Posts filed under ‘Earnings’

Green Lights Everywhere… But Is It Time to Tap the Brakes?

The economic and market fundamentals appear to be flashing green lights everywhere. Growth is strong, inflation has cooled, and financial conditions have eased. Yet even with clear skies and open roads, experienced drivers know conditions can change quickly. It may not be time to slam on the brakes—but it could be time to keep a foot hovering nearby.

After the Federal Reserve aggressively applied the brakes in 2022 with seven rate hikes—taking the federal funds rate from 0.25% to 4.50%—the stock market declined nearly 19%. Since rates peaked at 5.50% in 2023, the Fed has cut rates six times, lowering them by a cumulative 1.75% to approximately 3.75%. Those cuts have helped pave the way for a smoother ride, providing a meaningful tailwind to equity markets.

That said, the most recent quarter-point cut produced mixed results. Last month, the Dow Jones Industrial Average rose +0.7%, the S&P 500 was essentially flat at –0.1%, and the NASDAQ lagged with a –0.5% decline.

Navigating the Winning Streak

We have encountered a few economic speed bumps along the way—tariffs and geopolitical events earlier in 2025, for example—but once investors realized those tariffs were more bark than bite (as I discussed previously in Tariff Sheriff), stocks resumed their impressive run. The market has now delivered three consecutive years of strong returns: 2023 (+24%), 2024 (+23%), and 2025 (+16%).

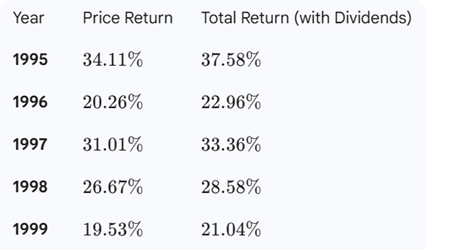

With these strong gains, today’s environment can feel like cruising on a national highway—clear roads, sunny skies, cruise control engaged, and little traffic in sight. The momentum could continue. Three strong years in a row do not rule out a fourth or fifth. In fact, the late 1990s offer a powerful reminder: from 1995 through 2000, the stock market averaged approximately 29% annual returns through the March 2000 peak (see table below). However, once the technology bubble burst, it took more than 13 years for the market to reclaim new year-end highs.

Source: Gemini

After more than three decades of investing, one lesson remains clear: trees can grow for years—but they do not grow to the sky forever. Bull markets often last longer than expected, but they eventually end.

Why the Forecast Looks Rosy

Several factors are supporting today’s strong market backdrop:

- Strong Economic Growth: Third-quarter GDP growth of 4.3% marked the fastest expansion in two years (see chart below)

Source: Trading Economics

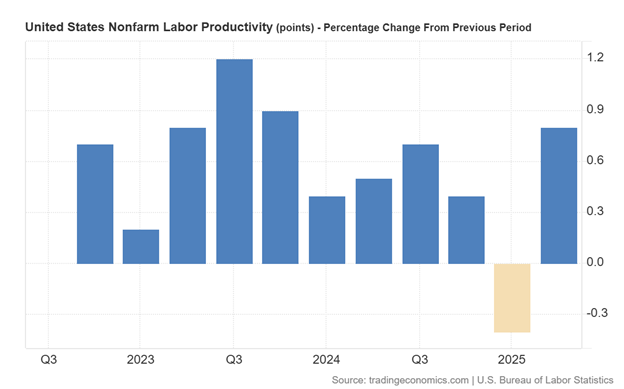

- AI-Driven Productivity: GDP growth has remained robust even as unemployment has risen from 4.0% earlier in the year to approximately 4.6% today. Growth outpacing employment is the definition of productivity, and the proliferation of artificial intelligence is accelerating this trend. Large companies such as Amazon.com (AMZN), Microsoft (MSFT), Alphabet-Google (GOOGL), and Meta Platforms (META) have reduced headcount significantly by tens of thousands in recent years while revenues and profits continue to surge (see also Mag 7 Takes Cash to the Bank).

Source: Trading Economics

- Taming Inflation: Crude oil prices have fallen roughly 20% over the last year, and Owner’s Equivalent Rent (which makes up about one-third of CPI inflation) has been steadily declining—both positive signals for inflation pressures ahead (see chart below).

Source: Calafia Beach Pundit

- Lapping Tariffs: Tariffs represented a one-time price increase. As we move into 2026, their inflationary impact should diminish as those increases roll off.

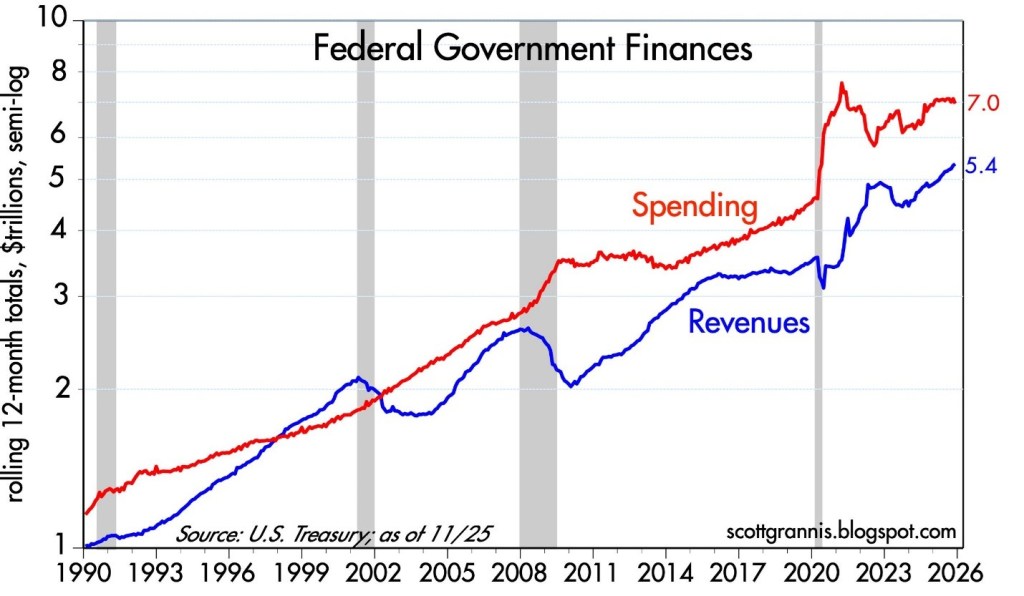

- Narrowing Budget Deficit: While debt and deficits remain headline risks, federal spending has been flat over the past year while revenues have increased roughly 10%, according to Scott Grannis (see chart below).

