Posts filed under ‘Announcements’

Quickly Out of the Gate

The race into 2024 has begun, and the U.S. market is off to a quick start. The S&P 500 jumped out of the gates by +1.6%, and the technology and AI (Artificial Intelligence) – heavy NASDAQ index raced out by +1.2%. The bull market rally broadened out at the end of 2023, but 2024 returned to the leaders of last year’s pack, the Magnificent 7 (see also Mission Accomplished). Out front, in the lead of the Mag 7, is Nvidia with a +24% gain in January.

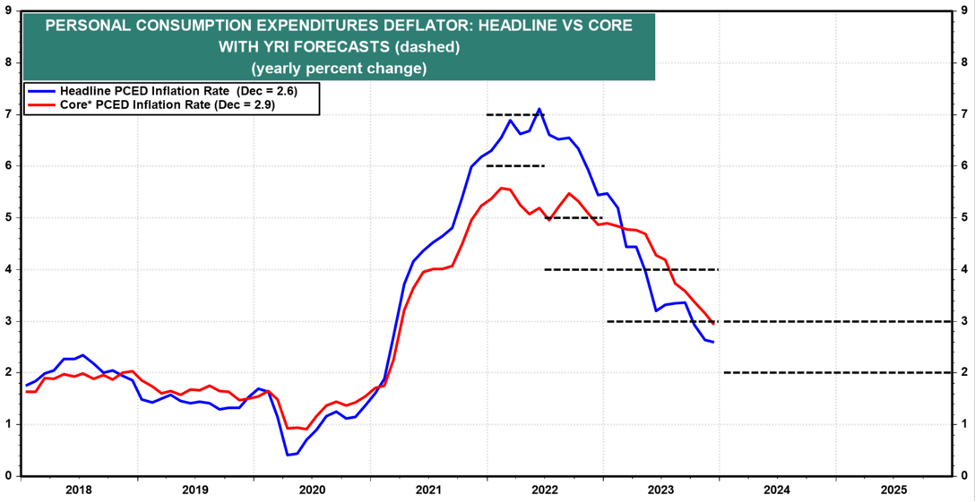

Inflation dropping (see chart below), the Federal Reserve signaling a decline in interest rates, low unemployment (3.7%), and healthy economic growth (+3.3% Q4 – GDP) have all contributed to the continuing bull market run.

Source: Yardeni.com

Consumer spending is the number one driver of economic growth, and consumers remain relatively confident about future prospects as seen in the recently released Conference Board Consumer Confidence numbers released this week (see chart below).

Source: Conference Board

But the race isn’t over yet, and there are always plenty of issues to worry about. The world is an uncertain place. Here are some of the concerns du jour:

– Red Sea conflict led by the Yemen-based, rebel group, Houthis

– Gaza war between Israel and Hamas

– Anxiety over November presidential election

– Ukraine – Russia war

Money Goes Where It is Treated Best

There are plenty of domestic concerns regarding government debt, deficit levels, and political frustrations on both sides of the partisan aisle remain elevated. When it comes to the financial markets, money continues to go where it is treated best. Sure, we have no shortage of problems or challenges, but where else are you going to put your life savings? China? Europe? Russia? Japan?

Well, as you can see in the chart below, anti-democratic, anti-American business, and confrontational military policies instituted by China have not benefitted investors – the U.S. stock market (S&P 500) has trounced the Chinese stock market (MSCI) over the last 30 years.

