Archive for April, 2010

EBITDA: Sniffing Out the Truth

Financial analysts are constantly seeking the Holy Grail when it comes to financial metrics, and to some financial number crunchers EBITDA (Earnings Before Interest Taxes Depreciation and Amortization – pronounced “eebit-dah”) fits the bill. On the flip side, Warren Buffett’s right hand man Charlie Munger advises investors to replace EBITDA with the words “bullsh*t earnings” every time you encounter this earnings metric. We’ll explore the good, bad, and ugly attributes of this somewhat controversial financial metric.

The Genesis of EBITDA

The origin of the EBITDA measure can be traced back many years, and rose in popularity during the technology boom of the 1990s. “New Economy” companies were producing very little income, so investment bankers became creative in how they defined profits. Under the guise of comparability, a company with debt (Company X) that was paying interest expense could not be compared on an operational profit basis with a closely related company that operated with NO debt (Company Z). In other words, two identical companies could be selling the same number of widgets at the same prices and have the same cost structure and operating income, but the company with debt on their balance sheet would have a different (lower) net income. The investment banker and company X’s answer to this apparent conundrum was to simply compare the operating earnings or EBIT (Earnings Before Interest and Taxes) of each company (X and Z), rather than the disparate net incomes.

The Advantages of EBITDA

Although there is no silver bullet metric in financial statement analysis, nevertheless there are numerous benefits to using EBITDA. Here are a few:

- Operational Comparability: As implied above, EBITDA allows comparability across a wide swath of companies. Accounting standards provide leniency in the application of financial statements, therefore using EBITDA allows apples-to-apples comparisons and relieves accounting discrepancies on items such as depreciation, tax rates, and financing choice.

- Cash Flow Proxy: Since the income statement traditionally is the financial statement of choice, EBITDA can be easily derived from this statement and provides a simple proxy for cash generation in the absence of other data.

- Debt Coverage Ratios: In many lender contracts certain debt provisions require specific levels of income cushion above the required interest expense payments. Evaluating EBITDA coverage ratios across companies assists analysts in determining which businesses are more likely to default on their debt obligations.

The Disadvantages of EBITDA

While EBITDA offers some benefits in comparing a broader set of companies across industries, the metric also carries some drawbacks.

- Overstates Income: To Charlie Munger’s point about the B.S. factor, EBITDA distorts reality. From an equity holder’s standpoint, in most instances, investors are most concerned about the level of income and cash flow available AFTER all expenses, including interest expense, depreciation expense, and income tax expense.

- Neglects Working Capital Requirements: EBITDA may actually be a decent proxy for cash flows for many companies, however this profit measure does not account for the working capital needs of a business. For example, companies reporting high EBITDA figures may actually have dramatically lower cash flows once working capital requirements (i.e., inventories, receivables, payables) are tabulated.

- Poor for Valuation: Investment bankers push for more generous EBITDA valuation multiples because it serves the bankers’ and clients’ best interests. However, the fact of the matter is that companies with debt or aggressive depreciation schedules do deserve lower valuations compared to debt-free counterparts (assuming all else equal).

Wading through the treacherous waters of accounting metrics can be a dangerous game. Despite some of EBITDA’s comparability benefits, and as much as bankers and analysts would like to use this very forgiving income metric, beware of EBITDA’s shortcomings. Although most analysts are looking for the one-size-fits-all number, the reality of the situation is a variety of methods need to be used to gain a more accurate financial picture of a company. If EBITDA is the only calculation driving your analysis, I urge you to follow Charlie Munger’s advice and plug your nose.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Measuring the Market with Valuation Dipstick

Investor opinions about the stock market’s value are all over the map.

Doomsayers think the market is valued at crazy levels, and believe that “buy-and-hold” investing is dead. Bears remind investors that stocks have led to nothing good except for a lost decade of performance (read article on Lost Decade). Many speculators on the other hand believe they have the ability to “time the markets” to take advantage of volatility in any market (see also Market Timing article). In trader land, overconfidence is never in short-supply. Certainly, if you are a trader at Goldman Sachs (GS) or UBS and you are trading with privileged client data, then taking advantage of volatility can be an extremely lucrative endeavor. However most day-traders, and average investors, are not honored with the same information. Rather, the public gets overwhelmed by online brokerage firms and their plethora of software bells and whistles – inadequate protection when investing among a den of wolves. Equipping speculators with day trading tools is a little like giving a 7-year old a squirt gun and shipping them off to Afghanistan to fight the Taliban – the odds are not in the kid’s favor.

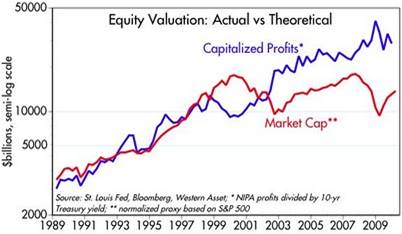

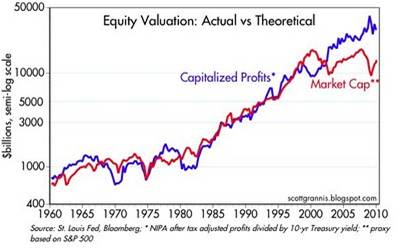

With so much uncertainty out in the marketplace, how do we know if the overall market is cheap or expensive? According to Scott Grannis, former Chief Economist at Western Asset Management and author of the Calafia Beach Pundit blog, the dipstick components necessary to measure the value of the market are corporate profits relative to the level of Gross Domestic Product (GDP) and the value (market cap) of the S&P 500 index. Grannis is a believer in the tenet that stock prices follow earnings, and as you can see from his charts below, earnings have grown much faster than stock prices over the last 10 years:

20 Year Chart

50 Year Chart

As you can see there is an extremely tight correlation on the 50-year chart until the last decade. What does the recent diverging trend mean? Here’s what Grannis has to say:

“Note that profits doubled from 1998 to 2009, yet the S&P 500 index today is still lower than it was at the end of 1998…equities continue to be extremely undervalued. Another way of looking at this is that the market is discounting current profits using an 8% 10-yr Treasury yield, or a 50% drop in corporate profits from here. Simply put, according to this model the market is priced to some very awful assumptions.”

