Posts filed under ‘Profiles’

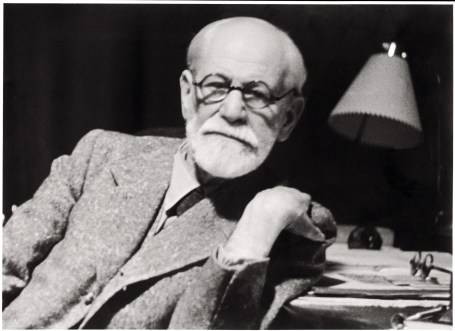

Sigmund Freud the Portfolio Manager

Byron Wien, former investment strategist at Morgan Stanley (MS) and current Vice Chairman at Blackstone Advisory Partners (BX), traveled to Austria 25 years ago and used Sigmund Freud’s success in psychoanalytical theory development as a framework to apply it to the investment management field.

This is how Wien describes Freud’s triumphs in the field of psychology:

“He accomplished much because he successfully anticipated the next step in his developing theories, and he did that by analyzing everything that had gone before carefully. This is the antithesis of the way portfolio managers approach their work.”

Wien attempts to reconcile the historical shortcomings of investment managers by airing out his dirty mistakes for others to view.

“I think most of us have developed patterns of mistake-making, which, if analyzed carefully, would lead to better performance in the future…In an effort to encourage investment professionals to determine their error patterns, I have gathered the data and analyzed my own follies, and I have decided to let at least some of my weaknesses hang out. Perhaps this will inspire you to collect the information on your own decisions over the past several years to see if there aren’t some errors that you could make less frequently in the future.”

Here are the recurring investment mistakes Wien shares in his analysis:

Selling Too Early: Wien argues that “profit-taking” alone is not reason enough to sell. Precious performance points can be lost, especially if trading activity is done for the sole purpose of looking busy.

The Turnaround with the Heart of Gold: Sympathy for laggard groups and stocks is inherent in the contrarian bone that most humans use to root for the underdog. Wien highlights the typical underestimation investors attribute to turnaround situations – reality is usually a much more difficult path than hoped.

Overstaying a Winner: Round-trip stocks – those positions that go for long price appreciation trips but return over time to the same stock price of the initial purchase – were common occurrences for Mr. Wien in the past. Wien blames complacency, neglect, and infatuation with new stock ideas for these overextended stays.

Underestimating the Seriousness of a Problem: More often than not, the first bad quarter is rarely the last. Investors are quick to recall the rare instance of the quick snapback, even if odds would dictate there are more cockroaches lurking after an initial sighting. As Wien says, “If you’re going to stay around for things to really improve, you’d better have plenty of other good stocks and very tolerant clients.”

It may have been 1986 when Byron Wien related the shortcomings in investing with Sigmund Freud’s process of psychoanalysis, but the analysis of common age-old mistakes made back then are just as relevant today, whether looking at a brain or a stock.

See also: Killing Patients to Prosperity

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MS, BX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Gospel from 20th Century Investment King

Exceptional returns are not achieved by following the herd, and Sir John Templeton, the man Money magazine called the greatest global stock investor of the 20th century, followed this philosophy to an extreme. This contrarian, value legend put his money where his mouth was early on in his career. After graduating from Yale and becoming a Rhodes Scholar at Oxford, Templeton moved onto Wall Street. At the ripe young age of 26, and in the midst of World War II tensions, Templeton borrowed $10,000 (a lot of dough back in 1939) to purchase 100 shares in more than 100 stocks trading at less than $1 per share (34 of the companies were in bankruptcy). When all was said and done, only four of the investments became worthless and Templeton made a boatload of money. This wouldn’t be the end of Templeton’s success, but rather the beginning to a very long, prosperous career -Templeton ended up living a full life to age 95 (1912 – 2008).

Shortly after his penny stock buying binge in 1939, Templeton parlayed those profits into buying an investment firm in 1940 – this move served as a precursor for his Templeton Growth Fund that was launched in 1954. How successful was Templeton’s fund? So successful that an initial $10,000 investment made at the fund’s 1954 inception would have compounded into $2 million in 1992 (translating into a +14.5% annual return) when Templeton’s company was sold to Franklin Resources Inc. (BEN) for $913 million.

Mixing Religion & Science

But this pioneer of global investing didn’t stop after accumulating big bucks from all his investments. His pursuit for investment divinity was coupled with a thirst for spiritual knowledge. In 1987 he established the Templeton Foundation, which grew total assets to well north of $1 billion in the 2000s. The mission of the Templeton Foundation was to reconcile science and religion. Here is what Templeton had to say about the foundation:

“We are trying to persuade people that no human has yet grasped 1% of what can be known about spiritual realities. So we are encouraging people to start using the same methods of science that have been so productive in other areas, in order to discover spiritual realities.”