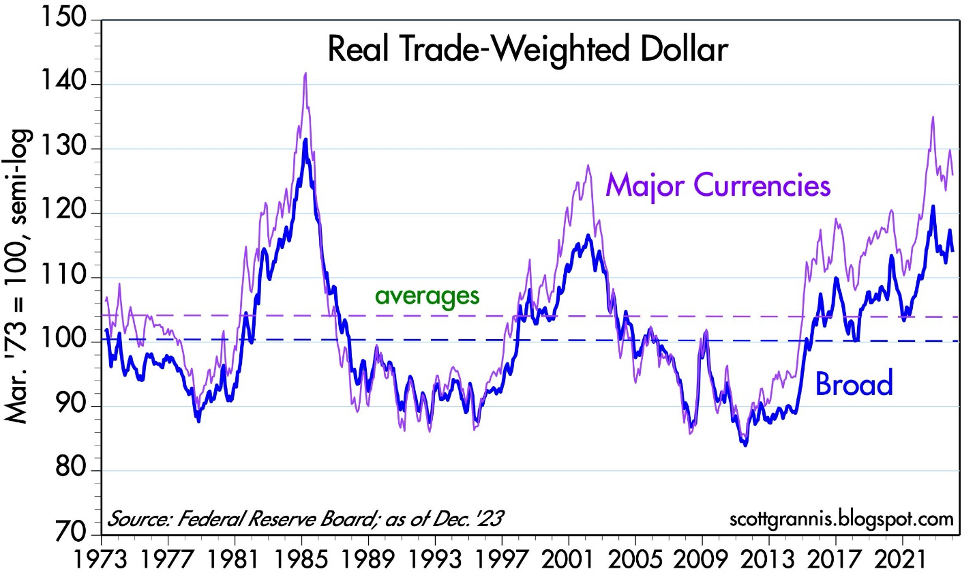

Source: Calafia Beach Pundit

For years, market critics and pessimists have been screaming doom-and-gloom as it relates to the United States. The story goes, the U.S. is falling apart, government spending and debt levels are out of control, politicians are corrupt, and we’re going into recession, thanks in part to higher interest rates and inflation. Well, if that’s the case, then why has the value of the U.S. dollar increased over the last 10 years (see chart below)? And why is the stock market at all-time record-highs?

Source: Calafia Beach Pundit

Global investors are discerning in which countries they invest their hard-earned money. Global capital will flow to those countries with a rule of law, financial transparency, prudent tax policy, lower inflation, higher profit growth, lower interest rates, sensible fiscal and monetary policies, among other pragmatic business practices. There’s a reason they call it the “American Dream” and not the “Chinese Dream.” Our capitalist economy is far from perfect, but finding another country with a better overall investing environment is nearly impossible. There’s a reason why venture capitalists, private equity managers, sovereign wealth funds, hedge funds, and foreign institutions are investing trillions of their dollars in the United States. Money goes where it is treated best!

As money sloshes around the world, the 2024 investing race has a long way before it’s over, but at least the stock market has quickly gotten out of the gate and built a small lead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia Webinar: The Keys to ’23 & What’s in Store for ’24 – Market Update

Unlock valuable insights at our upcoming webinar:

The Keys to ’23 & What’s in Store for ’24!

Tuesday, January 30th at 12:00 PM

Click the Zoom link below to register:

https://sidoxia.link/Webinar-Registration

Don’t miss out on the latest trends and expert discussions.

We will delve into a comprehensive market update. Register now!

The Douglas Coleman Show Interviews Wade Slome

Wade Slome, President and Founder of Sidoxia Capital Management, recently had the pleasure of being featured on The Douglas Coleman Show hosted by Douglas Coleman.

Drawing from professional and personal life lessons, Wade shares his knowledge about navigating market trends, building investment strategies, and also discuss the books he has authored.

If you are interested in learning more about the books Wade has authored, please visit: https://www.sidoxia.com/wades-books

This Baby Bull Has Time to Grow

You may have witnessed some fireworks on New Year’s Eve, but those weren’t the only fireworks exploding. The last two months of 2023 finished with a bang! More specifically, over this short period, the S&P 500 index skyrocketed +13.7%, NASDAQ +16.8%, and the Dow Jones Industrial Average +14.0%. The gains have been even more impressive for the cheaper, more interest-rate-sensitive small-cap stocks (IJR +21.8%), which I have highlighted for months (see also AI Revolution).

For the full year, the bull market was on an even bigger stampede: S&P 500 +24%, NASDAQ +43%, and Dow +14%.

Although 2023 closed with a festive explosion, 2022 ended with a bearish growl. Effectively, 2023 was a reverse mirror image of 2022. In 2022, the stock market fell -19% (S&P) due to a spike in inflation. Directionally, interest rates followed inflation higher as the Fed worked through the majority of its 0% to 5.5% Federal Funds rate hiking cycle.

To sum it up simply, the last two years have been like riding a rollercoaster. For the year just ended, much of the year felt like a party, but 2022 felt more like a funeral. When you add the two years together, it was more of a lackluster result. For 2022-2023 combined, results registered at a meager +0.1% for the S&P, +3.7% for the Dow, and -4.0% for the NASDAQ (see chart below).

For those saying the good times of 2023 cannot continue, investors should understand that history paints a different picture. As you can see from the stock market cycles chart (below) that spans back to 1962, the average bull market lasts 51 months (i.e., 4 years, 3 months), while the average bear market persists a little longer than 11 months. This data suggests the current one-year-old baby bull market has plenty of room to grow more.

Source: Visual Capitalist

Why So Bullish?

