Posts tagged ‘Pete Rose’

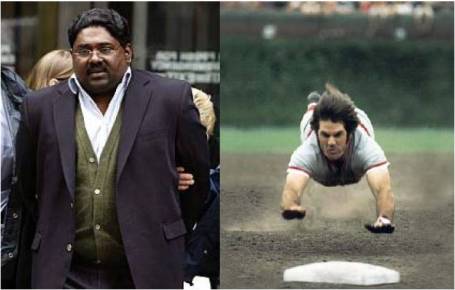

Insider Trading: Raj Rajaratnam vs. Pete Rose

A recent Wall Street Journal article written by Donald J. Boudreaux, a professor of Economics at George Mason University, makes the case that insider trading is actually healthy for the operations of the financial markets. The arrest of Galleon Group founder and hedge fund manager, Raj Rajaratnam, is a tragedy according to the article’s author. Specifically he says, “Insiders buying and selling stocks based on their knowledge play a critical role in keeping asset prices honest—in keeping prices from lying to the public about corporate realities.”

Oh really? Then I suppose Professor Boudreaux would be fine with all-time leading hitter and former Cincinnati Reds Manager betting on his own baseball team to win or lose.

Another disputed aspect of insider trading by Boudreaux is the inability to monitor the crime. “Insider trading is impossible to police and…parsing the difference between legal and illegal insider trading is futile—and a disservice to all investors.” Maybe heroin and cocaine should be legalized too, since we can’t completely police these crimes either? Seems to me the insider trading laws are pretty clear what insiders can and cannot do with material information. The digital world we live in today only empowers investigators more than ever to discover clear electronic footprint trails connecting trading and banking accounts. Certainly, there will be creative crooks like Bernie Madoff that can slyly succeed for a period of time, but those that grasp too far will eventually get caught.

Professor Boudreaux goes on to describe the scenario of an unscrupulous CEO at a hypothetical company (Acme Inc.) driving a company into bankruptcy. He argues employees, creditors, and investors would be better served by a CEO enriching himself with insider trading in the name of price efficiency. Capital productivity would be enhanced for creditors/investors thanks to information efficiency and employees could manage their job hunting effectively.

Sounds great Don, but in a legal insider trading world, don’t you think inefficient, unscrupulous behavior for siphoning information from executives might lead to distracting and wasteful corporate actions? If I’m an employee at ACME Inc. and I can make more money trading ACME stock, rather than being a productive employee making widgets, then it doesn’t take a genius to figure out where my 40 hour work week concentration will reside. Moreover, how is a sabotaging CEO, who is raking in millions by shorting his company’s stock ,supposed to be a good thing for stakeholders? I strongly disagree. Stakeholders will be jeopardized more by an unfocused, greed-absorbed workforce than by the current enforcement structure, which strives for an even playing field of information.

After forcefully arguing trading on insider information should not be prohibited, the professor hedges his stance by saying there are exceptions: “There are, of course, situations in which it is in the interest of both a company and the public for that company to delay the release of information.” For example, he describes a merger situation where early information leakage could “jeopardize the prospect of achieving greater efficiencies.” If according to Boudreaux, policing of insider information is impossible, then determining what he calls “proprietary” versus “non-proprietary” information is only going to stir up a worse hornet’s nest.

In the end, if price efficiency (see story on market efficiency) and cheaper cost of capital is Professor Boudreaux’s central aim, then perhaps disclosing inside information, rather than selfishly profiting from trading on inside information, is a more suitable approach. For Pete Rose, I recommend sticking to legalized sports betting in Las Vegas as a superior strategy.

Read Full Professor Boudreaux WSJ Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Celebrity Tax Evaders Run But Can’t Hide

As Mark Twain said, “The only certainties in life are death and taxes.” That is, of course, unless you decide to not pay your taxes. Some well known celebrities fall into this camp.

The financial crisis has hit the economy hard and the impact has been felt directly by our nation’s cash register (i.e., the Internal Revenue Service – IRS). Based on 2006 IRS data, the U.S. had about an 84% Voluntary Compliance Rate (VCR) by tax payers in 2001; a goal of 85% VCR in 2009; and Senate Finance Committee Chairman Max Baucus has thrown out a 90% voluntary compliance goal by 2017. Those collection goals may be a little ambitious given the recession and the escalating unemployment trends over 2008 – 2009.

So who makes up the deadbeats who have deliberately or unintentionally not paid their taxes? Obviously 10-15% of the non-paying tax-payer base is a large number, but the real fun comes by tracking the smaller celebrity component of the tax evaders. Let’s take a look at some of the more prominent dodgers (data provided by The Daily Beast):

- O.J. Simpson: In 2007 the state of California placed listed Mr. Simpson as one of their worst tax offenders, owing close to $1.5 million. Currently he is serving a 33-year sentence in a Nevada prison for an armed robbery and kidnapping conviction.

- Willie Nelson: The long-haired hippy and king of country music, Willie Nelson, was hunted down by the IRS for $16.7 million in 1990. Fortunately for him, his star-power allowed him to record albums and pay back his debt by 1993.

- Wesley Snipes: The Blade movie star claimed the reason he owed more than $17 million in taxes, penalties, and interest is because he was a “non-resident alien.” The judge didn’t buy the explanation, and now he is appealing a three-year prison sentence.

- Pete Rose: “Charlie Hustle,” the all-star baseball player of the Cincinnati Reds served five months in prison for not paying taxes on his autograph, memorabilia, and horse-racing income. Mr. Rose cleared the slate by performing 1,000 hours of community service and paying off $366,000 in debt.

- Nicolas Cage: Not sure if he is shooting a movie in New Orleans, but Mr. Cage is attempting to iron out a $6.2 million tax liability through a Louisiana court for his failure to keep up with 2007 taxes.

- Judy Garland: Men are not the only non-compliers, even if they account for the majority. Judy Garland, from Wizard of Oz fame, had her own tax problems. Besides tax evasion charges in the early 1950s, she accumulated about $4 million in IRS debt after her 1964 variety show (The Judy Garland Show) was cancelled.

- Al Capone: One of most well known cases in tax evasion history is tied to famous mobster Al Capone. After a long, controversial trial, Mr. Capone was convicted and handed an 11-year sentence, predominantly at Alcatraz. He got out early on parole in 1939 and kept a relatively low profile.

There are countless others that have gotten into tax problems with the IRS. Many of them make plenty of money to pay their taxes, however spending habits, laziness, or aggressive tax accountants may explain the reasons behind the tax evasion problems.

See a more complete media gallery of tax evaders here, provided by The Daily Beast.

Regardless of the celebrities’ tax-paying compliance rates, the IRS will have its collection hands full, given the sad state of the current economic environment and the crafty tax-dodging techniques pursued by some citizens. Unlike others, I’ll make sure to write myself a note, reminding me to write a check to my friends at the IRS on April 15th – especially if it involves millions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.