Posts filed under ‘Fixed Income (Bonds)’

Misery Loves Company – Ruler Waffling

Besides using a ruler for measuring small distances and rapping disobedient knuckles, the wooden instrument can also be used for extrapolating trends. This ruler is a very convenient tool when rigorous analysis is a second choice.

Misery loves company, so the often maligned pool of inaccurate Wall Street equity analysts are happy to share the limelight with their trend leaning junk bond analyst cousins. As default rate expectations have bounced around like a jack rabbit post the Lehman Brothers bankruptcy, these bond forecasters have been caught flat-footed.

Reuters highlighted the backpedaling of Standard & Poor’s recent forecast changes:

“S&P said it now expects defaults to decline to 6.9 percent a year from now from a September rate of 10.8 percent. On Oct 2, it had said it expected defaults to escalate to 13.9 percent by August 2010.”

For a lazy analyst, extrapolation is a good fall-back strategy. Sticking your neck out by looking out further into the future or grasping the concept of reversion to the mean can be difficult and politically risky from a job retention perspective. It’s much easier to constantly hug current trends because it then becomes virtually impossible to be wrong.

Just as the rating agencies contributed to the subprime and auction rate securities (ARS) debacles by rubber stamping their AAA approvals last year through the financial crisis, so too have we witnessed the failure of bond analysts to properly analyze junk bond default rates.

Hopefully the narrowing of credit spreads is a leading indicator for economic improvement, but regardless the number and amount of high yield deals hitting the market is flowing heavily. The Wall Street Journal recently reported billions of junk bond deals being priced this week and next, including the $500 million Crown Castle International’s 10-year deal; $200 million Mohegan Tribal Gaming’s eight-year bonds; $325 million in Headwaters Inc.’s five-year notes; and over $2.4 billion of bonds from four other borrowers, including Boise Paper Holdings, Reynolds Group, Murray Energy Corp. and Universal City Development.

As larger companies are freely tapping the capital markets for capital, it’s becoming more and more evident that small businesses are having tougher and tougher times accessing credit, thanks in large part to banks hunkering down and reducing lending. Reference the flattening commercial bank credit curve chart provided by the Federal Reserve System:

As we watch the credit flow drama unfold in these uncertain economic times, don’t panic if you wondering what will happen next. Just reach into the desk drawer and pull out the favorite tool of Wall Street equity and junk bond analysts…the righteous ruler.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management and its client accounts do have direct positions in HYG shares at the time this article was originally posted. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Is Trump’s Business Better than His Hair?

Fiery debate still swirls around the authenticity of Donald Trump’s hair (piece), but what about his business acumen? Just this year in February, Trump Entertainment filed for Chapter 11 bankruptcy. Maybe “The Donald” should be “fired?!”

If this was his only economic fatality in Trump’s career, one might cut him a little slack. I however am not enslaved into his glorified status in the media and press. My critical eye lacks the generosity necessary to honor him a free hall pass. When looking at Trump’s career, the tabloids must not forget that Trump’s Taj Mahal Casino was also run into bankruptcy purgatory in 1991. Number #11 must be Trump’s magic number because in less than a year, Trump filed for Chapter 11 on the Trump Plaza Hotel and Casino and Trump’s Castle (March 1992).

Like an infomercial, “But wait, there’s more!” In November 2004, Trump Hotels & Casino Resorts Inc. filed for Chapter 11 bankruptcy. This company reemerged out of bankruptcy as a new operating company, Trump Entertainment Resorts Inc., only to…you guessed it, file bankruptcy again. I think I see a pattern here.

With the vast bankruptcy experience Trump holds and with him and his daughter Ivanka Trump quitting from Trump Entertainment earlier this year, Donald is now trying to scoop up this company for a $100 million steal. The bankruptcy court and creditors will determine if it’s a fair deal. If not approved, rest assured, Donald will have an extra $100 million to spend wisely – possibly building another company into bankruptcy failure or perhaps…better hair care?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Cash Strapped Bond Issuers Should Follow Willie Sutton

When infamous bank robber Willie Sutton was asked why he robs banks, he coyly responded, “Because that’s where the money is.” Willie Sutton was one of the more prominent bank robbers in American history. During his long career he had robbed close to 100 banks from the late 1920s to 1952. He was known as “Slick Willie” or “The Actor.” As a master of disguise the FBI files show that Sutton masqueraded himself as a mailman, policeman, telegraph messenger, maintenance man and a host of other personas. The Credit Default Swap market has also been disguised in mystery and opaqueness.