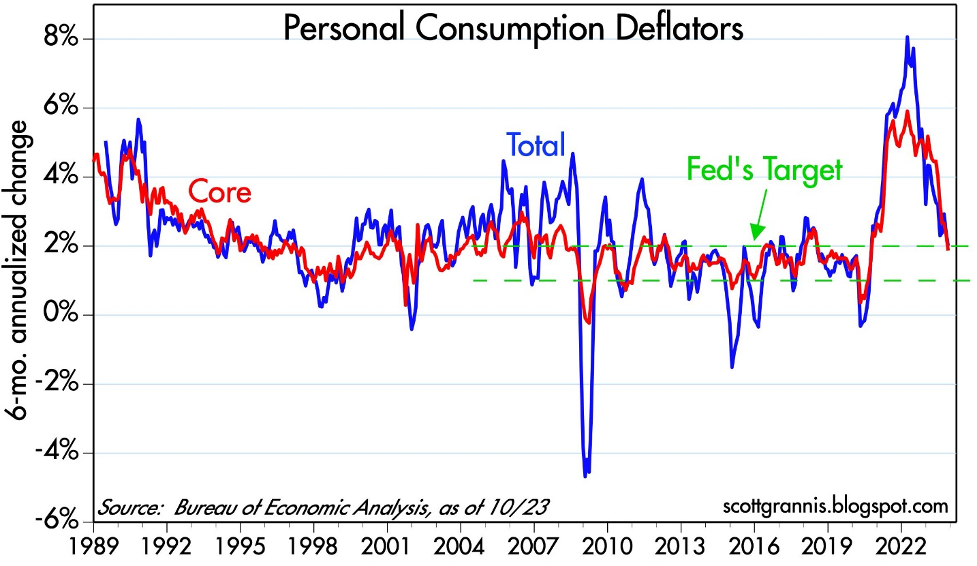

What has investors so jazzed up in recent months? For starters, inflation has been on a steady decline for many months. With China’s stagnating economy, it has helped our inflationary cause by exporting deflationary goods to our country. As you can see from the Personal Consumption Deflator chart below, this broad inflation measure has declined to the Federal Reserve’s 2% target level. Jerome Powell, the Federal Reserve Chairman has been paying attention to these statistics, as evidenced by the central bank’s forecast at the Fed’s recent policy meeting last month on December 13th for three interest rate cuts in 2024. This so-called “Powell Pivot” is a reversal in tone by the Fed, which had been on a relentless rampage of interest rate hikes, over the last two years.

Source: Calafia Beach Pundit

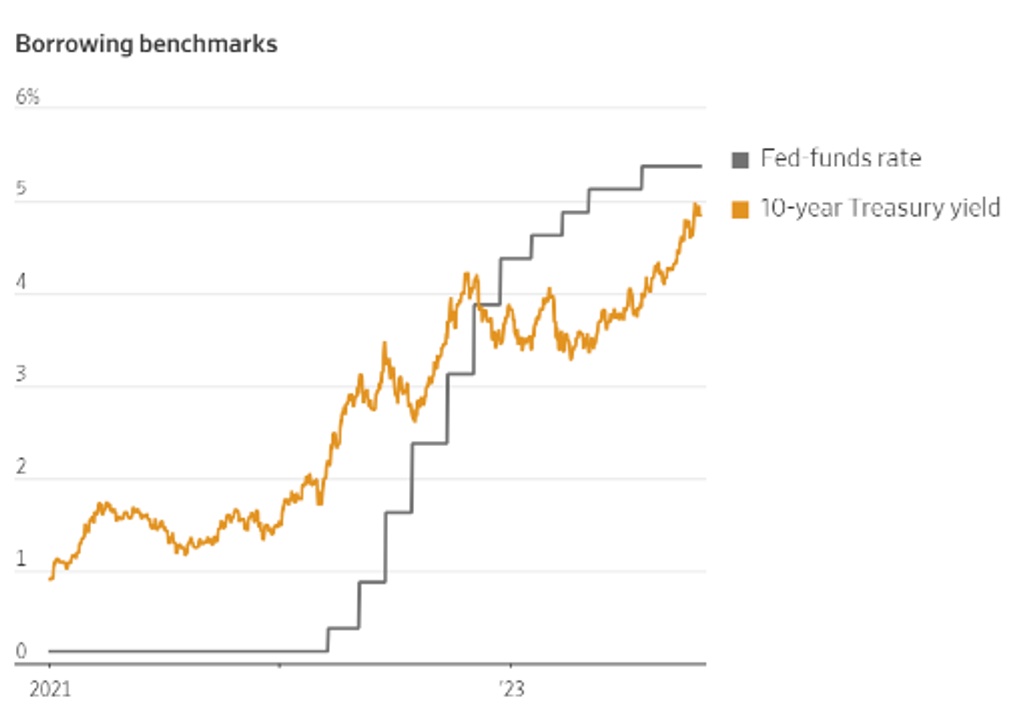

This interest rate cycle headwind has turned into a tailwind as investors now begin to discount the probability of future rate cuts in 2024. The relief of lower interest rates can be felt immediately, whether you consider declining mortgage and car loan rates for consumers, or credit line and corporate loan rates for businesses. This trend can be seen in the benchmark 10-Year Treasury Note yield, which has declined from a peak of 5.0% a few months ago to 3.9% today (see chart below).

