Posts filed under ‘Profiles’

Ellis on Battling Demons and Mr. Market

A lot of ground was covered in the first cut of my review on Charles Ellis’s book, Winning the Loser’s Game (“WTLG”). His book covers a broad spectrum of issues and reasons that help explain why so many amateurs and professional investors dramatically underperform broad market indexes and other forms of passive investing (such as index funds).

A major component of investor underperformance is tied to the internal or emotional aspects to investing. As I have written in the past, successful investing requires as much emotional art as it does mathematical science. Investing solely based on numbers is like a tennis player only able to compete with a backhand – you may hit a few good shots, but will end up losing in the long-run to the well-rounded players.

Ellis recognizes these core internal shortcomings and makes insightful observations throughout his book on how emotions can lead investors to lose. As George J.W. Goodman noted, “If you don’t know who you are, the stock market is an expensive place to find out.” Hopefully by examining more of Ellis’s investment nuggets, we can all become better investors, so let’s take a deeper dive.

Mischievous Mr. Market

Why is winning in the financial markets so difficult? Ellis devotes a considerable amount of time in WTLG talking about the crafty guy called “Mr. Market.” Here’s how Ellis describes the unique individual:

“Mr. Market is a mischievous but captivating fellow who persistently teases investors with gimmicks and tricks such as surprising earnings reports, startling dividend announcements, sudden surges of inflation, inspiring presidential announcements, grim reports of commodities prices, announcements of amazing new technologies, ugly bankruptcies, and even threats of war.”

Investors can easily get distracted by Mr. Market, and Ellis makes the point of why we are simple targets:

“Our internal demons and enemies are pride, fear, greed, exuberance, and anxiety. These are the buttons that Mr. Market most likes to push. If you have them, that rascal will find them. No wonder we are such easy prey for Mr. Market with all his attention-getting tricks.”

The market also has a way of lulling investors into complacency. Somehow, bull markets manage to make geniuses not only out of professionals and amateur investors, but also cab drivers and hair-dressers. Here is Ellis’s observation of how we tend to look at ourselves:

“We also think we are ‘above average’ as car drivers, as dancers, at telling jokes, at evaluating other people, as friends, as parents, and as investors. On average, we also believe our children are above average.”

This overconfidence and elevated self-assessment generally leads to excessive risk-taking and eventually hits arrogant investors over the head like a sledgehammer. Michael Mauboussin, Legg Mason Chief Investment Strategist and author of Think Twice, is a current thought leader in the field of behavioral finance that tackles many of these behavioral finance issues (read my earlier piece).

The Collateral Damage

As mentioned by Ellis in the previous WTLG article I wrote, “Eighty-five percent of investment managers have and will continue over the long term to underperform the overall market.” When emotions take over our actions, Mr. Market has a way of making investors make the worst decisions at the worst times. Ellis describes this phenomenon in more detail:

“The great risk to individual investors is not that the market can plummet, but that the investor may be frightened into liquidating his or her investments at or near the bottom and miss all the recovery, making the loss permanent. This happens to all too many investors in every terrible market drop.”

With the market about doubling from the early 2009 equity market lows, this devastating problem has become more evident. With volatility rearing its ugly head throughout 2008 and early 2009, investors bailed into low-yielding cash and Treasuries at the nastiest time. Now the stock market has catapulted upwards and those same investors now face significant interest rate risk and still are experiencing meager yields.

The Winning Formula

Ellis acknowledges the difficulty of winning at the investing game, but experience has shown him ways to combat the emotional demons. Number one…know thyself.

“’Know thyself’ is the cardinal rule in investing. The hardest work in investing is not intellectual; it’s emotional.”

Knowing thyself is easier said than done, but experience and mistakes are tremendous aids in becoming a better investor – especially if you are an investor who spends time studying the missteps and learns from them.

From a practical portfolio construction standpoint, how can investors combat their pesky emotions? Probably the best idea is to follow Ellis’s sage advice, which is to “sell down to the sleeping point. Don’t go outside your zone of competence because outside that zone you may get emotional, and being emotional is never good for your investing.”

Finding good investment ideas is just half the battle – fending off the demons and Mr. Market can be just as, if not more, challenging. Fortunately, Mr. Ellis has been kind enough to share his insights, allowing investors of all types to take this valuable investment advice to help win at a losing game.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Winning the Loser’s Game

Besides hanging out with family and friends, and stuffing my face with endless amounts of food, the other benefit of the holidays is the quality time I’m afforded to dive into a few books. While sinking into the couch in my bloated state, I had the pleasure of reading an incredible, investment classic by Charles Ellis, Winning the Loser’s Game – “WTLG” (click here to view other remarkable book I read [non-investment related]). To put my enthusiasm in perspective, WTLG has even achieved the elite and privileged distinction of making the distinguished “Recommended Reading” list of Investing Caffeine (located along the right-side of the page). Wow…now I know you must be really impressed.