Source: Calafia Beach Pundit

- Tax Cuts & Higher Refunds Ahead: Many provisions of the One Big Beautiful Bill (OBBB) will be felt more fully in 2026, including 100% bonus depreciation for businesses, higher SALT deduction caps, increased standard deductions, no tax on tips or overtime, and a higher Child Tax Credit (CTC). Collectively, these could result in refunds up to $1,000 higher per individual.

Together, these factors could support continued market strength into 2026. But weather, road conditions, and markets can change quickly.

Reasons to Keep Your Foot Near the Brake Pedal

While the road looks smooth, several caution signs deserve attention:

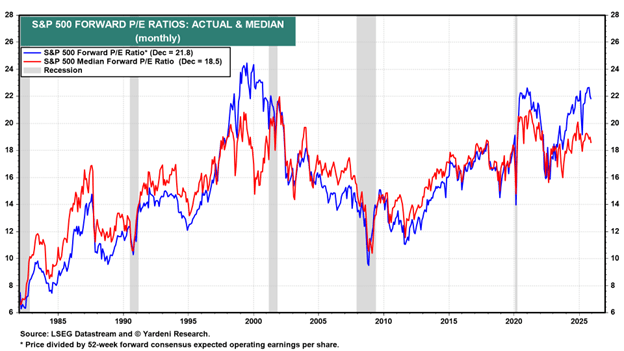

- Elevated Valuations: Forward price-to-earnings ratios (P/E) are at their highest levels since the late 1990s, outside of the brief post-COVID period. (see chart below).

Source: Yardeni Research

- Animal Spirits Are Back: Speculation has expanded well beyond traditional markets. Prediction platforms such as Kalshi, Polymarket, FanDuel, DraftKings, Robinhood, Coinbase, and others now allow bets on everything from political outcomes to economic data—further evidence of speculative behavior.

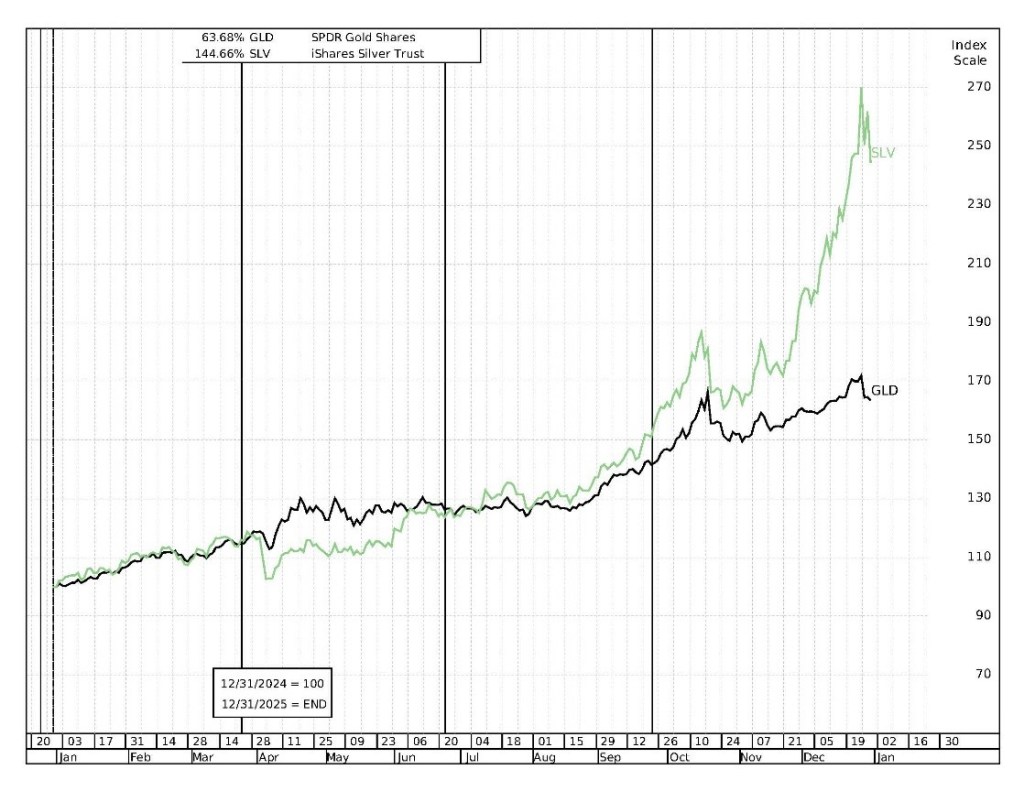

- Gold and Silver Speculation: Despite a relatively stable U.S. dollar over the past six months, gold rose +64% and silver catapulted +145% in 2025—moves difficult to justify by fundamentals alone (see chart below).

Source: MarketSurge

- Investor Complacency: The Volatility Index (VIX), often called the “fear gauge,” currently hovers near 15, well below its long-term average of 20. Historically, true fear doesn’t surface until readings exceed 25.

- Market Concentration: The “Magnificent 7” stocks represent roughly 1% of the companies in the S&P 500 but account for about 37% of the index’s weighting (see Mag 7 Takes Cash to the Bank)—a concentration reminiscent of the late 1990s. When leadership narrows, downturns can be sharper.

The Sidoxia View

At Sidoxia Capital Management, we have implemented all-weather, time-tested strategies through decades of both bull and bear markets. We believe diversification and disciplined risk management are essential—not fruitless prediction attempts. Rather than attempting to time short-term market moves, we focus on adapting portfolios to changing conditions and navigating inevitable financial potholes.

We don’t always get it right, but over the long run, this approach has allowed us to earn and retain the trust, loyalty, and confidence of our clients.

After three years of strong performance, it’s easy to assume clear roads and blue skies will continue indefinitely. But history teaches us that the most dangerous moments often occur when confidence is highest. This is not a call to abandon the journey—only a reminder to stay alert. When markets accelerate this quickly, discipline, diversification, and risk management matter more than ever.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Jan. 2, 2026). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in MSFT, GOOGL, AMZN, META, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in ORCL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

As We Give Thanks, AI and Mag 7 Take Cash to the Bank

Market volatility resurfaced last month as speculation intensified over whether an AI bubble may be forming—and potentially bursting. Yet despite the jitters, equity markets remain solidly positive for the year (S&P 500 +16.5%, NASDAQ +21.0%, Dow +12.2%) – see S&P 500 chart below. A significant portion of the gains have been powered in large part by ongoing strength in the Magnificent 7. Standouts such as NVIDIA (+31.8%) and Alphabet (+68.1%) have been instrumental in carrying the broader indices higher.

