Posts filed under ‘Politics’

The SaaSpocalypse Has Arrived…Or Has It?

Well, the new month has started with a bang. Financial markets have not only experienced a bang from another military strike on Iran, but also an explosion of AI paranoia. As hundreds of billions of AI investment dollars flood into the economy, fears are intensifying that the AI displacement of workers could have a detrimental impact on the economy and financial markets.

The Monthly Scorecard

It was a mixed performance in the market last month. Geopolitical headlines surrounding Iran and the Middle East are currently front and center, but under the surface, the real story isn’t just geopolitics—it’s a growing investor anxiety around artificial intelligence and its disruptive potential. Here’s what happened last month:

- S&P 500: -0.9%

- Dow Jones Industrial Average: +0.2%

- NASDAQ: -3.4%

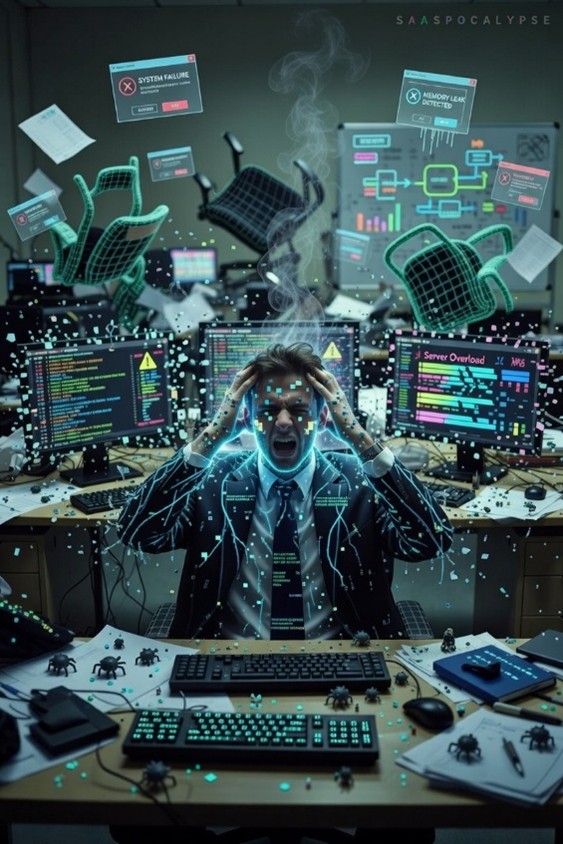

The “SaaSpocalypse” and the Tech Identity Crisis

Software stocks are currently under assault, plunging -9.7% for the month and a staggering -22.8% for the start of the year (as measured by the IGV iShares Software index). Analysts are calling this the “SaaSpocalypse” (Software as a Service)—a phenomenon where the market fear is that AI is “eating” software companies.

High-profile casualties have added fuel to the fire. IBM, for example, suffered its worst trading day in 25 years, dropping -13% in a single day. Concerns came to light that new AI agent coding tools like Anthropic’s Claude Code could threaten IBM’s legacy dominance in COBOL-based mainframe systems.

Paranoia vs. Reality

This “AI Paranoia” has spread far beyond Silicon Valley, infecting industries like transportation, banking, travel, real estate, and food delivery. Two major catalysts fueled this fire:

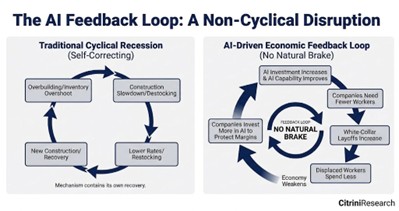

The Citrini Report: A viral, dystopian report from described an “avalanche” of white-collar firings (see chart below). The report argues that while the government may try to intervene with stimulus, it “won’t change the fact that an AI Claude agent can do the work of a $180,000 product manager for $200/month.”

Source: Citrini Research

- Corporate Reductions: High-profile cuts have validated these fears. Block Inc. (led by Jack CEO Dorsey, former Twitter Founder) announced it is slashing 40% of its workforce due to AI advancements, while Amazon recently eliminated 30,000 white-collar positions (10% of its corporate staff).

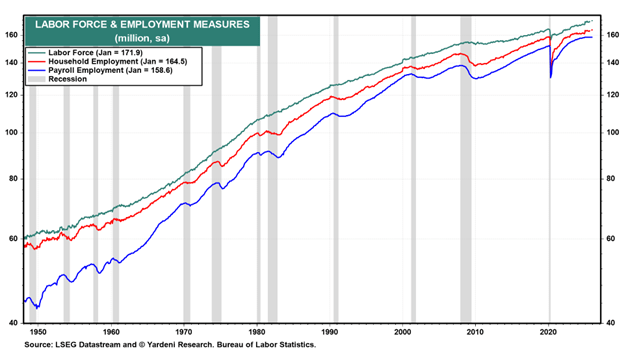

However, there is a silver lining to that perspective. While software jobs have flattened since ChatGPT arrived in late 2022, we have yet to see the “cliff dive” in total employment that many predicted. In fact, employment (165 million employed) and labor force (172 million) figures are near record levels, so we have not seen AI kill the economy quite just yet (see chart below).

Source: Yardeni Research and Bureau of Labor Statistics

The Great Rotation: Looking for “HALO”

As investors try to decipher the winners and losers, they are migrating away from technology and rotating into HALO stocks (Hard Asset, Low Obsolescence). These companies are seen as less susceptible to AI disruption. Evidence of this shift is clear in the outperformance of value, small-cap, and mid-cap stocks. Notably, the Dow Jones Industrial Average, an index heavy with hard asset exposure, just posted its 10th consecutive month of gains despite the broader technology stock volatility.

A Massive Bet on the Future

Despite the “bubble” murmurs, the AI juggernauts are doubling down. OpenAI just closed the largest private financing in history, raising $110 billion—including $50 billion from Amazon, $30 billion from NVIDIA, and $30 billion from SoftBank. The demand for compute and data centers remains insatiable, supported by the $700 billion being spent by the large hyperscalers (Amazon, Alphabet-Google, Microsoft, and Meta Platforms) this year.

Geopolitical and Legal Headwinds

Adding to the month’s complexity are external shocks:

- Middle East Tensions: Military strikes on Iran recently killed the Iranian Supreme Leader, Ali Khamenei, and other key leaders, injecting significant geopolitical risk.

- Tariff Uncertainty: The Supreme Court recently ruled against the IEEPA tariffs instituted by the Trump administration. While temporary alternatives are in place, the markets are waiting for a permanent solution to work through the courts.

Resilience in the Face of Technological Change

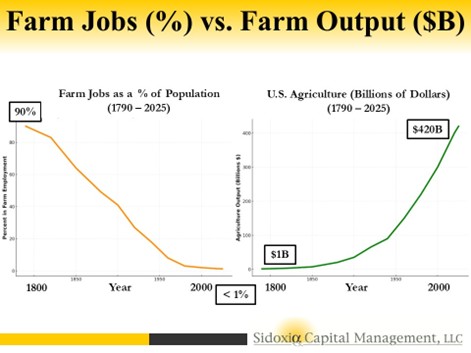

It is easy to get lost in the dystopian narrative, but history offers a more hopeful guide. Technology has been replacing human workers for centuries—from the looms of the Industrial Revolution to the tractors of the Agricultural Revolution – see chart below (1790 – 2025). In every instance, while specific roles were displaced, new industries emerged that not only soaked up the unemployed but expanded the labor force into areas we couldn’t have previously imagined (see also The Fallacy Behind Technological Innovation).

