Posts filed under ‘Financial Markets’

Par for the Course

Stocks have been in a multi-year bull market, but just as investors cannot earn positive returns every month, golfers also cannot achieve a hole-in-one or birdie on every hole, either. A challenging performance is exactly what happened last month when stocks recorded a bogey on the scorecard.

More specifically, this is how far out-of-bounds the major indexes were last month:

- S&P 500: -1.4%

- Dow Jones Industrial Average -1.6%

- NASDAQ: -4.0%

Technology stocks and the Magnificent 7 stocks felt the largest brunt of the force last month as tariffs and the impact of Chinese AI (Artificial Intelligence) competition gave investors heartburn as they digested the information (see New Year, New AI ERA & New Tariff Sheriff).

Tariffs – More Molehill Than Mountain

As mentioned, a large part of last month’s volatility can be explained by the policy uncertainty surrounding the impending tariffs on China, Canada, and Mexico. Despite the absence of new tariffs being implemented, in an attempt to lock in cheaper imported goods, U.S. corporations and consumers have been stockpiling foreign goods before prices move higher due to tariffs. The 25% proposed tariffs on Canadian and Mexican goods are set to be applied as soon as March 4th. A flat 25% tariff on imported steel and aluminum products is expected to begin on March 12th – these particular tariffs are expected to have a disproportionately negative impact on the automotive industry.

Regarding other proposed reciprocal trade agreements, the White House’s analysis on tariffs for all other countries (beyond China, Canada, and Mexico) is expected to arrive on the president’s desk on April 2nd.

All these proposed changes are having an immediate economic impact whether intended or not. Not only are consumers buying more overseas products now, as they brace for higher prices, but businesses are also shifting supply chains to countries outside of China, Canada, and Mexico, in hopes of finding temporary tariff loopholes.

The bottom-line is our country’s imports have been spiking up recently, especially in the first quarter. Imports by definition subtract from America’s economic activity, so if businesses and consumers are rationally stockpiling foreign goods before prices go up from tariffs, investors should not be surprised that GDP (Gross Domestic Product) growth is set to go negative in the first quarter (-1.5%), according to the Federal Reserve Bank of Atlanta.

This short-term spike in foreign product purchases should be temporary until the tariffs are officially put in place. Subsequently, demand for relatively cheaper U.S. goods should rise because foreign goods will be pricier. In other words, buyers may begin purchasing more American-made t-shirts on Amazon because those shirts could be cheaper than the Chinese-made t-shirts after the additional tariffs commence on China.

How large are these overall tariffs? When it comes to Mexico and Canada, the size of these countries’ imports is estimated at $918 billion (see the 2023 import breakdown below for the two countries). On the surface, this sounds like a very large number, and it is. However, if you consider the size of the U.S. GDP ($29.4 trillion), these tariffs will mathematically have less than a 1% impact on the direction of our country’s economic activity.

However, if demand for American products goes up after the tariffs begin, as mentioned above, then it is perfectly logical to expect the drag from imports can be diminished or possibly completely reversed, if consumers decide to buy more American goods.

Source: Visual Capitalist

Also worth noting, as I documented last month in my Investing Caffeine blog, imports only account for 13.9% of our country’s economic activity (see New Tariff Sheriff). So, while tariffs make for great scary headlines, the reality of the numbers paints a different picture. Overall, the uncertainty surrounding the discussion of tariffs is having a much larger economic impact than the actual tariffs themselves. In other words, what we are discussing is more molehill than mountain. We saw this same movie before during the administration’s first-term when tariffs did not crater the economy into recession or create disproportionately high inflation.

War at the White House

A geopolitical soap opera played out on global television last Friday during a meeting between Ukraine’s President Volodymyr Zelensky and President Trump in the Oval Office. The meeting was designed to be a celebratory signing of a minerals deal in which the U.S. would gain access to strategically important Ukrainian rare earth metals in exchange for continued U.S. aid and military support. A signed deal would increase the probability of a peace deal between Russia and Ukraine dramatically. What actually happened was a war of words at the White House, which resulted in Zelensky getting kicked out of the White House with no signed deal.

Both sides have economic and strategic incentives to reengage in peace and mineral deal negotiations, but if the U.S.-Ukraine relationship totally crumbles, Europe and the other NATO (North Atlantic Treaty Organization) countries will need to pick up the slack in their military and economic aid to Ukraine. Regardless, increased European support is required to stave off a broader incursion by Russia and Vladimir Putin into a wider portion of Europe.

