Posts filed under ‘Profiles’

Too Big to Sink

If I got paid a nickel for every time I heard the phrase “too big to fail” to describe the state of affairs of our major financial institutions, I’d be retired on my private island by now. Jeremy Grantham, famed value investor and Chairman of Grantham Mayo Van Otterloo, recently compared the redesigning of our financial system to the Titanic and aptly described the hubris surrounding the ship’s voyage as “too big to sink!”

Mr. Grantham argues that many of the financial institution reform proposals have an irrelevant, misguided focus on improving the safety of the Titanic’s lifeboats rather than the structural design or competence of the captain. Maybe it’s better to plan for disaster prevention rather than disaster preparation? Grantham adds:

“By working to mitigate the pain of the next catastrophe, we allow ourselves to downplay the real causes of the disaster and thereby invite another one.”

When analyzing system failures, incentives are important to understand too. For example, the ship was “under-designed” and the captain had an ill-advised reward baked into a compensation bonus, if he beat the speed record (see article on compensation).

The Solution

Rather than protecting the bankers’ interests, Grantham contends we need “smaller, simpler banks that are not too big to fail.” At the heart of these massive financial conglomerates, pruning is necessary to separate the risky, proprietary trading departments, thereby ridding an “egregious conflict of interest with their clients.” As a former fund manager for a $20 billion fund, I was acutely aware of how my fund trading information and my conversations were being tracked by investment bankers and traders for themselves and their clients’ benefit. When the banks are managing your money alongside their own money, greed has a way of creeping in.

Beyond the prop trading desk legislation, Grantham believes those financial institutions “too big to fail” should be cut down into smaller pieces that can actually fail. Many of these entities are already what I like to call, “too complex to succeed,” evidenced by the stupefied responses provided by Congressmen and the CEOs of the banking institutions during the aftermath of the crisis. Reintroduction of some form of Glass-Steagall legislation (separation of investment banks from commercial banks) is another recommendation made by Grantham.

These suggestions sound pretty reasonable to me, but the bankers scream “If we become smaller and simpler and more regulated, the world will end and all serious banking will go to London, Switzerland, Bali Hai, or wherever,” Grantham adds in a mocking voice. If the foreigners want to operate irresponsibly, then Grantham says let them suffer the negative consequences every 15 years, or so.

The political will of legislators will be tested if substantive financial reforms actually come to pass. Jeremy Grantham understands the extreme importance of reform as explained concisely here, “A simpler, more manageable financial system is much more than a luxury. Without it we shall surely fail again.” Fail that is…like a sinking Titanic.

Read Jeremy Grantham’s Full Quarterly Newsletter

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Meat & Potatoes Investing with Joel Greenblatt

Joel Greenblatt has a long resume. Besides being the founder and managing partner of Gotham Capital, Mr. Greenblatt is the author of The Little Book That Beats the Market and an adjunct Professor at Columbia Business School. Now he is adding “Quant-fund Manager” to his work history. In his recent CNBC interview (below), Greenblatt discusses the real-world portfolio implementation of his “Magic Formula” on www.FormulaInvesting.com, a new venture he has undertaken.

The Magic Formula as it turns out is not all that magical, but rather very simple. The formula is based on two straightforward meat and potato factors gathered from Standard & Poor’s data: 1) the trailing Price/Earnings ratio on a stock (value factor); and 2) the Return on Capital ratio of a stock using historical earnings. The portfolio management strategy is fairly basic as well. Twenty to thirty securities are selected from the model, with the ability of the investor to customize if they so choose, and the portfolios are rebalanced on an annual basis making sure any relevant tax-loss selling occurs before the end of the calendar year.

Based on the back-tests, the model portfolio was up +291% over the last 10 years versus down -2% for the S&P 500 index. For 2008, however, the performance of the Magic Formula was not too enchanting – down about -36% versus -37% for the S&P 500 index, according to Greenblatt.

As with any back-test, or model, I am very skeptical about the output and inferences that can be drawn. Here are a few reasons why:

1) Past ≠Future: Just because this strategy worked in the past doesn’t mean it will work in the future. Greenblatt admits that the strategy can underperform for long periods of time.

2) Limited Data: Ten years is an extremely limited period of time to base a robust strategy on – much more data should be used.

