Posts filed under ‘inflation’

Consumer Wallets Strong, Rate Hikes Long, What Could Go Wrong?

Consumer wallets and balance sheets remain flush with cash as employment remains near record-high levels. Cash in consumer wallets and money in the bank help the economy keep chugging along at a healthy clip. More specifically, as you can see in the chart below, the net worth of U.S. households has reached a record $154.3 trillion dollars in the most recent month, thanks to appreciation in stocks, gains in real estate, and relatively stable levels of debt.

Source: Calafia Beach Pundit

Unemployment Remains Low

In addition, the unemployment rate is sitting at 3.8%, near multi-decade lows (see chart below).

Source: Trading Economics

As long as consumers continue to hold a job, they will continue spending to buoy economic activity – remember, consumer spending accounts for roughly 70% of our country’s economic activity. Case in point are the most recently released GDP (Gross Domestic Product) forecasts by the Atlanta Federal Reserve, which show 3rd quarter GDP growth estimated at a 4.9% rate (see chart below).

Rates Up, Housing Prices Up?

Yes, it’s true, despite a dramatic surge in mortgage rates over the last few years, the housing market remains strong due to a very tight supply of homes available for sale. Most homeowners with a mortgage have refinanced to a rate in the range of 3% (or in some cases even lower), so selling and moving into a new home with a mortgage at current rates of 7.3% is not that appealing. In other words, if you decide to move, your monthly mortgage payment could potentially go up by more > 50%, which could equate to thousands of dollars per month. Under this scenario, you are likely to stay put and not sell your home.

Source: Trading Economics

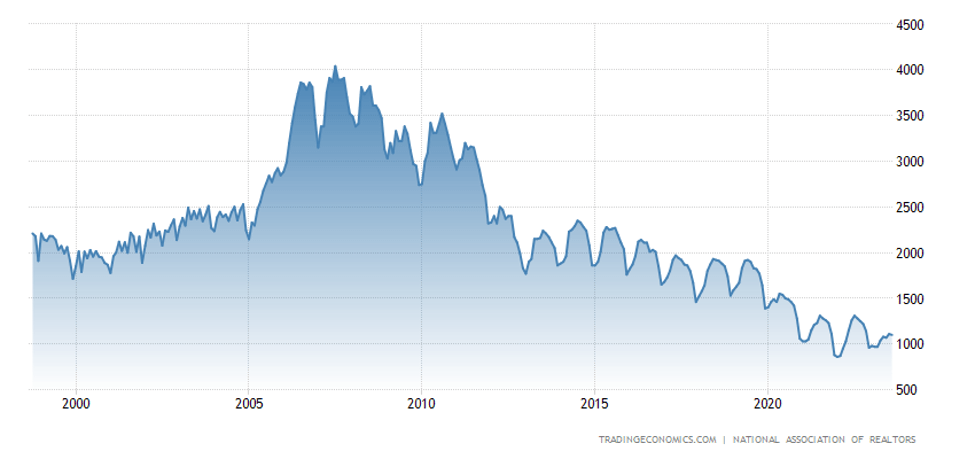

The embedded economic disincentive of selling a home with a mortgage has really put a real crimp on the supply of homes available for sale (chart below). As you can see, the inventory of homes has dramatically collapsed from a peak of about four million homes, circa the 2008 Financial Crisis, to around one million homes today.