With many cash strapped bond issuers looking for ways to negotiate more favorable credit terms during these tough economic times, one strategy has been to approach holders of the CDS instruments. However, CDS holders have no reason to negotiate with corporate bond issuers (for pennies on the dollar) when they stand to collect a full dollar from their bank (due to terms in the CDS contracts). Cash starved corporations rather should listen to Willie Sutton and go straight to the money source – the banks that issued the CDS to the investors. As bankruptcies increase, and bank failures rise, the trio of bond holders, bond issuers, and CDS issuers (banks) will become closer friends (and/or enemies).

Research Reloaded delved more into this issue by discussing the tactics used by media companies, Gannett and McClatchy (Read Article Here). Lots of wrinkles need to be ironed out in the CDS market, measured in the tens of trillions in notional value, but part of the solution involves the bond issuer and investor going straight to the money source (the bank issuer of the CDS). Willie would be proud.

Wade W. Slome, CFA, CFP® www.Sidoxia.com

Treasury Bubble Hasn’t Burst….Yet

Clusterstlock’s Joe Weisenthal’s takes a historical look on 10-year Treasury yields going back to 1962. As you can see, the yield is still below 1962 levels, despite the massive inflationary steps the Federal Reserve and Treasury have taken over the last 18 months (6-26-09 yield was 3.51%). These trends can also be put into perspective by reading Vincent Fernando’s post at http://www.researchreloaded.com. Take a peek.

Ways to take advantage of this trend include purchases of TBT (UltraShort 20+ Year Treasury ProShares) or short TLT (iShares Barclays 20+ Year Treasury Bond)*.

*Disclosure: Sidoxia Capital Management clients and/or Slome Sidoxia Fund may have a short position in TLT.

Debt: The New Four-Letter Word

D-E-B-T, our country’s new four-letter word, used to be a fun toy the masses played and danced with to buy all kinds of goods and services. Debt was creatively utilized for all types of things, including, our super-sized McMansions purchased with Option ARM (Adjustable Rate Mortgage) Countrywide loans; our 0% financing car binges (thanks to now-bankrupt Chrysler and General Motors); and our no-payment-for-two-years, big screen plasma TVs (financed at now-bankrupt Circuit City). Eventually consumers, corporations, and governments realized excessive debt creates all kinds of lingering problems – especially in recessionary periods. We are by no means out of the woods yet, but consumers are now spending less than they are taking in, as evidenced by a positive and rising savings rate. This slowdown in spending is bad for short-term demand, but eventually these savings will be recycled into our economy leading to productive and innovative value creating jobs that will jumpstart the economy back on a path to sustainable growth.

Click Here For Excellent Article from the Peterson Foundation

In our hot-cold society, where the pendulum of greed and fear swing dramatically from one side to the next, we are also observing an unhealthy level of risk aversion by financial institutions. This excessive caution is unfortunately choking off the health of legitimate businesses that need capital/debt in order to survive. As we continue to see a pickup in the leading indicators for an economic recovery, banks should loosen up the credit purse strings to provide capital for profitable, growing businesses – even if there are hiccups along the way.

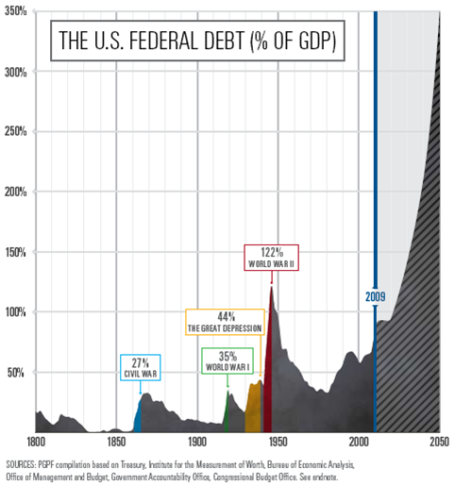

National Debt “Blob” Must Be Slowed

In the famous 1958 sci-fi horror film, “The Blob”, a gelatinous, ever-growing creature from outer space threatens to take over the town of Downingtown, Pennsylvania by methodically engulfing everything in its path. Steve McQueen eventually learns that freezing the Blob will halt its progression. In our country, entitlements, in the form of Medicare and Social Security, serve as our 21st century Blob. As the chart above shows, entitlements have expanded dramatically over the last 40 years and stand to expand faster, as the 76 million Baby Boomers reach retirement and demand more Social Security and Medicare benefits. Clearly the current path we are travelling on is not sustainable, and beyond breakthroughs in technology, the only way we can suitably address this problem is by cutting benefits or raising taxes. We only dug ourselves in a deeper financial hole with the enactment of Medicare Part D (prescription drug benefits for Medicare participants). I must admit I have great difficulty in understanding how we are going to expand health care coverage for the vast majority of Americans in the face of exploding deficits and debt burdens. I eagerly await specifics.

