Posts filed under ‘Education’

Hollywood Shuts Down & Market Goes Uptown

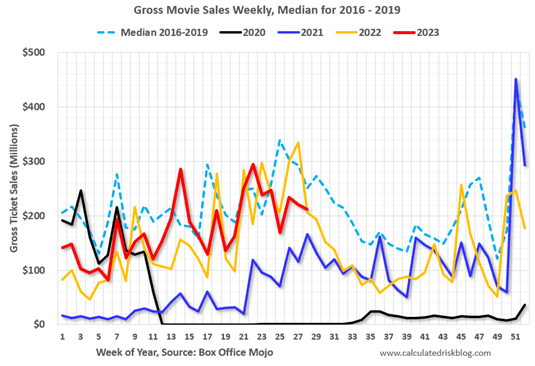

According to scientists, July set a record as the hottest month in 120,000 years. In order to beat the scorching heat, millions of Americans made the pilgrimage to their local air-conditioned movie theaters to watch the combo-blockbuster “Barbenheimer” (Barbie and Oppenheimer), which has raked in sales of more than $1 billion globally in the first two weeks of its release. Thankfully, in the short-run, Barbenheimer has given a shot in the arm to the beleaguered movie industry that suffered dramatically during the pandemic. The chart below (before Barbenheimer) shows industry sales have recovered (red line) somewhat, almost to pre-pandemic averages (dashed light blue line), but still has some ground to gain before industry sales consistently outpaces pre-pandemic levels.

Source: Calculated Risk

Movie Strike Explained

If movies are your gig, you better race to the theaters now because Hollywood has come to a grinding halt, thanks to a dual strike of Hollywood acting unions (SAG-AFTRA) and the Writers Guild of America (WGA) union. The feud between the unions and the movie/television studios centers around demands for higher pay, better working conditions, and protections from AI (Artificial Intelligence) technologies, which could theoretically replace actors and writers. Combined, the unions almost carry an estimated 200,000 members, which means a broad strike like equals no new movies, tv shows, or streaming content. The last time there was a “double strike” like this occurred in 1960 when former President Ronald Reagan was running SAG. Until the dispute is resolved, you better pace your media binging consumption habits because with no new content currently being created, the dispute may begin to eat into your show backlog on Netflix and disrupt your happy couch-streaming time.

Stocks on Fire

But scorching heat and red-hot popular movies were not the only things on fire last month. The stock market continued its fiery, blistering pace with the S&P 500 boiling higher by +3.1%, making the seven-month total gain of 2023 a spicy +20% (see chart below). The Dow Jones Industrial Average joined in on the fun too. Not only did the Dow increase by +3.4% for the month, the index rose for 13 consecutive days, the longest streak of daily advances since 1987. Bubbling up to the top of the performance table, however, is the technology-heavy NASDAQ index (home of the largest Magnificent 7 technology stocks – see also Fight the Fed) with a sizzling +4.1% return for the month, and a scalding +37% rise for the year, so far. The pace of gains is not sustainable forever, so it’s important to have a disciplined process in place to manage the risk of over-extended, over-valued investments, which is exactly what we do at Sidoxia Capital Management.

Source: TradingEconomics.com

Inflation Moving in the Right Direction

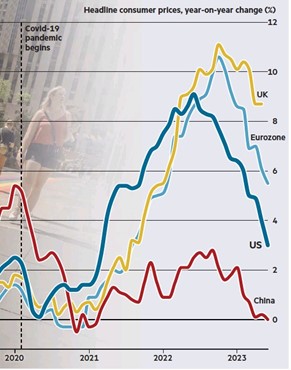

After such a lousy 2022 in the financial markets, why such a searing return for 2023? The biggest reason can be summed up with three words: inflation, inflation, and inflation. More specifically, it’s the pace of “disinflation” we are witnessing that is getting people so excited. As you can see from the chart below, annualized inflation as measured by the Consumer Price Index (CPI) has declined dramatically to 3.3% (blue line), while CPI less shelter (red line) has dropped to 1.4%, which is below the Federal Reserve’s 2% target (green line). These trends have gotten investors excited because they believe Jerome Powell, the Fed Chairman, is closer to ending this year-and-a-half long interest rate hiking cycle. In fact, investors are currently betting for multiple interest rate cuts in 2024.

Source: Calafia Beach Pundit

And the disinflation phenomenon is just not limited to U.S. borders – we are witnessing the same disinflationary trends across our borders (see chart below).

Source: The Financial Time (FT)

Confident Consumers

While many economists and traders have incorrectly been calling for a recession for some two years, a more resilient U.S. economy just reported better-than-expected growth for the 2nd quarter (+2.4% – Gross Domestic Product [GDP] growth). The stronger economy along with the improving inflation dynamics mentioned previously have buoyed Consumer Confidence too, as you can see from the chart below.

Source: Calafia Beach Pundit

Everything isn’t perfect (it never is). We continue to experience geopolitical risk as a result of the destabilized war between Russia and Ukraine; growth in China has stalled and not recovered from the pandemic; complacency is beginning to filter into investor attitudes; and we live with a dysfunctional Washington political process. But the economy remains strong, inflation appears to be cooling, and short-term interest rates could be close to peaking. Your air-conditioning bill may be going up this summer, but so will your stock market portfolio, if your investments are being properly managed.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

AI Revolution and Debt Ceiling Resolution

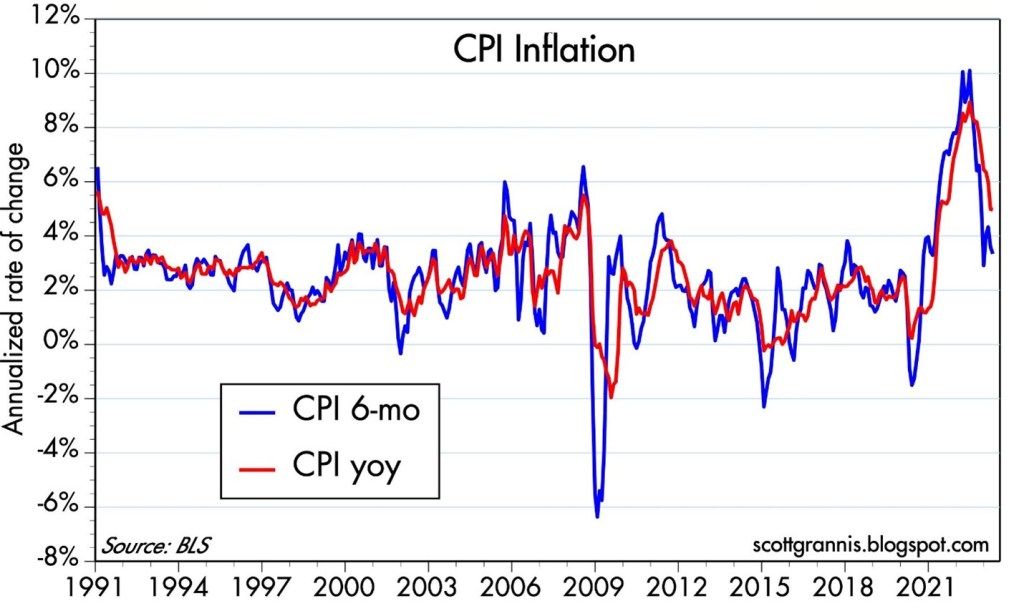

On the surface, last month’s performance of the stock market as measured by the S&P 500 index (+0.3%) seemed encouraging, but rather pedestrian. Fears of sticky-high inflation, more potential Federal Reserve interest rate hikes, contagion uncertainty surrounding a mini-banking crisis, along with looming recession concerns led to a -3.5% monthly decline in the Dow Jones Industrial Average (-1,190 points). The good news is that inflation is declining (see chart below) and currently the Federal Reserve is expected to pause from increasing interest rates in June (the first time in more than a year).