Source: Trading Economics

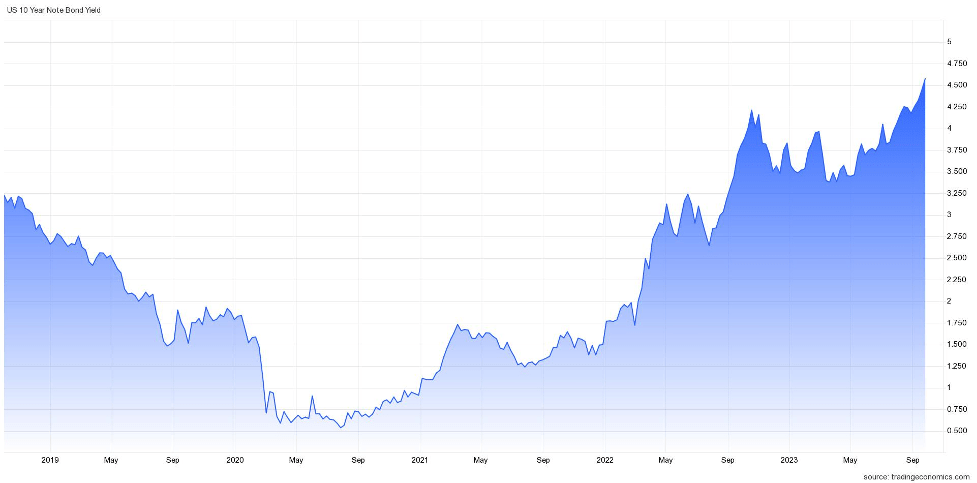

In the face of this mixed data, the stock market finished a hot summer with a cool whimper last month, in large part due to a 0.49% increase in the 10-Year Treasury Note yield to 4.58% (see chart below). The S&P 500 index fell -4.9% for the month, the technology-heavy NASDAQ index dropped even further by -5.8%, while the Dow Jones Industrial Average outperformed, down -3.5% for the month. Worth noting, however, the Dow has significantly underperformed the other indexes so far this year.

Source: Trading Economics

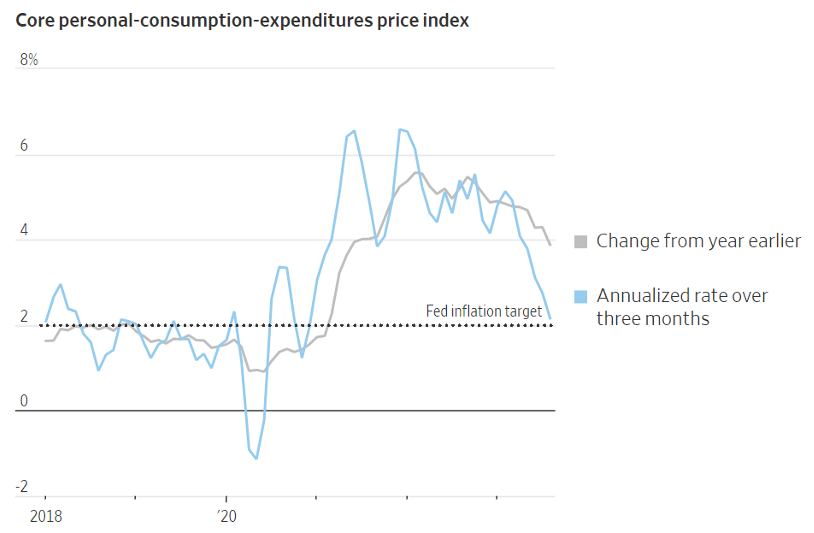

Inflation on the Mend

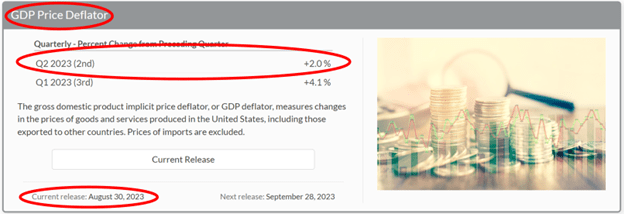

The Fed continues to talk tough about fighting inflation after taking interest rates from 0% to 5.5% over the last two years, nevertheless inflation continues to come down. The Fed’s go-to Core PCE inflation datapoint that came out last Friday at +0.1% is consistent with the downward inflation trend we have been witnessing for many months now (see chart below). As you can see, inflation on annualized basis has reached 2.2%, nearly achieving the Federal Reserve’s target of 2.0%.