Source: Trading Economics

Declining inflation and interest rates explain a lot of investor optimism, but there are additional reasons to be sanguine. The economy remains strong, unemployment remains low, AI (Artificial Intelligence) applications are improving worker productivity, trillions of potential stock market dollars remain on the sidelines in money market accounts, and corporate profits have resumed rising near all-time record levels (see chart below).

Source: Yardeni.com

What could go wrong? There are always plenty of unforeseen issues that could slow or reverse our economic train. Geopolitical events in Russia or the Middle East are always difficult to predict, and we have a presidential election in 2024, which could always negatively impact sentiment. This new bull market had a great start in 2023, but in historical terms, it is only a baby. Time will tell if 2024 will make this baby cry, but whatever the market faces, declining inflation and interest rates should act as a pacifier.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Market Roar Due to War

The devastating damage to humanity from the Israeli-Hamas war that is in and around the Gaza strip should not be diminished or understated – innocent lives on both sides suffer in any conflict. However, the economic impact should not be overstated either. In other words, the hundreds of billions of dollars in financial stock market losses this month are not proportional to the Mideast economic losses incurred thus far.

To put the events in perspective, the population of Israel approximates 10 million people and the population located in the Gaza Strip is about two million people. There are more than eight billion people on the planet, so Israel/Gaza represents roughly 1/7 of 1% of the global population.

From an economic standpoint, the combined economic output of Israel/Gaza Strip accounts for around ½ of 1% of global GDP (see chart below – small slivers in the blue section).

And let’s not forget, economic activity is not dropping to zero. From an economic standpoint, the war’s financial impact is even smaller – a rounding error.

Source: Visual Capitalist

However, wars do not exist in a vacuum, and tensions in the Middle East have the potential of having a ripple effect. Whenever rumblings occur in the Mideast, one of the largest global sectors to be first impacted is the oil market. Approximately 20-30% of the world’s oil is trafficked through the Strait of Hormuz in the Persian Gulf, so it was not surprising to see a short-term spike in oil prices to almost $90 per barrel in early October after the Gaza invasion of Israel. By the end of the month, oil has settled back down to about $81 per barrel, almost precisely the same price right before the war started. On a year-over-year basis, oil prices are actually down approximately -5%, thereby providing minor relief to gas-powered car drivers.

If Iran, or Iran-backed militant group Hezbollah, throws their hat into the Israel-Hamas war ring, the U.S. and other Western allies may retaliate and escalate tensions in the region, which would unlikely be received well by the financial markets.

As a result of these domino effect fears in the region, the stock market took another leg down last month with the S&P 500 index declining -2.2%, the Dow Jones Industrial Average -1.4%, and the NASDAQ index fell the most, -2.8%. The world is a dangerous place, but we have seen this movie before – this is nothing new. We would all prefer world peace, but unfortunately, wars and skirmishes have gone on for centuries.

As Interest Rates Soar, Bonds Offer More

Source: Wall Street Journal

No, TINA is not the name of my high school girlfriend or wife, but rather the acronym TINA (There Is No Alternative) existed in recent years during the Federal Reserve’s zero-interest rate policy days. More specifically, TINA referred to the lack of investment alternatives to equities (i.e., stocks) when money effectively earned 0% in the bank and close-to-0% in many fixed income securities (i.e., bonds). In fact, at one point, although it is still hard to believe, there were more than $16 trillion in bonds paying negative interest rates – pure insanity.

TINA Turns into FIONA

Given the large increase in interest rates by the Federal Reserve over two years (from 0% to 5.50%), investors have been given a short-term gift. As you can see from the chart above, yields on 10-Year Treasury Notes have risen to almost 5.0%. And believe it or not, shorter term bonds are currently providing yields even higher than this. The three-month, six-month, one-year, and two-year Treasuries are all yielding higher rates than 10-Year Treasury yields (i.e., inverted yield curve) – see table below. So, TINA has changed to FIONA – Fixed Income Opens New Alternatives. What’s more, for individuals with taxable accounts, the interest earned on Treasuries is tax-free at the state level, thereby making this short-term gift in yields even more attractive for investors.