Source: Calafia Beach Pundit

Overall stock market performance has been a mixed-bag at best. Adding to investor anxiety, if you haven’t been living off-the-grid in a cave, is the debt ceiling negotiations. Essentially, our government has maxed out its credit card spending limit, but Republicans and Democrats have agreed in principle on a resolution for an expanded credit line. More specifically, the House of Representatives just approved to raise the debt ceiling by a resounding margin of 314 – 117. If all goes well, after months of saber rattling and brinksmanship, the bill should be finalized by the Senate and signed by the President over the next two days.

Beyond the Washington bickering, and under the surface, an artificial intelligence (AI) revolution has been gaining momentum and contributed to the technology-heavy NASDAQ catapulting +5.8% for the month and +23.6% for 2023. At the center of this disruptive and transformational AI movement is NVIDIA Corp., a leading Silicon Valley chip manufacturer of computationally-intensive GPUs (graphics processing units), which are used in generative AI models such as OpenAI’s ChatGPT (see NVIDIA products below). Adoption and conversations surrounding NVIDIA’s AI technology have been spreading like wildfire across almost every American industry, resulting in NVIDIA’s stratospheric stock performance (+36% for the month, +159% for the year, +326% on a 3-year basis).

Source: NVIDIA Corp. – the computing engines behind the AI revolution.

Why Such the Fuss Over AI?

Some pundits are comparing AI proliferation to the Industrial Revolution – on par with productivity-enhancing advancements like the steam engine, electricity, personal computers, and the internet. The appetite for this new technology is ravenous because AI is transforming a large swath of industries with its ability to enhance employee efficiency. By leveraging machine learning algorithms and massive amounts of data, generative AI enables businesses to automate repetitive tasks, streamline processes, and unlock new levels of productivity. A study released by MIT researchers a few months ago showed that workers were 37% more efficient using ChatGPT.

If you have created an account and played around with ChatGPT at all you can quickly realize there are an endless number of potential applications and use-cases across virtually all industries and job functions. Already, application of generative AI systems is disrupting e-commerce, marketing, customer service, healthcare, robotics, computer vision, autonomous vehicles, and yes, even accounting. Believe it or not, ChatGPT recently passed the CPA exam! Maybe ChatGPT will do my taxes next year?

Other industries are quickly being disrupted too. Lawyers may feel increased pressure when contracts or briefs can be created with a click of the button. Schools and teachers are banning ChatGPT too in hopes of not creating lazy students who place cheating and plagiarism over critical thinking.

At one end of the spectrum, some doomsday-ers believe AI will become smarter than humans, replace everyone’s job, and AI robots will take over the world (see Elon Musk warns AI could cause “civilization destruction”). At the other end of the spectrum, others see AI as a transformational tool to help worker productivity. As generative AI continues to advance, its impact on employee efficiency will only grow, optimizing processes, driving innovation, and reshaping industries for a more productive future. Embracing this transformative technology will be critical for businesses seeking to thrive in the new digital age.

2023 Stock Performance Explained – Index Up but Most Stocks Down

Although 2022 was a rough year for the stock market (i.e., S&P 500 down -19%), stock prices have rebounded by +20% from the October 2022 lows, and +9% this year. This surge can be in large part attributed to the lopsided performance of the top 1% of stocks in the S&P 500 index (Apple Inc., Microsoft Corp., Amazon.com Inc., NVIDIA Corp., and Alphabet-Google), which combined account for almost 25% of the index’s total value. These top 5 consumer and enterprise technology companies have appreciated on average by an astounding +60% in the first five months of the year and represent a whopping $9 trillion in value. It gets a little technical, but it’s worth noting these larger companies have a disproportionate impact on the calculation of the return percentages, and vice versa for the smaller companies. To put these numbers in context, Apple’s $2.8 trillion company value is greater than the Gross Domestic Product (GDP) of many entire countries, including Italy, Canada, Australia, South Korea, Brazil, and Russia.

On the other hand, if we contrast the other 99% of the S&P 500 index (495 companies), these stocks are down -1% each on average for 2023 (vs +60% for the top 5 mega-stocks). If you look at the performance summary below, you can see that basically every other segment of the stock market outside of technology (e.g., small-cap, value, mid-cap, industrial) is down for the year.

