Posts filed under ‘Profiles’

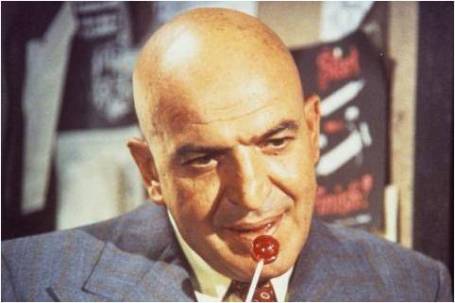

Simmons Wants to Kiss Life Insurance Worries Away

The Makeup Master

Gene Simmons, lead singer of rock group Kiss, was born as Chaim Witz in Israel 60 years ago. After 40 years of rocking & rolling, the band is still alive and well and touring this spring in the U.K. I am no stranger to Gene Simmons – as a matter of fact, Kiss was the first concert I attended as a kid at the San Francisco Cow Palace in the 1970s. Despite his early professional career success, all the limelight and money was not enough for Gene Simmons, so he put his entrepreneurial skills to the test and aggressively added a broad Kiss merchandising line (over 3,000 licensed/merchandise items), including everything from Kiss baby clothing and Kiss wine to Kiss dart boards and Kiss caskets. Yep, soup to nuts, from the cradle to the grave, and you can even purchase the merchandise with your Kiss Visa credit card!

All Aboard the Premium Financing Train

Now, Mr. Simmons has expanded his business interests to a broader set of financial services. Specifically, Simmons has co-founded a company (Cool Springs Life) that sells premium finance life insurance targeted at high net worth individuals. Simmons and CEO Samuel Watson stopped off at Bloomberg to spread the premium finance gospel:

Premium financing arrangements set up for life insurance are primarily designed for wealthy individuals with large, multi-million dollar estates. This explains a little about whom are the prime targets for life insurance premium financing, but why would wealthy individuals potentially want this financing tool?

Premium Financing Benefits:

- Pay for Estate Taxes: The primary advantage of life insurance for the wealthy is to provide liquidity to beneficiaries (in the form of a death benefit) at the death of the “insured” to fund future estate taxes. Estate tax legislation is still up in the air, but in my view will likely increase to a hefty 45% to 55% rate over the next year. The tax-free liquidity (see a knowledgeable CPA to confirm tax status) provided to the surviving beneficiary by the insurance policy can be especially important if the deceased person’s assets are tied up in illiquid assets like real estate. The government is impatient in regards to tax collections, so gaining immediate access to the death benefit proceeds is a more attractive alternative than forced sales of illiquid assets (potentially at fire-sale prices).

- Other People’s Money: Some people prefer to purchase things with other people’s money. The cost of the financing can be another benefit to the strategy. The interest rate owed on a premium financing deal may be lower than the return a client can earn on alternative investments. If the investment strategy proves successful, the borrower will earn a positive spread on the loan (borrow low, invest high).

- Lower Estate Value: By gifting life insurance assets to a trust (e.g., an Irrevocable Life Insurance Trust – ILIT), there are ways for a wealthy donor to lower his estate value by employing gifting strategies and other estate planning structures. These estate planning tactics often preserve asset values for designated beneficiaries, rather than forking over unnecessarily high taxes to the IRS (Internal Revenue Service). In some cases a knowledgeable attorney can structure premium payments in such a fashion that exemption allowances alleviate any potential gift tax consequence.

Normally nothing in life comes risk-free and the same principle applies to life insurance premium financing.

Premium Financing Risks:

- Interest Rate Risk: Many of these contracts are constructed based on a floating interest rate structure like LIBOR (London Interbank Offered Rate) , therefore if interest rates rise, the borrowers could expose themselves to higher interest payments.

- Credit Risk of Lender: Heaven forbid we go through another financial crisis of the same scale as 2008-2009, but insurance players such as AIG were large players in the premium financing market during this period and caused significant disruption to all relevant participants in the premium financing food chain. Failure of a lender could compromise the integrity of the life insurance and estate planning strategy.

- Risk of Deteriorating Borrower Assets: Depending on the circumstances and facts surrounding the premium financing structure, the lender may require different forms of borrower collateral (i.e., stocks, bonds, real estate, letter of credit, etc.) on top of the cash value/surrender value of the life insurance policy. If the borrower’s collateral value decreases below a certain threshold, the borrower may be forced to supply additional collateral.

