Posts filed under ‘Profiles’

The Porsche-Yacht Indicator

Tiger Woods is not the only person who has realized yacht purchases do not guarantee happiness. In previous articles (Back to Future article #1, article #2, article #3), I showed how magazine covers could be used for identifying tops and bottoms in the market. Now I’m researching yacht and Porsche purchases as a complementary indicators for future performance deterioration with the thanks of Slate.com and Bloomberg.

1) Bill Miller: After an incredible 15 consecutive years winning streak against the S&P 500 index, Bill Miller (Fund manager of the Legg Mason Value Trust) thought it was a bright idea to add a yacht to his portfolio in 2006. Needless to say, from that point on, his five-star Morningstar rated fund went on a horrific losing streak, landing him in the bottom decile of peers and forced him to relinquish four of his fund rating stars (See Bill Miller Revenge of the Dunce) .

2) Paul Allen: The jinxing of yacht buying is not limited to fund managers. Paul Allen was the Co-Founder of Microsoft (MSFT) with Bill Gates, Chairman of cable company Charter Communications (CHTRQ), and owner of the Seattle Seahawks football team, and the Portland Trailblazers basketball team. Ever since buying his 300-foot Tatoosh yacht in 2000 and his 400-foot+ Octopus yacht in 2003, Allen’s cable company, Charter Communications, deteriorated and his company went bankrupt before recently reemerging from Chapter 11.

3) Dennis Kozlowski: Corruption didn’t slow down Dennis Kozlowski, CEO of Tyco International (TYC), from buying his 130 foot sailing yacht Endeavor. From around the time he purchased the yacht until he resigned based on the charges, Tyco stock collapsed approximately -70%.

4) Robert Rodriguez: The $1.1 billion FPA Capital Fund has been captained by Bob Rodriguez since 1984 and his 15% average annual return qualifies him as the best manager among diversified U.S. equity funds, according to Morningstar Inc. As a value-based investor his wealthy indulgences are concentrated on driving Porsches. So comfortable is Rodriguez about the performance of the fund, he has decided to take 2010 off traveling. Perhaps he can be my first experimental subject in the testing of my “sabbatical indicator?”

5) Tiger Woods: With the endless media coverage, Tiger’s 155-foot yacht Privacy unfortunately has not secured him any. The $20 million purchase was made in 2004, but with six wins in golf “Majors” over the last five years, the yacht indicator is less conclusive. In the field of faithfulness, there is a higher correlation.

Obviously, there are many instances in which performance has improved over time, even after luxury asset purchase like yachts. I haven’t placed the order for my 400-foot yacht just quite yet, but I have made notes to myself to avoid bankruptcy, jail, car crashes and one-star performances if I decide to go through with the purchase. I’ll keep you posted on my order…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in MSFT, LM, CHTRQ, NKE. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Read Full Yacht Article on Slate.com

New Normal is the Old Normal

By Bruce Wimberly (Contributing Writer to Investing Caffeine)

Pimco bond gurus love to talk about the “new normal” as if there is such a thing in financial markets. The problem with promoting such a view is that it assumes markets are static. Ask John Meriwether and his pack of Nobel Prize winning colleagues at LTCM how static the markets are? The point is nothing is normal about the markets or the economy for that matter. No one has a magic crystal ball that can predict the future and if you did you would certainly not promote it on CNBC. Mohamed El-Erian and his bond fund mavens (see also article on Bill Gross) are the poster children for the “new normal.” I will give them credit it is a great marketing gimmick. Not only does it sound cool but it covers just about everything while packaging it into a nice neat sound bite. Talk about media hounds –does El-Erian actually have time to run Pimco after spending hours getting his make-up ready for the countless interviews he gives each day? And what is up with the 1970ʼs mustache?

In the world according to Pimco the new normal, “reflects a growing realization that some of the recent abrupt changes to markets, households, institutions, and government policies are unlikely to be reversed in the next few years. Global growth will be subdued for a while and unemployment high; a heavy hand of government will be evident in several sectors…. But, hold on, I am getting ahead of myself here. I still have a few more preambles”! Iʼll bet he does.