3) Cost Estimates: Following a potentially very illiquid, out of favor value strategy with possibly large sums of money can cause past results to look quite different. Factors such as trading costs and impact costs can be underappreciated in computer based back-tests.

4) Data Mining: With any model, problems can arise when reams of data are sliced and diced for the sole purpose of creating a positive outcome. Often, there are no cause and effect between a variable and future returns, yet practitioners will jump to that conclusion because the factors fit the data.

To learn more about shortcomings in quantitative models, I suggest you learn more about butter production in Bangladesh (read article here). I will eagerly watch how Mr. Greenblatt’s “Magic Formula” works from a distance. In the mean time, I’m hungry. I think I’ll keep it simple…a steak and baked potato.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Now You See It, Now You Don’t: TARP

Elizabeth Warren, who oversees the TARP (Troubled Asset Relief Program), along with being the Chair on the Congressional Oversight Panel and a professor at the Harvard Law School, goes out on a limb and candidly states, “ We not only don’t know [where the TARP money is], Maria, we’re not ever going to know.”

Ms. Warren is quick to blame former Treasury Secretary Henry “Hank” Paulson for not implementing accountability for the TARP funds handed to the large commercial and investment banks (see my earlier TARP article). How do you prove the money handed over to the banks was used for non-lending activities, such as marketing, compensation, television advertising, dividends, acquisitions or other corporate purposes other than lending? The short answer…you can’t! Even if TARP capital tracking was instituted, I think it would have been a fruitless effort since even legitimate use of the TARP funds would only free up additional capital for other suboptimal purposes. If my mom gave me $100 while I was struggling for money in college and told me to use it for food – well I, like a good chunk of students, would have eaten anyways without the handout. The windfall $100 bailout would likely be used for a guys trip to Las Vegas or some Laker basketball tickets. The banks will certainly lend, but not at the same pre-Lehman bankruptcy levels, regardless of whether TARP tracking was instituted or not. Ms. Warren correctly points out that regulators are speaking out of both sides of their mouths. The government wants banks to lend more (which reduces the bank’s capital base) and also raise their sickly reserve levels at the same time.

See TARP commentary on CNBC video interview at minute 2:48

Maria Bartiromo also probes the topic of executive pay compensation given a recent Congressional proposal that TARP recipients cut salaries of the top 25 executives by -90%. Seems like a reasonable request given the circumstances. However, having the government force banks into making bad loans is probably not the right answer. This stance will only force the banks to take higher loan deliquency provisions and recognize more potential writedowns in the future. Eventually the Fed will cut interest rates paid to banks on the reserves held at the central bank, thereby invcentivizing the banks to take advantage of the steeper yield curve and make handsome spreads on loans.

Until then, some of the banks will sit patiently on their TARP capital (not lending) while Ms. Warren and government officials will wonder how the billions of TARP bailouts magically disappeared.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management and its clients had a direct position in VFH and BAC shares at the time this article was originally posted. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Siegel Digs in Heels on Stocks

Jeremy Siegel, Wharton University Professor and author of Stocks for the Long Run, is defending his long-term thesis that stocks will outperform bonds over the long-run. Mr. Siegel in his latest Financial Times article vigorously defends his optimistic equity belief despite recent questions regarding the validity and accuracy of his long-term data (see my earlier article).

He acknowledges the -3.15% return of U.S. stock performance over the last decade (the fourth worst period since 1871), so what gives him confidence in stocks now? Let’s take a peek on why Siegel is digging in his heels:

Since 1871, the three worst ten-year returns for stocks have ended in the years 1974, 1920, and 1978. These were followed, respectively, by real, after-inflation stock returns of more than 8 per cent, 13 per cent, and 9 per cent over next ten years. In fact for the 13 ten-year periods of negative returns stocks have suffered since 1871, the next ten years gave investors real returns that averaged over 10 per cent per year. This return has far exceeded the average 6.66 per cent real return in all ten years periods, and is twice the return offered by long-term government bonds.