Source: Trading Economics

Stock prices were down again for the month, and investment sentiment has been souring due to the war in the Middle East, but there is still plenty of reasons to remain constructive. Not only is the economy strong (e.g., 3rd quarter GDP of +4.9%), but the consumer also remains strong (see Consumer Wallets Strong) in large part because the unemployment rate remains near record lows (+3.8%). While anxiety rises due to the war, stock prices get cheaper, and opportunities increase. And although interest rates remain elevated, the Federal Reserve is signaling they are closer to a rate hiking end, inflation is cooling and FIONA is offering more attractive yields than during the TINA era. It’s true, this month stocks did not roar due to the war, but patient and opportunistic investors will be rewarded with more.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Consumer Wallets Strong, Rate Hikes Long, What Could Go Wrong?

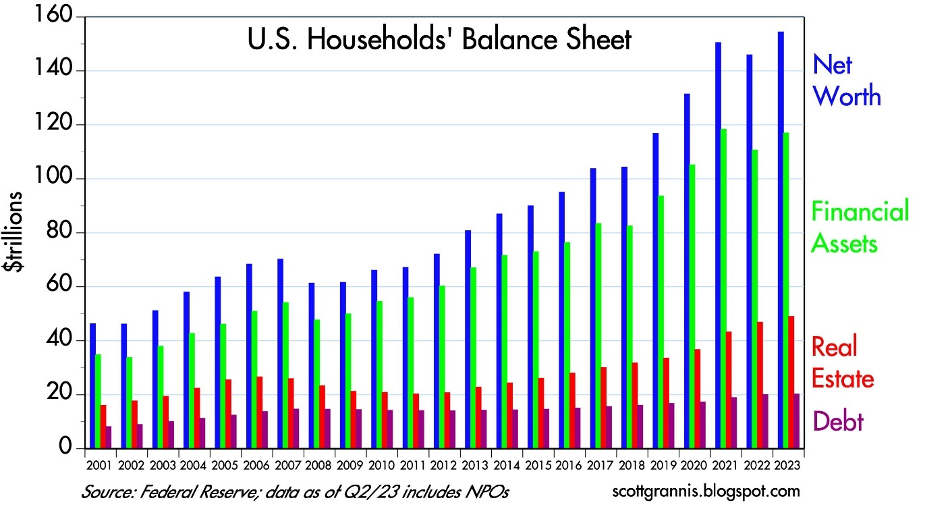

Consumer wallets and balance sheets remain flush with cash as employment remains near record-high levels. Cash in consumer wallets and money in the bank help the economy keep chugging along at a healthy clip. More specifically, as you can see in the chart below, the net worth of U.S. households has reached a record $154.3 trillion dollars in the most recent month, thanks to appreciation in stocks, gains in real estate, and relatively stable levels of debt.

Source: Calafia Beach Pundit

Unemployment Remains Low

In addition, the unemployment rate is sitting at 3.8%, near multi-decade lows (see chart below).

Source: Trading Economics

As long as consumers continue to hold a job, they will continue spending to buoy economic activity – remember, consumer spending accounts for roughly 70% of our country’s economic activity. Case in point are the most recently released GDP (Gross Domestic Product) forecasts by the Atlanta Federal Reserve, which show 3rd quarter GDP growth estimated at a 4.9% rate (see chart below).

Rates Up, Housing Prices Up?

Yes, it’s true, despite a dramatic surge in mortgage rates over the last few years, the housing market remains strong due to a very tight supply of homes available for sale. Most homeowners with a mortgage have refinanced to a rate in the range of 3% (or in some cases even lower), so selling and moving into a new home with a mortgage at current rates of 7.3% is not that appealing. In other words, if you decide to move, your monthly mortgage payment could potentially go up by more > 50%, which could equate to thousands of dollars per month. Under this scenario, you are likely to stay put and not sell your home.

Source: Trading Economics

The embedded economic disincentive of selling a home with a mortgage has really put a real crimp on the supply of homes available for sale (chart below). As you can see, the inventory of homes has dramatically collapsed from a peak of about four million homes, circa the 2008 Financial Crisis, to around one million homes today.

Source: Trading Economics

In the face of this mixed data, the stock market finished a hot summer with a cool whimper last month, in large part due to a 0.49% increase in the 10-Year Treasury Note yield to 4.58% (see chart below). The S&P 500 index fell -4.9% for the month, the technology-heavy NASDAQ index dropped even further by -5.8%, while the Dow Jones Industrial Average outperformed, down -3.5% for the month. Worth noting, however, the Dow has significantly underperformed the other indexes so far this year.