Source: The Wall Street Journal and Commerce Department

There is never a shortage of investor concerns. Today, worries include Federal Reserve policy; restarting of school loan repayments (after a three-year hiatus); a potential government shutdown; an auto and Hollywood strike; higher oil prices; and a presidential election that is heating up. Many of these worries are nothing new. The bull market took a pause for the month, but consumer wallets remain fat, the economy keeps chugging, the employment picture remains strong, and stock prices remain up +12% for the year (S&P 500). For the time being, betting on a soft economic landing over an imminent recession could be a winning use for that cash in your wallet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 2, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

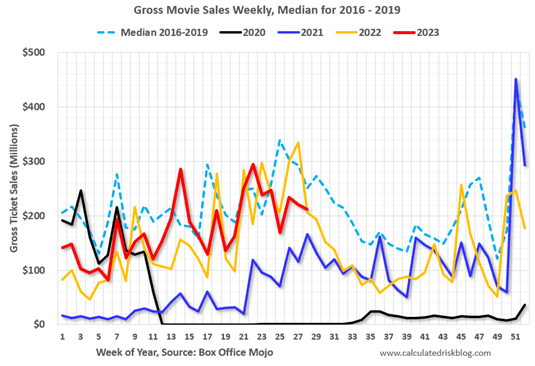

Hollywood Shuts Down & Market Goes Uptown

According to scientists, July set a record as the hottest month in 120,000 years. In order to beat the scorching heat, millions of Americans made the pilgrimage to their local air-conditioned movie theaters to watch the combo-blockbuster “Barbenheimer” (Barbie and Oppenheimer), which has raked in sales of more than $1 billion globally in the first two weeks of its release. Thankfully, in the short-run, Barbenheimer has given a shot in the arm to the beleaguered movie industry that suffered dramatically during the pandemic. The chart below (before Barbenheimer) shows industry sales have recovered (red line) somewhat, almost to pre-pandemic averages (dashed light blue line), but still has some ground to gain before industry sales consistently outpaces pre-pandemic levels.

Source: Calculated Risk

Movie Strike Explained

If movies are your gig, you better race to the theaters now because Hollywood has come to a grinding halt, thanks to a dual strike of Hollywood acting unions (SAG-AFTRA) and the Writers Guild of America (WGA) union. The feud between the unions and the movie/television studios centers around demands for higher pay, better working conditions, and protections from AI (Artificial Intelligence) technologies, which could theoretically replace actors and writers. Combined, the unions almost carry an estimated 200,000 members, which means a broad strike like equals no new movies, tv shows, or streaming content. The last time there was a “double strike” like this occurred in 1960 when former President Ronald Reagan was running SAG. Until the dispute is resolved, you better pace your media binging consumption habits because with no new content currently being created, the dispute may begin to eat into your show backlog on Netflix and disrupt your happy couch-streaming time.

Stocks on Fire

But scorching heat and red-hot popular movies were not the only things on fire last month. The stock market continued its fiery, blistering pace with the S&P 500 boiling higher by +3.1%, making the seven-month total gain of 2023 a spicy +20% (see chart below). The Dow Jones Industrial Average joined in on the fun too. Not only did the Dow increase by +3.4% for the month, the index rose for 13 consecutive days, the longest streak of daily advances since 1987. Bubbling up to the top of the performance table, however, is the technology-heavy NASDAQ index (home of the largest Magnificent 7 technology stocks – see also Fight the Fed) with a sizzling +4.1% return for the month, and a scalding +37% rise for the year, so far. The pace of gains is not sustainable forever, so it’s important to have a disciplined process in place to manage the risk of over-extended, over-valued investments, which is exactly what we do at Sidoxia Capital Management.

Source: TradingEconomics.com

Inflation Moving in the Right Direction

After such a lousy 2022 in the financial markets, why such a searing return for 2023? The biggest reason can be summed up with three words: inflation, inflation, and inflation. More specifically, it’s the pace of “disinflation” we are witnessing that is getting people so excited. As you can see from the chart below, annualized inflation as measured by the Consumer Price Index (CPI) has declined dramatically to 3.3% (blue line), while CPI less shelter (red line) has dropped to 1.4%, which is below the Federal Reserve’s 2% target (green line). These trends have gotten investors excited because they believe Jerome Powell, the Fed Chairman, is closer to ending this year-and-a-half long interest rate hiking cycle. In fact, investors are currently betting for multiple interest rate cuts in 2024.