El-Erian is never short on opinions. As an investor all I really care about is what does this mean for asset prices? Ok, so global GDP is going to slow as consumers and institutions repair balance sheets, government policies are becoming more burdensome, and unemployment stays high. Check. Got it. While I am not El-Erain I think what he really meant to say is, “We have already established our bond positions and if you want to help our shareholders you should follow our example and invest on the short end of the curve and be wary of inflation. The Fed is printing money and history suggests this will end badly.”

El-Erian is never short on opinions. As an investor all I really care about is what does this mean for asset prices? Ok, so global GDP is going to slow as consumers and institutions repair balance sheets, government policies are becoming more burdensome, and unemployment stays high. Check. Got it. While I am not El-Erain I think what he really meant to say is, “We have already established our bond positions and if you want to help our shareholders you should follow our example and invest on the short end of the curve and be wary of inflation. The Fed is printing money and history suggests this will end badly.”

As a formal multi-billion dollar fund manager, I happen to agree with the guy. While I think he could have been more direct with his message, there is no way the fed can inflate us out of this mess without their being some pain down the road. The United States cannot print its way to a recovery. Todayʼs long bond auction is just the first shot against the bow. The 4 3/8% coupon went off at a price of $97.6276 for a 4.52% yield versus a 4.49% prior. In other words, the so-called “new normal” really is the old normal and rates are heading higher my friends.

In this so- called “new normal” of higher rates what should an investor do? First, avoid the treasury bubble like the plague. This is where irrational exuberance is occurring the most. Wake-up people. What Pimco bond managers should be telling you is, “Donʼt buy our funds” (except Reits, Tips and Commodities). Bonds are going to get killed. That is the “new normal”. The “new normal” is inflation is your worst nightmare for bonds and bond buyers. Yes, bonds had a great run the last decade and that is the point! History will not repeat itself. The “new normal” is stocks will outperform bonds over the next ten years handily. Yes, stocks might get hit in the short run as rates rise but in the long run they are a far better asset class to weather inflation. The simple truth is businesses can raise prices. That is all you need to know. Donʼt anchor to the last ten years, as Pimco would like you to do. Donʼt worry about slick slogans – like the “new normal”. Just think about all the assets that have poured into Pimcoʼs funds over the last 10-15 and ask yourself “is this likely to continue?”

To paraphrase Wayne Gretzky great investors “skate to where the puck will be”. In my opinion, that leads you away from the mutual fund behemoth that is Pimco and the safe haven of bonds and back into equities. Yes, the S&P 500 has gone nowhere the last 11 years and that is my point…. the “new normal” is the old normal and equities regain their long term return advantage over other asset classes.

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and equity securities in client and personal portfolios at the time of publishing. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

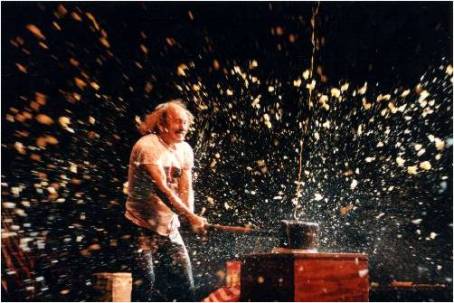

Stewart Makes Skewered Beck-Kebabs

Since Fox news-host, Glenn Beck, has been peddling death and destruction, John Stewart, host of the The Daily Show, decided to dish out some devastation of his own to Mr. Beck by skewering him on several issues. Specifically, Stewart questions whether Beck’s Armageddon view on the economy may be influenced by an economic conflict of interest in gold (not just a political axe to grind)?

Beck on Gold

View The Daily Show Clip on Glenn Beck

As the third party mentions, “If you are worried about worrying, you go out and you buy gold.”

Is Glenn Beck a worried, gold lover? (see other IC articles: Gold #1 & Gold #2) Well, judging by the seven responses of Beck specifically spouting out “gold”, along with his panic-filled quotes, I would say “yes”:

- “America is burning down to the ground!”

