500 +24%, NASDAQ +43%, and Dow +14%.

Although 2023 closed with a festive explosion, 2022 ended with a bearish growl. Effectively, 2023 was a reverse mirror image of 2022. In 2022, the stock market fell -19% (S&P) due to a spike in inflation. Directionally, interest rates followed inflation higher as the Fed worked through the majority of its 0% to 5.5% Federal Funds rate hiking cycle.

To sum it up simply, the last two years have been like riding a rollercoaster. For the year just ended, much of the year felt like a party, but 2022 felt more like a funeral. When you add the two years together, it was more of a lackluster result. For 2022-2023 combined, results registered at a meager +0.1% for the S&P, +3.7% for the Dow, and -4.0% for the NASDAQ (see chart below).

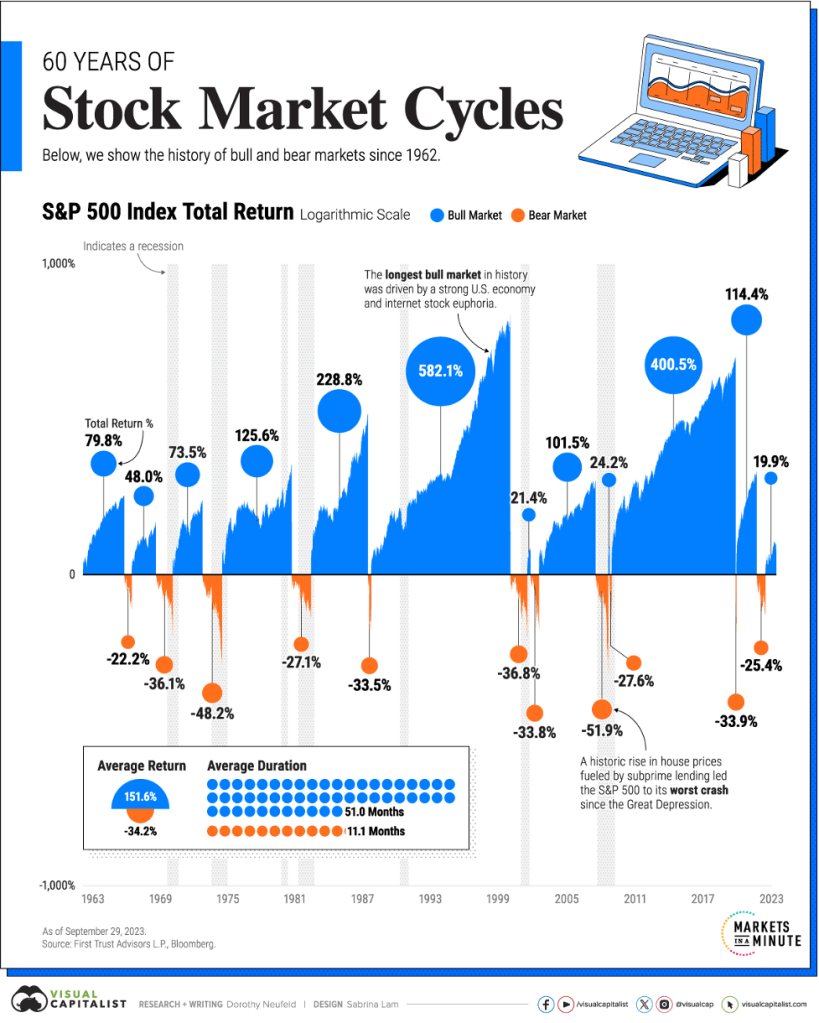

For those saying the good times of 2023 cannot continue, investors should understand that history paints a different picture. As you can see from the stock market cycles chart (below) that spans back to 1962, the average bull market lasts 51 months (i.e., 4 years, 3 months), while the average bear market persists a little longer than 11 months. This data suggests the current one-year-old baby bull market has plenty of room to grow more.

Source: Visual Capitalist

Why So Bullish?