For those people who want to rock and roll all night and party every day, perhaps life insurance premium financing is not for you. However, if you got a lot of dough and want to preserve the value of your estate, maybe you should give Gene Simmons a call. With a signed contract, he might even include a Kiss casket for your future funeral plans.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and a derivative security of an AIG insurance subsidiary, but at time of publishing had no direct positions in AIG. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Gekko & Greed – Friedman & Freedom

As the old saying goes, the more things change, the more things stay the same. The topic of greed, fat cat bankers, and political self-preservation is just as prevalent and relevant today as it was three decades ago, as evidenced by Milton Friedman’s past television interview (see video below). Milton Friedman and Gordon Gekko, the conniving financier from Oliver Stone’s movie Wall Street played by Michael Douglas, both may not philosophically agree on all aspects of life and politics but Friedman would likely buy into much of Gekko’s view on greed:

“Greed, for lack of a better word, is good. Greed is right, greed works. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit. Greed, in all of its forms; greed for life, for money, for love, knowledge has marked the upward surge of mankind. And greed, you mark my words, will not only save Teldar Paper, but that other malfunctioning corporation called the USA.”

Although Friedman held some extreme views on certain issues, fundamentally underlying all his principles was his convicted belief in freedom – political, individual, and economic freedom.

Some things never change – Milton Friedman talks about greed and capitalism with Phil Donahue.

Background

Milton Friedman (1912-2006), one of the greatest economists of the 20th Century was a Nobel Prize winner in economics, Professor at the University of Chicago (1946-1977), and an economic advisor to President Ronald Reagan. Friedman’s laissez-faire economic views coupled with his belief that government should be severely restricted, not only had a significant influence on the field of economics in the United States, but also globally. His body of work was expansive, but some major areas of contribution include his impact on Federal Reserve monetary policy; his written work on consumption and the natural rate of unemployment; and his rejection of the Phillips curve (the inverse relation of inflation relative to unemployment), to name a few.

Political & Economic Firestorm on the Horizon

Although Friedman is tightly associated with his Republican advisor work (including Ronald Reagan), he strictly considered himself a Libertarian at the core. As much as politically left leaning Americans are blaming the 2008-2009 financial crisis on Friedman-backed deregulation and a lack of government oversight, Conservatives and Libertarians are screaming bloody murder at the Democratic controlled Congress when it comes to all the bailouts, stimulus, and entitlement legislation. If Milton Friedman is looking down upon us now, my guess is that his vote is to flush all the proposed government spending down the toilet, let the failing financial institutions drown, and for Gordon Gekko’s sake, let the greedy, fat cat bankers thrive.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct position on any security referenced. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Inside the Brain of an Investing Genius

Those readers who have frequented my Investing Caffeine site are familiar with the numerous profiles on professional investors of both current and prior periods (See Profiles). Many of the individuals described have a tremendous track record of success, while others have a tremendous ability of making outrageous forecasts. I have covered both. Regardless, much can be learned from the successes and failures by mirroring the behavior of the greats – like modeling your golf swing after Tiger Woods (O.K., since Tiger is out of favor right now, let’s say Phil Mickelson). My investment swing borrows techniques and tips from many great investors, but Peter Lynch (ex-Fidelity fund manager), probably more than any icon, has had the most influence on my investing philosophy and career as any investor. His breadth of knowledge and versatility across styles has allowed him to compile a record that few, if any, could match – outside perhaps the great Warren Buffett.

Consider that Lynch’s Magellan fund averaged +29% per year from 1977 – 1990 (almost doubling the return of the S&P 500 index for that period). In 1977, the obscure Magellan Fund started with about $20 million, and by his retirement the fund grew to approximately $14 billion (700x’s larger). Cynics believed that Magellan was too big to adequately perform at $1, $2, $3, $5 and then $10 billion, but Lynch ultimately silenced the critics. Despite the fund’s gargantuan size, over the final five years of Lynch’s tenure, Magellan outperformed 99.5% of all other funds, according to Barron’s. How did Magellan investors fare in the period under Lynch’s watch? A $10,000 investment initiated when he took the helm would have grown to roughly $280,000 (+2,700%) by the day he retired. Not too shabby.