- “Here are the three scenarios that we could be facing: recession, depression, or collapse.”

- “Here’s our second scenario: global civil unrest.”

- “You are the protector of liberty. You are the guardian of freedom.”

If these feelings were not enough, Beck also goes on to compare the country’s situation to Nazi Germany.

Do any of these issues worry you? Well if they do, then good for gold prices and good also for Glenn Beck, because he is a paid spokesman for Goldline.com, a site that sells gold.

This is how John Stewart boils down the incestuous relationship between Fox, Goldline.com, and Beck:

“This is a kinda nice feedback loop. Glenn Beck is paid by Goldline to drum up interest in gold, which increases in value during times of fear, an emotion reinforced nightly on Fox by Glenn Beck. Alright, I’m almost sold. Fox is vouching for Beck, and Beck is vouching for Goldmine.”

Gold Pricing & Demand

With gold prices setting new all-time highs earlier this month, one might expect gold demand to be sky-rocketing…actually not. Just last month, the World Gold Council said gold demand totaled 800.3 tons in Q3, down -34% year-over-year. What’s more, the supply of gold inventories is at record highs (Comex) and mining production rose +6% over the same time period. Generally speaking, economics would say the combination of these factors would be a bad formula for prices.

Beck and the CEO of Goldmine.com use inflation adjusted prices based on the last $850/oz. peak in 1980 to rationalize $2,000/oz+ targets for gold. If that’s the case then I guess NASDAQ targets of 10,000 (2x of the 5,000 year 2000 peak) shouldn’t be out of the question either (the index currently trades around 2,190)? In the meantime, I’ll let the speculative gold dust settle and comfortably watch from the sidelines.

Hemorrhoid Hypocrisy on Healthcare

In an earlier The Daily Show episode, Stewart questions the consistency of Beck’s changing views on healthcare. So which one is it? Is it the best healthcare program in the world, or the one that doesn’t care for Glenn Beck and the “schlubs that are just average working stiffs?”

In creating a feeling of alarm regarding healthcare reform, here’s what Beck had to say in the middle of the healthcare reform debate:

- “You’re about to lose the best healthcare system in the world.”

- “America already has the best healthcare in the world. We do take care of our sick.”

Rewind 16 months earlier upon completion of Beck’s hemorrhoid surgery:

- “Getting well in this country, can almost kill you.”

- “No matter how much the health care system would try to keep me down, I’m back.”

See Daily Show Clip on Healthcare and Glenn Beck

All this bickering can upset your stomach, but after John Stewart’s skewering of Glenn Beck, I have this sudden urge for shish kebabs. Bon appétit until next time…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (VFH) and RTP in client and personal portfolios at the time of publishing. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

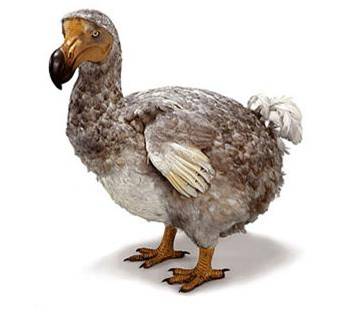

Rogers: Fed Following in Path of Dodo

Jimmy Rogers, the bow-tie boss of Rogers Holdings and past co-founder of the successful Quantum Fund with George Soros, is no stranger to making outrageous predictions. His latest prophetic assessment is the Federal Reserve Bank is on the path of the Dodo bird to extinction:

“Don’t worry – the Fed is going to abolish itself. Between Bernanke and Greenspan, they’ve made so many mistakes that within the next few years the Fed will disappear.”

Given the shock and awe that transpired from the Lehman Brothers collapse, I can only wonder how investors might react to this scenario….hmmm. If this doozy of an outlandish call catches you off guard, please don’t be surprised – Rogers is not shy about sharing additional ones (Read other IC article on Rogers). For example, just six months ago Rogers said the Dow Jones could collapse to 5,000 (currently around 10,472) or skyrocket to 30,000, but “of course it would be in worthless money.” Oddly, the printing presses that Rogers keeps talking about have actually produced deflation (-0.2%) in the most recently reported numbers, not the same 79,600,000,000% inflation from Zimbabwe (Cato Institute), he expects.