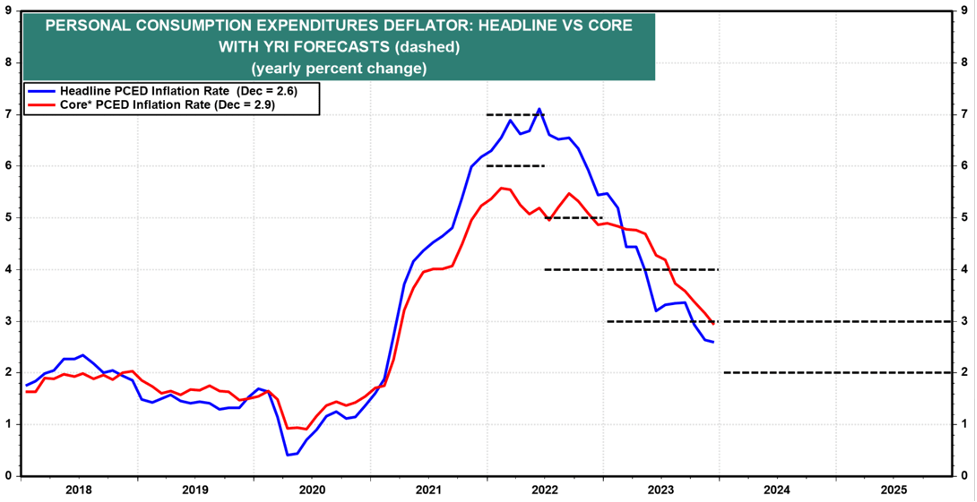

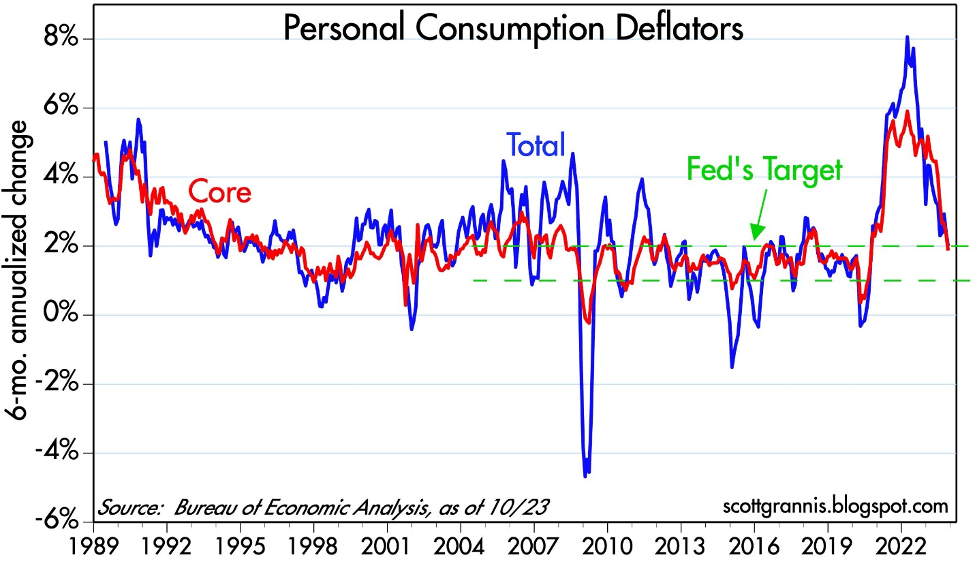

What has investors so jazzed up in recent months? For starters, inflation has been on a steady decline for many months. With China’s stagnating economy, it has helped our inflationary cause by exporting deflationary goods to our country. As you can see from the Personal Consumption Deflator chart below, this broad inflation measure has declined to the Federal Reserve’s 2% target level. Jerome Powell, the Federal Reserve Chairman has been paying attention to these statistics, as evidenced by the central bank’s forecast at the Fed’s recent policy meeting last month on December 13th for three interest rate cuts in 2024. This so-called “Powell Pivot” is a reversal in tone by the Fed, which had been on a relentless rampage of interest rate hikes, over the last two years.