2023 Year-To-Date Performance (%)

S&P 500: +8.9%

S&P 500 (Equal-Weight): -1.2%

S&P Small-Cap Index: -2.3%

Russell 1000 Value Index: -2.0%

S&P Mid-Cap Index: -0.7%

Dow Jones Industrial: -0.7%

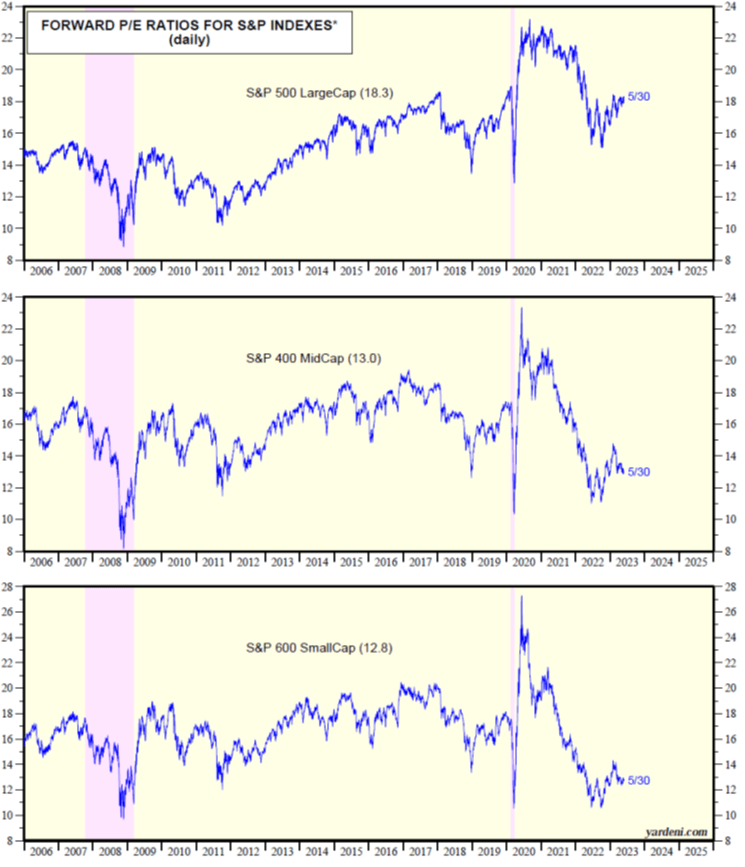

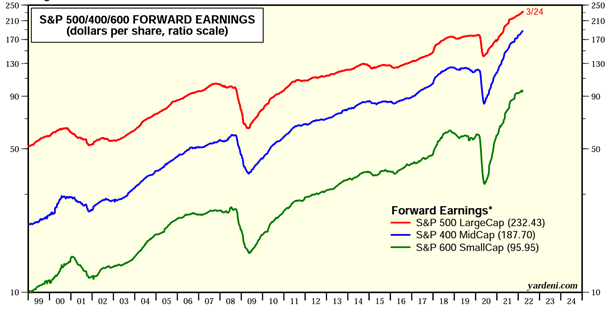

While most stocks have dramatically underperformed technology stocks this year, this phenomenon can be explained in a few ways. First of all, smaller companies are more cyclically sensitive to an economic slowdown, and do not have the ability to cut costs to the same extent as the behemoth companies. The majority of stocks have factored in a slowdown (or mild recession) and this is why valuations for small-cap and mid-cap stocks are near multi-decade lows (12.8x and 13.0x, respectively) – see chart below.

Source: Yardeni.com

The stock market pessimists have been calling for a recession for going on two years now. Not only has the recession date continually gotten delayed, but the severity has also been reduced as corporate profits remain remarkably resilient in the face of numerous economic headwinds. Regardless, investors can stand on firmer ground now knowing we are upon the cusp of an AI revolution and near the finish line of a debt ceiling resolution.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Motel 6 or Four Seasons? Preparing, Not Panicking, for Retirement

Stock prices go up more often than down, and that was the case again last month. The S&P 500, Dow Jones Industrial Average, and the NASDAQ were all up in April. For the year, the S&P has gained +8.6%, Dow +2.9%, and NASDAQ +16.8%. What’s more, these increases are built upon the appreciation experienced in the fourth quarter of last year – the S&P 500 index has rebounded more than +19% since the last lows seen in the middle of last October.

Even when the unemployment rate currently stands at 3.5%, and GDP continues to grow for the third consecutive quarter, there is never a shortage of concerns (see also A Series of Unfortunate Events) as evidenced by worrying questions like these:

- Is the Federal Reserve going to increase interest rates again?

- Has inflation peaked?

- Are we going into a recession?

- Is Silicon Valley Bank and First Republic Bank the beginning or the end of bank failures?

- Will Vladimir Putin use nuclear weapons in Ukraine?

- What is going to happen with the Debt Ceiling deadline and will the U.S. default on its debt?

- How will elections affect the economy?

- Will AI (artificial intelligence) take all our jobs?

Hope is Not a Strategy

We have lived through an endless number of scary headlines in some shape or fashion throughout our lifetimes. These are all interesting and important questions, but preparation for retirement is much more important than panicking over issues you have no control over. For many investors, however, the more important questions to ask and answer relate to your retirement strategy. The answers to your questions should not contain the word hope – hope is not a strategy. Just guessing and waiting out of fear is unlikely to produce optimal results.

Many Americans spend more time planning a vacation than they do preparing for retirement or planning their finances. Rather than constantly scrolling through headlines on your mobile phone news app, here are some areas of focus and questions you should be asking yourself:

· Investment Strategy: What type of investment strategy should you be utilizing to reach your retirement goals? A passive investment strategy with low-cost index funds and ETFs (Exchange Traded Funds)? Or an active investment strategy with individual stocks, bonds, and mutual funds?

· Diversification: How diversified are your investments? Are you overly concentrated in one asset class, sector, or individual security? If you are over-tilted on one side of your financial boat, it could tip over.

· Risk Tolerance: What is your asset allocation? If you are close to retirement, and you have too much exposure to equities, a retrenchment in the stock market could delay your retirement plans by years. This concept highlights the importance of rebalancing your portfolio as you get closer to retirement.

· Fees: What are you paying in advisor fees and/or product fees? Fees are like a leaky faucet. You may not notice a leak over a day or week, but over a period of a month or longer, you are likely to receive huge water bills. Over the long-run, even a small pin-hole leak can cause extreme water damage to floors, ceilings, and walls just like fees could delay retirement or dramatically reduce your nest egg.

· Tax Planning: Are you maximizing your tax-deferred investment accounts? Whether you are contributing the limit to your IRA (Individual Retirement Account), 401(k) retirement plan at work, or pension (for larger business owner contributions), these are tremendous tax-deferral savings vehicles. By squirreling away savings during your prime earnings years, your investments can enjoy the snowballing effect of compounding over the long-term.

· Retirement Timing: When do you plan to retire? Do you have enough money to retire, and what type of liquidity needs will you need during retirement? Figuring out the timing of Social Security can be another variable that may factor into your retirement timing decision (see also Can You Retire? Getting to Your Number).

· DIY or Hire Advisor: When it comes to managing your investments, do you plan on doing it yourself (DIY) or hiring a financial advisor? Many people are not adequately equipped to manage their own investments, however identifying a proper financial advisor still requires significant legwork and research as well. Check out a recent webinar I produced with key questions to ask when looking for a financial advisor (Click here: Questions to Ask When Looking for a Financial Advisor).

In summary, there are a lot of frightening news headlines, but you will be better off focusing on those things you can control. The harsh reality is Americans are not saving sufficiently for retirement. It is true, you can survive off a smaller nest egg, if you plan to subsist off cat food and live in a tent, but most Americans and retirees have become accustomed to a higher standard of living. Also worth noting, we humans are living longer. Thanks to the miracles of modern medicine, lifespans are expanding, with the pandemic caveat. But inflation remains stubbornly high, and you do not want to outlive your savings. Drained savings during retirement may just land you a job as a greeter at Wal-Mart in your 80s.

Although the summer travel season is fast approaching, if you feel you are not satisfactorily prepared for retirement, this is a perfect time to invest attention to this important area. Do yourself a favor and devote at least as much time to answering the key retirement questions above as you do in planning your summer vacation. You may be partying like a rock star now, but if you have not been properly saving for retirement, I will ask you the following question: During retirement, do you want to vacation at the Motel 6 off a local freeway or would you prefer vacationing at a Four Seasons somewhere in Europe? I know what my answer is.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Air Bags Deployed to Cushion Bank Crashes

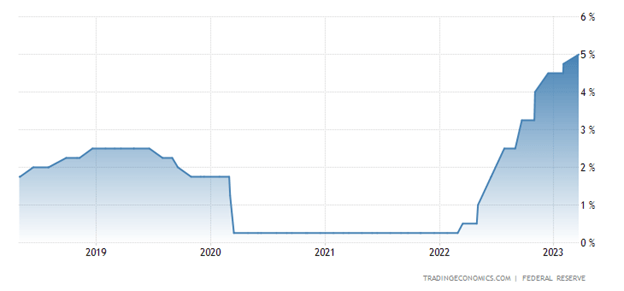

In recent years, COVID and a ZIRP (Zero Interest Rate Policy) caused out-of-control inflation to swerve the economy in the wrong direction. However, the Federal Reserve and its Chairman, Jerome Powell, slammed on the brakes last year by instituting the most aggressive interest rate hiking policy in over four decades.