Source: Calafia Beach Pundit

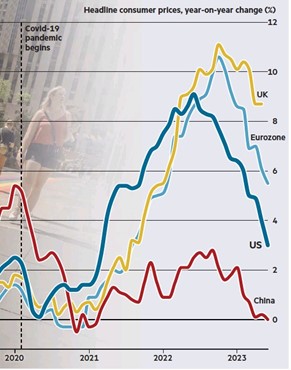

And the disinflation phenomenon is just not limited to U.S. borders – we are witnessing the same disinflationary trends across our borders (see chart below).

Source: The Financial Time (FT)

Confident Consumers

While many economists and traders have incorrectly been calling for a recession for some two years, a more resilient U.S. economy just reported better-than-expected growth for the 2nd quarter (+2.4% – Gross Domestic Product [GDP] growth). The stronger economy along with the improving inflation dynamics mentioned previously have buoyed Consumer Confidence too, as you can see from the chart below.

Source: Calafia Beach Pundit

Everything isn’t perfect (it never is). We continue to experience geopolitical risk as a result of the destabilized war between Russia and Ukraine; growth in China has stalled and not recovered from the pandemic; complacency is beginning to filter into investor attitudes; and we live with a dysfunctional Washington political process. But the economy remains strong, inflation appears to be cooling, and short-term interest rates could be close to peaking. Your air-conditioning bill may be going up this summer, but so will your stock market portfolio, if your investments are being properly managed.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

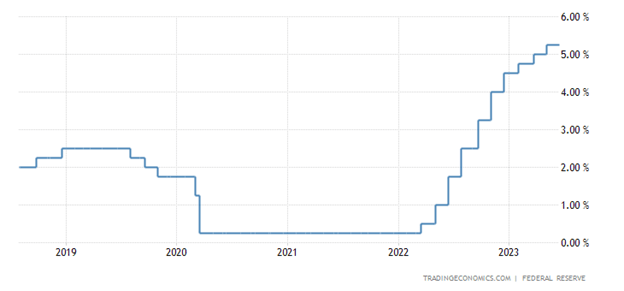

Fight the Fed… Or Risk Your Account Going Dead!