Going Against the Tide

Central to Templeton’s contrarian investment philosophy was to purchase superior stocks at cheap prices at points of “maximum pessimism.” Like a lot of excellent investors, Templeton was never afraid to go against the tide and make big bets.

In the 1960s, Templeton held more than 60% of his fund’s assets in Japan. More than three decades later he was astute enough to recognize the tech bubble in 1999 and to profit from this trend by shorting the tech sector. He famously predicted that 90% of the new internet companies would go bankrupt within five years.

Templeton’s Tutelage

Although Sir John Templeton is no longer with us, he has left numerous books and writings that investors of all shapes and sizes can draw upon. One of the best distilled pieces of knowledge distributed by Templeton is his 22 investment maxims.

1.) For all long-term investors, there is only one objective-“maximum total real return after taxes.”

2.) Achieving a good record takes much study and work, and is a lot harder than most people think.

3.) It is impossible to produce a superior performance unless you do something different from the majority.

4.) The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.

5.) To put “Maxim 4” in somewhat different terms, in the stock market the only way to get a bargain is to buy what most investors are selling.

6.) To buy when others are despondently selling and to sell what others are greedily buying requires the greatest fortitude, even while offering the greatest reward.

7.) Bear markets have always been temporary. Share prices turn upward from one to twelve months before the bottom of the business cycle.

8.) If a particular industry or type of security becomes popular with investors, that popularity will always prove temporary and, when lost, won’t return for many years.

9.) In the long run, the stock market indexes fluctuate around the long-term upward trend of earnings per share.

10.) In free-enterprise nations, the earnings on stock market indexes fluctuate around the book value of the shares of the index.

11.) If you buy the same securities as other people, you will have the same results as other people.

12.) The time to buy a stock is when the short-term owners have finished their selling, and the time to sell a stock is often when the short-term owners have finished their buying.

13.) Share prices fluctuate more widely than values. Therefore, index funds will never produce the best total return performance.

14.) Too many investors focus on “outlook” and “trend.” Therefore, more profit is made by focusing on value.

15.) If you search worldwide, you will find more bargains and better bargains than by studying only one nation. Also, you gain the safety of diversification.

16.) The fluctuation of share prices is roughly proportional to the square root of the price.

17.) The time to sell an asset is when you have found a much better bargain to replace it.

18.) When any method for selecting stocks becomes popular, then switch to unpopular methods. As has been suggested in “Maxim 3,” too many investors can spoil any share-selection method or any market-timing formula.

19.) Never adopt permanently any type of asset, or any selection method. Try to stay flexible, open-minded, and skeptical. Long-termy changing from popular to unpopular the types of securities you favor and your methods of selection.

20.) The skill factor in selection is largest for the common-stock part of your investments.

21.) The best performance is produced by a person, not a committee.

22.) If you begin with prayer, you can think more clearly and make fewer stupid mistakes.

Sir John Templeton lived a rich life of many interests spanning investments, science, and religion. Applying a few points of this investor of the 20th century can only improve your results.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in BEN, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Spoonfuls of Investment Knowledge

When it comes to investment advice, I’m a sucker for good quotes, so it should come as no surprise that I am highlighting some rousing material I stumbled upon from a 1978 Financial Analyst Journal article written by Gary Helms (Toward Bridging the Gap). Helms is a Wall Street veteran who managed major mutual funds in the 1970s, the research department for Loeb Rhoades & Co. in the 1980s, and the University of Chicago’s endowment in the 1990s. In an attempt to codify conventional investment wisdom he learned in his career, he established the Helms Ultimate Truths (HUT) system, which cataloged the tenets of real world investment wisdom consistent with practical experience. In order to satisfy the numerical needs of quant-jocks programming for an investment Holy Grail, Helms spoon-feeds readers with a list of tenets – each truth has a nine-digit HUT code attached (with tongue firmly in Helms’s cheek). Here is a partial list of my conventional wisdom favorites bundled into categories that I organized:

Hodgepodge Truisms

“Never confuse brilliance with a bull market.”

“You can’t spend relative performance.”

“If anybody really knew, they wouldn’t tell you.”

“None of the old rules work anymore, but then they never did.”

“When everybody likes a stock, it must go down; when nobody likes a stock, it may go up.”

“You never understand a stock until you’re long (or short).

“A penny saved will depreciate rapidly.”

“Chart breakouts don’t count if your own buying does it.”

“The new high list will do better in the subsequent six months than the new low list will.”

Common Sense Commandments

“In a bull market, be bullish.”

“Two things cause a stock to move – the expected and the unexpected.”

“The stock doesn’t know you own it.”

“The market will fluctuate.”

“A portfolio that goes down 50 per cent and comes back 50 percent is still down 25 per cent.”