The Man, The Myth, the Ellis

For those not familiar with Charley Ellis, he has a long, storied investment career. Not only has he authored 12 books, including compilations on Goldman Sachs (GS) and Capital Group, but his professional career dates back prior to 1972, when he founded institutional consulting firm Greenwich Associates. Besides earning a college degree from Yale University, and an MBA from Harvard Business School, he also garnered a PhD from New York University. Ellis also is a director at the Vanguard Group and served as Investment Committee chair at Yale University along investment great David Swensen (read also Super Swensen) from 1992 – 2008.

For those not familiar with Charley Ellis, he has a long, storied investment career. Not only has he authored 12 books, including compilations on Goldman Sachs (GS) and Capital Group, but his professional career dates back prior to 1972, when he founded institutional consulting firm Greenwich Associates. Besides earning a college degree from Yale University, and an MBA from Harvard Business School, he also garnered a PhD from New York University. Ellis also is a director at the Vanguard Group and served as Investment Committee chair at Yale University along investment great David Swensen (read also Super Swensen) from 1992 – 2008.

With this tremendous investment experience come tremendous insights. The original book, which was published in 1998, is already worth its weight in gold (even at $1,384 per ounce), but the fifth edition of WTLG is even more valuable because it has been updated with Ellis’s perspectives on the 2008-2009 financial crisis.

Because the breadth of topics covered is so vast and indispensable, I will break the WTLG review into a few parts for digestibility. I will start off with the these hand-picked nuggets:

Defining the “Loser’s Game”

Here is how Charles Ellis describes the investment “loser’s game”:

“For professional investors, “the ‘money game’ we call investment management evolved in recent decades from a winner’s game to a loser’s game because a basic change has occurred in the investment environment: The market came to be dominated in the 1970s and 1980s by the very institutions that were striving to win by outperforming the market. No longer is the active investment manager competing with cautious custodians or amateurs who are out of touch with the market. Now he or she competes with other hardworking investment experts in a loser’s game where the secret to winning is to lose less than others lose.”

Underperformance by Active Managers

Readers that have followed Investing Caffeine for a while understand how I feel about passive (low-cost do-nothing strategy) and active management (portfolio managers constantly buying and selling) – read Darts, Monkeys & Pros. Ellis’s views are not a whole lot different than mine – here is what he has to say while not holding back any punches:

“The basic assumption that most institutional investors can outperform the market is false. The institutions are the market. They cannot, as a group, outperform themselves. In fact, given the cost of active management – fees, commissions, market impact of big transactions, and so forth-85 percent of investment managers have and will continue over the long term to underperform the overall market.”

He goes on to say individuals do even worse, especially those that day trade, which he calls a “sucker’s game.”

Exceptions to the Rule

Ellis’s bias towards passive management is clear because “over the long term 85 percent of active managers fall short of the market. And it’s nearly impossible to figure out ahead of time which managers will make it into the top 15 percent.” He does, however, acknowledge there is a minority of professionals that can beat the market by making fewer mistakes or taking advantage of others’ mistakes. Ellis advocates a slow approach to investing, which bases “decisions on research with a long-term focus that will catch other investors obsessing about the short term and cavitating – producing bubbles.” This is the strategy and approach I aim to achieve.

Gaining an Unfair Competitive Advantage

According to Ellis, there are four ways to gain an unfair competitive advantage in the investment world:

1) Physical Approach: Beat others by carrying heavier brief cases and working longer hours.

2) Intellectual Approach: Outperform by thinking more deeply and further out in the future.

3) Calm-Rational Approach: Ellis describes this path to success as “benign neglect” – a method that beats the others by ignoring both favorable and adverse market conditions, which may lead to suboptimal decisions.

4) Join ‘em Approach: The easiest way to beat active managers is to invest through index funds. If you can’t beat index funds, then join ‘em.

The Case for Stocks

Investor time horizon plays a large role on asset allocation, but time is on investors’ side for long-term equity investors:

“That’s why in the long term, the risks are clearly lowest for stocks, but in the short term, the risks are just as clearly highest for stocks.”

Expanding on that point, Ellis points out the following:

“Any funds that will stay invested for 10 years or longer should be in stocks. Any funds that will be invested for less than two to three years should be in “cash” or money market instruments.”

While many people may feel stock investing is dead, but Ellis points out that equities should return more in the long-run:

“There must be a higher rate of return on stocks to persuade investors to accept risks of equity investing.”

The Power of Regression to the Mean

Investors do more damage to performance by chasing winners and punishing losers because they lose the powerful benefits of “regression to the mean.” Ellis describes this tendency for behavior to move toward an average as “a persistently powerful phenomenon in physics and sociology – and in investing.” He goes on to add, good investors know “that the farther current events are away from the mean at the center of the bell curve, the stronger the forces of reversion, or regression, to the mean, are pulling the current data toward the center.”

The Power of Compounding

For a 75 year period (roughly 1925 – 2000) analyzed by Ellis, he determines $1 invested in stocks would have grown to $105.96, if dividends were not reinvested. If, however, dividends are reinvested, the power of compounding kicks in significantly. For the same 75 year period, the equivalent $1 would have grown to $2,591.79 – almost 25x’s more than the other method (see also Penny Saved is Billion Earned).