I suppose Rogers will either point to a data conspiracy, or use the “just you wait” rebuttal. I eagerly await, with bated breath, the ultimate outcome.

Is U.S. Fed Alone?

If the U.S. Federal Reserve system is indeed about to disappear after over nine decades of operations, does that mean Rogers advocates shutting all of the other 166 global reserve banks listed by the Bank for International Settlement? Should the 3 ½ century old Swedish Riksbank (origin in 1668) and the Bank of England (1694) central banks also be terminated? Or does the U.S. Federal Reserve Bank have a monopoly on incompetence and/or corruption?

Sidoxia’s Report Card on Fed

I must admit, I believe we would likely be in a much better situation than we are today if the Federal Reserve board let Adam Smith’s “invisible hand” self adjust short-term interest rates. Rather, we drank from the spiked punch bowls filled with low interest rates for extended periods of time. The Federal Reserve gets too much attention/credit for the impact of its decisions. There is a much larger pool of global investors that are buying/selling Treasury securities daily, across a wide range of maturities along the yield curve. I think these market participants have a much larger impact on prices paid for new capital, relative to the central bank’s decision of cutting or raising the Federal funds rate a ¼ point.

Although I believe the Fed gets too much attention for its monetary policies, I think Bernanke and the Fed get too little credit for the global Armageddon they helped avoid. I agree with Warren Buffett that Bernanke acted “very promptly, very decisively, very big” in helping us avert a second depression while we were on the “brink of going into the abyss.”

Beyond the monetary policy of fractional rate setting, the Fed also has essential other functions:

- Supervise and regulate banking institutions.

- Maintain stability of the financial system and control systemic risk of financial markets.

- Act as a liaison with depository institutions, the U.S. government, and foreign institutions.

- Play a major role in operating the country’s payments system.

I will go out on a limb and say these functions play an important role, and the Fed has a good chance of being around for the 2012 London Olympic Games (despite Jimmy Rogers’ prediction).

Sidoxia’s Report Card on Rogers

As I have pointed out in the past, I do not necessarily disagree (directionally) with the main points of his arguments:

- Is inflation a risk? Yes.

- Will printing excessive money lower the value of our dollar? Yes.

- Is auditing the Federal Reserve Bank a bad idea? No.

My beef with Rogers is merely in the magnitude, bravado, and overconfidence with which he makes these outrageous forecasts. Furthermore, the U.S. actions do not happen in a vacuum. Although everything is not cheery at home, many other international rivals are in worse shape than we are.

From a media ratings and entertainment standpoint, Rogers does not disappoint. His amusing and outlandish predictions will keep the public coming back for more. Since according to Rogers, Bernanke will have no job at the Fed in a few years, I look forward to their joint appearance on CNBC. Perhaps they could discuss collaboration on a new book – Extinction: Lessons Learned from the Fed and Dodo Bird.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (VFH) at the time of publishing, but had no direct ownership in BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Fuss Making a Fuss About Bonds

Dan Fuss has been managing bond investments since 1958, longer than many of his competing managers have lived on this planet. At 75 years old, he is as sharp, if not sharper, than ever as he manages the flagship $18.7 billion Loomis Sayles Bond Fund (LSBRX). Over his 33-year tenure at Loomis, Sayles & Company (he started in 1976), he has virtually seen it all. After a challenging 2008, which saw his bond fund fall -22%, the bond markets have been kinder to him this year – Fuss’s fund performance registers in the top quartile on a 1-year, 5-year, and 10-year basis, according to Morningstar.com (through 12/3/09). With a track record like that, investors are listening. Unfortunately, based on his outlook, he now is making a loud fuss about the dreadful potential for bonds.