Background

Lynch graduated from Boston College in 1965 and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968. Like the previously mentioned Warren Buffett, Peter Lynch shared his knowledge with the investing masses through his writings, including his two seminal books One Up on Wall Street and Beating the Street. Subsequently, Lynch authored Learn to Earn, a book targeted at younger, novice investors. Regardless, the ideas and lessons from his writings, including contributing author to Worth magazine, are still transferrable to investors across a broad spectrum of skill levels, even today.

The Lessons of Lynch

Although Lynch has left me with enough financially rich content to write a full-blown textbook, I will limit the meat of this article to lessons and quotations coming directly from the horse’s mouth. Here is a selective list of gems Lynch has shared with investors over the years:

Buy within Your Comfort Zone: Lynch simply urges investors to “Buy what you know.” In similar fashion to Warren Buffett, who stuck to investing in stocks within his “circle of competence,” Lynch focused on investments he understood or on industries he felt he had an edge over others. Perhaps if investors would have heeded this advice, the leveraged, toxic derivative debacle occurring over previous years could have been avoided.

Do Your Homework: Building the conviction to ride through equity market volatility requires rigorous homework. Lynch adds, “A company does not tell you to buy it, there is always something to worry about. There are always respected investors that say you are wrong. You have to know the story better than they do, and have faith in what you know.”

Price Follows Earnings: Investing is often unnecessarily made complicated. Lynch fundamentally believes stock prices will follow the long-term trajectory of earnings growth. He makes the point that “People may bet on hourly wiggles of the market, but it’s the earnings that waggle the wiggle long term.” In a publicly attended group meeting, Michael Dell, CEO of Dell Inc. (DELL), asked Peter Lynch about the direction of Dell’s future stock price. Lynch’s answer: “If your earnings are higher in 5 years, your stock will be higher.” Maybe Dell’s price decline over the last five years can be attributed to its earnings decline over the same period? It’s no surprise that Hewlett-Packard’s dramatic stock price outperformance (relative to DELL) has something to do with the more than doubling of HP’s earnings over the same time frame.

Valuation & Price Declines: “People Concentrate too much on the P (Price), but the E (Earnings) really makes the difference.” In a nutshell, Lynch believes valuation metrics play an important role, but long-term earnings growth will have a larger impact on future stock price appreciation.

Two Key Stock Questions: 1) “Is the stock still attractively priced relative to earnings?” and 2) “What is happening in the company to make the earnings go up?” Improving fundamentals at an attractive price are key components to Lynch’s investing strategy.

Lynch on Buffett: Lynch was given an opportunity to write the foreword in Buffett’s biography, The Warren Buffett Way. Lynch did not believe in “pulling out flowers and watering the weeds,” or in other words, selling winners and buying losers. In highlighting this weed-flower concept, Lynch said this about Buffett: “He purchased over $1 billion of Coca-Cola in 1988 and 1989 after the stock had risen over fivefold the prior six years and over five-hundredfold the previous sixty years. He made four times his money in three years and plans to make a lot more the next five, ten, and twenty years with Coke.” Hammering home the idea that a few good stocks a decade can make an investment career, Lynch had this to say about Buffett: “Warren states that twelve investments decisions in his forty year career have made all the difference.”

You Don’t Need Perfect Batting Average: In order to significantly outperform the market, investors need not generate near perfect results. According to Lynch, “If you’re terrific in this business, you’re right six times out of 10 – I’ve had stocks go from $11 to 7 cents (American Intl Airways).” Here is one recipe Lynch shares with others on how to beat the market: “All you have to do really is find the best hundred stocks in the S&P 500 and find another few hundred outside the S&P 500 to beat the market.”

The Critical Element of Patience: With the explosion of information, expansion of the internet age, and the reduction of trading costs has come the itchy trading finger. This hasty investment principle runs contrary to Lynch’s core beliefs. Here’s what he had to say regarding the importance of a steady investment hand:

- “In my investing career, the best gains usually have come in the third or fourth year, not in the third or fourth week or the third or fourth month.”

- “Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

- “Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100% correlation between the success of a company and the success of its stock. It pays to be patient, and to own successful companies.”

- “The key to making money in stocks is not to get scared out of them.”