Ellis throws in another compounding example:

“Remember that if investments increase by 7 percent per annum after income tax, they will double every 10 years, so $1 million can become $1 billion in 100 years (before adjusting for inflation).”

The Lessons of History

As philosopher George Santayana stated – “Those who cannot remember the past are condemned to repeat it.” Details of every market are different, but as Ellis notes, “The major characteristics of markets are remarkably similar over time.”

Ellis appreciates the importance of history plays in analyzing the markets:

“The more you study market history, the better; the more you know about how securities markets have behaved in the past, the more you’ll understand their true nature and how they probably will behave in the future. Such an understanding enables us to live rationally with markets that would otherwise seem wholly irrational.”

Home Sweet International Home

Although Ellis’s recommendation to diversify internationally is not controversial, his allocation recommendation regarding “full diversification” is a bit more provocative:

“For Americans, this would mean about half our portfolios would be invested outside the United States.”

This seems high by traditional standards, but considering our country’s shrinking share of global GDP (Gross Domestic Product), along with our relatively small share of the globe’s population (about 5% of the world’s total), the 50% percentage doesn’t seem as high at first blush.

Beware the Broker

This is not new territory for me (see Financial Sharks, Fees/Exploitation, and Credential Shell Game), and Ellis warns investors on industry sales practices:

“Those oh so caring and helpful salespeople make their money by convincing you to change funds. Friendly as they may be, they may be no friend to your long-term investment success.”

Unlike a lot of other investing books, which cover a few aspects to investing, Winning the Loser’s Game covers a gamut of crucial investment lessons in a straightforward, understandable fashion. A lot of people play the investing game, but as Charles Ellis details, many more investors and speculators lose than win. For any investor, from amateur to professional, reading Ellis’s Winning the Loser’s Game and following his philosophy will not only help increase the odds of your portfolio winning, but will also limit your losses in sleep hours.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Groupon: From $0 to $6 Billion in 26 Months

Between football and basketball television viewing, along with non-stop eating, I have found little time to update Investing Caffeine. However, between Oreo and eggnog curls I did find time to plop on the couch and watch an interesting interview with Groupon CEO, Andrew Mason. This is the internet-based coupon company that started operations in November 2008 and has already grown to 40 million members (adding 3 million per week). Within 26 short months, Groupon has already established a presence within 35 countries and supposedly garnered a $6 billion takeover offer from Google (GOOG).

Regardless of whether Groupon becomes a multi-billion division of Google, I’m certain Mr. Mason’s wallet has grown fatter over this year, just as I sit down for another 4,000 calorie, belt-busting, holiday meal. Happy viewing and Happy New Year!

Related Article: Valuing Facebook & Twitter

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing SCM had no direct position in Groupon, KFT, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Rams Butting Heads: Rosenberg vs. Paulsen

After a massive decline in financial markets during 2008, followed by a significant rebound in during 2009, should it be a surprise to anyone that economists hold directly opposing views? Financial markets are Darwinian in many respects, and Bloomberg was not bashful about stirring up a battle between David Rosenberg (Chief Economist & Strategist at Gluskin Sheff) and James Paulsen (Chief Investment Strategist at Wells Capital Management). The two economists, like the equivalent of two rams, lowered their horns and butted heads regarding their viewpoints on the economy. Rams butt heads (two words) together as a way to create a social order and hierarchy, so depending on your views, you can determine for yourself whom is the survival of the fittest. Regardless of your opinion, the exchange is an entertaining clash:

Paulsen’s Case (see also Unemployment Hypochondria): Paulsen makes the case that although the recovery has not been a gangbuster, nonetheless, the rebound has been the strongest in 25 years if you look at real GDP growth in the first year after a recession ends. He blames demographic atrophy in labor force growth (i.e., less job growth from Baby Boomers and fewer women joining the workforce relative to the mid-1980s) for the less than stellar absolute number.

Rosenberg’s Case: Rosenberg explains that the last two recoveries bear no resemblance to the recent recovery. The recent recession was one of the worst of all-time, therefore we should have experienced a sharper V-shaped recovery. All the major economic statistics are at dismal levels, and nowhere near the levels experienced in late 2007. He goes on to add that the stimulus, monetary policy, and bailouts have not produced the bang for our buck. Rosenberg says he will put on his bull hat once we enter a credit creation cycle that allows the economy to grow on an organic, sustained basis without artificial stimuli.

Like other pre-crisis bears who have floated to the top of the media mountain, Rosenberg has had difficulty adjusting his doom and gloom playbook as markets have rebounded approximately +80% from March 2009. Rosenberg maintained his pessimistic outlook as he transitioned from Merrill Lynch to Gluskin Sheff and has been wrong ever since. How wrong? Let’s take a look at Rosenberg’s first letter at his new employer, Gluskin Sheff (dated May 19th 2009):

Statement #1: “It stands to reason that this was just another counter-trend rally.” Reality: Dow Jones Industrial Average was at 8,475 then, and 11,114 today.