“An outstanding portfolio always contains an outstanding stock.”

Numerical Rules of Thumb

“You can be 200 per cent wrong when you switch.”

“Money management is 10 per cent inspiration and 90 per cent perspiration.”

“More stocks double than go to zero.”

“The market is a random walk up a 9.3 per cent grade.”

“Nobody has been right three times.”

“Turnarounds take seven years.”

“The bottom is always 10 per cent below your worst case expectation.”

“If you have a great thought and write it down, it will look stupid 10 hours later.”

“If the idea is right, eighths and quarters won’t matter.”

Principles of Selling

“Sell the stock when it runs off the top (or bottom) of the chart.”

“Sell down to your sleep point.”

“Sell the stock when the company announces a new corporate headquarters.”

“Sell when the research file gets full.”

“Sell your losers and let your runners run.”

Investment Management Realities

“The best thing about money management is that it’s indoor work with no heavy lifting.”

“A good portfolio manager never asks a question unless he knows the answer.”

“The first word in analyst is anal.”

“A bright and energetic guy can make all the mistakes in this business in five years, but fools and sluggards can take a lifetime.”

“Analysts write long research reports when they don’t have time to write short ones.”

“Someone will always have a better record.”

“The trouble with managing money is that everybody once made a successful investment.”

“Every time a trade is made, somebody was wrong.”

“Don’t apologize for acting on your instincts if you’ve spent years developing them.”

“Be long term but watch the ticks.”

“You’ll never know who your friends are until you’ve had two bad years in a row.”

“A guy who likes a stock but doesn’t own it has no right to an opinion.”

Ha-Ha Truths

“Bulls make money and bears make money, but pigs get swine flu.”

“The truth will set you free, but Scotch isn’t bad either.”

“Babe Ruth once led the league in strikeouts.”

“Trust everybody but cut the cards.”

“You can’t kiss all the girls.”

“Get caught bluffing once a night.”

“There is more than one way to skin a cat, and six ways to roll a seven.”

Economic Truths

“Cyclic stocks should be bought when their multiples are high and sold when their multiples are low.”

“Growth will bail you out – if you live long enough.”

“All growth is temporary.”

“Half of your portfolio is cyclic, but you don’t know which half.”

“Own West Coast companies in bull markets, Boston companies in bear.”

Helms’s rules can be very helpful, but I think heeding his advice provided in HUT #: 272451-79-9, “All generalizations are false, including this one,” is an important truth. As you can tell from the abbreviated but extensive list, these spoonfuls of investment gems can be both playfully messy and informatively tasty.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

6 Traits of a Winning Aggressive Investor

“Winning” means different things to different people, including Charlie Sheen. As I have stated in the past, there is a diverse set of strategies to win in the investment business, much like there are numerous paths to enlightenment among the extensive choices of religions. Regardless of the differences, followers of a strategy or religion generally believe their principles will lead them to prosperity (financial and/or spiritual). One specific flavor of investment religion follows a path of aggression, which Douglas Bellemore describes in his book The Strategic Investor, published in 1963.

Modern finance and textbooks teach us the virtues and powers of diversification, but Bellemore has learned from the school of Warren Buffett, who stated, “Put all your eggs in one basket and then watch that basket very carefully.” Buffett also believes, “Diversification is protection against ignorance.” It’s no surprise that Buffett’s partner Charlie Munger also harbors some skepticism on the topic, “Wide diversification, which necessarily includes investment in mediocre businesses, only guarantees ordinary results.”

Bellemore’s Big 6

In his book, Bellemore builds upon this bold, concentrated strategy that he taught at New York University for four decades. He believed there are six basic traits necessary for a successful aggressive investor. Here is a synopsis of the characteristics:

1) Patience: Bellemore explains that success in the investment world does not come overnight, and much of the same thought processes necessary to prosper can be found in the in corporate management world.

“Success depends, in large measure, on the ability to select undervalued situations not presently recognized by the majority of investors and to wait for expected developments to provide capital gains which may only come after several years… Many of the personal qualities for successful business management are the same as those for an aggressive investor.”

2) Courage: When it comes to investments, hiding in a cave will not get you very far. On the topic of courage, Bellemore believed:

“The investor must have solid convictions and the courage and confidence emanating from them –that is, courage, at times, to ignore those who disagree…It is this willingness to differ and accept responsibility that distinguishes the top executive and the top investor.”

3) Intelligence: One need not be a genius to be a successful investor, according to Bellemore, but common sense is much more important:

“Many highly intelligent investors have had poor investment records because they lacked common sense, i.e., the down-to-earth, practical ability to evaluate a situation.”