Even with these sizable year-to-date gains, memories of the 2000 Tech Bubble and 2008 Financial Crisis resurfaced and prompted investors to temporarily tap the brakes. Mid-month, the NASDAQ retreated roughly -9% from its October peak. After a month-end bounce, the S&P 500 finished essentially flat (+0.1%), the NASDAQ slipped -1.5%, and the Dow eked out a +0.3% increase.

OpenAI and the $1.4 Trillion Question

At the center of the AI controversy sits OpenAI, parent of the three-year-old technology toddler, ChatGPT (Generative Pre-trained Transformer), which now boasts more than 800 million global users (see chart below). The company reportedly runs at a $20 billion annual revenue pace, yet faces difficult questions about how it intends to fund its staggering $1.4 trillion AI infrastructure commitments.

Those concerns came to a head when tech investor Brad Gerstner pressed CEO Sam Altman on his podcast last month. Instead of answering how OpenAI plans to underwrite such an enormous buildout, Altman childishly shot back defensively:

“If you want to sell your shares, I’ll find you a buyer.” (See clip here — or full interview here)

Source: Digital Information World

OpenAI is a key player, but just one component in the vast—and rapidly expanding—web of global AI infrastructure. Gartner, a global research and advisory firm, forecasts $2 trillion of AI investment in 2026, while NVIDIA CEO Jensen Huang recently said:

“Over the next five years, we’re going to scale into… effectively a $3 to $4 trillion AI infrastructure opportunity.”

These provocative “Is this a bubble?” questions make for great headlines, but to truly evaluate AI sustainability, it’s wise to follow the classic Watergate guidance from of All the President’s Men character, Deep Throat (FBI Associate Director, Mark Felt), who tells journalist Bob Woodward to “follow the money,” if he wants to get to the bottom of the Watergate scandal.

The same principle applies to investors who follow the money – the picture looks very different from past bubbles.

Forget Pets.com—Today’s AI Buildout Is Being Funded by Cash-Rich Titans

Unlike the flimsy, profitless internet startups of the late 1990s—companies that raised billions based on “eyeballs” and cocktail-napkin business plans—the current AI buildout is being financed largely by profitable cash-generating giants.

Yes, some firms like Oracle (ORCL) are leaning on debt financing for data-center expansion. But the overwhelming majority of AI capex is being funded by customers and by the cash flow of the Magnificent 7, a group with the financial firepower to sustain multi-year spending without relying heavily on capital markets.

This dynamic alone separates today’s environment from classic bubble conditions.

Do the Magnificent 7 Really Deserve a $22 Trillion Valuation?

The Mag 7 represent only 1% of S&P 500 constituents yet account for a massive 35% of the index’s market value. That concentration understandably raises eyebrows, evoking historical parallels to the “Nifty Fifty” of the 1970s or the “Four Horsemen” of the 1990s.

But headline concentration can be misleading—because the fundamentals tell a very different story. Here are some of the major disparities:

1.) Mag 7 Share of Profits Matches Their Share of Market Value: The Mag 7 collectively contribute $22 trillion of the S&P 500’s $58 trillion total value (below). Said differently, the market values and weightings of the Mag 7 equate to about $22 trillion and 37% of the S&P 500, respectively:

· Nvidia Corp: $4.3T & 7.0%

· Apple Inc.: $4.1 T & 6.7%

· Alphabet Inc.: $3.9 T & 6.3%

· Microsoft Corp.: $3.7 T & 5.9%

· Amazon.com Inc.: $2.5 T & 4.0%

· Meta Platforms Inc.: $1.6T & 2.6%

· Tesla Inc.: $1.4T & 2.3%

· TOTAL: $22T / 37%

Source: Slickcharts

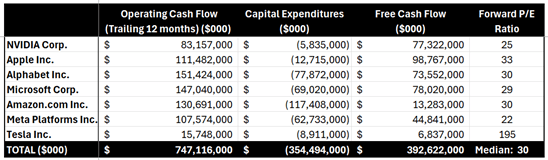

Conveniently (and importantly), the Mag 7’s roughly $747 billion in annual cash flow (see table below) is a good proxy for their profit contribution to the $2 trillion in S&P profits.

Source: SEC Filings & MarketSurge

The $747 billion in Mag 7 cash flows divided by the $2 trillion in S&P 500 coincidentally also equates to 37% ($747B/$2T).

These calculations of the Mag 7 are not bubble math—these calculation comparisons are rational math. Arguments could be made that Mag 7 market values are actually undervalued (not in bubble territory) and should appreciate to a higher percentage of the S&P 500 weightings because these 7 stocks are growing sales and profits faster than compared to the other “absentee” 493 stocks in the index.

2.) Mag 7 are Swimming in Cash: That $747 billion in annual cash flow is on track to hit a jaw-dropping $1 trillion, giving these firms ample capital to fund AI buildouts without substantially accessing the equity or credit markets. The ability to self-fund a multi-trillion-dollar infrastructure expansion is the opposite of bubble behavior.

3.) Valuations Are Elevated—but Far from Bubble Territory: During the 2000 Tech Bubble, many leading tech names traded at 100x+ earnings (See also: Rational or Irrational Exuberance. Today, the Mag 7 trade at a median forward P/E around 30x. Expensive? Historically, yes, versus long-term averages, but nowhere near historical extremes. Relative to growth, profitability, and cash flow, valuations are far more grounded today than during prior manias.

The bottom line is there is plenty to be thankful for and bubble fears are overstated. Despite pockets of AI froth, the underlying economic engine powering AI adoption is real, profitable, and well-capitalized. When investors follow the money, they discover:

· The Mag 7 generate over one-third of S&P 500 profits

· They generate and hold hundreds of billions in cash

· They largely fund their own AI capital expenditures

· Valuations remain far below bubble-era extremes

Investors have a lot to be thankful for. And while volatility will likely continue, the ingredients for a classic, catastrophic AI bubble are noticeably absent. For disciplined, long-term investing strategies like those employed at Sidoxia Capital Management, this environment still offers abundant opportunity—without the need to fear a pricked AI balloon anytime soon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Dec. 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN, META, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in ORCL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Rational or Irrational Exuberance?

