Posts filed under ‘Profiles’

Quickly Out of the Gate

The race into 2024 has begun, and the U.S. market is off to a quick start. The S&P 500 jumped out of the gates by +1.6%, and the technology and AI (Artificial Intelligence) – heavy NASDAQ index raced out by +1.2%. The bull market rally broadened out at the end of 2023, but 2024 returned to the leaders of last year’s pack, the Magnificent 7 (see also Mission Accomplished). Out front, in the lead of the Mag 7, is Nvidia with a +24% gain in January.

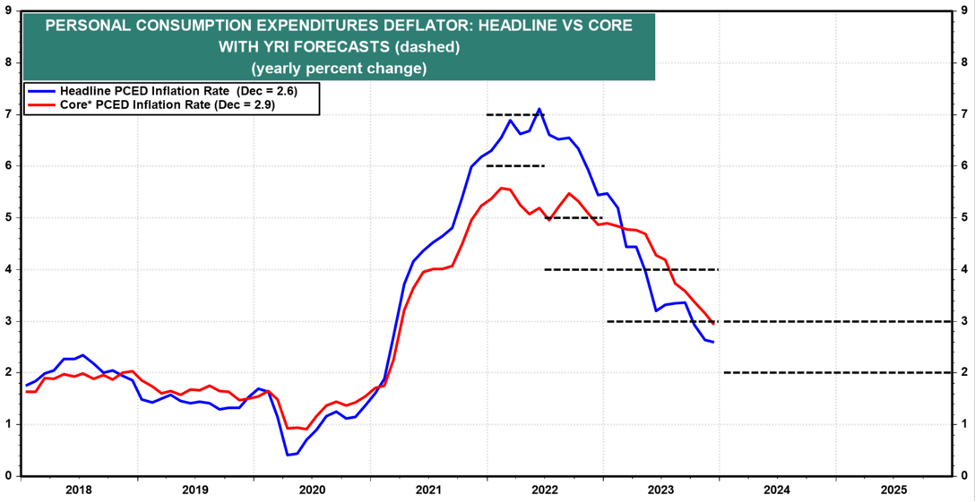

Inflation dropping (see chart below), the Federal Reserve signaling a decline in interest rates, low unemployment (3.7%), and healthy economic growth (+3.3% Q4 – GDP) have all contributed to the continuing bull market run.

Source: Yardeni.com

Consumer spending is the number one driver of economic growth, and consumers remain relatively confident about future prospects as seen in the recently released Conference Board Consumer Confidence numbers released this week (see chart below).

Source: Conference Board

But the race isn’t over yet, and there are always plenty of issues to worry about. The world is an uncertain place. Here are some of the concerns du jour:

– Red Sea conflict led by the Yemen-based, rebel group, Houthis

– Gaza war between Israel and Hamas

– Anxiety over November presidential election

– Ukraine – Russia war

Money Goes Where It is Treated Best

There are plenty of domestic concerns regarding government debt, deficit levels, and political frustrations on both sides of the partisan aisle remain elevated. When it comes to the financial markets, money continues to go where it is treated best. Sure, we have no shortage of problems or challenges, but where else are you going to put your life savings? China? Europe? Russia? Japan?

Well, as you can see in the chart below, anti-democratic, anti-American business, and confrontational military policies instituted by China have not benefitted investors – the U.S. stock market (S&P 500) has trounced the Chinese stock market (MSCI) over the last 30 years.

Source: Calafia Beach Pundit

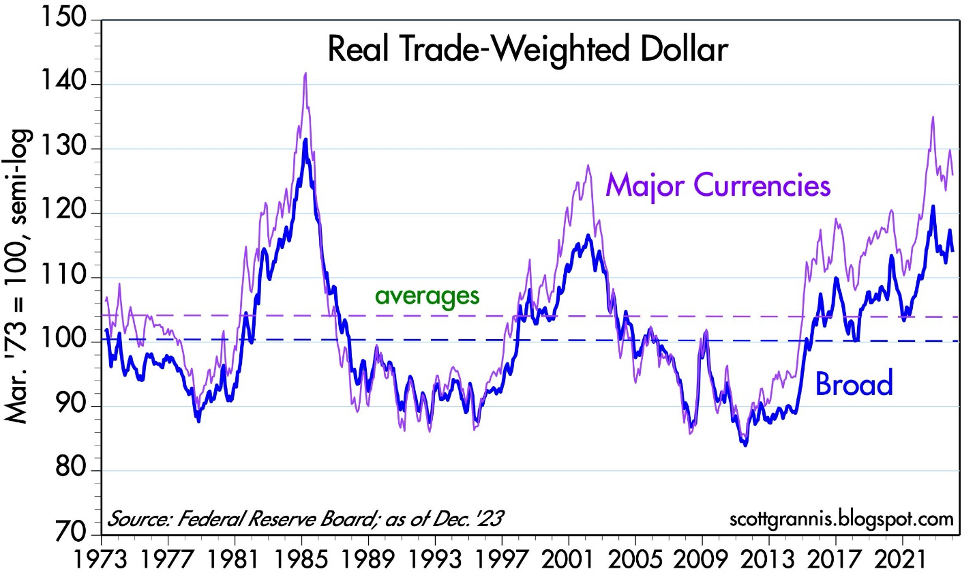

For years, market critics and pessimists have been screaming doom-and-gloom as it relates to the United States. The story goes, the U.S. is falling apart, government spending and debt levels are out of control, politicians are corrupt, and we’re going into recession, thanks in part to higher interest rates and inflation. Well, if that’s the case, then why has the value of the U.S. dollar increased over the last 10 years (see chart below)? And why is the stock market at all-time record-highs?

