Archive for November, 2009

Back to the Future: Mag Covers (Part III)

Congratulations to those who have graduated through my first two articles (Part I and Part II) regarding the use of media magazine covers as contrarian investment indicator tools. We’ve reviewed magazine’s horrendous ability of predicting market shifts during the 1970s and Tech Bubble of 2000, and now we will take a peek at the “Great Recession” of 2008 and 2009. If you have the stamina to complete this final article, your diploma and selfless glory will be waiting for you at the end.

This magazine cover series was not designed to be utilized as an exploitable investment strategy, but rather to increase awareness and raise skepticism surrounding investment content. Just because something is written or said by journalist or blogger does not mean it is a fact (although I fancy facts). In the field of investing, along with other behavioral disciplines, there are significant gray areas left open to interpretation. A more educated, critical eye exercised by the general public will perhaps release us from the repetitive boom-bust cycles we’ve become accustomed to. Perhaps my goal is naïve and idealistic, nonetheless I dare to dream.

The wounds from a year ago are still fresh, and we have not fully escaped from the problems that originally got us into this mess, but it is amazing what a 60%+ market move since March can do to the number of “Great Depression” references. Let’s walk down calamity memory lane over the last year:

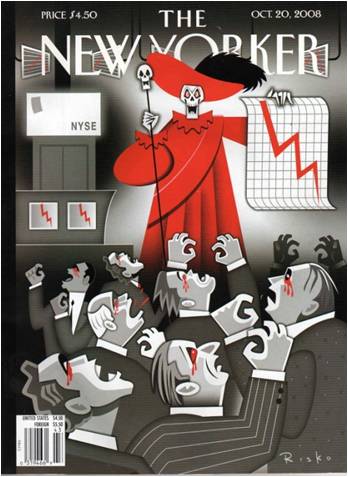

Great Depression Redux?

Months ago we were in the midst of a severe recession, and the media was not shy about jumping on the “pessimism porn” bandwagon for the sake of ratings. Like a Friday the 13th sequel (nice tie in!), CNBC just weeks ago was plugging the crisis anniversary of the Lehman Brothers failure. Time magazine’s portrayal of the financial crisis as the next Great Depression, including the soup kitchen lines, mass unemployment, and collapse of thousands of banks, was used like chum to feed the frenzy of shocked investing onlookers. Unemployment rates are still creeping up, albeit at a slower rate, but we are nowhere near the 25% levels seen in the Great Depression.

American Disintegration

One of my favorite articles (read here) of the global crisis was written by The Wall Street Journal late last year about a Russian Professor, Igor Panarin (also a former KGB analyst). I find it absurdly amusing that the WSJ would even give credence to this story, but perhaps now I can look forward to an Op-Ed in their newspaper from Iranian President Mahmoud Ahmadinejad or North Korean Leader Kim Jong Ill. Not only did Professor Panarin pronounce the complete evaporation of the United States, but he also provided a specific timeframe. In late June or early July 2010, he expects the U.S. to fall into civil war and subsequently get carved up into six pieces by particular foreign regions, including China, Mexico, E.U., Japan, Canada, and Russia (which will control Alaska of course). I guess Sarah Palin will not be a happy camper?

Other Crisis Souvenirs

Market Mayhem

Lessons Learned

Contrarianism for the sake of contrarianism is not necessarily a good thing. Trend can be your friend too. Bubbles take much longer to inflate than they burst, so it may be in your best interest to ride the wave of ecstasy for longer than the early alarm ringers. Take for example Alan Greenspan’s infamous irrational exuberance speech in 1996, when the NASDAQ index was trading around 1300. As we all know, the NASDAQ went on to pierce the 5000 mark, four years later. Sorry Al…right idea, but a tad early. Although he may have been correct directionally, his timing and degree were way off. Pundits like Nouriel Roubini and Peter Schiff are other examples of prognosticators who identified the financial crisis many years before the catastrophe actually hit. As I noted previously, trading based on magazine covers was not conceived as a legitimate investable strategy, but as I’ve shown they can be indicators of sentiment. And these sentiment indicators can be used as a valuable apparatus in your toolbox to prevent harmful decisions at the worst possible times.

Thanks for coming Back to the Future on this historical tour of cover stories. Now that you have graduated with honors, next time you are in line at the grocery store, feel free to flash your diploma to receive a discount on a magazine purchase.

