Posts tagged ‘Italy’

S.T.I.N.K. – Deja Vu All Over Again

Yogi Berra is a Baseball Hall of Fame catcher and manager who played 18 out of 19 seasons with the New York Yankees. Besides his incredible baseball skills, Berra was also known for his humorous and witty quotes, which were called “Yogi-isms.” Reportedly, one of Berra’s most famous Yogi-isms occurred after he observed fellow teammates, Mickey Mantle and Roger Maris, continually hitting back-to-back home runs:

“It’s déjà vu all over again.”

The Merriam-Webster dictionary defines déjà vu as “a feeling that one has seen or heard something before.” I experienced the same sense last month as I was bombarded with ominous news headlines. Some of you may recall the panic attack over the PIIGS regions during the 2010 – 2012 timeframe (Solving Europe & Deadbeat Cousin). I’m obviously not referring to the pork product, but rather Portugal, Italy, Ireland, Greece, and Spain, which rocked financial markets due to investor fears that Greece’s fiscal irresponsibility may force the country to leave the eurozone and drag the rest of Europe into financial ruin.

Suffice it to say, the imploding Greece/Europe disaster scenario did not happen. If you fast forward to today, the fear has returned again, however with a different acronym spin. Rather than speak about PIIGS, today the talking heads are fretting over S.T.I.N.K. – Spain, Tariffs, Italy, and North Korea.

*Worth noting, the letter “I” in S.T.I.N.K. could also be sustained or replaced by the word Iran, given the Trump administration’s desire to exit the Iran Nuclear Deal. The move comes despite support by our country’s tight NATO (North Atlantic Treaty Organization) allies who want the U.S. to remain in the agreement.

An overview of S.T.I.N.K. unease is summarized here:

Spain: After a reign of six years, Spain’s Prime Minister Mariano Rajoy is on the verge of being ousted to socialist opposition leader, Pedro Sanchez. Corruption convictions involving former members in Rajoy’s conservative Popular Party only increases the probability that the imminent no-confidence vote in the Spanish parliament will lead to Rajoy’s exit.

Tariffs: President Trump is lifting the temporary steel and aluminum tariff exemptions provided to many of our allies, including Canada, Mexico, and the European Union. Recent breakdowns in trade discussions with allies like Mexico and Canada are likely to make the renegotiation of NAFTA (North American Free Trade Agreement) even more challenging. Handicapping President Trump’s global trade rhetoric can be difficult, especially given the periodic inconsistency in Trump’s actions relative to his words. Time will tell whether Trump’s tough trade talk is merely a negotiating tool designed to gain better trade terms for the U.S., or whether this strategy backfires, and trading partner allies choose to retaliate with tariffs of their own. For example, the EU has threatened to impose import taxes on bourbon; Mexico has warned about levying taxes on American farm products; and Canada is focused on the same steel and aluminum tariffs that Trump has been referencing.

Italy: Pandemonium temporarily set in when Italy’s President Sergio Mattarella essentially vetoed the finance minister selection by Italian Prime Minister Giuseppe Conte. Initially, Italian bond prices plummeted and interest rates spiked as fears of an Italian exit from the euro currency, but after the rejection of the original finance chief, the populist Five Star and League coalition parties agreed to institute a more moderate finance minister and bond prices/rates stabilized.

North Korea: The on-again-off-again denuclearization summit between the U.S. and North Korea may actually take place in Singapore on June 12th. In recent days, Secretary of State Mike Pompeo has held face-to-face meetings with North Korean General Kim Yong Chol in New York. The senior North Korean leader is also planning to hand deliver a letter from Korean leader Kim Jong Un to President Trump in preparation for the nuclear summit. The U.S. is attempting to incentivize North Korea with economic relief in return for North Korea giving up their nuclear capabilities.