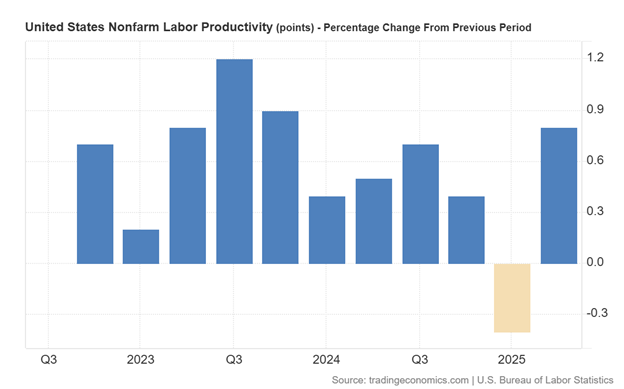

The reality today is that the economy remains remarkably strong. Employment data is resilient, labor force participation is near record levels, and corporate profits are breaking out to new all-time highs. Furthermore, the ISM Manufacturing PMI (Purchasing Managers Index) recently spiked to 52.6, signaling an expansion in a sector that had been declining for years (see chart below).

Source: Trading Economics

We are not witnessing the end of work, but rather a high-speed evolution. As we’ve seen before, the human capacity for innovation and adaptation usually outruns the machines.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Mar. 2, 2026). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AMZN, GOOGL, META, MSFT, NVDA, certain exchange traded funds (ETFs), but at the time of publishing had no direct position in IBM, XYZ or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Green Lights Everywhere… But Is It Time to Tap the Brakes?

The economic and market fundamentals appear to be flashing green lights everywhere. Growth is strong, inflation has cooled, and financial conditions have eased. Yet even with clear skies and open roads, experienced drivers know conditions can change quickly. It may not be time to slam on the brakes—but it could be time to keep a foot hovering nearby.

After the Federal Reserve aggressively applied the brakes in 2022 with seven rate hikes—taking the federal funds rate from 0.25% to 4.50%—the stock market declined nearly 19%. Since rates peaked at 5.50% in 2023, the Fed has cut rates six times, lowering them by a cumulative 1.75% to approximately 3.75%. Those cuts have helped pave the way for a smoother ride, providing a meaningful tailwind to equity markets.

That said, the most recent quarter-point cut produced mixed results. Last month, the Dow Jones Industrial Average rose +0.7%, the S&P 500 was essentially flat at –0.1%, and the NASDAQ lagged with a –0.5% decline.

Navigating the Winning Streak

We have encountered a few economic speed bumps along the way—tariffs and geopolitical events earlier in 2025, for example—but once investors realized those tariffs were more bark than bite (as I discussed previously in Tariff Sheriff), stocks resumed their impressive run. The market has now delivered three consecutive years of strong returns: 2023 (+24%), 2024 (+23%), and 2025 (+16%).

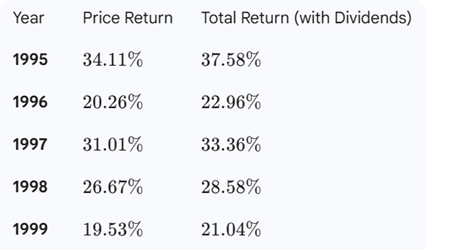

With these strong gains, today’s environment can feel like cruising on a national highway—clear roads, sunny skies, cruise control engaged, and little traffic in sight. The momentum could continue. Three strong years in a row do not rule out a fourth or fifth. In fact, the late 1990s offer a powerful reminder: from 1995 through 2000, the stock market averaged approximately 29% annual returns through the March 2000 peak (see table below). However, once the technology bubble burst, it took more than 13 years for the market to reclaim new year-end highs.

Source: Gemini

After more than three decades of investing, one lesson remains clear: trees can grow for years—but they do not grow to the sky forever. Bull markets often last longer than expected, but they eventually end.

Why the Forecast Looks Rosy

Several factors are supporting today’s strong market backdrop:

- Strong Economic Growth: Third-quarter GDP growth of 4.3% marked the fastest expansion in two years (see chart below)

Source: Trading Economics

- AI-Driven Productivity: GDP growth has remained robust even as unemployment has risen from 4.0% earlier in the year to approximately 4.6% today. Growth outpacing employment is the definition of productivity, and the proliferation of artificial intelligence is accelerating this trend. Large companies such as Amazon.com (AMZN), Microsoft (MSFT), Alphabet-Google (GOOGL), and Meta Platforms (META) have reduced headcount significantly by tens of thousands in recent years while revenues and profits continue to surge (see also Mag 7 Takes Cash to the Bank).

Source: Trading Economics

- Taming Inflation: Crude oil prices have fallen roughly 20% over the last year, and Owner’s Equivalent Rent (which makes up about one-third of CPI inflation) has been steadily declining—both positive signals for inflation pressures ahead (see chart below).

Source: Calafia Beach Pundit

- Lapping Tariffs: Tariffs represented a one-time price increase. As we move into 2026, their inflationary impact should diminish as those increases roll off.

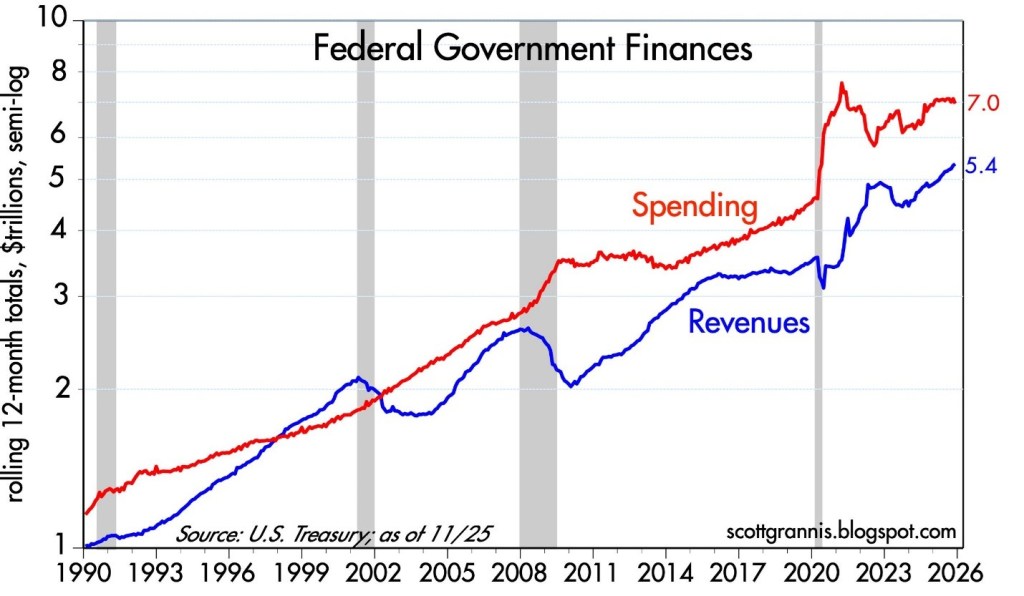

- Narrowing Budget Deficit: While debt and deficits remain headline risks, federal spending has been flat over the past year while revenues have increased roughly 10%, according to Scott Grannis (see chart below).

Source: Calafia Beach Pundit

- Tax Cuts & Higher Refunds Ahead: Many provisions of the One Big Beautiful Bill (OBBB) will be felt more fully in 2026, including 100% bonus depreciation for businesses, higher SALT deduction caps, increased standard deductions, no tax on tips or overtime, and a higher Child Tax Credit (CTC). Collectively, these could result in refunds up to $1,000 higher per individual.

Together, these factors could support continued market strength into 2026. But weather, road conditions, and markets can change quickly.

Reasons to Keep Your Foot Near the Brake Pedal

While the road looks smooth, several caution signs deserve attention:

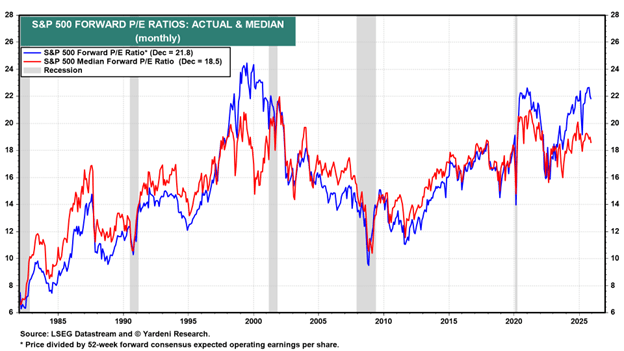

- Elevated Valuations: Forward price-to-earnings ratios (P/E) are at their highest levels since the late 1990s, outside of the brief post-COVID period. (see chart below).