Source: Calafia Beach Pundit

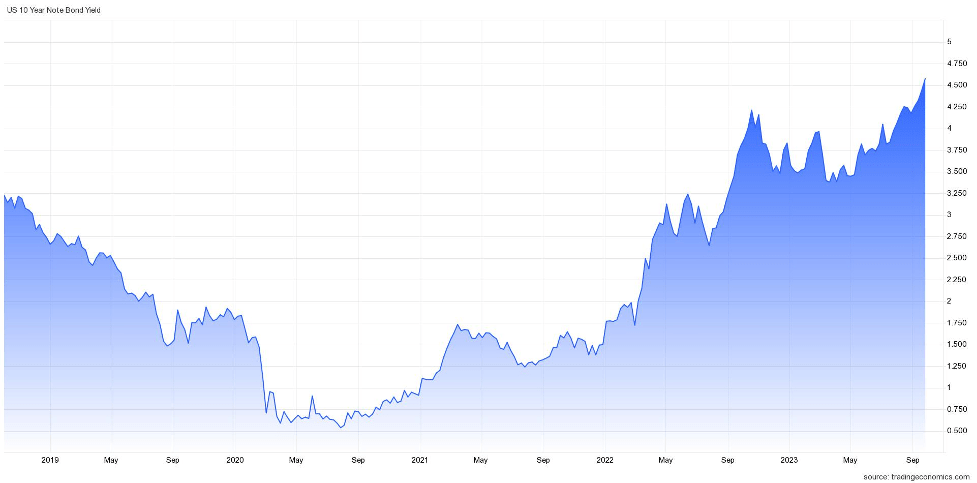

This interest rate cycle headwind has turned into a tailwind as investors now begin to discount the probability of future rate cuts in 2024. The relief of lower interest rates can be felt immediately, whether you consider declining mortgage and car loan rates for consumers, or credit line and corporate loan rates for businesses. This trend can be seen in the benchmark 10-Year Treasury Note yield, which has declined from a peak of 5.0% a few months ago to 3.9% today (see chart below).

Source: Trading Economics

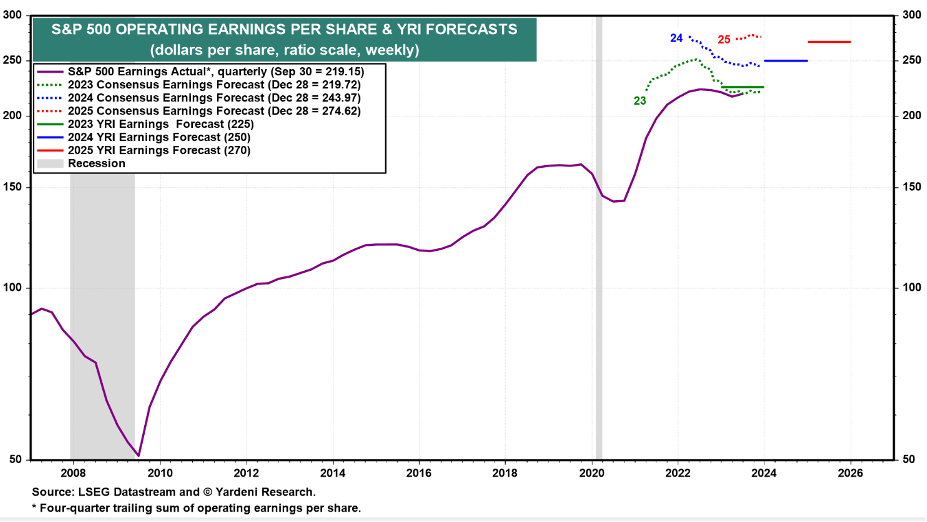

Declining inflation and interest rates explain a lot of investor optimism, but there are additional reasons to be sanguine. The economy remains strong, unemployment remains low, AI (Artificial Intelligence) applications are improving worker productivity, trillions of potential stock market dollars remain on the sidelines in money market accounts, and corporate profits have resumed rising near all-time record levels (see chart below).

Source: Yardeni.com

What could go wrong? There are always plenty of unforeseen issues that could slow or reverse our economic train. Geopolitical events in Russia or the Middle East are always difficult to predict, and we have a presidential election in 2024, which could always negatively impact sentiment. This new bull market had a great start in 2023, but in historical terms, it is only a baby. Time will tell if 2024 will make this baby cry, but whatever the market faces, declining inflation and interest rates should act as a pacifier.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Market Roar Due to War

The devastating damage to humanity from the Israeli-Hamas war that is in and around the Gaza strip should not be diminished or understated – innocent lives on both sides suffer in any conflict. However, the economic impact should not be overstated either. In other words, the hundreds of billions of dollars in financial stock market losses this month are not proportional to the Mideast economic losses incurred thus far.

To put the events in perspective, the population of Israel approximates 10 million people and the population located in the Gaza Strip is about two million people. There are more than eight billion people on the planet, so Israel/Gaza represents roughly 1/7 of 1% of the global population.