Tariffs, the Russia-Ukraine war, and AI issues may have heightened investor anxiety last month, but long-term investors understand that annual -5% and -10% corrections in the equity markets are considered par for the course. In fact, over the last 12 months, the S&P 500 index has declined -5% five times, and -10% one time, yet the stock market is still up +16% on a trailing 12-month basis (see chart below).

Source: Trading Economics

Financial markets end up in the rough plenty of the time, which often results in performance scorecard bogeys. However, long-term investors and Sidoxia Capital Management clients have won more often than not because the benefits of American capitalism have created many more birdies and pars over time.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 3, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in META, NVDA, certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BABA or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

How to Profit from the Trump Crypto Wave

We were honored to have our white paper on the cryptocurrency market published by the California Business Journal last month. Please enjoy the article below.

Newly inaugurated President Donald Trump has wholeheartedly embraced the multi-trillion dollar cryptocurrency and digital asset industry. This is a seismic shift from the anti-crypto stance harbored by the previous administration. In the first week of his second term, President Trump not only appointed crypto-friendly Paul Atkins as the SEC Chairman, but Trump also named David Sacks as the first-ever White House Crypto Czar. If that was not a strong enough signal, Trump issued an executive order on his third day in the Oval Office, entitled, “Strengthening American Leadership in Digital Financial Technology.”

With this massive political and legislative tailwind behind the cryptocurrency industry, what is the best way to profit from this cryptocurrency wave? Is it just as easy as buying Bitcoin? Not exactly, if history repeats itself. Since Bitcoin was introduced in early 2009, the value of the cryptocurrency has fallen by more than -50% seven times. There have been many causes for Bitcoin’s historical volatility, including the hacking of the largest Bitcoin exchange in 2011 (Mt. Gox); China banning Bitcoin in 2013; and the COVID pandemic crash in 2020. Matters got worse for the cryptocurrency industry when FTX, one of the world’s largest crypto exchanges went bankrupt in 2022, and its founder and CEO, Sam Bankman-Fried, was subsequently arrested and convicted for fraud and money laundering.

Investing in a currency or asset class with that much volatility is very challenging. To compensate for volatility and risk, investors require the potential for higher returns backed by robust fundamentals. Unfortunately, to date, many of the broadest use cases for cryptocurrencies have been limited to illicit and illegal activities. There certainly are some speed and security advantages to the blockchain technology and the associated ledger structure of the major cryptocurrencies. However, the benefits have not been so clear-cut that Fortune 1000 companies and mass consumers have adopted it. A relatively small 15.5% of Americans (and 6.9% worldwide) are estimated to own a cryptocurrency, and a smaller fraction of that actually transact in a crypto.

Even though the practical use cases for cryptocurrencies over the last two decades have been extremely constrained, the speculative fervor surrounding this asset class has grown exponentially to the point there are over an estimated 10,000 cryptocurrencies that exist today, including speculative meme coins such as Dogecoin, the Trump coin, and other crude joke coins.

In my more than three decades of investing, I have repeatedly encountered extensive segments of the financial markets that would qualify as speculative bubbles, whether it was subprime mortgages and credit default swaps (CDS) in the 2008 Financial Crisis, or dot-com companies in the 2000 bursting of the technology bubble.

Today, in 2025, the current cryptocurrency wave definitely qualifies as another bubble. But depending on an investor’s time horizon, there is still potential to make significant profits during these frothy investment waves. For example, take Amazon.com, which was at the epicenter of the dot-com bubble as it saw its stock price crater approximately -95% in the 2000-2001 timeframe. Before Amazon’s stock collapsed, its price peaked at $5.65 per share at the end of 1999 – today, the stock price in 2025 has exceeded $240 per share (a more than 40-fold increase). Despite the bursting of the tech bubble, a tremendous amount of money has been made by long-term investors in Amazon and a select few other long-term technology winners.

I believe the same opportunity exists today in the cryptocurrency market. There are a few historical parallels that inform our crypto investment strategy at my investment firm, Sidoxia Capital Management. Let’s begin with the gambling industry that flourished in Las Vegas during the 1940s after the end of Prohibition. It was not the gamblers and speculators that made all the money, but rather the casinos, including some remaining today like the Flamingo and the Golden Nugget.