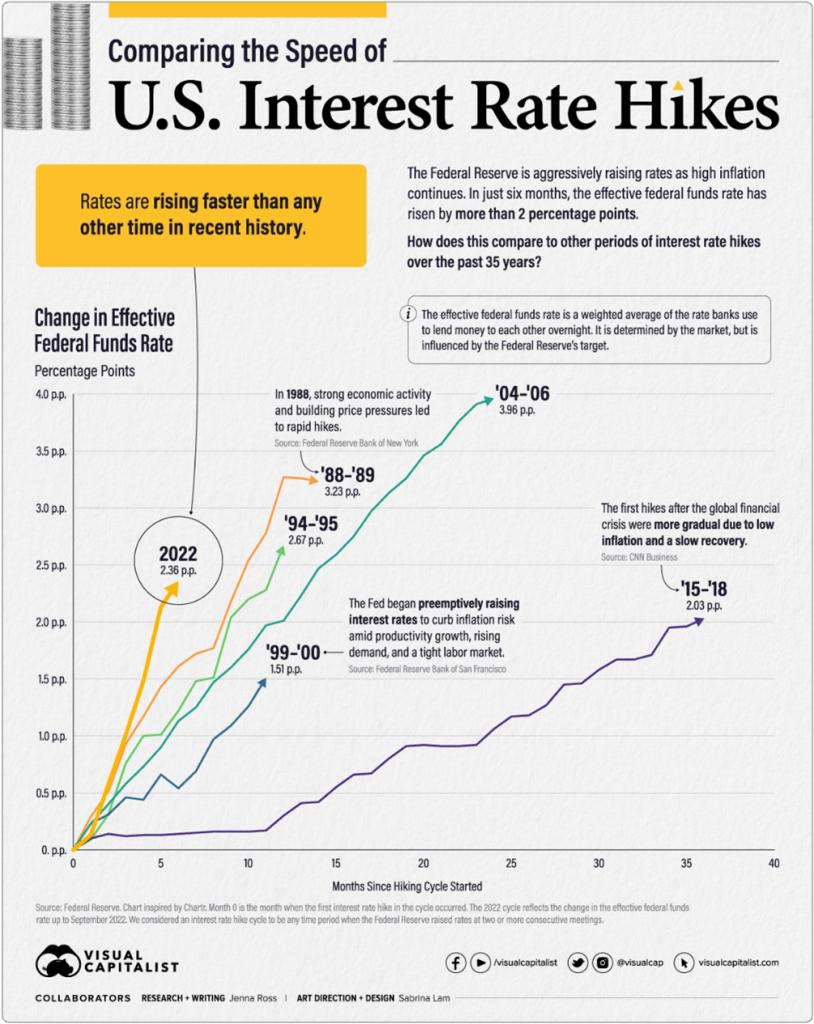

Throughout history the prominent Wall Street mantra has been, “Don’t fight the Fed.” In essence, the credo instructs investors to sell stocks when the Federal Reserve increases its Federal Funds interest rate target and buy stocks when the Fed cuts its benchmark objective. The pace of interest rate increases since early 2022 has increased at the fastest rate in over four decades (see chart below). Unfortunately for those following this overly simplistic guidance of not opposing the Fed, investor portfolio balances have been harmed dramatically during 2023 by missing a large bull market run. Despite this year’s three interest rate hikes and an 87% probability of another increase next month by the Federal Reserve, the S&P 500 index surged +6.5% last month and has soared +15.9% for 2023, thus far.

Source: TradingEconomics.com

The technology-heavy NASDAQ index has skyrocketed even more by +31.7% this year, thanks in part to Apple Inc. (AAPL) surpassing the $3 trillion market value (+49.3%), thereby exceeding the total gross domestic product (GDP) of many large individual countries like France, Italy, Canada, Brazil, Russia, South Korea, Australia, Mexico, and Spain.

But Apple’s strong performance only explains part of the technology sector’s impact on stock returns this year. The lopsided influence of technology stocks can be seen through the performance of the largest seven mega-stocks in the S&P 500 (a.k.a., The Magnificent 7), which have averaged an eye-popping return of +89%. Artificial intelligence (AI) juggernaut, NVIDIA Corporation (NVDA), has led the way by almost tripling in value in the first six months of the year from $146 per share to $423.

GDP & Profits Growing

Economists and skeptical investors have been calling for a recession for well over a year now, however GDP growth and forecasts remain positive, unemployment remains near generationally low levels (below 4%), and corporate profit forecasts are beginning to creep higher (see chart below – red line). You can see, unlike previous recessions, profits have not collapsed and actually have reversed course upwards.

Source: Yardeni.com

These factors, coupled with the cooling of inflation pressures have contributed to this bull market in stocks that has soared +27% higher since the October 2022 bottom in the S&P 500. With this advance in stock prices, we have also seen green shoots sprout in the Initial Public Offering (IPO) market for new publicly traded companies (see chart below) like Mediterranean fast-casual restaurant chain CAVA Group, Inc. (CAVA), which has catapulted +86% in its opening month and thrift store company Savers Value Village, Inc. (SVV) which just recently climbed over +31% in its debut week.

Source: The Financial Times (FT)

Dumb Rules of Thumb

Wall Street is notorious for providing rules of thumb and shortcuts for the masses, but if investing was that easy, I’d be retired on my private island consuming copious amounts of coconut drinks with tiny umbrellas. Case in point, following the guideline to “sell in May and go away” would have cost you dearly last month with prices gushing higher. And although the “January Effect” has been documented by academics as a great period to buy stocks, this so-called phenomenon has failed in three of the last four years. Which brings us back to the Fed. It is true that “not fighting the Fed” worked well last year, given the shellacking stocks took after a steep string of Fed interest rate increases, but following the same strategy this year would have only resulted in a large bath of tears. As is the case with most things investing related, there are no cheap and easy rules to follow that will lead you to financial prosperity. The best recommendation I can provide when it comes to investing advice squawked by the media masses is that the true path to wealth creation often comes from ignoring or disobeying these unreliable and inconsistent rules of thumb. Therefore, contrary to popular belief, fighting the Fed may actually lead to knockout returns for investors.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 3, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CAVA, SVV, or anyother security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

From Hard Landing to Soft Landing to No Landing?