With an enlarging national debt burden and widening deficits, the U.S. is only becoming more reliant on foreign investors to finance our shortcomings. This trend too cannot last forever (see chart below). At some point, foreigners will either balk by not providing us the financing, or demanding prohibitively high interest rates on any funding we request – thereby negatively escalating our already high interest payment streams to bondholders.

Regardless of your political view, the problem pretty simply boils down to elementary school math. The government either needs to cut expenses or raise revenue (taxes or growth initiatives). Politically, the stimulative spending path is easier to rationalize, but as we see in California, eventually the game ends and tough cuts are forced to be made.

Regardless of your political view, the problem pretty simply boils down to elementary school math. The government either needs to cut expenses or raise revenue (taxes or growth initiatives). Politically, the stimulative spending path is easier to rationalize, but as we see in California, eventually the game ends and tough cuts are forced to be made.

Let’s hope the painful lessons learned from this financial crisis will steer us back on path to more responsible borrowing – a point where D-E-B-T is no longer considered a dirty four-letter word.

“Bill, Say It Ain’t So…”

Bond guru and Newport Beach neighbor, Bill Gross, is out with his entertaining monthly PIMCO piece (Click Here). Try to keep a box of tissues close by in case you cry during the read. His views support my stance on short duration bonds and TIPs (Treasury Inflation Protected Securities), but big Bill would NEVER stand to root for equities – especially after his call for Dow 5000 a while back.

In this CNBC piece, he points out the obvious troubles we face from all the debt we’re choking on. As a country, we need the “Heimlich Maneuver!”

Building Your Financial Future – Mistakes Made in Investment Planning

Building Your Dream Future Requires a Plan

Building your retirement and financial future can be likened with the challenge of designing and building your dream home. The tools and strategies selected will determine the ultimate cost and outcome of the project.

I constantly get asked by investors, “Wade, is this the bottom – is now the right time to get in the markets?” First of all, if I precisely knew the answer, I would buy my own island and drink coconut-umbrella drinks all day. And secondarily, despite the desire for a simple, get-rich quick answer, the true solution often is more complex (surprise!). If building your financial future is like designing your dream home, then serious questions need to be explored before your wealth building journey begins:

1) Do I have enough money, and if not, how much money do I need to develop my financial future?

2) Can I build it myself, or do I need the help of professionals?

3) Do I have contingency plans in place, should my circumstances change?

4) What tools and supplies do I need to effectively bring my plans to life?

Most investors I run into have no investment plan in place, do not know the costs (fees) of the tools and strategies they are using, and if they are using an advisor (broker) they typically are in the dark with respect to the strategy implemented.

For the “Do-It-Yourselfers”, the largest problem I am witnessing right now is excessive conservatism. Certainly, for those who have already built their financial future, it does not make sense to take on unnecessary risk. However, for most, this is a losing strategy in a world laden with inflation and ever-growing entitlements like Medicare and Social Security. There’s clearly a difference between stuffing money under the mattress (short-term Treasuries, CDs, Money Market, etc.) and prudent conservatism. This is a credo I preach to my clients.

In many cases this conservative stance merely compounds a previous misstep. Many investors undertook excessive risk prior to the current financial crisis – for example piling 100% of investment portfolios into five emerging market commodity stocks.

What these examples prove is that the average investor is too emotional (buys too much near peaks, and capitulates near bottoms), while paying too much in fees. If you don’t believe me, then my conclusions are perfectly encapsulated in John Bogle’s (Vanguard) 1984-2002 study. The analysis shows the average investor dramatically underperforming both the professionally managed mutual fund (approximately by 7% annually) and the passive (“Do Nothing”) strategy by a whopping 10% per year.

Building your financial future, like building your dream home, requires objective and intensive planning. With the proper tools, strategies and advice, you can succeed in building your dream future, which may even include a coconut-umbrella drink.

Steepening Yield Curve – Disaster or Recovery?

Various Treasury Maturities in 2006 Highlighting Inversion

Wait a second, aren’t we suffering from the worst financial crisis in some seven decades; our GDP (Gross Domestic Product) is imploding; real estate prices are cratering; and we are hemorrhaging jobs faster than we can say “bail-out”? We hear it every day – our economy is going to hell in a hand basket.