Currently, the dominant casino in the cryptocurrency industry is Coinbase Global Inc. (COIN). Coinbase is the 800-pound gorilla in the U.S. cryptocurrency exchange space, handling transactions that total more than $4 billion in daily trading volume across hundreds of cryptocurrencies, stable coins, meme coins and other digital assets. And the company is highly profitable with substantial growth. More specifically, the company has generated more than $5 billion in sales and greater than $1 billion in profits over the last year. Just like Las Vegas casinos make money off every gambler’s bets, so too does Coinbase make profits off every crypto speculator’s trades, whether those transactions in Bitcoin, Tether, Ethereum, or meme coins go up or down in value.

Another lucrative way for investors to look at the nascent cryptocurrency industry is to compare it to the California gold rush that occurred from 1848 – 1855. Hundreds of thousands of “forty-niners” (the peak year of gold rush immigration – 1849) flocked out west in hopes of discovering perceived limitless riches – an attitude held by many cryptocurrency purchasers presently. Unfortunately, it was not the forty-niners digging and panning for gold who made most of the money, it was the merchants selling all the picks and shovels to the gold rush speculators that profited the greatest.

The contemporary merchants in today’s cryptocurrency world are companies like NVIDIA Corp. (NVDA), the creator of the graphics processing unit (GPU) semiconductors that power the critical mining operations of cryptocurrencies like Bitcoin. The GPUs serve as the picks and shovels for crypto miners who receive rewards in the form of cryptocurrencies (i.e., Bitcoin) in return for performing computationally intensive calculations, which are necessary to verify transactions on a digital decentralized crypto ledger. NVIDIA GPUs have a broad range of applications beyond crypto mining, including data center applications for artificial intelligence (AI), video games, gene sequencing, virtual-augmented reality, and other large-scale markets. Over the last year, NVIDIA has produced more than $110 billion in sales and created more than $60 billion in net profits. Not only was NVDIA successful commercially, but equity investors were also rewarded handsomely last year with an appreciation of +171% in the share price.

There are plenty of reasons to remain skeptical about the euphoria surrounding the cryptocurrency industry, especially due to the lack of legitimate use cases across the avalanche of digital assets endlessly introduced. However, the pro-crypto wave of Trump regulations and policies allow plenty of ways for investors to profit from this digital gold rush, especially if you can find the winning crypto casino and leading merchant of digital picks and shovels.

By Wade W. Slome, CFA, CFP®, Exclusive to California Business Journal

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, COIN, IBIT, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Time in the Market Beats Timing the Market

It was another great year in the stock market. But predicting the timing of a bear or bull market is more challenging. Fortunately for investors, the stock market is up a lot more of the time than it is down. More specifically, over the last century, the stock market has been up 73% of the time for one-year periods and 94% of the time for 10-year periods (see graphic below and Time is What Matters). That’s why investors’ time in the market beats the fools’ errand strategy of trying to time the market. The long-term, consistent upward trend in stock prices makes investing in the stock market akin to sailing around the world with a persistent tailwind for the whole trip.

Source: Capital Group and S&P 500 Index

Many people believe investing in the stock market is gambling, but 73% and 94% odds for stock market gains seem a lot better than the probabilities of making money in Las Vegas. I explored this concept further in one of my recent articles (see Elections Status Quo). Even with those favorable, lopsided odds, recessions do occur, albeit infrequently. As you can see from the chart below, since World War II, we have experienced a dozen recessions averaging 10 months in duration. And guess what? Successful post-recession recoveries have equaled 100% (12 for 12). Despite the short-lived bear markets, stock prices have appreciated more than 30x-fold since the end of World War II.

Source: Yardeni.com

2024 Predictions

There were plenty of pundits and talking heads who falsely predicted a recession in 2024, but the odds certainly worked in investors’ favor. For 2024, the S&P 500 index gained +23%, and this comes on the heels of a banner 2023, which was up +24%. Experiencing back-to-back +20%-years is a rare occurrence, which hasn’t occurred since the late-1990s. As we look into 2025, achieving three consecutive positive years in the stock market is not unprecedented, but as I mentioned earlier, predicting the timing of a down market can be tricky.

Case in point, predicting the outcome of stock returns, even with perfect information can be very daunting. What would have been your prediction of the 2024 stock market return, if I told you the following events were to occur this year (in no particular order)?