Source: Trading Economics

Inflation on the Mend

The Fed continues to talk tough about fighting inflation after taking interest rates from 0% to 5.5% over the last two years, nevertheless inflation continues to come down. The Fed’s go-to Core PCE inflation datapoint that came out last Friday at +0.1% is consistent with the downward inflation trend we have been witnessing for many months now (see chart below). As you can see, inflation on annualized basis has reached 2.2%, nearly achieving the Federal Reserve’s target of 2.0%.

Source: The Wall Street Journal and Commerce Department

There is never a shortage of investor concerns. Today, worries include Federal Reserve policy; restarting of school loan repayments (after a three-year hiatus); a potential government shutdown; an auto and Hollywood strike; higher oil prices; and a presidential election that is heating up. Many of these worries are nothing new. The bull market took a pause for the month, but consumer wallets remain fat, the economy keeps chugging, the employment picture remains strong, and stock prices remain up +12% for the year (S&P 500). For the time being, betting on a soft economic landing over an imminent recession could be a winning use for that cash in your wallet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 2, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Market Expands and So Does Sidoxia’s Team

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (March 3, 2014). Subscribe on the right side of the page for the complete text.

After a brief pause at the beginning of the year, the stock market built on the tremendous gains of 2013 (S&P 500 up +30%) by reaching record highs again in February by expanding another +4.3% for the month. My investment management and financial planning firm, Sidoxia Capital Mangement, LLC, has been expanding as well. Just this last month, we added a key investment and financial planning professional (Keith C. Bong, CFA, CPA Press Release) with more than 25 years of experience in the fields.

The Record Setting Advance Continues

Now entering the sixth year of this record setting bull market, many investors and pundits have been surprised by the strength and duration of the advance. At the nadir of the financial crisis, the stock market reached a multi-year low of 666 on March 9, 2009. For comparison purposes, the S&P 500 recently closed at 1,845, almost tripling in value since the crisis lows. Pessimists and skeptics, who locked in losses during the crisis plunge, have watched the explosive gains while sitting on their hands. While I freely admit, the low-hanging fruit has been picked, many of the doubters are still calling for a collapse as “troubling news continues to pour in from all over the planet.” However, what the naysayers neglect to acknowledge is the fact that S&P 500 reported profits, the lifeblood of bull markets, have also tripled in value. Despite what the bears say, not everything is a speculative house of cards.

Late to the Party Because of Uncertainty

Although the stock party has lasted five years thus far, individuals have only begun buying for about one year (see ICI fund flows data in Here Comes the Dumb Money) – about +$28 billion of new money in 2013 and another +$12 billion so far this year (ICI data through February 19th). After approximately six years and -$600 billion in stock sales (2007-2012), it’s no wonder investors have been slow to reverse course. Adding to the angst, investors have been bombarded with an endless stream of political and economic concerns on a daily basis, leading to the late arrival of most individuals to the stock investing party. While it’s true that more people have joined the party in recent months, floods of investors are still waiting outside in the cold. Here are a few reasons for the tardiness:

- Geopolitical Concerns: Most recently it was Syria, Iran, and Argentina that got short-term traders chewing their fingernails…now it’s the Ukraine. Just yesterday, I had to spend about 10 minutes locating the Ukranian province of Crimea on a map. For those who have not been keeping track, after days of civil unrest that left some 75 protesters dead, Ukrainian President Viktor Yanukovych fled the capital city of Kiev and agreed with opposition leaders to reduce his powers and hold early presidential elections later this year. For context, in 1954, the former Soviet Union leader Nikita Khrushchev transferred Crimea from the Russian Soviet republic to Ukraine on the basis of economic ties that were closer with Kiev than with Moscow. Prior to that transfer, Russia seized Crimea from the declining Ottoman Empire in the 18th century. Fast forward to today, and fresh off a successful Olympics in Sochi, Russia, Russian President Vladimir Putin hasn’t been happy about the citizen uprising in neighboring Ukraine, so he has decided to flex his muscles and move Russian troops into Crimea. The situation is very fluid and the U.S., along with other global leaders, are crying foul. Time will tell if this situation escalates into a military conflict like the 2008 Georgia-Russia crisis, or if cooler heads prevail.

- Fed Policy Concerns: Federal Reserve Chair Janet Yellen gave her inaugural address last month before Congress, where she signaled continuity in policy with former Fed Chair Ben Bernanke. Indications remain strong that the reduction of bond buying stimulus (i.e., “tapering”) will continue in the months ahead, despite mixed economic results. The “Polar Vortex” occurring on the East Coast, coupled with a record draught on the West Coast contributed to the recent reduction of Q4-2013 GDP growth figures, which were revised lower to +2.4% growth (from +3.2%).