Class dismissed.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Back to the Future: Mag Covers (Part II)

In my most recent article, I went Back to the Future to examine the role magazine covers play as a contrarian indicator in fear-driven markets like we experienced in the 1970s (see previous story). Investing is both an art and science. While measuring the scientific aspects of the market can be more straight-forward, the behavioral and emotional sides to investing are more subjective. Magazines act as sentiment sensors to gauge the fear and froth pulses of the general investing public. Since last time we explored fear, let’s check out some froth from the 1990s technology boom.

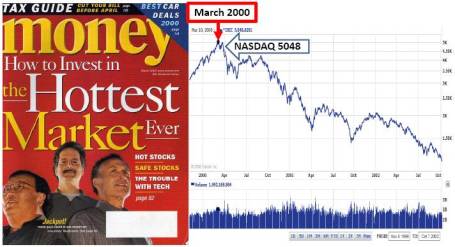

How to Invest in the Hottest Market Ever

Seeing the forest from the trees can be difficult when you’re trapped in the thick of it, but the March 2000 issue of Money magazine’s “How to Invest in the Hottest Market Ever” is a classic example of the mentality that reigned supreme in the late 1990s technology bubble. Objective, fact-filled articles that challenge the status quo are not necessary to generate sales, but articles and magazine covers that pander to the raw emotions of fear and greed keep the cash register ringing. If you don’t believe me, just read the sensational headlines at your local grocery store explaining how swine flu will kill us all and how there are millions to be made in melting gold coins and jewelry (read gold article).

I love some of the quotes from the article, especially from Pam, the 51 year old divorced New York City art museum volunteer who bought AOL, Microsoft, and Qualcomm (which rose +2,621% in 1999) who dismisses diversification: “I feel pretty safe now. I think we are in a new paradigm now.” Yeah, a “new economy” that catapulted Yahoo to a Price/Earnings ratio of 400x’s earnings; Cisco 109x’s earnings; and Sun Microsystems practically a bargain basement steal at 88x’s earnings. For reference purposes, the S&P 500 index currently trades for about 14.6x’s estimated 2010 earnings and 19.5x on 2009 estimates.

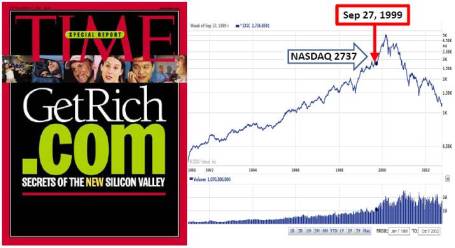

GetRich.com

Another landmark masterpiece I love is the September 1999 Time cover, “GetRich.com.” Never mind the unabated technology boom (excluding a brief hiccup in 1998) that inflated the bubble for a decade – Time still managed to unearth the “Secrets of the New Silicon Valley.” The article goes onto to express the get-rich formula:

“Can’t program a computer? Not a techno savvy? Not a problem. If you’ve got a hot Internet business idea, Silicon Valley’s astonishing start-up machine will do the rest.”

Like a drug dealer pushing heroin on an addict, the article goes on to entice its readers to question “Why have a boss when you and three buddies can build your own publicly traded company in two years? Windows this big don’t open very often.”

A Few More Favorites

As we saw during the technology boom, media outlets have no shame in shoveling greed inducing slop to the hungry general public. Like all historical events that end tragically, valuable lessons can be learned from our mistakes. Developing a discerning palette for the news we digest is a critical quality to generating an informed investment decision process. With the 1970s and 1990s behind us, as the last of my three part series, we’ll use time travel to another period to see if modern magazine editors fare any better in market timing as compared to their predecessors. Please excuse me while I jump in my time machine.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) or its clients has a long position in CSCO and QCOM at the time this article was originally posted. SCM owns certain exchange traded funds, but currently has no direct position in YHOO, MSFT, or JAVA. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Back to the Future: Mag Covers (Part I)

Magazine Covers Part II – – – Magazine Covers Part III

I’m not referring to the movie, Back to the Future, about a plutonium-powered DeLorean time machine that finds Marty McFly (played by Michael J. Fox) traveling back in time. Rather, I am shining the light on the uncanny ability of media outlets (specifically magazines) to mark key turning points in financial markets – both market bottoms and market tops. This will be the first in a three part series, providing a few examples of how magazines have captured critical periods of maximum fear (buying opportunities) and greed (selling signals).