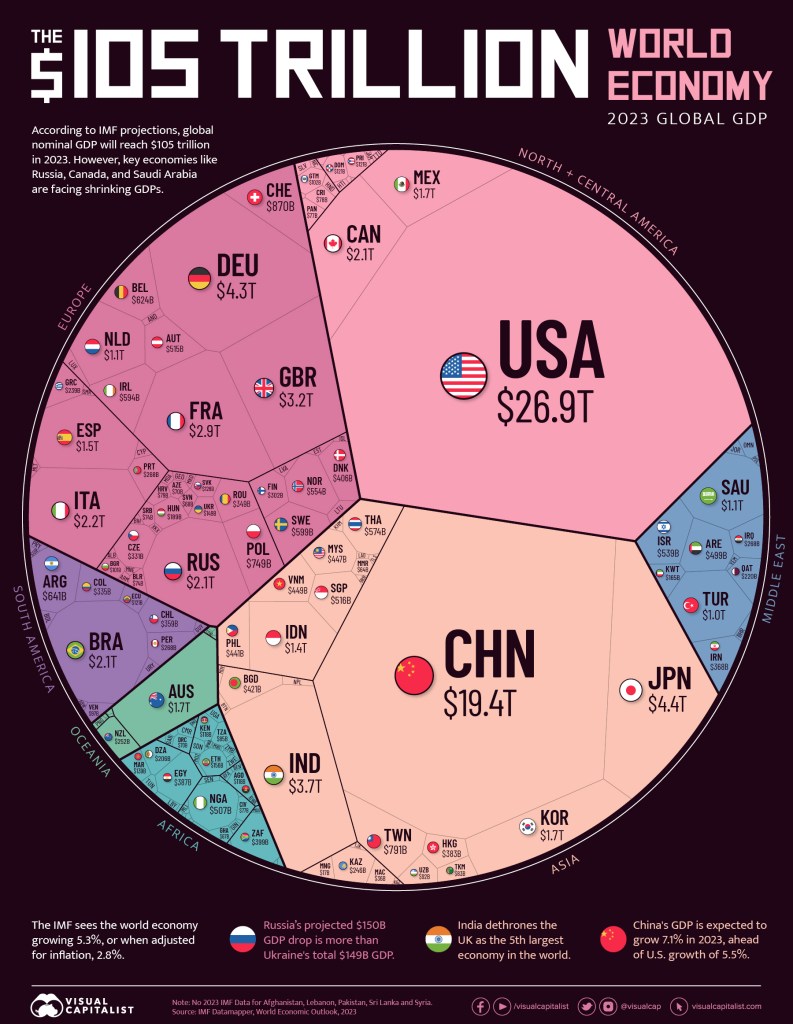

From an economic standpoint, the combined economic output of Israel/Gaza Strip accounts for around ½ of 1% of global GDP (see chart below – small slivers in the blue section).

And let’s not forget, economic activity is not dropping to zero. From an economic standpoint, the war’s financial impact is even smaller – a rounding error.

Source: Visual Capitalist

However, wars do not exist in a vacuum, and tensions in the Middle East have the potential of having a ripple effect. Whenever rumblings occur in the Mideast, one of the largest global sectors to be first impacted is the oil market. Approximately 20-30% of the world’s oil is trafficked through the Strait of Hormuz in the Persian Gulf, so it was not surprising to see a short-term spike in oil prices to almost $90 per barrel in early October after the Gaza invasion of Israel. By the end of the month, oil has settled back down to about $81 per barrel, almost precisely the same price right before the war started. On a year-over-year basis, oil prices are actually down approximately -5%, thereby providing minor relief to gas-powered car drivers.

If Iran, or Iran-backed militant group Hezbollah, throws their hat into the Israel-Hamas war ring, the U.S. and other Western allies may retaliate and escalate tensions in the region, which would unlikely be received well by the financial markets.

As a result of these domino effect fears in the region, the stock market took another leg down last month with the S&P 500 index declining -2.2%, the Dow Jones Industrial Average -1.4%, and the NASDAQ index fell the most, -2.8%. The world is a dangerous place, but we have seen this movie before – this is nothing new. We would all prefer world peace, but unfortunately, wars and skirmishes have gone on for centuries.