Bear Market Beliefs: “I’m always more depressed by an overpriced market in which many stocks are hitting new highs every day than by a beaten-down market in a recession,” says Lynch. The media responds in exactly the opposite manner – bear markets lead to an inundation of headlines driven by panic-based fear. Lynch shares a similar sentiment to Warren Buffett when it comes to the media holding a glass half full view in bear markets.

Market Worries: Is worrying about market concerns worth the stress? Not according to Lynch. His belief: “I’ve always said if you spend 13 minutes a year on economics, you’ve wasted 10 minutes.” Just this last March, Lynch used history to drive home his views: “We’ve had 11 recessions since World War II and we’ve had a perfect score — 11 recoveries. There are a lot of natural cushions in the economy now that weren’t there in the 1930s. They keep things from getting out of control. We have the Federal Deposit Insurance Corporation [which insures bank deposits]. We have social security. We have pensions. We have two-person, working families. We have unemployment payments. And we have a Federal Reserve with a brain.”

Thoughts on Cyclicals: Lynch divided his portfolio into several buckets, and cyclical stocks occupied one of the buckets. “Cyclicals are like blackjack: stay in the game too long and it’s bound to take all your profit,” Lynch emphasized.

Selling Discipline: The rationale behind Lynch’s selling discipline is straightforward – here are some of his thoughts on the subject:

- “When the fundamentals change, sell your mistakes.”

- “Write down why you own a stock and sell it if the reason isn’t true anymore.”

- “Sell a stock because the company’s fundamentals deteriorate, not because the sky is falling.”

Distilling the genius of an investing legend like Peter Lynch down to a single article is not only a grueling challenge, but it also cannot bring complete justice to the vast accomplishments of this incredible investment legend. Nonetheless, his record should be meticulously studied in hopes of adding jewels of investment knowledge to the repertoires of all investors. If delving into the head of this investing mastermind can provide access to even a fraction of his vast knowledge pool, then we can all benefit by adding a slice of this greatness to our investment portfolios.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in DELL, KO, HPQ or any other security mentioned. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

John Paulson and the “Gutsiest” Trade Ever

Although the pain and suffering of the 2008-09 financial crisis has been well documented and new books are continually coming out in droves, less covered are the winners who made a bonanza by predicting the collapse of the real estate and credit markets. Prizewinning Wall Street Journal reporter Gregory Zuckerman decided to record the fortunes made by hedge fund manager John Paulson in his book The Greatest Trade Ever (The Behind-the-Scenes story of How John Paulson Defied Wall Street and Made Financial History).

Paulson’s Cartoonish Cut

Zuckerman puts Paulson’s massive gains into perspective:

“Paulson’s winnings were so enormous they seemed unreal, even cartoonish. His firm, Paulson & Co., made $15 billion in 2007, a figure that topped the gross domestic products of Bolivia, Honduras, and Paraguay…Paulson’s personal cut was nearly $4 billion…more than the earnings of J.K. Rowling, Oprah Winfrey, and Tiger Woods put together.”

As impressive as those gains were, Paulson added another $5 billion into his firm’s coffers and $2 billion into his personal wallet over 2008 and early 2009.

There are many ways to skin a cat, and there are countless strategies used by the thousands of hedge fund managers looking to hit the jackpot like Paulson. John Paulson primarily made his multi-billion fortune thanks to his CDS positions (Credit Default Swaps), the same product that led to massive multi-billion bailouts and government support for various financial institutions.

Bigger Gamble than Perception

One surprising aspect I discovered from reading the book was the uncertainty surrounding Paulson’s negative real estate trade. Here’s how Zuckerman described the conviction level of John Paulson and Paolo Pelligrini (colleague) as it related to their CDS positions on subprime CDO (Collateralized Debt Obligation) debt:

“In truth, Paulson and Pellegrini still were unsure if their growing trade would ever pan out. They thought the CDOs and other risky mortgage debt would become worthless, Paulson says. ‘But we still didn’t know.’”

Often the trades that cause you to sweat the most tend to be the most profitable, and in this case, apparently the same principle held.

Disingenuous Dramatic License

Before Paulson made his billions, Zuckerman uses a little dramatic license in the book to characterize Paulson as a small fry manager, “Paulson now managed $1.5 billion, a figure that sounded like a lot to friends outside the business. But the firm was dwarfed by its many rivals.” Zuckerman goes on to call Paulson’s hedge fund “small potatoes.” I don’t have the industry statistics at my fingertips, but I’ll go out on a limb and make an educated guess that a $1.5 billion hedge fund has significantly more assets than the vast majority of hedge fund peers. Under the 2 and 20 model, I’m guessing the management fee alone of $30 million could cover Paulson’s food and shelter expenses. Before he struck the payload, the book also references the $100 million of his personal wealth he invested with the firm. I think John Paulson was doing just fine before he executed the “greatest trade.”