People tend to have short memories, especially when it comes to the emotional rollercoaster ride we call the stock market. Thanks to globalization, the internet, and the 24/7 news cycle, we are bombarded with some fear factor to worry about every day. Although I might forget what I had for breakfast, I have been a student of financial market history and have experienced enough cycles to realize as Mark Twain famously stated, “History never repeats itself, but it often rhymes” (read previous market history article). In that vein, let us take a look at a few covers from the 1970s:

Newsweek’s “The Big Bad Bear” issue came out on September 9, 1974 when the collapse of the so-called “Nifty Fifty” (the concentrated set of glamour stocks or “Blue Chips”) was in full swing. This group of stocks, like Avon, McDonalds, Polaroid, Xerox, IBM and Disney, were considered “one-decision” stocks investors could buy and hold forever. Unfortunately, numerous of these hefty priced stocks (many above a 50 P/E) came crashing down about 90% during the1973-74 period.

Why the glum sentiment? Here are a few reasons:

- Exiting Vietnam War

- Undergoing a Recession

- 9% Unemployment

- Arab Oil Embargo

- Watergate: Presidential Resignation

- Franklin National Failure

Not a rosy backdrop, but was this scary and horrific phase the ideal time to sell, as the magazine cover may imply? No, actually this was a shockingly excellent time to purchase equities. The Dow Jones Industrial Average, priced at 627 when the magazine was released, is now trading around 10,247…not too shabby a return considering the situation looked pretty darn bleak at the time.

Reports of the Market’s Death Greatly Exaggerated

Sticking with the Mark Twain theme, the reports of the market’s demise was greatly exaggerated too – much the same way we experienced the overstated reaction to the financial crisis early in 2009. BusinessWeek’s August 13, 1979 magazine captured the essence of the bearish mood in the article titled, “The Death of Equities.” This article came out, of course, about 18 months before a multi-decade upward explosion in prices that ended in the “Dot-com” crash of 2000. In the late 1970s, inflation reached double digit levels; gold and oil had more than doubled in price; Paul Volcker became the Federal Reserve Chairman and put on the economic brakes via a tough, anti-inflationary interest rate program; and President Jimmy Carter was dealing with an Iranian Revolution that led to the capture of 63 U.S. hostages. Like other bear market crashes in our history, this period also served as a tremendous time to buy stocks. As you can see from the chart above, the Dow was at 833 at the time of the magazine printing – in the year 2000, the Dow peaked at over 14,000.

The walk down memory lane is not over yet. Conveniently, the Back to the Future story was designed as a trilogy (just like my three-part magazine review), so stay tuned for “Part II” – coming soon to your future.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) has a short position in MCD at the time this article was originally posted. SCM owns certain exchange traded funds, but currently has no direct position in Avon (AVP), Polaroid, Xerox (XRX), IBM or Disney (DIS). No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

One Size Does Not Fit All

When you go shopping for a pair of shoes or clothing what is the first thing you do? Do you put on a blindfold and feel for the right size? Probably not. Most people either get measured for their personal size or try on several different outfits or shoes. When it comes to investments, the average investor makes uninformed decisions and in many instances relies more on what other advisors recommend. Sometimes this advice is not in the best interest of the client. For example, some broker recommendations are designed to line their personal pockets with fees and/or commissions. In some cases the broker may try to unload unpopular product inventory that does not match the objectives and constraints of the client. Because of the structure of the industry, there can be some inherent conflicts of interest. As the famous adage goes, “You don’t ask a barber if you need a haircut.”

Tabulate Inventory

A more appropriate way of managing your investment portfolio is to first create a balance sheet (itemizing all your major assets and liabilities) individually or with the assistance of an advisor (see “What to Do” article) – I recommend a fee-only Registered Investment Advisor (RIA)* who has a fiduciary duty towards the client (i.e., legally obligated to work for the best interest of the client). Some of the other major factors to consider are your short-term and long-term income needs (liquidity important as well) and your risk tolerance.

Risk Appetites

The risk issue is especially thorny because the average investor appetite for risk changes over time. Typically there is also a significant difference between perceived risk and actual risk.