4) Emotional Stability: Bellemore acknowledges the similarities of this trait to patience but emotional stability encompasses a broader context. Here he describes the necessary trait of emotional stability:

“It is needed to prevent the investor from being engulfed in waves of optimism and pessimism that periodically sweep over Wall Street. Moreover, it is required to separate the facts from the entangled web of human emotions.”

5) Hard Work: Ignorance is not an asset in the investment business, therefore in order to become a successful investor it requires hard work. Bellemore underscores the following:

“[An investor] must be knowledgeable about the company in which he considers making an investment, the industry, the position of the company in the industry, and the place and future of that industry in the economy as a whole.”

6) Willingness to Sacrifice Diversification: By definition, Bellemore asserts outsized gains cannot be achieved with diversification:

“Although wide diversification reduces risks by offsetting mediocre selections with good ones, it also reduces substantially the profit or capital gain potential of a portfolio.”

Bellemore acknowledges aggressive investing is not for everyone, and if the six tenets are not followed, the unqualified investor would be much better off by following a conservative, diversified investment approach. The cost of the conservative path, however, is the potential of winning outsized returns. If winning is a priority for you, and your goal is to achieve outperformance, then you and Charlie Sheen would be in agreement to follow Douglas Bellemore’s six traits of an aggressive investor.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Cutting Losses with Fisher’s 3 Golden Sell Rules

Returning readers to Investing Caffeine understand this is a location to cover a wide assortment of investing topics, ranging from electric cars and professional poker to taxes and globalization. Investing Caffeine is also a location that profiles great investors and their associated investment lessons.

Today we are going to revisit investing giant Phil Fisher, but rather than rehashing his accomplishments and overall philosophy, we will dig deeper into his selling discipline. For most investors, selling securities is much more difficult than buying them. The average investor often lacks emotional self-control and is unable to be honest with himself. Since most investors hate being wrong, their egos prevent taking losses on positions, even if it is the proper, rational decision. Often the end result is an inability to sell deteriorating stocks until capitulating near price bottoms.

Selling may be more difficult for most, but Fisher actually has a simpler and crisper number of sell rules as compared to his buy rules (3 vs. 15). Here are Fisher’s three sell rules:

1) Wrong Facts: There are times after a security is purchased that the investor realizes the facts do not support the supposed rosy reasons of the original purchase. If the purchase thesis was initially built on a shaky foundation, then the shares should be sold.

2) Changing Facts: The facts of the original purchase may have been deemed correct, but facts can change negatively over the passage of time. Management deterioration and/or the exhaustion of growth opportunities are a few reasons why a security should be sold according to Fisher.

3) Scarcity of Cash: If there is a shortage of cash available, and if a unique opportunity presents itself, then Fisher advises the sale of other securities to fund the purchase.

Reasons Not to Sell

Prognostications or gut feelings about a potential market decline are not reasons to sell in Fisher’s eyes. Selling out of fear generally is a poor and costly idea. Fisher explains:

“When a bear market has come, I have not seen one time in ten when the investor actually got back into the same shares before they had gone up above his selling price.”

In Fisher’s mind, another reason not to sell stocks is solely based on valuation. Longer-term earnings power and comparable company ratios should be considered before spontaneous sales. What appears expensive today may look cheap tomorrow.

There are many reasons to buy and sell a stock, but like most good long –term investors, Fisher has managed to explain his three-point sale plan in simplistic terms the masses can understand. If you are committed to cutting investment losses, I advise you to follow investment legend Phil Fisher – cutting losses will actually help prevent your portfolio from splitting apart.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Buffett on Gold Fondling and Elephant Hunting

Warren Buffett is kind enough to occasionally grace investors with his perspectives on a wide range of subjects. In his recently released annual letter to shareholders he covered everything from housing and leverage to liquidity and his optimistic outlook on America (read full letter here). Taking advice from the planet’s third wealthiest person (see rankings) is not a bad idea – just like getting basketball pointers from Hall of Famer Michael Jordan or football tips from Pro Bowler Tom Brady isn’t a bad idea either.

Besides being charitable with billions of his dollars, the “Oracle of Omaha” was charitable with his time, spending three hours on the CNBC set (a period equal to $12 million in Charlie Sheen dollars) answering questions, all at the expense of his usual money-making practice of reading through company annual reports and 10Qs.

Buffett’s interviews are always good for a few quotable treasures and he didn’t disappoint this time either with some “gold fondling” and “elephant hunting” quotes.

Buffett on Gold & Commodities

Buffett doesn’t hold back on his disdain for “fixed-dollar investments” and isn’t shy about his feelings for commodities when he says:

“The problem with commodities is that you are betting on what someone else would pay for them in six months. The commodity itself isn’t going to do anything for you….it is an entirely different game to buy a lump of something and hope that somebody else pays you more for that lump two years from now than it is to buy something that you expect to produce income for you over time.”