Thanks to S.T.I.N.K., volatility has risen, but the downdrafts have been relatively muted as evidenced by the moves in the stock averages this month. More specifically, the S&P 500 index rose +2.2% last month, while the technology-heavy Nasdaq index catapulted +5.3%. Nevertheless, not all indexes are created equally as witnessed by the Dow Jones Industrial Index, which climbed a more muted +1.1% for the month. For the year, the Dow is down -1.2%, while the S&P and Nasdaq indexes are higher by +1.2% and +7.8%, respectively.

Ever since the 2008-2009 financial crisis, observers have incessantly and anxiously waited for the return of a “stinky” economic and/or geopolitical catastrophe that will wreck the American economy. Unfortunately for the pessimists, stock prices have more than quadrupled in value since early-2009. Yogi Berra may have been correct when he said, “It’s déjà vu all over again,” but just like PIIGS concerns failed to cause global economic contagion, STINK concerns are unlikely to cause significant economic damage either. Over the last year, the only “stink” occurring has been the stink of cool, hard cash.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Digesting the Anchovy Pizza Market

Article is an excerpt from previously released Sidoxia Capital Management’s complementary July 2012 newsletter. Subscribe on right side of page.

I love pizza, and most fellow connoisseurs have difficulty refusing a hot, fresh slice of heaven too. Pizza is so universally appreciated that people consider pizza like ice cream – it’s good even when it’s bad (I agree). However, even the biggest, diehard pizza-lover will sheepishly admit their fondness for the flat and circular cheesy delight changes when you integrate anchovies into the mix. Not many people enjoy salty, slimy, marine creatures layered onto their doughy mozzarella and marinara pizza paradise.

With all the turmoil and uncertainty going on in the global financial markets, prudently investing in a widely diversified portfolio, including a broad range of equity securities, is viewed as palatable as participating in an all-you-can-eat anchovy pizza contest. Why are investors’ appetites so salty now? Hmmm, let me think. Oh yes, here are a few things that come to mind:

- Presidential Election Uncertainty

- European Financial Crisis

- Impending Fiscal Cliff (tax cut expirations, automatic spending cuts, termination of stimulus, etc.)

- Unsustainable Fiscal Debt & Deficits

- Slowing Subpar Domestic Economic Growth

- Partisan Politics and Gridlock in Washington

- High Unemployment

- Fears of a Hard Economic Landing in China

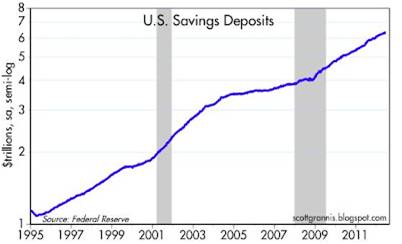

Doesn’t sound too appealing, does it? So, what are most investors doing in this unclear market? Rather than feasting on a pungent pie of anchovies, investors are flocking to the perceived safety of low yielding asset classes, no matter the price. In other words, the short-term warmth and comfort of CDs, money market, checking, and fixed income assets are being gobbled up like nicotine-laced pepperoni pizzas selling for $29.95/each + tax. The anchovy alternative, like stocks, is much more attractively priced now. After accounting for dividends, earnings, and cash flows, the anchovy/stock option is currently offering a 2-for-1 special with breadsticks and a salad…quite the bargain!

Nonetheless, the plain and expensive pepperoni/bond option remains the choice du jour and there are no immediate signs of a pepperoni hangover just quite yet. However, this risk aversion addiction cannot last forever. The bond gorging buffet has gone on relatively unabated for the last three decades, as you can see from the chart below. In spite of this, the bond binging game is quickly approaching a mathematical terminal end-game, as interest rates cannot logically go below zero.

Since my firm (Sidoxia Capital Management) is based in Newport Beach, next to PIMCO’s global headquarters, we get to follow the progression of the bond binging game firsthand. I’ve personally learned that if I manage close to $2 trillion in assets under management, I too can construct a 23-story Taj Mahal-esque headquarters that overlooks the Pacific Ocean from a stones-throw away.