For many investors in the late 1990s, technology stocks seemed like a low risk investment and everyone from cab drivers to retired teachers wanted into the game at the exact worst (riskiest) time. Now, as we have just suffered through the so-called Great Recession, the risk pendulum has swung back in the opposite direction and many investors have piled into what historically has been perceived as low-risk investments (e.g., Treasuries, corporate bonds, CDs, and money market accounts). The problem with these apparently safe bets is that some of these securities have higher duration characteristics (higher price volatility due to interest rate changes) and other fixed income assets have higher long-term inflation risk.

Source (6/30/09): Morningstar Encorr Analyzer (Ibbotson Associates) via State Street SPDR Presentation

A more objective way of looking at risk is by looking at the historical risk as measured by the standard deviation (volatility) of different asset classes over several time periods. Many investors forget risk measurements like standard deviation, duration, and beta are not static metrics and actually change over time.

Diversification Across Asset Classes Key

Correlation, which measures the price relationship between different asset classes, increased dramatically across asset classes in 2008, as the global recession intensified. However, over longer periods of time important diversification benefits can be achieved with a proper mixture of risky and risk-free assets, as measured by the Efficient Frontier (above). Conceptually, an investor’s main goal should be to find an optimal portfolio on the edge of the frontier that coincides with their risk tolerance.

Tailor Portfolio to Changing Circumstances

In my practice, I continually run across clients or prospects that initially find themselves at the extreme ends of the risk spectrum. For example, I was confronted by an 80 year old retiree needing adequate income for living expenses, but improperly forced by their broker into 100% equities. On the flip side, I ran into a 40 year old who decided to allocate 100% of their retirement assets to fixed income securities because they are unsure of stocks. Both examples are inefficient in achieving their different investment objectives, yet there are even larger masses of the population suffering from similar issues.

In my practice, I continually run across clients or prospects that initially find themselves at the extreme ends of the risk spectrum. For example, I was confronted by an 80 year old retiree needing adequate income for living expenses, but improperly forced by their broker into 100% equities. On the flip side, I ran into a 40 year old who decided to allocate 100% of their retirement assets to fixed income securities because they are unsure of stocks. Both examples are inefficient in achieving their different investment objectives, yet there are even larger masses of the population suffering from similar issues.

Financial markets and client circumstances are constantly changing, so the objectives of the portfolio should be periodically revisited. One size does not fit all, so it’s important to construct the most efficient customized portfolio of assets that meets the objectives and constraints of the investor. Take it from me, I’m constantly re-tailoring my wardrobe (like my investments) to meet the needs of my ever-changing waistline.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: For disclosure purposes, Sidoxia Capital Management, LLC is a Registered Investment Advisor (RIA) certified in the State of California. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Ross Warns of Commercial Shoe Drop

The next shoe to drop in commercial real estate has been highly telegraphed for some time now. Wilbur Ross, restructuring specialist and founder of WL Ross & Co, has a long track record of success and he weighs in with his views regarding the impending crash in commercial real estate through several recent interviews.

What exactly is Mr. Ross worried about? He sees a correlation of what happened in the residential mortgage markets to what we are now beginning to see in the commercial real estate markets:

Click Hear to See CNBC Interview with Wilbur Ross

“I have felt for quite some time that the same reckless lending that characterized the subprime mortgage business in residential was also characterizing what had gone on in commercial real estate in the mid-2000s. You had properties being bought at a 3% cash-on-cash yield. You had properties being financed at on such an aggressive basis that the lenders had to give them an advance – several years worth of interest – because there wasn’t enough cash coming from the properties even to pay the interest. And the theory was that rent rolls would go up, occupancy would go up, and eventually the property would grow its way into paying interest. Well now that clock is ticking – rents haven’t gone up, they’ve gone down; occupancy hasn’t gone up, it has gone down; and capitalization rates that people require from properties have gone up. So everything is going in the wrong direction, and I think we are going to see quite a lot of tragedies in that sector. “

Although Mr. Ross unequivocally sees a “huge crash in commercial real estate,” he puts his pessimistic views on impending destruction into perspective (read more about pessimism). The size of the commercial real estate market is quite a bit smaller than residential:

“The total of commercial mortgages is only about $3.5 trillion versus $11 trillion for residential mortgages.”