I haven’t received my pilot’s license yet, but in trying to figure out whether the economy is heading for a hard landing, soft landing, or no landing, I’m planning to enroll in flight school soon! With the Federal Reserve approaching the tail end of an aggressive interest rate hiking cycle, investors have been bracing for a hard landing. However, with near record-low unemployment (3.4%) and multi-trillion dollars in government stimulus still working its way through the system, others see an economic soft landing. More recently, economic data has been flying in at an accelerating pace, which could mean the economy will stay in the air and have no landing.

For those waiting for an imminent recession, it looks like there could be a delay. In other words, bearish pessimists may be waiting at the gate longer than expected. As you can see in the chart below, economists at the Atlanta Federal Reserve are currently forecasting economic growth (GDP – Gross Domestic Product) to increase to a respectable +2.8% rate for the first quarter.

How have investors been interpreting this confusing array of landing scenarios? The stock market has stabilized and risen since last October (S&P +13.7%) but has also hit a temporary air pocket last month (-2.6%). Similarly, the Dow Jones Industrial Average has rebounded +13.9% since October, but pulled back further in February (-4.2%). As mentioned earlier, investors are having difficulty reading all the economic dials, instruments, and controls in the cockpit because there is no consensus on interest rates, inflation, economic growth, corporate earnings growth, and employment.

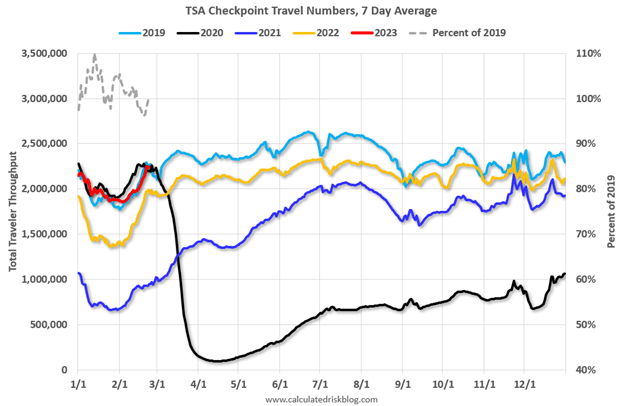

At the one end of the spectrum, you have a consumer who remains employed and willing to spend his/her savings accumulated during the pandemic. Case in point, air travel has hit pre-pandemic levels of 2019, despite business travelers staying at home conducting business on Zoom (see red line on chart below).