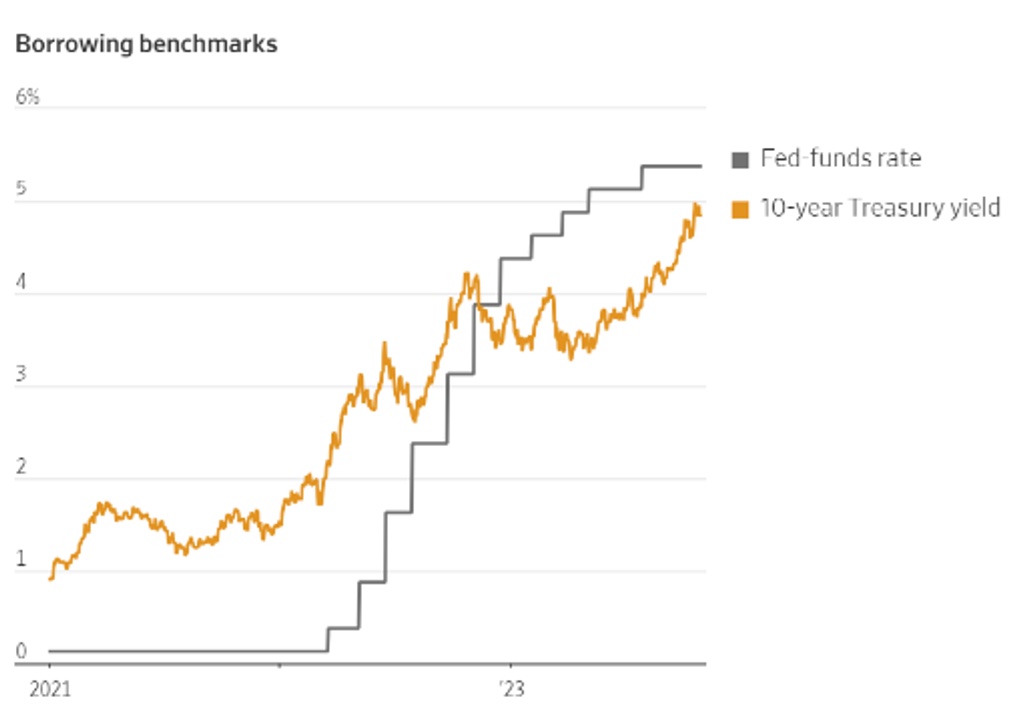

As Interest Rates Soar, Bonds Offer More

Source: Wall Street Journal

No, TINA is not the name of my high school girlfriend or wife, but rather the acronym TINA (There Is No Alternative) existed in recent years during the Federal Reserve’s zero-interest rate policy days. More specifically, TINA referred to the lack of investment alternatives to equities (i.e., stocks) when money effectively earned 0% in the bank and close-to-0% in many fixed income securities (i.e., bonds). In fact, at one point, although it is still hard to believe, there were more than $16 trillion in bonds paying negative interest rates – pure insanity.

TINA Turns into FIONA

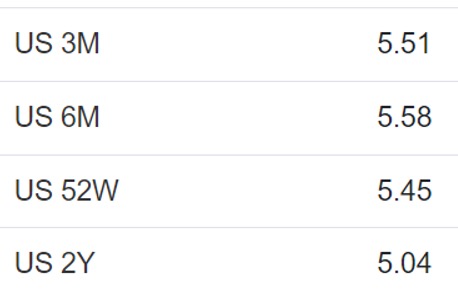

Given the large increase in interest rates by the Federal Reserve over two years (from 0% to 5.50%), investors have been given a short-term gift. As you can see from the chart above, yields on 10-Year Treasury Notes have risen to almost 5.0%. And believe it or not, shorter term bonds are currently providing yields even higher than this. The three-month, six-month, one-year, and two-year Treasuries are all yielding higher rates than 10-Year Treasury yields (i.e., inverted yield curve) – see table below. So, TINA has changed to FIONA – Fixed Income Opens New Alternatives. What’s more, for individuals with taxable accounts, the interest earned on Treasuries is tax-free at the state level, thereby making this short-term gift in yields even more attractive for investors.

Source: Trading Economics

Stock prices were down again for the month, and investment sentiment has been souring due to the war in the Middle East, but there is still plenty of reasons to remain constructive. Not only is the economy strong (e.g., 3rd quarter GDP of +4.9%), but the consumer also remains strong (see Consumer Wallets Strong) in large part because the unemployment rate remains near record lows (+3.8%). While anxiety rises due to the war, stock prices get cheaper, and opportunities increase. And although interest rates remain elevated, the Federal Reserve is signaling they are closer to a rate hiking end, inflation is cooling and FIONA is offering more attractive yields than during the TINA era. It’s true, this month stocks did not roar due to the war, but patient and opportunistic investors will be rewarded with more.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Consumer Wallets Strong, Rate Hikes Long, What Could Go Wrong?