The government may be shut down, but the stock market hasn’t noticed. In fact, stocks just capped another record-breaking month. The S&P 500 gained +2.3%, the NASDAQ climbed +4.7%, and the Dow rose +2.5%.

Millions of Americans are feeling the downside of the shutdown—from disrupted travel to stalled services and furloughed workers. Historically, such uncertainty rattles Wall Street. This time? Investors seem more captivated by the transformative promise of artificial intelligence (AI).

So, the key question today: Is this AI-driven exuberance rational—or irrational?

Exuberance Then vs. Exuberance Now

Having invested for more than 35 years, I’ve seen periods of euphoria and fear. I vividly remember December 1996 when Fed Chair Alan Greenspan famously questioned whether markets were becoming “irrationally exuberant.” Back then, the NASDAQ sat near 1,300. Over the next three years it soared past 5,100 (almost quadrupling), only to crash nearly 80% by 2002.

But here’s the twist: it’s true, we did experience a “tech bubble burst”, but where is the NASDAQ index value today? Amazingly, the index stands at 23,000 (see chart below) – an 18x increase above the 1996 level when Greenspan gave his irrational exuberance speech! So, in hindsight, the sound we heard during 2000 was not the tech bubble bursting but rather an internet Big Bang! The internet wasn’t a speculative fad—it was the foundation of a global transformation.

So, what about AI?

Source: Macrotrends LLC

Internet Cycle vs. AI Supercycle

The internet era lifted the number of online users from zero to five billion—over 60% of the planet (see chart below). The AI wave kicked off publicly in November 2022 with ChatGPT’s release. In under three years, the NASDAQ has more than doubled. That pace isn’t sustainable forever, of course. Bubbles form, emotions swing, and markets correct. But dismissing AI as a fad ignores its unmistakable—and accelerating—impact.

Source: BOND – Mary Meeker

With the rapid appreciation in the stock market, it’s important for investors to identify and understand the warning signs of potential bubble bursting or market crash. In fact, I continue to do my part by studying past crashes. My shipment of Andrew Ross Sorkin’s book, 1929: Inside the Greatest Crash in Wall Street History just arrived and all these lessons remind us that not all booms are bubbles, and not all crashes end innovation.

Not All Bubbles are Created Equal

Major market drawdowns are part of a long-term investor’s journey:

- 1929: Great Crash

- 1973-74: Nifty-Fifty

- 1987: Black Monday

- 2000: Dot-com bust

- 2008: Financial crisis

- 2020: COVID crash

Many pundits today are now asking is this AI surge the next bubble? Valuations, as measured by P/E ratios (Price/Earnings), suggest a very different setup than in 2000.

Back then, many tech leaders traded at 100x+ earnings. Today’s Magnificent Seven tech leaders are elevated, but nowhere near dot-com extremes:

- NVIDIA Corporation (NVDA): 57x

- Apple Inc. (AAPL): 36x

- Microsoft Corp. (MSFT): 36x

- Alphabet Inc. (GOOG): 32x

- Amazon.com, Inc. (AMZN): 31x

- Meta Platforms, Inc. (META): 23x

*Source: MarketSurge – only Tesla, Inc. (TSLA) has a P/E higher than 100x.

For the S&P 500 overall, the index has a forward P/E of 22.8x (Yardeni Research), significantly lower than 2000 levels and nowhere near bubble territory.

Source: Wall Street Journal – March 14, 2000

Life After the Internet and Life After AI Introduction

Think back 25 years:

- Renting movies at Blockbuster before Netflix went digital

- Driving to the bank for deposits

- Buying stamps to mail checks before Venmo or Zelle

Today, those activities feel prehistoric. AI is set to reshape daily life on an even faster timeline — from medicine and logistics to entertainment and marketing.

I’m discovering “AI epiphanies” weekly.

- With a few prompts, I created a beautiful Mother’s Day poem and became a poet hero despite never writing poetry before.

- When I recently needed to write an obituary for my mother, AI helped structure and refine it in minutes instead of taking me hours.

- Just last month I needed to hunt down lobster bisque for a shrimp pasta recipe I wanted to make. It turned into a time-wasting scavenger hunt. Thankfully, AI found it in stock, even when multiple apps insisted it wasn’t available. Needless to say, the recipe was incredibly delicious, and my stomach thanked ChatGPT.

And when it comes to investing? Evaluating biotech companies used to take weeks. Now, detailed research can be synthesized in days without sacrificing rigor. AI isn’t replacing insight — it’s amplifying output.

Not All AI Stories Are “Unicorns and Rainbows”

AI boosts productivity. Higher productivity means some companies need fewer people. Amazon recently announced 14,000 layoffs despite reporting amazing financial results. Microsoft and Meta have also announced thousands of employee layoffs even as profits rise.

This isn’t doom and gloom — it’s innovation cycles in action. Technology displaces tasks before ultimately creating new industries and roles.

So… Rational or Irrational?

Although there has been much debate regarding whether we are in an AI bubble, from my perspective, we are in the very early innings of a long AI revolutionary game. There are definitely pockets of frothiness that expose investors to undue risk, but if you can follow a disciplined, diversified, valuation-sensitive investment strategy, like we implement at Sidoxia Capital Management, I feel that the current exuberance is more rational than irrational.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Nov. 3, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN, META, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Trade & OBBB Deals Sealed, Fed Dread, and AI/Meme Dreams

As the stock market reached new all-time highs, investors had plenty to juggle—both in Washington, D.C., and on Wall Street. The S&P 500 climbed +2.2%, the NASDAQ surged +3.7%, and the Dow Jones Industrial Average edged higher by +0.1% for the month.

The One Big Beautiful Bill

What has fueled the rally? A major catalyst was President Trump’s signing of the One Big Beautiful Bill Act (OBBB) on July 4th. The nearly 900-page legislation spans a broad range of economic issues including tax reform, healthcare, energy policy, and national security.

According to the Congressional Budget Office (CBO), the combined impact of tax cuts, new spending, and spending reductions will result in a net cost of $3.4 trillion over 10 years (see chart above). Supporters of the bill argue that this projection underestimates the long-term stimulative effects of tax relief and strategic investments. Whether the deficit widens as the CBO projects, or narrows thanks to a stronger, growing economy, remains to be seen.