Rising Yields, Declining Prices

Fuss sees the bond market at the beginning stages of a rate-increase cycle. In his Barron’s interview earlier this year, Fuss made a forecast that the 10-Year Treasury Note yield will reach 6.25% in the next 4-5 years (the yield currently is at 3.38%). Not mincing words when describing the current dynamics of the federal and municipal bond markets, Fuss calls the fundamentals “absolutely awful.” Driving the lousy environment is a massive budget deficit that Fuss does not foresee declining below 4.5% of (GDP) Gross Domestic Product – approximately two times the historical average. Making matters worse, our massive debt loads will require an ever increasing supply of U.S. issuance, which is unsustainable in light of the aggressive domestic expansion plans in emerging markets. This issuance pace cannot be maintained because the emerging markets will eventually need to fund their development plans with excess reserves. Those foreign reserves are currently funding our deficits and Fuss believes our days of going to the foreign financing “well” are numbered.

Fuss also doesn’t see true economic expansion materializing from the 2007 peak for another four years due to lackluster employment trends and excess capacity in our economy. What does a bond guru do in a situation like this? Well, if you follow Fuss’ lead, then you need to shorten the duration of your bond portfolio and focus on individual bond selection. In July 2009, the average maturity of Fuss’ portfolio was 12.8 years (versus 13.8 years in the previous year) and he expects it to go lower as his thesis of higher future interest rates plays out. Under optimistic expectations of declining rates, Fuss would normally carry a portfolio with an average maturity of about 20 years. In Barron’s, he also discussed selling longer maturity, high-grade corporate bonds and buying shorter duration high-yield bonds because he expects spreads to narrow selectively in this area of the market.

Unwinding Carry Trade – Pricking the Bubble

How does Fuss envisage the bond bubble bursting? Quite simply, the carry trade ending. In trading stocks, the goal is to buy low and sell high. In executing a bond carry trade, you borrow at low rates (yields), and invest at high rates (yields). This playbook looks terrific on paper, especially when money is essentially free (short-term interest rates in the U.S. are near 0%). Unfortunately, just like a stock-based margin accounts, when investment prices start moving south, the vicious cycle of debt repayment (i.e., margin call) and cratering asset prices builds on itself. Most investors think they can escape before the unwind occurs, but Fuss intelligently underscores, “Markets have a ferocious tendency to get there before you think they should.” This can happen in a so-called “crowded trade” when there are, what Fuss points out, “so many people doing this.”

The Pro Predictor

Mr. Fuss spoke to an audience at Marquette University within three days of the market bottom (March 12, 2009), and he had these prescient remarks to make:

“I’ve never seen markets so cheap…stocks and bonds…not Treasury bonds.”

He goes on to rhetorically ask the audience:

“Is there good value in my personal opinion? You darn bethcha!”

Bill Gross, the “Bond King” of Newport Beach (read more) receives most of the media accolades in major bond circles for his thoughtful and witty commentary on the markets, but investors should start making a larger fuss about the 75 year-old I like to call the “Leader of Loomis!”

Adviser Perspectives Article on Dan Fuss and Interest Rates

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including fixed-income) and is short TLT. At time of publishing, SCM had no positions in LSBRX. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Friedman Looks to Flatten Problems in Flat World

Thomas Friedman, author of recent book Hot, Flat, and Crowded and New York Times columnist, combines a multi-discipline framework in analyzing some of the most complex issues facing our country, from both an economic and political perspective. Friedman’s distinctive lens he uses to assimilate the world, coupled with his exceptional ability of breaking down and articulating these thorny challenges into bite-sized stories and analogies, makes him a one-of-a-kind journalist. Whether it’s explaining the history of war through McDonald’s hamburgers, or using the Virgin Guadalupe to explain the rise of China, Friedman brings highbrow issues down to the eye-level of most Americans.

In his seminal book, The World is Flat, Friedman explains how technology has flattened the global economy to a point where U.S. workers are fighting to keep their domestic tax preparation and software engineering jobs, as new emerging middle classes from developing countries, like China and India, steal work.

