Posts filed under ‘Exchange Traded Funds (ETFs)’

Passive vs. Active Investing: Darts, Monkeys & Pros

Bob Turner is founder of Turner Investments and a manager of several funds at the investment company. In a recent article he reintroduces the all-important, longstanding debate of active management (“hands-on”) versus passive management (“hands off”) approaches to investing.

Mr. Turner makes some good arguments for the active management camp, however some feel differently – take for example Burton Malkiel. The Princeton professor theorizes in his book A Random Walk Down Wall Street that “a blindfolded monkey throwing darts at a newspaper’s stock page could select a portfolio that would do just as well as one carefully selected by experts.” In fact, The Wall Street Journal manages an Investment Dartboard contest that stacks up amateur investors’ picks against the pros’ and random stock picks selected by randomly thrown darts. In many instances, the dartboard picks outperform the professionals.

Given the controversy, who’s right…the darts, monkeys, or pros? Distinguishing between the different categorizations can be difficult, but we will take a stab nevertheless.

Arguments for Active Management

Turner contends, active management outperforms in periods of high volatility and he believes the industry will be entering such a phase:

“Active managers historically have tended to perform best in a market in which the performance of individual stocks varies widely.”

He also acknowledges that not all active managers outperform and admits there are periods where passive management will do better:

“The reason why most active investors fail to outperform is because they in fact constitute most of the market. Even in the best of times, not all active managers can hope to outperform…The business of picking stocks is to some degree a zero-sum game; the results achieved by the best managers will be offset at least somewhat by the subpar performance of other managers.”

Buttressing his argument for active management, Turner references data from Advisor Perspectives showing an inconclusive percentage (40.5%-67.8%) of the actively managed funds trailing the passively managed indexes from 2000 to 2008.

The Case for Passive Management

Turner cites one specific study to support his active management cause. However, my experience gleaned from the vast amounts of academic and industry data point to approximately 75% of active managers underperforming their passively managed indexes, over longer periods of time. Notably, a recent study conducted by Standard & Poor’s SPIVA division (S&P Indices Versus Active Funds) discovered the following conclusions over the five year market cycle from 2004 to 2008:

- S&P 500 outperformed 71.9% of actively managed large cap funds;

- S&P MidCap 400 outperformed 79.1% of mid cap funds;

- S&P SmallCap 600 outperformed 85.5% of small cap funds.

Read more about the dirty secrets shrinking your portfolio.

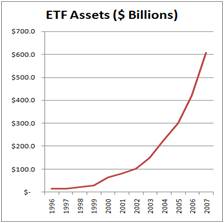

According to the Vanguard Group and the Investment Company Institute, about 25% of institutional assets and about 12% of individual investors’ assets are currently indexed (passive strategies). If you doubt the popularity of passive investment strategies, then look no further than the growth of Exchange Traded Funds (ETFs – see chart), index funds, or Vanguard Groups more than $1 trillion dollars in assets under management.

Although I am a firm believer in passive investing, one of its shortcomings is mean reversion. This is the idea that upward or downward moving trends tend to revert back to an average or normal level over time. Active investing can take advantage of mean reversion, conversely passive investing cannot. Indexes can get very top-heavy in weightings of outperforming sectors or industries, meaning theoretically you could be buying larger and larger shares of an index in overpriced glamour stocks on the verge of collapse. We experienced these lopsided index weightings through the technology bubbles in the late 1990s and financials in 2008. Some strategies may be better than other over the long run, but every strategy, even passive investing, has its own unique set of deficiencies and risks.

Professional Sports and Investing

As I discuss in my book, there are similarities that can be drawn between professional sports and investing with respect to active vs. passive management. Like the scarce number of .300 hitters in baseball, I believe there are a select few investment managers who can consistently outperform the market. In 2007, AssociatedContent.com did a study that showed there were only 22 active career .300 hitters in Major League Baseball. I recognize in the investing world there can be a larger role for “luck,” which is difficult, if not impossible, to measure (luck won’t help me much in hitting a 100 mile per hour fastball thrown by Nolan Ryan). Nonetheless, in the professional sports arena, there are some Hall of Famers (prospects) that have proved they could (can) consistently outperform their peers for extended durations of time.