How will this valuation gap be alleviated? Grannis correctly identifies two scenarios to achieve this end: 1) Rising treasury yields; and 2) Rising equity prices. His base case would be a move on the 10-year yield to 5.5%, and a move upwards in the S&P 500 index +50%.

Judging by Grannis’s dipstick measurement, there’s plenty of oil in the system to prevent the market engine from overheating just quite yet.

Read the Complete Scott Grannis Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in GS, UBS, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sidoxia Introduces “Fusion”

With the quote machines taking a temporary breather, what better time than now to talk about a new product creation from Sidoxia Capital Management – Fusion. For those readers following Investing Caffeine for some time, you likely have an informed understanding of Sidoxia Capital Management’s investment philosophy (www.Sidoxia.com). Well, now Sidoxia has formalized its investment product through the introduction of Fusion, a hybrid product integrating low-cost, tax-efficient investment vehicles and strategies, including individual stocks, individual bonds, equity ETFs (Exchange Traded Funds), and fixed income ETFs. Rather than being boxed into a simplistic life cycle fund, Fusion offers a customized investment vehicle that can meet investors’ wide ranging objectives and constraints. A key differentiating component of Fusion is its inclusion of some of the same stocks and securities employed in the Slome Sidoxia Fund (a hedge fund also managed by Sidoxia Capital Management for accredited investors). The aim of Fusion is to maximize the risk-adjusted returns in the context of a broadly diversified balanced portfolio (including international exposure).

Client Product Process

For those qualified investors, a one-on-one interview is conducted with each separate account investor to determine the objectives and constraints associated with the account. Subsequently, a customized Investment Policy Statement (IPS) is created for each client, effectively creating a blueprint for how the account will be managed. Depending on the risk-tolerance, time horizon, and objectives of the client, an equity allocation will be customized to meet the client’s needs. The balance of the portfolio will be invested in fixed-income, cash/liquid assets, and hybrid securities – including convertible bonds and alternative investments on a more limited basis. Individual security selection is derived from implementing fundamental and quantitative screening tools, leveraging the investment experience of the investment manager (Wade Slome), and the ranking of securities on a risk-adjusted valuation basis. Lower ranked securities are generally used as funding sources for purchases of higher ranked investment candidates.

Buy Discipline

A systematic, disciplined process is performed before the inclusion of any security is finalized into a portfolio. With respect to the selected equity securities, particular emphasis is placed on valuation metrics, including cash flows, earnings growth, dividend yields, price-earnings ratios, and other important fundamental statistics. In regards to equity related exchange traded funds (ETFs), some of the previously mentioned factors will be considered in addition to a top-down view of a funds underlying long-term growth potential. The buy discipline, established for the fixed income allocation of the portfolio, carefully considers dynamics such as yield, duration, maturity, income, inflation-protection, currency risk, and other factors. Compared to other competing domestic-centric products, Fusion has the ability and willingness to invest globally to explore attractive risk-reward investment opportunities abroad.

Portfolio Construction

Within the parameters of the various Fusion product versions (aggressive, conservative, and moderate), each portfolio is constructed with flexibility in meeting the unique objectives and constraints of each account – including any liquidity or income requirements indicated by the client. Every portfolio is constructed from the same menu of underlying investment options, thereby assuring relative consistency across accounts. Allocations across investment selections will vary based upon the Fusion product version selected.

Trading Strategies

Under normal economic circumstances, Fusion invests with a long-term time horizon of three to five years for its equity positions. As a result, factors such as transaction costs, impact costs, opportunity costs, bid-ask spreads, tax consequences, are considered before conducting trades. Regarding fixed income portfolios, the previously mentioned factors along with the underlying yield, duration, and fundamental factors will determine the holding period. Trading frequency may fluctuate, depending on financial market and client-specific circumstances, but generally speaking heightened volatility will lead to additional opportunistic portfolio activity.

Sell Discipline

The Fusion sell discipline is fairly straight forward. If a security reaches a designated price target, provides an inferior risk-adjusted return profile relative to other opportunities, or if the original investment rationale negatively changes, then the investment becomes a sell candidate. If Fusion discovers opportunities with superior investment characteristics, the sell candidates, in addition to cash, will be utilized to fund new purchases.

Product Fee Structure

The annual fee charged for portfolio management services is rendered on a percentage of assets under management basis. As a fee-only investment advisor, inherent incentives are built-in to preserve and grow client account values – a principle not practiced by many commissioned based brokers/advisors. Contact a Sidoxia Capital Management representative by phone (949-258-4322) or e-mail (info@Sidoxia.com) to learn more about Fusion’s fee structure and account minimum threshold.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.