Beyond glorified headquarters, there is evidence of other low-risk appetite examples. Here are some reinforcing pictures:

The Bond Binge

Cash Hoarding

Source (Calafia Beach Pundit): Stuffing money under the mattress has accelerated in recent years as fear, uncertainty, and doubt have reigned supreme.

The Anchovy Special

Even though anchovy pizza, or a broadly diversified portfolio across asset class, size, geography, and style may not sound appealing, there are plenty of reasons to fight the urges of caving to fear and skepticism. Here are a few:

1) Growth Rolls On: Despite the aforementioned challenges occurring domestically and abroad, growth has continued unabated for 11 consecutive quarters, albeit at a rate less than desired. We are not immune to global recessionary forces, but regardless of European forces, the U.S. has been resilient in its expansion.

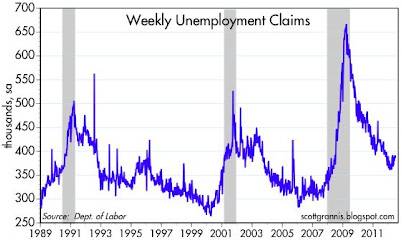

2) Jobs and Housing on the Upswing: Unemployment remains high, but our country has experienced 27 consecutive months of private creation, leading to more than 4 million new jobs being added to our workforce. As you can see from the clear longer-term downward trend in unemployment claims, we are moving in the right direction.

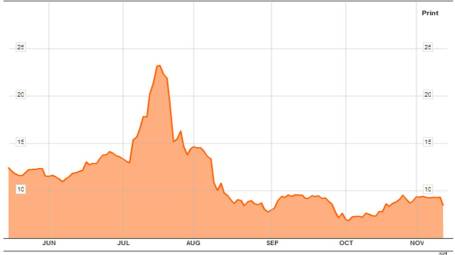

3) Eurozone Slowly Healing its Wounds: The Greek political and fiscal soap opera is grabbing all the headlines, but quietly in the background there are signs that the eurozone is slowly healing the wounds of the financial crisis. If you look at the 2-year borrowing costs of Europe’s troubled countries (ex-Greece), there is an unambiguous and beneficial decline. There is no doubt that Spain and Italy play a larger role than Portugal and Ireland, but at least some seeds of change have been planted for optimism.

4) Record Corporate Profits: Investors are not the only people reading uncertain newspaper headlines and watching CNBC business television. CEOs are reading the same gloomy sensationalistic stories, and as a result, corporations have been cautious about dipping their short arms into their deep pockets. Significant expense reductions and a reluctance to hire have led to record profits and cash hoards. As evidenced by the chart below, profits continue to rise, and these earnings are being applied to shareholder friendly uses like dividends, share buybacks, and accretive acquisitions.

5) Attractive Valuations (Pricing): We have already explored the lofty prices surrounding bonds and $30 pepperoni pizzas, but counter-intuitively, stock prices are trading at a discount to historical norms, despite record low interest rates. All else equal, an investor should pay higher prices for stocks when interest rates are at a record low (and vice versa), but currently we are seeing the opposite dynamic occur.

Even though the financial markets may look, smell, and taste like an anchovy pizza, the price, value, and return benefits may outweigh the fishy odor. And guess what…anchovies are versatile. If you don’t like them on your pizza, you can always take them off and put them on your Caesar salad or use them for bait the next time you go fishing. The gloom-filled headlines haven’t been spectacular, but if they were, the return opportunities would be drastically reduced. Therefore you are much better off by following investor legend Warren Buffett’s advice, which is to “buy fear and sell greed.”

Investing has never been more difficult with record low interest rates, and it has also never been more important. Excluding a small minority of late retirees and wealthy individuals, efficiently investing your retirement dollars has become even more critical. The safety nets of Social Security and Medicare are likely to be crippled, which will require better and more prudent investing by individuals. Inflation relating to food, energy, healthcare, gasoline, and entertainment is dramatically eroding peoples’ nest eggs.