- Two assassination attempts on a presidential candidate

- An ongoing bloody war between Russia and Ukraine that reaches one million deaths

- Brutal Israeli-Hamas war in Gaza moves into its second year

- Nationwide Palestinian protests across college campuses

- Israeli-Hezbollah war commences in Lebanon

- Rebels in Syria topple the Assad regime

- A hotly contested presidential election triggering fears of a civil war

- A Baltimore bridge collapses killing six people and costing the overall economy upwards of $10 billion

- After crypto exchange goes bankrupt, CEO is sentenced to 25 years in prison for fraud

Most intelligently honest people would not have predicted a +23% return, but that is exactly what happened. As part of this extended bull market, some major stock market milestones were achieved: 1.) the Dow Jones Industrial average eclipsed 40,000; 2.) the main benchmark S&P 500 index surpassed 6,000; and 3.) the NASDAQ index temporarily triumphed the 20,000 level. The market took a breather in December (the Dow -5.3% and S&P -2.5%), so we have momentarily pulled back from some of these key levels.

What Next in 2025?

As I alluded to earlier, pulling off a three-peat in 2025 with a third consecutive year of gains may be a difficult feat, but not impossible. There remains some room for optimism. First of all, we have an accommodative Federal Reserve that has cut interest rates three times in 2024 (see chart below) from a target of 5.5% to 4.5% (see red line). Currently, expectations are set for the Fed to make another two interest rate cuts in 2025. All else equal, this should provide some mild stimulus for both borrowers and investors in 2025.

Source: Yardeni.com

Next, we have a new pro-business administration entering the White House that has promised lower taxes and less regulation, which should aid business profits. Tariff policies remain a wildcard, but if used judiciously for negotiation purposes, perhaps there could be more bark than bite from the rhetoric. Time will tell.

The 2024 chapter has closed, and we have started the 2025 chapter. Regardless of the outcome this year, history teaches us the time in the market is much more important than timing the market. This philosophy has served Sidoxia Capital Management and its clients well over the long-run.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Market Misgiving on This Thanksgiving

We’ll see if there is any gravy left for investors during the last month of the year, but so far 2024 has been a satiating feast that has stuffed investors. There has been a cornucopia of items to be thankful for, including the Federal Reserve, which is expected to provide some dessert this month in the form of its third interest rate cut this year.

Investors certainly can also be grateful for the performance of the stock market, which has had a phenomenal year thus far (see chart below):

• S&P 500: +26.5%

• Dow Jones Industrial Average:+19.2%

• NASDAQ: +28.0%

On a two-year basis, the S&P 500 results look even tastier: +57.1%

Why is there such a large appetite for stocks? For starters, we are coming off a fresh election last month, and the majority of Americans decided to vote for the new administration that has promised additional stimulative tax cuts, and deregulation. If these promises come to fruition, these changes could augur well for corporate profits and a rising stock market. Regardless of whether your candidate won or lost the election, investors can agree there is less uncertainty with an uncontested election, which is welcomed by all. In addition, the two Fed rate cuts that started in September have also buoyed enthusiasm.

What is less clear are the effects of President-elect Donald Trump’s tariff policy threats, which if enacted run the risk of increasing inflation, stifling global trade, and jeopardizing future Fed rate cuts. Combined, these negative side effects have the potential of significantly dampening economic growth. On the other hand, if the tariffs are only used as a negotiating tool with our larger trading partners (including China, Mexico, Canada, and Europe), the tariff discussion will likely have more bark than bite. Time will tell.

Dissecting Stock Performance & Valuations

A lot of pundits are pointing to an overheated market, but on a 3-year basis, returns are looking more normalized (+8.2% per year) because of the -20% hit on stocks during 2022. As you may recall, much of the 2022 decline was caused by the Fed slamming on the economic breaks with its fastest rate-hiking cycle in four decades (raising rates from 0.0% to 5.5%).

Objectively, stock values, as measured by the Price-Earnings (P/E) ratio of the S&P 500, are at elevated levels – registering in at approximately 22-times next year’s forecasted profits. As you can see from the chart below, the stock market is priced at levels not seen since 2001 and valuations are roughly double what they were at the lows of the 2008 Financial Crisis.