Statement #2: “It now looks as though the major averages are about to embark on the fabled retesting phase towards the March lows.” Reality: Dow never got close to 6,470 and stands at 11,114 today.

Statement #3: “It is unlikely that we have crossed the Rubicon into new bull market terrain and that the fundamental lows have been put in.” Reality: Dow just needs to fall -42% and Rosenberg will be right.

Statement #4: “[Unemployment] looks like we will likely get back to that old peak of 10.8% in coming quarters.” Reality: We peaked at 10.1% in October a year ago, and stand at 9.6% today.

Statement #5: “Deflation risks continue to trump inflation risks, at least over the near- and intermediate-term.” Reality: Commodity prices are dramatically escalating (CRB commodity index skyrocketing) across many categories, including the four-Cs (copper, corn, cotton, and crude oil).

I don’t pretend to be whistling past the graveyard, because we indeed have serious structural problems (deficits, debt, unsustainable entitlements, high unemployment, etc., etc., etc.), but when was there never something to worry about? See 1963 article? Like the endless “double dip” economists before him (see also Double-Dip Guesses). As the evidence shows, Rosenberg’s anything-but-rosy outlook is a tad extreme and has been dead wrong…at least for the last 1 and ½ years or almost 3,000 Dow Points. Just a few months ago, Rosenberg raised the odds of a double-dip recession from 45% to 67%.

Perhaps the sugar high stimulus will wear off, the steroid side-effects will kick in, and the Fed’s printing presses will break down and cause an economic fire? Until then, corporate profits continue to swell, cash is piling higher, valuations have been chopped in half from a decade ago (see Marathon Investing), and money stuffed under the mattress earning 0.5% will eventually leak back into the market.

I do however agree with Rosenberg in a few respects, and that revolves around his belief that banking industry will not be the leading group out of this cyclical recovery, and housing headwinds will remain in place for a extended period of time. Moreover, I agree with many of the bears when it comes to government involvement. Artificially propping up sectors like housing makes no sense. Why delay the inevitable by flushing taxpayer money down the toilet. Did you see the government running cash for clunker servers and storage in 2000 when the tech bubble burst? Does incentivizing capacity expansion with free money in an industry with boatloads of excess capacity already really make sense? Although media commentators and gloomy economists like Rosenberg paint everything as black and white, most reasonable people understand there are many shades of gray.

Gray that is…like the color of two rams butting heads.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

PIMCO – The Downhill Marathon Machine

How would you like to run a marathon? How about a marathon that is prearranged all downhill? How about a downhill marathon with the wind at your back? How about a downhill marathon with the wind at your back in a wheelchair? Effectively, that is what a 30-year bull market has meant for PIMCO (Pacific Investment Management Co.) and the “New Normal” brothers (Co-Chairman Bill Gross and Mohamed El-Erian) who are commanding the bond behemoth (read also New Normal is Old Normal). Bill Gross can appreciate a thing or two about running marathons since he once ran six marathons in six consecutive days.

This perseverance also assisted Gross in co-founding PIMCO in 1971 with $12 million in assets under management. Since then, the company has managed to add five more zeroes to that figure (today assets exceed $1.2 trillion). In the first 10 years of the company’s existence, as interest rates were climbing, PIMCO managed to layer on a relatively thin amount of assets (approximately $1 billion). But with the tailwind of declining rates throughout the 1980s, PIMCO’s growth began to accelerate, thereby facilitating the addition of more than $25 billion in assets during the decade.

The PIMCO Machine

For the time-being, PIMCO can do no wrong. As the endless list of media commentators and journalists bow to kiss the feet of the immortal bond kings, the blinded reporters seem to forget the old time-tested Wall Street maxim:

“Never confuse genius with a bull market.”

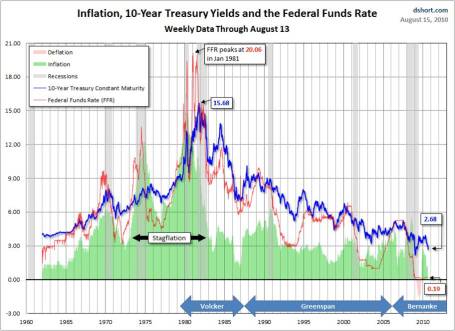

The gargantuan multi-decade move in interest rates, the fuel used to drive bond prices to the moon, might have something to do with the company’s success too? PIMCO is not exactly selling ice to the Eskimos – many investors are scooping up PIMCO’s bond products as they wait in their bunkers for Armageddon to arrive. Thanks to former Federal Reserve Chairman Paul Volcker (appointed in 1979), the runaway inflation of the early 1980s was tamed by hikes he made in the key benchmark Federal Funds Rate (the targeted rate that banks lend to each other). From a peak of around 20% in 1980-1981 the Fed Funds rate has plummeted to effectively 0% today with the most recent assistance coming from current Fed Chairman Ben Bernanke.