Source: Yardeni Research

- Animal Spirits Are Back: Speculation has expanded well beyond traditional markets. Prediction platforms such as Kalshi, Polymarket, FanDuel, DraftKings, Robinhood, Coinbase, and others now allow bets on everything from political outcomes to economic data—further evidence of speculative behavior.

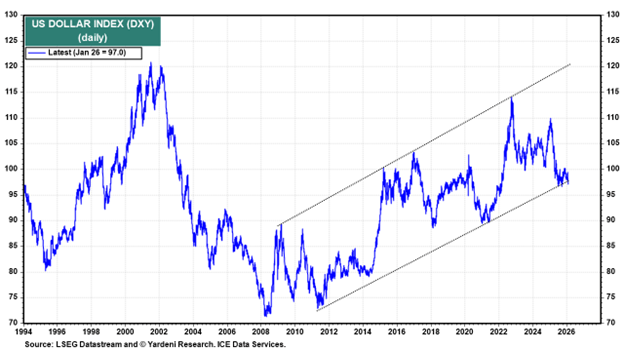

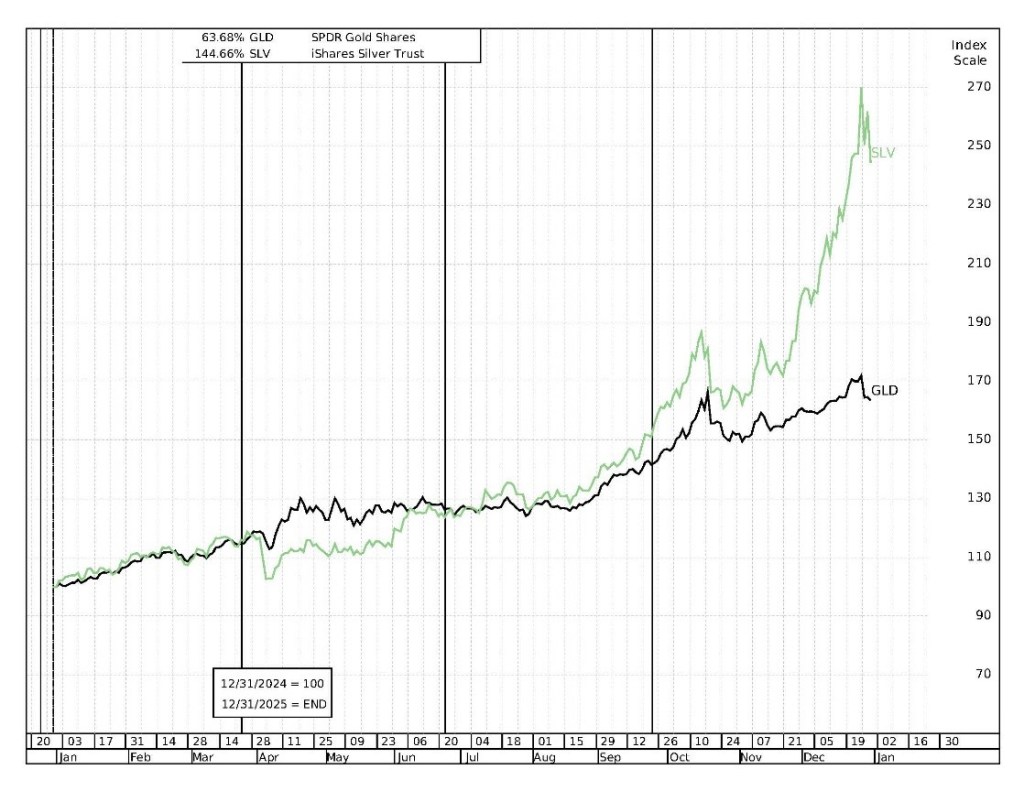

- Gold and Silver Speculation: Despite a relatively stable U.S. dollar over the past six months, gold rose +64% and silver catapulted +145% in 2025—moves difficult to justify by fundamentals alone (see chart below).

Source: MarketSurge

- Investor Complacency: The Volatility Index (VIX), often called the “fear gauge,” currently hovers near 15, well below its long-term average of 20. Historically, true fear doesn’t surface until readings exceed 25.

- Market Concentration: The “Magnificent 7” stocks represent roughly 1% of the companies in the S&P 500 but account for about 37% of the index’s weighting (see Mag 7 Takes Cash to the Bank)—a concentration reminiscent of the late 1990s. When leadership narrows, downturns can be sharper.

The Sidoxia View

At Sidoxia Capital Management, we have implemented all-weather, time-tested strategies through decades of both bull and bear markets. We believe diversification and disciplined risk management are essential—not fruitless prediction attempts. Rather than attempting to time short-term market moves, we focus on adapting portfolios to changing conditions and navigating inevitable financial potholes.

We don’t always get it right, but over the long run, this approach has allowed us to earn and retain the trust, loyalty, and confidence of our clients.

After three years of strong performance, it’s easy to assume clear roads and blue skies will continue indefinitely. But history teaches us that the most dangerous moments often occur when confidence is highest. This is not a call to abandon the journey—only a reminder to stay alert. When markets accelerate this quickly, discipline, diversification, and risk management matter more than ever.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Jan. 2, 2026). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in MSFT, GOOGL, AMZN, META, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in ORCL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

As We Give Thanks, AI and Mag 7 Take Cash to the Bank

Market volatility resurfaced last month as speculation intensified over whether an AI bubble may be forming—and potentially bursting. Yet despite the jitters, equity markets remain solidly positive for the year (S&P 500 +16.5%, NASDAQ +21.0%, Dow +12.2%) – see S&P 500 chart below. A significant portion of the gains have been powered in large part by ongoing strength in the Magnificent 7. Standouts such as NVIDIA (+31.8%) and Alphabet (+68.1%) have been instrumental in carrying the broader indices higher.

Even with these sizable year-to-date gains, memories of the 2000 Tech Bubble and 2008 Financial Crisis resurfaced and prompted investors to temporarily tap the brakes. Mid-month, the NASDAQ retreated roughly -9% from its October peak. After a month-end bounce, the S&P 500 finished essentially flat (+0.1%), the NASDAQ slipped -1.5%, and the Dow eked out a +0.3% increase.

OpenAI and the $1.4 Trillion Question

At the center of the AI controversy sits OpenAI, parent of the three-year-old technology toddler, ChatGPT (Generative Pre-trained Transformer), which now boasts more than 800 million global users (see chart below). The company reportedly runs at a $20 billion annual revenue pace, yet faces difficult questions about how it intends to fund its staggering $1.4 trillion AI infrastructure commitments.

Those concerns came to a head when tech investor Brad Gerstner pressed CEO Sam Altman on his podcast last month. Instead of answering how OpenAI plans to underwrite such an enormous buildout, Altman childishly shot back defensively:

“If you want to sell your shares, I’ll find you a buyer.” (See clip here — or full interview here)

Source: Digital Information World

OpenAI is a key player, but just one component in the vast—and rapidly expanding—web of global AI infrastructure. Gartner, a global research and advisory firm, forecasts $2 trillion of AI investment in 2026, while NVIDIA CEO Jensen Huang recently said:

“Over the next five years, we’re going to scale into… effectively a $3 to $4 trillion AI infrastructure opportunity.”