Source: Calafia Beach Pundit

Global investors are discerning in which countries they invest their hard-earned money. Global capital will flow to those countries with a rule of law, financial transparency, prudent tax policy, lower inflation, higher profit growth, lower interest rates, sensible fiscal and monetary policies, among other pragmatic business practices. There’s a reason they call it the “American Dream” and not the “Chinese Dream.” Our capitalist economy is far from perfect, but finding another country with a better overall investing environment is nearly impossible. There’s a reason why venture capitalists, private equity managers, sovereign wealth funds, hedge funds, and foreign institutions are investing trillions of their dollars in the United States. Money goes where it is treated best!

As money sloshes around the world, the 2024 investing race has a long way before it’s over, but at least the stock market has quickly gotten out of the gate and built a small lead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia Webinar: The Keys to ’23 & What’s in Store for ’24 – Market Update

Unlock valuable insights at our upcoming webinar:

The Keys to ’23 & What’s in Store for ’24!

Tuesday, January 30th at 12:00 PM

Click the Zoom link below to register:

https://sidoxia.link/Webinar-Registration

Don’t miss out on the latest trends and expert discussions.

We will delve into a comprehensive market update. Register now!

The Douglas Coleman Show Interviews Wade Slome

Wade Slome, President and Founder of Sidoxia Capital Management, recently had the pleasure of being featured on The Douglas Coleman Show hosted by Douglas Coleman.

Drawing from professional and personal life lessons, Wade shares his knowledge about navigating market trends, building investment strategies, and also discuss the books he has authored.

If you are interested in learning more about the books Wade has authored, please visit: https://www.sidoxia.com/wades-books

This Baby Bull Has Time to Grow

You may have witnessed some fireworks on New Year’s Eve, but those weren’t the only fireworks exploding. The last two months of 2023 finished with a bang! More specifically, over this short period, the S&P 500 index skyrocketed +13.7%, NASDAQ +16.8%, and the Dow Jones Industrial Average +14.0%. The gains have been even more impressive for the cheaper, more interest-rate-sensitive small-cap stocks (IJR +21.8%), which I have highlighted for months (see also AI Revolution).

For the full year, the bull market was on an even bigger stampede: S&P 500 +24%, NASDAQ +43%, and Dow +14%.

Although 2023 closed with a festive explosion, 2022 ended with a bearish growl. Effectively, 2023 was a reverse mirror image of 2022. In 2022, the stock market fell -19% (S&P) due to a spike in inflation. Directionally, interest rates followed inflation higher as the Fed worked through the majority of its 0% to 5.5% Federal Funds rate hiking cycle.

To sum it up simply, the last two years have been like riding a rollercoaster. For the year just ended, much of the year felt like a party, but 2022 felt more like a funeral. When you add the two years together, it was more of a lackluster result. For 2022-2023 combined, results registered at a meager +0.1% for the S&P, +3.7% for the Dow, and -4.0% for the NASDAQ (see chart below).

For those saying the good times of 2023 cannot continue, investors should understand that history paints a different picture. As you can see from the stock market cycles chart (below) that spans back to 1962, the average bull market lasts 51 months (i.e., 4 years, 3 months), while the average bear market persists a little longer than 11 months. This data suggests the current one-year-old baby bull market has plenty of room to grow more.

Source: Visual Capitalist

Why So Bullish?

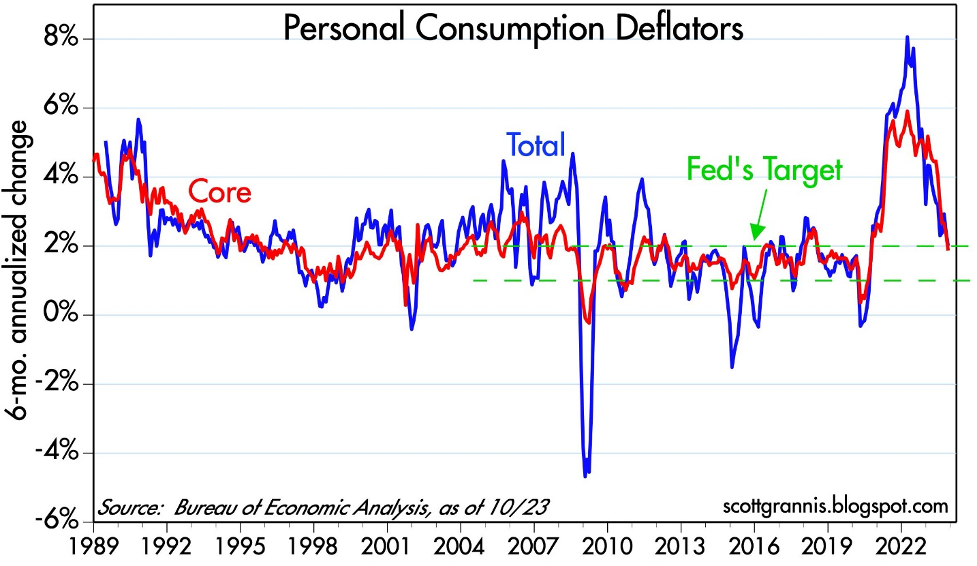

What has investors so jazzed up in recent months? For starters, inflation has been on a steady decline for many months. With China’s stagnating economy, it has helped our inflationary cause by exporting deflationary goods to our country. As you can see from the Personal Consumption Deflator chart below, this broad inflation measure has declined to the Federal Reserve’s 2% target level. Jerome Powell, the Federal Reserve Chairman has been paying attention to these statistics, as evidenced by the central bank’s forecast at the Fed’s recent policy meeting last month on December 13th for three interest rate cuts in 2024. This so-called “Powell Pivot” is a reversal in tone by the Fed, which had been on a relentless rampage of interest rate hikes, over the last two years.