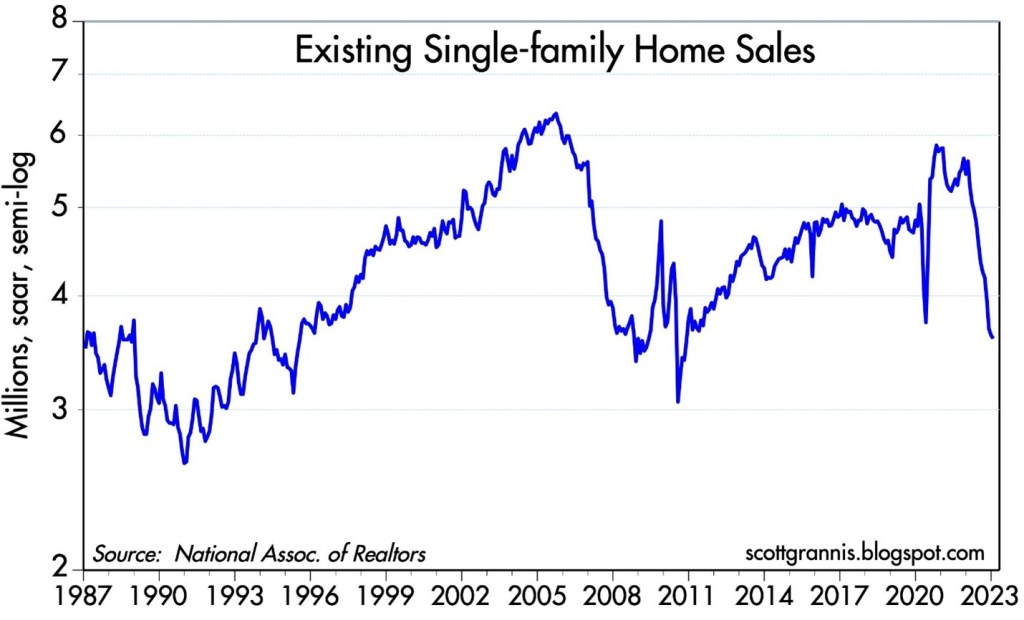

At the other end of the spectrum, we are witnessing the crippling effects that 7% mortgage rates can have on the $4 trillion real estate industry. As you can see from the chart below, sales of existing homes have plummeted at the fastest rate since the beginning of the 2008 Financial Crisis.

With all of that said, there is a consensus building that inflation is steadily coming down. Even the very skeptical and hawkish Federal Reserve Chairman, Jerome Powell, acknowledged that the “disinflationary process has begun.” We can see that in this inflation expectation chart below (green line), which measures the average anticipated inflation over the next five years by comparing the difference in yields between the five-year Treasury Notes and the five-year TIPS (Treasury Inflation Protection Securities).

Although, currently, there are many financial crosswinds swirling, the good news is that in the near-term, the economy has been maintaining its elevation and there is no imminent sign of a hard landing. We certainly could face the potential of turbulence and changing weather conditions, but that is always the case when you invest in the financial markets. If, however, inflation continues to move in the same direction, and growth continues to surprise on the upside, there may be no landing at all. Under this scenario of maintaining a comfortable altitude, I guess I can put my pilot training on hold.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Mar. 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

10 Ways To Destroy Your Investment Portfolio

Video Replay – February 22nd 2023

Volatility has spiked due to changing concerns over inflation, interest rates, recession fears, geopolitics, and other fear-provoking issues, but how can you grow and protect your retirement nest egg?

Wade W. Slome, CFA®, CFP®, Founder of Sidoxia Capital Management, LLC, will share 10 crucial mistakes made by investors that can destroy your portfolio. Learn how to avoid these missteps and expand your wealth.

Feasting on a Full Plate of Concerns

Investors and Thanksgiving feasters alike had a full plate to consume last month – and there has been a lot to digest. The buffet of issues includes the Federal Reserve’s fastest rate hike cycle in decades (see chart below), spiking inflation, a slowing economy, an unresolved war between Russia and Ukraine, declining home prices, and a volatile stock market to boot.

Source: Visual Capitalist (*Note: Current year line estimated to reach midpoint of 4.00% – 4.50% this month)

Let’s not forget the bankruptcy of Bahamas-based cryptocurrency exchange (FTX), and the downfall of its 30-year-old, billionaire founder Sam Bankman-Fried. Unfortunately for Fried, he has essentially lost his whole $16 billion fortune, and after his recent resignation he will be spending the subsequent years in court fighting charges of fraud and misappropriated funds.

Nevertheless, despite the laundry list of concerns swirling around, this year’s Thanksgiving feast was quite delicious with the S&P 500 surging +5.4% last month. It’s hard to believe for many, but after a strong performance in October and November, stock market losses during 2022 have registered in at a mere -4.8%, as measured by the Dow Jones Industrial Average. This reasonable drawdown in stock prices is not too shabby, considering the meteoric gains of 2019-2020-2021 (+90% cumulatively), as I have highlighted on numerous occasions (see my July Newsletter, Winning Teams Occasionally Lose).

Part of the credit for the current market surge can be attributed to the dessert Federal Reserve Chairman, Jerome Powell, just served up to investors. In a statement yesterday, Powell suggested interest rate hikes would likely slow from an aggressive 0.75% pace to a slower 0.50% rate after an unprecedented string of increases. Bets are changing daily, but after starting the year at a 0.0% Federal Funds target rate, the Fed is likely to exit the year at 4.5%. Whether this will be the peak rate (or near the peak rate) will depend on the direction of economic data, especially as it relates to inflation and employment. We get a fresh helping of unemployment figures this Friday, which could provide clues regarding the direction of future Fed policy.