These provocative “Is this a bubble?” questions make for great headlines, but to truly evaluate AI sustainability, it’s wise to follow the classic Watergate guidance from of All the President’s Men character, Deep Throat (FBI Associate Director, Mark Felt), who tells journalist Bob Woodward to “follow the money,” if he wants to get to the bottom of the Watergate scandal.

The same principle applies to investors who follow the money – the picture looks very different from past bubbles.

Forget Pets.com—Today’s AI Buildout Is Being Funded by Cash-Rich Titans

Unlike the flimsy, profitless internet startups of the late 1990s—companies that raised billions based on “eyeballs” and cocktail-napkin business plans—the current AI buildout is being financed largely by profitable cash-generating giants.

Yes, some firms like Oracle (ORCL) are leaning on debt financing for data-center expansion. But the overwhelming majority of AI capex is being funded by customers and by the cash flow of the Magnificent 7, a group with the financial firepower to sustain multi-year spending without relying heavily on capital markets.

This dynamic alone separates today’s environment from classic bubble conditions.

Do the Magnificent 7 Really Deserve a $22 Trillion Valuation?

The Mag 7 represent only 1% of S&P 500 constituents yet account for a massive 35% of the index’s market value. That concentration understandably raises eyebrows, evoking historical parallels to the “Nifty Fifty” of the 1970s or the “Four Horsemen” of the 1990s.

But headline concentration can be misleading—because the fundamentals tell a very different story. Here are some of the major disparities:

1.) Mag 7 Share of Profits Matches Their Share of Market Value: The Mag 7 collectively contribute $22 trillion of the S&P 500’s $58 trillion total value (below). Said differently, the market values and weightings of the Mag 7 equate to about $22 trillion and 37% of the S&P 500, respectively:

· Nvidia Corp: $4.3T & 7.0%

· Apple Inc.: $4.1 T & 6.7%

· Alphabet Inc.: $3.9 T & 6.3%

· Microsoft Corp.: $3.7 T & 5.9%

· Amazon.com Inc.: $2.5 T & 4.0%

· Meta Platforms Inc.: $1.6T & 2.6%

· Tesla Inc.: $1.4T & 2.3%

· TOTAL: $22T / 37%

Source: Slickcharts

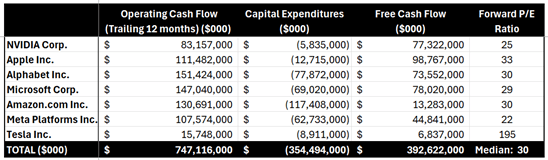

Conveniently (and importantly), the Mag 7’s roughly $747 billion in annual cash flow (see table below) is a good proxy for their profit contribution to the $2 trillion in S&P profits.

Source: SEC Filings & MarketSurge

The $747 billion in Mag 7 cash flows divided by the $2 trillion in S&P 500 coincidentally also equates to 37% ($747B/$2T).

These calculations of the Mag 7 are not bubble math—these calculation comparisons are rational math. Arguments could be made that Mag 7 market values are actually undervalued (not in bubble territory) and should appreciate to a higher percentage of the S&P 500 weightings because these 7 stocks are growing sales and profits faster than compared to the other “absentee” 493 stocks in the index.

2.) Mag 7 are Swimming in Cash: That $747 billion in annual cash flow is on track to hit a jaw-dropping $1 trillion, giving these firms ample capital to fund AI buildouts without substantially accessing the equity or credit markets. The ability to self-fund a multi-trillion-dollar infrastructure expansion is the opposite of bubble behavior.

3.) Valuations Are Elevated—but Far from Bubble Territory: During the 2000 Tech Bubble, many leading tech names traded at 100x+ earnings (See also: Rational or Irrational Exuberance. Today, the Mag 7 trade at a median forward P/E around 30x. Expensive? Historically, yes, versus long-term averages, but nowhere near historical extremes. Relative to growth, profitability, and cash flow, valuations are far more grounded today than during prior manias.

The bottom line is there is plenty to be thankful for and bubble fears are overstated. Despite pockets of AI froth, the underlying economic engine powering AI adoption is real, profitable, and well-capitalized. When investors follow the money, they discover:

· The Mag 7 generate over one-third of S&P 500 profits

· They generate and hold hundreds of billions in cash

· They largely fund their own AI capital expenditures

· Valuations remain far below bubble-era extremes

Investors have a lot to be thankful for. And while volatility will likely continue, the ingredients for a classic, catastrophic AI bubble are noticeably absent. For disciplined, long-term investing strategies like those employed at Sidoxia Capital Management, this environment still offers abundant opportunity—without the need to fear a pricked AI balloon anytime soon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Dec. 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN, META, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in ORCL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Markets Surge Higher Despite Shutdown Anxiety Fire

Wars rage on in Ukraine and Gaza, political violence is on the rise at home, tariff-driven inflation remains debated, and anxiety over a looming government shutdown is intensifying. On the surface, this might sound like the perfect recipe for a market meltdown. But Wall Street seems unfazed. In fact, U.S. equities pushed to new record highs again this month, continuing the bull market’s relentless advance in the face of these concerns.

Here is a market performance snapshot for the month:

- S&P 500: +3.5% (+13.7% year-to-date)

- Dow Jones Industrial Average: +1.9% (+9.1% year-to-date)

- NASDAQ Composite: +5.6% (+17.3% year-to-date)

What’s fueling the optimism?

• A Strong Economy: The economy just produced a final +3.8% GDP growth for the 2nd quarter, and the Atlanta Federal Reserve is forecasting an even stronger economy for the 3rd quarter of +3.9% (see below).

• Robust Corporate Earnings: S&P 500 corporate profits surged by +11.8% in the 2nd quarter and consensus estimates call for 3rd quarter growth of +7.9%. Historically, CEOs tend to set conservative forecasts, therefore actual results often exceed low-bar expectations. Therefore, it’s very possible that Q3 earnings growth could achieve double-digit growth levels once again.

• A.I. Drive Still Alive: With trillions of dollars in A.I. spending plans already announced, hungry investors once again gobbled up A.I. tech stocks last month. For instance, Oracle Corp’s (ORCL) stock jumped +24% for the month in large part driven by a $317 billion increase in backlog orders during the company’s first fiscal quarter. Reportedly, the majority of the massive increase in orders came from one customer, OpenAI – the brains behind the A.I. juggernaut, ChatGPT. The rise in Oracle’s share price temporarily propelled CEO Larry Ellison past Tesla’s (TSLA) CEO Elon Musk as the world’s richest person, before markets began critically questioning whether OpenAI’s CEO (Sam Altman) can ultimately fund the hundreds of billions of dollars in Oracle commitments.

Source: Atlanta Federal Reserve

Shutdown Jitter History

Market anxiety has shifted from a hypothetical government shutdown nightmare to a scary reality, given the funding deadlines have already lapsed. Many investors are asking what this means for stocks. Fortunately, government shutdowns are nothing new. Our country has flourished over the last 50 years despite experiencing around two dozen shutdowns, many of which only lasted a few hours, a few days, or a few weeks. According to Kiplinger, since the 1970s, the stock market has averaged a +0.3% return during shutdown periods (see chart below).

Source: Kiplinger

In fact, the longest shutdown on record occurred most recently from December 2018 to January 2019 (35 days during President Trump’s first term) and resulted in a sharp +10% gain (see chart below).

Source: Kiplinger / YCharts

The partisan finger-pointing will continue, but history suggests that shutdowns are short-term noise with little bearing on long-term market direction. Long-term investors understand there is never a shortage of concerns during bad times (e.g., potential recessions, job losses, credit defaults, bankruptcies, etc.), or good times as well (e.g. fear of inflation, restrictive monetary policy, politics, etc.). Turning off the TV is often the best course of action (see also – Turn Off the TV).

What’s Next? Looking Ahead After more than 30 years of investing—including weathering the dot-com tech sense of purpose collapse in 2000—I’ve learned that markets always have a tendency of climbing a wall of worry, so it’s better to not react emotionally to daily news headlines. Rather, it’s better for investors to stay focused on those market leading, innovative companies and concentrate on those sectors experiencing long-term secular trends.