- Domestic Politics: In a sharply politically divided country like the U.S., is there ever a complete hugs & kisses consensus? In short, “no”. How can there be 100% agreement when sharply divisive issues like Obamacare, immigration, tax reform, entitlements, budgets, and foreign affairs are always in flux? Layer on a Congressional midterm election this November and you have a recipe for uncertainty.

Because of all this uncertainty, there are still literally trillions of dollars in cash sitting on the sidelines, waiting to come join the fun. But uncertainty is a relative term because there is always doubt surrounding geopolitics, economics, and Washington D.C. Sentiment moves like a pendulum from fear to greed. Eventually panic/fear sways back the other direction as business/consumer confidence overshadow the deep scarred emotions of 2008-09. As the stock markets have grinded to record highs, fear and skepticism have slowly begun to erode.

Sidoxia Uncertainty

Speaking of uncertainty, I too encountered many doubters and skeptics when I started my firm, Sidoxia Capital Management, LLC in early 2008. Great timing, I thought at the time, as our economy entered the worst recession and financial crisis in a generation and the walls of our nation’s financial system were caving in.

With virtually no company assets or revenues at the time, this was the backdrop as I embarked on my entrepreneurial journey. Seemingly secure investment banking pillars like Bear Stearns and Lehman Brothers, which each had been around for more than a century, crumbled within the blink of an eye. As bailouts were occurring left and right, in conjunction with recurring multi-hundred point collapses in the Dow Jones Industrial index, cynics would repeatedly ask me, “Wade it’s great that you have a lot of experience, but how are you going to gain clients?” It was a fair and reasonable question at the time, but perseverance and hard work have allowed Sidoxia to beat the odds. Publishing several books, conducting numerous media appearances, and gaining thousands of social media followers (InvestingCaffeine.com) hasn’t hurt in building Sidoxia’s brand either.

After achieving record growth in the first five years of the firm, Sidoxia more than doubled its assets under management again in 2013. More important than all of the previously mentioned achievements has been our ability to service our clients with a disciplined, customized process that has demonstrated strong long-term results and helped solidify our valued relationships.

A Few Party Animals Getting Reckless at the Stock Party

Success for Sidoxia or any investor has not come easy over the last six years. As I wrote in a Series of Unfortunate Events, we’ve had to navigate our clients’ investment assets through the following events and more:

- Flash Crash

- Debt Ceiling Debates-Brinksmanship

- U.S. Debt Downgrade

- European Recession

- Arab Spring – Tunisia, Libya, Egypt

- Greek Crisis and Potential Exit from EU

- Uncertain U.S. Presidential Elections

- Sequestration

- Cyprus Financial Crisis

- Income Tax Hikes

- Federal Reserve Tapering

- Syrian Civil War / Military Threat

- Government Shutdown

- Obamacare & Its Glitches

- Iranian Nuclear Threat

- Argentinian Currency Collapse

- Polar Vortex

- Ukrainian Instability

It is no small feat that stock markets have made new records in the face of these daunting concerns. But simply ignoring scary headlines won’t earn you an investing trophy. Successful investing also requires controlling temptation and greed. At a celebratory bash, there are always irresponsible party animals, just like there are always reckless speculators gambling in the financial markets. It certainly is possible to party responsibly without getting crazy during festivities and still have fun. Even though the majority of investors currently are behaving well, as substantiated by the reasonable P/E ratio being paid (15x’s estimated 2014 profits) there are a few foolish players. Pockets of speculative fervor can be found in several areas of the financial markets. Here are a few:

- Bitcoin Breakdown: The world’s largest Bitcoin exchanged filed for bankruptcy after it lost 750,000 Bitcoin units, worth about $477,000,000, based on current exchange rates. The popularity of this speculative virtual currency seems eerily similar to the great Dutch Tulip-Mania of the 1630s.

- Biotech Bliss: Ignorance is a bliss, and apparently so is buying biotech stocks. There’s no need to speculate on gold or Bitcoins when you can invest in the Biotechnology Index (BTK), which has already advanced +21% this year on top of a 51% gain in 2013. Over the last 5+ years, the index has more than quadrupled.

- Facebook Folly: WhatsApp with Facebook Inc’s (FB) $19 billion acquisition of the cellphone texting company? CEO Mark Zuckerberg is claiming he got a bargain by paying almost 1,000x’s the estimated annual revenue of WhatsApp ($20 million). When only a fraction of the 450 million users are paying for the service, I’m OK going out on a limb and calling this deal kooky.