Consumer wallets and balance sheets remain flush with cash as employment remains near record-high levels. Cash in consumer wallets and money in the bank help the economy keep chugging along at a healthy clip. More specifically, as you can see in the chart below, the net worth of U.S. households has reached a record $154.3 trillion dollars in the most recent month, thanks to appreciation in stocks, gains in real estate, and relatively stable levels of debt.

Source: Calafia Beach Pundit

Unemployment Remains Low

In addition, the unemployment rate is sitting at 3.8%, near multi-decade lows (see chart below).

Source: Trading Economics

As long as consumers continue to hold a job, they will continue spending to buoy economic activity – remember, consumer spending accounts for roughly 70% of our country’s economic activity. Case in point are the most recently released GDP (Gross Domestic Product) forecasts by the Atlanta Federal Reserve, which show 3rd quarter GDP growth estimated at a 4.9% rate (see chart below).

Rates Up, Housing Prices Up?

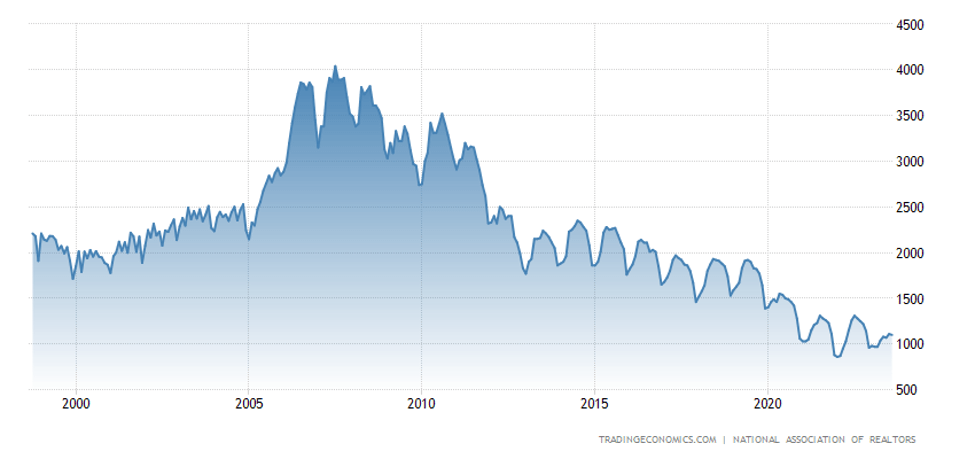

Yes, it’s true, despite a dramatic surge in mortgage rates over the last few years, the housing market remains strong due to a very tight supply of homes available for sale. Most homeowners with a mortgage have refinanced to a rate in the range of 3% (or in some cases even lower), so selling and moving into a new home with a mortgage at current rates of 7.3% is not that appealing. In other words, if you decide to move, your monthly mortgage payment could potentially go up by more > 50%, which could equate to thousands of dollars per month. Under this scenario, you are likely to stay put and not sell your home.

Source: Trading Economics

The embedded economic disincentive of selling a home with a mortgage has really put a real crimp on the supply of homes available for sale (chart below). As you can see, the inventory of homes has dramatically collapsed from a peak of about four million homes, circa the 2008 Financial Crisis, to around one million homes today.

Source: Trading Economics

In the face of this mixed data, the stock market finished a hot summer with a cool whimper last month, in large part due to a 0.49% increase in the 10-Year Treasury Note yield to 4.58% (see chart below). The S&P 500 index fell -4.9% for the month, the technology-heavy NASDAQ index dropped even further by -5.8%, while the Dow Jones Industrial Average outperformed, down -3.5% for the month. Worth noting, however, the Dow has significantly underperformed the other indexes so far this year.

Source: Trading Economics

Inflation on the Mend

The Fed continues to talk tough about fighting inflation after taking interest rates from 0% to 5.5% over the last two years, nevertheless inflation continues to come down. The Fed’s go-to Core PCE inflation datapoint that came out last Friday at +0.1% is consistent with the downward inflation trend we have been witnessing for many months now (see chart below). As you can see, inflation on annualized basis has reached 2.2%, nearly achieving the Federal Reserve’s target of 2.0%.