The Flat World

In boiling down the recent financial crisis, Friedman used Iceland to explain the “flattening” of the globe:

“Fifteen British police departments lost all their money in Icelandic online savings accounts. Like who knew? I knew the world was flat – I didn’t know it was that flat…that Iceland would become a hedge fund with glaciers.”

The left-leaning journalist hasn’t been afraid to bounce over to the “right” when it comes to foreign affairs and certain fiscally conservative issues. For example, he initially full-heartedly supported George W. Bush’s invasion of Iraq. And on global trade, he has a stronger appreciation of the economic benefits of free trade as compared to traditionally Democratic protectionist views.

Calling All Better Citizens

In a recent Charlie Rose interview, Friedman’s patience with our country’s citizenry has worn thin – he believes government leaders cannot be relied on to solve our problems.

When it comes to the massive deficits and foreign affair issues, Friedman comes to the conclusion we need to cut expenses or raise taxes. By creating a $1 per gallon gasoline tax, Friedman sees a “win-win-win-win” solution. Not only could the country wean itself off foreign oil addiction from authoritarian governments and create scores of new jobs with E.T. (Energy Technologies), the tax could also raise money to reduce our fiscal deficit, and pay for expanded healthcare coverage.

It’s fairly clear to me that government can’t show the leadership in cutting expenses. Since cutting benefits for voters won’t get you re-elected, taxes most certainly will have to go up. Wishful thinking that a recovering economy will do the dirty, debt-cutting work is probably naïve. If forced to pick a poison, the gas tax is Friedman’s choice. I’m not so sure the energy lobby would feel the same?

Political gridlock has always been an obstacle for getting things done in Washington. Technology, scientific polling, 24/7 news cycles, and deep-pocketed lobbyists are only making it tougher for our country to deal with our difficult challenges. Regardless of whether Friedman’s gasoline tax is the silver bullet, I welcome the clear, passionate voice from somebody that understands the challenges of living in a flat world.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) owns certain exchange traded funds (BKF, FXI) and has a short position in MCD at the time this article was originally posted. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Meredith Whitney’s Cloudy Crystal Ball

Meredith Whitney, prominent banking analyst at her self-named advisory group, should have worn a bib to protect her from the adoring drool supplied by Maria Bartiromo in a recent CNBC interview. Ms. Whitney has quickly become a banking rock star during this “Great Recession” period. She was right at a critical juncture, and as a result she was thrust into the limelight. Much like Abby Joseph Cohen, the perma-bull Goldman Sachs strategist who gained notoriety in the late 1990s, Whitney (the perma-banking bear) will continue having difficulty living up to the lofty expectations demanded of her.

Despite the accolades, Whitney’s crystal ball has gotten cloudy in 2009. I suppose accuracy is not very important, judging by her bottom-half 2007 ranking (year of her major Citigroup call) in recommendation performance and 48%-ile ranking in the first half of 2008. Analysts, much like reporters, can avoid looking dumb by reporting the news du jour and by following the herd. Whitney has followed this formula with her continuous bearishness on the financial sector, excluding a brief but late upgrade of Goldman Sachs in July. Not only was her analysis tardy (Goldman’s stock tripled from the 2009 bottom), but her call has also underperformed the S&P 500 index since the upgrade.

Incoherent Inconsistencies

Like a bobbing and weaving wrestler (her husband John Layfield is a retired staged professional wrestler from the WWE), Whitney tries to concoct a completely mind-boggling narrative to explain her forecasts this year in the CNBC interview with Maria Bartiromo:

11/18/09 (XLF Price $14.60): “For the year, I have been at least ‘cover your shorts, go long.’ I haven’t been this bearish in a year.” (See Maria Bartiromo Interview)

Hmm, really? Are you kidding me? Wait a second…is this the same “go long” Meredith Whitney that expressed the following?

3/17/09: (XLF: 8.55 then, 14.60 now +71% ex-dividends): “These big banks are sitting on loans that were underwritten with bad math, and the stocks are going to go down…these stocks are uninvestable.”