Trade Deals Sealed

Since Liberation Day on April 2nd, trade negotiations have progressed unevenly. The administration’s reciprocal tariff hikes were paused through August 1st to allow final agreements to be reached. Following months of tough rhetoric, multiple major trading partners ultimately signed deals before the deadline—including the European Union, Japan, the United Kingdom, Vietnam, and South Korea—thereby avoiding punitive tariffs.

Talks with our two key trading partners, Mexico and Canada, remain ongoing. While Mexico was granted a 90-day extension amid constructive dialogue, Trump slapped a 35% tariff on Canada (from 25%) due to what the White house said was “continued inaction and retaliation.” The tariff pause with China stops on August 12th.

Here’s a list of the new country tariffs released by the president late yesterday: CLICK HERE

Regardless of all the tariff uncertainty, investor sentiment improved last month as the terms of the signed deals were significantly milder than originally feared.

Adding to the optimism:

- Core inflation in June remained modest at 2.8% (Reuters), and

- Tariff revenues collected through July reached $126 billion, beating initial estimates (Politico) – see chart below. Strategist Ed Yardeni forecasts that 2025 tariff revenues could surge to between $400 billion and $500 billion (Barron’s).

Source: Politico

Fed Dread

Of course, when it comes to financial markets, everything can’t just be rainbows and unicorns without something for investors to worry about—and this month, a key concern remains Federal Reserve policy. Critics, including the president, argue that interest rates are too high, with the Federal Funds Rate currently set at 4.25%–4.50% (Yardeni Research) – see chart below.

By comparison:

- The European Central Bank’s Deposit Facility Rate stands at 2.00%, and

- The Bank of Japan’s overnight rate is only 0.50%.

Source: Yardeni Research

Fed Chair Jerome Powell has held off on further cuts, citing the need for more clarity on inflation and labor market data, especially in light of recent tariffs. Ironically, when the Fed last cut rates by -1.00% late last year, the 10-year Treasury yield rose by roughly +1% (see chart above), reflecting fears of rising inflation.

This week, the Fed held rates steady for the fifth consecutive meeting (YouTube). Notably, two FOMC members—Christopher Waller and Michelle Bowman—dissented, voting in favor of a rate cut. It was the first dual dissent by Fed governors in over 30 years—a clear signal of division inside the central bank.

Meme Dreams

With the major indexes at new highs, speculation has returned in full force. Money-losing, struggling companies like Opendoor Technologies, GoPro Inc., and Kohl’s Corp. saw their shares double, triple, or even quadruple over a short span (WSJ) – see chart below. We saw similar trends occur during the GameStop and AMC meme craze in 2021.

Source: The Wall Street Journal

Adding fuel to the fire:

- Cryptocurrency prices are on the rise again.

- Euphorically priced IPOs (Initial Public Offerings) like Figma, Inc. (FIG), which more than tripled in value ($115 per share) on its first trading day above its offering price ($33 per share) valuing the company above $50 billion – more than 30 times next year’s forecasted revenues.

- SPACs (Special Purpose Acquisition Companies)—often criticized for poor governance—are staging a comeback.

Combined, all these trends raise concerns about froth, which investors have experienced at previous peaks.

Climb in AI Stocks Persists

No discussion of this rally would be complete without highlighting the AI mega-cap giants. Companies like Alphabet (Google), Meta (Facebook), Microsoft, and Amazon all recently announced capital expenditures for 2025 that will likely exceed an astounding $350 billion —most of it allocated to AI infrastructure.

Meanwhile, NVIDIA Corp., the AI-chip juggernaut and major beneficiary of all the AI capex, has seen its share price soar +63% in just three months, reaching a staggering $4.4 trillion market value.

Source: Yardeni Research

Valuations High but Fundamentals Remain Strong

While stock valuations remain elevated above historical averages (the S&P 500 red line trades at 22x forward earnings, according to Yardeni) – see chart above, the macro backdrop remains supportive:

- The economy is strong,

- Unemployment is low,

- Corporate profits are growing, and

- Monetary policy may turn more accommodative in coming months.

In this momentum environment, the market should continue its productive juggling, but if the frothy or economic winds worsen, investors should be prepared for a dropped ball.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GOOGL, META, AMZN, MSFT, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in OPEN, GPRO, KSS, GME, AMC, FIG or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Animal Spirits to Animal Hibernation

Investor mood or sentiment can change rather quickly. Immediately after the 2024 presidential elections, positive animal spirits catapulted the stock market higher due to hopes of stimulating tax cuts and deregulation legislation. However, those warm and fuzzy feelings soured last month, as investor focus shifted to on-again, off-again tariff talks, and stagflation concerns, which have converted animal spirits into gloomy feelings of hibernation.

As a result, the advancing bull market took a breather and transformed into a weary bear during March. For the month, the S&P 500 (-5.8%), NASDAQ (-8.2%), and the Dow Jones Industrial Average (-4.2%) all fell significantly in the wake of tariffs, inflation, and recession worries.

Lovely Liberation Day or Tariff Trouble?

Since the President took office in January, he has announced, reversed, and implemented tariffs across a wide range of countries and sectors, including China, Canada, Mexico, the EU, Colombia, Venezuela, steel, aluminum, oil, automobiles, digital services taxes, and more.

The day of reckoning begins on April 2nd, designated Liberation Day by the president. This is when the president and the White House officially announce global reciprocal tariffs on foreign countries in an attempt to reverse the nation’s large trade deficit (see chart below) and bring manufacturing back to the United States. For example, if Germany subsidizes BMW cars sold in the U.S. while simultaneously placing tariffs (i.e., additional taxes) on American Ford Explorers sold in Germany, the president wants to impose equivalent reciprocal tariffs on those same BMWs sold in the U.S. in an effort to level the trading playing field. On the surface, a $131 billion trade deficit sounds very significant, but when compared to a $30 trillion economy (Gross Domestic Product – GDP), this negative trade balance represents less than 0.5% of GDP – effectively a rounding error. I have previously written how tariffs represent more of a molehill than a mountain (see Tariff Sheriff), in part because consumer spending and services make up the vast majority of our country’s economic activity, whereas trade and manufacturing are relatively smaller segments.

Source: Trading Economics

Driving home the point that tariffs are more bark than bite, Senior White House trade and manufacturing counselor Peter Navarro recently stated the 2025 tariffs could add $700 billion annually to U.S. revenues, including $100 billion from the recently announced 25% auto tariffs. Many economists believe this collection estimate is too optimistic. However, even if this target is achievable, $700 billion only represents a measly 2% of overall GDP.

Tariffs = Recession or Stagflation?