Source: Calafia Beach Pundit

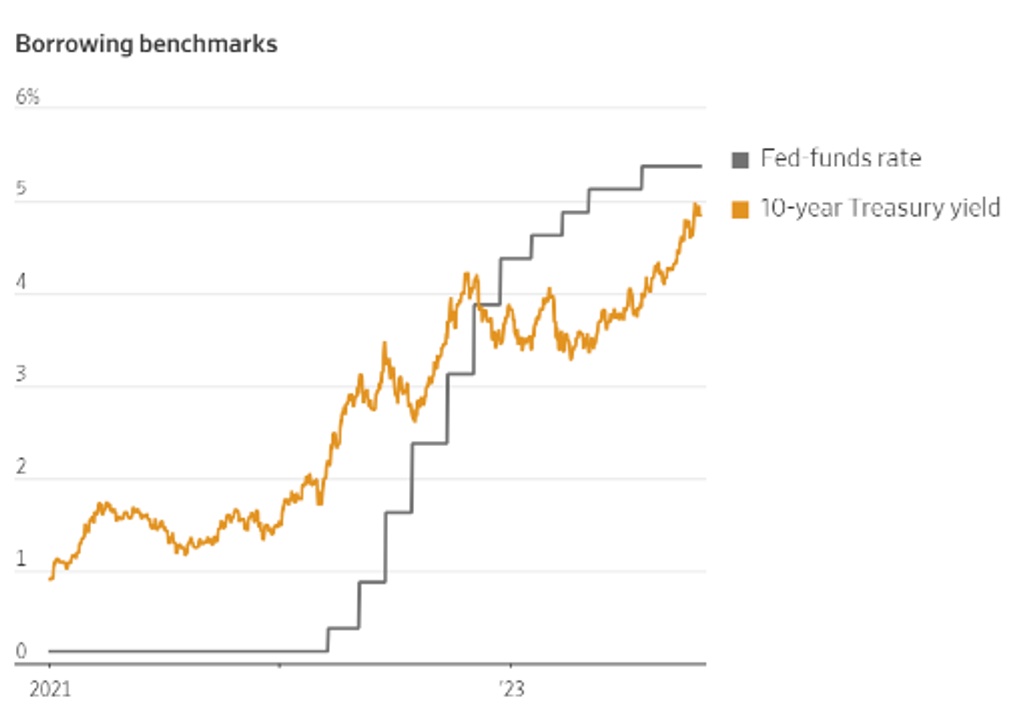

This interest rate cycle headwind has turned into a tailwind as investors now begin to discount the probability of future rate cuts in 2024. The relief of lower interest rates can be felt immediately, whether you consider declining mortgage and car loan rates for consumers, or credit line and corporate loan rates for businesses. This trend can be seen in the benchmark 10-Year Treasury Note yield, which has declined from a peak of 5.0% a few months ago to 3.9% today (see chart below).

Source: Trading Economics

Declining inflation and interest rates explain a lot of investor optimism, but there are additional reasons to be sanguine. The economy remains strong, unemployment remains low, AI (Artificial Intelligence) applications are improving worker productivity, trillions of potential stock market dollars remain on the sidelines in money market accounts, and corporate profits have resumed rising near all-time record levels (see chart below).

Source: Yardeni.com

What could go wrong? There are always plenty of unforeseen issues that could slow or reverse our economic train. Geopolitical events in Russia or the Middle East are always difficult to predict, and we have a presidential election in 2024, which could always negatively impact sentiment. This new bull market had a great start in 2023, but in historical terms, it is only a baby. Time will tell if 2024 will make this baby cry, but whatever the market faces, declining inflation and interest rates should act as a pacifier.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Market Roar Due to War

The devastating damage to humanity from the Israeli-Hamas war that is in and around the Gaza strip should not be diminished or understated – innocent lives on both sides suffer in any conflict. However, the economic impact should not be overstated either. In other words, the hundreds of billions of dollars in financial stock market losses this month are not proportional to the Mideast economic losses incurred thus far.

To put the events in perspective, the population of Israel approximates 10 million people and the population located in the Gaza Strip is about two million people. There are more than eight billion people on the planet, so Israel/Gaza represents roughly 1/7 of 1% of the global population.

From an economic standpoint, the combined economic output of Israel/Gaza Strip accounts for around ½ of 1% of global GDP (see chart below – small slivers in the blue section).

And let’s not forget, economic activity is not dropping to zero. From an economic standpoint, the war’s financial impact is even smaller – a rounding error.

Source: Visual Capitalist

However, wars do not exist in a vacuum, and tensions in the Middle East have the potential of having a ripple effect. Whenever rumblings occur in the Mideast, one of the largest global sectors to be first impacted is the oil market. Approximately 20-30% of the world’s oil is trafficked through the Strait of Hormuz in the Persian Gulf, so it was not surprising to see a short-term spike in oil prices to almost $90 per barrel in early October after the Gaza invasion of Israel. By the end of the month, oil has settled back down to about $81 per barrel, almost precisely the same price right before the war started. On a year-over-year basis, oil prices are actually down approximately -5%, thereby providing minor relief to gas-powered car drivers.

If Iran, or Iran-backed militant group Hezbollah, throws their hat into the Israel-Hamas war ring, the U.S. and other Western allies may retaliate and escalate tensions in the region, which would unlikely be received well by the financial markets.

As a result of these domino effect fears in the region, the stock market took another leg down last month with the S&P 500 index declining -2.2%, the Dow Jones Industrial Average -1.4%, and the NASDAQ index fell the most, -2.8%. The world is a dangerous place, but we have seen this movie before – this is nothing new. We would all prefer world peace, but unfortunately, wars and skirmishes have gone on for centuries.

As Interest Rates Soar, Bonds Offer More

Source: Wall Street Journal

No, TINA is not the name of my high school girlfriend or wife, but rather the acronym TINA (There Is No Alternative) existed in recent years during the Federal Reserve’s zero-interest rate policy days. More specifically, TINA referred to the lack of investment alternatives to equities (i.e., stocks) when money effectively earned 0% in the bank and close-to-0% in many fixed income securities (i.e., bonds). In fact, at one point, although it is still hard to believe, there were more than $16 trillion in bonds paying negative interest rates – pure insanity.