(Fast forward to minute 8:20 for quote above)

2/4/09 (XLF: 8.97 then, 14.60 now +63% ex-dividends): “Investors should not even consider owning banks on an equity basis” (Click here and fast forward to minute 8:10 for quote).

The schizophrenic accounting of her postures are all the more confusing given her stance that the sector was “fairly valued” in October, according to the CNBC Bartiromo interview.

Don’t get me wrong, she made an incredible bearish call on Citigroup in the fall of 2007 and was expecting blood in the streets until a massive rebound in 2009 surprised her. Investors need to be wary of prognosticators that get thrust into the limelight (see Peter Schiff article) for a single prediction. The law of large numbers virtually guarantees a new breed of extreme forecasters will be rotated into the spotlight any time there is a major shift in the market direction. I choose to follow the footsteps of Warren Buffett and stay away from the game of market timing and market forecasts. I believe James Grant from the Interest Rate Observer states it best:

“The very best investors don’t even try to forecast the future. Rather, they seize such opportunities as the present affords them.”

Meredith Whitney may be a bright banking analyst and perhaps she’ll ultimately be proven right regarding the downward banking stock price trajectories, but like all bold forecasters she must live by the crystal ball, and die by the crystal ball.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and its clients own certain exchange traded funds (including VFH), but currently have no direct positions in C, GS, or XLF. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Standing on the Shoulders of a Growth Giant: Phil Fisher

It was English physicist, astronomer, philosopher, and mathematician Sir Isaac Newton who in 1675 stated, “If I have seen further it is by standing on the shoulders of giants.” Investors too can stand on the shoulders of market giants by studying the timeless financial knowledge from current and past market legends. The press, all too often, focuses on the hot managers of our time while forgetting or kicking to the curb those managers whom are temporarily out of favor. Famous and enduring value managers typically have gained the press spotlight, rightfully so in the case of current greats like Warren Buffett or past talents like Benjamin Graham, because they managed to prosper through numerous economic cycles. However, when it comes to growth legends like Phil Fisher, author of the must-read classic Common Stocks and Uncommon Profits, many people I bump into have never heard of him. Hopefully that will change over time.

The Past

Born on September 8, 1907, Mr. Fisher lived until the ripe age of 96 when he passed on March 4, 2004. Fisher was no dummy – he enrolled in college at age 15 and started graduate school at Stanford a few years later, before he dropped out and started his own investment firm in 1931. His son, Ken, currently heads his own investment firm, Fisher Investments, writes for Forbes magazine, and has authored multiple investment books. Unlike his dad, Ken has more of a natural bent towards value stocks.

Buy-And-Hold

Phil Fisher’s iconic book, Common Stocks and Uncommon Profits, was published in 1958. Mr. Fisher believed in many things and perhaps would have been thrown under the bus today for his long-term convictions in “buy-and-hold.” Or as Mr. Fisher put it, “If the job has been correctly done when a common stock is purchased, the time to sell it is – almost never.” Not every investment idea made the cut, however he is known to have bought Motorola (MOT) stock in 1955 and held it until his death in 2004 for a massive gain. Generally, he gave initial stock purchases a three-year leash before considering a change to his investment position. If the conviction to purchase a stock for such duration is not present, then the investment opportunity should be ignored.

Fisher’s concentration on growth stocks also shaped his view on dividends. Dividends were not important to Fisher – he was more focused on how the company is investing retained earnings to achieve its earnings growth. Like Fisher, Peter Lynch is another growth hero of mine that also felt there is too much focus on the Price/Earnings (PE) ratio rather than the long-term earnings potential.

“Scuttlebutt”

Another classic trademark of Fisher’s investing style was his commitment to fundamental research. He was focused on accumulating data covering a broad range of areas including, customers, suppliers, and competitors. Fisher also emphasized factors like market share, return on invested capital, margins, and the research & development budget. What Mr. Fisher called his varied approach to gathering diverse sets of information was “scuttlebutt.”

Buying & Selling Points

Although Fisher believed firmly in buy and hold, he was not scared to sell when the firm no longer met the original buying criteria or his original assessment for purchased was deemed incorrect.