What Drove the Greatest Trade

Hind sight is always 20/20, but looking back, there was ample evidence of the real estate bubble forming. Fortunately for Paulson, he got the timing generally right too. Here are some of the factors leading to the great trade:

- CDO Leverage in Subprime: By the end of 2006, the subprime loan market was relatively large at around $1.2 trillion (representing around 10% of the overall mortgage market). But thanks to the introduction of CDOs, there were more than $5 trillion of risky investments created from all the risky subprime loans.

- Liars & Ninjas: “Liar Loans” loans based on stated income (using the honor system) and “ninja loans” (no income, no job, no assets) gained popularity and prevalence, which just led to more defaults and foreclosures in the mid-2000s.

- No Down Payments: What’s more, by 2005, 24% of all mortgages were completed with no down payment, up from approximately 3% in 2001. The percentage of first-time home buyers with no down payment was even higher at 43%.

Overall, I give kudos to Gregory Zuckerman, who spent more than 50 hours with John Paulson, for bringing something so abstract and homogenous (a skeptical real estate trade) to life. Zuckerman does a superb job of adding spice to the Paulson story by introducing other narratives and characters, even if the story lines don’t blend together perfectly. After reading The Greatest Trade Ever I came away with a new found respect for Paulson’s multi-billion dollar gutsy trade. Now, Paulson has reloaded his gun and is targeting the U.S. dollar. If Paulson’s short dollar and long gold position works out, I’ll keep an eye out for his next book…The Greatest Trad-er Ever.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including VNQ), but at time of publishing had no direct positions in companies mentioned. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Mauboussin Takes the Outside View

Michael Mauboussin, Legg Mason Chief Investment Strategist and author of Think Twice, is a behavioral finance guru and in his recent book he explores the importance of seriously considering the “outside view” when making important decisions.

What is Behavioral Finance?

Behavioral finance is a branch of economics that delves into the non-numeric forces impacting a diverse set of economic and investment decisions. Often these internal and external influences can lead to sub-optimal decision making. The study of this psychology-based discipline is designed to mitigate economic errors, and if possible, improve investment decision making.

Two instrumental contributors to the field of behavioral finance are economists Daniel Kahneman and Amos Tversky. In one area of their research they demonstrated how emotional fears of loss can have a crippling effect in the decision making process. In their studies, Kahneman and Tversky showed the pain of loss is more than twice as painful as the pleasure from gain. How did they illustrate this phenomenon? Through various hypothetical gambling scenarios, they highlighted how irrational decisions are made. For example, Kahneman and Tversky conducted an experiment in which participating individuals were given the choice of starting with an initial $600 nest egg that grows by $200, or beginning with $1,000 and losing $200. Both scenarios created the exact same end point ($800), but the participants overwhelmingly selected the first option (starting with lower $600 and achieving a gain) because starting with a higher value and subsequently losing money was not as comfortable.

The impression of behavioral finance is burned into our history in the form of cyclical boom, busts, and bubbles. Most individuals are aware of the technology bubble of the late 1990s, or the more recent real estate/credit craze, however investors tend to have short memories are unaware of previous behavioral bubbles. Take the 17th century tulip mania, which witnessed Dutch citizens selling land, homes, and other assets in order to procure tulip bulbs for more than $70,000 (on an inflation-adjusted basis), according to Stock-Market-Crash.net. We can attempt to delay bubbles, but they will forever be a part of our economic fabric.

The Outside View

Click here for Michael Mauboussin interview with Morningstar

Click here for Michael Mauboussin interview with Morningstar

In his book Think Twice Mauboussin takes tenets from behavioral finance and applies it to individual’s decision making process. Specifically, he encourages people to consider the “outside view” when making important decisions.