At the beginning of last year, interest rates (Federal Funds Rate target) stood at 0% (at the low end of the target), and today the benchmark interest rate stands at 5.0% (at the upper-end of the target) – see chart below.

Source: Trading Economics

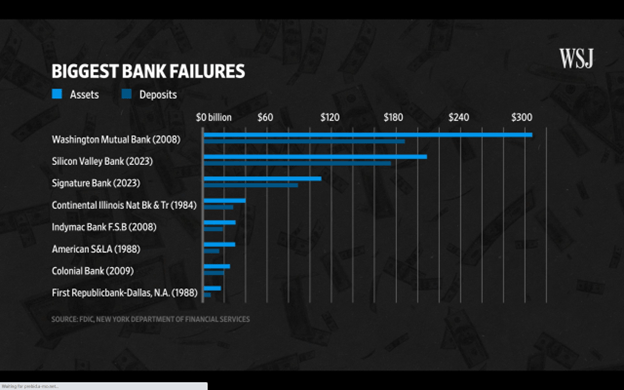

Unfortunately, this unparalleled spike in interest rates contributed to the 2nd and 3rd largest bank failures in American history, both occurring in March. The good news is the Federal Reserve and banking regulators (the Treasury and FDIC – Federal Deposit Insurance Corporation) deployed some safety airbags last month. Most notably, the Fed, FDIC, and Treasury jointly announced the guarantee of all deposits at SVB, shortly after the bank failure. Moreover, the Fed and Treasury also revealed a broader emergency-lending program to make more funds available for a large swath of banks to meet withdrawal demands, and ultimately prevent additional runs on other banks.

Investors were generally relieved by the government’s response, and the financial markets reacted accordingly. The S&P 500 rose +3.5% last month, and the technology-heavy NASDAQ index catapulted even more (+6.7%). But not everyone escaped unscathed. The KBW Bank Index got pummeled by -25.2%, which also injured the small-cap and mid-cap stock indexes, which declined -5.6% (IJR) and -3.5% (IJH), respectively.

Nevertheless, as mentioned earlier, slamming on the economic brakes too hard can lead to unintended consequences, for example, a bank failure or two. Well, that’s exactly what happened in the case of Silicon Valley Bank (SVB), the 2nd largest bank failure in history ($209 billion in assets), and cryptocurrency-heavy Signature Bank, the 3rd largest banking collapse in history – $110 billion in assets (see below).

Source: The Wall Street Journal

How did this Silicon Valley Bank failure happen? In short, SVB suffered a bank run, meaning bank customers pulled out money faster than the bank could meet withdrawal requests. Why did this happen? For starters, SVB had a concentrated customer base of financially frail technology start-ups. With a weak stock market last year, many of the start-ups were bleeding cash (i.e., shrinking their bank deposits) and were unable to raise additional funds from investors.

As bank customers began to lose confidence in the liquidity of SVB, depositors began to accelerate withdrawals. SVB executives added gasoline to the fire by making risky investments long-term dated government bonds. Essentially, SVB was making speculative bets on the direction of future interest rates and suffered dramatic losses when the Federal Reserve hiked interest rates last year at an unprecedented rate. This unexpected outcome meant SVB had to sell many of its government bond investments at steep losses in order to meet customer withdrawal requests.

It wasn’t only the large size of this bank failure that made it notable, but it was also the speed of its demise. It was only three and a half weeks ago that SVB announced a $1.8 billion loss on their risky investment portfolio and the subsequent necessity to raise $2.3 billion to fill the hole of withdrawals and losses. The capital raise announcement only heightened depositor and investor anxiety, which led to accelerated bank withdrawals. Within a mere 24-hour period, SVB depositors attempted to withdraw a whopping $42 billion.

Other banks, such as First Republic Bank (FRB), and a European investment bank, Credit Suisse Group (CS), also collapsed on the bank crashing fears potentially rippling through other financial institutions around the globe. Fortunately, a consortium of 11 banks provided a lifeline to First Republic with a $30 billion loan. And Credit Suisse was effectively bailed out by the Swiss central bank when Credit Suisse borrowed $53 billion to bolster its liquidity.

While stockholders and bondholders lost billions of dollars in this mini-banking crisis, financial vultures swirled around the remains of the banking sector. More specifically, First Citizens BancShares (FCNA) acquired the majority of Silicon Valley Bank’s assets with the assistance of the FDIC, and UBS Group (UBS) acquired Credit Suisse for more than $3 billion, thereby providing some stability to the banking sector during a volatile period.

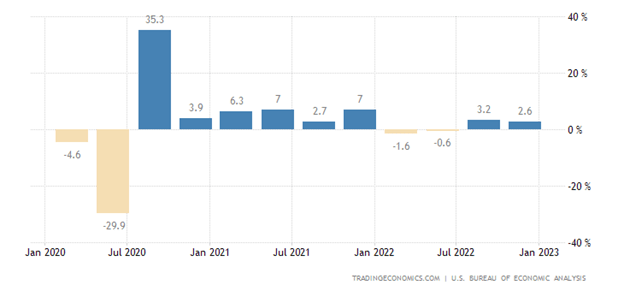

Many pundits have been predicting the U.S. economy to crash into a recession as a result of the aggressive, interest rate tightening policy of the Federal Reserve. So far, Mark Twain would probably agree that the death of the U.S. economy has been greatly exaggerated. Currently, the first quarter measurement of economic activity, GDP (Gross Domestic Product), is estimated to measure approximately +2.0% after closing 2022’s fourth quarter at +2.6% (see chart below). As you probably know, a definition of a recession is two consecutive quarters of negative GDP growth.

Source: Trading Economics

Regardless of the economic outcome, investors are now predicting the Federal Reserve to be at the end or near the end of its interest rate hiking cycle. Presently, there is roughly a 50/50 chance of one last 0.25% interest rate increase in May (see chart below), and then investors expect at least one interest rate cut by year-end.

Source: CME Group

Last year was a painful year for most investors, but stocks as measured by the S&P 500 have bounced approximately +18% since the October 2022 lows. Market participants are still worried about a possible recession crashing the economy later this year, but hopefully last year’s stock market collision and subsequent banking airbag protections put in place will protect against any further financial pain.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Apr. 3, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in SIVB, FCNA, UBS, FRB, CS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

From Hard Landing to Soft Landing to No Landing?