- High Ticket Tesla: Tesla Motors Inc (TSLA) has become a cult stock. The company has a price tag of $30 billion despite burning $7 million in cash last year. The announcement of a $4-5 billion battery “Gigafactory” added to the company’s recent hype. To put things into perspective, General Motors (GM) has revenues 75x’s larger than Tesla and GM generated over $5 billion in 2013 free cash flow. Nevertheless, GM is only valued at 1.9x’s the market value of Tesla…head scratch.

- Social Media Silliness: Maybe not quite as wacky as the $19 billion price tag paid for WhatsApp, but the $30 billion value placed on Twitter Inc (TWTR) for a company that burned $30 million of cash in their most recent financial report is silly too. Yelp Inc (YELP) is another multi-billion valued company that is losing money. I love all these services, but great services don’t always make great stocks. Investors from the dot-com era vividly remember what happened to those overvalued stocks once the bubble burst.

Fear and greed are omnipresent, and some of these speculative areas may continue to appreciate in value. However, controlling or ignoring the powerful emotions of fear and greed will help you in achieving your financial goals. As the markets (and Sidoxia’s team) expand, our disciplined investment process should allow us to objectively identify attractive investment opportunities without succumbing to the pitfalls of panic-selling or performance-chasing.

Other Recent Investing Caffeine Articles:

Retirement Epidemic: Poison Now or Later?

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in FB, TWTR, YELP, TSLA, BTK, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia Adds 25-Year Veteran to Team

NEWPORT BEACH, CA – (Wire-Business) – Keith C. Bong, CFA, CPA, has recently joined Sidoxia Capital Management, LLC (“Sidoxia”) as Vice President of Investments and Financial Planning. Keith brings over 25 years of experience to Sidoxia’s investment team, having worked as a Financial Consultant with Merrill Lynch, before founding the investment firm Topper Capital Management in Irvine, California.

“We are truly excited to bring such a high caliber individual like Keith on board,” stated Wade W. Slome, CFA, CFP®, President and Founder of Sidoxia Capital Management. “We’re confident that Keith’s unique experience and knowledge will bring tremendous value to Sidoxia’s clients as our firm continues to expand.”

For over a decade, while managing his former advisory firm, Keith has worked closely with business owners, corporations, and individuals, assisting these clients with critical investment planning, tax planning, and financial planning goals.

“I believe my experience in building corporate retirement plan solutions meshes well with Sidoxia’s successful investment platform,” noted Keith. “I’m thrilled to join an independent firm like Sidoxia that places clients’ needs first, unlike some other financial institutions.”

To learn more about Sidoxia and Keith Bong’s background, please visit http://www.Sidoxia.com and reference the “Investment Team” section.

Click here to download a copy of the press release.

Plan. Invest. Prosper.

DISCLOSURE: No information provided here constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia’s Slome Hits Airwaves

Sidoxia’s President & Founder Conducts Series of Radio Interviews Spanning Topics Ranging from the Stock Market & Syria to Financial Planning & Government Debt

Click on Interview Links Below:

Memphis

Memphis

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. Radio interviews included opinions of Wade Slome – not advice. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

2012 Investing Caffeine Greatest Hits

Between Felix Baumgartner flying through space at the speed of sound and the masses flapping their arms Gangnam style, we all still managed to survive the Mayan apocalyptic end to the world. Investing Caffeine also survived and managed to grow it’s viewership by about +50% from last year.

Thank you to all the readers who inspire me to spew out my random but impassioned thoughts on a somewhat regular basis. Investing Caffeine and Sidoxia Capital Management wish you a healthy, happy, and prosperous New Year in 2013!

Here are some of the most popular Investing Caffeine postings over the year:

Explaining how billions of dollars in stock selling can lead to doubling in stock prices.

2) Uncertainty: Love It or Hate It?

Source: Photobucket

Good investors love ambiguity.

3) USA Inc.: Buy, Hold or Sell?

What would you do if our country was a stock?

4) Fiscal Cliff: Will a 1937 Repeat = 2013 Dead Meat?

Source: StockCharts.com

Determining whether history will repeat itself after the presidential elections.

5) Robotic Chain Saw Replaces Paul Bunyan

How robots are changing the face of the global job market.

6) Floating Hedge Fund on Ice Thawing Out

Lessons learned from Iceland four years after Lehman Brothers.

7) Sidoxia’s Investor Hall of Fame

Continue reading at IC & perhaps you too can become a member?!

8) Broken Record Repeats Itself

It appears that the cycle from previous years is happening again.

9) The European Dog Ate My Homework

Explaining the tight correlation of European & U.S. markets, and what to do about it.

10) Cash Security Blanket Turns into Tourniquet

Stock market returns are beginning to make change perceptions about holding cash.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.