As we enter Q4 and head toward 2026, A.I. remains the defining theme. Since the launch of ChatGPT in November 2022, the S&P 500 has surged +24% in 2023, +23% in 2024, and +14% so far in 2025. Unfortunately, trees do not grow to the sky forever.

At Sidoxia Capital Management, we understand that valuations currently are stretched on a historic basis and that markets never move in a straight line. As a result, a correction at some point in stock prices should not come as a surprise to anyone. Nevertheless, whether you’re bullish on the productivity gains from large language models (LLMs) or skeptical of over-investment and hype, one thing is clear: A.I. is here to stay, and it doesn’t matter if you believe the government shutdown flames will grow into an inferno or fizzle out in smoke, which is usually the case.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in ORCL, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Trade & OBBB Deals Sealed, Fed Dread, and AI/Meme Dreams

As the stock market reached new all-time highs, investors had plenty to juggle—both in Washington, D.C., and on Wall Street. The S&P 500 climbed +2.2%, the NASDAQ surged +3.7%, and the Dow Jones Industrial Average edged higher by +0.1% for the month.

The One Big Beautiful Bill

What has fueled the rally? A major catalyst was President Trump’s signing of the One Big Beautiful Bill Act (OBBB) on July 4th. The nearly 900-page legislation spans a broad range of economic issues including tax reform, healthcare, energy policy, and national security.

According to the Congressional Budget Office (CBO), the combined impact of tax cuts, new spending, and spending reductions will result in a net cost of $3.4 trillion over 10 years (see chart above). Supporters of the bill argue that this projection underestimates the long-term stimulative effects of tax relief and strategic investments. Whether the deficit widens as the CBO projects, or narrows thanks to a stronger, growing economy, remains to be seen.

Trade Deals Sealed

Since Liberation Day on April 2nd, trade negotiations have progressed unevenly. The administration’s reciprocal tariff hikes were paused through August 1st to allow final agreements to be reached. Following months of tough rhetoric, multiple major trading partners ultimately signed deals before the deadline—including the European Union, Japan, the United Kingdom, Vietnam, and South Korea—thereby avoiding punitive tariffs.

Talks with our two key trading partners, Mexico and Canada, remain ongoing. While Mexico was granted a 90-day extension amid constructive dialogue, Trump slapped a 35% tariff on Canada (from 25%) due to what the White house said was “continued inaction and retaliation.” The tariff pause with China stops on August 12th.

Here’s a list of the new country tariffs released by the president late yesterday: CLICK HERE

Regardless of all the tariff uncertainty, investor sentiment improved last month as the terms of the signed deals were significantly milder than originally feared.

Adding to the optimism:

- Core inflation in June remained modest at 2.8% (Reuters), and

- Tariff revenues collected through July reached $126 billion, beating initial estimates (Politico) – see chart below. Strategist Ed Yardeni forecasts that 2025 tariff revenues could surge to between $400 billion and $500 billion (Barron’s).

Source: Politico

Fed Dread

Of course, when it comes to financial markets, everything can’t just be rainbows and unicorns without something for investors to worry about—and this month, a key concern remains Federal Reserve policy. Critics, including the president, argue that interest rates are too high, with the Federal Funds Rate currently set at 4.25%–4.50% (Yardeni Research) – see chart below.

By comparison:

- The European Central Bank’s Deposit Facility Rate stands at 2.00%, and

- The Bank of Japan’s overnight rate is only 0.50%.

Source: Yardeni Research

Fed Chair Jerome Powell has held off on further cuts, citing the need for more clarity on inflation and labor market data, especially in light of recent tariffs. Ironically, when the Fed last cut rates by -1.00% late last year, the 10-year Treasury yield rose by roughly +1% (see chart above), reflecting fears of rising inflation.

This week, the Fed held rates steady for the fifth consecutive meeting (YouTube). Notably, two FOMC members—Christopher Waller and Michelle Bowman—dissented, voting in favor of a rate cut. It was the first dual dissent by Fed governors in over 30 years—a clear signal of division inside the central bank.

Meme Dreams

With the major indexes at new highs, speculation has returned in full force. Money-losing, struggling companies like Opendoor Technologies, GoPro Inc., and Kohl’s Corp. saw their shares double, triple, or even quadruple over a short span (WSJ) – see chart below. We saw similar trends occur during the GameStop and AMC meme craze in 2021.

Source: The Wall Street Journal

Adding fuel to the fire:

- Cryptocurrency prices are on the rise again.

- Euphorically priced IPOs (Initial Public Offerings) like Figma, Inc. (FIG), which more than tripled in value ($115 per share) on its first trading day above its offering price ($33 per share) valuing the company above $50 billion – more than 30 times next year’s forecasted revenues.

- SPACs (Special Purpose Acquisition Companies)—often criticized for poor governance—are staging a comeback.

Combined, all these trends raise concerns about froth, which investors have experienced at previous peaks.

Climb in AI Stocks Persists

No discussion of this rally would be complete without highlighting the AI mega-cap giants. Companies like Alphabet (Google), Meta (Facebook), Microsoft, and Amazon all recently announced capital expenditures for 2025 that will likely exceed an astounding $350 billion —most of it allocated to AI infrastructure.

Meanwhile, NVIDIA Corp., the AI-chip juggernaut and major beneficiary of all the AI capex, has seen its share price soar +63% in just three months, reaching a staggering $4.4 trillion market value.

Source: Yardeni Research

Valuations High but Fundamentals Remain Strong

While stock valuations remain elevated above historical averages (the S&P 500 red line trades at 22x forward earnings, according to Yardeni) – see chart above, the macro backdrop remains supportive:

- The economy is strong,

- Unemployment is low,

- Corporate profits are growing, and

- Monetary policy may turn more accommodative in coming months.

In this momentum environment, the market should continue its productive juggling, but if the frothy or economic winds worsen, investors should be prepared for a dropped ball.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GOOGL, META, AMZN, MSFT, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in OPEN, GPRO, KSS, GME, AMC, FIG or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Mideast War an Investor Bore as Markets Soar

If I told you at the beginning of the year that the U.S. would bomb key nuclear sites in Iran, would you have guessed that Middle East stability would follow—and that global financial markets would soar to record highs? Personally, I wouldn’t have bet on that outcome. But that’s exactly what happened last month. While geopolitical dynamics remain fluid, markets shrugged off the chaos. The S&P 500 rallied +5.0%, the Dow Jones Industrial Average climbed +4.3%, and the NASDAQ catapulted +6.6%, powered largely by artificial intelligence stocks like NVIDIA Corp., which surged +16.9% for the month to a market value of $3.9 trillion (more on AI below). This is an important reminder that trading off of news headlines is a fool’s errand.

Economy Resilient Despite Tariffs and Geopolitical Turmoil

Source: Calafia Beach Pundit

Credit Default Swaps (CDS) act as insurance contracts that protect investors against corporate debt defaults. During financial stress—like the 2008 crisis or the COVID crash in 2020—CDS prices surge as investors seek protection. Today, however, CDS prices are falling across both high-yield (junk bonds) and investment-grade (Blue Chip) debt. As seen in the chart above, the cost to insure corporate bonds has declined steadily over the past two years. This signals bond investors aren’t worried about a recession or a wave of defaults, despite tariff policy uncertainty, geopolitical risk, and modest GDP growth.

Inflation Tame as Tariffs Loom

President Trump has repeatedly criticized Fed Chair Jerome Powell for not cutting interest rates, calling him everything from a “dummy” to a “major loser” and a “stupid person” to a “numbskull”. While the name-calling is colorful, the economic pressure is real: U.S. GDP contracted -0.5% in Q1 2025. Powell, however, wants to see the full impact of upcoming tariffs before making a move. . A new tariff deadline looms on July 9th, and the market is anxiously awaiting clarity. But even if tariffs are implemented, many economists believe the inflationary impact will be temporary—what’s known as a one-time price shock.