If Armageddon is indeed upon us, then why in the heck is the yield-curve steepening more than a Jonny Moseley downhill ski run? Bears typically point to one or all of the following reasons for the rise in long-term rates:

- Printing Press: The ever-busy, government “Printing Press” is working overtime and jacking up inflation expectations.

- Debt Glut: Our exploding debt burden and widening budget and trade deficits are rendering our dollar worthless.

- Foreign “Nervous Nellies”: Foreign Treasury debt buyers (the funders of our excessive spending) are now demanding higher yields for their lending services, particularly the Chinese.

- Yada, Yada, Yada: Other frantic explanations coming from nervous critics hiding in their bunkers.

All these explanations certainly hold water; however, weren’t these reasons still in place 3, 6, or even 9 months ago? If so, perhaps there are some other causes explaining steepening yield curve.

One plausible explanation for expanding long-term rates stems from the idea that the bond market actually does integrate future expectations and is anticipating a recovery. Let us not forget the “inverted yield curve” we experienced in 2006 (see Chart ABOVE) that accurately predicted the looming recession in late 2007. Historically, when short-term rates have exceeded long-term rates, this dynamic has been a useful tool for determining the future direction of the economy. Now we are arguably observing the reverse take place – the foundations for recovery are forming.

Treasury Yield Curve (June 2009)

Alternatively, perhaps the trend we are currently examining is merely a reversal of the panic rotation out of equities last fall. If Japanese style deflation is less of a concern, it makes sense that we would see a rebound in rates. The appetite for risk was non-existent last year, and now there have been some rays of sunlight that have glimmered through the dark economic clouds. Therefore, the selling of government guaranteed securities, which pushed prices down and yields upward, is a logical development. This trend doesn’t mean the equity markets are off to the races, but merely reflects investors’ willingness to rotate a toe (or two) back into stocks.

Navigating the Fixed Income Waters

Fixed Income Rapids Can Be Treacherous

Given the downward plunge in equity markets that started at the beginning of 2008, investors have flocked to fixed income options in droves. But buyers should beware. Swimming in the fixed income markets is not like frolicking around in the kiddy pool, but rather more like swimming in treacherous, crocodile-infested waters. Not all bonds are created equally, so arming yourself with knowledge regarding bond investing risks can save lots of money (and limbs).

Bond prices move in the inverse direction of interest rates – so now that interest rates have fallen to five-decade lows, is now the best time to buy bonds? Certainly there are segments of the bond market that offer tremendous value, but when the Federal Funds Rate (the key benchmark inter-bank lending rate that the Federal Reserve sets) stands at effectively 0%, that means there is only one regrettable direction for rates to go.

Before diving head first into the bond market, investors should educate themselves about the following risks:

Interest Rate Risk: With record low interest rates, coupled with massive amounts of government stimulus injected both here and abroad, the risk of rising interest rates is becoming a larger reality. Large government deficits and expanding government debt issuance can lead to inflation pressures that are correlated to upward movements in interest rates.

Default Risk: Bonds typically pay bondholders interest payments (coupons) until maturity (expiration), however in challenging financial times, various issuing entities may be incapable of paying its investors, and therefore may default. As the recession matures, more and more companies are defaulting on their debt obligations.

Reinvestment Risk: Owning healthy yielding bonds in a declining interest rate environment is the equivalent of sailing with a tailwind – however all good things must eventually come to an end. At maturity, investors must also face the risk of potentially reallocating proceeds into lower yielding (lower coupon) alternatives. For those investors relying on higher fixed income payments to cover living expenses, reinvestment risk can pose a real threat to their financial future.

Callable Risk: Just like ice cream comes in different flavors, so do bonds. Certain bonds come equipped with an add-on “callable” feature that allows the issuer to retake possession of the bond for a predetermined price. In periods of declining interest rates, as we have experienced since the early 1980s, this advantageous option has been included repeatedly by many bond issuing entities. Prepayment risk for mortgage securities can also lead to suboptimal investment returns.

Liquidity Risks: This whole banking crisis that our global financial system is currently digesting has highlighted the importance of liquidity, and the painful clogging effects of illiquid fixed income securities. Forced sales of illiquid securities (due to lack of buyers) can lead to unanticipated and drastically low proceeds for sellers.

Overall, bonds offer tremendous diversification benefits to an investment portfolio and with the exploding baby boom generation entering retirement these fixed income vehicles are attractive. Just remember, before you dip that toe into the bond market waters, beware of the lurking risks hiding below the surface.

![940614_83408820[1] 940614_83408820[1]](https://investingcaffeine.com/wp-content/uploads/2009/07/940614_834088201.jpg?w=455&h=336)