Source: Yardeni.com

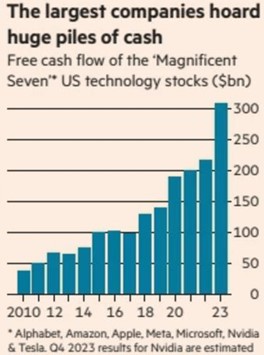

A major reason for escalated valuations has been the concentration of performance in the largest seven companies, or the so-called Magnificent 7 stocks, which include, Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla. In fact, the index concentration is the highest it has been in more than a half century – even higher than at the peak of the 2000 Tech Bubble when Cisco Systems, Microsoft, GE, Intel, and Exxon Mobil were the five largest companies by market capitalization (see chart below).

The good news is the other 493 companies in the S&P 500 (I call them the “Absentee 493”) are priced much more reasonably. This bifurcated dynamic between the largest seven companies versus everything else, highlights the plethora of opportunities available to be harvested in Value stocks, Small-cap stocks, and Mid-cap stocks.

As is evident in the chart below, the S&P 500 index (red-line), which is skewed by the Magnificent 7, is about 30% more expensive than Small-cap and Mid-cap stocks, which are hovering near historically attractive valuation levels.

Source: Yardeni.com

Value stocks (blue-line) in the market look equally attractive (about 30% cheaper than the S&P 500), as can be seen in the chart below.

Source: Yardeni.com

As always, the future is uncertain, and risks abound for next year. But 2024 has been a blockbuster year and there has been plenty to be thankful for, especially the performance of the U.S. stock market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, AMZN, MSFT, GOOGL, META, TSLA, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CSCO, GE, XOM, INTC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Past Elections Status Quo Means No Need for Woe

Scarier than Halloween, the current presidential election is causing people on both sides of the political aisle to be frightened by the idea of their candidate potentially losing. Uncertainty is generally petrifying to investors, resulting in downward pressure on stock prices, but with less than a week until election day, the stock market is providing more treats than tricks. Sweetness has come in the form of a stock market up +20% in 2024 (up 8 out of 10 months this year), and only off -3% from its record high reached a few weeks ago. For the month, investors experienced modest declines as they braced for the election results. The S&P 500 dropped -1.0%, the Dow Jones Industrial Average -1.3%, and NASDAQ -0.5%.

Regardless of whether the red team or blue team wins the presidential election, the good news is history reminds us the end result has little effect on the long-term results of the stock market. As you can see from the chart below, over the last century, stock prices have gone up under both Republican and Democrat presidents. As Mark Twain famously stated, “History doesn’t repeat itself, but it often rhymes.” If that’s the case, past elections teach us, there is no need to fear the status quo of a Republican or Democrat president.

Source: Yardeni Research (Yardeni.com)

More recently, over the last 26 years, the stock market has been up significantly under each president, regardless of political party. Here are the results of the S&P 500 under the last three presidents:

- President Barack Obama(November 4, 2008 – November 8, 2016 – Democrat): +137%

- President Donald Trump(November 8, 2016 – November 3, 2020 – Republican): +51%

- President Joe Biden (November 3, 2020 – Present – Democrat): +63%

No matter who wins the White House, they will be inheriting a relatively strong economy. Consider the following tailwinds benefitting the new president:

- Strong Economy: The broadest measurement of economic activity, Gross Domestic Product (GDP), registered a healthy +2.8% growth rate for Q3

- Resilient Jobs Market: The just-reported unemployment rate of 4.1% today is representative of a strong but slowing job market. The unemployment rate has climbed modestly since troughing in 2023, but unemployment is still relatively low compared to historic levels much higher.

- Declining Inflation: As I pointed out last month (see Rate Cut Adrenaline) inflation has been on a fairly consistent downward trajectory over the last two years, which has allowed the Federal Reserve to cut interest rates by 0.50% in September. Moreover, based on the current economic environment, the Fed has signaled more stimulative interest rate cuts are likely ahead – economic strategists and pundits are predicting another 0.25% cut at the next Federal Reserve meeting that occurs over the two days following the elections.

- Record Corporate Profits (see chart below): The United States economy is the envy of the world, and the reason why is evident by the 65-year chart below showing record corporate profits and GDP. If you were an entrepreneur, where would you choose to start your company? China? Japan? UK? Russia? There’s plenty of room for improvements in our country’s policies, but there’s a reason the U.S. dominates in creating the largest and most profitable multi-trillion companies in the world.