TINA Turns into FIONA

Given the large increase in interest rates by the Federal Reserve over two years (from 0% to 5.50%), investors have been given a short-term gift. As you can see from the chart above, yields on 10-Year Treasury Notes have risen to almost 5.0%. And believe it or not, shorter term bonds are currently providing yields even higher than this. The three-month, six-month, one-year, and two-year Treasuries are all yielding higher rates than 10-Year Treasury yields (i.e., inverted yield curve) – see table below. So, TINA has changed to FIONA – Fixed Income Opens New Alternatives. What’s more, for individuals with taxable accounts, the interest earned on Treasuries is tax-free at the state level, thereby making this short-term gift in yields even more attractive for investors.

Source: Trading Economics

Stock prices were down again for the month, and investment sentiment has been souring due to the war in the Middle East, but there is still plenty of reasons to remain constructive. Not only is the economy strong (e.g., 3rd quarter GDP of +4.9%), but the consumer also remains strong (see Consumer Wallets Strong) in large part because the unemployment rate remains near record lows (+3.8%). While anxiety rises due to the war, stock prices get cheaper, and opportunities increase. And although interest rates remain elevated, the Federal Reserve is signaling they are closer to a rate hiking end, inflation is cooling and FIONA is offering more attractive yields than during the TINA era. It’s true, this month stocks did not roar due to the war, but patient and opportunistic investors will be rewarded with more.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Consumer Wallets Strong, Rate Hikes Long, What Could Go Wrong?

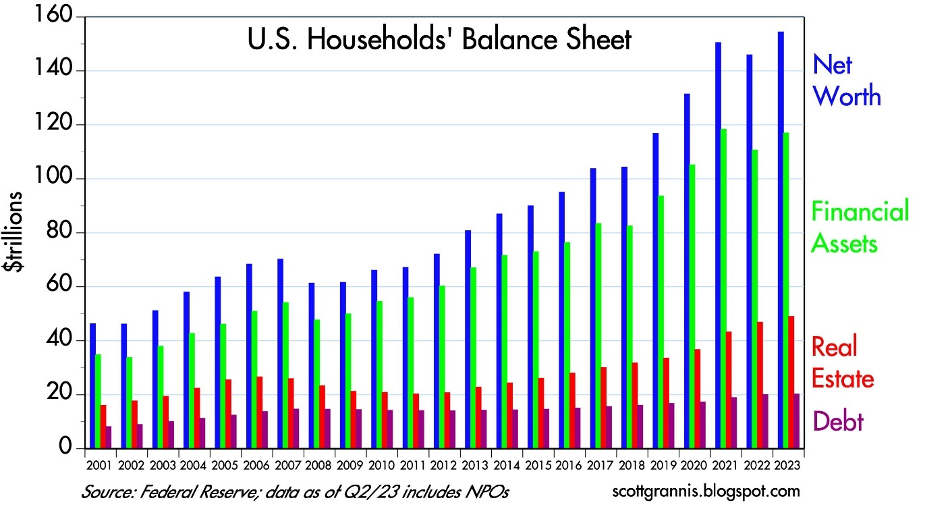

Consumer wallets and balance sheets remain flush with cash as employment remains near record-high levels. Cash in consumer wallets and money in the bank help the economy keep chugging along at a healthy clip. More specifically, as you can see in the chart below, the net worth of U.S. households has reached a record $154.3 trillion dollars in the most recent month, thanks to appreciation in stocks, gains in real estate, and relatively stable levels of debt.

Source: Calafia Beach Pundit

Unemployment Remains Low

In addition, the unemployment rate is sitting at 3.8%, near multi-decade lows (see chart below).

Source: Trading Economics

As long as consumers continue to hold a job, they will continue spending to buoy economic activity – remember, consumer spending accounts for roughly 70% of our country’s economic activity. Case in point are the most recently released GDP (Gross Domestic Product) forecasts by the Atlanta Federal Reserve, which show 3rd quarter GDP growth estimated at a 4.9% rate (see chart below).

Rates Up, Housing Prices Up?

Yes, it’s true, despite a dramatic surge in mortgage rates over the last few years, the housing market remains strong due to a very tight supply of homes available for sale. Most homeowners with a mortgage have refinanced to a rate in the range of 3% (or in some cases even lower), so selling and moving into a new home with a mortgage at current rates of 7.3% is not that appealing. In other words, if you decide to move, your monthly mortgage payment could potentially go up by more > 50%, which could equate to thousands of dollars per month. Under this scenario, you are likely to stay put and not sell your home.

Source: Trading Economics

The embedded economic disincentive of selling a home with a mortgage has really put a real crimp on the supply of homes available for sale (chart below). As you can see, the inventory of homes has dramatically collapsed from a peak of about four million homes, circa the 2008 Financial Crisis, to around one million homes today.

Source: Trading Economics

In the face of this mixed data, the stock market finished a hot summer with a cool whimper last month, in large part due to a 0.49% increase in the 10-Year Treasury Note yield to 4.58% (see chart below). The S&P 500 index fell -4.9% for the month, the technology-heavy NASDAQ index dropped even further by -5.8%, while the Dow Jones Industrial Average outperformed, down -3.5% for the month. Worth noting, however, the Dow has significantly underperformed the other indexes so far this year.

Source: Trading Economics

Inflation on the Mend

The Fed continues to talk tough about fighting inflation after taking interest rates from 0% to 5.5% over the last two years, nevertheless inflation continues to come down. The Fed’s go-to Core PCE inflation datapoint that came out last Friday at +0.1% is consistent with the downward inflation trend we have been witnessing for many months now (see chart below). As you can see, inflation on annualized basis has reached 2.2%, nearly achieving the Federal Reserve’s target of 2.0%.