Siegel’s bullish stock stance has also been attacked by Robert Arnott, Chairman of Research Affiliates, when he noted a certain bond strategy bested stocks over the last 40 years. Here’s what Mr. Siegel has to say about stock versus bond performance:

Even with the recent bear market factored in, stocks have always done better than Treasury bonds over every 30-year period since 1871. And over 20-year periods, stocks bested Treasuries in all but about 5 per cent of the cases… In fact, with the recent stock market recovery and bond market decline, stock returns now handily outpace bond returns over the past 30 and 40 years.

If you’re 50, 60, or older, then Siegel’s time horizons may not fit into your plans. Nonetheless, in any game one chooses to play (including the game of money), I, like many, prefer to have the odds stacked in my favor.

In addressing the skeptics, such as Bill Gross who believes the U.S. is entering a “New Normal” phase of sluggish growth, Mr. Siegel notes this commentary even if true does not account for the faster pace of international growth – Siegel goes on to explain that the S&P 500 corporations garner almost 50% of revenues from these faster growing areas outside the U.S.

On the subject of valuation, Mr. Siegel highlights the market is trading at roughly 14x’s 2010 estimates, well below the 18-20x multiples usually associated with low-interest rate periods like these.

In periods of extreme volatility (upwards or downwards), the prevailing beliefs fight reversion to the mean arguments because trend followers believe “this time is different.” Just think of the cab drivers who were buying tech stocks in the late 1990s, or of the neighbor buying rental real estate in 2006. Bill Gross with his “New Normal” doesn’t buy the reversion argument either. Time will tell if we have entered a new challenging era like Mr. Gross sees? Regardless, Professor Siegel will be digging in his heels as he invests in stocks for the long run.

Read the Whole Financial Times Article Written by Professor Siegel

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Strong Advice from Super Swensen

Playing the financial markets is a challenging game, and over the last decade we’ve witnessed events we will never see again in our lifetimes. Through these muscle aches and pains, listening and paying attention to powerful, seasoned industry veterans, like David Swensen, becomes paramount. Mr. Swensen has proven his durability – he has managed the Yale endowment for 24 years and has overseen the growth of the university’s portfolio from $1 billion to $17 billion. For the decade ending in June 2008, the Yale portfolio averaged an incredible 16.3% annual return.

So what commanding advice does Mr. Swensen have to share? Here are a few nuggets regarding equities as discussed in his May interview published in The Guru Investor (TGI):

“With a long time horizon you should have an equity orientation, because over longer periods of time, equities are going to deliver better results,” he says. “If they don’t, then capitalism isn’t working. And we could well be at a point where investments in equities are going to produce returns going forward that are higher than what we’ve seen in the past five or ten years.”

I find it difficult to argue with him. Perhaps we still have a ways to go, but the equity markets had an explosion after the 1966-1982 hiatus. Perhaps the 2000-2009 period isn’t long enough to mark bottom, but at a minimum, the spring is coiling based on history.

When it comes to diversification, TGI summarized Swensen’s asset allocation as follows:

“He recommends that investors have 30% of their funds in U.S. stocks, 15% in Treasury bonds, 15% in Treasury Inflation-Protected Securities, 15% in Real Estate Investment Trusts, 15% in foreign developed market equities, and 10% in emerging market equities. As investors get older, they should keep this type of allotment for a portion of their portfolio but begin to decrease the size of that portion, putting part of their portfolios into less risky assets like cash or Treasuries.”

Many investors were taking excessive risk in 2008 (within their asset allocations), and they were not even aware. Let’s hope valuable lessons have been learned and investors adjust the risk levels of their portfolios as they age.

Mr. Swensen has some choice words for the mutual fund management industry as well:

“The problem is that the quality of the management in the mutual fund industry is not particularly high, and you pay an extraordinarily high price for that not-very-good management,” he says. Swensen cites one study performed by Rob Arnott that measured mutual fund performance over a two-decade period. The study found that you’d have had a 15% chance of beating market after fees and taxes by investing in mutual funds — and that includes only funds that were around for the entire period; many other weaker funds didn’t last, meaning the results have a survivorship bias.

Tough to disagree, and as I’ve written in the past, I believe there are only so many .300 hitters in baseball (a study in 2007 showed only 12 active career .300 hitters in the Major Leagues – highlighted in my previous Ron Baron article). Outside of baseball, there are consistent alpha generators in the market too. However, I’d make the case that identifying the alpha generators in the financial markets is much more difficult because of the extreme fund performance volatility. Even the best managers can string some bad years together.