I haven’t received my pilot’s license yet, but in trying to figure out whether the economy is heading for a hard landing, soft landing, or no landing, I’m planning to enroll in flight school soon! With the Federal Reserve approaching the tail end of an aggressive interest rate hiking cycle, investors have been bracing for a hard landing. However, with near record-low unemployment (3.4%) and multi-trillion dollars in government stimulus still working its way through the system, others see an economic soft landing. More recently, economic data has been flying in at an accelerating pace, which could mean the economy will stay in the air and have no landing.

For those waiting for an imminent recession, it looks like there could be a delay. In other words, bearish pessimists may be waiting at the gate longer than expected. As you can see in the chart below, economists at the Atlanta Federal Reserve are currently forecasting economic growth (GDP – Gross Domestic Product) to increase to a respectable +2.8% rate for the first quarter.

How have investors been interpreting this confusing array of landing scenarios? The stock market has stabilized and risen since last October (S&P +13.7%) but has also hit a temporary air pocket last month (-2.6%). Similarly, the Dow Jones Industrial Average has rebounded +13.9% since October, but pulled back further in February (-4.2%). As mentioned earlier, investors are having difficulty reading all the economic dials, instruments, and controls in the cockpit because there is no consensus on interest rates, inflation, economic growth, corporate earnings growth, and employment.

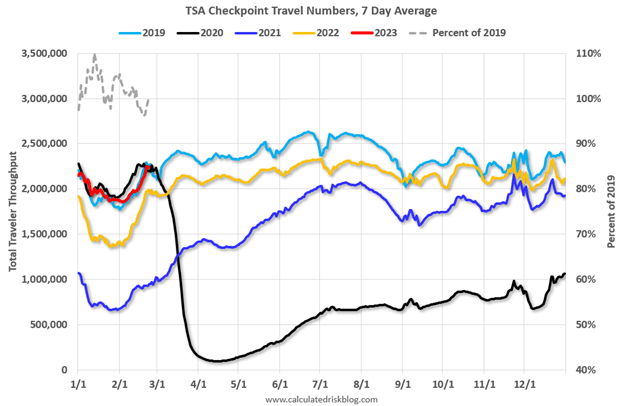

At the one end of the spectrum, you have a consumer who remains employed and willing to spend his/her savings accumulated during the pandemic. Case in point, air travel has hit pre-pandemic levels of 2019, despite business travelers staying at home conducting business on Zoom (see red line on chart below).

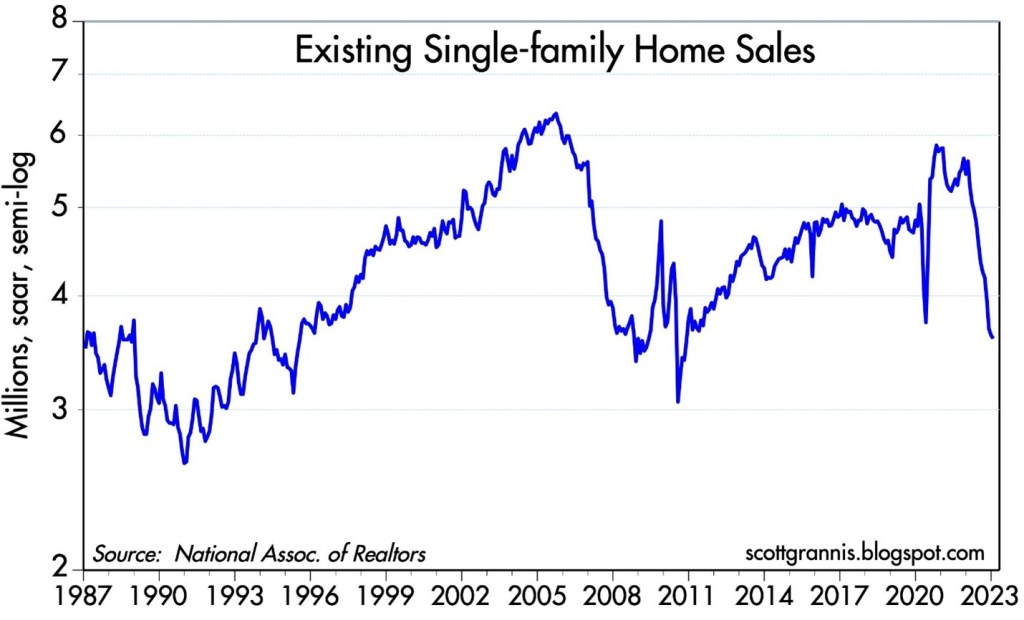

At the other end of the spectrum, we are witnessing the crippling effects that 7% mortgage rates can have on the $4 trillion real estate industry. As you can see from the chart below, sales of existing homes have plummeted at the fastest rate since the beginning of the 2008 Financial Crisis.

With all of that said, there is a consensus building that inflation is steadily coming down. Even the very skeptical and hawkish Federal Reserve Chairman, Jerome Powell, acknowledged that the “disinflationary process has begun.” We can see that in this inflation expectation chart below (green line), which measures the average anticipated inflation over the next five years by comparing the difference in yields between the five-year Treasury Notes and the five-year TIPS (Treasury Inflation Protection Securities).

Although, currently, there are many financial crosswinds swirling, the good news is that in the near-term, the economy has been maintaining its elevation and there is no imminent sign of a hard landing. We certainly could face the potential of turbulence and changing weather conditions, but that is always the case when you invest in the financial markets. If, however, inflation continues to move in the same direction, and growth continues to surprise on the upside, there may be no landing at all. Under this scenario of maintaining a comfortable altitude, I guess I can put my pilot training on hold.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Mar. 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

10 Ways To Destroy Your Investment Portfolio

Video Replay – February 22nd 2023

Volatility has spiked due to changing concerns over inflation, interest rates, recession fears, geopolitics, and other fear-provoking issues, but how can you grow and protect your retirement nest egg?

Wade W. Slome, CFA®, CFP®, Founder of Sidoxia Capital Management, LLC, will share 10 crucial mistakes made by investors that can destroy your portfolio. Learn how to avoid these missteps and expand your wealth.

Recession Storm Fears Reign Supreme as Stocks Gain Steam

Commentators continue to shout the doom-and-gloom forecasts of a hard landing recession, but after an economic hurricane in 2022 there are some signs the financial clouds have begun to lift this year. The stock market has reflected this positive fundamental shift during January, as the S&P 500 catapulted +6.2%, NASDAQ +10.8%, and the Dow Jones Industrial Average +2.8%.

Last year, a major influencing cause to the -19% downdraft in the stock market (S&P 500) was due to the highest inflation readings experienced in four decades, compounded by a Federal Reserve hell-bent on slamming on the interest rate brakes. A big contributing factor to the surge in inflation was the spike in consumer spending fueled by trillions in government stimulus, coupled with widespread shortages in goods triggered by supply chain disruptions.