Experience is another distinction I would highlight in comparing sports and investing. Unlike sports, in the investment world I believe there is a positive correlation between age and ability. The more experience an investor gains, generally the better long-term return achieved. Like many professions, the more experience you gain, the more valuable you become. Unfortunately, in many sports, ability deteriorates and muscles atrophy over time.

Size Matters

Experience alone will not make you a better investor. Some investors are born with an innate gift or intellect that propels them ahead of the pack. However, most great investors eventually get cursed by their own success thanks to accumulating assets. Warren Buffet knows the consequences of managing large amounts of dollars, “gravity always wins.” Having managed a $20 billion fund, I fully appreciate the challenges of investing larger sums of money. Managing a smaller fund is similar to navigating a speed boat – not too difficult to maneuver and fairly easy to dodge obstacles. Managing heftier pools of money can be like captaining a supertanker, but unfortunately the same rapid u-turn expectations of the speedboat remain. Managing large amounts of capital can be crippling, and that’s why captaining a supertanker requires the proper foresight and experience.

Room for All

As I’ve stated before, I believe the market is efficient in the long run, but can be terribly inefficient in the short-run, especially when the behavioral aspects of emotion (fear and greed) take over. The “wait for me, I want to play too” greed from the late 1990s technology craze and the credit-based economic collapse of 2008-2009 are further examples of inefficient situations that can be exploited by active managers. However, due to multiple fees, transaction costs, taxes, not to mention the short-term performance/compensation pressures to perform, I believe the odds are stacked against the active managers. For those experienced managers that have played the game for a long period and have a track record of success, I feel active management can play a role.

At Sidoxia Capital Management, I choose to create investment portfolios that blend a mixture of passive and active investment strategies. Although my hedge fund has outperformed the S&P 500 in 2009, that fact does not necessarily mean it’s the appropriate sole approach for all clients. As Warren Buffet states, investors should stick to their “circle of competence” so they can confidently invest in what they know. That’s why I generally stick to the areas of my expertise when I’m actively investing in stocks, and fill in the remainder of client portfolios with transparent, low-cost, tax-efficient equity and fixed income products (i.e., Exchange Traded Funds).

Even though the actively managed Turner Funds appear to have a mixed-bag of performance numbers relative to passively managed strategies, I appreciate Bob Turner’s article for addressing this important issue. I’m sure the debate will never fully be resolved. In the meantime, my client portfolios will aim to mix the best of both worlds within active and passive management strategies in the eternal quest of outwitting the darts, monkeys, and other pros.

Read the full Bob Turner article on Morningstar.com

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds but had no direct position in stocks mentioned in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Leveraged ETFs…Too Much Adrenaline?

Isn’t the market volatile enough without leverage? I believe the vast majority of individuals have plenty of adrenaline in their daily investment lives without the necessity of exotic inverse ETFs (Exchange Traded Funds) or other leveraged investment vehicles. FINRA (Financial Industry Regulatory Authority), the largest regulating body overseeing U.S. securities firms feels much the same way. Many of these ETFs seek to earn a daily return double or triple a designated index – the inverse instruments strive to mirror the return in the opposite direction.

Read WSJ Article (FINRA Urges Caution on Leveraged Funds)

No doubt, many exchange traded funds have some key advantages over actively managed mutual funds such as lower costs, tax efficiency, and improved liquidity; however most investors have no business in trading these crazy leveraged gimmicks. For example, I wouldn’t recommend average investors speculating in the Direxion 3X Inverse Financial Bull (FAS) ETF, which was down more than 95% in its first four months of existence. Do yourself a favor and heed the advice of stuntmen that advise, “Please, do not try this at home.”