Mauboussin makes the case that our decisions are unique, but share aspects of other problems. Often individuals get trapped in their heads and internalize their own problems as part of the decision making process. Since decisions are usually made from our personal research and experiences, Mauboussin argues the end judgment is usually biased too optimistically. Mauboussin encourages decision makers to access a larger outside reference class of diverse opinions and historical situations. Often, situations and problems encountered by an individual have happened many times before and there is a “database of humanity” that can be tapped for improved decision making purposes. By taking the “outside view,” he believes individual judgments will be tempered and a more realistic perspective can be achieved.

In his interview with Morningstar, Mauboussin provides a few historical examples in making his point. He uses a conversation with a Wall Street analyst regarding Amazon (AMZN) to illustrate. This particular analyst said he was forecasting Amazon’s revenue growth to average 25% annually for the next ten years. Mauboussin chose to penetrate the “database of humanity” and ask the analyst how many companies in history have been able to sustainably grow at these growth rates? The answer… zero or only one company in history has been able to achieve a level of growth for that long, meaning the analyst’s projection is likely too optimistic.

Mean reversion is another concept Mauboussin addresses in his book. I consider mean reversion to be one of the most powerful principles in finance. This is the idea that upward or downward moving trends tend to revert back to an average or normal level over time. In describing this occurrence he directs attention to the currently, overly pessimistic sentiment in the equity markets (see also Pessimism Porn article). At end of 1999 people were wildly optimistic about the previous decade due to the significantly above trend-line returns earned. Mean reversion kicked in and the subsequent ten years generated significantly below-average returns. Fast forward to today and now the pendulum has swung to the other end. Investors are presently overly pessimistic regarding equity market prospects after experiencing a decade of below trend-line returns (simply look at the massive divergence in flows into bonds over stocks). Mauboussin, and I concur, come to the conclusion that equity markets are likely positioned to perform much better over the next decade relative to the last, thanks in large part to mean reversion.

Behavioral finance acknowledges one sleek, unique formula cannot create a solution for every problem. Investing includes a range of social, cognitive and emotional factors that can contribute to suboptimal decisions. Taking an “outside view” and becoming more aware of these psychological pitfalls may mitigate errors and improve decisions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AMZN, but at time of publishing had no direct positions in LM, or MORN. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Invisible Giant

Bruce Berkowitz has not exactly been a household name (he apparently is not even Wikipedia-worthy). With his boyish looks, nasally voice, and slicked-back hair, one might mistake Berkowitz for a graduate student. However, his results are more than academic, which explains why this invisible giant was recently named the equity fund manager of the decade by Morningstar. It’s difficult to argue with long-term results, especially in the roller coaster market like we’ve experienced over the last ten years. The Fairholme Fund (FAIRX) fund earned a 13% annualized return over the ten-year period ending in 2009, beating the S&P 500 index by an impressive 14%.

Click here to view Bloomberg invterview with Bruce Berkowitz

Click here to view Bloomberg invterview with Bruce Berkowitz

How He Did It

Berkowitz states the stellar performance was achieved by

“Ignoring the crowd and going towards stressed areas that many people are running from…We make our judgments based on the cash that securities generate.”

Fairholme is effectively a “go anywhere” fund that adheres tightly to the value-based philosophy. Berkowitz’s portfolio is centered on equity securities, but his team has also shown willingness to go up and down the capital structure, if they find value elsewhere.

The Fund and its History

Berkowitz started the fund in 1999 as an extension of his separate account business, which was created in his previous life at Smith Barney and Lehman Brothers. The Fairholme fund tends to concentrate around 15 to 25 securities on average, with some holdings accounting for more than 10% of the portfolio. An example of Fairholmes concentration is evidenced by its favorably timed trade in the energy sector, which resulted in a 35% weighting in the fund. Fortunately Berkowitz redeployed that winning position – before energy prices cratered in 2008 – into unloved areas like healthcare and defense stocks.

Berkowitz models his investment style after Warren Buffett, focused on good businesses with prolific cash flows. Like many value investors, Berkowitz fishes for contrarian based ideas residing in pockets of the market that are out of favor. He also likes to have a significant weighting in “special situations,” which are limited to about 25% of the portfolio. In order to take advantage opportunities, Berkowitz is not shy or bashful about carrying around a good chunk of cash in his pocket. He likes to keep about 15% on average to scoop up out of favor opportunities.