Swensen doesn’t stop there. He expands on the reasons behind mutual fund manager underperformance:

Taxes and fees are the big culprits, Swensen says: “Why are the tax bills so high? Because turnover’s too high. The mutual fund managers are trading the portfolios as if taxes don’t matter, and taxes do matter. And they’re trading the portfolios as if transactions cost and market impact don’t matter, and they do matter. And as they trade the portfolios, basically what’s happening is Wall Street is siphoning off its slice of the pie … and that’s at the expense of the investor.”

One thing we learned from the real estate and financial bubble that burst over the last few years is that incentive structures were misaligned. Manager compensation, whether you are talking hedge funds or mutual funds, is based on too short a time horizon, and therefore incentive structures encourage abnormal risk-taking. In baseball terms, you have those that take excessive risk and swing for the mega-bucks fences (loose cannons) and the bunters (benchmark huggers) who seek the comfort of “lower” mega-bucks. Swensen is a much bigger believer in passive strategies (as am I), using passive investment vehicles like ETFs (Exchange Traded Funds).

Mr. Swensen continues his critical perspective by targeting investors too:

Individuals and institutions who buy mutual funds “take this mutual fund industry which produces a bunch of products that are not great to start with, and then they screw it up by chasing hot performance and selling after things turn cold.”

The 1984-2002 John Bogle data (Vanguard) included in my “Action Dan” article hammers that point home.

Where should investors go now?

Asked what the one recommendation he has right now for investors is, Swensen cited TIPS. “We’ve had this massive fiscal stimulus, massive monetary stimulus, and it’s hard to see how that doesn’t translate into pretty substantial inflation, or at least pretty substantial risk of inflation … down the road at some point,” he said.

Ditto, once again – I’m a believer in having some inflation protection in your portfolio. Of course there is no free lunch in the investment world, and so there are certainly some risk factors in Swensen’s alternative investment strategy (e.g. hedge funds, private equity, and real estate). Certainly, due to significant illiquidity and other factors, many of these areas got absolutely hammered in 2008.

The best investors prepare their portfolios for these strenuous times. Do yourself a favor and work on your muscle tone too – and listen to the strong advice of David Swensen.

Read the Full TGI Article Here

Wade W. Slome, CFA, CFP

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management and client accounts do have direct long positions in TIP at the time article was originally posted. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Metamorphosis of a Bear into Bull

James Grant, a self-admitted, “glass half-full kind of fellow,” recently contributed a Wall Street Journal article predicting the economic recovery will be a “bit of a barn burner.” Traditionally a pessimist, he recently experienced the metamorphosis from a bear to a bull. James Grant is a multi-book author who has written for the Interest Rate Observer for more than 25 years with thoughtful observations on economics and interest rates. With a value-tilted investment philosophy, Mr. Grant prides himself as a contrarian and anti-CNBC advocate.

Current Environment

Markets have transitioned from sheer panic (what Grant calls the “bomb shelter”) to a manageable utter fear – meaning a lot of investors still have cash stuffed under the mattress in low yielding money market and CD (Certificates of Deposit) accounts. This bed cash will ultimately act as dry powder to ignite the market higher, should earnings and macroeconomic variables continue to improve. Despite the approximate 60% index bounce from the March 2009 lows, the S&P 500 still remains more than 30% below the late 2007 highs.

Glass Half Empty Crowd

Skeptics of the market advance generally fall into one of the following buckets:

1) Armageddon is coming, just wait. Our country is choking on too much debt.

2) The stock market advance is merely a bear market rally within a secular bear market.

3) Rally fueled by temporary stimulus, which once it dries up will lead to another recession and bear market.

4) Earnings results that are coming in better than expected are merely coming from unsustainable cost-cutting.

Grant’s Rose-Colored Glasses

James Grant has a different view of the unfolding recovery in light of historical cycle patterns:

“Growth snapped back following the depressions of 1893-94, 1907-08, 1920-21 and 1929-33. If ugly downturns made for torpid recoveries, as today’s economists suggest, the economic history of this country would have to be rewritten.”

