Posts filed under ‘Banking’

Cash Strapped Bond Issuers Should Follow Willie Sutton

When infamous bank robber Willie Sutton was asked why he robs banks, he coyly responded, “Because that’s where the money is.” Willie Sutton was one of the more prominent bank robbers in American history. During his long career he had robbed close to 100 banks from the late 1920s to 1952. He was known as “Slick Willie” or “The Actor.” As a master of disguise the FBI files show that Sutton masqueraded himself as a mailman, policeman, telegraph messenger, maintenance man and a host of other personas. The Credit Default Swap market has also been disguised in mystery and opaqueness.

With many cash strapped bond issuers looking for ways to negotiate more favorable credit terms during these tough economic times, one strategy has been to approach holders of the CDS instruments. However, CDS holders have no reason to negotiate with corporate bond issuers (for pennies on the dollar) when they stand to collect a full dollar from their bank (due to terms in the CDS contracts). Cash starved corporations rather should listen to Willie Sutton and go straight to the money source – the banks that issued the CDS to the investors. As bankruptcies increase, and bank failures rise, the trio of bond holders, bond issuers, and CDS issuers (banks) will become closer friends (and/or enemies).

Research Reloaded delved more into this issue by discussing the tactics used by media companies, Gannett and McClatchy (Read Article Here). Lots of wrinkles need to be ironed out in the CDS market, measured in the tens of trillions in notional value, but part of the solution involves the bond issuer and investor going straight to the money source (the bank issuer of the CDS). Willie would be proud.

Wade W. Slome, CFA, CFP® www.Sidoxia.com

TARP: Squeezing Blood from Banking Stones

There was a sense of relief in the financial markets when it was announced that 10 banks repaid Troubled Asset Relief Program (TARP) funds in the amount of $68 billion back to the federal government. The ten banks included JPMorgan Chase, Goldman Sachs, Morgan Stanley and American Express. Timothy Geithner, the Treasury Secretary, said the repayments were encouraging, but warned that the crisis in the banking industry was not over yet (Economist).

Unfortunately, the falling tide has left some banks stranded, unable to repay TARP loans or the dividends on the preferred shares issued to the government.

The Wall Street Journal reported the following:

At least three small, cash-strapped banks have stopped paying the U.S. government dividends that they owe because they got $315.4 million in capital infusions under the Troubled Asset Relief Program. Pacific Capital Bancorp, a Santa Barbara, Calif., lender that got $180.6 million from the Treasury Department in November, has since posted net losses of $49.7 million. Pacific Capital said … that it suspended dividend payments on its common and preferred stock as part of a wider effort to save about $8 million per quarter. A bank spokeswoman confirmed that the U.S.’s preferred shares are included in the dividend freeze.

With around 40 bank failures already in 2009, these TARP dividend suspensions may be more the trend rather than the exception. Maybe next time the Treasury will ask for a deposit or driver’s license to guarantee dividend payments before they fork over more TARP money?

With around 40 bank failures already in 2009, these TARP dividend suspensions may be more the trend rather than the exception. Maybe next time the Treasury will ask for a deposit or driver’s license to guarantee dividend payments before they fork over more TARP money?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in JPMorgan Chase (JPM), Goldman Sachs (GS), Morgan Stanley (MS), American Express (AXP), or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Banking Pigs Back at the Trough

Sooey! With some of the TARP (Troubled Asset Relief Program) government loans paid back, it appears that the malnourished pigs of the banking sector are hungry again and back at the trough for loftier pay packages. A recent Wall Street Journal article pointed out Goldman Sachs is on track to pay its employees $20 billion in 2009, almost double the compensation of 2008, and forking out even a higher average ($700,000 per employee) than 2007.

Beyond gluttonous appetites, these banking execs are attempting to make pigs fly as well. Like a magician using the art of illusion to move an object from one shell to the next, or divert attention with smoke and mirrors, these large Wall Street banks are shuffling around their compensation plans. A recent Bloomberg article noted that Citigroup Inc. is moving to raise base salaries by as much as 50% to help counterbalance reductions in annual bonuses. Citigroup is particularly in hot water because the U.S. bank received $45 billion in government fund assistance. According to the Wall Street Journal, similar trends are bubbling up at Zurich-based UBS, where executives raised banker base pay by 50%. Bank of America also said in March 2009 it may boost salaries as a percentage of total compensation. The banks are hoping that reducing bonuses tied to risky behavior, while raising salaries, will appease the regulators.

The governments “pay czar,” Kenneth Feinberg, may have something to say about these inflating compensation trends. The WSJ points out:

Feinberg will have the authority to regulate compensation for 175 executives at seven companies, including Citigroup, that received “exceptional” government help.

As a rule of thumb, securities firms generally pay out approximately 50% of revenue in employee compensation. Bonuses have traditionally made up about two-thirds of bankers’ total compensation. Compensation consultant Alan Johnson in New York says salaries typically range from $80,000 to $300,000, with bonuses often adding millions of dollars. The article goes onto highlight the five biggest Wall Street firms awarded their employees a record $39 billion of bonuses in 2007. Sparking some of this heated debate stems from the eye-popping bonuses paid out to Merrill employees before the Bank of America merger. Merrill Lynch emptied $14.8 billion out of its wallet for pay and benefits last year before it was acquired by Bank of America – the New York Attorney General Andrew Cuomo is investigating $3.6 billion of the bonuses (tied mostly to payments made in December 2008).