Source: Calafia Beach Pundit

The Fed’s preferred inflation gauge—the Personal Consumption Expenditure (PCE) index—has been easing and is now near the 2% target (see chart above). With inflation cooling, Trump’s case for rate cuts gains credibility. Still, the Fed appears in no rush. It will take time to understand the lasting effects of the tariff rollout.

AI Wave Fueling Markets

For a generation, the semiconductor revolution has quietly powered innovation, guided by Moore’s Law—the principle that chip performance doubles roughly every two years (see my article The Traitorous 8). Sixty years after Gordon Moore wrote his seminal article, “Cramming More Components onto Integrated Circuits”, the power of software is catching up. NVIDIA’s Grace Blackwell GB200 chip contains an astronomical 208 billion transistors, supercharging AI software models like ChatGPT.

The AI revolution is fueling trillions in global investment and rapidly transforming industries – from data centers and self-driving cars to robotics and drug discovery. It’s important to realize that this AI arms race is not just occurring in the United States. AI investment spending extends way beyond Silicon Valley to countries like Saudi Arabia, Singapore, and China.

The AI boom is not a U.S.-only phenomenon. Countries like China, Saudi Arabia, and Singapore are pouring capital into AI, creating a global arms race in tech. In the U.S., the four biggest hyperscalers—Amazon, Microsoft, Google, and Meta—are projected to spend over $300 billion on capital expenditures in 2025 alone (see chart below).

To illustrate the scale: Amazon is forecasted to spend more than $100 billion in CapEx this year. For context, that’s 40% more than the company spent over the entire 2000–2020 period combined.

Source: The Financial Times

The Stargate Initiative: AI Infrastructure on a Galactic Scale

A prime example of the AI gold rush is the $500 billion Stargate initiative, with Phase 1 already underway in Abilene, Texas (see rendering below). The initial construction includes two buildings totaling 1,000,000 square feet. Ultimately, the full project will cove about 1,000 acres and be powered by an on-site natural gas facility generating 360 megawatts—enough to support 300,000 homes.

A huge portion of the project costs are dedicated to the budget for NVIDIA super chips. Oracle Corp. has committed $40 billion to purchase 400,000 of NVIDIA’s GB200 chips, making this project a centerpiece of the global AI infrastructure boom. Just this week, Oracle also announced a new $30 billion cloud deal, which will soak up a good chunk of the data center supply created by the database and enterprise software company.

Source: CoStar

The Big Picture: Volatility and Opportunity

There’s no shortage of risk—geopolitics, inflation, Fed uncertainty, tariffs. But the economy is showing surprising resilience. If tariff clarity improves, interest rate cuts materialize, and AI capital spending accelerates, a “boring” market could rapidly turn into a soaring one.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Tariffs & Free Trade by Wade

Tariffs and trade have dominated the media headlines since the beginning of the year, creating a volatile rollercoaster ride in the financial markets and broader economy. What were screams of fear just last month turned into cheers of optimism after a trade deal between the U.S. and the U.K. was announced earlier this month.

This agreement—combined with hopes for future trade deals and the absence of runaway inflation or economic collapse—sparked a rally in stock prices. The minimum 10% baseline tariff in the U.K. agreement has fueled optimism that a simplified framework might extend to other international trade pacts. For the month, the S&P 500 surged by +6.2%, the Dow Jones Industrial Average climbed +3.9%, and the tech-heavy NASDAQ soared by +9.6%.

However, tariffs and trade haven’t faded into the background. In fact, just this week, a federal court ruled that the president’s tariff policies were illegal, citing misuse of emergency powers under the International Emergency Economic Powers Act (IEEPA) of 1977. Subsequently, the same court has granted the Trump administration a reprieve pending appeal—potentially escalating the issue to the Supreme Court. Even if the ruling stands, the president has alternative avenues to impose tariffs through other legal mechanisms.

So, what is all this fuss over tariffs and trade really about? I’ve previously written extensively on the topic (“Tariff Sheriff”), but some fundamental economic concepts still get lost in the tariff chaos noise.

It’s true that many countries engage in unfair trade practices against the U.S.—including subsidies, currency manipulation, non-tariff barriers, dumping, quotas, complex permitting, and value-added taxes (VAT). However, the powerful benefits of free trade are often underappreciated or poorly explained by the pundits.

Tariffs and Free Trade 101: China & France Experiment

To illustrate, let’s reference an example drawn from an op-ed by Princeton economist Burton Malkiel, author of the legendary finance book A Random Walk Down Wall Street.

Every country enjoys a comparative advantage in producing certain goods. For example, China historically benefits from low labor costs, making it a global manufacturing hub. Meanwhile, the U.S. leads in technological innovation, and countries like Brazil leverage vast land resources to dominate agricultural exports—such as being the world’s top coffee exporter. Let’s consider a simplified example using two countries: China and France, each with 100 labor hours available, and only able to produce T-shirts and wine.

China’s Output (see graphic above) – China’s comparative advantage in making more T-shirts than bottles of wine results in the following:

- 50 hours = 50 T-shirts

- 50 hours = 10 bottles of wine

France’s Output (see graphic above) – France’s comparative advantage in making more bottles of wine than T-shirts results in the following:

- 50 hours = 50 bottles of wine

- 50 hours = 20 T-shirts

Combined Total (China + France): 70 T-shirts + 60 bottles of wine = 130 total units of goods.

Example #2: Production Plan #2 (Each country specializes in their comparative advantage)

China’s Output (T-shirt specialization):

- 100 hours = 100 T-shirts

France’s Output (Wine specialization):

- 100 hours = 100 bottles of wine

Combined Total: 100 T-shirts + 100 bottles of wine = 200 total units of goods.

But here’s the challenge: the Chinese still want wine, and the French still want T-shirts. That’s where free trade comes in – see next example (graphic below).

Example #3: Production Plan #2 + Free Trade

Through free trade, each country can specialize in what they do best and then trade for other goods wanted or needed. If China trades 50 T-shirts for 50 bottles of wine with France, both countries end up with:

- China: 50 T-shirts + 50 bottles of wine

- France: 50 bottles of wine + 50 T-shirts

This plan produces 54% more total goods than the original production plan (200 vs. 130 – Example #1), with no increase in labor hours. China gets 300% more wine, and France gets 150% more T-shirts—a clear win-win.

Today’s Tariff Reality

In 2024, the U.S. trade deficit stood at $918 billion. President Trump’s aggressive tariff strategy aims to reduce this gap by incentivizing domestic manufacturing, increasing exports, and reducing imports. The challenge is that tariffs also raise prices for consumers and disrupt the benefits of free trade.

If the administration succeeds in establishing fairer rules for a level trading field, increasing government revenue, and narrowing the trade deficit, then history will likely view President Trump’s tariff policy favorably. But if tariffs lead to higher prices, inflation, and a weaker economy, the tariff policy may be judged as a costly misstep. The stock market, voters, and time will ultimately serve as the principal judges.

Looking ahead, two key dates are on the calendar:

- July 9 marks the end of the 90-day reciprocal tariff pause. Without new trade agreements, tariffs will spike on imports from many countries — raising costs for consumers.

- July 4 is not only Independence Day, but also the target date for Senate Republicans to pass the “One Big Beautiful Bill”, which packages several of President Trump’s top priorities: tax cuts, welfare reform, energy expansion, and border security. While the bill could stimulate growth, critics warn of its potential to balloon the national deficit.

Most Americans support the idea of fairer global trade. The question is whether aggressive tariffs across the globe are the right tool to achieve that goal — and whether trading partners will agree to new deals. Regardless of the outcome, this crash course in Tariffs & Free Trade 101 underscores the enduring value of specialization and free trade, even amid today’s turbulent tariff battles.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 2, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Turn Off TV – Emperor Media Has No Clothes!