Although these west-coast beach loving bond gurus are not the sole beneficiary in this “bond bubble” (see Bubblicious Bonds story), PIMCO has separated itself from the competition with its shrewd world-class marketing capabilities. A day can hardly go by without seeing one of the bond brothers on CNBC or Bloomberg, spouting on about interest rates, inflation, and global bond markets. As PIMCO has been stepping on fruit in the process of collecting the low-hanging fruit, the firm has not been shy about talking its own book. Subtlety is not a strength of El-Erian – here’s what he had to pimp to the USA Today a few months ago as bond prices were continuing to inflate: “Simply put, investors should own less equities, more bonds, more global investments, more cash and more dry ammunition.”

If selling a tide of fear resulted in a continual funnel of new customers into your net, wouldn’t you do the same thing? Fearing people into bonds is something El-Erian is good at: “In the New Normal you are more worried about the return of your capital, not return on your capital.” Beyond alarm, accuracy is a trivial matter, as long as you can scare people into your doomsday way of thinking. The fact Bill Gross’s infamous Dow 5,000 call never came close to fruition is not a concern – even if the forecast overlapped with the worst crisis in seven decades.

Mohamed Speak

Mohamed El-Erian is a fresher face to the PIMCO scene and will be tougher to pin down on his forecasts. He arrived at the company in early 2008 after shuffling over from Harvard’s endowment fund. El-Erian has a gift for cryptically speaking in an enigmatic language that could only make former Federal Reserve Chairman Alan Greenspan proud. Like many economists, El-Erian laces his commentary with many caveats, hedges, and generalities – concrete predictions are not a strength of his. Here are a few of my favorite El-Erian obscurities:

- “ongoing paradigm shift”

- “endogenous liquidity”

- “tail hedging”

- “deglobalization”

- “post-realignment”

- “socialization losses”

Excuse me while I grab my shovel – stuff is starting to pile up here.

Don’t get me wrong…plenty of my client portfolios hold bonds, with some senior retiree portfolios carrying upwards of 80% in fixed income securities. This positioning is more a function of necessity rather than preference, and requires much more creative hand-holding in managing interest-rate risk (duration), yield, and credit risk. At the margin, unloved equities, including high dividend paying Blue Chip stocks, provide a much better risk-adjusted return for those investors that have the risk tolerance and time-horizon threshold to absorb higher volatility.

PIMCO has traveled along a long prosperous road over the last 30 years with the benefit of a historic decline in interest rates. While PIMCO may have coasted downhill in a wheelchair for the last few decades, this behemoth may be forced to crawl uphill on its hands and knees for the next few decades, as interest rates inevitably rise. Now that is a “New Normal” scenario Bill Gross and Mohamed El-Erian have not forecasted.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in PIMCO/Allianz, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Productivity & Trade: Pins, Cars, Coconuts & Chips

The concepts of productivity and free trade go all the way back to Adam Smith, widely considered the “father of economics,” who wrote the original capitalism Bible called the Wealth of Nations. Many of the same principles discussed in Smith’s historic book are just as applicable today as they were in 1776 when it was first published.

Economics at its core is the thirst for efficiency and productivity for the sake of profits. Ultimately, for the countries that successfully practice these principles, a higher standard of living can be achieved for its population. For the U.S. to thrive in the 21st century like we did in the 20th century, we need to embrace productive technology and efficiently integrate proven complex systems. To illustrate the benefits of productivity in a factory setting, Smith wrote about the division of labor in a pin factory. Murray N. Rothbard, an economic historian, and political philosopher summed up the takeaways here:

“A small pin-factory where ten workers, each specializing in a different aspect of the work [18 steps], could produce over 48,000 pins a day, whereas if each of these ten had made the entire pin on his own, they might not have made even one pin a day, and certainly not more than 20.”

Dividing up the 18 pin making steps (i.e., pull wire, cut wire, straighten wire, put on head, paint, etc.) lead to massive productivity improvements.

Another economic genius that changed the world we live in is the father of mass production…Henry Ford. He revolutionized the car industry by starting the Ford Motor Company in 1903 with $100,000 in capital and 12 shareholders. By the beginning of 1904, Ford Motors had sold about 600 cars and by 1924 Ford reached a peak production of more than 2,000,000 cars, trucks, and tractors per year. Although, Ford had a dominant market share here in the U.S., the innovative technology and manufacturing processes allowed him to profit even more by exporting cars internationally. This transformation of the automobile industry allowed Ford to hire thousands of workers with handsome wages and spread 15 million of his cars around the globe from 1908 to 1927.

Comparative Advantage: Lessons from Smith & Ford

Foreign trade has continually been a hot button issue – especially during periods of softer global economic activity. Here is what Adam Smith had to add on the subject:

“If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them with some part of the produce of our own industry, employed in a way in which we have some advantage.”

Smith believed that parties with an “absolute advantage” in manufacturing would benefit by trading with other partners. Today, it’s fairly clear the U.S. has an absolute advantage in creating biotech drugs, Hollywood movies, and internet technologies (i.e., Google), however in other industries, such as industrial manufacturing, the U.S. has lost its dominant position.