Source: The Wall Street Journal and Commerce Department

There is never a shortage of investor concerns. Today, worries include Federal Reserve policy; restarting of school loan repayments (after a three-year hiatus); a potential government shutdown; an auto and Hollywood strike; higher oil prices; and a presidential election that is heating up. Many of these worries are nothing new. The bull market took a pause for the month, but consumer wallets remain fat, the economy keeps chugging, the employment picture remains strong, and stock prices remain up +12% for the year (S&P 500). For the time being, betting on a soft economic landing over an imminent recession could be a winning use for that cash in your wallet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 2, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

AI Revolution and Debt Ceiling Resolution

On the surface, last month’s performance of the stock market as measured by the S&P 500 index (+0.3%) seemed encouraging, but rather pedestrian. Fears of sticky-high inflation, more potential Federal Reserve interest rate hikes, contagion uncertainty surrounding a mini-banking crisis, along with looming recession concerns led to a -3.5% monthly decline in the Dow Jones Industrial Average (-1,190 points). The good news is that inflation is declining (see chart below) and currently the Federal Reserve is expected to pause from increasing interest rates in June (the first time in more than a year).

Source: Calafia Beach Pundit

Overall stock market performance has been a mixed-bag at best. Adding to investor anxiety, if you haven’t been living off-the-grid in a cave, is the debt ceiling negotiations. Essentially, our government has maxed out its credit card spending limit, but Republicans and Democrats have agreed in principle on a resolution for an expanded credit line. More specifically, the House of Representatives just approved to raise the debt ceiling by a resounding margin of 314 – 117. If all goes well, after months of saber rattling and brinksmanship, the bill should be finalized by the Senate and signed by the President over the next two days.

Beyond the Washington bickering, and under the surface, an artificial intelligence (AI) revolution has been gaining momentum and contributed to the technology-heavy NASDAQ catapulting +5.8% for the month and +23.6% for 2023. At the center of this disruptive and transformational AI movement is NVIDIA Corp., a leading Silicon Valley chip manufacturer of computationally-intensive GPUs (graphics processing units), which are used in generative AI models such as OpenAI’s ChatGPT (see NVIDIA products below). Adoption and conversations surrounding NVIDIA’s AI technology have been spreading like wildfire across almost every American industry, resulting in NVIDIA’s stratospheric stock performance (+36% for the month, +159% for the year, +326% on a 3-year basis).

Source: NVIDIA Corp. – the computing engines behind the AI revolution.

Why Such the Fuss Over AI?

Some pundits are comparing AI proliferation to the Industrial Revolution – on par with productivity-enhancing advancements like the steam engine, electricity, personal computers, and the internet. The appetite for this new technology is ravenous because AI is transforming a large swath of industries with its ability to enhance employee efficiency. By leveraging machine learning algorithms and massive amounts of data, generative AI enables businesses to automate repetitive tasks, streamline processes, and unlock new levels of productivity. A study released by MIT researchers a few months ago showed that workers were 37% more efficient using ChatGPT.

If you have created an account and played around with ChatGPT at all you can quickly realize there are an endless number of potential applications and use-cases across virtually all industries and job functions. Already, application of generative AI systems is disrupting e-commerce, marketing, customer service, healthcare, robotics, computer vision, autonomous vehicles, and yes, even accounting. Believe it or not, ChatGPT recently passed the CPA exam! Maybe ChatGPT will do my taxes next year?

Other industries are quickly being disrupted too. Lawyers may feel increased pressure when contracts or briefs can be created with a click of the button. Schools and teachers are banning ChatGPT too in hopes of not creating lazy students who place cheating and plagiarism over critical thinking.

At one end of the spectrum, some doomsday-ers believe AI will become smarter than humans, replace everyone’s job, and AI robots will take over the world (see Elon Musk warns AI could cause “civilization destruction”). At the other end of the spectrum, others see AI as a transformational tool to help worker productivity. As generative AI continues to advance, its impact on employee efficiency will only grow, optimizing processes, driving innovation, and reshaping industries for a more productive future. Embracing this transformative technology will be critical for businesses seeking to thrive in the new digital age.

2023 Stock Performance Explained – Index Up but Most Stocks Down

Although 2022 was a rough year for the stock market (i.e., S&P 500 down -19%), stock prices have rebounded by +20% from the October 2022 lows, and +9% this year. This surge can be in large part attributed to the lopsided performance of the top 1% of stocks in the S&P 500 index (Apple Inc., Microsoft Corp., Amazon.com Inc., NVIDIA Corp., and Alphabet-Google), which combined account for almost 25% of the index’s total value. These top 5 consumer and enterprise technology companies have appreciated on average by an astounding +60% in the first five months of the year and represent a whopping $9 trillion in value. It gets a little technical, but it’s worth noting these larger companies have a disproportionate impact on the calculation of the return percentages, and vice versa for the smaller companies. To put these numbers in context, Apple’s $2.8 trillion company value is greater than the Gross Domestic Product (GDP) of many entire countries, including Italy, Canada, Australia, South Korea, Brazil, and Russia.