Digesting a pepperoni pizza may sound like the most popular and best option given the gloomy headlines and uncertain outlook, but if you do not want financial heartburn you may consider alternative choices. Like the healthier and less loved anchovy pizza, a more attractively valued strategy based on a broadly diversified portfolio across asset class, size, geography, and style may be the best financial choice to satiate your long-term financial goals.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Dominoes, Deleveraging, and Justin Bieber

Despite significant 2011 estimated corporate profit growth (+17% S&P 500) and a sharp rebound in the markets since early October (+18% since the lows), investors remain scared of their own shadows. Even with trembling trillions in cash on the sidelines, the Dow Jones Industrial Average is up +5.0% for the year (+11% in 2010), and that excludes dividends. Not too shabby, if you think about the trillions melting away to inflation in CDs, savings accounts, and cash. With capital panicking into 10-year Treasuries, hovering near record lows of 2%, it should be no surprise to anyone that fears of a Greek domino toppling Italy, the eurozone, and the global economy have sapped confidence and retarded economic growth.

Deleveraging is a painful process, and U.S. consumers and corporations have experienced this first hand since the financial crisis of 2008 gained a full head of steam. Sure, housing has not recovered, and many domestic banks continue to chew threw a slew of foreclosures and underwater loan modifications. However, our European friends are now going through the same joyful process with their banks that we went through in 2008-2009. Certainly, when it comes to the government arena, the U.S. has only just begun to scratch the deleveraging surface. Fortunately, we will get a fresh update of how we’re doing in this department, come November 23rd, when the Congressional “Super Committee” will update us on $1.2 trillion+ in expected 10-year debt reductions.

Death by Dominoes?

Is now the time to stock your cave with a survival kit, gun, and gold? I’m going to go out on a limb and say we may see some more volatility surrounding the European PIIGS debt hangover (Portugal/Italy/Ireland/Greece/Spain) before normality returns, but Greece defaulting and/or exiting the euro does not mean the world is coming to an end. At the end of the day, despite legal ambiguity, the ECB (European Central Bank) will come to the rescue and steal a page from Ben Bernanke’s quantitative easing printing press playbook (see European Deadbeat Cousin).

Greece isn’t the first country to be attacked by bond vigilantes who push borrowing costs up or the first country to suffer an economic collapse. Memories are short, but it was not too long ago that a hedge fund on ice called Iceland experienced a massive economic collapse. It wasn’t pretty – Iceland’s three largest banks suffered $100 billion in losses (vs. a $13 billion GDP); Iceland’s stock market collapsed 95%; Iceland’s currency (krona) dropped 50% in a week. The country is already on the comeback trail. Currently, unemployment (@ 6.8%) in Iceland is significantly less than the U.S. (@ 9.0%), and Iceland’s economy is expanding +2.5%, with another +2.5% growth rate forecasted by the IMF (International Monetary Fund) in 2012.

Iceland used a formula of austerity and deleveraging, similar in some fashions to Ireland, which also has seen a dramatic -15% decrease in its sovereign debt borrowing costs (see chart below).

OK, sure, Iceland and Ireland are small potatoes (no pun intended), so how realistic is comparing these small countries’ problems to the massive $2.6 trillion in Italian sovereign debt that bearish investors expect to imminently implode? If these countries aren’t credibly large enough, then why not take a peek at Japan, which was the universe’s second largest economy in 1989. Since then, this South Pacific economic behemoth has experienced an unprecedented depression that has lasted longer than two decades, and seen the value of its stock market decline by -78% (from 38,916 to 8,514). Over that same timeframe, the U.S. economy has seen its economy grow from roughly $5.5 trillion to $15.2 trillion.

There’s no question in mind, if Greece exits the euro, financial markets will fall in the short-run, but if you believe the following…

1.) The world is NOT going to end.

2.) 2012 S&P profits are NOT declining to $65.

AND/OR

3.) Justin Bieber will NOT run and overtake Mitt Romney as the leading Republican candidate

…then I believe the financial markets are poised to move in a more constructive direction. Perhaps I am a bit too Pollyannaish, but as I decide if this is truly the case, I think I’ll go play a game of dominoes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.