The Future of Fairholme

I commend Berkowitz for his admirable record, but I caution investors to not go hog wild over outperforming funds. He has crushed the market over an extremely challenging investment period, but investors need to remember that “mean reversion,” the tendency for a trend to move towards averages, applies to investing styles too. Concentrated, go-anywhere, large cap value, market timing funds that outperform for ten years at a time may underperform or outperform less dramatically over the next ten years. Just ask Bill Miller (see also Bill Miller Revenge of the Dunce article), concentrated value manager at Legg Mason, about mean reversion. Miller beat the market for 15 consecutive years before recently ending up in the bottom 10-year decile (1-star Morningstar rated) after some bad concentrated bets and poor investment timing. Another challenge for Fairholme is size (currently around $10.5 billion in assets under management). Having managed a multi-billion fund myself (see also my book), I can attest to the complexities Berkowitz faces in managing a much larger fund now.

Regardless, Berkowitz’s performance should not be ignored given his sound philosophy and achievement over an unprecedented period. Already, just a few weeks into 2010, Fairholme is ranked #1 in its fund category by Morningstar.

This is one invisible man you should not let disappear off your radar.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in FAIRX, LM, BRKA/B or MORN. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

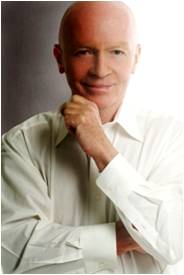

Mobius: The Kojak of Emerging Markets

Lieutenant Theo Kojak, played by Telly Savalas in the 1970s television series Kojak, is a bald, hard-nosed New York City police detective who hunts down criminals. Mark Mobius, executive chairman of Templeton Asset Management, is a bald, hard-nosed investment manager devoted to hunting down winning stocks in emerging markets. Expanding on his numerous authored books, Mobius recently decided to write his own blog expanding on his global travels and reporting back his investment findings.

Recently Mobius fielded some questions from his readers, covering emerging markets from China and Brazil to “Frontier” markets like Sri Lanka and Serbia (see also Trade of the Century). Here are a few of the exchanges:

In which countries, regions or sectors are you finding the best values?

“We are finding opportunities in almost all emerging markets. Our ground-up research process locates opportunities in countries where the political or economic outlooks may not, at first appearance, look good. Nevertheless, we generally favor China and Brazil, but also have large positions in Russia, India and Turkey. In terms of sectors, we believe commodity stocks look good because we expect the global demand for commodities to continue its long-term growth. We also favor consumer stocks. With rising per-capita income and strong demand for consumer goods and services in many emerging markets, we believe the earnings growth outlook for these stocks is positive.”

It appears that the financial market has changed, in that one needs to be more skeptical and cautious when investing than in the past. Alan Greenspan said that last year’s crash was unforeseen, and given the uncertainty of the markets and global financing, the big crash could happen again. What say you?

“Actually some analysts did see the crash coming in view of Greenspan’s loose monetary policies. The nature of markets is that there will always be booms and crashes since people tend to get either too optimistic or too pessimistic. The good news is that on average, bull markets have lasted longer than bear markets, and bull markets have gone up in percentage terms more than bear markets have gone down. In terms of other risks, I believe there is still a danger of the unregulated derivatives market.

Do you think Sri Lanka will turn around?

“We believe that Sri Lanka is fundamentally a rich country and that the challenges revolve around how the true potential in tourism, agriculture and industry can be effectively met. We have been investing in Sri Lanka for many years. For us, the biggest challenge in the public market is liquidity. Trading turnover is rather low although we have found some investment bargains.”

Belgrade’s Stock Exchange suffered heavy losses in the 2008 meltdown, with the Belex index falling sharply. I am from Serbia, and so I was thrilled to find out that Franklin Templeton is investing in Serbia.

“Yes, we are interested in the Serbian market and we are now looking at opportunities there. Of course, when markets are down, it is the best time to start looking and Belgrade is definitely on our list. We have already invested in a company in Serbia and look forward to looking more closely at that market.”

While Telly Savalas discovered fame 30 years ago from his Kojak role, Mr. Mobius has spent more than 30 years in the emerging markets chasing successful investments. Franklin Templeton Investors should remain happy if Mobius’ picks continue to shine, like his bald, polished crown.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (EEM, FXI, BKF). No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Soros on the Super Bubble

Like a bubble formed from chewing gum, the gradual expansion of the spherical formation occurs much slower than the immediacy of the pop. A minority of investors identified the treacherous, credit-induced bubble of 2008 before it burst, however not included in that group are financial regulators. Now we’re left with the task of cleaning up the sticky mess on our faces and establishing measures to prevent future blow-ups.