Here he equates gold demand to fear demand:

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid you make money, if they become less afraid you lose money, but the gold itself doesn’t produce anything.”

Buffett goes on to say this about the giant gold cube:

“I will say this about gold. If you took all the gold in the world, it would roughly make a cube 67 feet on a side…Now for that same cube of gold, it would be worth at today’s market prices about $7 trillion dollars – that’s probably about a third of the value of all the stocks in the United States…For $7 trillion dollars…you could have all the farmland in the United States, you could have about seven Exxon Mobils (XOM), and you could have a trillion dollars of walking-around money…And if you offered me the choice of looking at some 67 foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I’ll take the farmland and the Exxon Mobils.”

Although not offered up in this particular interview, here is another classic quote by Buffett on gold:

“[Gold] gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

For the most part I agree with Buffett on his gold commentary, but when he says commodities “don’t do anything for you,” I draw the line there. Many commodities, outside of gold, can do a lot for you. Steel is building skyscrapers, copper is wiring cities, uranium is fueling nuclear facilities, and corn is feeding the masses. Buffett believes in buying farms, but without the commodities harvested on that farm, the land would not be producing the income he so emphatically cherishes. Gold on the other hand, while providing some limited utility, has very few applications…other than looking shiny and pretty.

Buffett on Elephant Hunting

Another subject that Buffett addresses in his annual shareholder letter, and again in this interview, is his appetite to complete large “elephant” acquisitions. Since Berkshire Hathaway (BRKA/B) is so large now (total assets over $372 billion), it takes a sizeable elephant deal to be big enough to move the materiality needle for Berkshire.

“We’re looking for elephants. For one thing, there aren’t many elephants out there, and all the elephants don’t want to go in our zoo…It’s going to be rare that we are going find something selling in the tens of billions of dollars; where I understand the business; where the management wants to join up with Berkshire; where the price makes the deal feasible; but it will happen from time to time.”

Buffett’s target universe is actually fairly narrow, if you consider his estimate of about 50 targets that meet his true elephant definition. He has been quite open about the challenges of managing such a gigantic portfolio of assets. The ability to outperform the indexes becomes more difficult as the company swells because size becomes an impediment – “gravity always wins.”

With experience and age comes quote-ability, and Warren Buffett has no shortage in this skill department. The fact that Buffett’s investment track record is virtually untouchable is reason enough to hang upon his every word, but his uncanny aptitude to craft stories and analogies – such as gold fondling and elephant hunting – guarantees I will continue waiting with bated breath for his next sage nuggets of wisdom.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including commodities) and commodity related equities, but at the time of publishing SCM had no direct position in BRKA/B, XOM or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Alligators, Airplane Crashes, and the Investment Brain

“Neither a man nor a crowd nor a nation can be trusted to act humanely or think sanely under the influence of a great fear…To conquer fear is the beginning of wisdom.” – Bertrand Russell

Fear is a powerful force, and if not harnessed appropriately can prove ruinous and destructive to the performance of your investment portfolios. The preceding three years have shown the poisonous impacts fear can play on the average investor results, and Jason Zweig, financial columnist at The Wall Street Journal presciently wrote about this subject aptly titled “Fear,” just before the 2008 collapse.

Fear affects us all to differing degrees, and as Zweig points out, often this fear is misguided – even for professional investors. Zweig uses the advancements in neuroscience and behavioral finance to help explain how irrational decisions can often be made. To illustrate the folly in human’s thought process, Zweig offers up a multiple examples. Here is part of a questionnaire he highlights in his article:

“Which animal is responsible for the greatest number of human deaths in the U.S.?

A.) Alligator; B.) Bear; C.) Deer; D.) Shark; and E.) Snake

The ANSWER: C) Deer.

The seemingly most docile creature of the bunch turns out to cause the most deaths. Deer don’t attack with their teeth, but as it turns out, deer prance in front of speeding cars relatively frequently, thereby causing deadly collisions. In fact, deer collisions trigger seven times more deaths than alligators, bears, sharks, and snakes combined, according to Zweig.

Another factoid Zweig uses to explain cloudy human thought processes is the fear-filled topic of plane crashes versus car crashes. People feel very confident driving in a car, yet Zweig points out, you are 65 times more likely to get killed in your own car versus a plane, if you adjust for distance traveled. Hall of Fame NFL football coach John Madden hasn’t flown on an airplane since 1979 due to his fear of flying – investors make equally, if not more, irrational judgments in the investment world.

Professor Dr. Paul Slovic believes controllability and “knowability” contribute to the level of fear or perception of risk. Handguns are believed to be riskier than smoking, in large part because people do not have control over someone going on a gun rampage (i.e., Jared Loughner Tuscon, Arizona murders), while smokers have the power to just stop. The reality is smoking is much riskier than guns. On the “knowability” front, Zweig uses the tornadoes versus asthma comparison. Even though asthma kills more people, since it is silent and slow progressing, people generally believe tornadoes are riskier.