Fortunately, the headwinds of inflation now appear to be abating. Recently released inflation figures showed core inflation dropping from a peak of 9.1% last year to 3.5% in the fourth quarter (see chart below). Although the Fed will likely raise its interest rate target by 0.25% up to 4.75% this week, the downward reversal in inflation has raised the probabilities of the Federal Reserve “pausing” or “pivoting” on the direction of previous rate hikes. The odds of a halt or cut in rates will likely only increase if the descending trajectory of inflation persists and other upcoming economic data weaken further.

No Signs of Recession…Yet. Investors Waiting for Another Flood

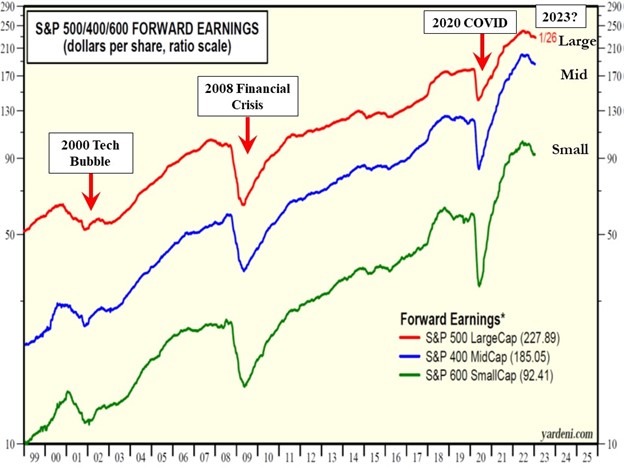

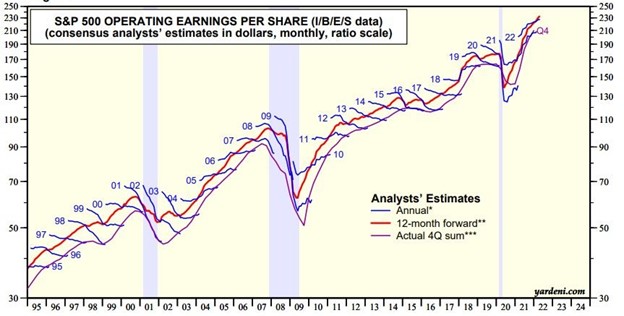

While the calls for a hard economic landing remain, healthy GDP growth (+2.9% in Q4), generationally low unemployment (3.5%), and relatively stable earnings (see chart below) all point to a stable economy with the ability to navigate a soft landing. China’s new reopening of the economy and Europe’s seeming ability of dodging a recession provide additional evidence for a soft landing scenario.

As you can see further from the 25-year earnings chart above, the drop in S&P 500 earnings in recent months has been fairly modest compared to previous downturns, and the forecast for 2023 earnings is currently estimating a modest gain on a year-over-year basis. Over the last 25 years, we have arguably experienced three 100-year floods (2000 Tech Bubble, 2008 Financial Crisis, and 2020 COVID pandemic), so investors have been bracing for another enormous financial hurricane.

Although the bursting of the 2000 Tech Bubble had an outsized impact on the technology sector, the effect on the overall economy was more muted, as you can observe from the shallow decline in the earnings. As the earnings show, during the Financial Crisis (2008) and COVID (2020), the crash in earnings was much more severe. Thus far in 2023, there has been no earnings plummet or sign of recession, and if financial conditions continue to soften, there is no reason we couldn’t undergo a more vanilla, garden-variety recession like we did in 1990 and 2000.

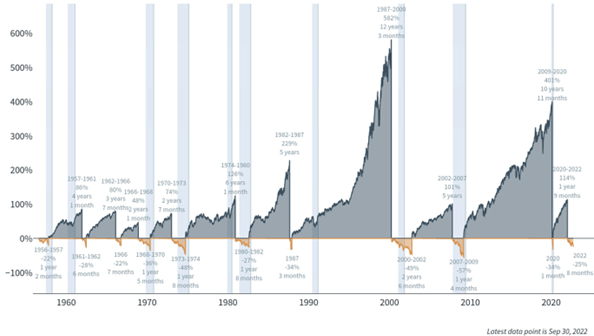

Stairs & Elevators

While the future always remains unclear, nobody knows for certain whether a recession will occur this year or if the 2022 bear market will endure into 2023. However, as you can notice below, history over the last 70 years shows the duration of bull markets (average of about 6 years) are much longer than bear markets (approximately 1 year). I like to compare bull markets to walking up stairs in a tall building, and bear markets to going down an elevator. The main difference is that the stock market elevator generally never goes to the bottom floor and the stairs keep growing to record heights over the long-run. Since World War II, Americans have experienced 13 economic recessions (see also Recession or Mental Depression?). Not only are investors batting 1,000% in successfully surviving these recessions, they have thrived. From 1956 until the present, the S&P 500 has vaulted approximately 80-fold.

Presently, economic skies might not all be clear, blue, and sunny, but the fact that inflation is dropping, our economy is still growing, labor markets remain healthy, China has reopened for business, and Europe hasn’t cratered all leave room for optimism. It may not be time to bust out the sunscreen quite yet, but the dark economic clouds of 2022 appear to be lifting slowly.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Feb. 1, 2023). Subscribe Here to view all February articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bad Weather Coming: Hurricane or Drizzle?

It was a stormy month in the stock market, but the sun eventually came out and the Dow Jones Industrial Average rallied more than 2,300+ points before eking out a small gain (up +0.04%) and the S&P 500 index also posted an incremental increase (+0.005%). But there are clouds on the horizon. Although the economy is currently very strong (i.e., record corporate profits and a generationally low unemployment rate of 3.6% – see chart below), some forecasters are predicting a recession during 2023 as a result of the Federal Reserve pumping the brakes on the economy by increasing interest rates, in addition to elevated inflation, supply chain disruptions, COVID lockdowns in China, and a war between Russia and Ukraine.

UNEMPLOYMENT RATE (1997 – 2022)

But like weather forecasters, economists are perpetually unreliable. While some doomsday-er economists are expecting a deeply destructive hurricane (deep recession), others are only seeing a mild drizzle (soft landing) developing. The truth is, nobody knows for certain at this point, but what we do know is that the correction in stock prices this year (-13% now and -20% two weeks ago) has already significantly discounted (factored in) a mild recession. In other words, even if a mild recession were to occur in the coming months or quarters, there may be very little reaction or negative consequences for investors. Similarly, if inflation begins to be peaking as it appears to be doing (see chart below), and the Fed can orchestrate a soft landing (i.e., raise interest rates and reduce balance sheet debt without crippling the economy), then substantial rewards could accrue to stock market investors. On the flip side, if the economy were to go into a deep recession, history would suggest this stormy forecast might result in another -10% to -15% of chilliness.