The commercial crash is already happening and forecasts for commercial property are expected to drop to the lowest levels in nearly two decades, according to according to property research firm Real Capital Analytics Inc. The sign of the times is evident by the recent Chapter 11 bankruptcy filing by Capmark Financial Group Inc., a company that originated about $60 billion in commercial real estate loans in 2006 and 2007 (Bloomberg). Anecdotally, at a professional event I just attended in southern California, I bumped into a real estate broker who informed me on the state of the market. The property across the street from the event location had a 50% vacancy rate and a glut of hedge funds were bidding on the building for 50% of its replacement value…ouch!

Reis Inc., a property research firm also notes:

“U.S. office vacancies hit a five-year high of almost 17 percent in the third quarter, while shopping center vacancies climbed to their highest since 1992.”

And from a fiscal response and taxpayer liability standpoint Ross is less worried because he thinks Washington, for the most part, will be watching the train wreck from the sidelines, with a bag of popcorn in hand:

“I don’t think the federal government’s going to do much to help the commercial building side because individual homeowners vote but buildings don’t vote.”

As Wilbur Ross has definitively communicated, he’s confident the commercial real estate mortgage market will cause the next surprising shoe to drop. Fortunately though, he feels the crash will be manageable. With all these shoes dropping, maybe I can find a new pair of shoes to wear?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Too Big to Sink

If I got paid a nickel for every time I heard the phrase “too big to fail” to describe the state of affairs of our major financial institutions, I’d be retired on my private island by now. Jeremy Grantham, famed value investor and Chairman of Grantham Mayo Van Otterloo, recently compared the redesigning of our financial system to the Titanic and aptly described the hubris surrounding the ship’s voyage as “too big to sink!”

Mr. Grantham argues that many of the financial institution reform proposals have an irrelevant, misguided focus on improving the safety of the Titanic’s lifeboats rather than the structural design or competence of the captain. Maybe it’s better to plan for disaster prevention rather than disaster preparation? Grantham adds:

“By working to mitigate the pain of the next catastrophe, we allow ourselves to downplay the real causes of the disaster and thereby invite another one.”

When analyzing system failures, incentives are important to understand too. For example, the ship was “under-designed” and the captain had an ill-advised reward baked into a compensation bonus, if he beat the speed record (see article on compensation).

The Solution

Rather than protecting the bankers’ interests, Grantham contends we need “smaller, simpler banks that are not too big to fail.” At the heart of these massive financial conglomerates, pruning is necessary to separate the risky, proprietary trading departments, thereby ridding an “egregious conflict of interest with their clients.” As a former fund manager for a $20 billion fund, I was acutely aware of how my fund trading information and my conversations were being tracked by investment bankers and traders for themselves and their clients’ benefit. When the banks are managing your money alongside their own money, greed has a way of creeping in.

Beyond the prop trading desk legislation, Grantham believes those financial institutions “too big to fail” should be cut down into smaller pieces that can actually fail. Many of these entities are already what I like to call, “too complex to succeed,” evidenced by the stupefied responses provided by Congressmen and the CEOs of the banking institutions during the aftermath of the crisis. Reintroduction of some form of Glass-Steagall legislation (separation of investment banks from commercial banks) is another recommendation made by Grantham.

These suggestions sound pretty reasonable to me, but the bankers scream “If we become smaller and simpler and more regulated, the world will end and all serious banking will go to London, Switzerland, Bali Hai, or wherever,” Grantham adds in a mocking voice. If the foreigners want to operate irresponsibly, then Grantham says let them suffer the negative consequences every 15 years, or so.

The political will of legislators will be tested if substantive financial reforms actually come to pass. Jeremy Grantham understands the extreme importance of reform as explained concisely here, “A simpler, more manageable financial system is much more than a luxury. Without it we shall surely fail again.” Fail that is…like a sinking Titanic.

Read Jeremy Grantham’s Full Quarterly Newsletter

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Drought in Higher Rates May Be Over

The drought in higher interest rates may be nearing an end? Ever since the global financial crisis accelerated into full force in the fall of 2008, there were a constant flow of coordinated interest rate cuts triggered around the world with the aim of stimulating global GDP (Gross Domestic Product) and improving credit flow through the clogged financial pipes. Central banks across the world cut key benchmark interest rate levels and the impact of these reductions has a direct influence on what consumers pay for their financial products and services. More recently, we have begun to see the reversal of previous cuts with rate hikes witnessed in several international markets. Last week we saw Norway become the first western European country to raise rates, following an earlier October rate lift by Australia and another by Israel in August. For some countries, the sentiment has switched from global collapse fears to a stabilization posture coupled with future inflation concerns. In the U.S., the data has been more mixed (read article here) and the Federal Reserve has been clear on its intention to keep short-term rates at abnormally low levels for an extended period of time. That stance would likely change with evidence of inflationary pressures or improved job market conditions.