With the recent stock market downdraft and growing concerns related to tariffs, some economists and pundits are raising the probability of a recession and the possibility of inflation accompanying an economic downturn (i.e., stagflation).

Economic data should clear some of the fog. Fresh employment numbers will be released this Friday, which should shine some light on the health of the economy. Irrespective of this month’s results, the most recent 4.1% unemployment rate (see chart below), though slightly higher over the last two years, does not strongly indicate a recession.

Source: Trading Economics

Other “hard” data, such as GDP, also suggest a slowing economy rather than a recession. For instance, a recent survey of 14 economists estimates the economy is growing at a paltry +0.3% rate in Q1 – 2025 versus +2.3% in Q4 – 2024. Data is continually changing, but if a looming recession were imminent, corporate earnings would likely be trending downward, not upwards, as evident in the chart below.

Source: Yardeni Research

Tariff Inflation Has Yet to Arrive

There is no doubt tariffs function as a tax hike on consumers because U.S. companies that pay the tariffs on imported goods are eventually forced to raise prices to maintain profit margins or limit margin degradation.

Nonetheless, inflation did not spike under President Trump’s first term. Even if the president’s new policies result in more aggressive tariff actions this go-around, inflation will likely remain in check due to the point mentioned earlier – imported goods represent a small percentage of overall consumer and business purchases.

Tariff implementation is just beginning, so only time will tell how pervasive inflation will become. However, what we do know now is that inflation has declined dramatically over the last couple of years and has not yet spiked (see Consumer Price Index chart below).

Source: Calafia Beach Pundit

Where Could I Be Wrong?

I have explained how some of the lagging “hard” data does not signal recession or stagflation, but what could I be missing? For starters, some of the leading “soft” data (e.g., surveys) indicate various cracks in the economic foundation are forming. Take the recent Consumer Confidence data (see chart below), which has weakened dramatically from pre-COVID and even post-COVID levels.

Source: Trading Economics

It’s not just consumers who are feeling uneasy about the economic environment; businesses are as well. Another soft data point flashing red is the NFIB Small Business Uncertainty index, which recently reported its second-highest reading in 48 years (see chart below). Even if my argument that tariffs are too small to materially impact the economy holds, if the psychological effects of tariff uncertainty paralyzes consumer and business economic activity to a standstill, then tariffs could indeed become a substantial factor.

Source: National Federation of Independent Business (NFIB)

What Comes Next After Liberation Day?

Liberation Day is unlikely to trigger an immediate and sustained V-shaped recovery in the stock market because international trading partners will be forced to announce retaliatory tariffs in response to President Trump’s reciprocal tariffs, potentially leading to additional reactionary tariffs by the U.S.

Additionally, the reciprocal tariffs announced on April 2nd will likely serve as a starting point for subsequent negotiations with trading partners. Without a comprehensive resolution, investor sentiment will likely remain somewhat unresolved and unsettled. Regardless of your views on the size and impact of tariffs, Liberation Day will at least bring some clarity and reduce the uncertainty surrounding the current murky and chaotic environment.

The multi-year bull market continued its charge after the presidential election, but investor sentiment has weakened the bull run due to tariff uncertainty. In response, the excited bull has temporarily turned into a sleepy bear. Depending on how these tariff events unfold, we will soon find out whether Liberation Day will awaken the bear to hunt for bulls or send it into deep hibernation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in F or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Par for the Course

Stocks have been in a multi-year bull market, but just as investors cannot earn positive returns every month, golfers also cannot achieve a hole-in-one or birdie on every hole, either. A challenging performance is exactly what happened last month when stocks recorded a bogey on the scorecard.

More specifically, this is how far out-of-bounds the major indexes were last month:

- S&P 500: -1.4%

- Dow Jones Industrial Average -1.6%

- NASDAQ: -4.0%

Technology stocks and the Magnificent 7 stocks felt the largest brunt of the force last month as tariffs and the impact of Chinese AI (Artificial Intelligence) competition gave investors heartburn as they digested the information (see New Year, New AI ERA & New Tariff Sheriff).

Tariffs – More Molehill Than Mountain

As mentioned, a large part of last month’s volatility can be explained by the policy uncertainty surrounding the impending tariffs on China, Canada, and Mexico. Despite the absence of new tariffs being implemented, in an attempt to lock in cheaper imported goods, U.S. corporations and consumers have been stockpiling foreign goods before prices move higher due to tariffs. The 25% proposed tariffs on Canadian and Mexican goods are set to be applied as soon as March 4th. A flat 25% tariff on imported steel and aluminum products is expected to begin on March 12th – these particular tariffs are expected to have a disproportionately negative impact on the automotive industry.

Regarding other proposed reciprocal trade agreements, the White House’s analysis on tariffs for all other countries (beyond China, Canada, and Mexico) is expected to arrive on the president’s desk on April 2nd.

All these proposed changes are having an immediate economic impact whether intended or not. Not only are consumers buying more overseas products now, as they brace for higher prices, but businesses are also shifting supply chains to countries outside of China, Canada, and Mexico, in hopes of finding temporary tariff loopholes.

The bottom-line is our country’s imports have been spiking up recently, especially in the first quarter. Imports by definition subtract from America’s economic activity, so if businesses and consumers are rationally stockpiling foreign goods before prices go up from tariffs, investors should not be surprised that GDP (Gross Domestic Product) growth is set to go negative in the first quarter (-1.5%), according to the Federal Reserve Bank of Atlanta.

This short-term spike in foreign product purchases should be temporary until the tariffs are officially put in place. Subsequently, demand for relatively cheaper U.S. goods should rise because foreign goods will be pricier. In other words, buyers may begin purchasing more American-made t-shirts on Amazon because those shirts could be cheaper than the Chinese-made t-shirts after the additional tariffs commence on China.

How large are these overall tariffs? When it comes to Mexico and Canada, the size of these countries’ imports is estimated at $918 billion (see the 2023 import breakdown below for the two countries). On the surface, this sounds like a very large number, and it is. However, if you consider the size of the U.S. GDP ($29.4 trillion), these tariffs will mathematically have less than a 1% impact on the direction of our country’s economic activity.

However, if demand for American products goes up after the tariffs begin, as mentioned above, then it is perfectly logical to expect the drag from imports can be diminished or possibly completely reversed, if consumers decide to buy more American goods.