INFLATION RATE (%)

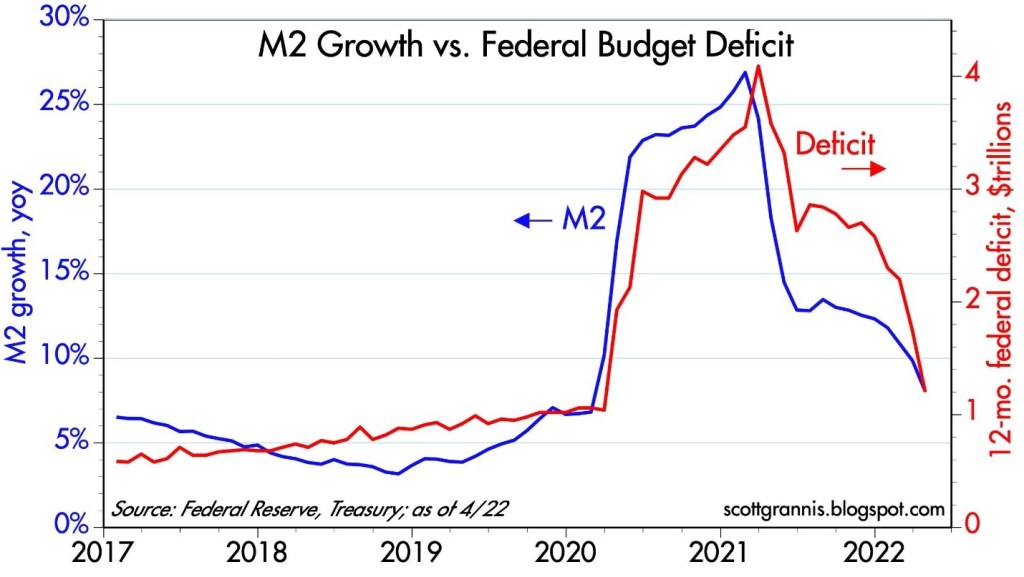

Due to trillions of dollars in increased stimulus spending and Federal Reserve Quantitative Easing (bond buying), we experienced an explosion in the government deficit and surge in money supply growth (i.e., the root cause for swelling inflation). Arguably, some or all of these accommodations were useful in surviving through the worst parts of the COVID pandemic, however, we are paying the price now in sky-high food costs, explosive gasoline prices, and expanding credit card bills. The good news is the deficit is plummeting (see chart below) due to a reduction in spending (due in part to no Build Back Better infrastructure spending legislation) and soaring income tax receipts from a strengthening economy and capital gains in the stock market.

MONEY SUPPLY GROWTH% (M2) VS. GOVERNMENT DEFICIT

For many investors, getting used to large multi-year gains has been very comfortable, but interpreting downward gyrations in the stock market can be very confusing and counterintuitive. In short, attempting to decipher the reasons behind the short-term zigs and zags of the market is a fool’s errand. Not many people predicted a +48% gain in the stock market during a global pandemic (2020-2021), just like not many people predicted a short-lived -20% reduction in the stock market during 2022 as we witnessed record-high corporate profits and unemployment rates hovering near generational lows (3.6%).

Stock market veterans understand that stock prices can go down when current economic news is sunny but future expectations are too high. Experienced investors also understand stock prices can go up when the current economic news may be getting too cloudy but future expectations are too low.

Apparently, the world’s greatest investor of all-time thinks that all this gloomy recession talk is creating lots of stock market bargains, which explains why Buffett has invested $51 billion of his cash at Berkshire Hathaway as the stock market has gotten a lot more inexpensive this year. So, while the economy will likely face a number of headwinds going into 2023, it doesn’t mean a hurricane is coming and you need to hide in a bunker. If you pull out your umbrella and rain gear, just like smart investors do during all previous challenging economic cycles, the drizzle from the storm clouds will eventually pass and blue skies shall reappear.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BRK.B/A or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Pain, No Gain

Long-term success is rarely achieved without some suffering. In other words, you are unlikely to enjoy gains without some pain. Last month was certainly painful for stock market investors. On the heels of concerns over the Russia-Ukraine war, Federal Reserve interest rate hikes, China-COVID lockdowns, inflation/supply chain disruptions, and a potential U.S. recession, the S&P 500 index declined -8.8% for the month, while the technology-heavy NASDAQ index fell -13.3%, and the Dow Jones Industrial Average weakened by -4.9%.

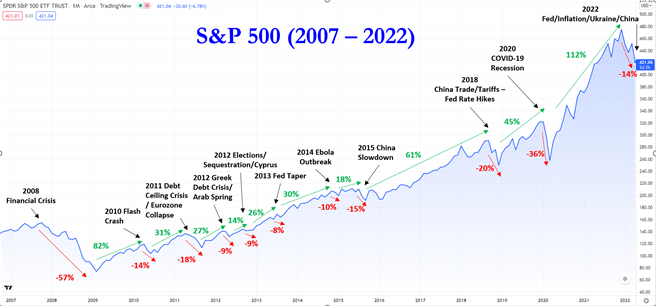

For long-term stock investors who have reaped the massive +520% rewards from the March 2009 lows, they understand this gargantuan climb was not earned without some rocky times along the way. As you can see from the chart below, there have been no shortage of issues and events to worry about over the last 15 years (2007 – 2022):

- 2008-2009: Financial Crisis

- 2010: Flash Crash (electronic trading collapse)

- 2011: Debt Ceiling – Eurozone Collapse

- 2012: Greek Debt Crisis – Arab Spring (anti-government protests)

- 2012: Presidential Elections – Sequestration (automatic spending cuts) – Cyprus Financial Crisis

- 2013: Federal Reserve Taper Tantrum (threat of removing monetary policy accommodation)

- 2014: Ebola Virus Outbreak

- 2015: China Economic Slowdown

- 2018: China Trade Tariffs – Federal Reserve Interest Rate Hikes

- 2020: COVID-19 Global Pandemic – Recession

- 2022: Russia-Ukraine War -Federal Reserve Interest Rate Hikes – Inflation/Supply Chain – Slowing China

So, that’s the bad news. The good news is that after the stock market eventually bottomed (S&P 500) around each of these events, one year later, stock prices rebounded on average approximately +32%, and prices moved even higher in the following two years. Suffice it to say, in most instances, patiently waiting and taking advantage of heightened volatility usually results in handsome rewards for investors over the long-run. As Albert Einstein stated, “In the middle of every difficulty lies an opportunity.”

There have been plenty of false recession scares in the past, and this could prove to be the case again. Although I have noted some of the key headwinds the economy faces above, it is worth noting that current corporate profits remain at/near all-time record highs (see chart below) and the 3.6% unemployment rate effectively stands at/near generationally record low levels. What’s more, housing remains strong, and consumer balance sheets remain very healthy as a result of elevated savings rates that occurred during COVID.

The S&P 500 is already off -14% from its highest levels experienced at the beginning of the year. Although there are no clear signs of a looming recession presently, if history is a guide, much of the pessimism is likely already discounted in current stock prices. Stated differently, even if the economy were to suffer a garden-variety recession, we may already be closer to a bottom than the potential gains from a subsequent rebound. The 15-year chart shows that stock prices have become significantly more attractively valued in recent months.