Source: The Wall Street Journal and Commerce Department

There is never a shortage of investor concerns. Today, worries include Federal Reserve policy; restarting of school loan repayments (after a three-year hiatus); a potential government shutdown; an auto and Hollywood strike; higher oil prices; and a presidential election that is heating up. Many of these worries are nothing new. The bull market took a pause for the month, but consumer wallets remain fat, the economy keeps chugging, the employment picture remains strong, and stock prices remain up +12% for the year (S&P 500). For the time being, betting on a soft economic landing over an imminent recession could be a winning use for that cash in your wallet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 2, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

S.T.I.N.K. – Deja Vu All Over Again

Yogi Berra is a Baseball Hall of Fame catcher and manager who played 18 out of 19 seasons with the New York Yankees. Besides his incredible baseball skills, Berra was also known for his humorous and witty quotes, which were called “Yogi-isms.” Reportedly, one of Berra’s most famous Yogi-isms occurred after he observed fellow teammates, Mickey Mantle and Roger Maris, continually hitting back-to-back home runs:

“It’s déjà vu all over again.”

The Merriam-Webster dictionary defines déjà vu as “a feeling that one has seen or heard something before.” I experienced the same sense last month as I was bombarded with ominous news headlines. Some of you may recall the panic attack over the PIIGS regions during the 2010 – 2012 timeframe (Solving Europe & Deadbeat Cousin). I’m obviously not referring to the pork product, but rather Portugal, Italy, Ireland, Greece, and Spain, which rocked financial markets due to investor fears that Greece’s fiscal irresponsibility may force the country to leave the eurozone and drag the rest of Europe into financial ruin.

Suffice it to say, the imploding Greece/Europe disaster scenario did not happen. If you fast forward to today, the fear has returned again, however with a different acronym spin. Rather than speak about PIIGS, today the talking heads are fretting over S.T.I.N.K. – Spain, Tariffs, Italy, and North Korea.

*Worth noting, the letter “I” in S.T.I.N.K. could also be sustained or replaced by the word Iran, given the Trump administration’s desire to exit the Iran Nuclear Deal. The move comes despite support by our country’s tight NATO (North Atlantic Treaty Organization) allies who want the U.S. to remain in the agreement.

An overview of S.T.I.N.K. unease is summarized here:

Spain: After a reign of six years, Spain’s Prime Minister Mariano Rajoy is on the verge of being ousted to socialist opposition leader, Pedro Sanchez. Corruption convictions involving former members in Rajoy’s conservative Popular Party only increases the probability that the imminent no-confidence vote in the Spanish parliament will lead to Rajoy’s exit.

Tariffs: President Trump is lifting the temporary steel and aluminum tariff exemptions provided to many of our allies, including Canada, Mexico, and the European Union. Recent breakdowns in trade discussions with allies like Mexico and Canada are likely to make the renegotiation of NAFTA (North American Free Trade Agreement) even more challenging. Handicapping President Trump’s global trade rhetoric can be difficult, especially given the periodic inconsistency in Trump’s actions relative to his words. Time will tell whether Trump’s tough trade talk is merely a negotiating tool designed to gain better trade terms for the U.S., or whether this strategy backfires, and trading partner allies choose to retaliate with tariffs of their own. For example, the EU has threatened to impose import taxes on bourbon; Mexico has warned about levying taxes on American farm products; and Canada is focused on the same steel and aluminum tariffs that Trump has been referencing.

Italy: Pandemonium temporarily set in when Italy’s President Sergio Mattarella essentially vetoed the finance minister selection by Italian Prime Minister Giuseppe Conte. Initially, Italian bond prices plummeted and interest rates spiked as fears of an Italian exit from the euro currency, but after the rejection of the original finance chief, the populist Five Star and League coalition parties agreed to institute a more moderate finance minister and bond prices/rates stabilized.

North Korea: The on-again-off-again denuclearization summit between the U.S. and North Korea may actually take place in Singapore on June 12th. In recent days, Secretary of State Mike Pompeo has held face-to-face meetings with North Korean General Kim Yong Chol in New York. The senior North Korean leader is also planning to hand deliver a letter from Korean leader Kim Jong Un to President Trump in preparation for the nuclear summit. The U.S. is attempting to incentivize North Korea with economic relief in return for North Korea giving up their nuclear capabilities.

Thanks to S.T.I.N.K., volatility has risen, but the downdrafts have been relatively muted as evidenced by the moves in the stock averages this month. More specifically, the S&P 500 index rose +2.2% last month, while the technology-heavy Nasdaq index catapulted +5.3%. Nevertheless, not all indexes are created equally as witnessed by the Dow Jones Industrial Index, which climbed a more muted +1.1% for the month. For the year, the Dow is down -1.2%, while the S&P and Nasdaq indexes are higher by +1.2% and +7.8%, respectively.

Ever since the 2008-2009 financial crisis, observers have incessantly and anxiously waited for the return of a “stinky” economic and/or geopolitical catastrophe that will wreck the American economy. Unfortunately for the pessimists, stock prices have more than quadrupled in value since early-2009. Yogi Berra may have been correct when he said, “It’s déjà vu all over again,” but just like PIIGS concerns failed to cause global economic contagion, STINK concerns are unlikely to cause significant economic damage either. Over the last year, the only “stink” occurring has been the stink of cool, hard cash.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

A Recipe for Disaster

Justice does not always get served in the stock market because financial markets are not always efficient in the short-run (see Black-Eyes to Classic Economists). However, over the long-run, financial markets usually get it right. And when the laws of economics and physics are functioning properly, I must admit it, I do find it especially refreshing.

There can be numerous reasons for stocks to plummet in price, but common attributes to stock price declines often include profit losses and/or disproportionately high valuations (a.k.a. “bubbles”). Normally, your garden variety, recipe for disaster consists of one part highly valued company and one part money-losing operation (or deteriorating financials). The reverse holds true for a winning stock recipe. Flavorful results usually involve cheaply valued stocks paired with improving financial results.