Source: Calafia Beach Pundit

One area for improvement in the U.S. revolves around our fiscal debt and deficits. Our government simply spends too much money and doesn’t collect enough (tax receipts) to cover those expenses (see chart below). Another lesson to learn from our government’s excessive spending over the last four decades is that the glut of expenditures can’t be blamed on any one political party – the slope of spending is consistently up and to the right for all serving politicians.

Source: Calafia Beach Pundit

As I have mentioned in the past, stocks do not perpetually move up forever. However, regardless of the election outcome, we know from history that up-markets (bull markets) occur about 85% of the time, if we look at the last 100 years (see chart below). Analysis by Dimensional Fund Advisors shows that from 1926 – 2023, bull markets have lasted 994 months versus much shorter bear markets of 177 months.

Source: Dimensional Fund Advisors

It is very possible that stock prices may take a breather or correct under various election outcomes, but if we follow the historic status quo, there will be no long-term reason for woe.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fed Injects Rate Cut Adrenaline

There were a lot of injections, of the COVID vaccine variety, four years ago, but now the Federal Reserve is injecting some financial adrenaline through stimulative interest rate cuts. Expectations are for seven more -0.25% cuts over the next 12 months, but this cycle started two weeks ago when the FOMC (Federal Open Market Committee) initiated a larger -0.50% reduction in the benchmark federal funds rate target (see chart below). For now, investors have enjoyed the boost of adrenaline, which should help lower consumer interest rates on things like home mortgages, credit cards, and car loans.

Source: Yardeni.com

For the month, the S&P 500 climbed +2.0%, the Dow Jones Industrial +1.9%, and the NASDAQ index +2.7%. The monthly gains are adding to a 2024 that is shaping up to be a potentially banner year. With one quarter left in the year, the S&P has catapulted +21% higher, the Dow Jones Industrial Average +12%, and the NASDAQ index +21% for the first nine months.

Economy Strong, So Why Cut Now?

Before the Fed’s last action a couple weeks ago, the last Fed rate cut occurred in 2020 (a -1.50% cut) in the midst of a global pandemic with the aim of boosting financial activity while the brick-and-mortar economy had effectively been shut down. But compared to today, the economy is performing much better. Second quarter GDP growth came in at +3.0% with 3rd quarter GDP growth forecasts coming in at +3.1%.

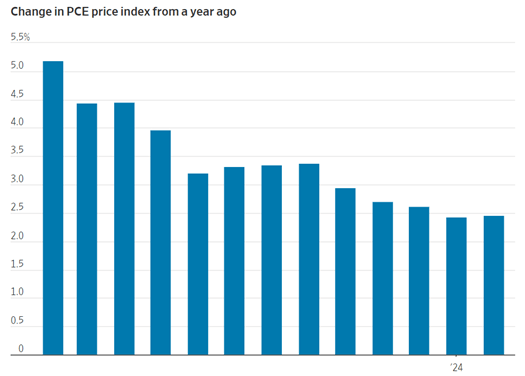

So, if things look so great, why would the Fed be cutting rates to stimulate the economy now? In short, inflation has been coming down (see chart below) from a peak of 9.1% a couple years ago to 2.5% last month (near the Fed’s long-term 2.0% target). And although the current unemployment rate is low at 4.2%, it has nevertheless weakened and climbed substantially from a 3.4% level last year).

Source: Trading Economics

China Chugs Higher

While the U.S. economy has been leading developed countries during the post-COVID recovery period, China’s financial system has been struggling due to a collapsing real estate market and deteriorating consumer spending. As a result, the Chinese stock market has been drastically underperforming other foreign markets, until Beijing just recently announced a number of stimulus initiatives last week in hopes of buoying economic growth closer to its 5% target.

Here are some of the Chinese government measures:

- China plans to issue 2 trillion yuan in special sovereign bonds

- China’s central bank cut its reserve requirement ratio by 50 basis points

- Fiscal policies to focus on increasing consumer subsidies and controlling government debt

- Shanghai, Shenzhen plan to lift key home purchase restrictions

Investors cheered the announcements by binge-buying Chinese stocks, as you can see from the CSI 300 China index, which rocketed +21% higher last month – the largest monthly gain since 2008.