To protect themselves, firms like Morgan Stanley and UBS have also added “clawback” provisions that allow portions of a worker’s bonus to be recouped under certain scenarios if the firms are harmed by an employee in the future. Perhaps this will create a disincentive for harmful behavior, but likely not enough to pacify the regulators

The pigs have regained their appetites and are eagerly awaiting for some more fixings at the trough. Time will tell if 2009 can produce squeals of swinish satisfaction or will regulators take the bankers to an unfortunate visit to the butchers?

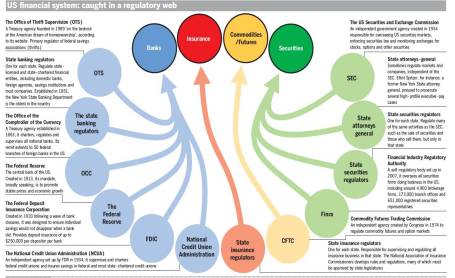

Government Looks to Strengthen Regulatory Web

As the chart from the Financial Times shows (BELOW), our messy regulatory cobweb system needs to be straightened out, so it can efficiently function. Not only to encourage risk taking and capitalism, but to also deter and punish those that take advantage of the U.S. system and its citizens. The President and Treasury Secretary Timothy Geithner will address the inefficient, entangled set of regulatory issues surrounding the intertwined agencies in our financial regulatory system. With a mix of federal, regional, and state- driven oversight, the current structure leaves potential gaps for rule-breakers to slide through.

As the FT article explains (http://is.gd/13YuS), a “council of regulators,” comprised of the agency heads, will be formed along with another consumer-related agency designed to protect areas such as home mortgages and credit cards. Will new unproductive layers be added to merely bog down risk-taking and innovation (i.e., Sarbanes-Oxley legislation), or will substantive reform occur, thereby allowing businesses to innovate and grow. The proof will be in the pudding when Geithner reveals the details of his plan.

What should regulatory reform include?

1) Consolidation: You can call me crazy, but simply looking at the layers of agencies cries for consolidation. Do we really need six different sets of regulators overseeing the banks?

2) Transparency/Capital Requirement Changes: When it comes to derivatives, heightened transparency and capital requirements feel like moves in the right direction. We have perfectly functioning options and futures markets that integrate margin and capital requirements for the various constituencies; I do not see why Credit Default Swaps should be any different. For more customized, exotic over-the-counter products, you could avoid much of the AIG debacle by increasing the capital requirements of the counterparties. I believe these aims without stifling innovation.

3) FDIC of Mega-Institutions: FDIC insurance has succeeded in managing the failures of retail depository institutions, so I see no reason why the same model for mega financial institutions. Certainly, managing the collapse of a global money center bank would be more convoluted; however a system to handle an orderly failure would limit the fallout effect we experienced with the folding of Lehman and crumbling of Bear Stearns.

Although many lawmakers will hunt for a silver bullet, we all know that in this complex global economy a path for reform will involve more evolution rather than revolution. Most controversial will be the consumer protection agency, as details still remain sparse. In my a healthy regulatory system boils down to more simplified structures with tighter oversight, mixed in with proper incentives and harsher punishments for criminals. We’ll know soon enough whether the government can weave a solution tight enough to capture the Bernie Madoffs and Allen Stanfords of the world without sacrificing our position as the global financial capitol of the world.

Who Will Pass the Stress Test?

The Government, including the Federal Reserve and U.S. Treasury department, is conducting a review of the 19 largest banks that pose “systemic” risk to the overall financial system. Although there will be no “Pass” or “Fail” grade given to the institutions, the government will clarify whether capital-raising will be necessary to weather a worsening economic storm. Scenarios under the stress test will contemplate the impact on the banks’ balance sheets and request capital increases for the weaker banks. The pessimistic case for the banks considers the following hypothetical setting:

The Government, including the Federal Reserve and U.S. Treasury department, is conducting a review of the 19 largest banks that pose “systemic” risk to the overall financial system. Although there will be no “Pass” or “Fail” grade given to the institutions, the government will clarify whether capital-raising will be necessary to weather a worsening economic storm. Scenarios under the stress test will contemplate the impact on the banks’ balance sheets and request capital increases for the weaker banks. The pessimistic case for the banks considers the following hypothetical setting:

Gross domestic product (GDP) declining by -3.3 percent in 2009 and growing by +0.5 percent in 2010.

Unemployment rate reaching 10.3 percent

Home prices to fall by another 29 percent, by 2010.

Right now the government is negotiating with the bank management teams regarding how much, if any, capital-raising will be necessary over the next six months. If the banks are unsuccessful raising capital on their own, then the government will standby to inject government money in to the banks. Rather than using tax-payer dollars, I’m in the camp that the banks’ bondholders should share the pain by converting their debt into equity – thereby relieving the burden on our debt-strapped government and taxpayers. Larry Summers, the Director of the White House’s National Economic Council, has hinted the administration is exploring this route. Regardless, the government needs to strengthen the equity positions of the banks if Bill Ackman at Pershing Square Capital Management is correct in estimating the financial system needing to repay $300 billion in debt coming due in 2009; $280 billion in 2010; and $250 billion in 2011.

In some respects this “Stress Test” is a “Lose-Lose” proposition because if certain banks are forced to raise large sums of capital, then the public will lose confidence in the banks. Conversely, if all the banks come out of the test with a clean bill of health, then the public will lose all confidence in the credibility of the tests themselves. Results will arrive soon enough – let’s hope the stress-test provides relief, not a migraine!

![940614_83408820[1] 940614_83408820[1]](https://investingcaffeine.com/wp-content/uploads/2009/07/940614_834088201.jpg?w=455&h=336)