The Tangible Cause

Deep within the brain are two tiny, almond-shaped tissue formations called the amygdala. These parts of the brain, which have been in existence since the period of early-man, serve as an alarm system, which effectively functions as a fear reflex. For instance, the amygdala may elicit an instinctual body response if you encounter a bear, snake, or knife thrown at you.

Money fears set off the amygdala too. Zweig explains the linkage between fiscal and physical fears by stating, “Losing money can ignite the same fundamental fears you would feel if you encountered a charging tiger, got caught in a burning forest, or stood on the crumbling edge of a cliff.” Money plays such a large role in our society and can influence people’s psyches dramatically. Neuroscientist Antonio Damasio observed, “Money represents the means of maintaining life and sustaining us as organisms in our world.”

The Solutions

So as we deal with events such as the Lehman bankruptcy, flash crashes, Greek civil unrest, and Middle East political instability, how should investors cope with these intimidating fears? Zweig has a few recommended techniques to deal with this paramount problem:

1) Create a Distraction: When feeling stressed or overwhelmed by risk, Zweig urges investors to create a distraction or moment of brevity. He adds, “To break your anxiety, go for a walk, hit the gym, call a friend, play with your kids.”

2) Use Your Words: Objectively talking your way through a fearful investment situation can help prevent knee-jerk reactions and suboptimal outcomes. Zweig advises to the investor to answer a list of unbiased questions that forces the individual to focus on the facts – not the emotions.

3) Track Your Feelings: Many investors tend to become overenthusiastic near market tops and show despair near market bottoms. Long-term successful investors realize good investments usually make you sweat. Fidelity fund manager Brian Posner rightly stated, “If it makes me feel like I want to throw up, I can be pretty sure it’s a great investment.” Accomplished value fund manager Chris Davis echoed similar sentiments when he said, “We like the prices that pessimism produces.”

4) Get Away from the Herd: The best investment returns are not achieved by following the crowd. Get a broad range of opinions and continually test your investment thesis to make sure peer pressure is not driving key investment decisions.

Investors can become their worst enemies. Often these fears are created in our minds, whether self-inflicted or indirectly through the media or other source. Do yourself a favor and remove as much emotion from the investment decision-making process, so you do not become hostage to the fear du jour. Worrying too much about alligators and plane crashes will do more harm than good, when making critical decisions.

Read Other Jason Zweig Article from IC

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Whitney the Netflix Waffler

No, I am not talking about Meredith Whitney (see Cloudy Crystal Ball), but rather Whitney Tilson, a well-known value and hedge fund manager at T2 Partners LLC. Less than eight weeks ago, Tilson boldly and brashly exclaimed why Netflix Inc. (NFLX) was an “exceptional short” and provided reasons to the world on why Netflix was his largest short position (read Tilson’s previous post). Fifty-five days later, Mr. Tilson evidently was overtaken by a waffle craving and decided to throw in the towel by covering his Netflix short position.

What Changed in Seven and Half Weeks?

Margin Thesis Compromised: Tilson explains, “The company reported a very strong quarter that weakened key pillars of our investment thesis, especially as it relates to margins.” Really? Netflix has grown revenues for nine straight years since its IPO (Initial Public Offering) in 2002, and growth has even accelerated for two whole years (as Netflix has shifted to streaming content over snail-mail), and just in Q4 he became surprised by this multi-year trend? The Q4 growth caught Tilson off-guard, but I guess Tilson wasn’t surprised by the 7.5 million subscribers Netflix added in 2009 and first three quarters of 2010. Never mind the five consecutive years of operating margin expansion either (source: ADVFN), nor the stealthy share price move from $30 to around $225. Apparently Tilson needed the recently reported Q4 financial results to hit him over the head.

Survey Provides Earth-Shattering Results: Tilson conducted an exhaustive study of “more than 500 Netflix subscribers, that showed significantly higher satisfaction with and usage of Netflix’s streaming service than we anticipated.” Come on…Netflix has more than 20 million subscribers, and you are telling me that a questionnaire of 500 subscribers (0.0025%) is representative. Even if these results are a cornerstone of Tilson’s modified thesis, I wonder also why the survey wasn’t taken before Netflix became Tilson’s largest negative short position. In addition, I can’t say it’s much of a revelation that Tilson found “significantly higher satisfaction” among paying subscribers. That’s like me going to a Justin Bieber concert and polling J-Beeb fans whether they like his music – I’ll go out on a limb and say paying customers will generally have a positive bias in their responses.