David Ricardo, an English economist who authored the famous work On the Principles of Political Economy and Taxation, is attributed with extending Smith’s “absolute advantage” concept one step further by introducing the idea of “comparative advantage.”

Producing Coconuts and Computer Chips

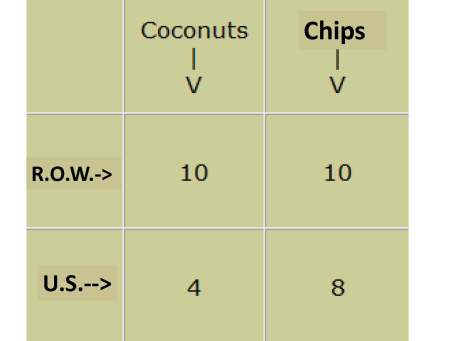

Let’s explore the comparative advantage concept some more by investigating coconuts and computer chips. As we hemorrhage jobs to other countries that can accomplish work more cheaply and efficiently, increasingly discussions shift to a more protectionist stance with dreams of higher import tariffs. Is this a healthy approach? Consider a two nation island able to produce only two goods (coconuts and computer “chips”), with the U.S. on one half of the island, and the Rest of the World (R.O.W.) on the other half.

Next, let’s assume the following production profile: The R.O.W. can choose to produce 10 coconuts or 10 chips AND the U.S. can produce 4 coconuts or 8 chips.

Scenario #1 (No Trade): If we assume both the R.O.W. and the U.S. each spend half their time producing coconuts and chips, then the R.O.W.’s production will create 5 coconuts/5 chips and the U.S. 2 coconuts/4 chips for a combined total of 7 coconuts and 9 chips (16 overall units).

If we were to contemplate the ability of trade between R.O.W. and the U.S., coupled with the concept of comparative advantage, we may see overall productivity of the nation island improve. Despite the R.O.W. having an “absolute advantage” over the U.S. in producing both coconuts (10 vs. 4) and chips (10 vs. 8), the next example demonstrates trade is indeed beneficial.

Scenario #2 (With Trade): If R.O.W. uses its comparative advantage (“more better”) to produce 10 coconuts and the U.S. uses its comparative advantage (“less worse”) to produce 8 chips for a combined total of 10 coconuts and 8 chips (18 overall units). Relative to Scenario #1, this example produces 12.5% more units (18 vs. 16) and with the ability of trade, the U.S. and R.O.W. should be able to optimize the 18 units to meet their individual country preferences.

If we can successfully escape from the island and paddle back to modern times, we can better understand the challenges we face as a country in the current flat global world we live in. Our lack of investment into education, innovation, and next generation infrastructure is making us less competitive in legacy rustbelt industries, such as in automobiles and general manufacturing. If the goal is to maximize productivity, efficiency, and our country’s standard of living, then it makes sense to select trade scenario #2 (even if it means producing zero coconuts and lots of computer chips). The coconut lobby may not be happy under this scenario, but more jobs will be created from higher output and trade while our citizens continue on a path to a higher standard of living.

The free trade strategy will only work if we can motivate, train, and educate enough people into higher paying jobs that produce higher value added products and services (e.g., computer chips and computer consulting). There is a woeful shortage of engineers and scientists in our country, and if we want to compete successfully in the modern world against the billions of people scratching and clawing for our standard of living, then we need to openly accept the productivity and trade principles taught to us by the Adam Smiths and Henry Fords of the world. Otherwise, be prepared to live on a remote, isolated island with a steady diet of coconuts for breakfast, lunch, and dinner.

Read Full NetMBA Article on “Comparative Advantage”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

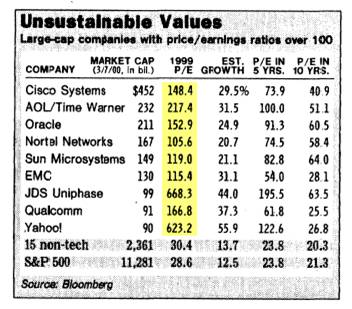

Siegel & Co. See “Bubblicious” Bonds

Siegel compares 1999 stock prices with 2010 bonds

Unlike a lot of economists, Jeremy Siegel, Professor at the Wharton School of Business, is not bashful about making contrarian calls (see other Siegel article). Just days after the Nasdaq index peaked 10 years ago at a level above 5,000 (below 2,200 today), Siegel called the large capitalization technology market a “Sucker’s Bet” in a Wall Street Journal article dated March 14, 2000. Investors were smitten with large-cap technology stocks at the time, paying balloon-like P/E (Price-Earnings) ratios in excess of 100 times trailing earnings (see table above).

Bubblicious Boom

Today, Siegel has now switched his focus from overpriced tech-stock bubbles to “Bubblicious” bonds, which may burst at any moment. Bolstering his view of the current “Great American Bond Bubble” is the fact that average investors are wheelbarrowing money into bond funds. Siegel highlights recent Investment Company Institute data to make his point:

“From January 2008 through June 2010, outflows from equity funds totaled $232 billion while bond funds have seen a massive $559 billion of inflows.”