Consistent with Mr. Grant’s views, Michael T. Darda, chief economist of MKM Partners stated “The most important determinant of the strength of an economy recovery is the depth of the downturn that preceded it. There are no exceptions to this rule, including the 1929-1939 period.” Grant goes on to compare the current recession with the 1981-82 variety:

“[During] the first three months of 1982, real GDP shrank at an annual rate of 6.4%, matching the steepest drop of the current recession, which was registered in the first quarter of 2009. Yet the Reagan recovery, starting in the first quarter of 1983, rushed along at quarterly growth rates (expressed as annual rates of change) over the next six quarters of 5.1%, 9.3%, 8.1%, 8.5%, 8.0% and 7.1%. Not until the third quarter of 1984 did real quarterly GDP growth drop below 5%.”

Further support for a stronger than anticipated recovery is provided via data supplied by the Economic Cycle Research Institute:

“The institute’s long leading index of the U.S. economy, along with supporting sub-indices, are making 26-year highs and point to the strongest bounce-back since 1983. A second nonconformist, the previously cited Mr. Darda, notes that the last time a recession ravaged the labor market as badly as this one has, the years were 1957-58 —after which, payrolls climbed by a hefty 4.5% in the first year of an ensuing 24-month expansion.”

Mr. Grant does not promise as large a recovery implied by Mr. Darda, but historical standards point in that direction, especially when you factor in vast pools of cash and cautious prognosticators and economists such as Ben Bernanke, Warren Buffett, and Paul Volcker. These financial “giants” have not deterred Mr. Grant’s metamorphosis from a bear to a bull.

Click Here to Read Full Grant WSJ Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and at the time of publishing had no direct positions in BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Action Dan (Poker King) and Professional Investing

As I write in my book (How I Managed $20,000,000,000.00 by Age 32), successful investing requires skillful use of both art and science. What I find so fascinating is that the same principles apply to poker playing. Like investing, poker is also a game of skill that rewards a player who adequately understands the mathematical probabilities (science) while still able to appropriately read the behavior of his or her opponents (art). Take for example professional poker player and 1995 WSOP champ Dan Harrington. In 2003 he finished 3rd at the World Series of Poker Main Event (the Super Bowl of poker) out of a pool of 839 players. In 2004, the following year, despite the pool more than tripling to 2,576 participants, Mr. Harrington managed to finish 4th and take home a cool $1.5 million in prize money. Did luck account for this success? I think not. Odds, if left to chance, would be 1 in 25,000 for repeating this feat, according to the Economist.

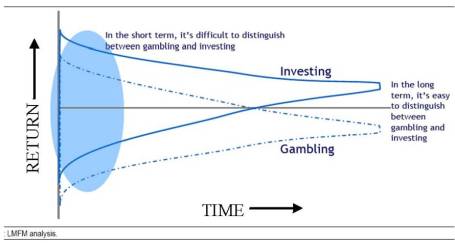

In the short-run, random volatility and luck can make the average investor look like Warren Buffett, but because of the efficiency of the market, that same average investor will look like a schmuck over the long-run. Legg Mason Funds Management put out an incredible chart that I believe so elegantly captures the incoherent and meaningless, short-term noise that the media attempts to interpret daily. What appears like outperformance in the short-run may merely be the lucky performance of a reckless speculator.

Dan Harrington, and so many other talented professionals know this fact all too well when an inexperienced “donkey” over-bets a clearly inferior hand, only to nail an inside-straight card on the “river” (last card of the round) out of pure luck – thereby knocking out a superior professional player. Over the long-run these out-of-control players end up losing all their money and professionals relish the opportunity of playing against them.

Talk to professionals and ask them what the biggest mistake new players make? The predominate answer: novices simply play too many hands. In the world of investing, the same can be said for excessive trading. Commissions, transactions costs, taxes and most importantly, ill-timed, emotionally driven trades lead the average investor to significantly underperform. I’ve referenced it before, and I’ll reference it again, John Bogle’s 1984-2002 study shows the significant drag the aforementioned costs have on professionals’ performance, and especially the average fund investor that underperformed the passive (a.k.a., “Do Nothing” strategy) S&P 500 return by more than a whopping 10% annually!