While the Federal Reserve is sucking a lot of wind out of the present news outlet airwaves, there are other factors contributing to the latest stock market upswing. For starters, the broadest measure of U.S. economic activity, GDP (Gross Domestic Product), was just revised higher for this year’s third quarter from +2.6% to +2.9%. But wait, there’s more! The latest growth forecast for the fourth quarter of 2022 is expected to accelerate to +4.3%, which was also revised higher, recently. Ever since the Fed started hiking interest rates this March, all we have been hearing from the so-called pundits has been the doom-and-gloom discussion of a definite, looming recession knocking at our door. I freely acknowledge there can be a negative economic lag effect from the significant rise in interest rates this year, however, the bark could prove much worse than the bite as everyone waits for the R-word, which may or may not arrive at all.

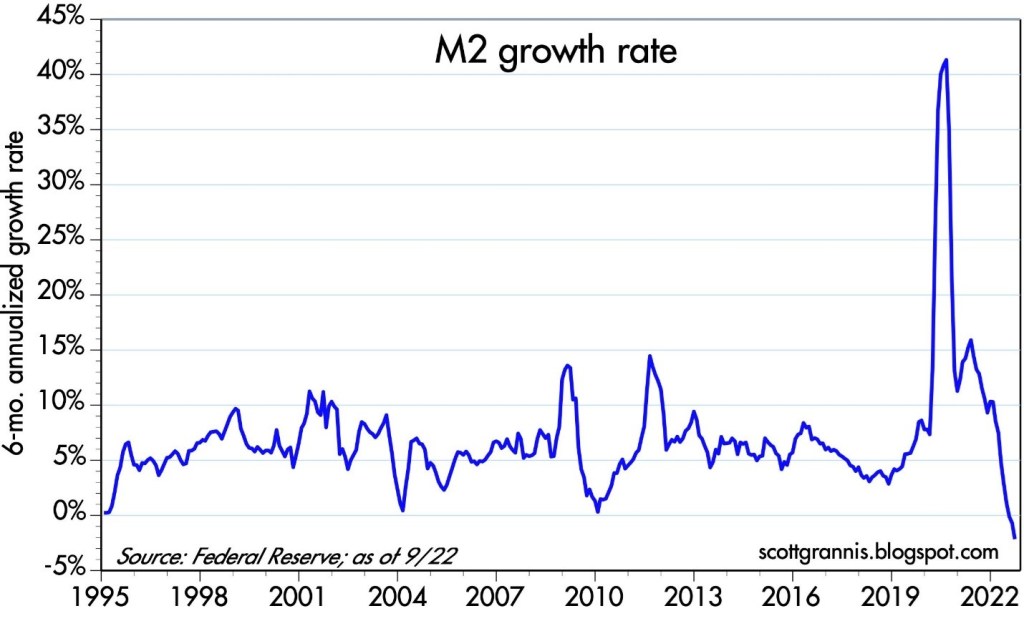

Another positive development supporting climbing stock prices relates to what I have been writing about for quite some time – peaking and declining inflation numbers. Scott Grannis at Calafia Beach Pundit has done a great job of explaining how monetary policy (M2 – see chart below) and fiscal stimulus, during the peak-COVID era (combined with supply chain disruptions), have fed the explosion in monetary supply growth, which directly relates to the spiking inflation we all have experienced. Thankfully, the shift from a looser COVID monetary policy to a tighter monetary policy (i.e., Quantitative Tightening and rate hikes), in conjunction with less government spending (i.e., improving government deficit), has led to a dramatic drop in money supply growth (actually negative growth), hence creating a better outlook for inflation.

Source: Calafia Beach Pundit

Inflation Picture Improving

You can clearly see the improving inflation picture breaking through in the Producer Price Index (PPI – see chart below), a measure of wholesale inflation that has come down dramatically in recent months.

Source: Calafia Beach Pundit

Thanksgiving often involves a lot of gorging, but for investors, digesting a full plate of concerns has caused some indigestion in the stock market this year. The good news is inflation appears to be peaking, the economy and the consumer remain on solid footing, despite the Federal Reserve’s rate-hiking rampage, and the unemployment rate remains near generationally low levels. If a steep recession doesn’t come to fruition, as many expect, you may be able to toast for a better 2023 with champagne rather than Pepto Bismol.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.