Source: Visual Capitalist

Also worth noting, as I documented last month in my Investing Caffeine blog, imports only account for 13.9% of our country’s economic activity (see New Tariff Sheriff). So, while tariffs make for great scary headlines, the reality of the numbers paints a different picture. Overall, the uncertainty surrounding the discussion of tariffs is having a much larger economic impact than the actual tariffs themselves. In other words, what we are discussing is more molehill than mountain. We saw this same movie before during the administration’s first-term when tariffs did not crater the economy into recession or create disproportionately high inflation.

War at the White House

A geopolitical soap opera played out on global television last Friday during a meeting between Ukraine’s President Volodymyr Zelensky and President Trump in the Oval Office. The meeting was designed to be a celebratory signing of a minerals deal in which the U.S. would gain access to strategically important Ukrainian rare earth metals in exchange for continued U.S. aid and military support. A signed deal would increase the probability of a peace deal between Russia and Ukraine dramatically. What actually happened was a war of words at the White House, which resulted in Zelensky getting kicked out of the White House with no signed deal.

Both sides have economic and strategic incentives to reengage in peace and mineral deal negotiations, but if the U.S.-Ukraine relationship totally crumbles, Europe and the other NATO (North Atlantic Treaty Organization) countries will need to pick up the slack in their military and economic aid to Ukraine. Regardless, increased European support is required to stave off a broader incursion by Russia and Vladimir Putin into a wider portion of Europe.

Tariffs, the Russia-Ukraine war, and AI issues may have heightened investor anxiety last month, but long-term investors understand that annual -5% and -10% corrections in the equity markets are considered par for the course. In fact, over the last 12 months, the S&P 500 index has declined -5% five times, and -10% one time, yet the stock market is still up +16% on a trailing 12-month basis (see chart below).

Source: Trading Economics

Financial markets end up in the rough plenty of the time, which often results in performance scorecard bogeys. However, long-term investors and Sidoxia Capital Management clients have won more often than not because the benefits of American capitalism have created many more birdies and pars over time.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 3, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in META, NVDA, certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BABA or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Time in the Market Beats Timing the Market

It was another great year in the stock market. But predicting the timing of a bear or bull market is more challenging. Fortunately for investors, the stock market is up a lot more of the time than it is down. More specifically, over the last century, the stock market has been up 73% of the time for one-year periods and 94% of the time for 10-year periods (see graphic below and Time is What Matters). That’s why investors’ time in the market beats the fools’ errand strategy of trying to time the market. The long-term, consistent upward trend in stock prices makes investing in the stock market akin to sailing around the world with a persistent tailwind for the whole trip.

Source: Capital Group and S&P 500 Index

Many people believe investing in the stock market is gambling, but 73% and 94% odds for stock market gains seem a lot better than the probabilities of making money in Las Vegas. I explored this concept further in one of my recent articles (see Elections Status Quo). Even with those favorable, lopsided odds, recessions do occur, albeit infrequently. As you can see from the chart below, since World War II, we have experienced a dozen recessions averaging 10 months in duration. And guess what? Successful post-recession recoveries have equaled 100% (12 for 12). Despite the short-lived bear markets, stock prices have appreciated more than 30x-fold since the end of World War II.

Source: Yardeni.com

2024 Predictions

There were plenty of pundits and talking heads who falsely predicted a recession in 2024, but the odds certainly worked in investors’ favor. For 2024, the S&P 500 index gained +23%, and this comes on the heels of a banner 2023, which was up +24%. Experiencing back-to-back +20%-years is a rare occurrence, which hasn’t occurred since the late-1990s. As we look into 2025, achieving three consecutive positive years in the stock market is not unprecedented, but as I mentioned earlier, predicting the timing of a down market can be tricky.

Case in point, predicting the outcome of stock returns, even with perfect information can be very daunting. What would have been your prediction of the 2024 stock market return, if I told you the following events were to occur this year (in no particular order)?

- Two assassination attempts on a presidential candidate

- An ongoing bloody war between Russia and Ukraine that reaches one million deaths

- Brutal Israeli-Hamas war in Gaza moves into its second year

- Nationwide Palestinian protests across college campuses

- Israeli-Hezbollah war commences in Lebanon

- Rebels in Syria topple the Assad regime

- A hotly contested presidential election triggering fears of a civil war

- A Baltimore bridge collapses killing six people and costing the overall economy upwards of $10 billion

- After crypto exchange goes bankrupt, CEO is sentenced to 25 years in prison for fraud

Most intelligently honest people would not have predicted a +23% return, but that is exactly what happened. As part of this extended bull market, some major stock market milestones were achieved: 1.) the Dow Jones Industrial average eclipsed 40,000; 2.) the main benchmark S&P 500 index surpassed 6,000; and 3.) the NASDAQ index temporarily triumphed the 20,000 level. The market took a breather in December (the Dow -5.3% and S&P -2.5%), so we have momentarily pulled back from some of these key levels.

What Next in 2025?

As I alluded to earlier, pulling off a three-peat in 2025 with a third consecutive year of gains may be a difficult feat, but not impossible. There remains some room for optimism. First of all, we have an accommodative Federal Reserve that has cut interest rates three times in 2024 (see chart below) from a target of 5.5% to 4.5% (see red line). Currently, expectations are set for the Fed to make another two interest rate cuts in 2025. All else equal, this should provide some mild stimulus for both borrowers and investors in 2025.

Source: Yardeni.com

Next, we have a new pro-business administration entering the White House that has promised lower taxes and less regulation, which should aid business profits. Tariff policies remain a wildcard, but if used judiciously for negotiation purposes, perhaps there could be more bark than bite from the rhetoric. Time will tell.

The 2024 chapter has closed, and we have started the 2025 chapter. Regardless of the outcome this year, history teaches us the time in the market is much more important than timing the market. This philosophy has served Sidoxia Capital Management and its clients well over the long-run.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Market Misgiving on This Thanksgiving

We’ll see if there is any gravy left for investors during the last month of the year, but so far 2024 has been a satiating feast that has stuffed investors. There has been a cornucopia of items to be thankful for, including the Federal Reserve, which is expected to provide some dessert this month in the form of its third interest rate cut this year.

Investors certainly can also be grateful for the performance of the stock market, which has had a phenomenal year thus far (see chart below):

• S&P 500: +26.5%

• Dow Jones Industrial Average:+19.2%

• NASDAQ: +28.0%

On a two-year basis, the S&P 500 results look even tastier: +57.1%

Why is there such a large appetite for stocks? For starters, we are coming off a fresh election last month, and the majority of Americans decided to vote for the new administration that has promised additional stimulative tax cuts, and deregulation. If these promises come to fruition, these changes could augur well for corporate profits and a rising stock market. Regardless of whether your candidate won or lost the election, investors can agree there is less uncertainty with an uncontested election, which is welcomed by all. In addition, the two Fed rate cuts that started in September have also buoyed enthusiasm.