Famous Danish author Hans Christian Andersen told a renowned fairy tale of an emperor who was conned into believing he is wearing an invisible suit. The crowd was too embarrassed to acknowledge his nakedness, so they pretend to not notice – until a young boy shouted, “The emperor has no clothes!”

Much like the fairy tale, when it comes to pointing out the many shortcomings of the financial media, I have no problem yelling, “The Emperor Media has no clothes!”

Media Spreads Fear and Misinformation

Mark Twain famously stated, “If you don’t read the newspaper, you’re uninformed. If you read the newspaper, you’re misinformed.” That sentiment rings especially true amid today’s swirl of alarming headlines. Here’s a sampling of recent media-induced worries:

- Global trade war caused by tariffs

- Declining value of the U.S. dollar

- Rising interest rates due to foreign debt sales

- Doubts over the U.S. dollar’s global reserve currency status

- Recession anxiety

- Stagflation fears

- Concerns about Executive Branch overreach

- Threats to remove the Federal Reserve Chairman

Is the sky falling? Is now the time to sell stocks, as the media often implies? Or are these risks being overstated and distorted by media outlets that chase monetary gains?

Issues are More Gray Than Black or White

Journalists – most of whom have little investing experience – like to authoritatively paint economic issues in black-or-white terms. But most reasonable people understand that these matters are complex, and the truth lies somewhere in the gray. To claim the media offers a balanced view of both the positives and negatives of complicated financial topics would be disingenuous.

I have been investing for over 30 years, and while I’ve never faced a global rebalancing of trade impacting trillions in economic activity, I’ve lived through far more uncertain times. Not only have my investments survived those volatile periods, but they have also thrived – repeatedly hitting new record highs.

F.U.D. Sells!

Does the media want you to believe the accurate, long-term stock market prosperity story? Hardly. As the saying goes, “If it bleeds, it leads.” Fear, uncertainty, and doubt (F.U.D.) sell more ads, subscriptions, newspapers, and magazines. The more blood, sweat, and anxiety in the headlines, the more money the media makes from distressed readers.

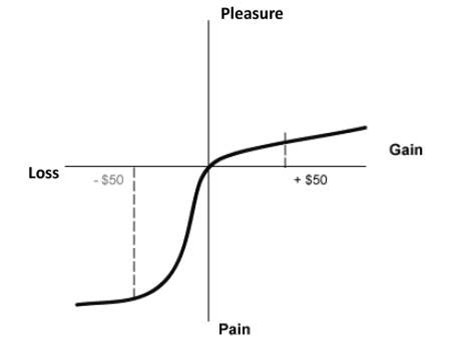

Behavioral finance pioneers, Nobel Prize winner Daniel Kahneman and Amos Tversky, showed that losses feel twice as painful as the pleasure of gains (see the Pleasure/Pain diagram below). Their Prospect Theory remains just as relevant today as when it was introduced in the late 1970s.

The greatest investor of all-time, Warren Buffett, once said, “Be fearful when others are greedy, and greedy when others are fearful.” Unfortunately, the media pushes the opposite mantra: “sell fear and buy greed.” When markets fall, they sell Armageddon. When markets soar, they sell nirvana. During periods of over-optimism, they also exploit FOMO (Fear of Missing Out) by feasting on investors’ emotional cycle of excitement.

Reassuring long-term investors that everything will be okay—or that dips are buying opportunities—doesn’t generate as much media profits and ad sales. Fear does.

History Doesn’t Repeat Itself, But It Often Rhymes

Too many investors suffer from short-term thinking and goldfish-like memory. But as Mark Twain wisely stated, “History doesn’t repeat itself, but It often rhymes.” And history has shown that listening to the media during times of extreme market volatility often leads to poor decisions.

Let’s take a look at some key examples where media-driven fear was more misleading than helpful over the decades:

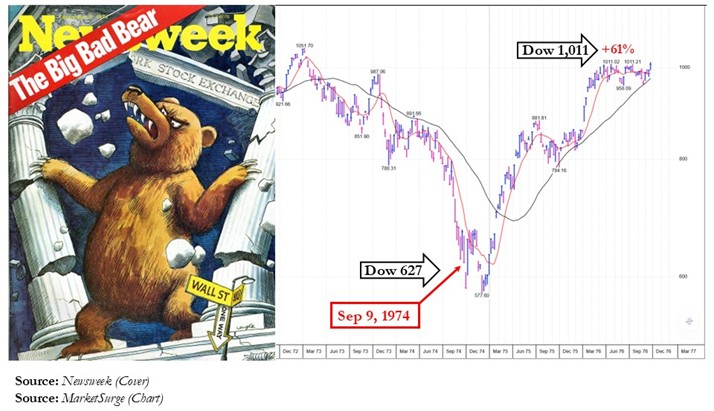

The Nifty Fifty Collapse (1973-1974)

In the early 1970s, long before the “Magnificent 7” stocks came to the fore, we had the “Nifty Fifty” stocks. These large-cap blue chip stocks traded at lofty P/E (Price-Earnings) ratios and were seen as invincible before they came crashing down in 1973-1974. Suffice it to say, the media headlines were horrific during this period.

Here is some context for this period:

- The U.S. was exiting the Vietnam War

- Economy was undergoing a major recession

- Watergate scandal and presidential resignation

- 9% unemployment

- The Arab Oil Embargo

- Surging inflation

The media’s response? Doom and gloom. Here’s an example of this sentiment from the Newsweek cover, “The Big Bad Bear,” published on September 9, 1974.

For those who sold in fear, the results were disastrous. The Dow bottomed shortly after the magazine was released and the market rebounded +61% in less than two years. Panic was the wrong move.

“The Death of Equities” (1979)

Inflation plagued the 1970s, and just before one of the longest bull markets in history, BusinessWeek declared “The Death of Equities” on its now-infamous September 1979 cover. Once again, the media acted as a perfect contrarian indicator with the Dow quadrupling over the next decade.

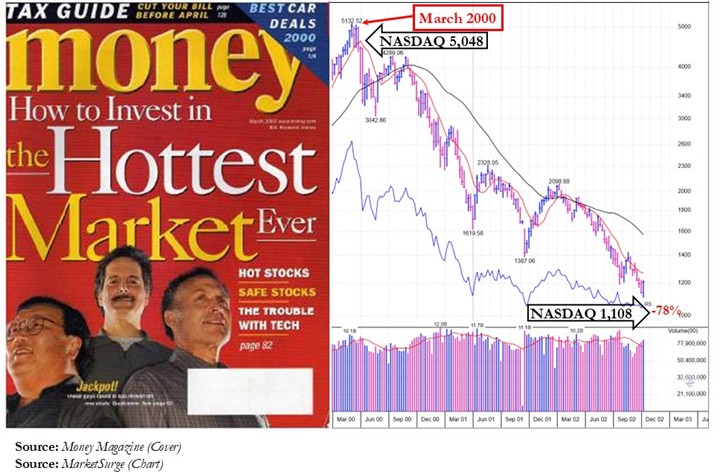

Dot-Com Bubble: “The Hottest Market Ever” (2000)

In March 2000, at the peak of the tech bubble, Money magazine ran a cover story: “How to Invest in the Hottest Market Ever.” Weeks later, the bubble burst. Suboptimal timing once again.

In that same timeframe, Newsweek captured the essence of FOMO with its July 5, 1999 cover: “Everyone Is Getting Rich but Me.” Right when risk was at its peak, most investors were blind to it and got sucked into the downdraft.

Source: NewsWeek

Financial Crisis – Depression 2.0 (2008)

In October 2008, the Time magazine cover encapsulated the zeitgeist of the period with a 1929 photo that included a line of desperate people waiting for food donations at a soup kitchen. Many feared a second Great Depression. Yet it was one of the best times in history to buy stocks with the Dow tripling over the next decade.