I consider myself an above average player, and I’ve won a few small tournaments, but match me up against a professional like “Action Dan” Harrington and I’ll get destroyed in the long-run. Investing, like professional poker, can lead to excess returns with the proper integration of patience and a disciplined systematic approach. I strongly believe that all great long-term investors successfully implement a strategy that marries the art and science aspects of investing. Don’t hold your breath if you expect to see me on ESPN, it may be a while before you see me at the Final Table with Dan Harrington at the World Series of Poker.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and at the time of publishing had no direct positions in LM, DIS, or BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Spitzer the Pot Calling the Fed Kettle Black

Eliot Spitzer, whose job as the former Attorney General of New York was to convict criminals, was forced to quit himself as Governor for his illegal solicitation of prostitutes that he funded with secretive ATM withdrawals of government funds. Now, Mr. Spitzer is getting on his soapbox and telling others the Federal Reserve has been committing a Ponzi Scheme.

There are a lot of conspiracy theories floating around regarding the Fed’s motives and questions relating to the benefits of those receiving government bailout funds. Dylan Ratigan’s interview of Mr. Spitzer on MSNBC feeds into these conspiracy views. I can buy into conflicts of interests and the need for more transparency arguments, but let’s be realistic, this is not the DaVinci Code, this is the slow, bureaucratic Federal Government. Even if you buy into this skeptical belief, the Fed isn’t exactly a “black box.” The Fed proactively provides the minutes from its private meetings and systematically releases a full accounting of the Fed’s balance sheet (assets).

Mr. Spitzer and other critics point to the egregious benefits handed down to the banks and financial institutions through the bailouts and monetary system actions. Well, wasn’t that the idea? I thought our banking system (and the global banking system) was on the verge of collapse and we were trying to save the world from impending disaster? So, I think most people get the fact that our financial institutions needed a lifeline to prevent worse outcomes from occurring.

Should the Fed have carte blanche on all financial system decisions? Certainly not, but extreme situations like this generational financial crisis we are slogging through now, requires extreme measures.

Accountability I believe is even more important than the micro-managing transparency details Ron Paul (Republican/Libertarian Congressman from Texas) and others are asking for. If indeed it is the Fed’s job to remain an independent body, then maybe it’s not Congress’ job to question every word and minor decision. However, when it comes to these massive bailouts (AIG, Fannie Mae, Freddie Mac, etc.), additional details and accountability should be provided and seems fair. What we don’t need are more regulatory bodies and committees creating more inefficiencies in an already tangled system of regulatory fiefdoms.

Before Mr. Spitzer starts pointing his finger at the black Fed-kettle, perhaps he should get his illegal decision making pot in order first?

Read Full Daniel Tencer Spitzer-Ponzi Scheme Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Words of Wisdom from the Money Flow Master

When Laszlo Birinyi talks, people should listen. Laszlo Birinyi, President of Birinyi Associates, has seen a lot in his days on Wall Street and he has the gray hair to prove it. Mr. Birinyi joined Salomon Brothers in 1976 with the job of developing products and analysis for the firm’s clients and traders. In 1989, after departing Salomon Brothers, Mr. Birinyi left to form Birinyi Associates where Bloomberg LP became a key client for a variety of equity functions.

When Laszlo Birinyi talks, people should listen. Laszlo Birinyi, President of Birinyi Associates, has seen a lot in his days on Wall Street and he has the gray hair to prove it. Mr. Birinyi joined Salomon Brothers in 1976 with the job of developing products and analysis for the firm’s clients and traders. In 1989, after departing Salomon Brothers, Mr. Birinyi left to form Birinyi Associates where Bloomberg LP became a key client for a variety of equity functions.

Mr. Birinyi made the concept of “money flow” – a price direction indicator based on supply-demand trade volume data – a key pillar for his clients’ research. Having lived through and studied many market cycles, Mr. Birinyi tries to take the emotion and misleading media headlines out of the investment decision making process. The “wall of anxiety” is very normal to be present in market cycle bottoms, but the market is always looking ahead. Rather than listen to the talking heads on television, Mr. Birinyi chooses to listen to the market statistics. The current market thinking is that we’ve come too far, too fast, therefore we are positioned for an imminent 10% pullback. Laszlo Birinyi calls the correction speak nonsense and highlights the limited data to support these claims. Mr. Birinyi begs for bears to “Give me the evidence…in 1982 we went 424 days before we had a correction. In 2000, we went seven years before we had a 10% correction. In 2002, we went three or four years.”