What is less clear are the effects of President-elect Donald Trump’s tariff policy threats, which if enacted run the risk of increasing inflation, stifling global trade, and jeopardizing future Fed rate cuts. Combined, these negative side effects have the potential of significantly dampening economic growth. On the other hand, if the tariffs are only used as a negotiating tool with our larger trading partners (including China, Mexico, Canada, and Europe), the tariff discussion will likely have more bark than bite. Time will tell.

Dissecting Stock Performance & Valuations

A lot of pundits are pointing to an overheated market, but on a 3-year basis, returns are looking more normalized (+8.2% per year) because of the -20% hit on stocks during 2022. As you may recall, much of the 2022 decline was caused by the Fed slamming on the economic breaks with its fastest rate-hiking cycle in four decades (raising rates from 0.0% to 5.5%).

Objectively, stock values, as measured by the Price-Earnings (P/E) ratio of the S&P 500, are at elevated levels – registering in at approximately 22-times next year’s forecasted profits. As you can see from the chart below, the stock market is priced at levels not seen since 2001 and valuations are roughly double what they were at the lows of the 2008 Financial Crisis.

Source: Yardeni.com

A major reason for escalated valuations has been the concentration of performance in the largest seven companies, or the so-called Magnificent 7 stocks, which include, Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla. In fact, the index concentration is the highest it has been in more than a half century – even higher than at the peak of the 2000 Tech Bubble when Cisco Systems, Microsoft, GE, Intel, and Exxon Mobil were the five largest companies by market capitalization (see chart below).

The good news is the other 493 companies in the S&P 500 (I call them the “Absentee 493”) are priced much more reasonably. This bifurcated dynamic between the largest seven companies versus everything else, highlights the plethora of opportunities available to be harvested in Value stocks, Small-cap stocks, and Mid-cap stocks.

As is evident in the chart below, the S&P 500 index (red-line), which is skewed by the Magnificent 7, is about 30% more expensive than Small-cap and Mid-cap stocks, which are hovering near historically attractive valuation levels.

Source: Yardeni.com

Value stocks (blue-line) in the market look equally attractive (about 30% cheaper than the S&P 500), as can be seen in the chart below.

Source: Yardeni.com

As always, the future is uncertain, and risks abound for next year. But 2024 has been a blockbuster year and there has been plenty to be thankful for, especially the performance of the U.S. stock market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, AMZN, MSFT, GOOGL, META, TSLA, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CSCO, GE, XOM, INTC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Past Elections Status Quo Means No Need for Woe

Scarier than Halloween, the current presidential election is causing people on both sides of the political aisle to be frightened by the idea of their candidate potentially losing. Uncertainty is generally petrifying to investors, resulting in downward pressure on stock prices, but with less than a week until election day, the stock market is providing more treats than tricks. Sweetness has come in the form of a stock market up +20% in 2024 (up 8 out of 10 months this year), and only off -3% from its record high reached a few weeks ago. For the month, investors experienced modest declines as they braced for the election results. The S&P 500 dropped -1.0%, the Dow Jones Industrial Average -1.3%, and NASDAQ -0.5%.

Regardless of whether the red team or blue team wins the presidential election, the good news is history reminds us the end result has little effect on the long-term results of the stock market. As you can see from the chart below, over the last century, stock prices have gone up under both Republican and Democrat presidents. As Mark Twain famously stated, “History doesn’t repeat itself, but it often rhymes.” If that’s the case, past elections teach us, there is no need to fear the status quo of a Republican or Democrat president.

Source: Yardeni Research (Yardeni.com)

More recently, over the last 26 years, the stock market has been up significantly under each president, regardless of political party. Here are the results of the S&P 500 under the last three presidents:

- President Barack Obama(November 4, 2008 – November 8, 2016 – Democrat): +137%

- President Donald Trump(November 8, 2016 – November 3, 2020 – Republican): +51%

- President Joe Biden (November 3, 2020 – Present – Democrat): +63%

No matter who wins the White House, they will be inheriting a relatively strong economy. Consider the following tailwinds benefitting the new president:

- Strong Economy: The broadest measurement of economic activity, Gross Domestic Product (GDP), registered a healthy +2.8% growth rate for Q3

- Resilient Jobs Market: The just-reported unemployment rate of 4.1% today is representative of a strong but slowing job market. The unemployment rate has climbed modestly since troughing in 2023, but unemployment is still relatively low compared to historic levels much higher.

- Declining Inflation: As I pointed out last month (see Rate Cut Adrenaline) inflation has been on a fairly consistent downward trajectory over the last two years, which has allowed the Federal Reserve to cut interest rates by 0.50% in September. Moreover, based on the current economic environment, the Fed has signaled more stimulative interest rate cuts are likely ahead – economic strategists and pundits are predicting another 0.25% cut at the next Federal Reserve meeting that occurs over the two days following the elections.

- Record Corporate Profits (see chart below): The United States economy is the envy of the world, and the reason why is evident by the 65-year chart below showing record corporate profits and GDP. If you were an entrepreneur, where would you choose to start your company? China? Japan? UK? Russia? There’s plenty of room for improvements in our country’s policies, but there’s a reason the U.S. dominates in creating the largest and most profitable multi-trillion companies in the world.

Source: Calafia Beach Pundit

One area for improvement in the U.S. revolves around our fiscal debt and deficits. Our government simply spends too much money and doesn’t collect enough (tax receipts) to cover those expenses (see chart below). Another lesson to learn from our government’s excessive spending over the last four decades is that the glut of expenditures can’t be blamed on any one political party – the slope of spending is consistently up and to the right for all serving politicians.

Source: Calafia Beach Pundit

As I have mentioned in the past, stocks do not perpetually move up forever. However, regardless of the election outcome, we know from history that up-markets (bull markets) occur about 85% of the time, if we look at the last 100 years (see chart below). Analysis by Dimensional Fund Advisors shows that from 1926 – 2023, bull markets have lasted 994 months versus much shorter bear markets of 177 months.

Source: Dimensional Fund Advisors

It is very possible that stock prices may take a breather or correct under various election outcomes, but if we follow the historic status quo, there will be no long-term reason for woe.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.