Feedback Tilts the Scales: Tilson received a “great deal of feedback, including an open letter from Netflix’s CEO, Reed Hastings.” If I received a penny for every time I heard a CEO speak positively about their company, I would be retired on a private island drinking umbrella drinks all day. Honestly, what does Tilson expect Hastings to say, “You know Whitney, you really hit the nail on the head with your analysis…I think you’re right and you should short our stock.”

Some other inconsistencies I’m still trying to figure out in Tilson’s new waffle thesis:

Valuation Head Scratcher: Also frustrating in Tilson’s 180 degree switch is his apparent incongruous treatment of valuation. In his initial bearish piece, Tilson explains how outrageously priced Netflix share are at 63.1x the high 2010 consensus estimate, but somehow a current 75.0x multiple (~20% richer) is reason enough for Tilson to blow out his short.

Competition: Although Tilson went from 100% short Netflix to 0% short Netflix, there does not appear to be any new information regarding Netflix’s competitive dynamics from the Q4 financial release to change his view. Here is what he said in his article eight weeks ago:

“Netflix’s brand and number of customers pale in comparison to its new, direct competitors like Apple (iTunes), Google (GOOG) (YouTube), Amazon.com (AMZN) (Amazon Video on Demand), Disney (DIS) and News Corp. (NWS) (part ownership of Hulu), Time Warner (TWX, TWC) (cable, HBO, etc.), Comcast (CMCSA) (cable, NBC Universal, part ownership of Hulu), and Coinstar’s Redbox (CSTR) (30,000 kiosks renting DVDs for $1/night and email addresses for 21 million customers).”

Little is said in his short covering note, other than these negative dynamics still exist and help explain why he is not long the stock.

Gently Under the Bus

Whitney Tilson was “against Netflix before he was for it,” a stance that could generate a tear of pride from fellow waffler John Kerry. However, I want to gently place Mr. Tilson under the bus with all my comments because his sudden strange reversal shouldn’t be blown out of proportion with respect to his full body of work. As a matter of fact, I have favorably profiled Tilson in several of my previous articles (read Tilson on BP and Tilson on Fat Lady Housing).

One would think given my profitable long position in Netflix that I would be congratulating Tilson for covering his short, but I must admit that I feel a little naked with fewer contrarians rooting against me. The herd is occasionally right, but the largest returns are made by not following the herd. Short interest was about 33% of the float (shares outstanding available for trading) mid-last month, and with the recent melt-up, my guess is that short percentage has shrunk with other short covering doubters. I haven’t decided how much, if any, profits I plan to lock-in with my Netflix positions, but as Tilson points out, they are not giving Netflix away for free.

Credit should also be given to Tilson for having the thickness of skin to openly flog himself and admit failure in such an open forum. I have been known to enjoy a waffle or two in my day as well (more often in the privacy of my own kitchen), and waffling on stocks can be preferable to loving stocks to the grave. Tilson has proven firsthand that eating waffles can be very expensive and detrimental to your profit waistline. By doing more homework on your stock consumption, your waffle eating should be spread further apart, making this habit not only cheaper, but also better for your long-term investment health.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) at the time of publishing had no direct position in DIS, NWS/Hulu, TWX, TWC, CMCSA, and CSTR but SCM and some of its clients own certain exchange traded funds, NFLX, AAPL, AMZN, AAPL, and GOOG, but did not own any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Yacktman’s Triangle of Success

Vodpod videos no longer available.

Donald Yacktman is no ordinary investor. As a matter of fact, he was a runner-up in Morningstar’s Fund Manager of the Decade award (see winner here). Besides stellar performance, how did Yacktman accomplish this honor? The answer is simple…a triangle. Yacktman wasn’t a geometry professor, but his investment philosophy is based on the three corners of this popular shape. Specifically, Yacktman looks to invest in companies trading at good prices, that are good businesses, with good management teams. Stated differently, one side of the investment philosophy represents a low purchase price, while the other sides represent good businesses and shareholder-oriented management.

Where the Magic Began

Like any legendary investor, experience plays a huge role in becoming a market master. Yacktman is no exception. Yacktman is the President and Co-Chief Investment Officer of Yacktman Asset Management Co., overseeing about $7 billion in assets. Prior to founding the firm in April 1992, he worked for 10 years as a portfolio manager at Selected Financial Services, Inc. and before then he served 14 years as a portfolio manager at Stein Roe & Farnham. Geographically, he has been all over the map. He earned his economics degree from the University of Utah and an MBA with distinction from Harvard University. After working for a longtime in Chicago, he decided to start the Yacktman Funds in Austin, Texas. Who knows, maybe the next stop will be Alaska or Hawaii?

Despite all the successes, life has not always been a bed of roses for Yacktman. As a matter of fact, during the late-1990s, the fund board attempted to oust him and investors left in a mass exodus. Even after posting stellar results in 2000-2003 relative to the S&P 500, Yacktman underperformed significantly in three out of four years from 2004 – 2007.