Click Here To View CNBC Interview

The bear case always sounds more intelligent, but based on his views into his crystal ball, Mr. Birinyi sees the S&P 500 hitting 1,700 over the next few years (approximately a 70% increase from current levels). What I like about Birinyi’s process is that it’s a strategy based on taking out emotions and following objective data – the strategy is not driven by witty, bearish media sound-bites.

I can’t objectively verify Laszlo Birinyi’s performance; however I can understand his sound, sage advice because his philosophy is based upon objective historical statistics and data, not on the whims of the skittish masses. Birinyi has been around for decades but in the coming weeks and months we’ll discover if the 10% correction boogeyman will spook him or not.

The Emperor Schiff Has No Clothes

In the Hans Christian Andersen fairy tale The Emperor’s New Clothes, the emperor unwittingly hires two swindlers whom he pays to create a special make-believe suit, which the cons claim appears invisible to stupid people. When the emperor cannot visibly see his clothes, he sheepishly avoids confronting the swindlers to escape appearing stupid. Not until a little boy, who is watching the royal precession, points out the “emperor has no clothes” does the emperor finally realize he has been had.

Peter Schiff, former stockbroker and President of Euro Pacific Capital, has been proudly parading along the business media network on route to his senatorial candidacy, taking credit for accurately predicting the timing of the economic financial collapse. Endless amounts of praise have swarmed the airwaves and cyberspace through countless interviews and YouTube clips.

Maybe the same lessons learned from aforementioned fairy tale can be applied to Mr. Schiff? Perhaps he too wears no clothes?!

Let’s take a look at Mr. Schiff’s track record. Certainly Mr. Schiff was correctly bearish on the housing market, albeit about five years too early. I thought “timing is everything?” Apparently not for the media masses judging Peter Schiff’s track record. Let’s take a look at the chief tea-leaf reader in 2002 when he was calling for NASDAQ to reach 500 and the Dow Jones Industrials to reach 2000.

As you can see documented in the video, the Dow didn’t ever come remotely close to collapsing from 10,000 to 2,000 and the NASDAQ didn’t plummet from 1,700 to anywhere near 500. The significant percentage of the Fortune 500 he predicted to file bankruptcy never materialized either. Rather the market proceeded to march upwards on a five year bull market run that led to a doubling in the S&P 500 index from the bottom in 2002. Like a broken clock, if you stubbornly stick to one position, chances are you will eventually become right (at least twice per day).

I am not the only person to question the accuracy of Mr. Schiff’s persistently bearish and often inaccurate calls.

For one, Mike Shedlock of Mish’s Global Economic Trend Analysis gave an incredibly detailed review of Schiff’s track record in an article titled, “Peter Schiff was Wrong.” To get a little flavor of the piece, here is an excerpt:

12 Ways Schiff Was Wrong in 2008

- Wrong about hyperinflation

- Wrong about the dollar

- Wrong about commodities except for gold

- Wrong about foreign currencies except for the Yen

- Wrong about foreign equities

- Wrong in timing

- Wrong in risk management

- Wrong in buy and hold thesis

- Wrong on decoupling

- Wrong on China

- Wrong on US treasuries

- Wrong on interest rates, both foreign and domestic

Todd Sullivan from Seeking Alpha wrote an equally scathing, although shorter, look at Mr. Schiff’s track record.

More recently the ever-bearish Schiff continues to call for a collapse in the U.S. dollar and economy but refuses to short (bet against) the U.S. market because a hyper-inflationary period may ensue, driving U.S. index prices higher. Wait a second; is he saying that buying U.S. equities would be a good hedge against rising inflation? All this talking in circles is getting me dizzy. As for his position on gold, just last year he said gold would hit $2,000 per ounce by 2009 – well if it rises 100%+ in the next few months, then Mr. Schiff will be right on target.

Peter Schiff certainly lacks no confidence in making bold predictions despite his spotty record. Whether you think Peter Schiff is an overly bearish buffoon filled with hot air, or you think he is the greatest market prognosticator since sliced bread, it never hurts to wipe your eyes to make sure the media king du jour is wearing clothes?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.