What Does This Mean for Consumers?

Prior to the financial crisis, credit availability flourished at affordably low rates. Now, with signs of a potential global recovery matched with regulatory overhauls, consumers may be impacted in several financial areas:

1) Credit Card Rates: Beyond regulatory changes in Washington (read more), the interest rate charged on unpaid credit card balances may be on the rise. When the Federal Reserve inevitably raises the targeted Federal Funds Rate (the interest rate for loans made between banks) from the current target rate range of 0.00% and 0.25%, this action will likely have direct upward pressure on consumer credit card rates. The associated increase in key benchmark rates such as the Prime Rate (the rate charged to a bank’s most creditworthy customers) and LIBOR (London Interbank Offer Rate) would result in higher monthly interest payments for consumers.

2) Other Consumer Loans: Many of the same forces impacting credit card rates will also impact other consumer loans, like home mortgages and auto loans. Pull out your loan documents – if you have floating or variable rate loans then you may be exposed to future hikes in interest rates.

3) Business Loans / Lines of Credit: Business owners -not just consumers – can also be impacted by rising rates. When the cost of funding goes up (.i.e., interest rates), the banks look to pass on those higher costs to the customer so the account profitability can be maintained.

4) Dollar & Import Prices: To the extent subsequent United States rate hikes lag other countries around the world, our dollar runs the risk of depreciating more in value (currency investors, all else equal, prefer currencies earning higher interest rates). A weaker dollar translates into foreign goods and services costing more. If international central banks continue to raise rates faster than the U.S., then imported good inflation could become a larger reality.

5) Hit to Bond Prices: Higher interest rates can also result in a negative hit to your bond portfolio. Higher duration bonds, those typically with longer maturities and lower relative coupon payments, are the most vulnerable to a rise in interest rates. Consider shortening the duration of your portfolio and even contemplate floating rate bonds.

Interest rates are the cost for borrowed money and even with the recent increase in consumers’ savings rate, consumers generally are still saddled with a lot of debt. Do yourself a favor and review any of your credit card agreements, loan documents, and bond portfolio so you will be prepared for any future interest rate increases. Shopping around for better rates and/or consolidating high interest rate debt into cheaper alternatives are good strategies as we face the inevitable end in the drought of higher global interest rates.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Style Drift: Hail Mary Investing

The mutual fund investing game is extraordinarily competitive. According to The Financial Times, there were 69,032 global mutual funds at the end of 2008. With the extreme competitiveness comes lucrative compensation structures if you can win (outperform) – I should know since I was a fund manager for many years. However, the compensation incentive structures can create style drift and conflicts of interest. You can think of style drift as the risky “Hail Mary” pass in football – you are a hero if the play (style drift) works, but a goat if it fails. When managers typically drift from the investment fund objective and investment strategy, typically they do not get fired if they outperform, but the manager is in hot water if drifting results in underperformance. Occasionally a fund can be a victim of its own success. A successful small-cap fund can have positions that appreciate so much the fund eventually becomes defined as a mid-cap fund – nice problem to have.

Drifting Issues

Why would a fund drift? Take for example the outperformance of the growth strategy in 2009 versus the value strategy. The Russell 1000 Growth index rose about +28% through October 23rd (excluding dividends) relative to the Russell 1000 Value index which increased +14%. The same goes with the emerging markets with some markets like Brazil and Russia having climbed over +100% this year. Because of the wide divergence in performance, value managers and domestic equity managers could be incented to drift into these outperforming areas. In some instances, managers can possibly earn multiples of their salary as bonuses, if they outperform their peers and benchmarks.

The non-compliance aspect to stated strategies is most damaging for institutional clients (you can think of pensions, endowments, 401ks, etc.). Investment industry consultants specifically hire fund managers to stay within the boundaries of a style box. This way, not only can consultants judge the performance of multitudes of managers on an apples-to-apples basis, but this structure also allows the client or plan participant to make confident asset allocation decisions without fears of combining overlapping strategies.

For most individual investors however, a properly diversified asset allocation across various styles, geographies, sizes, and asset classes is not a top priority (even though it should be). Rather, absolute performance is the number one focus and Morningstar ratings drive a lot of the decision making process.