Unfortunately, just because you have the proper recipe of investment ingredients, doesn’t mean you will immediately get to enjoy a satisfying feast. In other words, there isn’t a dinner bell rung to signal the timing of a crash or spike – sometimes there is a conspicuous catalyst and sometimes there is not. Frequently, investments require a longer expected bake time before the anticipated output is produced.

As I alluded to at the beginning of my post, justice is not always served immediately, but for some high profile IPOs, low-quality ingredients have indeed produced low-quality results.

Snap Inc. (SNAP): Let’s first start with the high-flying social media darling Snap, which priced its IPO at $17 per share in March, earlier this year. How can a beloved social media company that generates $515 million in annual revenue (up +286% in the recent quarter) see its stock plummet -48% from its high of $29.44 to $15.27 in just four short months? Well, one way of achieving these dismal results is to burn through more cash than you’re generating in revenue. Snap actually scorched through more than -$745 million dollars over the last year, as the company reported accounting losses of -$618 million (excluding -$2 billion of stock-based compensation expenses). We’ll find out if the financial bleeding will eventually stop, but even after this year’s stock price crash, investors are still giving the company the benefit of the doubt by valuing the company at $18 billion today.

Source: Barchart.com

Blue Apron Holdings Inc. (APRN): Online meal delivery favorite, Blue Apron, is another company suffering from the post-IPO blues. After initially targeting an opening IPO price of $15-$17 per share a few weeks ago, tepid demand forced Blue Apron executives to cut the price to $10. Fast forward to today, and the stock closed at $7.36, down -26% from the IPO price, and -57% below the high-end of the originally planned range. Although the company isn’t hemorrhaging losses at the same absolute level of Snap, it’s not a pretty picture. Blue Apron has still managed to burn -$83 million of cash on $795 million in annual sales. Unlike Snap (high margin advertising revenues), Blue Apron will become a low-profit margin business, even if the company has the fortune of reaching high volume scale. Even after considering Blue Apron’s $1 billion annual revenue run rate, which is 50% greater than Snap’s $600 million run-rate, Blue Apron’s $1.4 billion market value is sadly less than 10% of Snap’s market value.

Source: Barchart.com

Groupon Inc. (GRPN): Unlike Snap and Blue Apron, Groupon also has the flattering distinction of reporting an accounting profit, albeit a small one. However, on a cash-based analysis, Groupon looks a little better than the previous two companies mentioned, if you consider an annual -$7 million cash burn “better”. Competition in the online discounting space has been fierce, and as such, Groupon has experienced a competitive haircut in its share price. Groupon’s original IPO price was $20 in January 2011 before briefly spiking to $31. Today, the stock has languished to $4 (-87% from the 2011 peak).

Source: Barchart.com

Stock Market Recipe?

Similar ingredients (i.e., valuations and profit trajectory) that apply to stock performance also apply to stock market performance. Despite record corporate profits (growing double digits), low unemployment, low inflation, low-interest rates, and a recovering global economy, bears and even rational observers have been worried about a looming market crash. Not only have the broader masses been worried today, yesterday, last week, last month, and last year, but they have also been worried for the last nine years. As I have documented repeatedly (see also Market Champagne Sits on Ice), the market has more than tripled to new record highs since early 2009, despite the strong under-current of endless cynicism.

Historically market tops have been marked by a period of excesses, including excessive emotions (i.e., euphoria). It has been a long time since the last recession, but economic downturns are also often marked with excessive leverage (e.g., housing in the mid-2000s), excessive capital (e.g., technology IPOs [Initial Public Offerings] in the late-1990s), and excessive investment (e.g., construction / manufacturing in early-1990s).

To date, we have seen little evidence of these markers. Certainly there have been pockets of excesses, including overpriced billion dollar tech unicorns (see Dying Unicorns), exorbitant commercial real estate prices, and a bubble in global sovereign debt, but on a broad basis, I have consistently said stocks are reasonably priced in light of record-low interest rates, a view also held by Warren Buffett.

The key lessons to learn, whether you are investing in individual stocks or the stock market more broadly, are that prices will follow the direction of earnings over the long-run. This helps explain why stock prices always go down in recessions (and are volatile in anticipation of recessions).

If you are looking for a recipe for disaster, just find an overpriced investment with money-losing (or deteriorating) characteristics. Avoiding these investments and identifying investments with cheap growth qualities is much easier said than done. However, by mixing an objective, quantitative framework with more artistic fundamental analysis, you will be in a position of enjoying tastier returns.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in SNAP, APRN, GRPN, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Hot Dogs, Political Fireworks, and Our Nation’s Birthday

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 3, 2017). Subscribe on the right side of the page for the complete text.

The 4th of July has arrived once again as we celebrate our country’s 241st birthday of independence. Besides being a time to binge on hot dogs, apple pie, fireworks, and baseball, this national holiday allows Americans to also reflect on the greatness created by our nation’s separation from the British Empire.

As our Founding Fathers fought for freedom and believed in a more prosperous future, I’m not sure if the signers of our Declaration of Independence (Below [left to right]: Roger Sherman, Benjamin Franklin, Thomas Jefferson, John Adams, and Robert Livingston) envisioned a world with tweeting Presidents, driverless Uber taxis, internet dating, biotechnology medical breakthroughs, cloud storage, and countless other innovations that have raised the standard of living for billions of people around the world.

(These Founding Fathers may use different pictures for their Facebook profile, if they were alive today.)