When buying, Fisher preferred to buy stocks in downturns or temporary problems – contrary to your typical momentum growth manager today (read article on momentum). Fisher has this to say on the topic: “This matter of training oneself to not go with the crowd but to be able to zig when the crowd zags, in my opinion, is one of the most important fundamentals of the investment success.”

Learning from Mistakes

Like all great investors I have studied, Phil Fisher also believed in learning from your mistakes:

“I have always believed that the chief difference between a fool and a wise man is that the wise man learns from his mistakes, while the fool never does.”

He expanded on the topic by saying the following:

“Making mistakes is inherent cost of investing just like bad loans are for the finest lending institutions. Don’t blindly accept dominant opinion and don’t be contrary for the sake of being contrary.”

I could only dream of having a fraction of Mr. Fisher’s career success – he retired in 1999 at the age of 91 (not bad timing). As I continue on my investment journey with my investment firm (Sidoxia Capital Management, LLC), I will continue to study the legendary giants of investing (past and present) to sharpen my investment skills.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) or its clients owns certain exchange traded funds, but currently has no direct position in MOT or BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Ross Warns of Commercial Shoe Drop

The next shoe to drop in commercial real estate has been highly telegraphed for some time now. Wilbur Ross, restructuring specialist and founder of WL Ross & Co, has a long track record of success and he weighs in with his views regarding the impending crash in commercial real estate through several recent interviews.

What exactly is Mr. Ross worried about? He sees a correlation of what happened in the residential mortgage markets to what we are now beginning to see in the commercial real estate markets:

Click Hear to See CNBC Interview with Wilbur Ross

“I have felt for quite some time that the same reckless lending that characterized the subprime mortgage business in residential was also characterizing what had gone on in commercial real estate in the mid-2000s. You had properties being bought at a 3% cash-on-cash yield. You had properties being financed at on such an aggressive basis that the lenders had to give them an advance – several years worth of interest – because there wasn’t enough cash coming from the properties even to pay the interest. And the theory was that rent rolls would go up, occupancy would go up, and eventually the property would grow its way into paying interest. Well now that clock is ticking – rents haven’t gone up, they’ve gone down; occupancy hasn’t gone up, it has gone down; and capitalization rates that people require from properties have gone up. So everything is going in the wrong direction, and I think we are going to see quite a lot of tragedies in that sector. “

Although Mr. Ross unequivocally sees a “huge crash in commercial real estate,” he puts his pessimistic views on impending destruction into perspective (read more about pessimism). The size of the commercial real estate market is quite a bit smaller than residential:

“The total of commercial mortgages is only about $3.5 trillion versus $11 trillion for residential mortgages.”

The commercial crash is already happening and forecasts for commercial property are expected to drop to the lowest levels in nearly two decades, according to according to property research firm Real Capital Analytics Inc. The sign of the times is evident by the recent Chapter 11 bankruptcy filing by Capmark Financial Group Inc., a company that originated about $60 billion in commercial real estate loans in 2006 and 2007 (Bloomberg). Anecdotally, at a professional event I just attended in southern California, I bumped into a real estate broker who informed me on the state of the market. The property across the street from the event location had a 50% vacancy rate and a glut of hedge funds were bidding on the building for 50% of its replacement value…ouch!

Reis Inc., a property research firm also notes:

“U.S. office vacancies hit a five-year high of almost 17 percent in the third quarter, while shopping center vacancies climbed to their highest since 1992.”

And from a fiscal response and taxpayer liability standpoint Ross is less worried because he thinks Washington, for the most part, will be watching the train wreck from the sidelines, with a bag of popcorn in hand:

“I don’t think the federal government’s going to do much to help the commercial building side because individual homeowners vote but buildings don’t vote.”

As Wilbur Ross has definitively communicated, he’s confident the commercial real estate mortgage market will cause the next surprising shoe to drop. Fortunately though, he feels the crash will be manageable. With all these shoes dropping, maybe I can find a new pair of shoes to wear?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.