What is Growth and Value?

Unfortunately the style drift game is very subjective. Growth and value can be viewed as two sides of the same coin, whereby value investing can simply be viewed as purchasing growth for a discount. Or as Warren Buffet says, “Growth and value investing are joined at the hip.” The distinction becomes even tougher because stocks will often cycle in and out of style labels (value and growth). During periods of outperformance a stock may get categorized as growth, whereas in periods of underperformance the stock may change its stripes to value. Unfortunately, there are multiple third party data source providers that define these factors differently. The subjective nature of these style categorizations also can provide cover to managers, depending on how specific the investment strategy is laid out in the prospectus.

What Investors Can Do?

1) Read Prospectus: Read the fund objective and investment strategy in the prospectus obtained via mailed hardcopy or digital version on the website.

2) Review Fund Holdings: Compare the objective and strategy with the fund holdings. Not only look at the style profile, but also evaluate size, geography, asset classes and industry concentrations. Morningstar.com can be a great tool for you to conduct your fund research.

3) Determine Benchmark: Find the appropriate benchmark for the fund and compare fund performance to the index. If the fund is consistently underperforming (outperforming) on days the benchmark is outperforming (underperforming), then this dynamic could be indicating a performance yellow flag.

4) Rebalance: By periodically reviewing your fund exposures and potential style drift, rebalancing can bring your asset allocation back into equilibrium.

5) Seek Advice: If you are still confused, call the fund company or contact a financial advisor to clarify whether style drift is occurring in your fund(s) (read article on finding advisor).

Style drift can potentially create big problems in your portfolio. Misaligned incentives and conflicts of interest may lead to unwanted and hidden risk factors in your portfolio. Do yourself a favor and make sure the quarterback of your funds is not throwing “Hail Mary” passes – you deserve a higher probability of success in your investments.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Wade W. Slome, CFA, CFP is a contributing writer for Morningstar.com. Please read disclosure language on IC “Contact” page.

Meat & Potatoes Investing with Joel Greenblatt

Joel Greenblatt has a long resume. Besides being the founder and managing partner of Gotham Capital, Mr. Greenblatt is the author of The Little Book That Beats the Market and an adjunct Professor at Columbia Business School. Now he is adding “Quant-fund Manager” to his work history. In his recent CNBC interview (below), Greenblatt discusses the real-world portfolio implementation of his “Magic Formula” on www.FormulaInvesting.com, a new venture he has undertaken.

The Magic Formula as it turns out is not all that magical, but rather very simple. The formula is based on two straightforward meat and potato factors gathered from Standard & Poor’s data: 1) the trailing Price/Earnings ratio on a stock (value factor); and 2) the Return on Capital ratio of a stock using historical earnings. The portfolio management strategy is fairly basic as well. Twenty to thirty securities are selected from the model, with the ability of the investor to customize if they so choose, and the portfolios are rebalanced on an annual basis making sure any relevant tax-loss selling occurs before the end of the calendar year.

Based on the back-tests, the model portfolio was up +291% over the last 10 years versus down -2% for the S&P 500 index. For 2008, however, the performance of the Magic Formula was not too enchanting – down about -36% versus -37% for the S&P 500 index, according to Greenblatt.

As with any back-test, or model, I am very skeptical about the output and inferences that can be drawn. Here are a few reasons why:

1) Past ≠Future: Just because this strategy worked in the past doesn’t mean it will work in the future. Greenblatt admits that the strategy can underperform for long periods of time.

2) Limited Data: Ten years is an extremely limited period of time to base a robust strategy on – much more data should be used.

3) Cost Estimates: Following a potentially very illiquid, out of favor value strategy with possibly large sums of money can cause past results to look quite different. Factors such as trading costs and impact costs can be underappreciated in computer based back-tests.

4) Data Mining: With any model, problems can arise when reams of data are sliced and diced for the sole purpose of creating a positive outcome. Often, there are no cause and effect between a variable and future returns, yet practitioners will jump to that conclusion because the factors fit the data.

To learn more about shortcomings in quantitative models, I suggest you learn more about butter production in Bangladesh (read article here). I will eagerly watch how Mr. Greenblatt’s “Magic Formula” works from a distance. In the mean time, I’m hungry. I think I’ll keep it simple…a steak and baked potato.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.