The professor goes on to make the stretch that some government bonds (i.e., 10-year Treasury Inflation-Protected Securities or TIPS) are priced so egregiously that the 1% TIPS yield (or 100 times the payout ratio) equates to the crazy tech stock valuations 10 years earlier. Conceptually the comparison of old stock and new bond bubbles may make some sense, but let’s not lose sight of the fact that tech stocks virtually had a 0% payout (no dividends). The risk of permanent investment loss is much lower with a bond as compared to a 100-plus multiple tech stock.

Making Rate History No Mystery

What makes Siegel so nervous about bonds? Well for one thing, take a look at what interest rates have done over the last 30 years, with the Federal Funds rate cresting over 20%+ in 1981 (View RED LINE & BLUE LINE or click to enlarge):

As I have commented before, there is only one real direction for interest rates to go, since we currently sit watching rates at a generational low. Rates have a minute amount of wiggle room, but Siegel rightfully understands there is very little wiggle room for rates to go lower. How bad could the pain be? Siegel outlines the following scenario:

“If over the next year, 10-year interest rates, which are now 2.8%, rise to 3.15%, bondholders will suffer a capital loss equal to the current yield. If rates rise to 4% as they did last spring, the capital loss will be more than three times the current yield.”

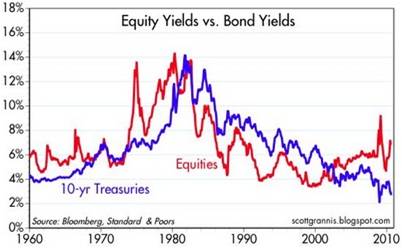

Siegel is not the only observer who sees relatively less value in bonds (especially government bonds) versus stocks. Scott Grannis, author of the Calafia Report artfully shows the comparisons of the 10-Year Treasury Note yield relative to the earnings yield on the S&P 500 index:

As you can see, rarely have there been periods over the last five decades where bonds were so poorly attractive relative to equities.

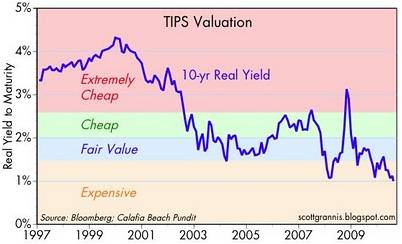

Grannis mirrors Siegel’s view on government bond prices through his chart on TIPS pricing:

Pricey Treasuries is not a new unearthed theme, however, Siegel and Grannis make compelling points to highlight bond risks. Certainly, the economy could soften further, and trying to time the bottom to a multi-decade bond bubble can be hazardous to your investing health. Having said that, effectively everyone should desire some exposure to fixed income securities, depending on their objectives and constraints (retirees obviously more). The key is managing duration and the risk of inflation in a prudent fashion. If you believe Siegel is correct about an impending bond bubble bursting, you may consider lightening your Treasury bond load. Otherwise, don’t be surprised if you do not collect on another “sucker’s bet.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP and other fixed income ETFs), but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sachs Prescribes Telescope Over Microscope

Jeffrey Sachs, Professor at Columbia University and one of Time magazine’s “100 most influential people” recommends that our country takes a longer-term view in handling our problems (read Sachs’s full bio). Instead of analyzing everything through a microscope, Sachs realizes that peering out over the horizon with a telescope may provide a clearer path to success versus getting sidetracked in the emotional daily battles of noise.

I do my fair share of media and politician bashing, but every once in a while it’s magnificent to discover and enjoy a breath of fresh common sense, like the advice coming from Sachs. Normally, I become suffocated with a wet blanket of incessant, hyper-sensitive blabbering that comes from Washington politicians and airwave commentators. With the advent of this thing we call the “internet,” the pace and volume of daily information (see TMI “Too Much Information” article) crossing our eyeballs has only snowballed faster. Rather than critically evaluate the fear-laced news, the average citizen reverts back to our Darwinian survival instincts, or to what Seth Godin calls the “Lizard Brain. ”

Sachs understands the lingering nature to our country’s problems, so in pulling out his long-term telescope, he created a broad roadmap to recovery – many of the points to which I agree. Here is an abbreviated list of his quotes:

On Short-Termism:

“Despite the evident need for a rise in national saving after 2008, President Barack Obama tried to prolong the consumption binge by aggressively promoting home and car sales to already exhausted consumers, and by cutting taxes despite an unsustainable budget deficit. The approach has been hyper short-term, driven by America’s two-year election cycle. It has stalled because US consumers are taking a longer-term view than the politicians.”

On Differences between China and the U.S.:

“China saves and invests; the US talks, consumes, borrows, and talks some more.”