AI Revolution Continues

While economic headwinds and tailwinds continue to swirl, the AI (Artificial Intelligence) revolution has persisted in the background. While some traders have solely focused on AI juggernaut NVIDIA Corp. (NVDA), which has steamrolled its way into becoming a three trillion-dollar valued company, there are other tech titan companies like Oracle Corp. (ORCL), which are also riding the AI wave. Just last month, Oracle’s billionaire founder, Larry Ellison, stated, “We have 162 data centers now. I expect we will have 1,000 or 2,000 or more data centers…around the world.” Each large-scaled data center can cost in the hundreds of millions or multi-billion-dollar range. With hundreds of billions (if not trillions) of dollars to be spent on the multi-year AI infrastructure buildout, as you can imagine, there is a large, diverse ecosystem of other companies that stand to benefit. At Sidoxia Capital Management (www.Sidoxia.com), we have identified a wide swath of AI investments that have benefited our investors and stand to do so in the future.

Flies in the Ointment

By simply judging the performance of the U.S. stock market, one might think there is nothing for investors to worry about. But as is always the case, there still remain some flies in the ointment. With a tight, hotly-contested presidential election just one month away, coupled with escalated wars in the Mideast and Ukraine, future volatility or a correction in the stock market should come as no surprise to anyone, especially in light of the rich gains already registered this year. Another concern is the risk of rising inflation, which could rear its ugly head again if the Federal Reserve misjudges its rate-cutting program and overheats the economy.

Normally, interest rate cuts are reserved by the Fed for periods when the economy is headed towards a recession or there are major systemic disruptions in the financial system, which affect market liquidity and/or bank lending. That’s not the case today. Thanks to declining inflation and a robust but weakening job market, the Fed has been equipped to provide investors with a healthy injection of adrenaline through an early round of interest rate cuts, which has contributed to the powerful stock market gains. So far, the adrenaline is doing its job.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including AMZN, MSFT, META, GOOGL, NVDA, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Great Rotation

There are many styles of investing, and many ways to make money in the stock market. Just like the styles of men’s ties or women’s dresses come in and out of fashion, so too do the styles of investing. Some stick around for a long time, while other fads flop in short order, leading consumers to rotate into new fashions. I’m still waiting for my Bermuda shorts and pleated pants to come back in style. At this year’s Olympics, the broad array of styles has been on full display.

Growth & Tech in Style

The stock market has been on a one-way freight train riding on the coattails of large capitalization growth stocks, primarily technology stocks, especially those associated with technology and artificial intelligence (AI). You can see the dominance of the Growth style over Value in the 30-year chart below.

Source: Yardeni.com

When the blue line is sloping upwards, that means Growth stocks are outperforming Value stocks, and when sloping downwards, Value stocks are outperforming Growth Stocks. For most of the 1990s, Growth was dominant, and ever since the aftermath of the 2008 Financial Crisis, Growth stocks have once again overshadowed Value stocks a majority of the time (2022 being a short-lived reprieve for Value stocks).

This mega-Growth trend reversed last month (at least temporarily), and investors decided to rotate out of large winners into the previously shunned areas of the market, including Small Cap and Value stocks. You can see in the chart below that Small Caps (S&P 600) have underperformed Large Caps (S&P 500) over the last six years.

Source: Yardeni.com

Is this rotation sustainable? At this point, I’d say it’s too early to tell, but during periods like these, when Wall Street darlings like NVIDIA Corp (NVDA) suffer a large hit (e.g., down -17% for NVDA since the June peak), diversification benefits are pushed to the forefront. The lesson of the year 2000 technology bubble bursting taught a generation of investors that getting overly concentrated in a single sector of technology stocks can be seriously dangerous to your wealth and financial well-being. By selecting a diversity of eggs in your basket, like Value and Small Cap stocks, you can protect your nest egg when there are substantial rotations like we experienced last month. Diversification is a core tenet of our investment philosophy at Sidoxia.

In order to place the recent rotation in perspective, let’s look at how a range of indexes performed last month. The Dow Jones Industrial Average increased a hefty +4.4%, while the S&P 500 finished up modestly +1.1%. As investors rotated out of technology (-3.3% – Technology Select Sector SPDR Fund / XLK), a good chunk of those sales rotated into small cap stocks (+10.3% – iShares Russell 2000 ETF / IWM) and value stocks (+5.1% – iShares Russell 1000 Value ETF / IWD).

Despite concerns over global geopolitics, political election madness, and a slowing economy, investors are more focused on the positive prospect of future interest rate cuts by the Federal Reserve, starting in September with a probability exceeding 90% (see chart below).