FINRA conveyed this sentiment in a recent notice:

“While such products may be useful in some sophisticated trading strategies, they are highly complex financial instruments that are typically designed to achieve their stated objectives on a daily basis. Due to effects of compounding, their performance over longer periods of time can differ significantly from their stated daily objective.”

The Wall Street Journal article goes on to show a return example of how three different funds performed (vanilla index fund, double long fund, double inverse fund) under alternating positive and negative +/-10% day scenarios. After 60 days of alternating up +10% and down -10% on an initial investment of $100, the index fund ended at a value of $40.47 while the double inverse funds finished worth a meager $2.54 each. The example proves that the correlation between the leveraged ETF and the underlying target index can vary dramatically when invested for longer periods than a day.

These levered products make for excellent brokerage and trading software commercials, but rather than getting sucked in to talking baby traders and fast moving graphics, the average day trader or casual investor would be better served by bungee jumping or sky diving to get their adrenaline fix.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in FAS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Water…the Next Oil?

Water engulfs our daily lives – we drink, bathe, wash clothes, soak our lawns and brush our teeth with it on a consistent basis. We notice our reliance in our monthly water bills. The earth is covered by approximately 70% water, so if this commodity is so abundant, then how could it be such a scarce, valuable resource? Water is so important; the majority of our body mass consists of the fluid (about 60% in males and 55% in females). Although our planet is covered with this liquid, the main problem surrounding the issue is that only about 2% of the water supply is considered fresh water (predominantly located in Antarctica). Desalinization of salt water is one solution to the limited amount of fresh water, but unfortunately the current technology and energy requirements make it a cost prohibitive process. As a result of the inadequate supply, over an estimated 1 billion people do not have access to clean water and 2.4 billion people are subject to stressed water conditions.

In the “Golden State” of California, budgetary problems are not the only concern on people’s minds – the state is in the middle of a water shortage. Certain water jurisdictions are escalating prices by upwards of +15%. Regardless of your view on “climate change,” objective data points to declining water levels and heightened scarcity. By 2030, OECD predicts that half of the world’s population will live in areas under severe water stress.

I’m certainly not the only believer in this theme as an investment opportunity. T. Boone Pickens, renowned commodity investor, is spending over $100 million on water investments (including access to water rights) because he believes that H2O is the next oil. Water, like oil, is a depleting resource that will experience intensified demand over time.

How to Invest in Water:

Not everyone has millions of dollars like Pickens to invest in land and water rights, so there are different ways for the average investor to participate in the rising demand for water. For example, investors, like Sidoxia Capital Management, can invest in ETFs (exchange traded funds) with a water focus. ETF options include, PowerShares Water Resources (PHO), PowerShares Global Water ETF (PIO), and/or Claymore S&P Global Water (CGW). For those wishing to invest in individual stocks, some water related companies include, Nalco Holding Company (NLC), Danaher Corporation (DHR), Itron Inc. (ITRI), and Valmont Industries, Inc. (VMI).

Water Demand Drivers

- The globe’s population of approximately 6.5 billion people is growing and becoming thirstier. Water demand is expanding much faster than population growth.

- Climate change exacerbates the growing water supply problem.

- Agriculture and irrigation needs are driving the majority of global water demand.

- There is no substitute for water at any price.

Conservation, technology, and efficiency are tools to improve the usage of our finite water resources. As the water problem becomes more acute, profiting from water investments is a way to offset the inevitably higher costs of usage. Now if you’ll please excuse me, I’m thirsty for a glass of water.

Wade W. Slome, CFA, CFP® www.Sidoxia.com

DISCLOSURE: At the time of publishing, Sidoxia Capital Management and some of its clients owned certain exchange traded funds (including PHO & CGW), but had no direct positions in PIO, CGW, NLC, DHR, ITRI, VMI, or any other security referenced. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.