I tend to agree with the wealthiest billionaire investor on the planet, Warren Buffett, that being born in the United States is the equivalent of winning the “Ovarian Lottery.” The opportunities for finding success are exponentially higher, if you were born in America vs. Bangladesh, for example. Surprisingly, the U.S. only accounts for about 4% of the global population (325 million out of 7.5 billion world total). However, even though we Americans make up such a small portion of the of the people on the planet, we still manage to generate over $18 trillion in goods and services, which makes us the world’s largest economy. As the #1 economy, we account for almost 25% of the world’s total economic output (see table & graphic below).

| Rank | Country | GDP (Nominal, 2015) | Share of Global Economy (%) |

| #1 | United States | $18.0 trillion | 24.3% |

| #2 | China | $11.0 trillion | 14.8% |

| #3 | Japan | $4.4 trillion | 5.9% |

| #4 | Germany | $3.4 trillion | 4.5% |

| #5 | United Kingdom | $2.9 trillion | 3.9% |

Source: Visual Capitalist

How do we create six times the output of our population (i.e., 4% of world’s population producing 25% of the world’s output)? Despite the nasty, imperfect, mudslinging politics we live through daily, the U.S. has perfected the art of capitalism, which has landed us on top of the economic Mt. Everest. Although, there is always room for improvement, culturally, the winning “entrepreneurial” strain is born into our American DNA. The recent merger announcement between Amazon.com Inc. (AMZN) and Whole Foods (WFM), the leading natural and organic foods supermarket, is evidence of this entrepreneurial strain. Amazon has come a long way and gained significant steam since its founding in July 1994 by CEO Jeff Bezos. Consequently, the momentum of this internet giant has it steamrolling the entire retail industry, which has led to a flood of store closings, including department store chains, Macy’s, J.C. Penney, Sears and Kmart. The Amazon-Whole Foods merger announcement was not a huge surprise to my family because we actually order more than half of our groceries from AmazonFresh (Amazon’s food delivery program). What’s more, since I despise shopping, I continually find myself taking advantage of Amazon’s “Prime Now” 2-hour delivery option to my office, which is free to all Prime subscribers. It won’t be long before Amazon’s multi-channel strategy will allow me to make same-day orders for groceries, electronics, and general merchandise from my office, then pick up those items on my way home from work at the local Whole Foods store.

Leading the Pack

Replicating this competitive advantage around the world is a challenge for competing countries, and our nation remains leap years ahead of others, regardless of their efforts. However, the United States does not have a monopoly on capitalism. We are slowly exporting our entrepreneurial secret sauce abroad with the help of technology and globalization. Just consider these three Chinese companies alone are valued at almost $1 trillion (Alibaba Group $360B [BABA]; Tencent Holdings $340B [TCEHY]; and China Mobile $220B [CHL]), and the largest expected IPO (Initial Public Offering) in the world could be a Saudi Arabian company valued at $2 trillion (Saudi Aramco). When 96% of the world’s population lies outside of the U.S., this reality helps explain why exporting our advancements should not be considered a bad thing. In fact, a growing international pie means more American jobs and more dollars will flow back to the U.S., as we export more value-added products and services abroad.

Even if other countries are narrowing the entrepreneurial competitive gap with the United States, we still remain a beacon of light for others to follow. Despite what you may read in the newspaper or hear on the TV, Americans are dramatically better off financially over the last 20 years. Not only has net worth increased spectacularly, but consumers have also responsibly reduced debt leverage ratios (see chart below).

Source: Calafia Beach Pundit

If you were a bright CEO working for an innovative new start-up company, would you choose to launch your company in a closed, censored society like China? How about a fractured Britain that is pushing to break away from the European Union? Better yet, how about Japan with its exploding debt levels, a declining population, and a stock market that is about half the level it peaked at 28 years ago? Do emerging markets like Brazil with widespread corruption scandals blanketing a new president (after a recently impeached president) seem like the best location for a hot new venture? The answer to all these questions is a resounding “no”, even when compared to the warts and flaws that come with our durable democracy.

Political Pyrotechnics

Besides the bombs bursting in air during the 4th of July celebration, there were plenty of political fireworks blasting in our nation’s capital last month. No matter what side of the political fence you stand on, last month was explosive. Consider ousted FBI Director Jim Comey’s impassioned testimony relating to his firing by President Donald Trump; the contentious Attorney General Jeff Sessions Senate Intelligence Committee interview; the politically driven Republican baseball shooting; and the Special Counsel leader Robert Mueller’s investigation into Russian interference and potential Trump administration collusion into the 2016 elections.

Despite the combative atmosphere in Washington D.C., the stock market managed to notch another record high last month, with the Dow Jones Industrial Average index advancing another 340.98 points (+1.6%) for the month, and +8.0% for the first half of 2017. As I have written numerous times, the scary headlines accumulating since 2009 have prevented investors, strategists, economists, and even professionals from adequately participating in the almost quadrupling in stock prices since early 2009. Unfortunately, to the detriment of many, large swaths of investors who were burned by the 2008-2009 Financial Crisis have been scarred to almost permanent risk aversion. The fact of the matter is stock prices care more about economic factors than political / news headlines (see Moving on Beyond Politics).

The bitter, vitriolic political discourse is unlikely to disappear anytime soon, so do yourself a favor, and focus on the more important factors driving financial markets to new record highs – mainly corporate profits, interest rates, valuations, and sentiment (see Don’t Be a Fool). During this year’s 4th of July, partaking in hot dogs, apple pie, fireworks, and baseball are wholly encouraged, but please also take the time to celebrate and acknowledge the magnitude of our country’s greatness. That’s a birthday wish, I think we can all agree upon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in WFM, BABA, TCEHY, CHL, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Munger: Buffett’s Wingman & the Art of Stock Picking

Simon had Garfunkel, Batman had Robin, Hall had Oates, Dr. Evil had Mini Me, Sonny had Cher, and Malone had Stockton. In the investing world, Buffett has Munger. Charlie Munger is one of the most successful and famous wingmen of all-time – evidenced by Berkshire Hathaway Corporation’s (BRKA/B) outperformance of the S&P 500 index by approximately +624% from 1977 – 2009, according to MarketWatch. Munger not only provides critical insights to his legendary billionaire boss, Warren Buffett, but he was also Chairman of Berkshire’s insurance subsidiary, Wesco Financial Corporation from 1984 until 2011. The magic of this dynamic duo began when they met at a dinner party 58 years ago (1959).