Source: CME Group

Some investors got caught up in the dizzying rotation last month, but timing these rotations is nearly impossible and one month does not make a long-term trend. Rather than getting caught up in a fool’s errand, make sure your investment portfolio is diversified and built to withstand volatile rotations.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Dow Knocking on the Door of 40,000

The stock market rang the doorbell of the New Year with a bang during the 1st quarter. The S&P 500 index built on last year’s +24% gain with another +10% advance during the first three months of the year. And as a result of these increases, the Dow Jones Industrial Average index is knocking on the door of the 40,000 milestone – more specifically, the Dow closed the month at 39,807 (see chart below). To put his into context, when I was born more than 50 years ago, the Dow was valued at less than 1,000 – not a bad run. This is proof positive of what Einstein called the 8th Wonder of the World, “compounding”. At Sidoxia Capital Management, we view investing as a marathon, not a sprint. You cannot realize the benefits of compounding without having a long-term time horizon. The sooner you start saving and the more you save, the faster and larger your retirement nest egg will grow.

If you are one of the people who thinks the stock market is too high, then you should definitely ignore Warren Buffett, arguably the greatest investor of all-time. Buffett predicted the Dow will reach an astronomical level of one million (1,000,000) within the next 100 years. I’m not sure I will still be around to witness this momentous achievement, however, if history repeats itself, this targeted timeframe could prove conservative.

Despite the magnitude and duration of this bull market, there is still a lot of angst and anxiety over the upcoming election. Nevertheless, investors are choosing instead to focus on the strong fundamentals of the economy. Just this last week, we saw the broadest measurement of economic activity, GDP (Gross Domestic Product), get revised higher to +3.4% growth during the 4th quarter of 2023 (see chart below). On the jobs front, the unemployment picture remains healthy (3.9%), near a generational low.

Source: Trading Economics and Bureau of Economic Analysis

And when it comes to the all-important inflation data, the Federal Reserve’s preferred inflation measure, Core PCE index (Core Personal Consumption Expenditures), was also just released in-line with economists’ projections at 2.5% (see chart below), very near the Fed’s long-term 2.0% inflation target and well below the Core PCE’s recent peak near 6%.

Source: The Wall Street Journal and Commerce Department

This resilient economic data, when combined with the declining inflation figures, has resulted in the Federal Reserve sticking with its plan of cutting its Federal Funds interest rate target three times this year. If inflation reverses course or remains stubbornly high, then there is a higher likelihood that interest rate cuts will be delayed. On the flip side, if economic data slows significantly or the country goes into a recession, then the probability of sooner and/or more Fed interest-rate cuts will increase.

In other news, here are some of the other major financial headlines this month:

- Francis Scott Key Baltimore Bridge Collapse: Six people died when a large container ship crashed into the Francis Scott Key bridge in the Port of Baltimore. An estimated 50 million tons of goods valued at $80 billion flows through this port, making this one of the top 10 ports in the country. The auto and coal industry supply chains will be disproportionately affected, but the good news is much of these goods will be diverted to other larger ports (e.g., Port of New York and Port of New Jersey).

- DJT Debut: A lot of hype surrounded the trading debut of Trump Media & Technology Group, which began trading last week under the initials of our country’s former president, Donald J. Trump (Ticker: DJT). Despite only posting a few million in revenue and -$50 million in losses during the first nine months of 2023, the stock skyrocketed +65% in its first week of trading and attained a $9 billion valuation. Time will tell if Trump’s Truth Social media platform will gain traction and justify the stock’s price, or rather suffer the declining fate of other meme stocks like GameStop Corp. (GME) or AMC Entertainment Holdings (AMC).

- SBF Sentenced to 25 Years: The former CEO of cryptocurrency exchange company FTX, Sam Bankman-Fried (SBF), was sentenced to 25 years in prison due to his conviction on seven counts of fraud and what is believed to be $8 billion in stolen client funds. SBF didn’t help his own cause by perjuring himself, tampering with witnesses, and showing a lack of remorse, according to the judge.

We are only 25% of the way through the year, but the Dow is knocking on the 40,000-milestone door. The way things look now, investors are wiping their feet on the welcome doormat and ready to walk right in.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), and notes including AMC 2026, but at the time of publishing had no direct position in DJT, GME, AMC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.