On the other hand, if we contrast the other 99% of the S&P 500 index (495 companies), these stocks are down -1% each on average for 2023 (vs +60% for the top 5 mega-stocks). If you look at the performance summary below, you can see that basically every other segment of the stock market outside of technology (e.g., small-cap, value, mid-cap, industrial) is down for the year.

2023 Year-To-Date Performance (%)

S&P 500: +8.9%

S&P 500 (Equal-Weight): -1.2%

S&P Small-Cap Index: -2.3%

Russell 1000 Value Index: -2.0%

S&P Mid-Cap Index: -0.7%

Dow Jones Industrial: -0.7%

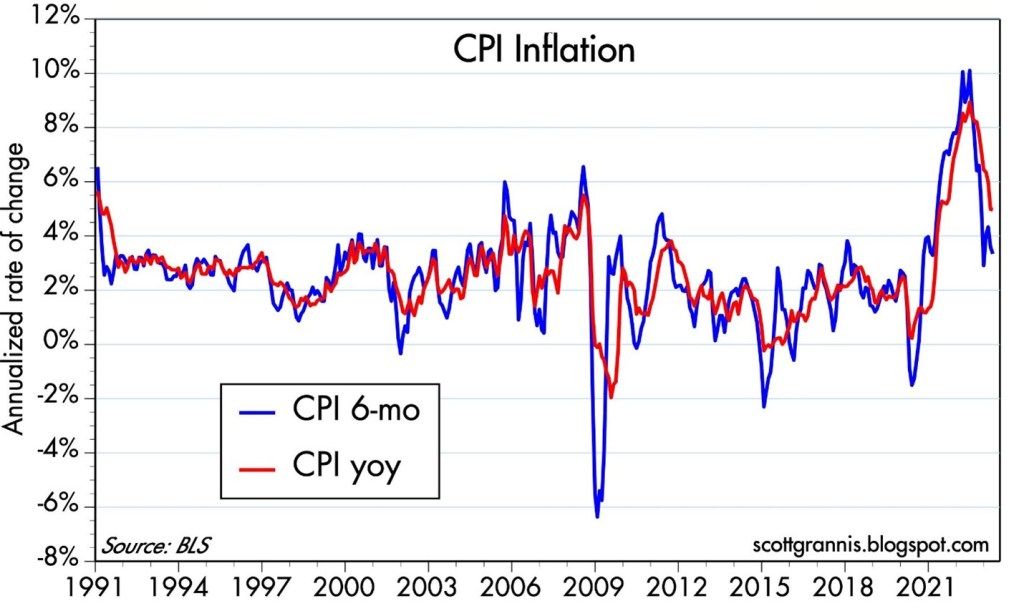

While most stocks have dramatically underperformed technology stocks this year, this phenomenon can be explained in a few ways. First of all, smaller companies are more cyclically sensitive to an economic slowdown, and do not have the ability to cut costs to the same extent as the behemoth companies. The majority of stocks have factored in a slowdown (or mild recession) and this is why valuations for small-cap and mid-cap stocks are near multi-decade lows (12.8x and 13.0x, respectively) – see chart below.

Source: Yardeni.com

The stock market pessimists have been calling for a recession for going on two years now. Not only has the recession date continually gotten delayed, but the severity has also been reduced as corporate profits remain remarkably resilient in the face of numerous economic headwinds. Regardless, investors can stand on firmer ground now knowing we are upon the cusp of an AI revolution and near the finish line of a debt ceiling resolution.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Are Stocks Cheap or Expensive? Weekly Rant and the Week in Review 4-7-19

The Weekly Grind podcast is designed to wake up your investment brain with a weekly overview of financial markets and other economic-related topics.

Episode 7

Weekly Market Review and This Week’s Rant: Are Stocks Cheap or Expensive?

Don’t miss out! Follow us on iTunes, Spotify, SoundCloud or PodBean to get a new episode each week. Or follow our InvestingCaffeine.com blog and watch for new podcast updates each week.

SoundCloud: soundcloud.com/sidoxia

PodBean: sidoxia.podbean.com