In an article he published in 2006, the magnificent Munger describes the “Art of Stock Picking” in a thorough review about the secrets of equity investing. We’ll now explore some of the 93-year-old’s sage advice and wisdom.

Model Building

Charlie Munger believes an individual needs a solid general education before becoming a successful investor, and in order to do that one needs to study and understand multiple “models.”

“You’ve got to have models in your head. And you’ve got to array your experience both vicarious and direct on this latticework of models. You may have noticed students who just try to remember and pound back what is remembered. Well, they fail in school and in life. You’ve got to hang experience on a latticework of models in your head.”

Although Munger indicates there are 80 or 90 important models, the examples he provides include mathematics, accounting, biology, physiology, psychology, and microeconomics.

Advantages of Scale

Great businesses in many cases enjoy the benefits of scale, and Munger devotes a good amount of time to this subject. Scale advantages can be realized through advertising, information, psychological “social proofing,” and structural factors.

The newspaper industry is an example of a structural scale business in which a “winner takes all” phenomenon applies. Munger aptly points out, “There’s practically no city left in the U.S., aside from a few very big ones, where there’s more than one daily newspaper.”

General Electric Co. (GE) is another example of a company that uses scale to its advantage. Jack Welch, the former General Electric CEO, learned an early lesson. If the GE division is not large enough to be a leader in a particular industry, then they should exit. Or as Welch put it, “To hell with it. We’re either going to be # 1 or #2 in every field we’re in or we’re going to be out. I don’t care how many people I have to fire and what I have to sell. We’re going to be #1 or #2 or out.”

Bigger Not Always Better

Scale comes with its advantages, but if not managed correctly, size can weigh on a company like an anchor. Munger highlights the tendency of large corporations to become “big, fat, dumb, unmotivated bureaucracies.” An implicit corruption also leads to “layers of management and associated costs that nobody needs. Then, while people are justifying all these layers, it takes forever to get anything done. They’re too slow to make decisions and nimbler people run circles around them.”

Becoming too large can also create group-think, or what Munger calls “Pavlovian Association.” Munger goes onto add, “If people tell you what you really don’t want to hear what’s unpleasant there’s an almost automatic reaction of antipathy…You can get severe malfunction in the high ranks of business. And of course, if you’re investing, it can make a lot of difference.”

Technology: Benefit or Burden?

Munger recognizes that technology lowers costs for companies, but the important question that many managers fail to ask themselves is whether the benefits from technology investments accrue to the company or to the customer? Munger summed it up here:

“There are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that’s still going to be lousy. The money still won’t come to you. All of the advantages from great improvements are going to flow through to the customers.”

Buffett and Munger realized this lesson early on when productivity improvements gained from technology investments in the textile business all went to the buyers.

Surfing the Wave

When looking for good businesses, Munger and Buffett are looking to “surf” waves or trends that will generate healthy returns for an extended period of time. “When a surfer gets up and catches the wave and just stays there, he can go a long, long time. But if he gets off the wave, he becomes mired in shallows,” states Munger. He notes that it’s the “early bird,” or company that identifies a big trend before others that enjoys the spoils. Examples Munger uses to illustrate this point are Microsoft Corp. (MSFT), Intel Corp. (INTC), and National Cash Register from the old days.

Large profits will be collected by those investors that can identify and surf those rare large waves. Unfortunately, taking advantage of these rare circumstances becomes tougher and tougher for larger investors like Berkshire. If you’re an elephant trying to surf a wave, you need to find larger and larger waves, and even then, due to your size, you will be unable to surf as long as small investors.

Circle of Competence

Circle of competence is not a new subject discussed by Buffett and Munger, but it is always worth reviewing. Here’s how Munger describes the concept:

“You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.”

For Munger and Buffett, sticking to their circle of competence means staying away from high-technology companies, although more recently they have expanded this view to include International Business Machines (IBM), which they are now a large investor.

Market Efficiency or Lack Thereof

Munger acknowledges that financial markets are quite difficult to beat. Since the markets are “partly efficient and partly inefficient,” he believes there is a minority of individuals who can outperform the markets. To expand on this idea, he compares stock investing to the pari-mutuel system at the racetrack, which despite the odds stacked against the bettor (17% in fees going to the racetrack), there are a few individuals who can still make decent money.

The transactional costs are much lower for stocks, but success for an investor still requires discipline and patience. As Munger declares, “The way to win is to work, work, work, work and hope to have a few insights.”

Winning the Game – 10 Insights / 20 Punches

As the previous section implies, outperformance requires patience and a discriminating eye, which has allowed Berkshire to create the bulk of its wealth from a relatively small number of investment insights. Here’s Munger’s explanation on this matter:

“How many insights do you need? Well, I’d argue: that you don’t need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it….I don’t mean to say that [Warren] only had ten insights. I’m just saying, that most of the money came from ten insights.”

Chasing performance, trading too much, being too timid, and paying too high a price are not recipes for success. Independent thought accompanied with selective, bold decisions is the way to go. Munger’s solution to these problems is to provide investors with a Buffett 20-punch ticket:

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches ‑ representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all.”

The great thing about Munger and Buffett’s advice is that it is digestible by the masses. Like dieting, investing can be very simple to understand, but difficult to execute, and legends like these always remind us of the important investing basics. Even though Charlie Munger may be slowing down a tad at 93-years-old, Warren Buffett and investors everywhere are blessed to have this wingman around spreading his knowledge about investing and the art of stock picking.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, BRKA/B, GE, MSFT, INTC, IBM but at the time of this 3/12/17 updated publishing, SCM had no direct position in National Cash Register, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.