On Why Tax Cuts and Stimulus Alone Won’t Work:

“Short-term tax cuts or transfers on top of America’s $1,500bn budget deficit are unlikely to do much to boost demand, while they would greatly increase anxieties over future fiscal retrenchment. Households are hunkering down, and many will regard an added transfer payment as a temporary windfall that is best used to pay down debt, not boost spending.”

On Malaise Hampering Businesses:

“Businesses, for their part, are distressed by the lack of direction….Uncertainty is a real killer.”

On 5-Point Plan to a U.S. Recovery:

1) Increased Clean Energy Investments: The recovery needs “a significant boost in investments in clean energy and an upgraded national power grid.”

2) Infrastructure Upgrade: “A decade-long program of infrastructure renovation, with projects such as high-speed inter-city rail, water and waste treatment facilities and highway upgrading, co-financed by the federal government, local governments and private capital.”

3) Further Education: “More education spending at secondary, vocation and bachelor-degree levels, to recognize the reality that tens of millions of American workers lack the advanced skills needed to achieve full employment at the salaries that the workers expect.”

4) Infrastructure Exports to the Poor: “Boost infrastructure exports to Africa and other low-income countries. China is running circles around the US and Europe in promoting such exports of infrastructure. The costs are modest – essentially just credit guarantees – but the benefits are huge, in increased exports, support for African development and a boost in geopolitical goodwill and stability.”

5) Deficit Reduction Plan: “A medium-term fiscal framework that will credibly reduce the federal budget deficit to sustainable levels within five years. This can be achieved partly by cutting defense spending by two percentage points of gross domestic product.”

Rather than succumb to the nanosecond, fear-induced headlines that rattle off like rapid fire bullets, Sachs supplies thoughtful long-term oriented solutions and ideas. The fact that Sachs mentions the word “decade” three times in his Op-ed highlights the lasting nature of these serious problems our country faces. To better see and deal with these challenges more clearly, I suggest you borrow Sachs’s telescope, and leave the microscope in the lab.

Read Full Financial Times Article by Jeffrey Sachs

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Paulson Funds: From Ruth’s Chris’s to Denny’s

Investing in hedge funds is similar to eating at a high-priced establishment like Ruth’s Chris’s (RUTH) – not everyone can eat there and the prices are high. In dining terms, John Paulson, President of Paulson & Co. (approximately $34 billion in assets under management), may be considered the managing chef of the upper-crust restaurant. But rather than opening the doors of his funds to an elite few, Paulson is now making his select strategies available to the masses through a much more affordable structure. Or in other words, Paulson is opening an investing version of Denny’s (DENN), in addition to his Ruth’s Chris, so a broader set of investors can buy into his funds at a reasonable price.

Hedge funds typically are reserved for pension funds, endowments, wealthy individuals, or so-called “accredited investors” – individuals earning $200,000 annually, couples earning $300,000, or people with a net worth greater than $1,000,000. By using alternate structures, Paulson will be able to bypass the accredited investor regulatory requirements and reach a more expansive audience.

UCITS Added as a New Item on the Menu

How exactly is Paulson opening his hedge fund strategies to the broader public on a Denny’s menu? He is assembling what is called a “Ucits” structure (Undertakings for Collective Investments in Transferable Securities). These investment vehicles, adopted in 1985, resemble mutual funds and are domiciled in Europe. Although Ucits have been used by relatively few hedge fund managers, Paulson is not the first to institute them (York Capital, Highbridge Capital Management, BlueCrest Capital, and AHL are among the others who have already taken the plunge). According to the Financial Times, Paulson’s Ucits funds will launch later this year. Part of the reason this structure was chosen over others is because the regulations associated with these structures are expected to be less stringent than other onerous regulations currently being discussed by the European Union.

Will the Investing Mouths be Fed?

Should this move by Paulson be surprising? Perhaps Andy Warhol’s quote about everyone being famous for 15 minutes is apropos. Paulson’s $15 billion subprime housing profits in 2007 (read The Greatest Trade Ever) were a handsome reward and now he is attempting to further his wealth position based on this notoriety. Do I blame him? No, not at all, but time will tell if he will be viewed as a one-hit wonder, or whether his subprime bet was only an opening act. More recently, Paulson has been vocal about his seemingly peculiar combination of bullish wagers on gold and California real estate, which he sees rising in price by +20% in 2010 (see Paulson on California home rally). With his optimistic outlook on the U.S. markets and economy, his gold play apparently is riding on the expectation of a future inflation flare up, not another financial meltdown, which was the catalyst that catapulted gold prices higher in late 2008 and throughout 2009.

I’m not sure how many domestic investors will participate in these Ucits investments, however I am eager to see the prospectuses associated with the funds. Like most hedge funds, caution should be used when investing in these types of vehicles, and should only be used as a part of a broadly diversified investment portfolio. For most investors, my guess is the Paulson funds will have an attractive price of entry (i.e., availability), much like a Denny’s restaurant, but the quality and fee structure may be as desirable as a $5.99 greasy steak and pile of gravy-covered mash potatoes.

Read the Entire Financial Times Article on Paulson’s Ucits Launch

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in RUTH, DENN, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.