Panic is rarely a profitable strategy, so now is probably not the best time to knee-jerk react to the price declines. Peter Lynch, arguably one of the greatest all-time investors (see Inside the Brain of an Investing Genius), said it best when he stated, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Market corrections are never comfortable, but successful, long-term investing comes with a price…no pain, no gain!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 2, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Insane Gain After Fed & Ukraine Pain

After a painful start to 2022, the stock market surged last month, with the S&P 500 index gaining a respectable +3.6%, while the technology-heavy NASDAQ index rose by +3.4%. With volatility on the rise, getting caught up in the emotions of the headlines can be challenging for some investors. At Sidoxia, we are determined to objectively stick to the facts and migrate investments to the areas of the market that provide the best risk-reward opportunities to our clients, based on their unique objectives and constraints. There certainly are some headwinds for investors to contend with, but for long-term investors, it’s also important to recognize the positive tailwinds and not miss the forest for the trees.

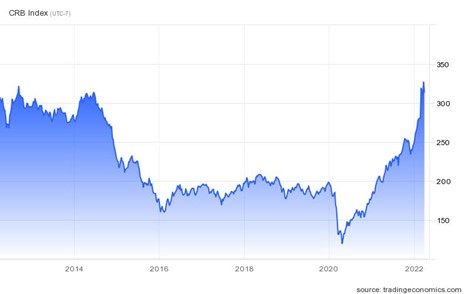

As I pointed out last month, we are coming off a heroic advance over the last three years (2019/2020/2021) with the S&P 500 soaring +90%. The hangover from COVID has created significant supply chain disruptions and widespread economic shortages. Adding the Russian invasion of Ukraine to the mix has been like pouring gasoline on the flames of inflation, especially when it comes to the energy and food sectors. As you can see from the CRB index below (a basket of 19 commodities ranging from aluminum to orange juice and live cattle to wheat), in recent years the index has been highly volatile in both directions, but is up +27% this year. Since the COVID-driven trough, prices have about tripled over the last two years, but that does not mean prices will fly to the moon forever.

Many traders have short-term memories. People forget that commodity prices approximately doubled after the 2008 Financial Crisis, only to experience a subsequent slow bleed over the next decade until prices were essentially chopped in half. As the saying goes, “price cures price.” In other words, as prices skyrocket, greedy capitalists and businesses then decide to take advantage of the high pricing environment by investing to produce more supply, which eventually leads to deflation. This supply expansion process takes time and will not happen overnight.

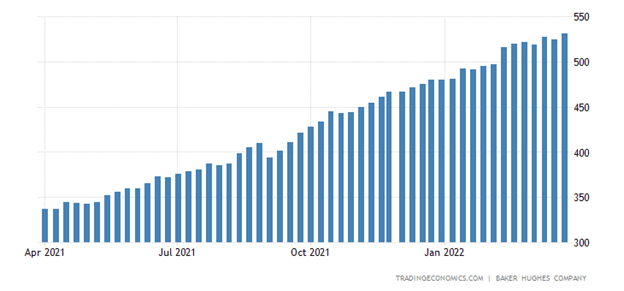

With gasoline prices exceeding $4/gallon nationally, and breaching $6/gallon in my Southern California backyard (see chart below), it should come as no surprise that oil companies are taking advantage of the lucrative environment by drilling for more oil.

The rising Baker Hughes drilling rig count below reflects the miracle of supply-demand economics operating in full force. As prices rise and accelerate during geopolitical shocks like we have experienced in Ukraine, naturally supply rises, which eventually depresses prices until an equilibrium is reached. Even our government is now attempting to increase supply by releasing up to 180 million barrels of oil from our country’s Strategic Petroleum Reserve (the largest release in the almost 50-year history of the reserve), while also pushing for penalties on those energy companies sitting on unused permits (i.e., not producing oil on leased oil land). High energy prices will most certainly become a hot-button political issue in the upcoming midterm elections.

Adding to investor anxiety, our Federal Reserve is embarking on an interest rate hiking cycle that is expected to take the targeted Federal Funds interest rate from effectively 0% to a range around 2.5% over the next couple of years. The Fed’s goal is to increase the cost of borrowing, thereby slowing down the economy and reducing inflation. On the surface this sounds scary, but do you remember what happened the last time the Fed tapped the interest rate brakes during 2015 – 2018? Despite the Fed raising interest rates from 0% to 2.5%, the stock market increased dramatically over that timeframe. The current Fed interest rate cycle may more closely resemble 1994 when the Fed aggressively hiked rates from 3% to 6%. Similar to now, back then stock prices swung wildly throughout the year to eventually finish the year flattish.

If Things Are So Bad, Why Are Prices Going Up?

In the face of such horrible and scary headlines, how can prices still go up? The short answer is that companies are making money hand over fist and the economy remains strong (3.6% unemployment rate; record 11.3m job openings; 3% forecasted growth in 2022 GDP) in a post-COVID recovery world, where consumers remain financially healthy and are now looking to spend their shelter-in-place savings on vacations, houses, and cars (all healthy industries).

Not only are corporate profits at record levels, they are also expected to grow at a healthy rate (+10% in 2022, +10% in 2023) after mind-boggling growth of +50% in 2021 (see chart below).

Could the headwinds previously described cause prices to go lower? They certainly could, but valuations remain attractive given where interest rates currently stand. If interest rates rise dramatically, all else equal, then that will be challenging for all asset pricing. Moreover, discounting or forecasting future Russian military actions is a difficult chore as well, which could also potentially throw a curve ball at investors.

In the meantime, what are companies doing with this flood of growing cash? Well, besides combing the job boards in search of hiring a scarce number of qualified workers, investing in technology to improve productivity, and expanding geographically to grow revenues, companies are also returning gobs of cash to investors in the form of record, swelling dividends and share buybacks (see charts below).

Darling Dividends

The gift that keeps on giving. Dividends now amount to more than half a trillion dollars and they are still growing.

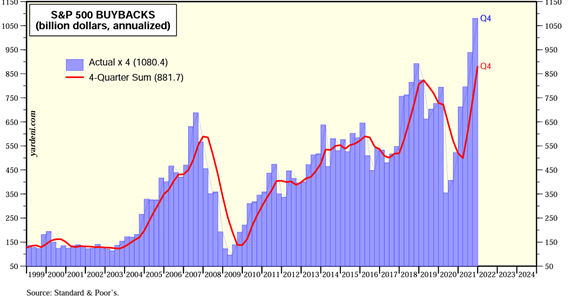

Beautiful Buybacks

As you can see, the trajectory of buybacks are more volatile and discretionary than dividends, but record profits are driving more than $1 trillion in share buybacks on an annualized basis – not too shabby.

Although there are plenty of reasons for investors to rationalize a run for the hills, there remains some extraordinarily strong fundamental tailwinds intact. In spite of the economic pain caused by Ukraine, the Fed, and inflation, there are plenty of reasons to remain optimistic. The strong economy, impressive profit growth, historically low interest rates (even though slowly rising), cash-rich corporations, and attractive valuations mean there is still ample room for future market gains.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.