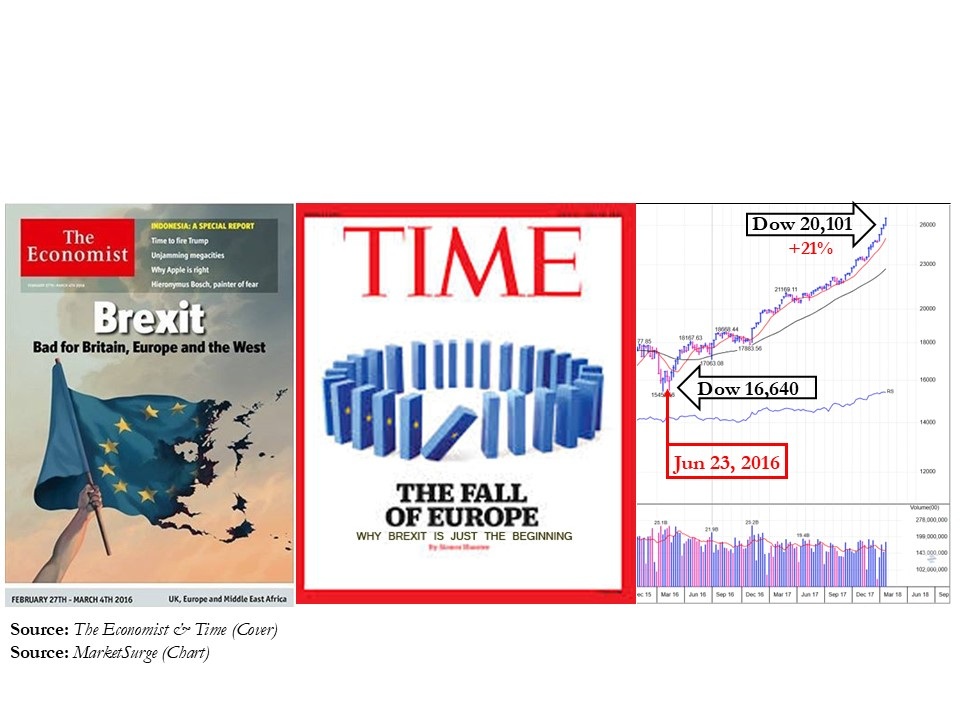

Brexit Panic (2016)

Media coverage around the U.K.’s Brexit vote to leave the EU (European Union) painted a picture of imminent recession and contagion. Instead, the media blitz surrounding Brexit turned out to be more molehill than mountain. Markets rebounded strongly and reached new highs in the subsequent months.

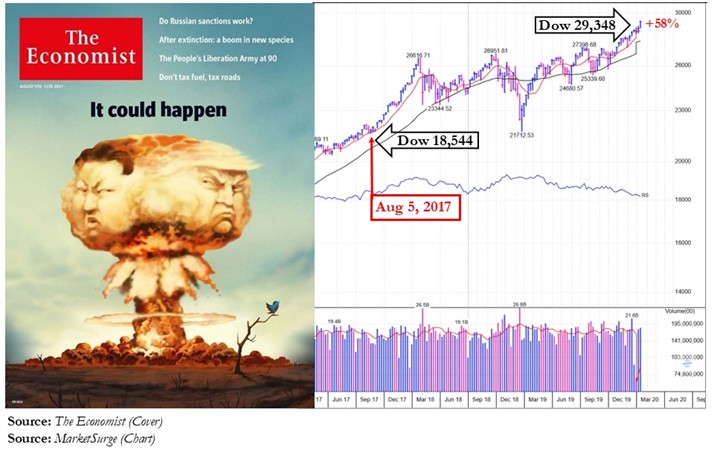

“Rocketman” and North Korea Missiles (2017)

Tensions flared in 2017 as North Korea tested missiles and President Trump threatened retaliation against dictator Kim Jong Un by bombing Pyongyang and “Rocket Man”. The media went into overdrive regarding the nuclear unease, but the market brushed it off and continued climbing +58% over the next few years.

COVID-19 Pandemic (2020)

With over 3 million deaths worldwide and a grinding halt to the global economy, markets initially fell roughly -35%. But as consumers stockpiled toilet paper, fast vaccine development and stimulus sparked a powerful rebound, with stocks finishing the year up +16%. Over the next two years, the Dow almost doubled.

Hostage to Our Lizard Brain

Why are we so susceptible to the sensationalist tendencies of the media? Evolution holds the answer. Humans’ DNA and brains are hard-wired to flee prey. The small almond-shaped tissue in our brain called the amygdala—or what author Seth Godin calls the “lizard brain”—evolved to respond instantly to danger. When headlines scream “crash” or “war,” our emotional brain overrides our logical one, which leads to poor long-term results. As Seth Godin explains, we’re wired to react, not reflect (Watch here). And the media knows it.

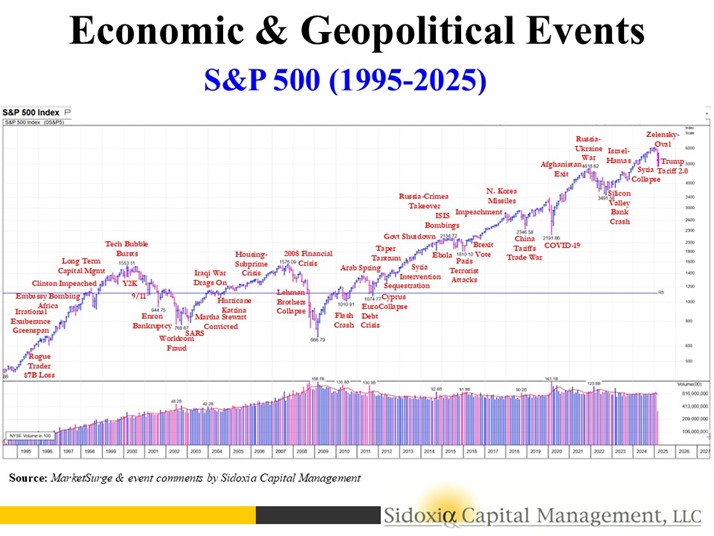

Headlines Change but the Long-Term Market Trend Doesn’t

Despite a barrage of negative headlines, stocks have remained resilient over the long run. The market has overcome wars, assassinations, currency crises, banking failures, terrorist attacks, pandemics, natural disasters, impeachments, tax hikes, recessions, restrictive Fed policies, debt downgrades, inflation, and yes, even tariffs (see chart below). Since WWII, we’ve had 12 recessions—each followed by a full recovery to new record highs. In baseball terms, the economy has batted a perfect 1.000 (12-for-12) with recession recoveries.

How to Survive the Avalanche of Media Headlines

Here are five key strategies:

- Turn off the TV: Don’t obsess over headlines. Emotional reactions result in poor decisions.

Buying high (greed) and selling low (fear) is not a recipe for long-term investment success.

- Diversify Your Investments: A well-balanced portfolio across asset classes helps reduce panic.

- Invest According to Time Horizon: Are you young? Assuming more risk and higher exposure to the stock market is generally fine. Are you near retirement? Don’t jeopardize your retirement goals – de-risk accordingly.

- Ignore Talking Heads: Most pundits don’t invest and their credibility is compromised by monetary conflicts of interest. It’s much more beneficial to follow seasoned professionals with real track records through multiple bull and bear markets.

- Avoid the Herd: Continually following the herd into the most popular investments often leads to underperformance. The grass is greener, and the food sources are more plentiful, off the beaten path trampled by the herd. Contrarian thinking works even though it can feel scary.

In the age of constant connectivity, headlines and the 24/7 news cycle are addictive. But if you’re tired of being a pawn in the media’s game, I invite you to join my fight by acknowledging that the Emperor Media has no clothes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.