George Soros, Chairman of Soros Fund Management and author of The Crash of 2008, has been around the financial market block a few times, so I think it pays to heed the regulatory reform recommendations as it relates to the “Super bubble” of 2008. As you probably know, financial bubbles are not a new concept. Beyond the oft-mentioned technology and real estate bubbles of this decade, bubbles such as the “Tulip-mania” of the 1630s serve as a gentle reminder of the everlasting existence of irrational economic behavior. If the Dutch were willing to pay $76,000 for a tulip bulb (inflation-adjusted) almost 400 years ago, then virtually any mania is possible.

Bubbles and Efficiency

Efficient markets are somewhat like UFOs. Some people believe in them, but many do not. In order to believe in the existence of bubbles, one needs to question the validity of the pure form of efficient markets (read more about market efficiency). Here’s how Soros feels about market efficiency:

“I contend that financial markets always present a distorted picture of reality.”

I believe we will be in a hyper-sensitive period of bubble witch-hunting for a while, as the fresh wounds of 2008-09 heal themselves. If you get in early enough, bubbles can be profitable. Unfortunately, like a distracted teen fixated on the sunbathers at a nude beach, the excitement can lead to a painful burn if preventative sunscreen measures are not taken. Most bubble participants are too exhilarated to carry out a thoughtful exit strategy – the news can just be too tempting to jump off the top.

In his analysis of market regulation, Soros lays some of the “Great Recession” blame on the Federal Reserve and Alan Greenspan (Chairman of Fed):

“Instead of a tendency towards equilibrium, financial markets have a tendency to develop bubbles. Bubbles are not irrational: it pays to join the crowd, at least for a while. So regulators cannot count on the market to correct its excesses…The crash of 2008 was caused by the collapse of a super-bubble that has been growing since 1980. This was composed of smaller bubbles. Each time a financial crisis occurred the authorities intervened, took care of the failing institutions, and applied monetary and fiscal stimulus, inflating the super-bubble even further.”

Soros’ Recipe for Reform

What is Soros’ solution for the “Super bubble?” Here are some recommendations from his Op-Ed in the Financial Times:

- Regulator Accountability: First of all, financial authorities need to accept responsibility for preventing excesses – excuses are not an acceptable response.

- Control Credit: Rather than having static monetary targets such as margin requirements, capital reserve requirements, and loan-to-value ratios, Soros argues these metrics can be adjusted in accordance with the swinging moods of economic cycles. He punctuates the point by saying, “To control asset bubbles it is not enough to control the money supply; you must also control credit.”

- Limit Overheating in Specific Sectors: Had regulators limited lending during the real estate explosion or had the SEC limited technology IPOs in the late 1990s, perhaps our country would be in better financial health today.

- Manage Derivatives and Systemic Risk: Basically what Soros is saying here is that many market participants can become overwhelmed by certain exposures or exotic instruments, therefore it behooves regulators to proactively step in and regulate.

- Manage Too Big to Fail (read related Graham IC article): According to Soros a big reason we got into this trouble relates to the irresponsible proprietary trading departments at some of the larger banks. Responsibly separating these departments and limiting the amount of risk undertaken is an important element to the safety of our financial system.

- Reformulate Asset Holding Rules: Underestimating the risk profile of a certain security can lead to concentration issues, which can potentially generate systemic risk. Soros highlights the European Basel Accord rules as an area that can use some improvement.

Soros admits most, if not all, the measures he proposes will choke off the profitability of banks. For this reason, regulators must be very careful with the implementation and timing of these financial strategies. If employed too aggressively, the economy could find itself in a deflationary spiral. Move too slowly, and the loose monetary measures instituted by the Fed could fan the flames of inflation.

Bubbles will never go away. Eventually, the recent panic-induced fear will fade away and the entrepreneurial seeds of greed will germinate into new budding flowers of optimism. As investors nervously chomp away at their chewing gum, I will patiently await for the next financial bubble to form. I echo George Soros’s hope that regulators prick future “mini-bubbles” before they become “super-bubbles.”

Read Full George Soros Op-Ed on The Financial Times 10/25/09

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in an security referenced. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.