Managing to sidestep the technology bubble in 2000 and then the financial sector bubble in 2008 contributed tremendously to Yacktman’s outperformance (see graph).

As you can see, the long-term track record of the Yacktman fund has been exceptional (#1 fund on a 3 yr., 5 yr., and 10 yr basis), but anyone can eventually lose the Midas touch – Bill Miller’s 15 consecutive market-beating returns subsequently reversed into a financial disaster in the following years (see Revenge of the Dunce). Even with all the boos and cheers Yacktman has received over the years, some of that attention should be directed towards his son Stephen Yacktman (Co-Manager of Yacktman funds) and other Co-Manager Jason Subotky.

More Yacktman Investment Nuts & Bolts

There are other key elements to the Yacktman strategy beyond the triangle philosophy. For example, Yacktman preaches the importance of patience, long-term thinking, and the ability to develop a repeatable process.

And how does Yacktman find these great opportunities for his funds? Driving the process of picking stocks is the ability to price equity securities like bonds. Using cash flows, inflation expectations, and forecasted growth, the Yacktman team derives a forward rate of return that they can compare against a broad set of investment alternatives, including bonds. This framework is very consistent with my free cash flow yield ranking system I use. If opportunities do not present themselves, Yacktman is not afraid to raise cash levels to unorthodox levels (e.g., around 30% cash near the 2007 peak).

Since the differential in return opportunities has narrowed between what Yacktman defines as high quality and low quality, he has shifted more of the portfolios toward Blue Chip companies, like News Corporation (NWS), PepsiCo, Inc. (PEP), Coca-Cola Company (KO), Procter & Gamble Company (PG), and Microsoft Corporation (MSFT). Since the return opportunity spreads have narrowed, Yacktman feels he can get more bang for his risk buck by investing in quality large capitalization stocks.

With a long-run magical track record like Donald Yacktman’s, it is difficult to critically critique his systematic investment process. By implementing a few cornerstones of Yacktman’s investment philosophy, we should all be able to triangulate a better investment strategy four ourselves.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in YACKX, YAFFX, NWS, PEP, PG, KO, MSFT, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Bove on Goldman-Facebook Deal: Hug the Public!

In a recent research report titled, Has Goldman Learned Anything?, esteemed Rochdale Research analyst Richard Bove chimed in about the recent controversy surrounding the failed U.S. private offering of Facebook shares by Goldman Sachs (GS) to the bank’s wealthiest clients. In the note, Bove states the following:

“The company is embroiled in a ‘headline’ controversy surrounding its handling of a Facebook offering which implies that Goldman does not understand the public’s interest at all.”

Bove goes onto add:

“I fear that this company may not yet understand that those actions that do not appear to be in the public’s interest can, in fact, harm the company.”

I’m having a real difficult time understanding how Goldman privately raising funds for a private company has anything to do with the public? Am I wrong, or don’t millions of private companies raise capital every year without getting approval from Mr. Joe and Mrs. Josephine Public? What exactly does Bove want Goldman CEO Lloyd Blankfein to say to Facebook chief Mark Zuckerberg?

“Oh hello Mr. Zuckerberg, this is Lloyd Blankfein calling from Goldman Sachs, and if I understand it correctly, you are interested in raising $1.5 billion for your company. I know you are arguably the greatest internet brand on this planet, but unfortunately I do not think we can help you because I believe the broader public may not be happy with their lack of ability to participate in the offering. If you don’t have Morgan Stanley’s or JP Morgan’s phone number, just let me know because perhaps they can assist you. Have a great day!”

Come on…Goldman Sachs is not a charitable organization with a mission to make the world a better place – they are one of thousands of publicly traded companies attempting to grow profits. Sure, could Goldman have more discreetly pursued this offering without attracting the massive media barrage? Absolutely. But let’s be fair, the buzz around Facebook is deafening and the paparazzi are following Mark Zuckerberg around as closely as Raj Rajaratnam chases insider trading tips. New York Times columnist and reporter Andrew Ross Sorkin (see Too Big to Fail book review) summed it up best when he said, “You take the words Facebook and Goldman Sachs and put them in the same sentence, it becomes a media sensation unto itself. So I think this was bound to happen one way or the other.”

So while I have no reason to cheerlead for Goldman Sachs, and I’m sure there are plenty of other reasons for the investment bank to be crucified, attempting to raise money for a private company is not a felony in my book. I commend Richard Bove’s altruistic intentions in protecting the public from Goldman Sachs’s evil capital raising activities, and I may even contribute to a group hug with the mass investing public. If he catches me on the right day, I may even give CEO Lloyd Blankfein a hug.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, MS, JPM, Facebook, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.